Gennaro Cuofano's Blog, page 114

February 27, 2022

What is break-bulk?

Break bulk is a form of shipping where cargo is bundled into bales, boxes, drums, or crates that must be loaded individually. Common break bulk items include wool, steel, cement, construction equipment, vehicles, and any other item that is oversized. While container shipping became more popular in the 1960s, break bulk shipping remains and offers several benefits. It tends to be more affordable since bulky items do not need to be disassembled. What’s more, break bulk carriers can call in at more ports than container ships.

Understanding break bulkBreak bulk is a form of shipping where cargo is bundled into bales, boxes, drums, or crates that must be loaded individually.

Break bulk is named after the somewhat antiquated term breaking bulk which describes the extraction of a portion of cargo from a ship or the start of the unloading process itself.

In a more modern context, break bulk describes cargo transported in bales, boxes, pallets, drums, crates, and bags. Note that to be considered break bulk, this cargo cannot be loaded in containers or in bulk as is the case with goods such as iron ore, coal, or grain. Instead, it must be loaded on an individual basis.

This method of loading ships was commonplace up until around the 1960s when container shipping started to become more popular. While there are obvious benefits to containerization in terms of speed and efficiency, there remain situations today where break bulk is still useful. For example, break bulk is sometimes used to transport goods to ships that are considered too large for shallow ports.

Common break bulk cargoBreak bulk cargo is transported to the quay next to the ship and then each item is lifted onto the ship by a heavy-duty crane. Once onboard, the item must also be separately stowed and secured.

Some examples of cargo that is shipped in this way include:

Construction equipment, vehicles, and vehicle components.Steel girders and structural steel.Baled commodities such as wool, paper, tobacco, rubber, and furs.Bagged or sacked goods such as sugar, cement, flour, and milk powder.Corrugated and wooden boxes.Any item that is long, heavy, or oversized.Hazardous materials that must be separated from other goods.Break bulk shipsThere are three types of ships that are utilized for break bulk goods, including:

Break bulk carriers.Multi-purpose carriers, andGeneral cargo vessels.Each of these types also comes in a variety of sizes, including single-decker, tween decker, and box hold. Size is quantified by deadweight (DWT), or the weight the ship can transport without sustaining damage or sinking. Break bulk ship sizes tend to range from 2,000 to 40,000 DWT.

Break bulk ships are also said to be:

Gearless – these ships do not possess cargo handling equipment and/or cranes. As a result, they are limited to terminals that do. In some cases, specialized barges with high deck strength may be required to facilitate the loading of cargo.Geared – these ships do possess the necessary break bulk equipment and have more choice in terms of the ports or terminals they can utilize.Advantages of break bulk shippingWhile break bulk is no longer the dominant form of shipping, it does have the following advantages:

Affordability – for shipping companies that require cargo to be transported to and from ports over land, the transportation of break bulk items is more affordable than container transportation. Since break bulk items do not need to be separated into pieces to be shipped, it also tends to be more affordable for companies with oversized cargo.Flexibility – as hinted at earlier, break bulk items are deliverable to more ports around the world since not all ports have facilities for loading and unloading containers. Geared break bulk ships that carry their own cranes and equipment have even more flexibility in terms of port choice.Efficiency – in general, break bulk shipping is more efficient than container shipping in terms of the paperwork involved. Since containers carry multiple goods, this necessitates several bills of lading per container. Break bulk shipping, on the other hand, only requires one bill of lading per shipment.Read Next: Cross-Docking, Supply Chain, AI Supply Chain, Metaverse Supply Chain, Costco Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What is break-bulk? appeared first on FourWeekMBA.

What is cross-docking?

Cross-docking is a procedure where goods are transferred from inbound to outbound transport without a company handling or storing those goods. Cross-docking methods include continuous, consolidation, and de-consolidation. There are also two types of cross-docking according to whether the customer is known or unknown before goods are distributed. Cross-docking has obvious benefits for virtually any industry, but it is especially useful in food and beverage, retail and eCommerce, and chemicals.

Understanding cross-dockingCross-docking is a procedure where goods are transferred from inbound to outbound transport without a company handling or storing those goods.

Irrespective of the business or industry, the carrying costs associated with inventory management can be expensive and difficult to reduce. These costs arise from warehouse maintenance, storage, labor, transportation, insurance, depreciation, and shrinkage, to name a few. Since these costs typically comprise 20-30% of the inventory’s total value, there is also a sizeable opportunity cost from having so many resources tied up in inventory management.

This is where cross-docking can be useful. The strategy saves time and money since products are transferred from inbound to outbound transport with minimal storage and handling on the part of the business. Cross-docking normally occurs in a custom warehouse or docking terminal that is partitioned into inbound and outbound lanes. Another space known as the cross-docking terminal is set aside to sort, pack, and redistribute the inventory. In most cases, inventory spends less than 24 hours in the facility before it is sent out.

Cross-docking typesThere are two main types of cross-docking:

Pre-distribution – where the goods are unloaded, sorted and reassembled according to predetermined distribution instructions. That is, the customer is known before the goods are loaded into outbound transport.Post-distribution – where the goods are held in the cross-docking facility for a little longer while a customer is identified based on demand. While post-distribution is not as efficient, both retailers and suppliers benefit from the extra time to make smarter, more profitable decisions on where to send their inventory.Cross-docking methodsHere is a look at a few of the ways cross-docking can be performed:

Continuous cross-docking – the most basic form of cross-docking with a non-stop and direct flow of inventory that moves from inbound to outbound shipping via the cross-docking area. This is an ideal method for when the customer is known and many trucks are arriving at different times of the day.Consolidation – where multiple smaller shipments are consolidated into one larger shipment before it is sent out. Goods awaiting consolidation are stored in a designated area and do not need to be warehoused in the interim.De-consolidation – the opposite of consolidation where a large load is broken down into multiple smaller loads such as the movement of goods from railcars to trucks. De-consolidation is often used in direct-to-consumer (D2C) businesses because it tends to be more efficient.Where is cross-docking most beneficial?The benefits of cross-docking as an operational system can be had in almost any industry. However, it is particularly important in the following industries:

Food and beverage – restaurants, for example, require a continuous and reliable stream of goods to operate efficiently. Cross-docking also reduces the likelihood that foods will spoil in transit since they are not stored for long periods.Retail and eCommerce – companies like Walmart and Amazon have redefined consumer expectations around availability, convenience, and price. Cross-docking can move items quickly and reduce instances of low or no inventory.Chemicals – the shipment of chemicals can be expensive and dangerous and as a result, inventory should be handled as little as possible. This makes chemical shipments ideally suited to cross-docking.Costco cross-docking example With a substantial part of its business focused on selling merchandise at the low-profit margin, Costco also has about fifty million members that each year guarantee to the company over $2.8 billion in steady income at high-profit margins. Costco uses a single-step distribution strategy to sell its inventory.

