Gennaro Cuofano's Blog, page 107

March 26, 2022

What happened to Second Life?

Second Life is an online multimedia platform where users can create a personalized avatar and interact with a virtual world. The platform was created by Philip Rosedale, who in 1999 formed Linden Lab to create hardware that would enable people to become immersed in other worlds.

Over the subsequent years, Rosedale shifted his focus toward software, releasing the application Linden World where users could complete task-based games and “socialize” in a three-dimensional online environment. In October 2002, Linden World was renamed Second Life with some early creators spending as many as 60 hours per week on the platform.

The platform was initially popular with over 2 million registered accounts by January 2007. At its peak, tech companies such as IBM and Dell created virtual offices within the Second Life world and bands played live gigs. Second Life surpassed 36 million accounts by 2013, but the popularity of the platform vanished almost as quickly as it appeared. Today, estimates suggest there are only around 900,000 active users.

Social networksAfter the platform peaked around 2007, the emergence of social media networks like Facebook, Twitter, and YouTube caused a slow and steady decline in the number of Second Life users.

Social media networks took many users away from Second Life primarily because they were the next big thing. There was also another key difference. Facebook, for example, did not require users to be on its network at the same time. Indeed, as long as there were frequent posts and status updates, users remained engaged with the platform. In Second Life, however, users needed to be online at the same time to interact. As a result, those who were online found that special events and other aspects of the platform were poorly attended and utilized.

What’s more, it became difficult to convince users to stay in a virtual world when they could interact with friends in the real world online – particularly when considering the issues mentioned in the following sections.

Usability issuesWhile Second Life was one of the first incarnations of the metaverse, it was to some extent ahead of its time. To run properly, the platform required a computer with a dedicated graphics card that most simply did not have. This problem was exacerbated by a shift toward laptops with slower integrated graphics cards that rendered Second Life slow or unresponsive.

Even those with access to more powerful computers found that the platform suffered from inadequate broadband speeds in most countries.

Learning curve and product confusionAnother factor affecting usability was the steep learning curve of Second Life and confusion as to whether it was a game, a social network, a virtual world, or all of the above.

The immense learning curve of Second Life was admitted by Rosedale in a 2016 interview with CNET: “Although Second Life is still challenging to get used to, about 10 percent of newly created residents are still logging [in] weekly, three months later.”

In essence, Second Life was hard to learn because with the world at their fingertips, individuals could not decide what to do or where to go. When they did decide on a course of action, it sometimes took hours to figure out how to complete simple actions like sitting down or initiating a conversation.

The usability issues combined with confusion over the product caused many to lose interest in the platform very quickly.

ControversiesLike many similar platforms that are loosely regulated, Second Life has attracted its fair share of controversies that have caused reputational harm. The platform has hosted several virtual riots and Ponzi schemes based on the in-game currency.

It has also been associated with increased cybersecurity risks around personal data and potential violations of anti-money laundering laws. At one point, the platform’s casinos were also visited by the FBI as part of a crackdown on offshore gambling websites.

Key takeaways:Second Life is an online multimedia platform where users can create a personalized avatar and interact with a virtual world. Second Life surpassed 36 million accounts by 2013, but the popularity of the platform vanished almost as quickly as it appeared.Second Life suffered from the rise of social media networks in the late 2000s, which did not require users to be online at the same time to interact. The game also experienced usability issues since it required a dedicated graphics card to run. Usability problems were also compounded by the fact that the product was poorly defined and required a steep learning curve that many were not willing to commit to.Second Life was also not immune to many of the controversies that plague loosely regulated online platforms. These include actual or alleged instances of money laundering, Ponzi schemes, illegal gambling, and cybersecurity risks.Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What happened to Second Life? appeared first on FourWeekMBA.

What happened to Ask Jeeves?

Ask Jeeves, now known as Ask.com, was a question-and-answer and search engine business that was founded in 1996 by David Warthen and Garrett Gruener.

Ask Jeeves was based on the eponymous character Jeeves, a butler named after a valet in a series of fictional books from author P. G. Wodehouse. Visitors to the site would type in a question and be directed an answer from crawler-based results, paid Google listings, or content from the Ask Jeeves editorial team. Some of the more difficult questions were sent directly to a site editor, with some paid and others volunteering their time and expertise.

All appeared well at the company after an IPO in 1999 worth $42 million and more than one million daily searches on the Ask Jeeves website. Less than seven years later, however, the Ask Jeeves brand was formally retired and the company made a belated but ultimately successful business model pivot.

Search engine wars and the dot-com bubbleAsk Jeeves existed at a time in the late 1990s and early 2000s characterized by heavy competition in the search industry. Google had formed in 1997, but there were also more established players such as AltaVista, Excite, Yahoo!, and Lycos.

This period was characterized by numerous companies competing to secure market share in what was an exciting time of possibility on the internet. Unfortunately, this period was also characterized by intense speculation in internet-based companies that ultimately could not be sustained.

When the dot-com bubble burst, Ask Jeeves posted a $425 million loss in 2001 and teetered on the edge of bankruptcy.

Site reconfigurationRealizing something needed to change, Gruener decided to make Ask Jeeves more of a traditional search engine and less of a question-and-answer platform. Jeeves himself was recast as something akin to a mascot rather than a provider of knowledge.

Thanks to an ad revenue deal struck with Google, the company returned to profit in 2003. However, it’s important to note that Google Adwords had already secured 32% of the market by this point. By comparison, Ask Jeeves held a paltry 3%.

AcquisitionInterActive Corp. (IAC) acquired Ask Jeeves for $1.85 billion in 2005. At the head of IAC was Barry Diller, who purchased the platform with the belief that he could take significant market share from Google, Yahoo, and MSN. These three competitors accounted for 83% of all web searches and, thanks to lucrative advertising revenue, had access to deep talent pools and vast amounts of resources.

To better compete in the industry, Ask Jeeves made several acquisitions and invested heavily in advertising as the business model pivoted to one based on search engine traffic. Ask Jeeves became Ask.com in 2006 and any trace of Jeeves the butler was removed.

Business model pivotAsk Jeeves was initially popular because of its user experience. Indeed, asking a butler to answer a question was a novelty at a time when the powerful search engines we take for granted today did not exist.

However, the platform ultimately failed because of the pivot from a question-and-answer platform to a search engine. Ask Jeeves effectively entered the industry at walking speed while players such as Google were already sprinting.

To some extent, Ask Jeeves was doomed either way. As web users became accustomed to the streamlined interface and functionality of search engines, few were willing to endure the hassle of asking using Ask Jeeves when Google could deliver multiple answers in a fraction of a second.

Key takeaways:Ask Jeeves, now known as Ask.com, is a question-and-answer and search engine business that was founded in 1996 by David Warthen and Garrett Gruener.When the dot-com bubble burst, Ask Jeeves entered into an ad-revenue share agreement with Google. Over the following years, it progressively shifted from a question-and-answer platform to one more closely resembling a search engine.Ask Jeeves was acquired by InterActive Corp. in 2005 with then-CEO Barry Diller instituting several acquisitions and a formal business model pivot to take market share from Google, Yahoo, and MSN. Ultimately, these companies had too much of a head start, and Ask Jeeves could not compete with their talent pool or resources.Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What happened to Ask Jeeves? appeared first on FourWeekMBA.

