Gennaro Cuofano's Blog, page 115

February 23, 2022

Who Owns Publix? The History of Publix In A Nutshell

Publix is an American supermarket chain that was founded in 1930 by George W. Jenkins. The founder named his new company after a cinema chain named Publix Theatres Corporation that was in the process of shutting down. The first Publix supermarket opened in Winter Haven, Florida, with another following suit in 1935. Despite the Great Depression, Jenkins’s stores were financially successful. One particular Publix store also had the distinction of being the first to be fully air-conditioned, while others pioneered the use of so-called “electric-eye” automatic doors which were considered revolutionary in the 1940s. The chain is one of only a few to operate more than 1,000 stores in the United States and employs approximately 227,000 people across the southeast of the country. Publix also has a rather unique ownership structure.

Employee ownershipPublix is now the largest employee-owned grocery store chain in the United States, with employees owning about 80% of the company. This arrangement harks back to the founding days of the company when Jenkins established an employee ownership and profit-sharing scheme. Such was his reverence that before his death in 1996, employees affectionally referred to him as “Mr. George”.

While shares in the company do exist, they are only available for purchase by employees, board members, and individuals in the Jenkins family. Publix is a private company and does not disclose how much its employees hold. However, financial magazine Barron’s estimates that the average employee holds $150,000 in stock and that some stalwarts may have seven-figure holdings.

Publix employees tend to be paid less than their counterparts at Walmart or Costco, but the company has a strong corporate culture because most are happy to work toward the success of the company and be compensated in shares and quarterly dividends. To that end, the company sets the share price each quarter and requires employees to sell back issued shares if they want to cash out.

Jenkins family ownershipThe remaining 20% or so is owned by the Jenkins family which is worth around $8.8 billion. Several members of the Jenkins family, including Walter, daughter Carol, and son Howard become billionaires in the process.

Current CEO Todd Jones became the first member outside the Jenkins family to hold the position. In a similar vein to Publix employees, Jones is paid a salary that is below his industry peers, earning a relatively modest $3.6 million in 2020 when compared to Kroger boss Rodney McMullen’s $22.4 million.

Key takeaways:Publix is an American supermarket chain that was founded in 1930 by George W. Jenkins. The company has a rather unique ownership structure where employees are the majority shareholders.Publix is now the largest employee-owned grocery store chain in the United States, with employees owning about 80% of the company. Publix is a private company that sets a share price and pays dividends to employees every quarter. Exact figures are not disclosed, but some long-term employees are likely to be millionaires on paper.The Jenkins Family owns the remaining 20% of the company, with many occupying senior management roles at one time or another. Like his employees, CEO Todd Jones earns a salary that might be considered meager by his peers but the company is no doubt better off as a result.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Who Owns Publix? The History of Publix In A Nutshell appeared first on FourWeekMBA.

What Is A Foreign Direct Investment?

Foreign direct investment occurs when an individual or business purchases an interest of 10% or more in a company that operates in a different country. According to the International Monetary Fund (IMF), this percentage implies that the investor can influence or participate in the management of an enterprise. When the interest is less than 10%, on the other hand, the IMF simply defines it as a security that is part of a stock portfolio. Foreign direct investment (FDI), therefore, involves the purchase of an interest in a company by an entity that is located in another country.

Understanding foreign direct investmentForeign direct investment is a critical component of growing economies that are transitioning from agriculture and raw material exports to rapid industrialization. The firms in these economies require capital to expand beyond their own borders, while governments use FDI capital to create jobs, build infrastructure, or invest in energy and water security.

Free trade agreements are one way that foreign direct investment can be stimulated. When the North American Free Trade Agreement (NAFTA) was signed between the United States, Canada, and Mexico in 1994, foreign direct investment increased in Mexico by 150% that same year despite economic problems in the country caused by a weakened peso. Canada also benefitted from the agreement, receiving $16 billion in FDI revenue in just five years.

Three components of foreign direct investmentForeign direct investment is comprised of three basic components:

Equity capital – this, as we noted in the introduction, involves an investor purchasing shares in a business located in another country. Once the 10% threshold has been reached, the investor is assumed to have some control over company assets.Reinvested earnings – this describes the investor’s share of earnings that are not distributed as dividends by affiliates or not remitted to the investor. In other words, this is capital that is reinvested into the company.Other direct investment capital or inter-company debt transactions – this encompasses the borrowing or lending of funds between the direct investor and branches, associates, or subsidiaries. These funds may take the form of debt securities or supplier’s credits.Foreign direct investment typesThere are also four general types of foreign direct investment:

Horizontal – where an investor invests funds abroad in the same industry that produces similar products and services. American company Nike may choose to invest in German firm Puma since they are both involved in athletic apparel and sports footwear.Vertical – here, the investment is made within a supply chain that may or may not be the same as the investment firm’s industry. Starbucks, for example, invest in the coffee producers that supply it with premium coffee beans around the world. In some instances, the other company in the supply chain may be acquired completely.Conglomerate – foreign direct investment is said to be conglomerate when there is no relationship between companies or industries. Investors in this scenario sometimes enter into joint ventures to compensate for their lack of experience in an industry.Platform – a more complex form where a business establishes a presence in another country to manufacture products that are then exported to a third country. In a hypothetical example, Volkswagen may invest in manufacturing facilities in China to then export vehicles to other parts of Asia.Key takeaways:Foreign direct investment (FDI) involves the purchase of an interest in a company by an entity that is located in another country. Free trade agreements are one way that foreign direct investment can be stimulated.Foreign direct investment is also critical to the growth of emerging economies. It contains three components that describe the nature of the investment and the entities involved: equity capital, reinvested earnings, and other investment capital or debt transactions.There are four types of foreign direct investment: horizontal, vertical, conglomerate, and platform. Each type is associated with a different investment strategy.Connected Business Concepts The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual.