With a substantial part of its business focused on selling merchandise at the low-profit margin, Costco also has about fifty million members that each year guarantee to the company over $2.8 billion in steady income at high-profit margins. Costco uses a single-step distribution strategy to sell its inventory.Costco generally sells inventory even before they’ve paid it. As pointed out in its annual report:

We buy most of our merchandise directly from manufacturers and route it to cross-docking consolidation points (depots) or directly to our warehouses. Our depots receive large shipments from manufacturers and quickly ship these goods to individual warehouses. This process creates freight volume and handling efficiencies, eliminating many costs associated with traditional multiple-step distribution channels.

Read Next: Supply Chain, AI Supply Chain, Metaverse Supply Chain, Costco Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What is cross-docking? appeared first on FourWeekMBA.

What is price discrimination?

Price discrimination is a pricing strategy where one business charges consumers different prices for identical goods and services in different markets. In essence, businesses use price discrimination to ensure they maximize the revenue that is made from each customer. Price discrimination is a pricing strategy where identical or near-identical products and services are sold at different prices in different markets by the same supplier.

Understanding price discriminationThe price of movie tickets is one example of price discrimination at work, with separate prices for children, adults, families, and seniors. Movie ticket prices also vary according to the time of day and whether the movie is a blockbuster new release or a timeless old classic.

Three types of price discriminationThere are three general types of price discrimination, with each consisting of various pricing strategies businesses use. An explanation of each of these is provided below.

First degreeFirst degree price discrimination is also known as perfect price discrimination and this perfection makes it difficult to implement in practice.

Nevertheless, it involves the business charging the maximum price consumers are willing to pay for each unit of product or service sold. This allows the business to capture all the consumer surplus in the market, which can be defined as the difference in price between what the consumer actually pays and what they are prepared to pay.

Second degreeSecond degree price discrimination is perhaps the most recognizable and involves the business charging a different amount according to the amount or quantity consumed. Frequent flyer programs, for example, reward customers with cheaper tickets the more they fly with an airline. Phone and internet data also tends to be cheaper the more data that is consumed.

Second-degree price discrimination is sometimes referred to as indirect price discrimination since companies allow consumers to choose what price they will ultimately pay. Some choices which appear more cost-effective on the surface are only affordable because the business imposes an extra cost on the consumer. This includes pricing that is influenced by coupon collecting and bulk purchases, among other factors.

Third degreeThird degree price discrimination is the strategy that movie theatres employ where different prices are charged to different groups of people such as:

Students.Seniors.Emergency services personnel.Veterans.Men or women.This form of price discrimination is also often used by utility, parking lot, and gym businesses to charge one price for peak usage and another for off-peak usage.

What are the necessary conditions for effective price discrimination?For price discrimination to be effective, a few conditions must be met:

The company must be a price maker – that is, it must operate in an imperfect market with a demand curve that slopes downwards. The company should also possess some degree of monopoly power.The ability to separate markets – the company must also be able to prevent the resale of its products and services to consumers who would otherwise have to pay a higher price. A children’s movie ticket, for instance, would need to be distinguishable from an adult’s ticket. Microsoft Office for university students must also be kept separate from home or workplace users. Online, eCommerce companies use dynamic pricing where prices vary from second to second according to real-time demand and other metrics.Elasticity of demand – there must also be different elasticities of demand within the same market for price discrimination to be effective. Lower-income individuals tend to be more elastic to the cost of an airline ticket than business travelers. This means the airline can sell cheaper “red-eye” flights or those without meals to target this segment.Key takeaways:Price discrimination is a pricing strategy where identical or near-identical products and services are sold at different prices in different markets by the same supplier.There are three types of price discrimination: first degree, second degree, and third degree. Each type has a selection of unique price discrimination strategies.To be effective, price discrimination must be carried out by a company operating in an imperfect market with the ability to segment its products. There must also be varying elasticity of demand within the market itself.Read Next: Pricing Strategies, Dynamic Pricing.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What is price discrimination? appeared first on FourWeekMBA.

Affle Business Model In A Nutshell

Affle is a global tech company that delivers targeted mobile advertising via a consumer intelligence platform. It was founded in Singapore by Anuj Khanna Sohum and Madhusudana Ramakrishna in 2005. Affle has a significant presence in India as one of the only listed companies to be involved in mobile advertising and ad technology in the country. Since only 25% of Indian internet users are shopping online, the company is well placed to attract new clients as more citizens move online. However, Affle faces strong competition in international markets where players such as Facebook and Google are already established.

What is Affle’s business model?The company utilizes user-intent indicators that are based on marketing attribution, certain behavioral signals, and transactional data. It then predicts the particular interests of users based on insights from the information it collects and continuously updates this information to maintain consumer engagement.

For example, Affle works with eCommerce companies to serve relevant mobile ads and complete transactions. The company also manages marketing campaigns based on intelligence from the data it collects. Some of the companies Affle has worked with include Amazon, Flipkart, BookMyShow, McDonald’s, Axis Bank, and Johnson & Johnson. Aside from eCommerce, the company primarily operates in real estate, travel, and transportation and has even worked on governmental campaigns.

Revenue is earned on a cost per converted user (CPCU) basis, with the exact amount dependent on the total purchase price of a product or service and the customer acquisition model. The company also earns revenue via advertising that generates engagement and awareness.