What happened to Justin.tv?

Justin.tv was a website that enabled anyone to broadcast online video on a personalized user account, otherwise known as a channel. It was created in 2007 by Justin Kan, Emmett Shear, Michael Siebel, and Kyle Vogt, initially as a way for Kan to broadcast his life 24/7.

Thanks in part to users who broadcasted live sport on the platform, Justin.tv more than tripled its user base to reach 21 million by October 2009. Less than two years later, however, Justin.tv became part of a new site called Twitch and the brand was officially shut down in August 2014.

Illegal contentMuch of the platform’s early success can be attributed to users who broadcasted sports matches without a license to do so. Traffic spiked appreciably on the weekends, particularly during football season and events such as the NCAA basketball tournament.

Inevitably, this attracted the attention of official broadcasters, with Siebel called to testify at a hearing into sports piracy in late 2009. He noted that while Justin.tv took steps to remove pirated content when a complaint was made, it was unrealistic to expect site administrators to monitor every single account. Such was the influence of Justin.tv that it also attracted the ire of sports broadcasters in the United Kingdom and Australia

After the UFC and a boxing promoter filed lawsuits, the company made a more concerted effort to remove illegal broadcasts. Traffic then plummeted by as much as 20% in 2010, representing a drop of approximately 5 million users. One user noted that ”Justin.tv is basically unusable at this point.” To compound the problem, Justin.tv’s association with pirated material made it difficult to attract serious investment capital.

Pivot to gamingAround 2011, the Justin.tv co-founders had a stagnant business with no real purpose. However, the lawless nature of the platform and the freedom it afforded users had resulted in the formation of a passionate video game streaming niche.

At the time, Kan disliked the niche because it required a lot of bandwidth and he didn’t understand why users would want to spend their time watching others play video games. But irrespective of Kan’s grievances, traffic data suggested this was exactly what Justin.tv users were doing. Emmett Shear, himself a gamer, noted that with some added features and embedded advertising, the niche had the potential to become profitable.

TwitchThe video game category from Justin.tv was then spun out to a new site called Twitch in June 2011. Three years later, Twitch was so popular that the entire company became known as Twitch Interactive and the Justin.tv brand was formally retired soon after.

Amazon purchased Twitch in August 2014 for $970 million in cash.

Key takeaways:Justin.tv was a website that enabled anyone to broadcast online video from a personalized user account. It was created by Justin Kan, Emmett Shear, Michael Siebel, and Kyle Vogt in 2007 as a way for users to broadcast their daily lives.Justin.tv was an instant success thanks mostly due to users who illegally streamed sports matches. When the company was sued for broadcasting pirated material, traffic dropped and growth stagnated.Justin.tv then pivoted to video game streaming after the co-founders noticed it was starting to become popular with users. The niche was then spun out into a website called Twitch that eventually became the company’s sole focus. The Justin.tv brand was formally retired in August 2014.Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What happened to Justin.tv? appeared first on FourWeekMBA.

What happened to Vevo?

Vevo is a multinational video hosting service that is most well-known for uploading music videos on YouTube. The company has also produced content for distribution across various online platforms and hardware devices such as smart televisions.

The service was founded in 2009 as a joint-venture between three record companies: Sony Music Entertainment, Universal Music Group, and EMI. Initially, Vevo entered into an ad-revenue share agreement with Google where music videos would be hosted on YouTube. Vevo’s own website was launched at the same time, featuring around 30,000 videos from some of the world’s most popular music artists.

In May 2018, Vevo announced that it would focus on YouTube syndication and shut down its website and app. Considering the company’s website saw 25 billion views per month and featured over 330,000 videos, many saw this as a somewhat perplexing decision.

World domination and complacencyVevo had dreams to become a world-dominating company early in its existence. For one, it had an immensely popular website and companion app. Vevo also owned most, if not all, of the world’s most famous music artists and their music. The company had unbridled power that it used to sell merchandise, control advertisers, and even add its brand name to the names of individual artists’ YouTube channels.

Over time, this power caused complacency within the company. With its sleek website and advertising revenue that it did not have to share with YouTube, Vevo believed the agreement with the video platform was unnecessary.

The ramifications for Vevo’s plans did not go unnoticed in the industry. Parting ways with YouTube would mean that almost every music video would have to be pulled from the site save for indie tracks. Many were also fearful that with every music video found in only one place, Vevo would implement a subscription model and charge consumers for music videos that had always been free.

Website and applications shutdownIn May 2018, YouTube announced the new streaming service YouTube Music which would feature a mobile app specifically created to play music including live versions, covers, remixes, and rare tracks. This placed extra pressure on Vevo, which was already unable to compete with YouTube’s market dominance and a new player called Spotify.

With most of Vevo’s ad revenue sent to record producers and YouTube and the company unable to raise capital from its majority owners, Vevo made the decision to shut down its website and apps three days later. The company then decided to focus on advertising on its distribution platforms and the sponsorship of video premieres. Primarily, this involved a renewed focus on YouTube and a new partnership.

YouTube partnershipPerhaps sensing it would never become a powerful, standalone entity, Vevo entered into a new agreement with YouTube where the video site would sell Vevo’s music clips directly to advertisers. Before the deal was struck, Vevo and its sales team had first access to this revenue source with Google earning what it could from automated ads.

While the merit of the deal was debated for some time, it was noted that Google’s team of over 15,000 sellers would generate more ad revenue for both companies irrespective of which made the sale. What’s more, Vevo videos would become part of YouTube’s “Google Preferred” tier which houses the platform’s most valuable, brand-safe content. YouTube chief business officer Robert Kyncl noted that “the availability of Vevo in Google Preferred enables UMG, Sony, and Vevo to participate in YouTube’s premium inventory sold to advertisers. It also increases the sales force deployed against music videos and maximizes revenue for artists and songwriters.”

Today, the Vevo website remains and content can be watched on a plethora of devices and networks including Apple TV, Comcast, Fetch, Foxtel, Roku, Fire TV, Virgin Media, and T-Mobile.

Key takeaways:Vevo is a multinational video hosting service that is most well-known for uploading music videos on YouTube. The service was founded in 2009 as a joint-venture between Sony Music Entertainment, Universal Music Group, and EMI.Vevo wanted to become a dominant company in the music industry but ultimately underestimated the size, power, and influence of YouTube. Many feared the company would pull its music from YouTube and charge consumers a subscription fee to access the content on its own website.Receiving a relatively small percentage of ad revenue and unable to raise the capital to expand, Vevo perhaps reluctantly entered into a new agreement with YouTube to become one of its preferred brands.Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What happened to Vevo? appeared first on FourWeekMBA.

What happened to Flappy Bird?

