Gennaro Cuofano's Blog, page 102

April 13, 2022

Amazon Revenue Breakdown

Read Next:

The post Amazon Revenue Breakdown appeared first on FourWeekMBA.

Google Revenue Breakdown

Read Next:

Google Business ModelHow Does Google Make MoneyThe post Google Revenue Breakdown appeared first on FourWeekMBA.

April 12, 2022

High-Performance Teams

In general, most teams possess the following characteristics:

They are united by priorities and goals that align with organizational priorities.Communication within the team is clear, streamlined, and collaborative. Conflict, when it does occur, is always seen as a way to improve.The most important tasks are completed first, with the team able to distinguish between urgency and impact.There is a strong culture of trust where members are respected for their unique skills and are encouraged to be themselves or take risks. All high-performance management teams have a growth mindset. They look for opportunities to improve and have the ability to accept and use feedback to their advantage.Any organization can recognize the importance of high-performance management teams, but how are they defined, exactly?

With the above points in mind, let’s take a look at some real-world examples of high-performance teams and how they are used.

General ElectricWhen General Electric set a goal to produce the largest commercial jet engine in the world, the stakes were high. The engine, dubbed the GE90, was the first such engine GE had designed from scratch in more than twenty years. What’s more, the development of the GE90 had cost $1.5 billion before it had even progressed to the manufacturing stage.

Then-CEO Jack Welch recognized that factory manager Robert Henderson could not accomplish this gargantuan task on his own: “We know where productivity comes from. It comes from challenged, empowered, excited, rewarded teams of people.” Despite this realization, both Henderson and Welch understood that factories were mostly unempowered workplaces where individuals felt like small cogs in a vast machine.

To develop high-performance teams within a factory environment, Henderson visited other establishments with high employee autonomy for inspiration. He then hired employees with Federal Aviation Administration (FAA) mechanic’s licenses instead of simply hiring general mechanics. This resulted in a far superior team that was capable of making crucial decisions on their own, which increased productivity and morale.

Henderson also stressed the importance of decluttering and contracted out non-job-related tasks such as bathroom and breakroom cleaning. The goal of this initiative was to allow factory employees to focus their skills and expertise where it mattered most.

AppleAs a company operating in the dynamic and disruptive consumer electronics industry, Apple relies on high-performance teams to innovate and maintain the company’s market dominance.

Apple’s research and development arm consists of a high-functioning and a largely self-managed team of designers, quality control experts, and professional engineers. To attract the best talent, the company relies on a rigorous recruitment process that was instituted by Steve Jobs.

In the early days of the company, candidates would start at 9 in the morning and spend the whole day meeting everyone in the building at least once. The hiring team would then convene and decide whether the candidate would progress to the next stage. This involved showing them a Macintosh prototype, with Jobs only hiring those who were genuinely excited and enthusiastic about the new piece of technology before them.

BoeingBoeing uses high-performance teams to make the company a better place to work via employee involvement. In a 2004 interview for the company magazine, Chief People and Administration Officer Laurette Koellner noted that “Competitors can duplicate our technologies and processes; however, they can’t duplicate our people. Our people are our competitive advantage.”

At its core, employee involvement at Boeing means staff can influence decisions that affect their work. Instead of the top-down, hierarchical approach, high-performance teams take responsibility for managing their workspaces and making process or workflow improvements. This means teams are afforded more autonomy and free access to important data and technology that makes their life easier.

One example of this process at work is the self-managed team that used to manufacture the struts for a Boeing 757. Based far away from company headquarters in Wichita, Kansas, teams at the strut factory were given the training, resources, and responsibility to manage the factory as if it were a standalone business.

Key takeaways:High-performance teams are characterized by collaborative communication and goals that align with organizational objectives. Team members also trust and respect one another and adopt a growth mindset.General Electric relied on high-performance teams to build the world’s largest commercial jet engine. Apple, on the other hand, relies on high-performance teams to maintain a competitive advantage.At Boeing, teams can influence decisions that affect their work and are given more autonomy and control over their areas of expertise.Read Next: High-Performance Management.

Read Also: Eisenhower Matrix, BCG Matrix, Kepner-Tregoe Matrix, Decision Matrix, RACI Matrix, SWOT Analysis, Personal SWOT Analysis, TOWS Matrix, PESTEL Analysis, Porter’s Five Forces.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post High-Performance Teams appeared first on FourWeekMBA.

April 11, 2022

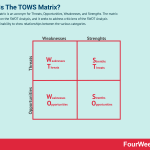

What Is The TOWS Matrix And How To Use It

The TOWS Matrix is an acronym for Threats, Opportunities, Weaknesses, and Strengths. The matrix is a variation on the SWOT Analysis, and it seeks to address criticisms of the SWOT Analysis regarding its inability to show relationships between the various categories.

Understanding the TOWS MatrixThe TOWS Matrix was developed by management consultant Heinz Weihrich. He recognized that the SWOT Analysis – although highly successful in its own right – had significant shortcomings.

While the SWOT Analysis identifies Strengths, Weaknesses, Opportunities, And Threats, it does not make any attempt to make links between them. For example, a business with a perceived weakness may then see it as a threat. Another business that identifies an opportunity may be able to match it to one of their existing strengths.

The TOWS Matrix, then, is a much more useful graphical representation of a SWOT Analysis. Internal strengths and weaknesses are compared to external opportunities and threats. Every one of the four individual factors can influence and impact each other.

The four strategy combinations of a TOWS Matrix

Strengths/Opportunities (SO)In this quadrant of the TOWS Matrix, a business must assess its strengths on a case by case basis to determine if it can use them to capitalize on opportunities. For example, a car manufacturer operating in a luxury car market (opportunity) with a strong R&D culture (strength) may design a feature-packed line of premium vehicles.

Strengths/Threats (ST)Here, the business should assess each strength based on its ability to counteract or avoid external threats. Returning to the car manufacturer example, unfavorable exchange rates (the threat) may be counteracted by the company using its R&D expertise to build a factory in a country with a better-valued currency.

Weaknesses/Opportunities (WO)In the WO quadrant, an organization must determine how its weaknesses can be eliminated or offset by external opportunities. For example, inexperience in dealing with foreign labor unions (weakness) can be overcome by hiring managers with the relevant experience (external opportunity).

Weaknesses/Threats (WT)In the final strategy combination, the business assesses each weakness and threat and determines if they can be avoided. The car manufacturer with little experience operating in foreign markets (weakness) can avoid entering that market altogether. Another maker with a heavy reliance on a single car model (weakness) can reduce the threat of competition by developing a range of different models.

Benefits of the TOWS MatrixThe benefits of creating a TOWS Matrix include:

A more versatile option than some other techniques that are glorified brainstorming sessions. It allows a business to link external and internal factors and their potential impact on business operations.Simple to understand through all levels of management and is relatively simple to execute. This increases employee focus and cohesiveness.The TOWS Matrix also facilitates the discovery of unknown aspects of a business. Whether they are unquantified strengths or hidden threats, newfound insights into operations help a company plan for the future, and facilitate growth.TOWS matrix exampleBelow is a TOWS matrix example for The Boeing Company with respect to the four strategy combinations outlined above.

Strengths/Opportunities (SO)Boeing has several strengths that it can turn into opportunities to maintain or increase market share. These include:

Established, reliable supplier network – over the years, Boeing has built a robust network of suppliers that allow it to overcome bottlenecks.Customer satisfaction – despite recent setbacks with the 737 MAX, Boeing’s extensive clientele in the form of airlines and government are satisfied with its products. Boeing enjoys extensive brand equity around the world which it uses to drive sales.Free cash flow – for Q4 2021, Boeing reported a free cash flow of $494 million. The company is using some of this cash to position itself as a safe and sustainable airline as the world returns to air travel after COVID-19.Strengths/Threats (ST)Here is a look at the strengths that can be used to avoid external threats:

Research and development – Boeing has a strong history of research and development, with several pioneering aircraft in both the commercial and defense industries. Today, the company is partnering with scientific organizations to make air travel more sustainable and reduce its environmental impact.Global and strategic partners – while Boeing has a strong presence in America, approximately 70% of commercial aircraft revenue is derived from customers outside the United States. This includes many emerging markets where there has also been a rapid increase in defense, space, and security revenue. What’s more, the company has over 20,000 suppliers and partners and collaborates with over 50 international universities. Taken as a whole, this helps Boeing counter the threat of Airbus and maintain or even increase its market share.Weaknesses/Opportunities (WO)How is Boeing turning its weaknesses into opportunities?

Unsafe aircraft – the release of the 737 MAX was rushed to counter a similar new aircraft released by Airbus. Two 737s crashed killing all on board, with both experiencing the same malfunction. In late 2021, the company admitted full responsibility for the disasters which paved the way for compensation to be paid to the victims’ families. Boeing is now using this weakness to improve its software development, technical documentation, and pilot training procedures.Anti-union stance – some 35% of Boeing’s 162,000 employees are union members. The company’s anti-union stance is well known, with production of the 787 Dreamliner moved from Seattle to South Carolina to reduce employee organization. Many of Boeing’s most senior or skilled employees were also terminated for their union affiliations, while others had their workloads increased significantly or were reprimanded for quality control issues. Moving forward, Boeing has an opportunity to adopt a less inflammatory stance and increase its productivity in the process.Weaknesses/Threats (WT)Finally, let’s look at a weakness that may turn out to be a threat:

Domestic workforce – with a strong domestic workforce in the United States, Boeing is vulnerable to recent, substantial increases in the minimum wage. This has seen much of aircraft component manufacturing move overseas, with a dedicated 737 completion factory opened in China in 2018. Off-shore manufacturing to counter rising wages is a clear trend, with 30% of the 787 Dreamliner made overseas compared to just 5% of the older 747 jumbo jet. While rising minimum wages do not impact Boeing’s senior engineers, it remains to be seen whether the company will continue to outsource more of its aircraft assembly.Key takeawaysThe TOWS Matrix builds on the success of the SWOT Analysis by allowing a business to identify appropriate strategic actions.The TOWS Matrix consists of four strategies that help a business understand, plan, and prepare for the possible interaction between threats and weaknesses with strengths and weaknesses.The TOWS Matrix creates cohesion in the workforce and helps a business unearth hidden strengths or weaknesses that will influence future decision making.Connected strategic frameworks SWOT Analysis A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.PESTEL Analysis

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.PESTEL Analysis The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Porter’s Five Forces

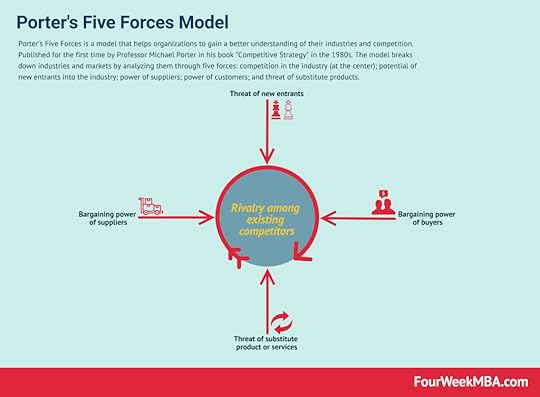

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Porter’s Five Forces Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesBlue Ocean Strategy

Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesBlue Ocean Strategy A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.BCG Matrix

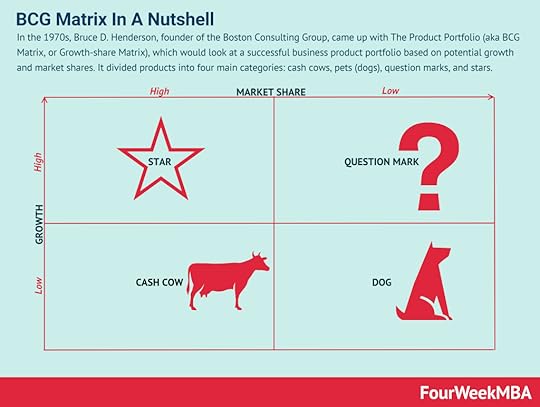

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.BCG Matrix In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Balanced Scorecard

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Balanced Scorecard First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Scenario Planning

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Scenario Planning Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.Other related business frameworks:

AIDA ModelAnsoff MatrixBusiness AnalysisBusiness Model CanvasBusiness Strategy FrameworksVRIO FrameworkAdditional resources:

Business ModelsBusiness StrategyDistribution ChannelsGo-To-Market StrategyMarketing StrategyMarket SegmentationNiche MarketingRevenue ModelsThe post What Is The TOWS Matrix And How To Use It appeared first on FourWeekMBA.

April 8, 2022

Agility Scales

Agility Scales take a specific topic or decision area and illustrate that there is a range of decision-making options. These options range from purely hierarchical (management-driven) decisions to purely networked (employee-driven) decisions.

Understanding Agility ScalesIn many organizations with a hierarchical management style, decision-making tends to be performed in a slow and bureaucratic manner by the chosen few. In this context, efficiency could be improved by involving employees in important decisions regarding purpose and strategy.

However, it would be unwise to suggest that management should delegate all decision-making to their subordinates. Indeed, employees who work without direction and make decisions without relevant experience also contribute to inefficiency within a business.

This begs the question: which decisions should be management driven and which should be driven by employees?

Core components of Agility ScalesAgility Scales work on the assumption that a balance must be struck between:

The centralized decision-making of management, favors specialization, exploitation, efficiency, and hierarchy. The de-centralized decision-making of employees favors generalization, exploration, networking, and effectivity.This balance is highly contextual. It is specific to the needs of the business or more accurately, to the needs of individual teams or departments within the business.

Defining context for Agility ScalesTo successfully respond to change, the business must first understand the context in which change needs to be made.

If the change requires a general increase in effectivity, then employees or project teams should delegate fewer decisions to upper management. However, if the context calls for more efficiency or specialist advice, upper management should take on most of the decision-making responsibility.

In some contexts, a blend of each form of decision-making and its inherent qualities will be required. What’s important is that the business is consistently moving between each end of the spectrum.

Ultimately, this helps an organization develop agile and innovative principles and characteristics.

Specific applications of Agility ScalesAgility Scales can be used in many different business contexts:

The formation of teams, groups, business units, or departments. How are these teams formed? Who takes initiative for team creation and who decides when a team has been finalized? How much autonomy do these teams have?Leadership. Will the leader be responsible for the actions of a group and be directly accountable to superiors? Alternatively, will individual team members assume leadership responsibilities when required without a formal title or interference from higher up?Purpose. Is the purpose of the organization clearly defined, with all employees required to work toward a singular goal? Or are individuals given freedom and flexibility to work toward a goal or purpose they have designated for themselves?Boundaries. This context describes the point where the work of one team ends and the work of another team begins. For example, who approves the installation or purchase of new tools or equipment? Which team will focus on iOS, and which will focus on Android? Who will decide if the regional sales team needs to be expanded or reduced because of urban sprawl?Key takeaways:Agility Scales encompass decision-making options ranging from purely hierarchical (management driven) to purely networked (employee-driven) decisions. Agility Scales help a business respond to change in an agile fashion by continuously moving along a spectrum according to the context of change itself.Agility Scales are useful in a variety of contexts, including team formation, leadership, boundary setting, and purpose.The post Agility Scales appeared first on FourWeekMBA.

How does Sezzle make money?

Sezzle is a fintech company operating in the United States and Canada. It was founded by Charlie Youakim, Paul Paradis, and Killian Brackey in 2016.

Youakim and Paradis, who met while studying their MBAs in Minnesota, created Sezzle as a payment platform that would compete with the likes of PayPal. The pair even went as far as calling the platform PayPal 2.0 for merchant processing, envisioning a service where merchants were charged 50% less and consumers could earn cashback rewards on their purchases. Unfortunately, the service failed to gain any traction.

While Youakim’s wife was scrolling through Instagram one day, she noticed Afterpay being offered as an option for merchants in Australia. In May 2017, Sezzle pivoted to offering interest-free credit to young people who preferred to make purchases with their debit cards.

The founders then sought funding in the United States, but the buy-now-pay-later movement was still in its infancy there. As a result, Youakim and Paradis decided to hold an IPO on the Australian Stock Exchange. The company raised $30 million on the first day of trading and by the time of the IPO in July 2019, Sezzle could already boast over 5,000 merchants and 430,000 customers.

Like many businesses, Sezzle profited enormously from the coronavirus pandemic as many shoppers migrated to making purchases online. During this time, the platform entered into partnerships with Google Pay and Apple Pay to allow its payment service to be used for in-store purchases. Merchant fees for 2020 increased by 266.9% over the previous year, with Sezzle adding over 1.3 million active users over the same period.

Sezzle revenue generationSezzle has a relatively simple revenue generation strategy. The service is essentially free to consumers, provided they pay on time.

With that said, below is an overview of how the company makes its money.

Merchant feesLike most buy-now-pay-late providers, Sezzle derives most of its income from merchant fees.

The merchant fee is charged at a flat rate of $0.30 plus 6% of the total transaction amount. Merchants who enjoy higher order volumes may be able to negotiate a custom rate with Sezzle.

The merchant fee may also be negotiable for non-profits and businesses operating in certain industries.

Rescheduled payment feeConsumers who want to reschedule the payments on a purchase for the second or third time are also charged a fee. It should be noted that the first reschedule is free, enabling the consumer to push a payment date out by up to a fortnight.

The exact rescheduling fee depends on individual state regulations and the region where the purchase was made. Generally speaking, the rescheduling fee is around $5.

Failed payment feeIf Sezzle is unable to process a payment, a $10 failed payment fee is added to the total amount owed.

However, this fee is waived if the individual manages to make the payment within 48 hours of the due date.

Key takeaways:Sezzle is a fintech company founded by Charlie Youakim, Paul Paradis, and Killian Brackey in 2016. Co-founders Youakim and Paradis created Sezzle to compete with PayPal but later pivoted after seeing the value in buy-now-pay-later.Sezzle derives much of its income from merchant fees, with merchants charged $0.30 plus 6% of the total transaction amount.Sezzle is essentially free to consumers provided they make payments by the due date. For late or failed payments the fee is $10. There are also fees associated with rescheduling payment dates.The post How does Sezzle make money? appeared first on FourWeekMBA.

How does Zip make money?

Zip is an Australian fintech company founded in 2013 by Larry Diamond and Peter Gray.

The year prior, former investment banker Diamond had been pitching to investors a new idea that would change the face of consumer finance. Diamond wanted to leverage technology to provide a quick and easy interest-free line of credit to consumers, but his pitches always fell flat because he lacked experience.

To help him refine his business case, Diamond hired credit specialist Peter Gray. For the next six months, the pair met in the bar of a Sydney hotel to create a business plan. The company, then known as ZipMoney Limited, was incorporated in June 2013 with the financial backing of friends and family. During this time, Diamond and Gray worked hard to convince retailers to join their platform.

After launching to the public around six months later, Zip debuted on the ASX via a reverse takeover. This strategy was considered more preferable since venture capital funding in Australia is more difficult to secure than in other parts of the world. Over the next few years, Zip successfully raised capital from an American asset manager and two Australian banks.

In May 2019, Zip became a $1 billion company and in the process, one of Australia’s most valuable fintech companies. Aggressive growth and expansion have occurred since, with the company acquiring rival service Quadpay and entering the lucrative U.S. market soon after.

Today, Zip has approximately 7.3 million customers and 51,300 retail partners around the world.

Zip revenue generationAs a fintech company, Zip makes money from merchant fees, loan interest, repayment fees, account establishment fees, and penalty fees.

Let’s take a look at each of these in more detail below.

Merchant service feesMerchant service fees are charged on a per-transaction basis and represent the largest source of revenue for Zip.

Whenever a consumer makes a purchase and selects Zip as the payment option, merchants are charged $0.30 plus 5% of the total transaction.

Loan interestConsumers who use Zip are charged interest for any purchases that remain outstanding after three months.

In Australia, for example, the monthly interest fee is $6.

Repayment feesRepayment fees are also charged in the Zip Business Trade Plus service, which offers a buy-now-pay-later solution for businesses.

Each account has a repayment fee of 3% if the business chooses to pay its statement balance in installments.

Account establishment feesZip also charges an account establishment fee to new applicants. This fee covers the cost of performing a background credit check.

Penalty feesIn most cases, monthly repayments on purchases are direct-debited from a consumer’s bank account.

In markets such as the United Kingdom, however, customers are charged a £6 penalty (late) fee if they fail to make a payment before the specified date.

Key takeaways:Zip is an Australian fintech company founded in 2013 by Larry Diamond and Peter Gray. Diamond had an idea to revolutionize consumer finance by giving shoppers quick and convenient access to credit.Zip makes the bulk of its revenue from merchant fees, which comprise a fixed amount plus a percentage of the total transaction. The company also charges interest on outstanding purchases and repayment fees as part of its business lending service.Zip charges an account establishment fee to cover the cost of performing a creditworthiness check. In some markets, it also charges a late fee.The post How does Zip make money? appeared first on FourWeekMBA.

How does Foodpanda make money?

Foodpanda is an online grocery and food delivery service owned by the European multinational company Delivery Hero.

Foodpanda was started in 2012 by Benjamin Bauer, Christian Mischler, Felix Plog, Kiren Tanna, Ralf Wenzel, Rico Wyder, Rohit Chadda, and Simon Schmincke. Each of the founders was working for German incubator Rocket Internet at the time, which was known to take proven business ideas and introduce them into underserved regions.

One such region was Southeast Asia, where it soon became apparent that the food delivery and grocery market was ripe for exploitation. In April 2012, Foodpanda was launched in Malaysia, Singapore, Thailand, and India, among other countries. Within twelve months, the service had partnered with thousands of restaurants across 27 countries.

Around 2015, Foodpanda changed its restaurant aggregator business model in response to the emergence of smartphones in the Southeast Asian region. Similar platforms such as DoorDash were providing their own couriers, allowing many restaurants to offer takeaway but not be required to deliver the food themselves.

By the end of 2016, Rocket Internet sold Foodpanda to Delivery Hero. As a result of the acquisition, Delivery Hero hoped to process over 20 million orders per month in 47 countries. Further expansion saw the Foodpanda platform offered in Myanmar, Cambodia, Japan, and Laos in 2019 and 2020.

Today, Foodpanda partners with more than 115,000 restaurants around the world in over 400 cities.

Foodpanda revenue generationFoodpanda has a typical revenue generation strategy for a food delivery business. The company utilizes the marketplace business model, matching riders and restaurants with customer demand.

A more detailed look at revenue generation is provided below.

CommissionsFoodpanda makes most of its money through restaurant commissions.

When a consumer places a food order, the company charges anywhere from 25 to 30% of the total order amount to restaurants.

Delivery feesConsumers ordering food also pay delivery fees, with the exact fee depending on the country-specific market. Fees are also contingent on how close the customer is to the restaurant, with larger distances commanding higher delivery fees.

Foodpanda also charges delivery fees as part of its Pandago service, where other businesses can utilize its fleet of couriers to make same-day deliveries on food, groceries, documents, and other retail products.

Given that Foodpanda cannot collect a restaurant commission from these orders, the delivery fee is likely to be much higher to compensate.

SubscriptionsPandapro is the name given to a monthly subscription program for consumers, allowing them to receive exclusive deals and benefits. Such perks include free delivery and access to various discounts and vouchers.

The subscription fee charged depends on the consumer’s country of residence.

Grocery salesGrocery sales are handled through a service called Pandamart, an on-demand platform selling over 3,500 daily essentials such as fresh produce, household items, beauty products, and medication.

Products are stored and distributed from Foodpanda-owned and operated warehouses. To make a profit, it can be assumed the company is marking up prices on certain items.

Key takeaways:Foodpanda is an online grocery and food delivery service owned by the European multinational company Delivery Hero. The founders of the platform worked for Rocket Internet, a start-up incubator known for replicating successful business models in underserved markets.Foodpanda adheres to a typical revenue generation strategy for a food delivery business. It charges restaurants a commission fee and consumers a delivery fee.Foodpanda also offers a consumer subscription service, giving them access to various discounts and perks. The company also operates an on-demand grocery platform for household staples and other essential items.The post How does Foodpanda make money? appeared first on FourWeekMBA.

What does Volkswagen Group own?

Volkswagen Group is a German automobile manufacturer founded in 1937 by the German Labour Front. The company was created to produce cheap and simple cars that could be mass-produced and thus more affordable for everyday Germans.

Volkswagen Group is perhaps most commonly associated with the Beetle and the Kombi, with both models becoming early pioneers in their respective market segments.

Today, the company sells a range of passenger vehicles, trucks, motorcycles, and turbomachinery across various brands.

Let’s take a look at some of them in the following paragraphs.

VolkswagenVolkswagen is the flagship brand of Volkswagen Group and was the largest carmaker by worldwide sales in 2016 and 2017.

Some of the best-selling Volkswagen models include the Tiguan, Polo, Golf, Jetta, and Passat.

BentleyBentley is a British luxury car and SUV manufacturer that became a subsidiary of the Volkswagen Group in 1998.

Models include the Bentley Continental, Flying Spur, Bentayga, and Mulsanne.

AudiAudi is a Bavarian automobile manufacturer founded in 1910 by August Horch.

Audi became part of the Volkswagen Group in 1964 with the company taking a 50% stake. On July 17, 2020, Volkswagen Group increased this stake to 99.64% with a $267 million purchase.

Audi is known for its luxury vehicles and revolutionary technology, which includes piloted driving, electromobility, and the use of artificial intelligence.

PorschePorsche is yet another German manufacturer specializing in high-performance sports vehicles, SUVs, and sedans. Popular models include the Porsche 911, Cayenne, Macan, Boxster, and 718.

Porsche is the most recent brand to become part of Volkswagen Group, with the company completing the acquisition in 2012.

SkodaSkoda is a Czech automobile manufacturer founded in 1895 by Vaclav Laurin and Vaclav Klement.

The manufacturer was state-owned for many years, but gradually became privatized by Volkswagen Group. By the year 2000, Skoda became a wholly-owned subsidiary.

Skoda is one of Volkswagen Group’s most successful brands, with profits for the 2020 financial year topping €756 million.

ScaniaScania is a Swedish vehicle manufacturer with a focus on commercial trucks, buses, and diesel engines for marine and industrial purposes.

The company is a subsidiary of Traton, itself a subsidiary of Volkswagen Group consisting of similar manufacturers such as MAN and Navistar.

DucatiDucati is an Italian motorcycle manufacturer headquartered in Bologna, Italy. The company is owned by Lamborghini through the German parent company Audi.

Volkswagen Group acquired Ducati for €860 million in 2012, with the acquisition largely driven by Volkswagen chairman and motorcycle enthusiast Ferdinand Piëch.

Ducati motorcycle models include the Monster, Multistrada, Diavel, Panigale, and Streetfighter.

Key takeaways:Volkswagen Group is a German automobile manufacturer founded in 1937 by the German Labour Front. The company was created to make car ownership more accessible to German citizens, with models such as the Beetle and Kombi paving the way for future automobile innovation.Volkswagen Group owns many successful automotive brands, including luxury manufacturers Bentley, Audi, and Porsche. Czech producer Skoda is one of the company’s most profitable subsidiaries. Volkswagen Group also owns truck manufacturer Scania and Italian motorcycle producer Ducati.Read Next: Who Owns Volkswagen?

The post What does Volkswagen Group own? appeared first on FourWeekMBA.

Star Atlas Business Model

Star Atlas is a next-generation video game incorporating aspects of the metaverse and Solana blockchain. The game, where players travel through space to discover new planets and hidden treasures, was created by Michael Wagner and launched in December 2021. The full, PC-version release date has yet to be specified.

Star Atlas is a play-to-earn game where players earn money by selling NFT items in an online marketplace. Ships are one of the core assets in the Star Atlas metaverse represented by NFTs, allowing players to explore the universe, perform work on the game, and battle others. Players must also choose between a human, android, or alien faction and then help their faction expand its sphere of control in deep space.

Star Atlas and the metaverseAt present, the developers of Star Atlas are focused on economics. They believe that the metaverse could potentially attract billions of new users, so it is important to balance the release of new assets with user adoption rates. This will ensure that the economy on which Star Atlas is based does not suffer from hyperinflation.

To that end and since the full version has yet to be released, the business model of Star Atlas is currently focused on a phased release of game assets. This approach will enable the developers to raise the capital required to bring their full vision to life.

Phases include:

Phase 01 (Galactic Asset Offering) – after Star Atlas was launched, the first batch of in-game NFT assets were sold. While these assets could not be used in the game until the second phase, they were available for trade on decentralized exchanges. Phase 02 (Browser Mini Game) – Star Atlas was then launched as a browser-based minigame where asset purchases on the Solana blockchain were usable across the entire Star Atlas feature set. During this phase, there is continuing revenue from the sale of the minigame.Phase 03 (Shipyard Module Sale) – production then commenced on Star Atlas in Unreal Engine 5, with the first milestone a shipyard module allowing collectors and players to see their final assets including ships, crew, and components. To fund this phase, another round of assets will be made available for purchase in addition to further revenue from minigame sales.Phase 04 (Final Pre-Sale at Beta) – all pre-live assets will go on sale once the beta version is released. Assets will be fully playable immediately after purchase.Phase 05 (Ongoing Sales) – in the final phase, revenue will occur from continuing sales of assets and concepts created by the Star Atlas development team. When the full version of the game is launched, production-ready assets will no longer be available for purchase (excluding Phase 03 beta version assets). Once this point is reached, the parent company of Star Atlas plans to collect transaction fees on all in-game trades.Key takeaways:Star Atlas is a next-generation video game incorporating aspects of the metaverse and Solana blockchain. A browser mini-game was released in late 2021, with a full version for PC in development but currently without a scheduled release date.The business model of Star Atlas is currently focused on a five-phase release of NFT assets sold to players in its marketplace. This approach will also allow the developers of Star Atlas to bring their vision of the game to life.Revenue will also come from ongoing sales of the browser minigame which was released in late 2021. Once the full version is live, the parent company of Star Atlas will collect transaction fees from in-game trades.The post Star Atlas Business Model appeared first on FourWeekMBA.