The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual. Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have. The Buffet Indicator is a measure of the total value of all publicly-traded stocks in a country divided by that country’s GDP. It’s a measure and ratio to evaluate whether a market is undervalued or overvalued. It’s one of Warren Buffet’s favorite measures as a warning that financial markets might be overvalued and riskier.

The Buffet Indicator is a measure of the total value of all publicly-traded stocks in a country divided by that country’s GDP. It’s a measure and ratio to evaluate whether a market is undervalued or overvalued. It’s one of Warren Buffet’s favorite measures as a warning that financial markets might be overvalued and riskier. Warren Buffett is an American investor, business tycoon, and philanthropist. Known as the “Oracle of Omaha”, Buffett is best known for his strict adherence to value investing and frugality despite his immense wealth. He is among the wealthiest people in the world. Most of his wealth is tied up in Berkshire-Hathaway and its 65 subsidiaries.

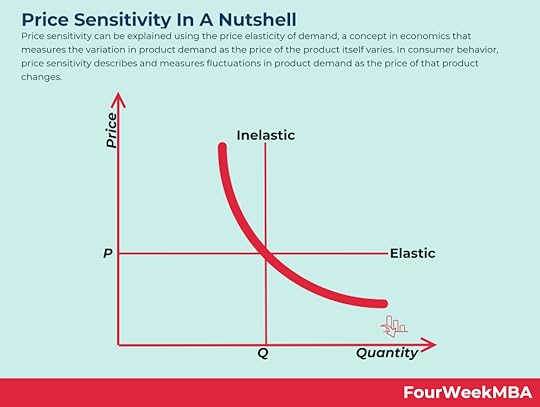

Warren Buffett is an American investor, business tycoon, and philanthropist. Known as the “Oracle of Omaha”, Buffett is best known for his strict adherence to value investing and frugality despite his immense wealth. He is among the wealthiest people in the world. Most of his wealth is tied up in Berkshire-Hathaway and its 65 subsidiaries. Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

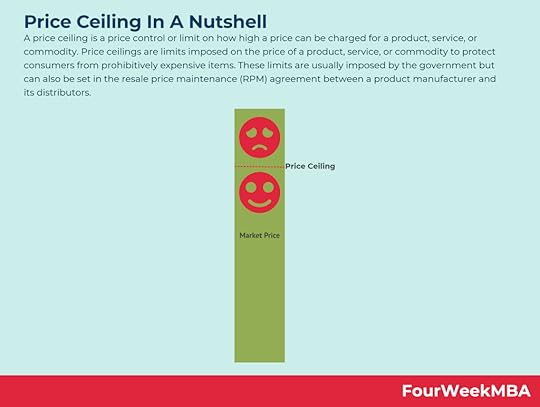

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes. A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.

A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.  Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services. In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is A Foreign Direct Investment? appeared first on FourWeekMBA.

What Is A Greenfield Investment?

Greenfield investments are those where a company establishes a new subsidiary on foreign soil by investing in new facilities such as offices, factories, staff accommodation, and distribution hubs. They are named after the notion that a company launching a new venture from scratch starts with nothing but a green field. A greenfield investment, therefore, is a form of foreign direct investment where a company establishes operations in another country by constructing new facilities from scratch.

Green investment examplesGreenfield investments differ from brownfield investments, where the company purchases or leases existing infrastructure for the same expansionary purpose. The strategy is commonly employed by companies who desire more control over their operations and want to avoid the extra costs associated with intermediaries.

In this section, let’s take a look at some real-world examples:

Toyota Motor CorporationIn 2015, Toyota announced it would be building a new production facility in the Mexican state of Guanajuato. The factory, which would produce the Corolla mid-size sedan, was slated to cost around $1 billion.

HyundaiSouth Korean auto manufacturer Hyundai made a similar commitment in 2006 when it received approval to build a factory in the Czech Republic. The factory opened three years later with an initial capacity of 200,000 vehicles per year, with the Czech government providing incentives to attract Hyundai in the hopes of lowering unemployment and stimulating economic activity in the country.

WeberIn 2021, American outdoor cooking innovation and technology company Weber opened its first manufacturing and distribution hub in southern Poland. The 50,000 square meter facility allows the company to produce high-quality barbecue products for the European market and improve its delivery and service speed in the process.

Advantages and disadvantages of greenfield investmentsAdvantagesControl – as noted earlier, greenfield investments tend to be associated with more control since the company can build its infrastructure to spec without the need to adapt or retrofit. This also the company more control over the quality of its products.Brand reputation – in some cases, a company that commits to establishing a presence in another country and recruits local expertise will enjoy a superior brand reputation. It may also be able to profit from stronger local networks and partnerships.Economic benefits – greenfield investments also come with several economic benefits. Companies sometimes receive incentivization from governments in the form of tax breaks and subsidies and may be able to bypass trade restrictions and import tariffs.DisadvantagesCapital expenditure – greenfield investments require vast sums of money which exposes the company to more risk should the project become unviable for whatever reason. If nothing else, the capital expenditure required is a substantial barrier to entry.Political risk – while a government may initially be supportive of greenfield investment, this can change after an election if a new government takes power and is less supportive of international companies operating within its jurisdiction.Regulations – some countries will also require that the foreign company use domestically manufactured components or services to support their operations. Others will require that a certain percentage of the workforce be comprised of local employees. These requirements can make a greenfield investment problematic for companies that must control every aspect of the process to maintain exacting standards.Key takeaways:A greenfield investment is a form of foreign direct investment where a company establishes operations in another country by constructing new facilities from scratch.Real-world examples of greenfield investment include Toyota in Mexico, Hyundai in the Czech Republic, and Weber in Poland.Greenfield investments can afford the company more control over its foreign operations and grant access to various financial incentives. However, the significant capital expenditure represents a substantial barrier to entry and can make the company more vulnerable to a change in government or regulations.Connected Business Concepts The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual.