Affle business model segmentationAccording to Indian chartered accountant Harsh Mody, Affle’s business model can be segmented into four sub-models:

The serving of ads on mobile devices to help companies attract new consumers.The use of tech tools to ensure existing customers are kept engaged and are more likely to make repeat purchases.An enterprise-only online-to-offline (O2O) platform, where a customer who leaves a digital footprint is served relevant advertisements about the offline presence of a brand to encourage them to purchase in a physical store.Further tools that help clients detect and block online advertisement fraud on a real-time basis. One such tool is mFaaS, a so-called fraud-analytics-as-a-service (FaaS) platform that helps marketers detect multiple types of ad fraud resulting from bots, devices, click spamming, and SDK spoofing. Key takeaways:Affle is a global tech company that delivers targeted mobile advertising via a consumer intelligence platform. It was founded in Singapore by Anuj Khanna Sohum and Madhusudana Ramakrishna in 2005.Affle’s core business model involves user-intent indicators that are based on marketing attribution, certain behavioral signals, and transactional data. Insights from this data are then used to serve relevant ads and increase user engagement and repeat purchases.In addition to serving ads and keeping existing customers engaged, Affle offers an enterprise O2O platform where online users who leave a digital footprint are marketed offline and encouraged to purchase in a physical store. Affle also sells a fraud-analytics-as-a-service (FaaS) platform to help its clients reduce various types of ad fraud.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Affle Business Model In A Nutshell appeared first on FourWeekMBA.

February 23, 2022

How Do Football Clubs Make Money?

Football club business models once relied on the sale of game day tickets to drive revenue. As the operating budgets of the most successful teams increase, teams are now finding other ways to make money to remain competitive.Revenue from television rights deals and championship prize money can be extremely lucrative, with the club that can win the most games enjoying the largest slice of the pie.Player transfers can be a way for smaller clubs to make money, particularly if they become adept at identifying talent early and moving them on to other clubs to collect a sell-on fee. Merchandise sales and other perks like stadium tours are also sources of revenue that are worth pursuing.Understanding Football clubs business models

Football club business models once relied on the sale of game day tickets to drive revenue. As the operating budgets of the most successful teams increase, teams are now finding other ways to make money to remain competitive.Revenue from television rights deals and championship prize money can be extremely lucrative, with the club that can win the most games enjoying the largest slice of the pie.Player transfers can be a way for smaller clubs to make money, particularly if they become adept at identifying talent early and moving them on to other clubs to collect a sell-on fee. Merchandise sales and other perks like stadium tours are also sources of revenue that are worth pursuing.Understanding Football clubs business modelsAccording to Forbes, Manchester United star Lionel Messi was the world’s best-paid football player with earnings of approximately $125 million in 2021.

While football is the most popular sport in the world, fans could be forgiven for wondering where the money or justification for Messi’s salary comes from. This is especially true in a pandemic-affected world with consumer confidence at record lows and crowd sizes severely restricted in any case.

Most would argue that football clubs exist to win championships, but they are also businesses whose very survival depends on turning a profit that can be difficult to achieve. According to a 2015 study titled New Business Strategies Of Football Clubs, the viability of a European football club’s business model was impacted by several industry trends, including:

Globalization of the sport and the player transfer market.Increasing human resource costs such as player transfer fees and support personnel wages. As costs rise, clubs without a solid financial foundation may not be able to attract the necessary talent in the future.Increasing operating losses, andThe concentration of sports and/or financial success to a select few clubs. The study reported that just 24 of the 237 clubs reported revenue exceeding €100 million annually.In this article, we’ll provide a general overview of how football clubs earn revenue to meet their expenses and navigate these broader trends.

Matchday revenueMatchday revenue was a source of revenue most football clubs relied on before football evolved into the money-making juggernaut it is today. Ticket sales are the most obvious form of matchday revenue, with clubs that play in the largest stadiums able to command the most revenue.

To supplement income in smaller stadiums or where demand for seats otherwise exceeds supply, many clubs offer corporate boxes for business clients and other VIP packages that include more comfortable seating and access to private bars and restaurants.

Television rightsRevenue resulting from television rights is a significant source of income for football clubs, with the broadcast rights to the English Premier League in the United States alone secured for £2 billion in a six-year deal.

The more matches a football club wins, the greater the slice of television revenue it earns. Despite only making it to the semi-final of the Champions League in 2015-16, Manchester City earned over £76 million from this source.

Prize moneyLike the revenue that is earned from television rights, prize money revenue tends to be concentrated to the most successful clubs.

The winner of the 2022 FA Cup, for example, receives a total of $4.625 million with bonuses awarded for each win as they progress toward the final. However, it’s worth noting that prize money varies markedly between the various competitions that take place around the world.

Player transfersAt the introduction, we noted that player transfer fees were on the rise. While this could be seen as a negative, it is important to remember that for every buyer there is a seller who reaps the rewards. Indeed, a football club may purchase a talented but inconsistent player and then sell them for a higher price once they have more experience.

Some clubs also incorporate a sell-on fee into a player contract that is applicable if the player in question decides to move to a larger club. Queens Park Rangers negotiated a 20% sell-on fee with Liverpool for Raheem Sterling, which netted the club approximately £10 million when Liverpool on-sold Sterling to Manchester City.

Merchandise and other perksMerchandise is an evergreen source of income for football clubs, with revenue reliant on the team’s success or the caliber of its players.

While it seems like every second football fan owns a shirt from their favorite club, the amount of money football clubs make from merchandise sales is relatively small. Manufacturers such as Nike and Adidas take most of the sale price of a jersey, for example, with a club such as Liverpool collecting only 20%. Most fare much worse at around 7.5%, but this can still result in millions of dollars in revenue for the most popular players.

Other sources of income include fan perks such as stadium tours where individuals can experience the player change rooms, walk on the pitch, or visit the club museum. Perks also encompass match day enhancements which we mentioned in a previous section.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Do Football Clubs Make Money? appeared first on FourWeekMBA.

What are barriers to entry?

Various interpretations of what constitutes a barrier to entry have been put forth since the 1950s. For this article, we will use the definition provided by American economist George Stigler in 1968, who stated that a barrier to entry was any “cost of producing that must be borne by a firm which seeks to enter an industry but is not borne by firms already in the industry.” In economics, therefore, barriers to entry prevent or make it difficult for new businesses to enter a specific market.