Flappy Bird is a mobile, arcade-style side-scroller game where players endeavor to fly birds between green pipes without hitting them. The game was created by Vietnamese programmer and video game artist Dong Nguyen in 2013.

Flappy Bird was an instant success, surpassing 50 million downloads in the first few days after its release and earning Nguyen over $50,000 per day in advertising revenue. In February 2014, however, Flappy Bird was removed from the App Store and Google Play despite becoming the most downloaded free game for iOS the previous month.

Negative reviewsDespite its popularity, the game was not immune from negative reviews. Some criticized Flappy Birds for its extreme level of difficulty, while others believed Nguyen had blatantly copied ideas from the Mario Bros franchise. However, there was never evidence that Flappy Birds had infringed on any copyrights.

It was also alleged that Nguyen had purchased installs from bot farms to make the game appear more popular than it actually was. But when one considers the advertising revenue he collected, this seems unlikely.

ShutdownIn early 2014, Nguyen announced he would be shutting Flappy Bird down forever: “Flappy Bird was designed to play in a few minutes,” he said in an interview with Forbes. “But it happened to become an addictive product. I think it has become a problem. To solve that problem, it’s best to take down Flappy Bird.”

It was also apparent that the creator was uncomfortable with the sudden fame to which he was exposed. Nguyen was bombarded with interview requests from national and international news outlets and even appeared on television in Vietnam.

Of course, Flappy Birds remained available to play on smartphones that had downloaded the app before it was pulled. Some of these phones were placed on auction sites to be sold off before they too were removed for violations.

RebirthSix months after Flappy Birds was shut down, a game called Flappy Birds Family then appeared in the Amazon Appstore for Fire TV. Amazon confirmed that the multiplayer version of the game was from the same developer, though it did not disclose whether any money changed hands.

Wisconsin-based electronics firm Bay Tek Entertainment then released an arcade version of the original game in 2015 on a 42-inch screen with a single, giant red button to control each bird.

Key takeaways:Flappy Bird is a mobile, arcade-style side-scroller game where players endeavor to fly birds between green pipes without hitting them. The game was created by Vietnamese programmer and video game artist Dong Nguyen in 2013.Flappy Birds was ultimately shut down because Nguyen was uncomfortable with the game’s addictiveness and did not enjoy the increased attention he received from the press. A family edition of Flappy Birds reappeared in the app store for Amazon Fire TVs a few months later, with the eCommerce giant confirming that it was from the same developer. An official arcade version was also released in 2015.Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What happened to Flappy Bird? appeared first on FourWeekMBA.

What happened to SmallWorlds?

SmallWorlds was a social network service and virtual online world that was created by New Zealand-based company Outsmart Games. The platform, which was created by Mitch Olson and Darren Green, was free to play and ran on Flash within web browsers.

SmallWorlds was released on 1 December 2008 and reached seven million users by 2016. Two years later, it was announced via Twitter that SmallWorlds would be shutting down.

Financial difficultiesThe first signs of financial trouble arose in 2015 when SmallWorlds held an event to increase purchases from the online store and also of Gold and VIP memberships. The company claimed that due to a shrinking audience, it was finding it difficult to meet server running costs.

Unfortunately, the company failed to meet its fundraising target for the event. On a Reddit FAQ page, the co-founders essentially admitted defeat: “We needed to see a wider gamut of support beyond the regulars which frequent our Store. Relying further on less-than-5% of supporting players was not going to work for us going-forward.”

A lack of financial interest in the game was compounded by the rising cost of server maintenance. Since SmallWorlds was based in New Zealand, it was at the mercy of unfavorable currency exchange rates. Ultimately, the increase in server costs outpaced the increase in users and the survival of the company became a very simple equation.

Mobile gamesAfter the game was shut down in 2018, Olson and Green also acknowledged that a lot had changed within the industry in the previous decade.

The shift toward mobile-based platforms and other forms of entertainment was one contributing factor, with SmallWorlds only available on desktops. When Adobe Flash was flagged for removal from web standards, this only made the problem worse.

RebirthIn December 2018 a prototype based on the original SmallWorlds platform was released. Dubbed TownCenter, the prototype served as an experiment to determine how much the user community could grow and support a viable business. The app is currently unavailable for download in the App Store.

On February 27, 2022, a new platform called Smallworlds Rewritten (SWR) was announced. The new iteration is not affiliated with Outsmart Games, instead developed by a team of ex-SmallWorlds players and moderators. It is scheduled for release later in 2022.

Key takeaways:SmallWorlds was a social network service and virtual online world that was created by New Zealand-based company Outsmart Games in 2008. Despite a user base of 7 million in 2016, the platform was shut down two years later.Financial trouble was made public in 2015 when SmallWorlds held an event to raise money to keep its servers running. A shift toward mobile-based gaming and an announcement concerning the end of Adobe Flash did not help the company’s cause. Ultimately, SmallWorlds was not sustainable because server maintenance costs outpaced growth in the user base.On February 27, 2022, a new platform called Smallworlds Rewritten (SWR) was announced. Created by a team of ex SmallWorlds players and moderators, it is scheduled for release later this year.Read More:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What happened to SmallWorlds? appeared first on FourWeekMBA.

Airbnb Unit Economics

As a peer-to-peer platform, once the transaction between host and guest goes through, Airbnb will collect a fee from both key players. As an example from a $100 booking per night set by the host, Airbnb might collect $3 as a hosting fee. While it might increase the price for the guest at $116 ($16 above the price set by the host) to collect its guest fees of $12 and taxes for the remaining amount.

Therefore, for a similar transaction, Airbnb will collect $15, the host will make $97 from an initial set price at $100, and the guest will pay $116 (tax comprised).

Image Source: Airbnb Financial Prospectus

Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.

Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.  The Airbnb story began in 2008 when two friends shared their accommodation with three travelers looking for a place to stay. Just over a decade later, it is estimated that the company now accounts for over 20% of the vacation rental industry. As a travel platform, Airbnb competes with other brands like Booking.com, VRBO, FlipKey, and given its massive amount of traffic from Google. Also, platforms like Google Travel can be considered potential competitors able to cannibalize part of Airbnb’s market.

The Airbnb story began in 2008 when two friends shared their accommodation with three travelers looking for a place to stay. Just over a decade later, it is estimated that the company now accounts for over 20% of the vacation rental industry. As a travel platform, Airbnb competes with other brands like Booking.com, VRBO, FlipKey, and given its massive amount of traffic from Google. Also, platforms like Google Travel can be considered potential competitors able to cannibalize part of Airbnb’s market.

Read Next: Airbnb Business Model.

The post Airbnb Unit Economics appeared first on FourWeekMBA.

Airbnb Statistics

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. In 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, of $155.94.