The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual. Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have. The Buffet Indicator is a measure of the total value of all publicly-traded stocks in a country divided by that country’s GDP. It’s a measure and ratio to evaluate whether a market is undervalued or overvalued. It’s one of Warren Buffet’s favorite measures as a warning that financial markets might be overvalued and riskier.

The Buffet Indicator is a measure of the total value of all publicly-traded stocks in a country divided by that country’s GDP. It’s a measure and ratio to evaluate whether a market is undervalued or overvalued. It’s one of Warren Buffet’s favorite measures as a warning that financial markets might be overvalued and riskier. Warren Buffett is an American investor, business tycoon, and philanthropist. Known as the “Oracle of Omaha”, Buffett is best known for his strict adherence to value investing and frugality despite his immense wealth. He is among the wealthiest people in the world. Most of his wealth is tied up in Berkshire-Hathaway and its 65 subsidiaries.

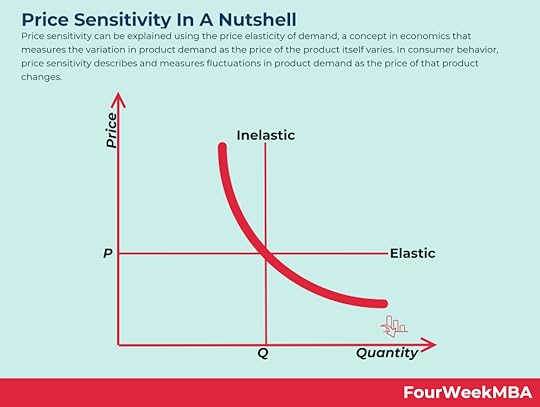

Warren Buffett is an American investor, business tycoon, and philanthropist. Known as the “Oracle of Omaha”, Buffett is best known for his strict adherence to value investing and frugality despite his immense wealth. He is among the wealthiest people in the world. Most of his wealth is tied up in Berkshire-Hathaway and its 65 subsidiaries. Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

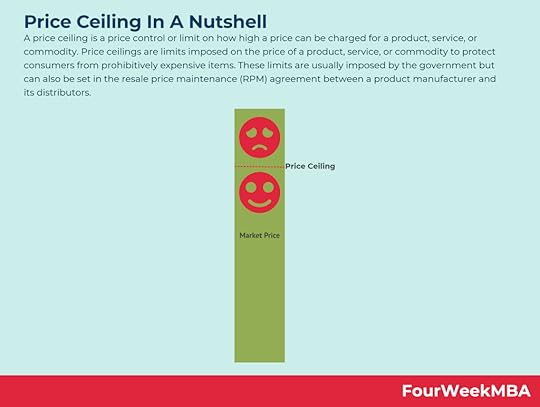

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes. A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.

A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.  Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services. In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is A Greenfield Investment? appeared first on FourWeekMBA.

February 21, 2022

What Is Affinity Marketing? Affinity Marketing In A Nutshell

Affinity marketing involves a partnership between two or more businesses to sell more products. Note that this is a mutually beneficial arrangement where one brand can extend its reach and enhance its credibility in association with the other.

Understanding affinity marketingAffinity marketing is a mutually beneficial partnership between two brands. For this reason, it is sometimes called co-marketing or partnership marketing.

This form of marketing involves a brand collaborating with a related (but non-competing) brand to offer products, services, or benefits that are suitable for each brand’s respective target audience. Marketing efforts carry the branding of both businesses, with each able to access a new market of prospective buyers.

Affinity marketing best practicesTo ensure the partnership is beneficial for both parties, it can be helpful to consider these best practices:

Choose the right partner – an obvious point, but one that is worth explaining further. Companies should always vet potential partners according to whether they share similar values, customers, or possess products that could be considered complementary.Ensure the partnership is mutually beneficial – for the partnership to work, both companies must contribute in unison to deliver mutually beneficial outcomes. In a situation where the partnership is lop-sided or worse still, one-sided, it will be impossible to keep the disadvantaged company interested.Define roles – like any partnership, it is also important to define roles and responsibilities from the outset to avoid confusion and potential conflict later. Two companies that want to create a product, for example, must discuss who is responsible for manufacturing and who will market and sell the product.Focus on communication – in the context of affinity marketing, effective communication means collaborative decision-making in real-time. In many cases, the two brands will require shared access to files and other important assets throughout the campaign. Partner relationship management (PRM) software can be used to onboard partners, protect stored assets, and track sales, among other things.Affinity marketing examplesIn this section, let’s take a look at some affinity marketing examples:

Disney and Lyft – to help families move around the Walt Disney World resort, Disney partnered with Lyft to create the Disney Minnie Van Service. Families can book a ride on the service by using the Lyft app while within the bounds of the resort itself.Chase and British Airways – American credit card company Chase partnered with British Airways to launch a branded British Airways Visa card to its customers. Individuals can use the card to collect the Avios reward currency which can then be redeemed for flights, hotel stays, and car rental.Red Bull and GoPro – with both brands geared toward adventure and extreme sports, affinity marketing was also used to great effect by Red Bull and GoPro. Red Bull once sponsored an attempt to skydive from a balloon, with the diver wearing a GoPro camera to record the action. The two brands continue to enjoy an enduring partnership where GoPro cameras are used in Red Bull sports events such as the Red Bull Rampage mountain bike competition.Key takeaways:Affinity marketing involves a partnership between two or more businesses to sell more products. This is a mutually beneficial arrangement where one brand can extend its reach and enhance its credibility in association with the other.Affinity marketing best practices include choosing the right partner, focusing on communication, defining roles and responsibilities, and ensuring the partnership is mutually beneficial at all times.Affinity marketing has been used in partnerships between Disney and Lyft, Chase and British Airways, and an enduring arrangement between Red Bull and GoPro.Connected Business Concepts

Service. Families can book a ride on the service by using the Lyft app while within the bounds of the resort itself.Chase and British Airways – American credit card company Chase partnered with British Airways to launch a branded British Airways Visa card to its customers. Individuals can use the card to collect the Avios reward currency which can then be redeemed for flights, hotel stays, and car rental.Red Bull and GoPro – with both brands geared toward adventure and extreme sports, affinity marketing was also used to great effect by Red Bull and GoPro. Red Bull once sponsored an attempt to skydive from a balloon, with the diver wearing a GoPro camera to record the action. The two brands continue to enjoy an enduring partnership where GoPro cameras are used in Red Bull sports events such as the Red Bull Rampage mountain bike competition.Key takeaways:Affinity marketing involves a partnership between two or more businesses to sell more products. This is a mutually beneficial arrangement where one brand can extend its reach and enhance its credibility in association with the other.Affinity marketing best practices include choosing the right partner, focusing on communication, defining roles and responsibilities, and ensuring the partnership is mutually beneficial at all times.Affinity marketing has been used in partnerships between Disney and Lyft, Chase and British Airways, and an enduring arrangement between Red Bull and GoPro.Connected Business Concepts

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What Is Affinity Marketing? Affinity Marketing In A Nutshell appeared first on FourWeekMBA.

What Is Buyer’s Remorse? Buyer’s Remorse In A Nutshell

Buyer’s remorse normally occurs after a sizeable purchase has been made. These purchases include expensive items such as cars, homes, shoes, electronics, and exercise equipment. However, the phenomenon can also be observed after smaller purchases involving supermarket groceries, cosmetic items, and kitchen gadgets. Buyer’s remorse, therefore, is a feeling of regret or anxiety that occurs after a purchase is made.

Understanding buyer’s remorseThe negative feelings that arise after such a purchase are caused by cognitive dissonance. This is a form of mental discomfort that arises when the individual holds beliefs, values, or attitudes that conflict with one another.

In the context of consumer psychology, dissonance occurs when the individual wants to do whatever makes them happy in the moment while simultaneously understanding that the purchase comes with inherent risks and consequences. After a purchase is made, a feeling of regret can then take hold as the individual considers alternate courses of action.

The severity of regret – and by extension, buyer’s remorse – is caused by three core factors:

Responsibility – regret may intensify when the individual realizes there is no one to blame but themselves.Effort – or the amount of time or money used in the purchase decision, andCommitment – whether real or imagined, the individual can feel remorse if they believe they must live with the product or service for a long time.What causes buyer’s remorse?According to business information company The Hustle, the five most prevalent reasons (with multiple answers accepted) for buyer’s remorse across more than 2,000 study participants included:

A product that didn’t meet expectations (58%), perhaps in terms of quality or performance.A product the consumer didn’t ultimately use (30%).A product the consumer felt they spend too much money on (20%).The subsequent discovery of a product that represented a better deal (15%), andA product the consumer didn’t ultimately need (15%).How to avoid buyer’s remorseTo avoid buyer’s remorse, there are multiple strategies:

Purchase experiences over material products – experiences such as vacations, concerts, and skydiving tend to result in less buyer’s remorse. This is because it is more difficult to compare one experience to another, reducing the likelihood that an individual will feel regret over a course of action not taken. Research has also shown that experiences create sustainable memories that eclipse the short-term boost in happiness that a material item tends to produce.Err on the side of caution – if there is even the slightest hint of doubt in a purchasing decision, then it is better not to purchase. Why? Because the regret associated with not purchasing a product tends to be less severe than the regret that occurs after a purchase has been made.Avoid sales – sales often cause impulse buying which then leads to regret. Promotional events make it easy to justify a purchase at the time, but no amount of discount can compensate for a product that is unwanted or unneeded. Give to others – for individuals who consider themselves shopaholics, a good way to avoid buyer’s remorse is to simply purchase gifts for others.Focus on personal development – in one study of millennial consumers and financial regret, researchers found that participants were most satisfied with purchases that enriched their own lives, whether that be related to community, arts, healthcare, or education.Key takeaways:Buyer’s remorse is a feeling of regret or anxiety that occurs after a purchase is made. The feeling itself arises due to cognitive dissonance.Buyer’s remorse is caused by a product that didn’t meet expectations or by one that was deemed too expensive or not ultimately used or needed. The presence of a more suitable alternative is also a contributor.Buyer’s remorse can be avoided by purchasing experiences over material items, ignoring sales promotions, buying gifts for others, and focusing on personal development.Connected Business Concepts Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What Is Buyer’s Remorse? Buyer’s Remorse In A Nutshell appeared first on FourWeekMBA.