Understanding barriers to entryBarriers to entry may arise naturally because of the particular characteristics of the market or the company itself, but they may also be imposed by firms in the market to reduce the potential for competition or by governments as an economic control measure.

The presence of entry barriers also explains why some markets are inefficient, with consumers forced to interact with monopolistic companies that charge exorbitant prices for their products and services.

Indeed, it is worth mentioning that some barriers to entry form because different firms employ different strategies or have access to different assets, capabilities, and skillsets. These barriers become dysfunctional when they prohibit new market entrants and encourage monopolies or oligopolies to form.

The two main types of barriers to entryAs we hinted in the previous section, there are two main types of entry barriers: natural (structural) and imposed (artificial, strategic). Let’s take a look at a few examples of each below.

Natural High research and development costs – when existing firms commit resources to research and development, it can dissuade new entrants since these firms tend to have significant operating budgets.Economies of scale – in a market where economies of scale have already been exploited, it is unlikely a new entrant could penetrate it and remain viable.Sunk costs – entering a new market is associated with several sunk costs, which is a cost that is not recoverable. These costs, which include those related to marketing and advertising, pose a significant risk to the market entrant.Prohibitive start-up costs – some industries also have prohibitive start-up costs. A new airline company, for example, needs to spend tens of millions of dollars on aircraft before it even considers the cost of employee salaries, training, permits, and airport taxes.Geographical – some countries can also present barriers to entry, particularly in commodities industries where resources are concentrated in specific areas. In Australia, where iron ore is abundant, some companies will avoid entering the market because of the cost or difficulty associated with establishing operations in a foreign country.Imposed Brand loyalty – some firms in an industry enjoy superior brand loyalty that deters new companies from trying to enter. However, this barrier may be overcome by brand differentiation.Patents – these are barriers to entry that are endorsed by governments and prevent competitors from legally entering a market or profiting from protected intellectual property. The pharmaceutical industry is one such example.Trade barriers – these encompass government-imposed tariffs, quotas, and other trade restrictions that make it difficult for companies to enter a market or remain viable. This applies to an international company that tries to enter a domestic market where economic measures and controls are established to favor local companies.Vertical integration – when is a firm is vertically integrated via mergers, acquisitions, or otherwise, it controls the entire supply chain. This makes it near impossible for another company to operate in that market.Key takeaways:Barriers to entry describe a suite of economic factors that prevent or make it difficult for new businesses to enter a specific market.Barriers to entry arise naturally because of the particular characteristics of the market or the company concerned. However, they may also be imposed by firms already in the market to reduce the potential for competition or by governments as a control measure.Barriers to entry may be natural, such as economies of scale, prohibitive start-up costs, and geographical region. They may also be imposed, or artificial, such as vertical integration, trade barriers, patents, and brand loyalty.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business FrameworksPorter’s Generic Strategies In his book, “Competitive Advantage,” in 1985, Porter conceptualized the concept of competitive advantage, by looking at two key aspects. Industry attractiveness, and the company’s strategic positioning. The latter, according to Porter, can be achieved either via cost leadership, differentiation, or focus.Porter’s Value Chain Model

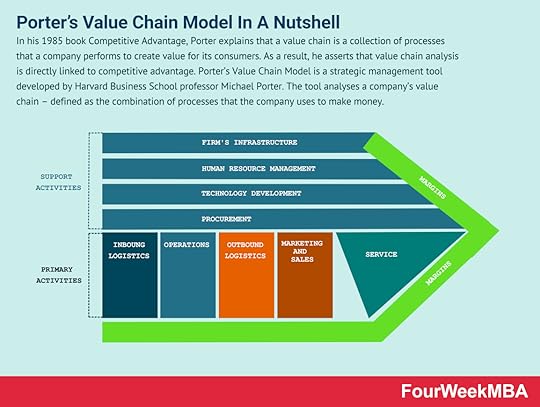

In his book, “Competitive Advantage,” in 1985, Porter conceptualized the concept of competitive advantage, by looking at two key aspects. Industry attractiveness, and the company’s strategic positioning. The latter, according to Porter, can be achieved either via cost leadership, differentiation, or focus.Porter’s Value Chain Model

In his 1985 book Competitive Advantage, Porter explains that a value chain is a collection of processes that a company performs to create value for its consumers. As a result, he asserts that value chain analysis is directly linked to competitive advantage. Porter’s Value Chain Model is a strategic management tool developed by Harvard Business School professor Michael Porter. The tool analyses a company’s value chain – defined as the combination of processes that the company uses to make money.Porter’s Diamond Model

In his 1985 book Competitive Advantage, Porter explains that a value chain is a collection of processes that a company performs to create value for its consumers. As a result, he asserts that value chain analysis is directly linked to competitive advantage. Porter’s Value Chain Model is a strategic management tool developed by Harvard Business School professor Michael Porter. The tool analyses a company’s value chain – defined as the combination of processes that the company uses to make money.Porter’s Diamond Model

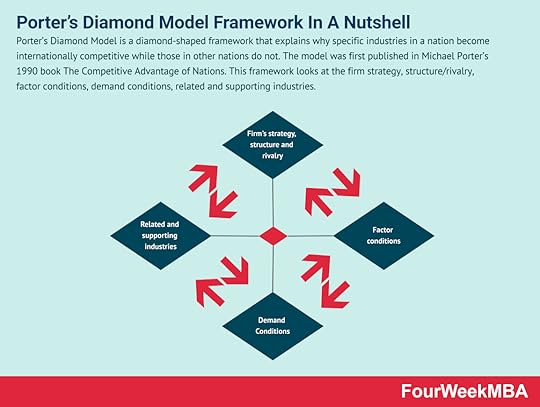

Porter’s Diamond Model is a diamond-shaped framework that explains why specific industries in a nation become internationally competitive while those in other nations do not. The model was first published in Michael Porter’s 1990 book The Competitive Advantage of Nations. This framework looks at the firm strategy, structure/rivalry, factor conditions, demand conditions, related and supporting industries.Porter’s Four Corners Analysis