Key FactsTotal Revenues in 2021$5.99 BNet Losses in 2021-$352 MillionFoundersBrian Chesky, Nathan Blecharczyk, Joe GebbiaYear & Place FoundedAugust 2008, San Francisco, CAAirbnb’s first investorY Combinator, on January 2009Year of IPODecember 10, 2020IPO Price$146.00Total Revenues at IPO$2.5 billion as of Nine Months Ended on September 30, prior to the IPOAirbnb Employees6,132 employees in 27 cities around the worldRevenues per Employee$977,129.81Key Financial Facts (Analysis by FourWeekMBA)2021Gross Booking Value$46.9 BillionRevenue$6 BillionNights and Experiences Booked$300.6 MillionAverage Service Fee12.78%Average Value per Booking$155.94

Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.

Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.  The Airbnb story began in 2008 when two friends shared their accommodation with three travelers looking for a place to stay. Just over a decade later, it is estimated that the company now accounts for over 20% of the vacation rental industry. As a travel platform, Airbnb competes with other brands like Booking.com, VRBO, FlipKey, and given its massive amount of traffic from Google. Also, platforms like Google Travel can be considered potential competitors able to cannibalize part of Airbnb’s market.

The Airbnb story began in 2008 when two friends shared their accommodation with three travelers looking for a place to stay. Just over a decade later, it is estimated that the company now accounts for over 20% of the vacation rental industry. As a travel platform, Airbnb competes with other brands like Booking.com, VRBO, FlipKey, and given its massive amount of traffic from Google. Also, platforms like Google Travel can be considered potential competitors able to cannibalize part of Airbnb’s market.

Read Next: Airbnb Business Model.

The post Airbnb Statistics appeared first on FourWeekMBA.

March 24, 2022

History of Facebook

Starting as a social experiment, at Harvard University, back in 2004, Facebook quickly expanded to reach over 1 million monthly active users by the end of the same year. By early 2005, Facebook was already present in 800 college networks. By 2012, as Facebook got ready for its IPO, the company reached over a billion monthly active users.

The early daysIn 2021, Facebook became the largest social media site in the world after amassing almost 3 billion users. Around half of these were using the platform daily. The story of how Facebook came to become the behemoth it is today has been told many times over, with much of it immortalized in the 2010 movie The Social Network.

Believe it or not, the company is now more than 18 years old and has recently started a new chapter in its life under the name Meta. Let’s tell the story of the history of Facebook with a particular focus on its earliest years.

FacemashWhile CEO Mark Zuckerberg was a second-year student at Harvard, he created a website called Facemash. After hacking into Harvard’s security network, he populated Facemash with the identification photo of every student on campus.

The site, which asked students to rate others based on how attractive they were, was launched on October 28, 2003, and almost immediately shut down three days later by the university. Zuckerberg came close to expulsion for his efforts, but the charges laid against him were eventually dropped.

TheFacebookIn early February of 2004, Zuckerberg launched TheFacebook, a site named after directories that were handed out to new Harvard students to facilitate introductions. TheFacebook was funded with fellow student Eduardo Saverin, with both Saverin and Zuckerberg pitching in $1,000.

Zuckerberg once again attracted the ire of Harvard University, with some classmates claiming he stole their idea to build a similar social network known as HarvardConnection.com. In 2008, Zuckerberg would ultimately settle the matter for 1.2 million shares worth $300 million.

In any case, membership to TheFacebook was initially restricted to any student at Harvard College. Within a month, more than 50% of all undergraduates had signed up. In March 2004, membership eligibility extended to students at Columbia, Yale, Stanford, all Ivy League Colleges, and eventually most of the universities in the United States and Canada.

FacebookSean Parker then became the company president in June 2004 as the headquarters moved to Palo Alto, California. Parker was one of the co-founders of Napster and was instrumental in securing Facebook’s first round of investment funding from PayPal co-founder Peter Thiel.

In 2005, TheFacebook shortened its name to Facebook after purchasing the Facebook.com domain name for $200,000. More funding was secured in May and the company expanded once more to become available for high school students and Apple and Microsoft employees, among other companies.

Finally, in September 2006, the platform was opened to anyone and everyone above the age of 13 with a valid email address. Around this time, Zuckerberg turned down a $1 billion offer from Yahoo to purchase Facebook, feeling that the company had undervalued his social network. He also introduced the News Feed which continues to be a mainstay of the social network today.

In February 2009, the iconic Like button was introduced. The platform experienced meteoric growth in the following years, surpassing 300 million members in September 2009 and 500 million in July 2010. From this point onward, the company would never be headed.

Key takeaways:While eventual CEO Mark Zuckerberg was a second-year student at Harvard, he created a website called Facemash featuring the identification photos of every student on campus. Since Zuckerberg had hacked his way into Harvard’s systems, Facemash was shut down after three days.An iteration of Facemash called TheFacebook was launched in early 2004, named after the Harvard directories that were handed out to students to help them become acquainted with one another. Zuckerberg was sued by several of his classmates who claimed he stole the idea for TheFacebook from a similar platform they were creating at the time.TheFacebook became Facebook in 2005 as the platform was progressively opened up to all universities students in North America, various companies, and then anyone over the age of thirteen with an email address. Three years after it was open to the general public, Facebook had already amassed 500 million users.Read Next: Facebook Business Model.

The post History of Facebook appeared first on FourWeekMBA.

How Does Airbnb Make Money? Airbnb Business Model – Updated 2022

Airbnb is a platform business model making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%. For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.

Airbnb business model evolutionIt was 2007, Brian Chesky and Joe Gebbia were trying to make extra income to pay their rent. Chesky and Gebbia, friends from design school, saw a big opportunity when back in 2007, a large international design conference was about to be hosted in San Francisco.

It wasn’t unusual to have all hotels sold out during these large conferences. However, at that time, Chesky and Gebbia swiftly built a website, which they called AirBedandBreakfast.com (their guests would sleep on air beds), and surprisingly rented it to three designers that were attending the conference.

As Chesky and Gebbia recalled, at the time, most people thought the idea was crazy as strangers would have never accepted to “stay in each other’s homes.”

And yet, that first weekend, something interesting happened. As the three designers had rented the air beds at Chesky and Gebbia apartment, they realized the potential of offering an experience as a local to someone coming from out of town.

Indeed, that was one of the key elements that would make Airbnb different, from the traditional Hotel. It wasn’t just a room, but potentially a whole end-to-end experience that made guests feel like locals, and hosts become the ambassadors of their own local community while building their own entrepreneurial journey.

That event made Chesky and Gebbia continue with this experiment and by 2008, software engineer, Nathan Blecharczyk joined the two co-founders, to focus on the UX of the platform, to solve what would become the central problem for Airbnb, that of “making strangers comfortable enough to stay in each other’s homes.”

Some of the elements that would make this possible combined a platform with:

Host and guest profiles.Integrated messaging.Two-way reviews.And secure payments.Over the years, other key elements were added to the platform, that helped gain further traction (like hiring professional freelance photographers to enrich the visual experience on the platform, or like adding experiences on top of the stay).

Each of those elements would help Airbnb achieve a larger and larger scale until the pandemic hit, and Airbnb had to figure how. to make its business model even more sustainable, to survive.

Image Source: Airbnb Financial Prospectus

As Airbnb wen throuhg the pandemic, it had to shift its business model.

