Gennaro Cuofano's Blog, page 106

April 2, 2022

User Story Examples

User stories are informal and general explanations of a software feature from the perspective of the end-user. The purpose of a user story is to articulate how a particular feature will provide value to the customer. In other words, how will they use the product to solve problems or address pain points in their life?

Most user stories are constructed in the following form: “As a [type of user], I want [some goal] so that [some reason].” Other teams use the construct “As a [description of user], I want [functionality] so that [benefit].”

With those definitions in mind, the rest of this article will be devoted to explaining some user story examples.

Some basic user story examplesHere are five basic user story examples:

As a brand manager, I want to receive an alert when a product reseller promotes our products at less than the predetermined price so that I can take steps to protect our brand reputation.As a remote team leader, I want our team-chat app to incorporate file sharing and annotation so the team can maintain an archive of their work in one place and collaborate in real-time.As a database administrator, I want to combine datasets from different sources automatically so that I can compile reports for internal customers more easily.As an iOS user, I want to be able to synchronize activity data with my Apple Watch so that I can better track calories burned.As a human resources manager, I need to view the status of a job candidate to better manage the application process across various recruitment phases.Note that in the second example, it is clear that the user in a user story does not necessarily have to denote someone’s job title. In fact, a remote team leader encompasses multiple roles, such as a company vice president, departmental head, or the CEO of a new startup.

To better explain the second user story, it makes sense to use the term “remote team leader” to describe an individual who leads a team of subordinates working in different locations.

User story example scenariosIn addition to the simple templates outlined in the introduction, user stories may also be required in scenarios that are more complex or multi-faceted. Some of the user story types ideal for these situations include:

SAFe feature user stories – a template that incorporates additional information about each product feature such as non-functional requirements, cost of delay, and the benefit hypothesis.Thematic user stories – this template is used by teams to identify user stories that are related to a similar theme, such as a common functional area. The work may entail multiple small improvements that deliver a more substantial performance increase. In most cases, there is no requirement that the work is completed in a specific order since each story provides some independent value to the end-user.Epic user stories – epics represent larger user stories that cannot be completed in a single sprint but that collectively deliver a particular outcome. An example of an epic user story requiring several iterations is “As a marketing data analyst, I want to create trend reports and forecasts that I can use to support the sales initiatives of marketing representatives in a specific region.”Key takeaways:User stories are informal and general explanations of a software feature from the perspective of the end-user.User stories are constructed in the following form: “As a [type of user], I want [some goal] so that [some reason].” Other teams use the construct “As a [description of user], I want [functionality] so that [benefit].”For more complex or multifaceted scenarios, the team may choose to base product development on SAFe feature user stories, thematic user stories, or epic user stories.The post User Story Examples appeared first on FourWeekMBA.

TRIZ: Theory of Inventive Problem Solving

The TRIZ method is an organized, systematic, and creative problem-solving framework. The TRIZ method was developed in 1946 by Soviet inventor and author Genrich Altshuller who studied thousands of inventions across many industries to determine if there were any patterns in innovation and the problems encountered.

Understanding the TRIZ methodTRIZ is a Russian acronym for Teoriya Resheniya Izobretatelskikh Zadatch, translated as “The Theory of Inventive Problem Solving” in English. For this reason, the TRIZ method is sometimes referred to as the TIPS method.

From careful research of over 200,000 patents, Altshuller and his team discovered that 95% of problems faced by engineers in a specific industry had already been solved. Instead, the list was used to provide a systematic methodology that would allow teams to focus their creativity and encourage innovation.

In essence, the TRIZ method is based on the simple hypothesis that somebody, somewhere in the world has solved the same problem already. Creativity, according to Altshuller, meant finding that prior solution and then adapting it to the problem at hand.

The five levels of the TRIZ methodWhile Altshuller analyzed hundreds of thousands of patents, he acknowledged that not every innovation was necessarily groundbreaking in scope or ambition.

After ten years of research between 1964 and 1974, he assigned each patent a value based on five levels of innovation:

Level 1 (32% of all patents) – these are innovations that utilize obvious or conventional solutions with well-established techniques.Level 2 (45%) – the most common form where minor innovations are made that solve technical contradictions. These are easily overcome when combining knowledge from different but related industries.Level 3 (18%) – these are inventions that resolve a physical contradiction and require knowledge from non-related industries. Elements of technical systems are either completely replaced or partly changed.Level 4 (4%) – or innovations where a new technical system is synthesized. This means innovation is based on science and creative endeavor and not on technology. Contradictions may be present in old, unrelated technical systems.Level 5 (1%) – the rarest and most complex patents involved the discovery of new solutions and ideas that propel existing technology to new levels. These are pioneering inventions that result in new systems and inspire subsequent innovation in the other four levels over time.How the TRIZ method worksSince its release, the TRIZ method has been refined and altered by problem-solvers and scientists multiple times. But the problem-solving framework it espouses remains more or less the same:

Problem solvers must start by gathering the necessary information to solve the problem. This includes reference materials, processes, materials, and tools.Information related to the problem should also be collected, organized, and analyzed. This may pertain to the practical experience of the problem, competitor solutions, and historical trial-and-error attempts.Once the specific problem has been identified, the TRIZ method encourages the problem solvers to transform it into a generic problem. Generic solutions can then be formulated and, with the tools at hand, the team can then create a specific solution that solves the specific problem.The last step in the TRIZ method appears to be rather complicated. But it is important for innovators to remember that most problems are not specific or unique to their particular circumstances. Someone in the world at some point in time has faced the same issue and overcome it.

Key takeaways:The TRIZ method is an organized, systematic, and creative problem-solving framework. It was developed in 1946 by Soviet inventor and author Genrich Altshuller who studied 200,000 patents to determine if there were patterns in innovation.Altshuller acknowledged that not every innovation was necessarily groundbreaking in scope or ambition. From the result of his research, he created five levels of innovation, with Level 1 innovations resulting from obvious or conventional solutions and Level 5 innovations resulting in new ideas that propelled technology forward.The TRIZ method has been altered multiple times since it was released and may appear complicated. However, problem-solving teams can take comfort from the fact that others have most likely prevailed against similar problems in the past.The post TRIZ: Theory of Inventive Problem Solving appeared first on FourWeekMBA.

How does Google Maps make money?

Google Maps is a web and app-based mapping platform that offers aerial photography, satellite imagery, terrain data, street maps, route planning, and real-time traffic information.

Google Maps is an immensely popular platform. In the United States, there are approximately 154 million active monthly users with this number increasing to well over 1 billion worldwide. But with so many users, it may surprise some to learn that Google has until recently done little to monetize the service directly.

Morgan Stanley predicts that Google Maps revenue will hit more than $11 billion by 2023, noting in an article on Yahoo Finance that “Google Maps is a utility-like service (similar to Search) and in our view, remains the most under-monetized asset that we cover.”

With the above figures in mind, let’s explain below how Google Maps makes money.

Google Maps revenue generationThe reasoning behind Morgan Stanley’s prediction of $11 billion in revenue is simple to understand when you consider Google’s revenue from search and related services. In Q4 2021, the company reported that $61.2 billion (or 82%) of total revenue came from advertising alone.