Porter’s Diamond Model is a diamond-shaped framework that explains why specific industries in a nation become internationally competitive while those in other nations do not. The model was first published in Michael Porter’s 1990 book The Competitive Advantage of Nations. This framework looks at the firm strategy, structure/rivalry, factor conditions, demand conditions, related and supporting industries.Porter’s Four Corners Analysis

Developed by American academic Michael Porter, the Four Corners Analysis helps a business understand its particular competitive landscape. The analysis is a form of competitive intelligence where a business determines its future strategy by assessing its competitors’ strategy, looking at four elements: drivers, current strategy, management assumptions, and capabilities.Six Forces Models

Developed by American academic Michael Porter, the Four Corners Analysis helps a business understand its particular competitive landscape. The analysis is a form of competitive intelligence where a business determines its future strategy by assessing its competitors’ strategy, looking at four elements: drivers, current strategy, management assumptions, and capabilities.Six Forces Models

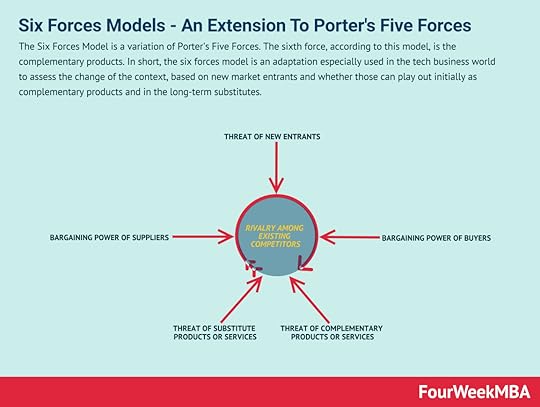

The Six Forces Model is a variation of Porter’s Five Forces. The sixth force, according to this model, is the complementary products. In short, the six forces model is an adaptation especially used in the tech business world to assess the change of the context, based on new market entrants and whether those can play out initially as complementary products and in the long-term substitutes.Ansoff Matrix

The Six Forces Model is a variation of Porter’s Five Forces. The sixth force, according to this model, is the complementary products. In short, the six forces model is an adaptation especially used in the tech business world to assess the change of the context, based on new market entrants and whether those can play out initially as complementary products and in the long-term substitutes.Ansoff Matrix You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Read: Ansoff Matrix In A Nutshell

BCG Matrix In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Read: BCG Matrix

Balanced Scorecard First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Read: Balanced Scorecard

Blue Ocean Strategy A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Read: Blue Ocean Strategy

PEST Analysis The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Read: Pestel Analysis

Scenario Planning Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.Read: Scenario Planning

SWOT Analysis A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.Read: SWOT Analysis In A Nutshell

Growth Matrix In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Read: Growth Matrix In A Nutshell

Comparable Analysis Framework A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.

A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.Read: Comparable Analysis Framework In A Nutshell

The post What are barriers to entry? appeared first on FourWeekMBA.

What Is Autarky?

Autarky comes from the Greek words autos (self)and arkein (to suffice) and in essence, describes a general state of self-sufficiency. However, the term is most commonly used to describe the economic system of a nation that can operate without support from the economic systems of other nations. Autarky, therefore, is an economic system characterized by self-sufficiency and limited trade with international partners.

Understanding autarkyA nation said to be in full autarky operates a closed and self-sufficient economy. In other words, it does not receive aid or other forms of support and does not trade with international partners. Japan is perhaps one of the best and most recent examples, with the country cut off from the rest of the world for over 200 years between 1635 and 1859.

Thanks to a move toward free trade after the Second World War, however, full autarky is now impossible to achieve. Indeed, even the most isolated countries such as North Korea cannot survive without some participation in the modern, globalized society.

Autarky, nationalism, and protectionismThroughout history, autarky has been promoted in line with nationalist and protectionist policies to ensure a reliable supply of critical goods and eliminate dependencies for goods on other nations.

Irrespective of the prevailing political structure of a nation, autarky appears to make sense at first glance. Nations that produce their own goods create more jobs and ensure that profits remain within the country. However, there are some downsides to autarky that were mentioned by economist Adam Smith in his 1776 text The Wealth of Nations.

Smith countered that a nation could generate more wealth if it became involved in free trade and produced goods where it enjoyed an absolute advantage. In other words, where it could create a good or service for a lower price or more efficiently than another nation and import any good or service where it did not enjoy such an advantage.

Fellow economist David Ricardo expanded on Smith’s idea to suggest that trade should be based on comparative advantage, where a nation produces a good or service not for a lower price but a lower opportunity cost. This, he posited, allowed countries to pool their resources and create more wealth from a global trade system.

Perhaps more importantly, autarkies tend to be associated with more significant opportunity costs for individuals and the nation as a whole. For instance, a farmer who must necessarily sew their own clothes and build their own furniture has less time to spend growing food. This means reduced income and output, fewer jobs, and more broadly, a smaller economy that is anything but self-sufficient.

Key takeaways:Autarky is an economic system characterized by self-sufficiency and limited trade with international partners.The best and most recent example of autarky occurred in Japan over more than 200 years across the 17th, 18th, and 19th centuries. In the modern, globalized world, full autarky cannot exist.Historically, autarky was promoted in line with nationalist and protectionist policies to ensure a reliable supply of critical goods and eliminate goods dependencies on other nations. However, economists believed the quest for self-sufficiency made economies smaller and, paradoxically, more dependent on other nations as free trade started to become more prevalent.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Autarky? appeared first on FourWeekMBA.

How Does ChowNow Make Money?

ChowNow is a food ordering platform connecting local restaurants with online customers. The company was founded in 2011 by Christopher Webb and Eric Jaffe. The company makes money via subscription (with three main plan options, with the monthly at $199/month, annual at $129/month, and two years at $129/month), setup fees (2.95% plus $0.15 for every order it facilitates), and order fees (12%, but the restaurant can essentially have this fee waived if it adjusts its menu prices to compensate).

History of ChowNowWhile Webb was working in finance in 2007, he took a call from his mother about an investment opportunity. Three people were starting a new restaurant in his neighborhood of New York City and were looking for backers. Webb was initially hesitant because he knew how difficult it was to turn a profit in a restaurant. But after reading the group’s detailed business plan, he decided it was a worthwhile investment.