Brian Chesky, highlighted the “pivot” (in startup lingo the change of direction) Airbnb went through:

Yet as Airbnb managed to go through the pandemic.

It is also managing to trhive, as the short-term travel industry is bouncing back many times over:

The history of AirbnbWhile the concept of short-term vacation rentals is certainly nothing new, Airbnb was the first company to see the potential of home sharing in the accommodation industry.

To profit from this potential, however, the company had to face and then overcome various obstacles with a combination of determination, ingenuity, hard work, and a bit of luck. The early history of Airbnb is a borderline rags-to-riches story with the ability to inspire millions of people from all walks of life.

Airbedandbreakfast.comIn essence, the idea for Airbnb was born from a need to simply pay the rent. When San Francisco-based designers Joe Gebbia and Brian Chesky were struggling to make ends meet, they were forced to come up with a novel way to support themselves.

After noticing that a design conference caused many of the city’s hotels to become booked out, the pair offered accommodation in the form of three air mattresses to any attendee that needed a place to sleep. Gebbia and Chesky launched the site airbedandbreakfast.com in August 2008 with a belief that Craigslist was a little too impersonal.

For their efforts, the pair received $80 for hosting three designers over the duration of the conference.

FundraisingSensing they were onto something, the pair enlisted the help of computer science graduate Nathan Blecharczyk to build a more functional website that allowed other users to share their homes online. To validate their idea, the company targeted users in the Denver area with the Democratic National Convention causing a similar shortage in hotel rooms. While the campaign was successful, the co-founders were still losing money and could not secure investment funding after meeting with 15 separate angel investors.

To raise cash and keep the fledgling company afloat, Gebbia and Chesky decided to take advantage of the imminent 2008 US election. Using their design skills, they created custom-made cereal boxes based on the two presidential candidates Barack Obama and John McCain. The pair sold 750 boxes at $40 each, netting them a total of $30,000.

Y CombinatorIn January 2009, computer programmer Paul Graham invited the pair to a winter session of the renowned Y Combinator startup accelerator where they received training and $20,000 in cash in exchange for a small slice of the company.

The first few months of 2009 were spent perfecting the product, with the co-founders using some of the cash to travel to New York where most Airbnb users lived. In the city, they spent time building deep relationships with hosts by staying with every single one of them on the platform, leaving a review, and taking professional photographs of their accommodation. In March, the company officially became known as Airbnb and secured a $600,000 seed investment from Sequoia Capital in April.

Growth and further fundingOver the next couple of years, Airbnb secured further rounds of funding to be a profitable company with global reach. By 2011, over 1 million nights had been booked on the platform in 89 countries.

After a Series B funding round led by Andreessen Horowitz in mid-2011, Airbnb then became a unicorn with a valuation of $1.3 billion.

The rest, as they say, is history.

Key takeaways from the Airbnb’s story:The idea for Airbnb was born from a need to simply pay the rent. When designers Joe Gebbia and Brian Chesky noticed that a design conference booked out many of the hotels in San Francisco, they decided to host attendees with air mattresses on the floor of their apartment.To raise cash and keep the company afloat long enough to receive sufficient interest, the co-founders sold custom cereal boxes based on the presidential candidates of the 2008 U.S. election. Eventually, Y Combinator co-founder Paul Graham took notice and provided training and $20,000 in funding.Gebbia and Chesky traveled to Airbnb hotspot New York City in 2011 to stay with each Airbnb host, leave a review, and take professional photographs of their listing. The platform’s popularity grew quickly that year and boasted over 1 million nights booked across 89 countries. The company also became a unicorn in 2011 after a Series B funding round.Airbnb’s early success? Make it into a storyboard A storyboard is a linear sequence of illustrations used in animation to develop a broader story. A storyboard process is now used also in business to understand and map customers’ experience and enable the growth of the company using that process.Storyboarding in business can help in many other cases like: Uncover customer experience.Align on a longer-term vision.Pitch a broader project idea.And more.

A storyboard is a linear sequence of illustrations used in animation to develop a broader story. A storyboard process is now used also in business to understand and map customers’ experience and enable the growth of the company using that process.Storyboarding in business can help in many other cases like: Uncover customer experience.Align on a longer-term vision.Pitch a broader project idea.And more.It’s no secret that Brian Chesky is a huge fan of Walt Disney. And as the story goes, he was on a short vacation from Airbnb, as he dived into the Disney’s biography. There he figured out about storyboarding and how to leverage this process for Airbnb’s growth:

An example of storyboarding the guest journey, from smashingmagazine.com

It was 2011, Brian Chesky, co-founder of Airbnb, over the Christmas vacation had picked up a biography of Walt Disney. In there he found a technique that Walt Disney used. As the story goes, during a passage of Walt Disney biography, Chesky noticed how, during the production of the movies “Snow White and the Seven Dwarfs” in the 1930s, Disney used storyboards, a technique invented by a Disney’s animator a few years earlier. Chesky felt that when Disney had used this technique, he was in a similar situation, that Airbnb was facing at the time. Thus, Chesky with the other co-founders had an animator from Pixar design the storyboard for the three key processes: The host process.The guest process.And the hiring process.Those storyboards brought in the Airbnb headquarter had the purpose of aligning everyone in theorganizationaround the critical elements of the customers’ experiences.As Nathan Blecharczyk, co-founder and CSO at Airbnb pointed out on Sequoia blog:

One thing that’s really helped is a storyboard we created that depicts the different steps someone goes through from the time she first hears about Airbnb to the time she leaves post-visit feedback. We have 15 pictures that cover the guest journey and 15 more that show the journey for the host.

And he further highlighted:

What the storyboard made clear is that we were missing a big part of the picture—the offline experience—that’s an even more meaningful part of using Airbnb than booking a property.

From there, Airbnb’s redesigned the whole UX for the platform.

When Airbnb reached ramen profitability Serial entrepreneur and venture capitalist Paul Graham popularized the term “Ramen Profitability.” As he pointed out “Ramen profitable means a startup makes just enough to pay the founders’ living expenses.”

Serial entrepreneur and venture capitalist Paul Graham popularized the term “Ramen Profitability.” As he pointed out “Ramen profitable means a startup makes just enough to pay the founders’ living expenses.”Ramen profitability is a key moment in a startup’s life. It marks the moment when the startup revenues can pay up at least for the founders’ living expenses.

As venture capitalist (among the first investors in Airbnb) Paul Graham pointed out in a piece called “The Airbnbs:”

Ramen profitability is not, obviously, the end goal of any startup, but it’s the most important threshold on the way, because this is the point where you’re airborne. This is the point where you no longer need investors’ permission to continue existing. For the Airbnbs, ramen profitability was $4000 a month: $3500 for rent, and $500 for food. They taped this goal to the mirror in the bathroom of their apartment.

To become “ramen profitable” Airbnb’s co-founders had to focus on a subset of the whole potential market. They started with New York. Indeed, as they further narrowed down their market, suddenly numbers started to grow quickly and in a few weeks, they reached ramen profitability.