This means the bulk of Google Maps revenue comes from advertisers who use Google Adwords to promote their businesses and will continue to do so in the future. However, a lesser-known source of income is derived by selling access to the Google Maps API.

Below is a look at each revenue source in more detail.

AdvertisingGoogle makes money from advertising in three ways.

Search listing adsSearch listing ads appear when a Google Maps user searches for a particular business or type of business, such as a gas station, mall, or their nearest Walmart.

Advertising here works the same as it does for a Google search; paid listings are shown at the top and businesses are only charged when a user clicks one of their ads.

Branded location pinsIn some situations, Google Maps will show branded location pins irrespective of whether the user is searching for that company.

Branded pins are available to any business provided their ad spend and ad quality is of a sufficient level. Businesses must also have a square logo (favicon) uploaded to their My Business accounts and have configured their location extensions for each ad campaign.

Retail locations as navigational landmarksLess common is the use of retail landmarks when receiving directions from the automated voice within the app. Some users have reported receiving messages such as “Turn right after the Burger King” or “Turn left at the Starbucks.”

Google Maps APIGoogle also makes money by selling the Google Maps API to other businesses and app developers that require mapping or navigation services. These include Uber, Lyft, Snapchat, Accenture, and Square.

API services come in three forms:

Routes – for example, Uber incorporates Google Maps into its app so that drivers do not need to switch between two apps to determine a route.Places – this encompasses geocoding, where street addresses are converted into geographic coordinates that can be used as place markers. This form also includes current place, time zone, place photos, and autocomplete for geographic search terms.Maps – these are maps that consumers see embedded in real-estate websites or food-delivery apps, for example. Customers may also choose from static or dynamic maps and static or dynamic Street View.Each of these API services comes with various fees, but Google offers $200 credit (equivalent to 28,500 map loads) for free every month.

Key takeaways:Google Maps is a web and app-based mapping platform that offers aerial photography, satellite imagery, terrain data, street maps, route planning, and real-time traffic information.Most Google Maps revenue comes from advertisers who use Google Adwords to promote their businesses. Some of the ad formats include search listing ads, branded location pins, and retail locations as navigational landmarks.Google Maps also makes money by selling its API to interested parties. API services are categorized as either Routes, Places, or Maps and will suit the majority of business applications.Read More:

Business ModelsGoogle Business ModelHow Does Google Make MoneyThe post How does Google Maps make money? appeared first on FourWeekMBA.

March 31, 2022

Multisided Platform Business Model Explained

A multisided platform business model is a company that leverages multisided network effects (coming from two or more sides of the network). Therefore, when one side of the network grows, this makes the overall platform more valuable for the other side of the network and vice-versa, triggering exponential growth for the platform business.

Understanding platform business models A platform business model generates value by enabling interactions between people, groups, and users by leveraging network effects. Platform business models usually comprise two sides: supply and demand. Kicking off the interactions between those two sides is one of the crucial elements for a platform business model’s success.

A platform business model generates value by enabling interactions between people, groups, and users by leveraging network effects. Platform business models usually comprise two sides: supply and demand. Kicking off the interactions between those two sides is one of the crucial elements for a platform business model’s success.In short, there are a few elements that define a platform business model:

Interactions vs. salesA platform business model focuses on enabling an underlying ecosystem of third-party players that can build their own companies on top of the platform.

In short, the platform business is more concerned about the health of the overall entrepreneurial ecosystem, underlying it, that the sales of its own products.

In fact, oftentimes, for platform business models, most products and services sold, on top of it, are by third parties.

And if the platform enables the sales of physical products, those might be primarily sold by third-party stores (see Amazon business model).

While, if the platform enables services, then it will collect a tax from one side, both sides, or multiple sides of the transactions (see Uber business model or Uber Eats business model, and Airbnb business model).

Transactions between the main parties of the networkUsually, a platform business model measures its financial success according to the gross value of the overall transactions happening on the platform.

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. In 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, of $155.94.

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. In 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, of $155.94.Take the Airbnb business model economics. The company enables a gross booking value of almost $47 billion in 2021.

As a consequence of that, it generated an almost $6 billion tax, in service revenues.

One user type network improvement, also exponentially improves the other sides of the networkA platform’s network is highly interconnected. This means that by improving a side of the network, you also improve the other side.

However, often, when platform business models kick off their operations, they need to figure out which side of the network, they need to kick off first.

For instance, in the case of Uber Eats, the choice was simple. Since the company had already millions of drivers and users, it only needed to add restaurants/partners to kick off the whole network.

Instead, if you take the case of Uber, initially, to make its network valuable in the first place, it had to pick one side of the network: drivers.

In fact, as drivers became available, the company could kick off its network effects, by offering rides across various neighborhoods, cities, and countries, at competitive rates, and low wait times.

Flywheel vs. funnel The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.

The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.Where the sales funnel is used with a linear logic (and more in line with traditional organizations). When it comes to platform businesses, it’s all about feedback loops.

Those feedback loops move in all directions, as they help the network solidify.

Thus, as a platform, it’s critical to think in terms of flywheels rather than funnels.

This leads us to another key point.

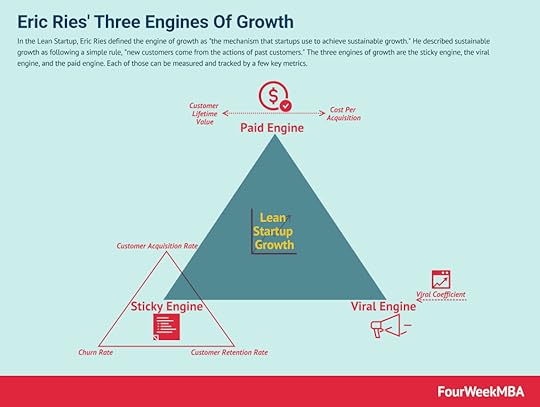

Growth engines, vs. business development In the Lean Startup, Eric Ries defined the engine of growth as “the mechanism that startups use to achieve sustainable growth.” He described sustainable growth as following a simple rule, “new customers come from the actions of past customers.” The three engines of growth are the sticky engine, the viral engine, and the paid engine. Each of those can be measured and tracked by a few key metrics.

In the Lean Startup, Eric Ries defined the engine of growth as “the mechanism that startups use to achieve sustainable growth.” He described sustainable growth as following a simple rule, “new customers come from the actions of past customers.” The three engines of growth are the sticky engine, the viral engine, and the paid engine. Each of those can be measured and tracked by a few key metrics. Business development is extremely important for any platform business, especially in the early days.

Indeed, think of the case of Uber Eats which needs to go out and find a restaurant network and partners willing to join the platform.

This is a complex deal, which requires experienced business people, able to navigate the deal and unlock it.

Once these deals are closed, while business development (especially for platform leveraging enterprise customers) will be an integrated part of the overall business model, growth engines become critical.

A growth engine is simply an integration between product, marketing, and distribution. Where within the platform there are built-in incentives to distribute the network.

