Gennaro Cuofano's Blog, page 101

April 14, 2022

How Does Afterpay Make Money? The Afterpay Business Model In A Nutshell

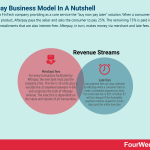

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.

Origin StoryAfterpay is an Australian financial technology with an additional presence in the UK, Canada, New Zealand, and the United States.

It was founded in 2015 by Nick Molnar and his former neighbor Anthony Eisen. Molnar was a young entrepreneur who was selling the excess stock from his parents’ jewelry business on eBay. As he worked late into the night packing inventory for shipping, he caught the attention of Eisen and the two quickly became friends.

At some point, they began to discuss the possibility of a company that removed the risk out of a typical retail experience for both the buyer and seller. From there, the idea for Afterpay was born. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free.

After initial success in Australia, Afterpay now has over 11 million users across the world.

Read Next: How Does Venmo Make Money

Afterpay revenue generationIn effect, Afterpay lends 75% of the total purchase price to consumers. But it is not a lender or credit provider in the traditional sense and does not generate revenue through interest fees.

Instead, it makes money in different ways.

Read Next: How Does PayPal Business Model

Merchant feesFor every transaction facilitated by Afterpay, the merchant must pay the company a fee.

This fee is 30 cents plus a variable fee of anywhere between 4-6% and comprises the bulk of Afterpay revenue. The exact fee is dependent on the value and volume of all transactions. Merchants that sell more or sell higher-priced items are charged a fee at the lower end of the spectrum.

It should be noted that the merchant is free to sell its products without Afterpay. However, Afterpay claims that providing an installment option increases the average order value by as much as 20%. It also increases the buyer conversion rate.

Afterpay also likely charges a merchant fee to mitigate the risk it takes on a customer defaulting on their payments.

Late feesLate payment fees are also collected by Afterpay when a consumer fails to make a scheduled payment on time.

The initial late fee is $10. A further $7 will be charged if the fortnightly payment remains unpaid for seven days past the initial due date.

Orders below $40 are capped at the single, initial late fee of $10. For orders above $40, the late fee is capped at 25% of the original order value or $68 – whichever is less.

Key takeaways:Afterpay is an Australian financial technology company with a presence in most developed, western economies. It was founded by entrepreneurs Nick Molnar and Anthony Eisen who imagined a retail industry free of risk for the buyer and seller.Afterpay is not a lender in the traditional sense and as a result, does not collect interest fees. However, it does charge merchants a fee for facilitating payments on their behalf.Afterpay also charges consumers a late fee based on the value of the original order and how long each repayment remains unpaid.Read Next: How Does PayPal Business Model

Other FinTech CompaniesAcorns Acorns is a fintech platform providing services related to Robo-investing and micro-investing. The company makes money primarily through three subscription tiers: Lite – ($1/month), which gives users access to Acorns Invest, Personal ($3/month) that includes Invest plus the Later (retirement) and Spend (personal checking account) suite of products, Family ($5/month) with features from both the Lite and Personal plans with the addition of Early. Affirm

Acorns is a fintech platform providing services related to Robo-investing and micro-investing. The company makes money primarily through three subscription tiers: Lite – ($1/month), which gives users access to Acorns Invest, Personal ($3/month) that includes Invest plus the Later (retirement) and Spend (personal checking account) suite of products, Family ($5/month) with features from both the Lite and Personal plans with the addition of Early. Affirm Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Alipay

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Alipay Alipay is a Chinese mobile and online payment platform created in 2004 by entrepreneur Jack Ma as the payment arm of Taobao, a major Chinese eCommerce site. Alipay, therefore, is the B2C component of Alibaba Group. Alipay makes money via escrows transaction fees, a range of value-added ancillary services, and through its Credit Pay Instalment fees.Betterment

Alipay is a Chinese mobile and online payment platform created in 2004 by entrepreneur Jack Ma as the payment arm of Taobao, a major Chinese eCommerce site. Alipay, therefore, is the B2C component of Alibaba Group. Alipay makes money via escrows transaction fees, a range of value-added ancillary services, and through its Credit Pay Instalment fees.Betterment Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts. Braintree

Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts. Braintree Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.Chime

Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.Chime Chime is an American neobank (internet-only bank) company, providing fee-free financial services through its mobile banking app, thus providing personal finance services free of charge while making the majority of its money via interchange fees (paid by merchants when consumers use their debit cards) and ATM fees. Coinbase

Chime is an American neobank (internet-only bank) company, providing fee-free financial services through its mobile banking app, thus providing personal finance services free of charge while making the majority of its money via interchange fees (paid by merchants when consumers use their debit cards) and ATM fees. Coinbase Coinbase is among the most popular platforms for trading and storing crypto-assets, whose mission is “to create an open financial system for the world” by enabling customers to trade cryptocurrencies. Its platform serves both as a search and discovery engine for crypto assets. The company makes money primarily through fees earned for the transactions processed through the platform, custodial services offered, interest, and subscriptions.Compass

Coinbase is among the most popular platforms for trading and storing crypto-assets, whose mission is “to create an open financial system for the world” by enabling customers to trade cryptocurrencies. Its platform serves both as a search and discovery engine for crypto assets. The company makes money primarily through fees earned for the transactions processed through the platform, custodial services offered, interest, and subscriptions.Compass Compass is a licensed American real-estate broker incorporating online real estate technology as a marketing medium. The company makes money via sales commissions (collected whenever a sale is facilitated or tenants are found for a rental property) and bridge loans (a service allowing the seller to purchase a home before the revenue from the sale of their previous home is available).Dosh

Compass is a licensed American real-estate broker incorporating online real estate technology as a marketing medium. The company makes money via sales commissions (collected whenever a sale is facilitated or tenants are found for a rental property) and bridge loans (a service allowing the seller to purchase a home before the revenue from the sale of their previous home is available).Dosh Dosh is a Fintech platform that enables automatic cash backs for consumers. Its business model connects major card providers with online and offline local businesses to develop automatic cash back programs. The company makes money by earning an affiliate commission on each eligible sale from consumers. E-Trade

Dosh is a Fintech platform that enables automatic cash backs for consumers. Its business model connects major card providers with online and offline local businesses to develop automatic cash back programs. The company makes money by earning an affiliate commission on each eligible sale from consumers. E-Trade E-Trade is a trading platform, allowing investors to trade common and preferred stocks, exchange-traded funds (ETFs), options, bonds, mutual funds, and futures contracts, acquired by Morgan Stanley in 2020 for $13 billion. E-Trade makes money through interest income, order flow, margin interests, options, future and bonds trading, and through other fees and service charges. Klarna

E-Trade is a trading platform, allowing investors to trade common and preferred stocks, exchange-traded funds (ETFs), options, bonds, mutual funds, and futures contracts, acquired by Morgan Stanley in 2020 for $13 billion. E-Trade makes money through interest income, order flow, margin interests, options, future and bonds trading, and through other fees and service charges. Klarna Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.Lemonade

Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.Lemonade Lemonade is an insurance tech company using behavioral economics and artificial intelligence to process claims efficiently. The company leverages technology to streamline onboarding customers while also applying a financial model to reduce conflicts of interest with customers (perhaps by donating the variable premiums to charity). The company makes money by selling its core insurance products, and via its tech platform, it tries to enhance its sales. NerdWallet

Lemonade is an insurance tech company using behavioral economics and artificial intelligence to process claims efficiently. The company leverages technology to streamline onboarding customers while also applying a financial model to reduce conflicts of interest with customers (perhaps by donating the variable premiums to charity). The company makes money by selling its core insurance products, and via its tech platform, it tries to enhance its sales. NerdWallet NerdWallet is an online platform providing tools and tips on all matters related to personal finance. The company gained traction as a simple web application comparing credit cards. NerdWallet makes money via affiliate commissions determined according to the affiliate agreements. Robinhood

NerdWallet is an online platform providing tools and tips on all matters related to personal finance. The company gained traction as a simple web application comparing credit cards. NerdWallet makes money via affiliate commissions determined according to the affiliate agreements. Robinhood Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, earn interests from customer cash and stocks, and rebates from market makers and trading venues.

Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, earn interests from customer cash and stocks, and rebates from market makers and trading venues.SoFi

SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization.

SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization. Squarespace

Squarespace is a North American hosting and website building company. Founded in 2004 by college student Anthony Casalena as a blog hosting service, it grew to become among the most successful website building companies. The company mostly makes money via its subscription plans. It also makes money via customizations on top of its subscription plans. And in part also as transaction fees for the website where it processes the sales.Stash

Squarespace is a North American hosting and website building company. Founded in 2004 by college student Anthony Casalena as a blog hosting service, it grew to become among the most successful website building companies. The company mostly makes money via its subscription plans. It also makes money via customizations on top of its subscription plans. And in part also as transaction fees for the website where it processes the sales.Stash Stash is a FinTech platform offering a suite of financial tools for young investors, coupled with personalized investment advice and life insurance. The company primarily makes money via subscriptions, cashback, payment for order flows, and interest for cash sitting on members’ accounts. Venmo

Stash is a FinTech platform offering a suite of financial tools for young investors, coupled with personalized investment advice and life insurance. The company primarily makes money via subscriptions, cashback, payment for order flows, and interest for cash sitting on members’ accounts. Venmo Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.

Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.Wealthfront

Wealthfront is an automated Fintech investment platform providing investment, retirement, and cash management products to retail investors, mostly making money on the annual 0.25% advisory fee the company charges for assets under management. It also makes money via a line of credits and interests on the cash accounts.

Wealthfront is an automated Fintech investment platform providing investment, retirement, and cash management products to retail investors, mostly making money on the annual 0.25% advisory fee the company charges for assets under management. It also makes money via a line of credits and interests on the cash accounts.Zelle

Zelle is a peer-to-peer payment network that indirectly benefits the banks’ consortium that backs it. Zelle also enables users to pay businesses for goods and services, free for users. Merchants pay a 1% fee to Visa or Mastercard, who share it with the bank that issued the card.

Zelle is a peer-to-peer payment network that indirectly benefits the banks’ consortium that backs it. Zelle also enables users to pay businesses for goods and services, free for users. Merchants pay a 1% fee to Visa or Mastercard, who share it with the bank that issued the card.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Afterpay Make Money? The Afterpay Business Model In A Nutshell appeared first on FourWeekMBA.

April 13, 2022

How Does Klarna Make Money? Klarna Business Model In A Nutshell

Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.

Origin storyKlarna is a financial technology company founded in Stockholm in 2005.

The company is perhaps best known for its buy now, pay later (BNPL) service. This enables consumers to purchase a product with no upfront cost. Instead, the product is paid off over four interest-free installments over a predetermined period. For larger purchases, Klarna users can finance their purchases over 3 years.

To onboard customers, Klarna allows consumers to shop with a temporary Visa card number known as a “ghost card”. That is, the customer does not need to provide payment details to the merchant when making a purchase. Klarna then performs a soft credit check on the card number ID and pays the merchant. Lastly, the consumer receives the product and an invoice from Klarna with payment instructions.

Klarna mission and visionKlarna’s mission is to “make paying as simple, safe and smooth as possible.“

While Klarna’s vision is to “transfer the power from the large corporations to the consumer and empower consumers to make fast and informed decisions.”

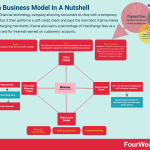

Klarna revenue generationTo drive revenue, Klarna very much relies on charging the merchant as opposed to the consumer.

Let’s take a look at some of the primary revenue drivers of Klarna.

Payment feesThe majority of Klarna’s revenue is derived from a merchant transaction and variable percentage fee. These fees fluctuate according to the payment method and country of origin of the customer. In the United States, for example, merchants must pay Klarna a 30 cent transaction fee on top of a variable fee between 3.29-5.99%.