Source: Paul Graham Twitter

This was the initial bootstrapping journey for Airbnb, what gave it initial traction, and also what gave it credibility for further investment rounds, later on!

How much money does Airbnb make?The digitalization that happened in the last two decades has facilitated the creation of peer to peer platforms in which business models disrupted the hospitality model that was created in the previous century by hotel chains like Marriott, Holiday Inn, and Hilton.

As a platform, Airbnb makes money by enabling transactions on the peer-to-peer network of hosts and guests. And it charges both for the successful transaction that happened through the platform.

Image Source: Airbnb Financial Prospectus

Due to the COVID pandemic, Airbnb revenue decreased by $1.2 billion, or 32%, for the nine months ending in September 2020 compared to the same period in 2019.

This revenue decrease was primarily driven by a 42% decrease in the number of check-ins related to Nights and Experiences as a result of the pandemic.

Breaking down the economics of an Airbnb bookingAs a peer-to-peer platform, once the transaction between host and guest goes through, Airbnb will collect a fee from both key players. As an example from a $100 booking per night set by the host, Airbnb might collect $3 as a hosting fee. While it might increase the price for the guest at $116 ($16 above the price set by the host) to collect its guest fees of $12 and taxes for the remaining amount.

Therefore, for a similar transaction, Airbnb will collect $15, the host will make $97 from an initial set price at $100, and the guest will pay $116 (tax comprised).

Image Source: Airbnb Financial Prospectus

How much is Airbnb worth?In March 2017 the company was valued at $31 billion. As of that date, the company had $5 billion at the bank, and it rejected an investment offer by SoftBank. Airbnb was among the largest potential tech unicorns.

Then, in 2020 the COVID pandemic hit particularly the travel industry which had to adapt. And at the time of the Airbnb IPO, the company might be valued around $20 billion. Of course, as Airbnb went public its price and valuation changed quickly. In fact, as the company IPOed it reached a hundred billion dollars market cap!

Airbnb mission and visionAirbnb’s mission is to create a world where people can belong through healthy travel that is local, authentic, diverse, inclusive and sustainable.

This is how Airbnb describes its mission. And it continues:

Airbnb uniquely leverages technology to economically empower millions of people around the world to unlock and monetize their spaces, passions and talents and become hospitality entrepreneurs.

The key element of a platform and peer-to-peer business model like Airbnb is the creation of a viable ecosystem. In this case, Airbnb becomes a platform for other entrepreneurs or aspiring hospitality entrepreneurs:

What are the key partners for Airbnb?Airbnb’s people-to-people platform benefits all our stakeholders, including hosts, guests, employees and the communities in which we operate.

There are three key strategic partners:

Hosts.Guests.Local communities.In the initial traction stage, freelance photographers also played a key role in the growth of the platform.

Guests (travelers) can easily find hosts (pretty much anyone with a private home for rent) through the Airbnb marketplace.

Also, Real estate agencies that have vacant units can use Airbnb as a way to rent the excess properties they were not able to rent on the market. Instead, freelance photographers can earn a living by joining Airbnb as independent contractors.

But let’s look at what makes Airbnb platform compelling for each of those key partners.

Airbnb value proposition to its key partnersThere are several value propositions for both hosts and guests. And for freelance photographers.

Hosts

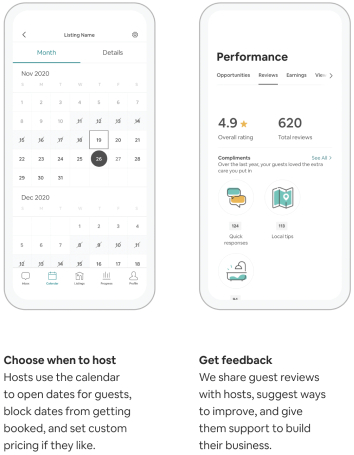

The Airbnb hosts’ platform, as shown in its prospectus.

Hosts can earn an extra income stream by renting additional space they have at home.Hosts can also turn into entrepreneurs by renting multiple locations with longer-term leases and making money with short-term rentals or by buying properties and generating a higher income with short-term rents. Hosts also have a set of tools for pricing, scheduling, payments, and more, which makes it easier for them to handle their customers without having to invest in proprietary technology. Hosts are also provided with insurance and liability coverage, the “Host Protection Coverage.”Trust, indeed, is a key element of the platform. In part, Airbnb’s success is given by its effort to make transactions as smooth as possible on its peer-to-peer marketplace.

Guests

The Airbnb guests’ platform, as shown in its prospectus.

The booking process is straightforward and the digital platform very effective.Travelers find affordable prices.Guests can also benefit from different experiences compared to the traditional hotel. Indeed, the host can act as a local touchpoint for the guest in the new community. For both hosts and guestsThe review system for both hosts and guests guarantee standards of quality.A secure payment system. A set of tools for them to connect, and to design experiences beyond the traditional stay.What is the revenue generation model?

Airbnb makes money in two ways:

1. It collects a commission from property owners, which is generally 3%. While it collects a commission fee from the same owners offering experiences, which is generally 20%.

2. It collects a transaction fee from guests of between 5% and 15% of the reservation subtotal

What are two key challenges to Airbnb’s success and further scale?There are two main issues Airbnb has to face:

TrustWhen hosts are listing their rooms and homes, they’re trusting the platform to put them in touch with good people. The same applies to guests. Would this trust be eroded over time so will be the value of the marketplace.

How does Airbnb tackles that? There are several buit-in features, developed over the years within Airbnb’s marketplace to enable trust at scale. As explained it its prospectus some of them are:

Reviews: user-generated reviews both for hosts and guests are the underlying factor enabling both parties to deal with each other. Secure messaging and account protection.Risk scoring through predictive analytics and machine learning to evaluate hundreds of signals to flag and investigate fraudulent accounts.Secure payments.Watchlist and background checks (for hosts and guests based in the United States).Cleanliness (become extremely important during the pandemic to make environment COVID-free).Fraud and scam prevention.Insurance and protections.Booking restrictions.Urgent Safety Line.24/7 Neighborhood Support Line.Guest refund policy.Customer retentionTravelers nowadays have plenty of options. If they revert back to hotels or other solutions, Airbnb loses momentum. Also, another risk might be that of losing guests that make friends with hosts. In fact, they might choose to organize their next transaction privately.

The paradox then is that Airbnb rather than strong incentive tie between hosts and guests. It has to create an experience so that both parties can trust each other enough to make the transaction but not so much to get out of the Airbnb marketplace.

Airbnb through the pandemicAirbnb has been among the most hit companies though the pandemic, as its business model was fine-tuned around global travel, and short-term stays and experiences.

In May 2020, this is how Brian Chesky, CEO, and co-founder of Airbnb explained the current scenario:

Let me start with how we arrived at this decision. We are collectively living through the most harrowing crisis of our lifetime, and as it began to unfold, global travel came to a standstill. Airbnb’s business has been hit hard, with revenue this year forecasted to be less than half of what we earned in 2019. In response, we raised $2 billion in capital and dramatically cut costs that touched nearly every corner of Airbnb.