The restaurant, known as Tender Greens, proved to be a success with a further seven restaurants opening over the next few years. However, Webb witnessed firsthand that online ordering was problematic. At the time, the only viable option for a restaurant business was to join a platform such as Grubhub and surrender 40% of every order.

Chains such as Chipotle and Domino’s realized this early and spent vast amounts of money on their own direct order systems. However, for smaller players, this was simply not feasible. Sensing there was a chance to do something about it, Webb quit his finance job in 2010, moved to Los Angeles, and founded ChowNow with Eric Jaffe.

After convincing the owner of a sandwich place in LA to beta test their new technology, Jaffe placed the first order on the ChowNow platform in 2011. The platform was an instant hit and expanded into multiple states thereafter. Webb and Jaffe made a deliberate play for to establish themselves in Chicago early on. Not only was it the home of Grubhub, but the pair figured it was full of restaurants who were tired of paying Grubhub’s commissions. They were ultimately correct, and it would not be long before ChowNow was available in all 50 states.

In mid-December 2020, ChowNow surpassed 100 million takeout orders and claims to have saved restaurants more than $400 million in commission fees. In addition to an app and website, ChowNow restaurants can also enhance their online presence with branded products, marketing assistance, and customer memberships.

ChowNow revenue generationUnlike many similar services, ChowNow does not receive a commission on food orders. Instead, the company makes money via subscription fees, setup fees, and order fees.

Let’s have a look at each of these in more detail below.

Subscription and setup feesChowNow charges a subscription fee for access to the full product suite. This includes takeout ordering, restaurant delivery, curbside ordering, QR code dining, email marketing tools, branded apps, and the ability to create customer membership programs, to name a few.

Setup fees vary from restaurant to restaurant, but typically cover the cost of point-of-sale system installation, tablet issuance, or the creation of branded apps and websites.

There are three plan options here:

Monthly ($199/month) – plus a $399 setup fee per location.Annual ($129/month) – plus a $199 setup fee per location.Two year ($129/month) – plus a $199 setup fee per location.The company also charges a fee of 2.95% plus $0.15 for every order it facilitates to cover the interchange fees incurred by Visa and Mastercard.

Order feesChowNow also charges order fees on its Order Better Network which connects client restaurants with a sizeable list of ordering traffic channels. These include Nextdoor, OpenTable, TripAdvisor, Yahoo!, and Yelp.

The order fee for this service is 12%, but the restaurant can essentially have this fee waived if it adjusts its menu prices to compensate.

Key takeaways:ChowNow is a food ordering platform connecting local restaurants with online customers. The company was founded in 2011 by Christopher Webb and Eric Jaffe after Webb realized smaller restaurants could not afford to develop their own order systems.Unlike its competitors, ChowNow does not charge order commissions. Instead, it charges a monthly subscription fee that gives full access to its product suite. There is also a setup should the restaurant want to open a new location.ChowNow charges a 12% order fee on orders that occur via its Order Better Network, which helps restaurants open digital storefronts on high-traffic sites. Business Models Connected To Flink DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace.

DoorDash is a platform business model that enables restaurants to set up at no cost delivery operations. At the same time, customers get their food at home and dashers (delivery people) earn some extra money. DoorDash makes money by markup prices through delivery fees, memberships, and advertising for restaurants on the marketplace. Glovo is a Spanish on-demand courier service that purchases and delivers products ordered through a mobile app. Founded in 2015 by Oscar Pierre and Sacha Michaud as a way to “uberize” local services. Glovo makes money via delivery fees, mini-supermarkets (fulfillment centers that Glovo operates in partnership with grocery store chains), and dark kitchens (enabling restaurants to increase their capacity).

Glovo is a Spanish on-demand courier service that purchases and delivers products ordered through a mobile app. Founded in 2015 by Oscar Pierre and Sacha Michaud as a way to “uberize” local services. Glovo makes money via delivery fees, mini-supermarkets (fulfillment centers that Glovo operates in partnership with grocery store chains), and dark kitchens (enabling restaurants to increase their capacity). Grubhub is an online and mobile platform for restaurant pick-up and delivery orders. In 2018 the company connected 95,000 takeout restaurants in over 1,700 U.S. cities and London. The Grubhub portfolio of brands like Seamless, LevelUp, Eat24, AllMenus, MenuPages, and Tapingo. The company makes money primarily by charging restaurants a pre-order commission and it generates revenues when diners place an order on its platform. Also, it charges restaurants that use Grubhub delivery services and when diners pay for those services.

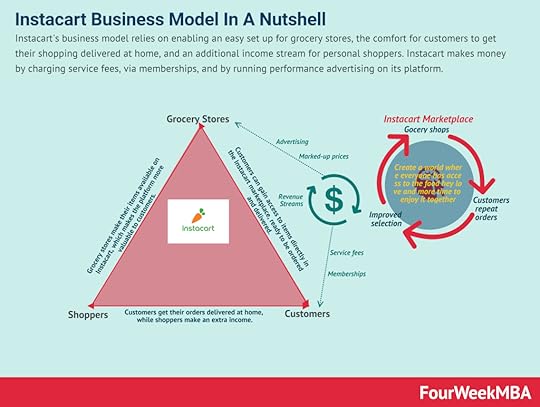

Grubhub is an online and mobile platform for restaurant pick-up and delivery orders. In 2018 the company connected 95,000 takeout restaurants in over 1,700 U.S. cities and London. The Grubhub portfolio of brands like Seamless, LevelUp, Eat24, AllMenus, MenuPages, and Tapingo. The company makes money primarily by charging restaurants a pre-order commission and it generates revenues when diners place an order on its platform. Also, it charges restaurants that use Grubhub delivery services and when diners pay for those services.  Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform.