What Does It Mean To Be Brand Agnostic? Brand agnostic In A Nutshell

Brand agnostic refers to a consumer who does not show a preference for one brand over another. Brand agnostic consumers typically possess several characteristics. They are motivated by discounts and bargains, associate value and inspiration with their consumption, and tend to search for ethical products at the best available price. Brand agnostic consumers contradict themselves to some extent. While they tend to be price conscious, they also purchase based on emotion and spend more money on brands they resonate with. This can cause brand loyalty, the opposite of brand agnosticism.

Understanding brand agnosticismBefore the digital era when communication was more difficult, infrequent, and required numerous barriers to be crossed, businesses needed to establish brand loyalty as a matter of survival.

Today, however, consumers faced with unlimited choice and a limited attention span tend to be more brand agnostic than previous generations. Brand loyalty has been replaced with a desire for new experiences, with a survey finding that 67% chose a product based on a whim or a preference for variety. From the same study, it was also found that 58% of consumers did not care whether a product was for sale under a national, specialty, or store brand.

With that in mind, a brand agnostic consumer is simply one that holds no preference for one brand over another. While the brand does remain an important factor in some purchase decisions, modern consumers now consider a range of other criteria, such as social responsibility, product quality, innovation, healthiness, and of course value. Supply chain disruptions arising from the COVID-19 pandemic also caused a rapid shift to brand agnosticism as consumers rushed to purchase whatever products were still in stock.

Characteristics of a brand agnostic consumerAccording to market research firm Euromonitor International, there are several characteristics of a brand agnostic consumer:

They are motivated by discounts and bargains.They search for the most ethical products at the most attractive prices.They associate value and inspiration with their consumption.They tend to be focused on the quality of a product or service.They are less concerned with notable brands and labels and more concerned with brands that are personable and with whom they can form an emotional connection.They can seamlessly switch between a brand or product, andThey choose products and services that deliver value via innovation.Apparent contradictions of the brand-agnostic consumerEuromonitor International also noted that brand-agnostic consumers tend to contradict themselves. While many of them search for discounts and bargains, they will also tend to spend more money on products they consider inspirational. This means there is a conflict between emotion and logic, with the former likely to cause a connection that results in brand loyalty and not brand agnosticism.

To at least partly address this contradiction, businesses should endeavor to develop simple, cost-effective products that inspire the consumer. The brand behind the product should also have a purpose the consumer can relate to and possess these four qualities:

A customer promise – this must be consistent with brand values and be relevant at all times.Continuous improvement – the business must also derive new insights to make progress. Trust – this can be facilitated with exemplary customer service and an ability to keep pace with dynamic consumer preferences.Innovation – thinking outside the box is also key to combatting brand agnosticism. Connected Business Concepts Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What Does It Mean To Be Brand Agnostic? Brand agnostic In A Nutshell appeared first on FourWeekMBA.

What Is Reverse Marketing? Reverse Marketing In A Nutshell

Reverse marketing describes any marketing strategy that encourages consumers to seek out a product or company on their own. This approach differs from a traditional marketing strategy where marketers seek out the consumer.

Understanding reverse marketingAccording to Cambridge Dictionaries Online, reverse marketing is a strategy that encourages individuals to choose a product or company via “general advertising, rather than marketing to a particular group of possible customers.”

In essence, reverse marketing seeks to build trust with the consumer such that they will seek out a brand of their own volition. Trust, as is the case with most marketing campaigns, is created when the business offers help, advice, or other useful information in such a way that the consumer considers them experts or authorities.

Businesses that use the reverse marketing technique must strike a delicate balance between avoiding coercion and not being so vague that the consumer fails to make the intended connection and chooses a competitor brand instead.

Beauty brand Dove, for example, ran a reverse marketing campaign in 2013 called the Dove Campaign for Real Beauty. The campaign aimed to show women they were more attractive than they supposed. Each woman described themselves to an artist who then sketched a portrait of them, with the portrait then compared to another sketch based on the description of the woman provided by a stranger.

The stranger’s image was invariably more flattering than the one provided by the woman herself, which invoked a powerful emotional connection in viewers and inspired women to consider that they were more beautiful than they thought. Note that Dove was not marketing its products as a way to reduce imperfections or enhance beauty per se. Instead, the company endeavored to reinforce that its brand was committed to enhancing the self-esteem and confidence of women. It was then up to the individual consumer to make the connection between these qualities and Dove’s beauty products.

Reverse marketing best practicesHere are some general tips to implementing a reverse marketing campaign:

Evaluate the business – in other words, how is the product, service, or company itself perceived by the general public? Does the company understand the aspirations and pain points of the target audience? Reverse marketing requires that goals are set and performance evaluated to measure success. Many businesses also use the approach to reposition their brand and set the tone for how they would like it to be portrayed.Do not be invasive – it is important to remain as inoffensive as possible during reverse marketing. Remember, the consumer must feel compelled to seek out the product or company on their own. If email addresses need to be collected, ask for permission first. A video advertising campaign on YouTube, for example, could also be made skippable to ensure consumers do not feel as if they are being forced to sit through a message.Focus on content – the value of premium quality content cannot be overstated. When Dove created their reverse marketing campaign, the company ran a series of professional videos for women of all shapes and sizes with the individual sketching each woman a former forensic artist at the FBI. The videos were released with a frequency that did not overwhelm viewers and touched on meaningful topics that fostered a deeper relationship between the company and its ideal buyers.Use social media – many companies also use Facebook pages, for example, to post relevant and useful content to their audiences. This positions the company as the go-to source for information on a topic. It’s important to provide value first before more strategic posts that sell products start to appear. This approach works equally well on platforms such as Twitter and YouTube.Key takeaways:Reverse marketing describes any marketing strategy that encourages consumers to seek out a product or company on their own.Reverse marketing is effective when the brand can build trust with consumers in its target audience. This can be facilitated by the brand positioning itself as an authority on a subject with information that provides value.Reverse marketing is not too dissimilar to other forms of marketing. Nevertheless, it is important to first evaluate how the business or product is seen by consumers and then set objectives that can be tracked and evaluated. It is also vital to avoid invasive marketing campaigns and instead focus on high-quality content and social media.Connected Business Concepts Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Content marketing is one of the most powerful commercial activities which focuses on leveraging content production (text, audio, video, or other formats) to attract a targeted audience. Content marketing focuses on building a strong brand, but also to convert part of that targeted audience into potential customers.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Integrated marketing describes the process of delivering consistent and relevant content to a target audience across all marketing channels. It is a cohesive, unified, and immersive marketing strategy that is cost-effective and relies on brand identity and storytelling to amplify the brand to a wider and wider audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Grassroots marketing involves a brand creating highly targeted content for a particular niche or audience. When an organization engages in grassroots marketing, it focuses on a small group of people with the hope that its marketing message is shared with a progressively larger audience.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Writing a copy is the art of crafting catchy texts to persuade a particular demographic. “A copy” is the written content aimed at converting impressions to clicks and converting clicks to high sales. Any form of writing that persuasively requests an action from your audience is called copywriting.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What Is Reverse Marketing? Reverse Marketing In A Nutshell appeared first on FourWeekMBA.