Payment fees are also generated when customers:

Want to check out with a few clicks. Known as the Instant Shopping feature, Klarna charges merchants a $30 monthly product fee with a fixed $0.30 transaction fee. Merchants are also hit with a 3.29% fee for onsite transactions and a 3.79% fee for offsite transactions.Want to pay in four installments. In this case, Klarna charges the same $0.30 transaction fee combined with variable fees as high as 5.99%.Want to pay monthly. Here, Klarna takes a $0.30 fixed transaction fee and 3.29% in variable fees. Customers will also be charged interest throughout the loan, with annual percentage rates as high as 29.99%.Fail to pay by the specified date. Late fees are charged monthly and can top $35.Interchange feesKlarna recently launched a bank account facility with the issuance of a free debit card to users in collaboration with Visa.

When a consumer makes an eligible purchase, an interchange fee (typically around 1%) is paid by the merchant to the card issuer. Klarna then takes a portion of the interchange fee in exchange for promoting Visa as a service to its customer base.

Cash interestWith the aforementioned bank account facility, Klarna earns money on the cash in those accounts by lending it out to other institutions.

Klarna vs Affirm vs AfterpayKlarna, Affirm, and Afterpay are all buy-now-pay-later (BNPL) providers that allow consumers to purchase goods and services and then pay them off with micro-installments over a set period.

While a new market entrant in this industry feels like a daily occurrence, Klarna, Affirm, and Afterpay represent some of the largest and most popular BNPL providers in 2022. In this article, we’ll compare and contrast aspects of their respective businesses to enable consumers and merchants to choose the one that best suits their needs.

Credit approvalLittle separates the three companies in terms of credit approvals, which many critics argue is a serious deficiency of the BNPL concept in any case.

Each app combines typical “soft” information such as salary and credit history with insights gleaned from machine learning and a user’s social media activity. For consumers, this means there is little appreciable difference between providers in terms of whether their application is accepted or rejected.

Interest and late feesWhere there are differences, however, is in the way payments and fees are charged.

For customers of Klarna and Afterpay, the “loan” that allows them to purchase products without having the funds to do so comes with no interest fees. Affirm will collect interest fees if the consumer chooses the monthly installment option instead of the typical fortnightly plan.

In terms of late fees, Affirm does not charge them while the fee is $7 for Klarna and $8 for Afterpay. Instead of a monetary penalty, Affirm will block its customers from being able to make additional purchases. Note that these are fees for North American customers and will vary by country.

Payment schedulingAfterpay users must pay 25% of the total purchase price upfront and split the remaining 75% with payments over the next three fortnights (six weeks).

Affirm is a more lenient, allowing customers to spread their payments out over up to three years. This makes it better suited to high-ticket items or for those who simply want a simple, long-term payment solution not unlike a traditional loan.

Klarna, on the other hand, offers terms similar to those of Afterpay when it was first launched. That is, four payments split over two months or eight weeks.

Merchant fees and featuresMerchants that want to include Afterpay as a payment option pay a commission rate of 4-6% of the transaction plus 30 cents. The exact fee is based on a negotiated amount between the merchant and Afterpay. Note also that merchants are not paid until the customer has received their items in the mail.

Affirm merchants are paid within 1-3 business days of the purchase and the company provides more flexibility with respect to the payment terms that are offered to consumers. Affirm also charges a commission and while the exact rate is undisclosed, most estimates suggest it is around 3%.

Klarna’s merchant fee structure is comparable to those offered by Afterpay. There is a 30-cent transaction fee plus a variable fee of between 3.29% to 5.99%. Unlike Afterpay, however, Klarna pays the merchant upfront and assumes the customer’s credit risk. It also offers merchants a diverse range of payment options, including direct checkout and even loan financing.