Take the case of the Amazon e-commerce platform, with millions of freely accessible product pages, which prompt billion of users to see them. The underlying platform is both a technical platform, supporting thousands and thousands of third-party stores and a distribution engine!

Understanding network effects A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.In the table below, we structured how network effects are kicked off:

Definition Network Effects: The value of a service/platform increases for each additional user, as more users, join in.Sub-typeDescription – ExampleDirect, Same Side, or One-SidedAs more users join, the platform’s value increases for each additional user. Take the case of a social media platform, like Facebook, Instagram, TikTok, LinkedIn, Twitter. The more users join, the more the platform will be valuable for each additional user, as the new user might find exponentially richer and broader content (provided the platform can prevent congestion or pollution).Indirect or Cross-SideIn this case, a user type joining the platform makes it more valuable for other user types. Take the case of LinkedIn. While LinkedIn enjoys the same-side network effects, the platform becomes more valuable to users looking to enhance their careers as more users join in. At the same time, LinkedIn enjoys indirect or cross-side network effects. More users who join the platform to grow their career make it more valuable for recruiters (so a different user type) as they can find more qualified candidates on top of the platform.Two-SidedTake the case of LinkedIn. While LinkedIn enjoys the same-side network effects, the platform becomes more valuable to users looking to enhance their careers as more users join in. At the same time, LinkedIn enjoys indirect or cross-side network effects. In this case, a user type joining the platform makes it more valuable for other user types. More users who join the platform to grow their career make it more valuable for recruiters (so a different user type) as they can find more qualified candidates on top of the platform.Multi-SidedIn this case, more than two user types are driven by the network dynamics. Take the case of Uber Eats; the more restaurants join the platform, the more the platform becomes valuable for eaters. While at the same time, by leveraging its existing platform, Uber drivers have additional riding options. So they can earn extra income by delivering food instead of giving rides. That makes the overall platform much more valuable for the three main user types: eaters, restaurants, and riders. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. Negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. Negative network effects (congestion or pollution) reduce the value of the platform for the next user joining. Below, instead we explain the curse of platform business models: negative network effects:

Definition Negative Network Effects: The Value of the service/platform decreases for each additional user, as more users join in. This might be due to congestion (when increased usage can’t be handled by the platform) or pollution (when the increased size of the network makes it hard to incrementally add value, and instead its value shrinks).Description – ExampleCongestion (Increased Usage)In this case, there is a reduced quality of the service when certain parts of the networks carry way more data than they can handle. That usually happens because of scale limitations and noise due to curation limitations. Since this is a technological issue, it manifests as service slowdown or perhaps the platform crashing. Take the case of services like YouTube crashing for too much traffic. Or, if you’re a professional, a service like Slack crashes as it cannot handle the traffic spikes. That becomes a disservice with potential negative network effects because you suddenly prevent a whole team from functioning properly. Therefore, a negative network effect can have exponential negative consequences. For instance, users would switch to alternatives en masse if this was repeatedly happening, thus creating structural damage to the network.Network Pollution (Increased Size)The case of pollution is more tied to the ability of the platform to keep its service relevant at scale. Thus, imagine the case of a platform like Twitter, in which the principal asset is the feed. As Twitter becomes more and more popular, it needs to make sure that the user-generated content is qualitatively on target. Otherwise, the risk is for the user’s Twitter feed to become less relevant and lose value. Or imagine the case that many user-generated platforms face today, where spambots take over. Here, suppose the platform cannot handle this automatically generated content. In that case, it can quickly lose value, as the service becomes worthless for users (take the case of a user who has to spend an hour a day cleaning up the feed because of spamming).The multi-sided platform DNALet’s see two case studies and examples of multi-sided platform business models.

LinkedIn Case StudyTake the example of LinkedIn, a platform for job seekers and recruiters.

Here the network effects dynamics are multi-sided, meaning that for more job seekers join LinkedIn, and enrich their profiles, the more the platform becomes valuable to recruiters.

And the more recruiters/companies join, the more the platform is valuable to job seekers.

LinkedIn is a two-sided platform running on a freemium model, where to unlock unlimited search and other features, you need to switch to a paid account. Acquired by Microsoft for $27 billion in 2016, LinkedIn made $5.2 billion in revenues in 2018 and had nearly 630M members by October 2019.Uber Eats Case Study

LinkedIn is a two-sided platform running on a freemium model, where to unlock unlimited search and other features, you need to switch to a paid account. Acquired by Microsoft for $27 billion in 2016, LinkedIn made $5.2 billion in revenues in 2018 and had nearly 630M members by October 2019.Uber Eats Case StudyAnother example is Uber Eats, in which complex dynamics between eaters, drivers, and restaurants/partners, enable the company to leverage multi-sied network effects to grow the company.

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner, and a customer with the Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay small delivery charges, and at times, cancellation fees; Drivers earn through making reliable deliveries on time.

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner, and a customer with the Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay small delivery charges, and at times, cancellation fees; Drivers earn through making reliable deliveries on time.Complimentary Resources:

Business ModelsPlatform Business ModelNetwork EffectsComplimentary Case Studies:

Amazon Business Model Uber Business ModelUber Eats Business ModelAirbnb Business ModelLinkedIn Business ModelThe post Multisided Platform Business Model Explained appeared first on FourWeekMBA.

March 30, 2022

The Freemium Business Model Complete Guide

The freemium – unless the whole organization is aligned around it – is a growth strategy rather than a business model. A free service is provided to a majority of users, while a small percentage of those users convert into paying customers through the sales funnel. Free users will help spread the brand through word of mouth.

Is a freemium a business model?You create a product or software, you make it available for free on the web, thus (if the tool is good) it gains visibility quickly, and you call your company a freemium business model.

Looking at things in this perspective makes you confuse your business strategy with your marketing strategy. This can be extremely limiting.

A marketing strategy will focus primarily in acquiring users, leads or potential customers for the business.

A business strategy looks at understanding the whole logic of your business to find a viable and potentially scalable business model.

To understand this key difference let’s look at the whole story behind freemiums.

The origin storyOn March 2006, venture capitalist Fred Wilson wrote an article entitled “My Favorite Business Model” which said:

Give your service away for free, possibly ad supported but maybe not, acquire a lot of customers very efficiently through word of mouth, referral networks, organic search marketing, etc, then offer premium priced value added services or an enhanced version of your service to your customer base.

He mentioned examples of this successful business model at Skype, Flickr, and a few others .

According to Fred Wilson, the core advantage of a “Freemium business model” is about fast customer acquisition. But he made clear that it had to be as frictionless as possible:

A customer is only a click away and if you can convert them without forcing them into a price/value decision you can build a customer base fairly rapidly and efficiently. It is important that you require as little as possible in the initial customer acquisition process. Asking for a credit card even though you won’t charge anything to it is not a good idea. Even forced registration is a bad idea. You’ll want to do some of this sort of thing once you’ve acquired the customer but not in the initial interaction.

The main aim was to “eliminate all barriers to the initial customer acquisition.” He didn’t have yet a name for this kind of revenue model.