February 20, 2022

PayPal Competitors

PayPal is an American multinational fintech company that offers a multitude of money transfer and associated services around the world. The company, which began life as Confinity in 1998, has enjoyed a first-mover advantage in the peer-to-peer payment industry for many years. Today, the company is consistently profitable and many assume that it will continue to grow and maintain market dominance as eCommerce and consumer finance evolves.

Google PayGoogle Pay is not that different from Amazon Pay, Samsung Pay, or even Apple Pay. However, it does come the closest to matching PayPal for functionality and, using the influence of parent company Google, has the ability to pose a serious threat.

Like PayPal, Google Pay users can send and receive money wherever and whenever they want for almost any purpose. Payments can also be attached to Gmail messages and merchants can also use it to manage their businesses and customer loyalty programs.

What’s more, Google does not charge merchants transaction fees for accepting Google Pay in their stores. This makes it a more attractive option than PayPal, with fees as high as 3.49% for sellers in the United States.

PayoneerPayoneer is another American fintech company founded in 2005 that offers online money transfers, digital payment services, and also provides small and medium-sized businesses with working capital. The latter feature makes it popular among eCommerce businesses, online advertisers, freelancers, and even vacation rental owners.

Sending and receiving money between Payoneer is free up to a specified amount. Like services such as TransferWise, the platform also provides a branded debit card so that funds can be withdrawn from ATMs. The same card can also be used as a hybrid credit card, but fees tend to be higher when compared to bank credit cards.

SkrillSkrill was founded as Moneybookers in 2001 by Daniel Klein and Benjamin Kullmann and, just six years later, was one of the top three online payment solution providers in Europe.

Skrill’s merchant fees tend to be lower than those of PayPal, and while the platform has millions of global users, it is not as recognized or widespread as its larger competitor.

Nevertheless, Skrill has an attractive product suite that incorporates forex, cryptocurrency, online games, sports, and betting. However, most enjoy the platform for its digital wallet that has zero withdrawal and deposit fees and the ability to send and receive money for free.

StripeStripe bills itself as “the new standard in online payments” and has millions of businesses on its platform from the smallest startups to the largest corporations. Stripe offers a fully integrated suite of payments products that is more diverse and functional than what PayPal offers.

Stripe fees are also competitive at 2.9% + 30 cents on every transaction in the United States. It may also be more convenient for business owners and consumers since the checkout process is self-hosted. In other words, there is no need to leave a merchant’s site to complete the transaction using an intermediary like PayPal.

Stripe’s API, dubbed Stripe Connect, is also more flexible in terms of payment processing. Transfers between businesses, customers, and recipients are handled with fewer manually initiated transfers, which makes the API ideal for marketplace and software platform business models. This also reduces the likelihood of fraud or delays that result from account holds.

Key takeaways:PayPal is an American multinational fintech company that offers a multitude of money transfer and associated services around the world. The PayPal platform is multi-dimensional and enjoyed a first-mover advantage in P2P transactions, but competitors have emerged to exploit various segments of the consumer and business finance market.Google Pay is not much different from several other payment platforms from other tech companies. However, it does come the closest to matching PayPal for functionality and can leverage the influence of parent company Google to become a serious threat.Other PayPal competitors include business-centric payment platform Payoneer, English digital wallet provider Skrill, and financial services and software company Stripe.See Also: History of PayPal

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post PayPal Competitors appeared first on FourWeekMBA.

Who is Michael Porter?

Michael Eugene Porter is an American academic born on May 23, 1947, in Ann Arbor, Michigan. Porter is widely considered to be the leading authority on business strategy and competitiveness, with his work resulting in several analytical tools and frameworks that are used by business schools, executives, non-profits, and governments alike.

Porter’s graduated with a Bachelor of Science in Engineering from Princeton University in 1969. Two years later, he earned an MBA at Harvard Business School and later went on to secure his doctorate in business economics two years later.

In an interview for the 2010 book The Lords of Strategy, Porter noted that his interest in competition stemmed from a love of sports. As a child, he played basketball, baseball, and football and was even on the NCAA championship golf squad while at Princeton.

Porter is now the author of over 20 books and approximately 125 publications on business, strategy, competition, and health care delivery, among other topics. He has been recognized for his contributions with over 30 major awards and honorary degrees. Indeed, according to Fortunemagazine senior editor Geoff Colvin, Porter “has influenced more executives – and more nations – than any other business professor on Earth.”