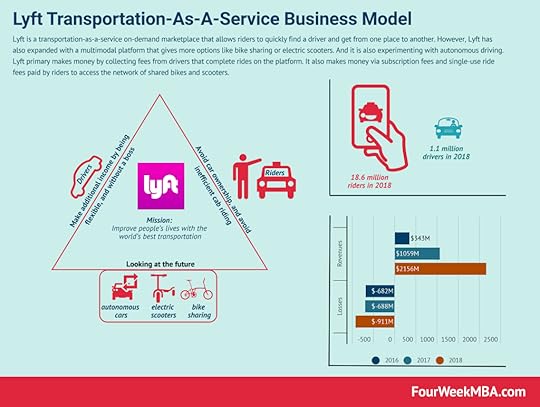

Instacart’s business model relies on enabling an easy set up for grocery stores, the comfort for customers to get their shopping delivered at home, and an additional income stream for personal shoppers. Instacart makes money by charging service fees, via memberships, and by running performance advertising on its platform. Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform.

Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform. Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

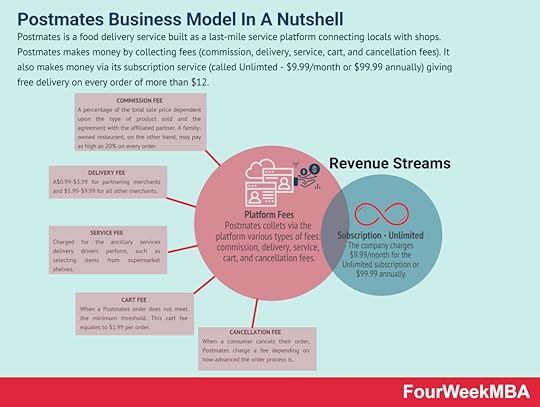

Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings. Postmates is a food delivery service built as a last-mile delivery service platform connecting locals with shops. Postmates makes money by collecting fees (commission, delivery, service, cart, and cancellation fees). It also makes money via its subscription service (called Unlimted – $9.99/month or $99.99 annually) giving free delivery on every order of more than $12.

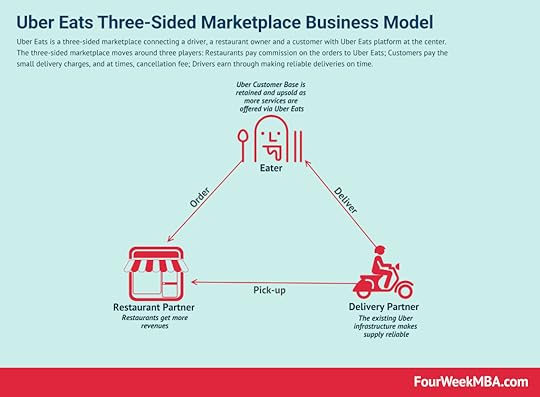

Postmates is a food delivery service built as a last-mile delivery service platform connecting locals with shops. Postmates makes money by collecting fees (commission, delivery, service, cart, and cancellation fees). It also makes money via its subscription service (called Unlimted – $9.99/month or $99.99 annually) giving free delivery on every order of more than $12. Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time.

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time. Coupang is a South Korean eCommerce company. Coupang makes money by selling consumer items through its desktop and mobile eCommerce platform. The company also collects various fees from its food delivery, video streaming, and advertising services.

Coupang is a South Korean eCommerce company. Coupang makes money by selling consumer items through its desktop and mobile eCommerce platform. The company also collects various fees from its food delivery, video streaming, and advertising services. Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership. Getir is a Turkish grocery and restaurant food delivery platform founded by Serkan Borancili, Tuncay Tutek, Dogancan Dalyan, and Nazim Salur. Salur got the idea for the company after wondering if food could be delivered nearly as quickly as taxis could be hailed. As a dark supermarket operator, Getir makes money by selling items at a 10% premium to traditional supermarkets and retailers. Margins are higher because the company only leases the warehouses where the dark stores are located. Getir also charges a flat delivery fee on orders above a certain threshold, with fees varying according to the country served.

Getir is a Turkish grocery and restaurant food delivery platform founded by Serkan Borancili, Tuncay Tutek, Dogancan Dalyan, and Nazim Salur. Salur got the idea for the company after wondering if food could be delivered nearly as quickly as taxis could be hailed. As a dark supermarket operator, Getir makes money by selling items at a 10% premium to traditional supermarkets and retailers. Margins are higher because the company only leases the warehouses where the dark stores are located. Getir also charges a flat delivery fee on orders above a certain threshold, with fees varying according to the country served.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does ChowNow Make Money? appeared first on FourWeekMBA.

What are customer success metrics?

Customer success metrics are those that quantify customer success and which help a business ensure that customers reach a desired outcome from using its products and services. Customer success metrics determine what sort of customer experience the business is delivering. In other words, is the product or service having a positive impact on the customer? Are they recommending it to their friends and family? These metrics help the business reach a point where recurring revenue and customer lifetime value are being created consistently. When used effectively, they deliver important insights across key areas such as customer churn, adaptation rate, and production satisfaction.

Net promoter score The Net Promoter Score (NPS) is a measure of the ability of a product or service to attract word of mouth advertising. NPS is a crucial part of any marketing strategy, since attracting and then retaining customers means they are more likely to recommend a business to others.

The Net Promoter Score (NPS) is a measure of the ability of a product or service to attract word of mouth advertising. NPS is a crucial part of any marketing strategy, since attracting and then retaining customers means they are more likely to recommend a business to others.Net promoter score (NPS) is derived from asking consumers one simple question: “On a scale of 1 to 10, how likely are you to recommend this product or service?”

Ratings can be considered thusly:

Detractors – scores between 0 and 6 denote unsatisfied consumers who tend to discourage others from purchasing the product or service.Passives – a score of 7 or 8 is likely to be given by a consumer who is satisfied but not so satisfied that they’re willing to tell others.Promoters – a score of 9 or 10 is the most desirable. These are loyal and passionate consumers who recommend products and services to friends and family.After rating their experience, the customer is asked to explain their decision. In this way, the NPS provides both qualitative and quantitative customer success data.

Customer lifetime value One of the first mentions of customer lifetime value was in the 1988 book Database Marketing: Strategy and Implementation written by Robert Shaw and Merlin Stone. Customer lifetime value (CLV) represents the value of a customer to a company over a period of time. It represents a critical business metric, especially for SaaS or recurring revenue-based businesses.