He also explained how uncertain the situation is at a global level:

We don’t know exactly when travel will return. When travel does return, it will look different.Airbnb which was among the companies that most surfed the change in the travel and real estate industry, of the last decade, can also give us a better perspective of what might happen in the coming years for this industry.

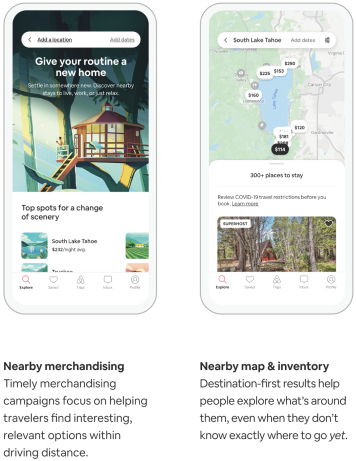

Airbnb new business strategy based on a sustainable cost modelTravel in this new world will look different, and we need to evolve Airbnb accordingly. People will want options that are closer to home, safer, and more affordable. But people will also yearn for something that feels like it’s been taken away from them — human connection. When we started Airbnb, it was about belonging and connection. This crisis has sharpened our focus to get back to our roots, back to the basics, back to what is truly special about Airbnb — everyday people who host their homes and offer experiences.

As Airbnb moves forward in this new normal, it looks at a few core elements:

Local travelSafetyAffordabilityAt the same time, the company is focusing back on its core, and yet converting from physical experiences to online experiences.

Airbnb stretching its business model In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling the whole new problems for new customers (reinvent mode).

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling the whole new problems for new customers (reinvent mode).As Airbnb knows the travel industry might not look as it used to, it’s now trying to redefine the boundaries of its business model, by leveraging on its tech platforms, an existent global audience, that used to be interested in physical experiences.

By stretching and extending its business model, Airbnb is trying to diversify it while the global pandemic will be over:

Example of the new section available on the Airbnb platform: Online Experiences

By leveraging on its audience Airbnb can test quickly a new product:

Example of an online experience where the “digital hosts” provide the format of the experience and the “digital guests” take part to it.

The online experience can take also the form of a private group where a limited number of “digital guests” can join by paying a premium price.

Will this platform be able to supplant, and integrate part of Airbnb’s revenues while the pandemic is over and the company can redesign also physical travel experiences?

Key lessons in redefining travel experiences and changing a whole business strategy, fast!Back in March 2017, Airbnb was valued at $31 billion. Then by May 2020, due to the pandemic, the company valuation fell to $18 billion.While its core business model is still sustained by two key strategic partners: hosts, guests. Airbnb has been also testing the expansion of its business model toward online experiences.In an interview in late June 2020, Airbnb’s CEO remarked a few key findings for the future of the company and of the overall travel industry.

He explained how he learned “not to try to get in the business of predicting the future.” And the only way to do that is to run a super lean organization (Airbnb cut over a billion in marketing expenses throughout the pandemic).

This key lesson came as Airbnb risked to lose it all in the space of a few weeks. While Airbnb’s CEO remarked the trend in travel was still very strong. He also explained how things had changed for Airbnb.

Safety comes first, this makes still people concerned about getting on planes or traveling to crowded cities. Instead, as he explained, “they are willing to do is to get in a car and drive a couple hundred miles to a small community where they are willing to stay in a house.”

Airbnb’s CEO explained how “one trend that is going to happen is that travel as we knew it is over. It doesn’t mean travel is over, just the travel we knew is over… and it’s never coming back. It’s just not.”

And he continued, “Instead of the world’s population traveling to only a few cities and staying in big tourist districts we are going to see a redistribution of where people travel. They’re going to start traveling because they are going nearby to thousands of local communities.”

That changes the whole Airbnb strategy. Skewed more toward digital experiences and local expansion, rather than just growing quickly in large crowded cities.

How the Airbnb product changed throughout the pandemicAs the company highlighted in its financial prospectus, it had to adjust its whole platform servicing to fit what its users needed at that moment, and how the global economy had been temporary shifted.

So the product and platform focused on:

Local travel

Above the example of the Airbnb platform changes to fit the local experiences.

Support for hosts and guestsAirbnb kicked off an hosts fund to support them through the pandemic. While the fund itself ($250 million + $17 million for Superhosts) was a small contribution in comparison to the loss many hosts experienced. It was at least a minimum release for some hosts.

Enhanced cleaning services

To enable more people to keep traveling, at least locally, during the pandemic, cleaning services to make environments COVID-free became a built-in features of the platform.

Online experiences

Airbnb also launched the online experiences platform, to help hosts to keep offering part of their services online.

Airbnb and how the future of travel is changingBy 2021, as Arbnb finally managed to go back to its pre-pandemic levels, it also found out how the world of travel is changing.

In fact, Airbnb had the most profitable quarter ever. Even better than 2019 Q3 revenue of $2.2 billion was its highest ever—36% higher than Q3 2019. Some realizations from Airbnb were:

People can travel anytime. People are traveling everywhere: Travel isn’t anymore toward cities but rather to rural destinations. Over 40% of gross nights booked in Q3 2021 were within 300 miles of home, up from 32% in Q3 2019, while gross nights booked to rural destinations increased more than 40% in Q3 2021 from Q3 2019.People are living on Airbnb: Long-term stays of 28 days or more remained Airbnb fastest-growing category by trip length and accounted for 20% of gross nights booked in Q3 2021, up from 14% in Q3 2019.More people are interested in hosting.In a tweet on November 9, Brian Chesky further explained:

Airbnb first-ever pitch deck

1. I think we’re on the verge of a revolution in travel

2. Before the pandemic, most people were tethered to the place they worked because they had to go into an office

3. The pandemic accelerated the mass adoption of technologies (like Zoom) that allowed millions of people (not everyone, but a large chunk) to work from home

4. Suddenly, they were untethered from the need to work in specific places at specific times

5. Millions of people can now travel anytime, anywhere, for any length — and even live anywhere

6. All you have to believe is that Zoom is here to stay to believe this trend is here to stay

7. This newfound flexibility is bringing about a revolution in how we travel

8. In recent months, some of the largest companies in the world, like Amazon, P&G, Ford, and PwC, have announced increased flexibility for employees to work remotely, and I expect more companies to follow

9. We’re seeing this in our own data

10. Travel anytime: Monday’s and Tuesday’s are our fastest growing days of the week for families to travel

11. Travel anywhere: over 100,000 towns & cities had a booking on Airbnb during the pandemic (6,000 places had their 1st booking)

12. Live anywhere: between July and September, 1 in 5 nights booked were for a month or longer. This is our fastest growing category by trip length

13. So basically, people aren’t just traveling on Airbnb, they’re now living on Airbnb

14. Okay, last tweet… to respond to this moment, I’ll share some updates to the Airbnb service at 8am pst tomorrow on our homepage (I have a short demo that I’ll share)