Summarizing the key differences between Klarna, Affirm and AfterpayKlarna, Affirm, and Afterpay represent some of the largest and most popular BNPL providers in 2022, but there are subtle differences in their business models.Klarna and Afterpay charge no interest fees provided the customer makes their payments on time, while Affirm will collect interest fees if a buyer chooses the monthly payment plan. Late fees are also charged by Klarna and Afterpay for missed payments. Affirm, on the other hand, simply chooses to ban customers from making additional purchases.In terms of payment scheduling, Afterpay asks for 25% of the total purchase price upfront with the remainder to be paid across three fortnights. Klarna has a similar schedule with payments spread out after eight weeks instead of six. Affirm allows consumers to spread their payments out over as many as three years. As a result, it tends to be more suitable for more significant purchases.Key takeaways:Klarna is a Swedish financial technology company founded in 2005. The company is known for its innovative payment services, including BNPL functionality and other flexible arrangements.Klarna makes its money by charging the merchant and not the consumer. The company only makes money from the customer when they elect to spread out the cost of a purchase over multiple months.In addition to typical payment and transaction fees, Klarna also earns a percentage of interchange fees as a commission. They also derive income from the cash sitting in the accounts of their customers.Connected Business ModelsAfterpay Business Model Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.SoFi Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.SoFi Business Model SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization.Chime Business Model

SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization.Chime Business Model Chime is an American neobank (internet-only bank) company, providing fee-free financial services through its mobile banking app, thus providing personal finance services free of charge while making the majority of its money via interchange fees (paid by merchants when consumers use their debit cards) and ATM fees.How Does Venmo Make Money

Chime is an American neobank (internet-only bank) company, providing fee-free financial services through its mobile banking app, thus providing personal finance services free of charge while making the majority of its money via interchange fees (paid by merchants when consumers use their debit cards) and ATM fees.How Does Venmo Make Money Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.FinTech Business Models

Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.FinTech Business Models Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry.

Fintech business models leverage tech and digital to enhance the financial service industry. Fintech business models, therefore, apply tech to various financial service use cases. Fintech business model examples comprise Affirm, Chime, Coinbase, Klarna, Paypal, Stripe, Robinhood, and many others whose mission is to digitize the financial services industry.Read Next:

How Does Robinhood Make MoneyHow Does Venmo Make MoneyHow Does Honey Make MoneyHow Does YouTube Make MoneyHow Does Telegram Make MoneyHow Does Discord Make MoneyMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelsThe post How Does Klarna Make Money? Klarna Business Model In A Nutshell appeared first on FourWeekMBA.

Apple Financials

iPod touch and accessories$38.36B10.49%Services (Company’s advertising, AppleCare, cloud, digital content, payment, and other

services)$68.42B18.70%Total$365.81Bin 2021, Apple generated over $365 billion in revenues, of which $191.9 billion was from iPhone sales, representing 52.5% of the total revenues. Mac generated $35.19 billion, while iPad sales generated $35.86 billion. Wearables and accessories generated over $38.36 billion. And Services generated over $68 billion. Thus, most of Apple’s revenues still come from the iPhone and services revenue stream, built on top of the company’s products is the second revenue stream, representing 18.7% of the total revenues. 2021Products$297.39BServices$68.42BTotal Revenues$365.81BOf the $365.81 billion revenues, $297 came from products, and $68.4 came from services. Gross Margins Products$105.12BGross Margin Products %35.35%Gross Margins Services$47.7BGross Margins Services %69.73%To understand Apple’s profitability, at the operating level, Gross margins for products were $105.12 billion, at a 35% gross margin percentage. While gross margins for services were $47.7 billion, or 69.7% gross margin percentage. Therefore, while the company’s success is built on top of successful products, the company also monetizes these products through services (like AppleCare), which run at much wider margins, compared to products revenues. 2021Americas$153.3BEurope$89.3BGreater China$68.36BJapan$28.48BRest of Asia Pacific$26.35BTotal$365.81BMost of Appel’s revenues come from the Americas, Europe, Greater China, and Japan.

Read Next: Apple Business Model

The post Apple Financials appeared first on FourWeekMBA.

Tesla Financials

September 30, 2009, prior to the IPOElon Musk becomes CEO2008Total Revenues in 2021$53.8 BillionEmployees99,290 full-time subsidiaries’ employees worldwideRevenues per Employee$542,079.00Who owns Tesla?Elon Musk is the primary individual shareholder, with 23.1% of the company’s sharesFounded on July 1, 2003, in San Carlos, CA, by Elon Musk, Martin Eberhard, JB Straubel, Marc Tarpenning, and Ian Wright, Tesla’s initial main investors comprised Elon Musk. By 2006 Elon Musk was appointed CEO back in 2008, and they remained CEO these days. Tesla IPOed on June 29, 2010, at a $17 price per share, and it recorded $93.35 million, as of Nine Months Ended, September 30, 2009, prior to the IPO. In 2021, Tesla generated $53.8 billion in revenue, with 99,290 full-time subsidiaries’ employees, generating $542,079.00 per employee. Elon Musk is the primary individual shareholder, with 23.1% of the company’s shares, making his net worth north of $200 billion dollars.

Founded in 2003, by Eberhard and Tarpenning, eventually, the initial co-founders left the company, and by 2004, Musk first became the main investor, and thereafter, by 2008, he took over as CEO of the company. Tesla would go through many near-death experiences, until 2018. And yet, by 2021, Tesla became a trillion-dollar company.

Founded in 2003, by Eberhard and Tarpenning, eventually, the initial co-founders left the company, and by 2004, Musk first became the main investor, and thereafter, by 2008, he took over as CEO of the company. Tesla would go through many near-death experiences, until 2018. And yet, by 2021, Tesla became a trillion-dollar company.  In 2021, Tesla generated over $53.8 billion in revenues, compared to the $31.5 billion in 2020. The largest segment in the automotive sales (comprising regulatory credits revenues), followed by leasing (as part of the automotive), generated $1.6 billion in 2021. Outside the automotive sales, services (non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and more) accounted for $3.8 billion. And energy generation and storage accounted for $2.8 billion. US and China are the primary markets, with almost $24 billion and nearly $14 billion respectively, in 2021. In 2021, Tesla generated $5.6 billion in Net Income, a net margin of over 10%.

In 2021, Tesla generated over $53.8 billion in revenues, compared to the $31.5 billion in 2020. The largest segment in the automotive sales (comprising regulatory credits revenues), followed by leasing (as part of the automotive), generated $1.6 billion in 2021. Outside the automotive sales, services (non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and more) accounted for $3.8 billion. And energy generation and storage accounted for $2.8 billion. US and China are the primary markets, with almost $24 billion and nearly $14 billion respectively, in 2021. In 2021, Tesla generated $5.6 billion in Net Income, a net margin of over 10%.  As an electric automaker and builder of sports cars and now trucks, Tesla’s competitors comprise companies like Ford, Mercedes-Benz, Porsche, Lamborghini, Audi, Rivian Lucid Motors, Toyota, and more. At the same time, Tesla is an electric energy production and storage company (SolarCity); it competes with Sunrun, SunPower, and Vivint Solar. And as an autonomous driving company, it competes with companies like Zoox, Waymo, and Baidu with the self-driving software.

As an electric automaker and builder of sports cars and now trucks, Tesla’s competitors comprise companies like Ford, Mercedes-Benz, Porsche, Lamborghini, Audi, Rivian Lucid Motors, Toyota, and more. At the same time, Tesla is an electric energy production and storage company (SolarCity); it competes with Sunrun, SunPower, and Vivint Solar. And as an autonomous driving company, it competes with companies like Zoox, Waymo, and Baidu with the self-driving software. Tesla is characterized by a functional organizational structure with aspects of a hierarchical structure. Tesla does employ functional centers that cover all business activities, including finance, sales, marketing, technology, engineering, design, and the offices of the CEO and chairperson. Tesla’s headquarters in Austin, Texas, decide the strategic direction of the company, with international operations given little autonomy.

Tesla is characterized by a functional organizational structure with aspects of a hierarchical structure. Tesla does employ functional centers that cover all business activities, including finance, sales, marketing, technology, engineering, design, and the offices of the CEO and chairperson. Tesla’s headquarters in Austin, Texas, decide the strategic direction of the company, with international operations given little autonomy.  Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, and eventually turned into a mass manufacturing electric car maker.

Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, and eventually turned into a mass manufacturing electric car maker.  Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.

Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores. Read Next: Tesla Business Model

The post Tesla Financials appeared first on FourWeekMBA.