One of the first mentions of customer lifetime value was in the 1988 book Database Marketing: Strategy and Implementation written by Robert Shaw and Merlin Stone. Customer lifetime value (CLV) represents the value of a customer to a company over a period of time. It represents a critical business metric, especially for SaaS or recurring revenue-based businesses. Customer lifetime value (CLV) measures the total value a customer is likely to generate over the course of their entire relationship with the business. When CLV increases, the business knows its products and services are contributing to customer success.

Customer lifetime value can be calculated by multiplying the average purchase frequency rate by the average purchase value. The resultant number should then be multiplied by the average customer lifespan.

Customer acquisition costCustomer acquisition cost (CAC) is an important metric since it determines how much it costs the business to acquire a new customer. CAC helps the business better direct its resources and maximize return on investment. When used with customer lifetime value, CAC tells the business whether it is likely to profit from acquiring new customers over the long term.

To calculate customer acquisition cost, add the costs associated with sales and marketing and then divide that sum by the number of new customers acquired.

Customer churn rateCustomer churn rate captures the percentage of customers who cease using a product or service for whatever reason. This may encompass closed accounts, canceled subscriptions, and the loss of recurring value, business, or contracts.

Customer churn rate can be determined by dividing the total number of churned customers by the total number of all customers.

Average revenue per user ARPU or average revenue per user is a critical measure to assess Facebook ability to monetize its users. ARPU is given by total revenue in a given geography during a given quarter, divided by the average of the number of monthly active users in the geography at the beginning and end of the quarter.

ARPU or average revenue per user is a critical measure to assess Facebook ability to monetize its users. ARPU is given by total revenue in a given geography during a given quarter, divided by the average of the number of monthly active users in the geography at the beginning and end of the quarter.Average revenue per user (ARPU) – also known as average revenue per unit – is the average revenue the business receives from a customer over a specific period.

ARPU is a customer success metric commonly used by social media, telecommunications, and SaaS companies to better understand profit potential and their customers. It also can be used to make financial forecasts and compare products and services to those offered by a competitor.

ARPU is calculated by determining the total revenue and dividing that figure by the average number of users over a given period. For most businesses, this will be monthly.

Monthly recurring revenueMonthly recurring revenue (MRR) is, perhaps unsurprisingly, a customer success metric favored by SaaS and other subscription-based companies.

MRR is a normalized calculation of predictable monthly revenue and is used to measure financial growth and momentum, among other things.

To calculate MRR, simply multiply the average revenue per user by the total number of monthly users.

Key takeaways:Customer success metrics are those that quantify customer success and which help a business ensure that customers reach a desired outcome from using its products and services. Customer success metrics include Net Promoter Score, a quantitative and qualitative measurement of how likely a product or service will be recommended to others. Customer acquisition cost is another metric that determines how much it costs the business to acquire a new customer and whether it will be profitable.Customer churn rate measures the percentage of customers who cease using a product or service, while average revenue per user (ARPU) is often used in conjunction with monthly recurring revenue (MRR) to make financial forecasts and determine profit potential.The post What are customer success metrics? appeared first on FourWeekMBA.

Who Ons Lexus? The History of Lexus In A Nutshell

Lexus is a luxury vehicle manufacturer that was founded in 1989 by then-Toyota chairman Eiji Toyoda. The story of Lexus began six years earlier, however, when a team of Japanese technicians, engineers, and designers were part of a secret project to design a new luxury sedan. Toyoda believed it was the right time to manufacture such a vehicle since competitors in Nissan and Honda were already in the process of developing their respective Infiniti and Acura premium brands. The first Lexus off the production line was the LS 400 which offered world-class speed, comfort, safety, dignity, beauty, and elegance. The LS 400, like every Lexus today, is associated with exemplary customer service that embodies omotenashi, or the Japanese spirit of hospitality that seeks to seek, anticipate, and then meet the needs of each customer. In more recent years, Lexus has expanded into SUVs, hybrid vehicles, high-performance sedans, and supercars. The company sold over 760,000 vehicles in 2021 with almost 45% of sales coming from the North American market.

Lexus ownershipToyota is the sole owner of the Lexus brand, but while Toyota is headquartered in Toyota City, Lexus has a separate Japanese headquarters in Nagoya.

Note that the company has also been operating its own design, engineering, training, and manufacturing facilities since 2005. This move was made to provide organizational separation between Lexus and Toyota which coincided with expansion efforts into the United States and China. Despite the separation between the two companies, Lexus executives nevertheless report directly to the Toyota CEO.

The Lexus RX 330 became the first model to be built outside of Japan, rolling off the line in Ontario, Canada, in 2003. Today, different models tend to be manufactured across seven locations:

Kitakyushu, Japan.Tahara, Japan.Toyota City, Japan.Cambridge, Ontario, Canada.Georgetown, Kentucky, USA.Susono, Japan, and Miyawaka, Japan.Lexus brand, design, and sales structureIn the United States, Lexus brand operations are managed by the U.S. Lexus Division in Texas, while a similar facility in Brussels is run by Lexus Europe. In terms of design, there are two standalone facilities in Southern California and central Japan with an entire studio devoted to Lexus in Toyota City.

Sales operations also tend to differ according to the region. The organization that manages all United States dealerships, for example, is separate to Toyota headquarters with Lexus showrooms independently owned and operated.

In Japan, on the other hand, all dealerships are owned and operated by Lexus, while several markets such as the UAE differ again by utilizing third-party regional distributors.

Key takeaways:Lexus is a luxury vehicle manufacturer that was founded in 1989 by then-Toyota chairman Eiji Toyoda. The story of Lexus began in 1983 when a team of technicians, engineers, and designers were involved in a secret project to design a new luxury sedan.Toyota is the sole owner of the Lexus brand, but while Toyota is headquartered in Toyota City, Lexus has a separate Japanese headquarters in Nagoya. The two companies made a formal separation in 2005, at which point Lexus began operating its own design, engineering, training, and manufacturing facilities.The degree to which Lexus is distinct from Toyota also varies from one region to the next and is influenced by various brand, design, and sales structures.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Who Ons Lexus? The History of Lexus In A Nutshell appeared first on FourWeekMBA.