Giving it a nameAt the end of his article, Fred Wilson had clear in mind what the Freemium business model looked like. However, he didn’t have a name for it.

That is why he invited people to comment and to come up with a proper name for this business model. A commenter, Jarid Lukin suggested the name Freemium model.

Thus, a service and product wholly free and frictionless, where most users don’t pay, and a small base of users pay for a product that has premium features.

Over the years Fred Wilson kept emphasizing the importance of free. Today the freemium business model has taken over also the gaming industry. But it has also become the most debated business model in the software industry.

On the power of freeBuilding a free product and make it available to anyone and then expect to make money isn’t the right strategy.

Instead, the “free” within the freemium, if appropriately used, can be a lever for quick success.

As Fred Wilson pointed out in October 2008 “freemium is far from dead, in fact, it may be the business model de rigueur.“

What did he mean? He recounted in a later article:

Freemium isn’t newFacebook is a perfect example of freeconomics at work. A woman who works for a major media company was in my office recently. She quoted her CEO as saying “why doesn’t Facebook just charge a monthly subscription fee, they’d be making money hand over fist?”. Well I believe that if Facebook did that, they’d be vulnerable to other networks offering a free service. And certainly not every one of those 200mm users are going to cough up a monthly subscription. But by offering a friction free service, they have built a powerful and growing network that they are now starting to monetize in various ways and that they will monetize even further in additional ways. And they are super hard to compete with because they are free.

As pointed out on broadstuff.com:

The new Free! plan is in fact Freemium – where a small number of people subsidise the majority, who get it for free. But “Freemium” models have existed since antiquity, they work in some situations, don’t work in others. This is also likely to be true for Digital goods. The issue lies in the price sensitivity

This point is critical, as freemium is not a size fits all (the “free” in it is meant to make money).

In fact, that also depends on the cost structure of the company offering the service. Also, freemium seems to work well in conjunction with advertising spending.

Think of the most popular services and apps we use today, like Facebook and Google. Those are free but not freemiums.

In short, users do not pay for the service, it gets subsidized by another player (in Facebook and Google cases there are companies investing marketing budgets) and that comes with a cost for the users (privacy, conflicts of interests). This is at the core of asymmetric business models, that are highly scalable.

In fact, millions of users are accessing them for free and with the least friction possible. Thousands of businesses are paying and financing those services through advertising.

This is also the power of the hidden revenue business model. In other cases, free needs to be offset with a different monetization strategy, just like the razor and blade monetization strategy. Where you get something for free, but then a complimentary service associated is costly.

Freemium is not a size fits allIn 2015 a SaaS company, Baremetrics, started to experiment with the Freemium, business model. In short, they created a version of the product the was entirely free.

That product version allowed users to switch to the premium if they wanted to add specific features or capabilities.

As the story went, the conversion rates on the freemium-based business model turned out to be also quite good compared to the traditional subscription-based business model.

In fact, in 11 weeks over a thousand accounts were created. The math on those new accounts wasn’t exciting, but it worked. As explained on Baremetrics blog:

Considering a 3-5% conversion rates on B2B the rates from the freemium seemed to be promising, until…Beware of the cost structure

So, of the 1,000 accounts, 461 were actually eligible to even think about becoming a paying customer.

Of the 461 eligible paying customers, 53 actually upgraded.

53 as a % of 461 = 11.5%

As pointed out by Baremetrics on the experiment they run with the freemium:

Quickly, we started coming up against a lot of performance and database issues. Within a few weeks our “free” customers were outnumbering our “paying” customers and the amount of data were both storing and processing had doubled.

This, in turn, created an adverse effect on the revenues:

Yet, besides the matter of whether free is after all good for the users, let’s take a different approach. Is free good for your business in the first place?

Yes, but only if you acknowledge the fact that sustaining the free infrastructure will be extremely expensive.

A company like Grammarly that has implemented successfully a freemium business model knows it well.

In Grammarly’s case, a browser expension might seem a simple thing, yet as the Grammarly engineering team specified:

These extensions may look easy on the outside because they are low profile and easy to use. But it is actually a complex product supported by a full team of engineers. We have been developing and perfecting it for 6 years.

That is why the engineering team has implemented a branching model to reduce manual tasks, which as you can imagine, on a user base of 20 million might be impossible to keep up for a company with a few hundreds of employees of which only about 24 people in support, according to LinkedIn:

Grammarly branching model to eliminate as much as possible manual actions, architectured by the engineering team (Source: Grammarly Engineering Blog) as an example of how tech helps to support Grammarly growth channels. In these cases, technology and engineering are the most important marketers, as they enable a free product to scale, thus making the brand resonate across millions of users across the world.

This raises a critical question to understand whether to go for the freemium or not.

Is “your 1” big enough to pay the bills for them all?On September 2009 MailChimp went freemium. Its user base went in one year to 450,000 users. Ever since MailChimp has grown into a successful company.

As pointed out one year after the experimentation with the freemium-based model, a critical question to ask is “whether or not your “one” is big enough to pay your bills yet.”

MailChimp didn’t start as a freemium. When they launched the company back in 2001, they didn’t even have a free trial.

They didn’t have an idea of what the freemium was. They only started to consider that the freemium model as a viable option when they realized that that paying customers was able to keep them going with the other nine unpaying customers.

As remarked by MailChimp:

Are you using the freemium just to get VC money?We’d never consider freemium until our “1” was big enough. Enough to pay for 70 employees, their health benefits, stash some cash for the future, etc.

In the Silicon Valley archetype “users” have become the most important asset a company seems to need to be eligible to get billion dollars of capital.

However, this system – I argue – is broken because it draws on the myth that once you have users then monetizing them is easy.

However, for anyone that has ever tried to grow a startup you know that monetization is the hardest part.

It might seem a trivial concept for small business owners that to build a sustainable business you need to balance things up so that your revenues will exceed your expenses.

The so-called “profit” seems to be a thing of the past. Thus, they use large user base to get VC money to keep growing revenues without focusing on profits.

Cases like ConvertKit are a great example of why generating profits is critical for your business. Many counterargue by mentioning cases like Google and Facebook.

Yet they forget that Google and Facebook were extremely profitable not long after they launched their services and I would not define them as freemiums (those are asymmetric business models subsidized by the core customers, made of businesses and enterprise clients).

Freemium business models that work: Dropbox case study Dropbox generated over 90% of its revenue via its self-serve channels to convert users in paying customers through in-product prompts and notifications, time-limited free trials of paid subscription plans, email campaigns, and lifecycle marketing. Dropbox generated over $1.1 billion revenue in 2017, with an average revenue per paying user of $111, $305 million in free cash flow and 11 million paying users

Dropbox generated over 90% of its revenue via its self-serve channels to convert users in paying customers through in-product prompts and notifications, time-limited free trials of paid subscription plans, email campaigns, and lifecycle marketing. Dropbox generated over $1.1 billion revenue in 2017, with an average revenue per paying user of $111, $305 million in free cash flow and 11 million paying usersDropbox is a classic example of a startup that managed to grow at a massive scale thanks to its freemium model:

The free basic account has a storage of 2GB. The free plan also allowed Dropbox to benefit from massive network effects. The more people joined in to get the free storage, the more people they invited. To speed up the organic growth of its user base, Dropbox also built incentives that allowed users to get more free space if they invited more users to join!