Industry competition and company strategyPorter’s earliest work saw him become a pioneer in the application of economic theory to better understand industry competition and how companies chose to compete.

Ideas from books such as Competitive Strategy (1980), Competitive Advantage (1985), and What is Strategy (1996) are taught in almost every business school around the world. Around this time, Porter also developed the Five Forces model to address what he considered to be weaknesses in the popular SWOT analysis.

His initial research into value chains, industry structure, and strategic positioning continues to be relevant in the dynamic and interconnected markets of today.

Economic development and competitivenessPorter is also interested in economic development and competitiveness with a particular focus on microeconomic foundations of regional and national development.

Perhaps his most defining work in this area is the U.S. Cluster Mapping Project, which houses over 50 million data records on industry clusters and business environments to facilitate economic growth and competitiveness.

Porter realized that the ability of the United States to be competitive was dependent on regional economies. For the country to produce quality goods and services, these regional economies needed to become hubs of innovation. Local authorities are now using the data from the project to make strategic decisions, attract new companies, and create new industries.

Environment, health, and societyIn more recent years, Porter started to work in environmental, health, and societal-based contexts.

As early as the 1990s, he was one of the first to posit that increasingly strict environmental standards could coexist with the profitability and competitiveness of a company. This idea was illustrated in the Porter hypothesis, which has since inspired hundreds of scholarly articles in environmental economics.

In the 2000s, Porter shared more visionary ideas on complex topics such as the role of capitalism in philanthropy and corporate social responsibility. In a 2011 paper Harvard Business Review article with Mark Kramer, he argued that some of society’s most wicked problems should be reframed as business opportunities. This the pair called “shared value”, describing policies and practices that increase competitive advantage and simultaneously strengthen the communities in which the company operates.

Since the turn of the millennium, Porter has also been involved in the economics of healthcare. In collaboration with various industry academics, he developed value-based healthcare. This novel approach focuses on patient value and outcomes and clarifies the true cost of healthcare according to specific medical conditions.

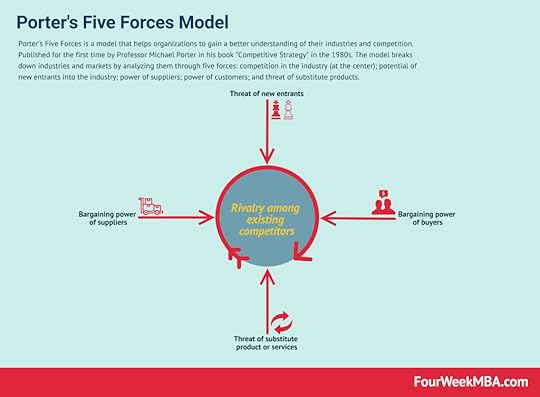

Key takeaways:Michael Porter is widely considered to be the leading authority on business strategy and competitiveness. His work forms the basis of many analytical tools and frameworks used by business schools, executives, non-profits, and governments alike.Michael Porter’s earliest work saw him become a pioneer in the application of economic theory to better understand industry competition, with many of his insights still relevant today. He is also behind the U.S. Cluster Mapping Project which helps regional areas become more innovative and contribute to national competitiveness.In more recent years, Porter has studied competitiveness in environmental, societal, and health-based contexts. He has continued to share revolutionary ideas, such as the impact of environmental standards on profitability and the positive role capitalism can play in philanthropy and corporate social responsibility. Other frameworks by Michael PorterPorter’s Five Forces Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesPorter’s Generic Strategies

Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesPorter’s Generic Strategies

In his book, “Competitive Advantage,” in 1985, Porter conceptualized the concept of competitive advantage, by looking at two key aspects. Industry attractiveness, and the company’s strategic positioning. The latter, according to Porter, can be achieved either via cost leadership, differentiation, or focus.Porter’s Value Chain Model

In his book, “Competitive Advantage,” in 1985, Porter conceptualized the concept of competitive advantage, by looking at two key aspects. Industry attractiveness, and the company’s strategic positioning. The latter, according to Porter, can be achieved either via cost leadership, differentiation, or focus.Porter’s Value Chain Model

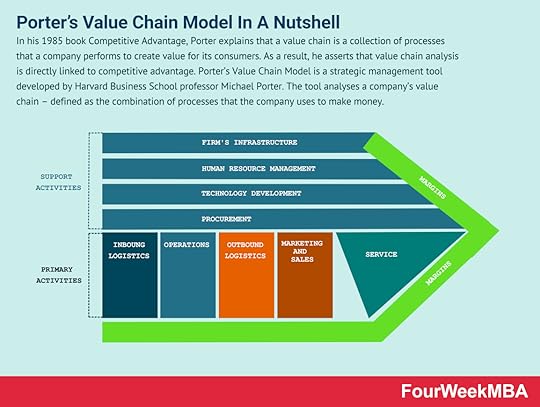

In his 1985 book Competitive Advantage, Porter explains that a value chain is a collection of processes that a company performs to create value for its consumers. As a result, he asserts that value chain analysis is directly linked to competitive advantage. Porter’s Value Chain Model is a strategic management tool developed by Harvard Business School professor Michael Porter. The tool analyses a company’s value chain – defined as the combination of processes that the company uses to make money.Porter’s Diamond Model

In his 1985 book Competitive Advantage, Porter explains that a value chain is a collection of processes that a company performs to create value for its consumers. As a result, he asserts that value chain analysis is directly linked to competitive advantage. Porter’s Value Chain Model is a strategic management tool developed by Harvard Business School professor Michael Porter. The tool analyses a company’s value chain – defined as the combination of processes that the company uses to make money.Porter’s Diamond Model