OTAs Connected Business ModelsBooking

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/11/booking-business-model-1.jpg?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Booking Holdings is the company the controls six main brands that comprise Booking.com, priceline.com, KAYAK, agoda.com, Rentalcars.com, and OpenTable. Over 76% of the company revenues in 2017 came primarily via travel reservations commissions and travel insurance fees. Almost 17% came from merchant fees, and the remaining revenues came from advertising earned via KAYAK. As a distribution strategy, the company spent over $4.5 billion in performance-based and brand advertising. Expedia

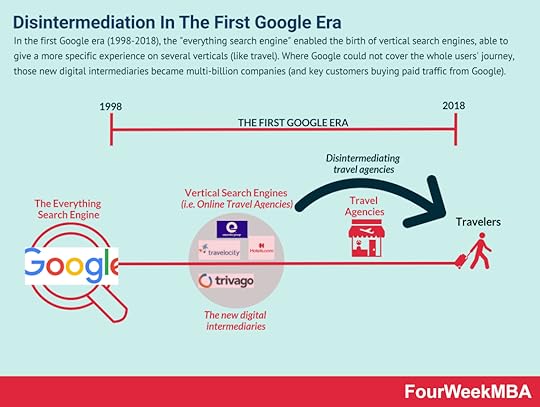

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/11/booking-business-model-1.jpg?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Booking Holdings is the company the controls six main brands that comprise Booking.com, priceline.com, KAYAK, agoda.com, Rentalcars.com, and OpenTable. Over 76% of the company revenues in 2017 came primarily via travel reservations commissions and travel insurance fees. Almost 17% came from merchant fees, and the remaining revenues came from advertising earned via KAYAK. As a distribution strategy, the company spent over $4.5 billion in performance-based and brand advertising. Expedia https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2021/03/trivago-business-model.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.Google (Google Travel)

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2021/03/trivago-business-model.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.Google (Google Travel) https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2020/07/first-google-era-1.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Born in 1996 as a travel platform of Microsoft, it would be spun off later on. Expedia became among the largest online travel agencies (OTAs) which comprise a set of brands that go from Hotels.com, Vrbo, Orbits, CheapTickets, ebookers, Travelocity, Trivago, and others. The company follows a multi-brand strategy.Kayak

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2020/07/first-google-era-1.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Born in 1996 as a travel platform of Microsoft, it would be spun off later on. Expedia became among the largest online travel agencies (OTAs) which comprise a set of brands that go from Hotels.com, Vrbo, Orbits, CheapTickets, ebookers, Travelocity, Trivago, and others. The company follows a multi-brand strategy.Kayak https://i1.wp.com/fourweekmba.com/wp-... data-large-file=”https://i1.wp.com/fourweekmba.com/wp-content/uploads/2021/04/how-does-kayak-make-money.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Kayak is an online travel agency and search engine founded in 2004 by Steve Hafner and Paul M. English as a Travel Search Company and acquired by Booking Holdings in 2013 for $2.1 billion. The company makes money via an advertising model based on cost per click, cost per acquisition, and advertising placements.OpenTable

https://i1.wp.com/fourweekmba.com/wp-... data-large-file=”https://i1.wp.com/fourweekmba.com/wp-content/uploads/2021/04/how-does-kayak-make-money.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Kayak is an online travel agency and search engine founded in 2004 by Steve Hafner and Paul M. English as a Travel Search Company and acquired by Booking Holdings in 2013 for $2.1 billion. The company makes money via an advertising model based on cost per click, cost per acquisition, and advertising placements.OpenTable OpenTable is an American online restaurant reservation system founded by Chuck Templeton. During the late 90s, it provided one of the first automated, real-time reservation systems. The company was acquired by Booking Holding back in 2014, for $2.6 billion. Today OpenTable makes money via subscription plans, referral fees, and in-dining with its first restaurant, as an experiment in Miami, Florida. ” data-image-caption=”

OpenTable is an American online restaurant reservation system founded by Chuck Templeton. During the late 90s, it provided one of the first automated, real-time reservation systems. The company was acquired by Booking Holding back in 2014, for $2.6 billion. Today OpenTable makes money via subscription plans, referral fees, and in-dining with its first restaurant, as an experiment in Miami, Florida. ” data-image-caption=”OpenTable is an American online restaurant reservation system founded by Chuck Templeton. During the late 90s, it provided one of the first automated, real-time reservation systems. The company was acquired by Booking Holding back in 2014, for $2.6 billion. Today OpenTable makes money via subscription plans, referral fees, and in-dining with its first restaurant, as an experiment in Miami, Florida.

” data-medium-file=”https://i1.wp.com/fourweekmba.com/wp-content/uploads/2021/04/how-does-opentable-make-money.png?fit=300%2C226&ssl=1″; data-large-file=”https://i1.wp.com/fourweekmba.com/wp-content/uploads/2021/04/how-does-opentable-make-money.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>OpenTable is an American online restaurant reservation system founded by Chuck Templeton. During the late 90s, it provided one of the first automated, real-time reservation systems. The company was acquired by Booking Holding back in 2014, for $2.6 billion. Today OpenTable makes money via subscription plans, referral fees, and in-dining with its first restaurant, as an experiment in Miami, Florida.Oyo https://i1.wp.com/fourweekmba.com/wp-... data-large-file=”https://i1.wp.com/fourweekmba.com/wp-content/uploads/2020/05/oyo-business-model-2.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>OYO’s business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.Tripadvisor

https://i1.wp.com/fourweekmba.com/wp-... data-large-file=”https://i1.wp.com/fourweekmba.com/wp-content/uploads/2020/05/oyo-business-model-2.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>OYO’s business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.Tripadvisor https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2019/05/tripadvisor-business-model.png?fit=1024%2C753&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>TripAdvisor’s business model matches the demand for people looking for a travel experience with supply from travel partners around the world providing travel accommodations and experiences. When this match is created TripAdvisor collects commission from partners on a CPC and CPM basis. The non-hotel revenue comprises experiences, restaurants, and rentals.Trivago

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2019/05/tripadvisor-business-model.png?fit=1024%2C753&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>TripAdvisor’s business model matches the demand for people looking for a travel experience with supply from travel partners around the world providing travel accommodations and experiences. When this match is created TripAdvisor collects commission from partners on a CPC and CPM basis. The non-hotel revenue comprises experiences, restaurants, and rentals.Trivago Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties. ” data-image-caption=”

Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties. ” data-image-caption=”Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.

” data-medium-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2021/03/trivago-business-model.png?fit=300%2C226&ssl=1″; data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2021/03/trivago-business-model.png?fit=1024%2C772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.Handpicked related articles:

Types of Business Models You Need to KnowVTDF FrameworkHow Does PayPal Make Money? The PayPal Mafia Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessThe Google of China: Baidu Business Model In A NutshellAccenture Business Model In A Nutshell Salesforce: The Multi-Billion Dollar Subscription-Based CRMHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedThe post How Does Airbnb Make Money? Airbnb Business Model – Updated 2022 appeared first on FourWeekMBA.