Related: Dropbox Self-Serve Business Model In A Nutshell

How to align your business model to a freemium offeringThe primary advantage of a freemium model is the fact it can be used as a powerful marketing tool. Indeed, if you offer a great product or service for free, the chances are that you won’t need much salesforce to bring you to more paying customers.

However, that highly depends by the customer profile (are you selling to individuals or to organizations?). In that case, you will need to align your sales team around the free service, just like in the Zoom freeterprise model.

Instead, if your product is simpler, and it targets smaller, individual customers, you’ll have to experiment on conversion marketing tactics to allow free members to become paying users quickly and at a sustainable rate.

This is a critical difference between marketing vs. sales and why your free service will become your best companion to scale up growth!

A freeterprise is a combination of free and enterprise where free professional accounts are driven into the funnel through the free product. As the opportunity is identified the company assigns the free account to a salesperson within the organization (inside sales or fields sales) to convert that into a B2B/enterprise account.

A freeterprise is a combination of free and enterprise where free professional accounts are driven into the funnel through the free product. As the opportunity is identified the company assigns the free account to a salesperson within the organization (inside sales or fields sales) to convert that into a B2B/enterprise account.Free also became a powerful way for brands to gain traction in the enterprise space.

As I explained in Zoom business model though, the whole organizaiton needs to be structured around the freeterprise model, where on the one end the company seamlessy uses teh fee product as entry point within companies.

And on the other end, sales people with the ability to built strong relationship with the account can get the whole company onboard, thus transforming a free professional account into a potential enterprise customer.

Of course, this leads the organization to skew its resources toward building an army of qualified salespeople to handle the volume of leads generated by the free offering (in 2019 Zoom spent 54% of its revenues primarily in salespeople headcounts).

What questions should you ask before you go with a freemium?So that you know what key questions to ask that person to make sure the freemium is the right growth tool for your business. Some of those questions are:

Do we have the resources to sustain a free product? Many forget that a free product still requires a lot of maintenance, updates, support or else. If you don’t have those things in place, your free product won’t be good, which will make it flop quickly.Is the free product cannibalizing my premium offering? It might sound obvious for some people, but engineering a free product isn’t easy. Do you know how much of that free offering is enough to be valued? Do you know how to strike a balance between what you offer for free and what instead should be paid? Is the free product in line with your overall business strategy?Is the freemium in line with my overall business model? For instance, if your organization is primarily structured on a sales team, which works with enterprise customers a freemium might make sense as it enables your brand to be known by more people. But will the fact that more people will know my brand a way to speed up the process of acquiring another potential enterprise customer? If not, is a freemium aligned with a business strategy where I want to get the lower-end of the market?Below an example of how a freemium decision tree might look like:

To make the freemium business model work it is critical to look closely at a few key metrics. Some of those metrics are matured from the gaming industry but are also used by traditional freemium business models:

The average cost of serving a free userThe rates at which free users convert to premium (paying) customersDAU (Daily Active Users) is used to show the number of people who engage with the product, service on a daily basis. For other platforms, other metrics like monthly active users might be more appropriateARPU: Average Revenue Per UserARPDAU: Average Revenue Per Daily Active UseARPPU: Average Revenue Per Paying UserLTV: Lifetime ValueDaily Sessions: The number of play sessions a user engages each day.CPA: Cost Per Acquisition or CostA final remark on how to do the Freemium rightI want to close this article with the extract from the MailChimp Freemium business model. The reason being, MailChimp has been one of the most effective companies in applying the freemium, and this is the greatest lesson learned:

Connected Business ConceptsI think there are too many startups out there who are interested in going freemium because that big “10” number is so attractive. This is dangerous when they don’t even have the “1” yet. How will they pay their bills while they figure out how to “monetize?” Answer: they will need to borrow that money. Does your VC have the patience for the long term, while you try to figure out how to “monetize” and build up that measely “1” number? Answer: No — no they don’t. Build up that “1” before you chase the “10.” After you’ve got your “1” all set, use VCs to help you chase after that “10” (if you must). That’s my personal opinion. Disclaimer: I’m wrong about 99% of the time.

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2019/04/slack-business-model-1.png?fit=1024,753&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Slack follows a freemium model, where a free version is offered, and users can convert in paying customers if they want more usage or advanced functionalities. Slack combines the free model with a direct sales force to acquire enterprise customers with yearly recurring revenue of over 100K. Those customers were 575 in 2019, and they accounted for 40% of its revenues.

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2019/04/slack-business-model-1.png?fit=1024,753&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Slack follows a freemium model, where a free version is offered, and users can convert in paying customers if they want more usage or advanced functionalities. Slack combines the free model with a direct sales force to acquire enterprise customers with yearly recurring revenue of over 100K. Those customers were 575 in 2019, and they accounted for 40% of its revenues.  https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/10/dropbox-business-model.jpg?fit=1024,772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Dropbox generated over 90% of its revenue via its self-serve channels to convert users into paying customers through in-product prompts and notifications, time-limited free trials of paid subscription plans, email campaigns, and lifecycle marketing. Dropbox generated over $1.1 billion revenue in 2017, with an average revenue per paying user of $111, $305 million in free cash flow and 11 million paying users.

https://i0.wp.com/fourweekmba.com/wp-... data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2018/10/dropbox-business-model.jpg?fit=1024,772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>Dropbox generated over 90% of its revenue via its self-serve channels to convert users into paying customers through in-product prompts and notifications, time-limited free trials of paid subscription plans, email campaigns, and lifecycle marketing. Dropbox generated over $1.1 billion revenue in 2017, with an average revenue per paying user of $111, $305 million in free cash flow and 11 million paying users.

Grammarly leverages on a freemium service, where free users are prompted to switch to a paid subscription. Grammarly makes money by selling premium plans starting at $11.66 to $29.95 per month. The company also makes money by selling human proofreading services to its paid users.

Grammarly leverages on a freemium service, where free users are prompted to switch to a paid subscription. Grammarly makes money by selling premium plans starting at $11.66 to $29.95 per month. The company also makes money by selling human proofreading services to its paid users. Open source is licensed and usually developed and maintained by a community of independent developers. While the freemium is developed in-house. Thus the freemium give the company that developed it, full control over its distribution. In an open-source model, the for-profit company has to distribute its premium version per its open-source licensing model.

Open source is licensed and usually developed and maintained by a community of independent developers. While the freemium is developed in-house. Thus the freemium give the company that developed it, full control over its distribution. In an open-source model, the for-profit company has to distribute its premium version per its open-source licensing model. Medium is an online media platform leveraging the concept of social media for journalism, where writers are prompted to the platform to build their following through in-depth writings and essays. The platform follows a freemium model, and it makes money by prompting users to subscribe to articles behind paid walls (Medium charges $5/month or $50/year), and writers are paid based on readership.