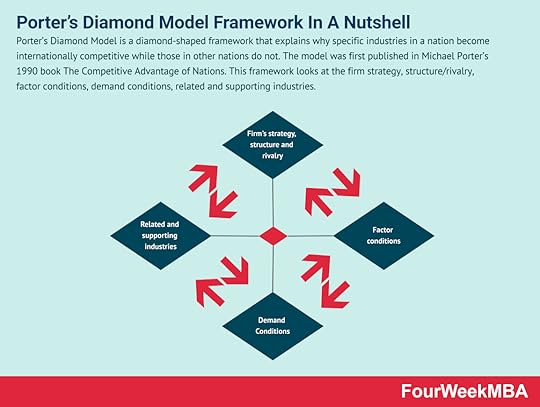

Porter’s Diamond Model is a diamond-shaped framework that explains why specific industries in a nation become internationally competitive while those in other nations do not. The model was first published in Michael Porter’s 1990 book The Competitive Advantage of Nations. This framework looks at the firm strategy, structure/rivalry, factor conditions, demand conditions, related and supporting industries.Porter’s Four Corners Analysis

Porter’s Diamond Model is a diamond-shaped framework that explains why specific industries in a nation become internationally competitive while those in other nations do not. The model was first published in Michael Porter’s 1990 book The Competitive Advantage of Nations. This framework looks at the firm strategy, structure/rivalry, factor conditions, demand conditions, related and supporting industries.Porter’s Four Corners Analysis

Developed by American academic Michael Porter, the Four Corners Analysis helps a business understand its particular competitive landscape. The analysis is a form of competitive intelligence where a business determines its future strategy by assessing its competitors’ strategy, looking at four elements: drivers, current strategy, management assumptions, and capabilities.Six Forces Models

Developed by American academic Michael Porter, the Four Corners Analysis helps a business understand its particular competitive landscape. The analysis is a form of competitive intelligence where a business determines its future strategy by assessing its competitors’ strategy, looking at four elements: drivers, current strategy, management assumptions, and capabilities.Six Forces Models

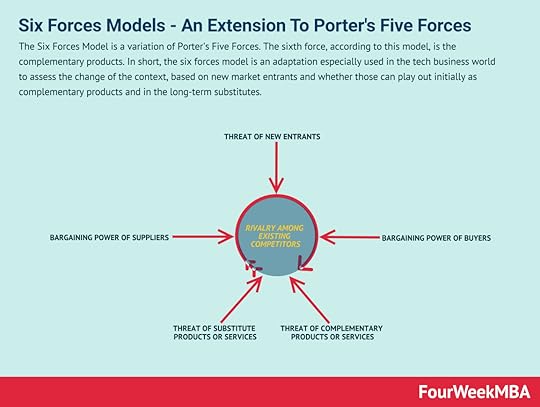

The Six Forces Model is a variation of Porter’s Five Forces. The sixth force, according to this model, is the complementary products. In short, the six forces model is an adaptation especially used in the tech business world to assess the change of the context, based on new market entrants and whether those can play out initially as complementary products and in the long-term substitutes.

The Six Forces Model is a variation of Porter’s Five Forces. The sixth force, according to this model, is the complementary products. In short, the six forces model is an adaptation especially used in the tech business world to assess the change of the context, based on new market entrants and whether those can play out initially as complementary products and in the long-term substitutes.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post Who is Michael Porter? appeared first on FourWeekMBA.

What happened to Teavana?

Teavana began its life as American tea company Teavana Corporation, which was founded in 1997 by husband-and-wife team Andrew and Nancy Mack. The first store was funded with the pair’s life savings, with its success allowing them to open subsequent stores in the years that followed. To accelerate the growth of the company, the Macks used the franchise model for a while but then had a change of heart and decided to buy out all of their franchisees. A substantial investment from SKM Growth Investors in 2005 set Teavana on a growth trajectory that allowed the company to open 50 stores and expand internationally. Six years later, the company debuted on the New York Stock Exchange, raised $121 million, and had close to 180 stores in several countries.

In 2017, however, every single one of Teavana’s 379 locations was shut down with more than 3,200 employees losing their jobs.

Starbucks acquisitionIn November 2012, Starbucks announced it had entered into a merger agreement with Teavana to acquire it for $620 million.

The coffee giant then embarked on an aggressive expansion strategy to open new stores, with tea bars also opened in New York City and Beverley Hills that gave consumers a tactile tea experience and allowed them to engage with the brand.

This strategy worked for a while since, at the time, the specialty tea products that Teavana sold were difficult to source and were somewhat of a novelty. What’s more, eCommerce had not yet taken off and most consumers shopped in malls where most Teavana stores were located.

Store closuresAs early as 2016, however, Teavana’s bricks-and-mortar stores started to feel the pressure from online sales. Tea bars were shut down and redesignated as Starbucks stores, but the company nevertheless continued its international expansion and entered into several high-profile partnerships. Teavana was particularly successful in countries such as China and India where there was a large cohort of tea drinkers.

CEO Howard Schultz saw the writing on the wall in April 2017, however, questioning whether the promotion of Teavana in physical stores was the correct strategy. A few months later, it was announced that all 379 stores would close.

Then VP of concept development and franchising Charlie Cain had this to say: “While tea has consistently been among the fastest-growing categories within Starbucks stores, maintaining Teavana as a stand-alone chain dedicated to bulk-tea and accessories proved to be a less efficient and profitable strategy for driving tea consumption and revenue.”