Robinhood Revenues Breakdown

Robinhood is an app that gamifies investing in stocks, ETFs, options, and cryptocurrencies, all commission-free. While the app is commission-free Robinhood made $1.81 billion in total revenues in 2021, primarily based on transaction-based revenue which represented over 77% ($1.4 billion) of the company’s overall revenues. Transaction-based revenues primarily include payment for order flow from routing customer orders for options, cryptocurrencies, and equities to market makers.

Robinhood is an app that gamifies investing in stocks, ETFs, options, and cryptocurrencies, all commission-free. While the app is commission-free Robinhood made $1.81 billion in total revenues in 2021, primarily based on transaction-based revenue which represented over 77% ($1.4 billion) of the company’s overall revenues. Transaction-based revenues primarily include payment for order flow from routing customer orders for options, cryptocurrencies, and equities to market makers. Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.  Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns. Read Next: How Does Robinhood Make Money, Robinhood Business Model

The post Robinhood Revenues Breakdown appeared first on FourWeekMBA.

Facebook Ad Revenue

Read Also: Facebook Business Model

The post Facebook Ad Revenue appeared first on FourWeekMBA.

Netflix Revenue Breakdown

Read Next: Netflix Business Model

The post Netflix Revenue Breakdown appeared first on FourWeekMBA.

How much money does Google make from advertising?

Read Next:

Google Business ModelHow Does Google Make MoneyThe post How much money does Google make from advertising? appeared first on FourWeekMBA.

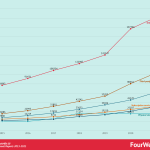

Amazon Growth Chart 2015-2021

In 2021, Online Stores generated $222B, while physical stores generated $17B. Third-party seller services generated $103.3B, subscription services generated $31.76B, while the cloud service, AWS generated $62.2B. Amazon advertising generated $31.16B. Online stores have grown from over $78 billion in 2015 to over $222 billion in 2021. Third-party seller services have grown from $16 billion in 2015 to over $103 billion in 2021.

Amazon has a diversified business model. In 2021 Amazon posted over $469 billion in revenues and over $33 billion in net profits. Online stores contributed to over 47% of Amazon revenues, Third-party Seller Services, Amazon AWS, Subscription Services, Advertising revenues and Physical Stores.

Amazon has a diversified business model. In 2021 Amazon posted over $469 billion in revenues and over $33 billion in net profits. Online stores contributed to over 47% of Amazon revenues, Third-party Seller Services, Amazon AWS, Subscription Services, Advertising revenues and Physical Stores. Amazon Marketplace is the world’s biggest online retailer, with sales greater than the eCommerce sales of entire countries. Marketplace Pulse estimates that there are over five million sellers on the Amazon marketplace, with over two million on Amazon.com alone. Amazon had enviable sales of over $232.8 bn in 2018 just from its product sales, with over 50% of sales coming from third-party vendors.

Amazon Marketplace is the world’s biggest online retailer, with sales greater than the eCommerce sales of entire countries. Marketplace Pulse estimates that there are over five million sellers on the Amazon marketplace, with over two million on Amazon.com alone. Amazon had enviable sales of over $232.8 bn in 2018 just from its product sales, with over 50% of sales coming from third-party vendors.Read Next: Amazon Business Model

The post Amazon Growth Chart 2015-2021 appeared first on FourWeekMBA.

Airbnb Revenues

Y Combinator, on January 2009Year of IPODecember 10, 2020IPO Price$146.00Total Revenues at IPO$2.5 billion as of Nine Months Ended on September 30, prior to the IPOAirbnb Employees6,132 employees in 27 cities around the worldRevenues per Employee$977,129.81Founded by Brian Chesky, Nathan Blecharczyk, and Joe Gebbia, in August 2008, in San Francisco, CA, Airbnb’s first investor was Y Combinator, in January 2009. The company IPOed on December 10, 2020, at a $146 share price. At IPO the company generated $2.5 billion as of Nine Months Ended on September 30, prior to the IPO, with 6,132 employees, thus $977,129.81 per employee.

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. In 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, $155.94.

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. In 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, $155.94. Read Also: Airbnb Business Model

The post Airbnb Revenues appeared first on FourWeekMBA.