Medium is an online media platform leveraging the concept of social media for journalism, where writers are prompted to the platform to build their following through in-depth writings and essays. The platform follows a freemium model, and it makes money by prompting users to subscribe to articles behind paid walls (Medium charges $5/month or $50/year), and writers are paid based on readership. The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.” data-image-caption=”

The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.” data-image-caption=”The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.

” data-medium-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2020/05/sales-funnel.png?fit=300,226&ssl=1″; data-large-file=”https://i0.wp.com/fourweekmba.com/wp-content/uploads/2020/05/sales-funnel.png?fit=1024,772&ssl=1″; data-recalc-dims=”1″ data-ll-status=”loaded” data-lazy-loaded=”1″>The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.Handpicked business resources:

Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?Business models analyses:

How Does PayPal Make Money? The PayPal Mafia Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessThe Google of China: Baidu Business Model In A NutshellAccenture Business Model In A Nutshell Salesforce: The Multi-Billion Dollar Subscription-Based CRMHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedThe post The Freemium Business Model Complete Guide appeared first on FourWeekMBA.

March 29, 2022

How Does Facebook [Meta] Make Money? Facebook Business Model Analysis- Updated 2022

Facebook, the main product of Meta is an attention merchant. As such, its algorithms condense the attention of over 2.91 billion monthly active users as of June 2021. Meta generated $117.9 billion in revenues, in 2021, of which $114.9 billion was from advertising (97.4% of the total revenues) and over $2.2 billion from Reality Labs (the augmented and virtual reality products arm).

Meta Revenue Breakdown2021%Advertising$114.9 Billion97.5%Other revenue (payments and fees)$721 Million0.6%Reality Labs (primarily sales of Oculus, now called Meta Quest)$2.27 Billion1.9%Total$117.9 Billion Key Facts FoundersMark Zuckerberg, Andrew McCollum, Dustin Moskovitz, Eduardo Saverin, Chris HughesYear FoundedFebruary 2004, Cambridge, MADate of IPOMay 18, 2012IPO Price$38.00Market Cap at IPO$104 BillionTotal Revenues at IPO$3.7 Billion by 2011, prior to the IPOTotal Revenues in 2021$117.9 BillionChanged nameMeta, in October 2021Employees71,970 employees, globally, as of December 31, 2021Revenues per Employee$1,642,693.97Who owns Meta?Mark Zuckerberg is the primary individual shareholder, with 81.7% of Class B shares, and 52.9% of the total voting powerMeta Business Model VTDF BreakdownWe describe the Meta business model via the VTDF framework developed by FourWeekMBA.

Meta Business ModelDescriptionValue Model: Connecting People At Scale.Facebook’s mission is “to give people the power to build community and bring the world closer together.” As the company rebranded to Meta in 2021, its vision shifted to “helping to bring the metaverse to life.” That implies the company’s effort in the coming years into developing a whole supply chain for the metaverse (hardware, operating system, browser, marketplace).Technological Model: Two-Sided Network Effects – Attention Marketplace.On the one hand, Meta’s main products (Facebook, Instagram, and Messenger) work as two-sided networks, where for each additional average power user joining (what we call “influencer”) the more the network will become valuable for average users, and the more power users will want to join the platform. On the advertising side, instead, Facebook is an attention marketplace. The more users engage on the platform, the more it becomes valuable for marketers and companies that invest a growing budget on top of the Facebook advertising marketplace (now rebranded as Meta Marketplace).Distribution Model: Growth Engine (Combining product development/marketing/distribution as a whole), Deal Making, Lobbying.For the company to keep growing, it needs to keep its user base growing through additional features built into the product, branding campaigns, and the ability to launch new products compelling to younger generations. On the other hand, as social media is under the radar for privacy issues, the company also needs a team of lobbyists to make the company compliant with regulations.Financial Model: Attention Merchant.The company monetizes by arbitraging the traffic acquired through its apps resold through its advertising marketplace. As long as the traffic is monetized many times over its acquisition costs, the company is highly profitable.The history of Facebook: the former rocket ship, turned into a heavy cruise shipBack in the 2010s, a few years after Facebook had been founded, it represented one of the most impressive growth companies that ever existed, also for the Internet standard.

Indeed, Facebook and a few other companies opened the way, to what we call – in hindsight – Web 2.0.

In an early 2004 interview, Mark Zuckerberg, 20 at the time, side by side with WesMatch’s founder, Dan Stillman, explained what Facebook was about. Facebook would eventually wreck down WebMatch and all the other early players in the social network space (Myspace, Friendster, and CampusHook to mention a few).

As Zuckerberg explained it at the time, Facebook was “an online directory that connects people through universities and colleges through their social networks.”

While today we give for granted a Facebook with billions of users, at the time with a hundred thousand users on the platform, it was very hard to tell how big it could become.

Facebook’s early growth trajectory (Source: Financial Prospectus).

When Facebook first launched, it was a rocket ship. The company used a staged rollout, where it would open its app to a larger and large set of users, not gradually, but exponentially.

In short, with its first release, in February 2004, it only proved the concept through Harvard. As growth picked up right on, and the product turned out to be very sticky among students at Harvard, Facebook opened to other top colleges, by the same year.

And this happened right after Facebook had built a very important feature, the Facebook Wall, which would become a place for users to post relevant staff and connect to each other.

This is how Facebook reached a million monthly active users.

After that, by early 2005, Facebook was already present in 800 college networks. By September and October of the same year, Facebook expanded to high schools and international networks. This, at the moment in which, it had introduced a new feature, photos, enabling users to upload their photos on the platform (a big deal at the time!).

By 2005, Facebook had reached 6 million monthly active users (a 6x growth).

By September 2006, Facebook introduced another key feature, which was as powerful as the “Stories feature” that Snapchat would introduce seven years later, in 2013. That was Facebook’s News Feed!

By 2006, Facebook had grown into a 12 million monthly active user base.

By 2007, Facebook launched the Facebook Platform, a third-party application platform, enabling developers to build apps/features on top of Facebook. While this would be slowly shut down over the years (Facebook deprecated various APIs over time) it was a great experimental platform for quick users growth.

In the same year, also Facebook Pages was launched. The company reached 58 monthly active users.

In 2008-2009 Facebook’s expansion continued, with Facebook reaching over 360 million monthly active users.

In the same year, 2009, Facebook introduced the like button.

By 2012, as Facebook got ready for the IPO, it also reached a billion monthly active users!

And as it grew, it also played with its privacy policies, to make its advertising machine extremely profitable (a blessing and a curse that would follow the company for years).

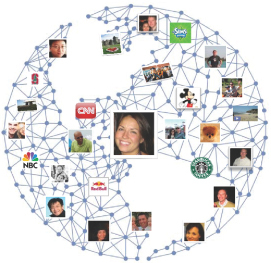

Leveraging a powerful social graph, it leveraged network effects, and it quickly grew, from a social network for universities, to mass social media company.

The Facebook Social Graph of the early days! (Source: Facebook Prospectus).

Facebook was an incredible innovation for its time. With a very simple interface users could upload photos, update their status, and send messages to their friends and have complete control over what they wanted to share:

(Source: Facebook Prospectus).

Back then, when Facebook was getting ready for its IPO, Zuckerberg highlighted the company’s playbook, founded on what Zuck called “The Hacker Way” (which also turned into the name of the street – 1 Hacker Way, Menlo Park – where the main headquarter is situated).

This playbook would also become the standard, for those building Internet companies who had to leverage fast users’ adoption, and network effects.

It would inspire disciplines like growth hacking, and growth marketing, now become a standard in the Internet industry.

The manifesto said:

As part of building a strong company, we work hard at making Facebook the best place for great people to have a big impact on the world and learn from other great people. We have cultivated a unique culture and management approach that we call the Hacker Way

The word “hacker” has an unfairly negative connotation from being portrayed in the media as people who break into computers. In reality, hacking just means building something quickly or testing the boundaries of what can be done. Like most things, it can be used for good or bad, but the vast majority of hackers I’ve met tend to be idealistic people who want to have a positive impact on the world.

Therefore, Zuckerberg reframed the meaning of hacker, not as something bad, but rather a mindset to be used to build valuable things in the world.

And he continued:

The Hacker Way is an approach to building that involves continuous improvement and iteration. Hackers believe that something can always be better, and that nothing is ever complete. They just have to go fix it — often in the face of people who say it’s impossible or are content with the status quo.

This would set the stage for the core mindset that Facebook had led for years of “moving fast, and breaking things.” This would be the main manifesto for years until Facebook had become such a popular company, that going too fast was no longer an option.

Indeed, in 2014, as Facebook had become a company generating over $12 billion in advertising revenues, and with almost 1.4 billion Monthly Active Users, the motto changed to “Move fast with stable infrastructure.”

However, like Zuckerberg, explained, back in 2012 – when Facebook was getting ready for the IPO:

Hackers try to build the best services over the long term by quickly releasing and learning from smaller iterations rather than trying to get everything right all at once. To support this, we have built a testing framework that at any given time can try out thousands of versions of Facebook. We have the words “Done is better than perfect” painted on our walls to remind ourselves to always keep shipping.

He also added:

Hacking is also an inherently hands-on and active discipline. Instead of debating for days whether a new idea is possible or what the best way to build something is, hackers would rather just prototype something and see what works. There’s a hacker mantra that you’ll hear a lot around Facebook offices: “Code wins arguments.”

What about its culture?

Hacker culture is also extremely open and meritocratic. Hackers believe that the best idea and implementation should always win — not the person who is best at lobbying for an idea or the person who manages the most people.

How did Facebook incentivize this hacker mindset?

To encourage this approach, every few months we have a hackathon, where everyone builds prototypes for new ideas they have. At the end, the whole team gets together and looks at everything that has been built. Many of our most successful products came out of hackathons, including Timeline, chat, video, our mobile development framework and some of our most important infrastructure like the HipHop compiler.

This implied an initial program, a Bootcamp, which anyone (also future managers) had to go through:

To make sure all our engineers share this approach, we require all new engineers — even managers whose primary job will not be to write code — to go through a program called Bootcamp where they learn our codebase, our tools and our approach. There are a lot of folks in the industry who manage engineers and don’t want to code themselves, but the type of hands-on people we’re looking for are willing and able to go through Bootcamp.

In 2012, Facebook had reached over $5 billion in revenues. By 2016, that number would be more than 5x, reaching over $27 billion in revenues.

And by 2021, Facebook 4xed again its growth to $114.9 Billion in advertising revenues!

Facebook, metaverse, and rebranding as MetaAt the end of October 2021, Mark Zuckerberg announced the Facebook Inc. rebrand as Meta. A company focused and dedicated to building the Metaverse. Beyond buzzwords and corporate communication. What does that imply?

With the announcement, Facebook changed its name to Meta. It wasn’t just a name change (although it was perceived by many as such) but it also worked as organizational restructuring.

Indeed, with this move Facebook, now Meta, wanted to show its bold move into VR/AR, which is seen by Zuckerberg as the next mass consumers platform after the smartphone.

In short, with this new organization, they are trying to go after, what today we call the Metaverse, which is something still hard to make sense of since its definition is getting shaped now.

Thus, Facebook, now Meta, is trying to become a leading player in this new market. But to really understand that we need to look at the overall Facebook business model.

Before we get to that, it’s important to emphasize that Meta is still an advertising company. And how do you measure the success of an advertising company? There is a metric for that: ARPU!

It’s all about ARPU: How much are you worth to Facebook? The ARPU or average revenue per user is a key metric to track the success of Facebook, – now Meta – family of products. For instance, by the end of 2021, Meta’s ARPU worldwide was $11.57. While in US & Canada it was $60.57, in Europe it was $19.68, in Asia $4.89 and in the rest of the world, it was $3.43.

The ARPU or average revenue per user is a key metric to track the success of Facebook, – now Meta – family of products. For instance, by the end of 2021, Meta’s ARPU worldwide was $11.57. While in US & Canada it was $60.57, in Europe it was $19.68, in Asia $4.89 and in the rest of the world, it was $3.43.ARPU stands for average revenue per user. In short, how much money a company can get on average from each user. In the Facebook case, we can take into account the monthly active users.

For a company like Facebook, for which over 97% of its revenues come from advertising the amount of time people spend on the so-called news feed is crucial to increase the profitability metrics of the company.

That isn’t only because Facebook is an advertising company, but also the way its business model was built.

If you think about Google, what makes the company able to monetize its users is not necessarily how much time they spend on the search results pages. Instead, that is based on how fast users can find what they need.

Once they click through that is how Google makes money.

Of course, things are changing fast both on Google and on Facebook.

Yet as of now the more time you spend on Facebook and the more you’re active on it, the more you allow it to make money.

What else? Not all users are born equal. In fact, according to the geography and the ad market of each country, the monetization strategy changes.

ARPU or average revenue per user is a key metric for attention merchants, like Facebook. It assesses the ability of the platform to monetize its users. For instance, in 2021, Facebook’s ARPU worldwide was $11.57. Its ARPU was driven by US & Canada ($60.57), followed by Europe ($19.68), and Asia ($4.89), and in the rest of the world it was $3.43.

ARPU or average revenue per user is a key metric for attention merchants, like Facebook. It assesses the ability of the platform to monetize its users. For instance, in 2021, Facebook’s ARPU worldwide was $11.57. Its ARPU was driven by US & Canada ($60.57), followed by Europe ($19.68), and Asia ($4.89), and in the rest of the world it was $3.43.For instance, that is how much each user based on geography was worth to Facebook in 2021:

US and Canada: $60.57.Europe: $19.68.Asia: $4.89.Rest of the World: $3.43.Therefore, a user from the US or Canada as of 2021 is worth more than a user from Europe or the Asia-Pacific region. To make a comparison, a user from US and Canada, on average, is worth 17x more than a user in the rest of the world!

Of course, also within the US, there are the so-called power users, which are worth way more to the company. For instance, think of an influencer profile, which has many millions of followers, and that when it posts, generates millions of interactions.

If you take, for instance, the most successful Instagram account, in 2021, that of Cristiano Ronaldo, with over 400 million followers, you realize that this account alone might be worth hundreds of millions for the company, each year.

Compared to the account of average users, with a few followers, which generates very few engagements. Thus, also when looking at ARPU, it’s important not to give it too much weight.

In fact, an analysis based on power users’ accounts and how those power users (like Cristiano Ronaldo) move their following across various social media platforms (imagine Ronaldo stopped posting on Instagram and only posted on TikTok) can tell us much more about the overall health of the platform user adoption.

This, of course, is a qualitative analysis.

From an internal standpoint, the long-term objective for Facebook is to keep increasing its monetization for each user, especially in the developing parts of the world where there is still space to grow the user base, which instead has stalled in the US and Canada.

While at the same time, it needs to make sure to keep growing its user base and keep attracting power users, which can generate millions of interactions with each post. And this is a matter of product development, engineering, distribution, and brand appeal to newer generations!

If we look at the current landscape of Facebook’s monthly active users (this only comprises Facebook users) you can see how growth in US & Canada has mostly slowed down.

It has also slowed down in Europe, wherein in 2020, Facebook had 419 million users, vs. the 394 million users in 2019 (an over 6% growth), compared to the less than 2% growth in 2021 (from 419 million monthly active users in 2020, to 427 monthly active users in 2021).

Snapshot of Facebook key stats and factsAs reported officially by Facebook, the company’s main headquarter is situated on 1 Hacker Way, Menlo Park, California 94025.As we highlighted the “Hacker Way” is Mark Zuckerbergs’ key driving business strategy mindset.Facebook, now Meta had f 71,970 employees as of December 31, 2021.The company also reported 2.91 billion monthly active users (remember that Facebook Inc, also comprises other products like Instagram, while they affect the Facebook bottom line, Facebook doesn’t report how much of it is coming from each product and doesn’t tell us the users count of those platforms). In 2021 Facebook, now Meta, generated $117.9 billion in revenues, compared to $85.9 billion in 2020. In 2021 Meta generated $39.3 billion in net income, compared to $29.1 billion in 2020. In 2021 Meta’s business model was driven by advertising revenues, which represented 97.4% of the total revenues, compared to 98.6% in 2020. As of 2021, Facebook spent over 20%($24.6 billion) of its revenues on R&D. While it spent about 12% of its revenues on Sales and Marketing activities ($14 billion).What drove Facebook’s business model in 2021? A FourWeekMBA Analysis shows that in 2021, the growth of Facebook’s revenues was driven by the US & Canada users’ monetization, due to a 24% price per ad increase 2021. This means that Facebook is squeezing its users’ attention, to give a boost to its advertising revenues.

A FourWeekMBA Analysis shows that in 2021, the growth of Facebook’s revenues was driven by the US & Canada users’ monetization, due to a 24% price per ad increase 2021. This means that Facebook is squeezing its users’ attention, to give a boost to its advertising revenues. As we saw, Facebook, now Meta makes money with an advertising business model. Almost all the revenue comes from targeted advertising.

Facebook revenue breakdown in 2021 was:

Advertising (over 97% of revenues): the company generated over $114.9 billion in advertising primarily consisting of displaying ad products on Facebook, Instagram, Messenger, and third-party. As Facebook highlighted, in 2021, the number of ads delivered increased by 10%, as compared with approximately 34% in 2020. And the price per ad increased by 24% in 2021, compared to a 5% decrease in 2020. This means that Facebook is squeezing users’ attention to drive up revenues (not a good sign).Payments and other fees (less than 1% of total revenues): $721 million in revenues primarily consisted of the net fee received from developers using Payments infrastructure or revenue from the delivery of virtual reality platform devices and most importantly revenue from the delivery of consumer hardware devices.Reality Labs generated about $2.27 billion in revenues (almost 2% of the total revenues) from the delivery of consumer hardware products, such as Meta Quest (former Oculus), Facebook Portal, wearables, and related software and content. In 2021, Facebook started to report this segment separately, compared to the advertising segment, as, in theory, this should become the main business unit for the company in the coming decade (this is a matter of survival for Facebook). Facebook’s same mission statement, changed vision (hint: it’s all about the metaverse)The company’s mission was “to give people the power to build community and bring the world closer together.”

As Facebook, became Meta, its mission statement stayed the same, however, its vision changed.

In fact, Meta’s mission is still to give people the power to build community and bring the world closer together.

The vision is “of helping to bring the metaverse to life.”

As the company highlighted in its 2021 financials:

The pillars of Meta’s business modelWe build technology that helps people connect, find communities, and grow businesses. Our useful and engaging products enable people to connect andshare with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. We also help peoplediscover and learn about what is going on in the world around them, enable people to share their opinions, ideas, photos and videos, and other activities withaudiences ranging from their closest family members and friends to the public at large, and stay connected everywhere by accessing our products. Meta is movingbeyond 2D screens toward immersive experiences like augmented and virtual reality to help build the metaverse, which we believe is the next evolution in socialtechnology

Meta business model can be broken down into two main segments:

Family of Apps (comprising the main products which make the advertising business successful – like Facebook, Instagram, Messenger, WhatsApp).And Reality Labs: the suite of products related to the Metaverse (former Oculus, wearables, and marketplaces related to VR/AR).And five main product pillars:

Facebook, which main digital assets comprise the News Feed, Stories, Groups, Watch, Marketplace, Reels, Dating.Instagram, which main digital assets comprise Instagram Feed, Stories, Reels, Video, Live, Shops, and messaging.Messenger, which main features comprise chat, audio and video calls, and Rooms.WhatsApp which main application is mobile chat. And Meta Quest is the company’s flagship hardware for virtual reality on top of which Meta is trying to build its new supply chain of data.And a “research factory”, which is Reality Labs, trying to build from scratch the whole Metaverse supply chain!

Facebook Reality Labs is an augmented and virtual reality laboratory that produces hardware and consumer devices. This is comprised of Oculus, a leader in VR headsets, which Facebook acquired in 2014 for $2.3 billion. Oculus Quest, the main product line of what has been rebranded as Facebook Reality Labs is the VR device, which will also play a key role in the development of the Metaverse.

We’ll see why the Metaverse plays such a key role in Facebook’s future. And it’s all about distribution.

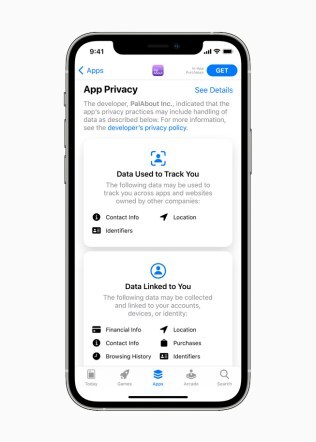

Comparing the attention merchants’ business models In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.Before we jump forward, to understand Facebook’s fast move into the Metaverse. Let’s highlight some core similarities, and differences between Google and Facebook business models.

Let’s see two major similarities: