Gennaro Cuofano's Blog, page 100

April 21, 2022

An Ad-Supported Netflix?

For the first time, in 10 years, Netflix has lost subscribers!

What happened there? Let’s try to make some clarity to this mess.

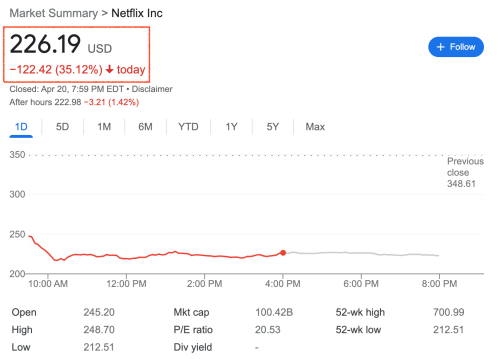

As Netflix announced its first-quarter results, the stock fell apart:

In a single session, the company lost 35%. And we’re not talking about a low-cap meme stock. That burned billions of dollars in a single stroke.

Not only this was unforeseen (clever investors like Bill Ackman had placed very large bets on Netflix) but it seems very hard to assess where the problem lies.

Indeed, it’s easy to point out all the issues Netflix has today.

But there is another fundamental problem: where’s the attention going?

Netflix explained how the COVID boost in revenues has ended, and numbers didn’t lie about that:

But what are the underlying problems Netflix has identified?

The executive team has identified a few core problems that caused this sudden loss in subscribers:

1. Uptake of connected TVs: as Netflix pointed out they do not control the hardware part, thus, the more streaming services are offered on smart TVs, and the more traditional TV services add their own on-demand services, the harder it gets for Netflix to keep the same level of attention.

In the past, I pointed out, how Netflix started to build its distribution on hardware, by placing its default button on the smart TV controller, before anyone else. Yet the remote controller is now, getting very busy!

2. 100m additional households are watching but not paying for Netflix.Over the years, Netflix has incentivized users to simply share their passwords. This is also what made Netflix cool in the first place.

Yet, when you reach saturation, you get, as a company, much less cool about users sharing their passwords.

Therefore, Netflix is working on new paid sharing features, where current members have the choice to pay for additional households, trying to monetize these users.

We can also foresee some crackdowns, where users will be prevented to access the platform if sharing the password on other devices (things might get ugly there!).

3. An ad-supported Netflix: in the last years, as we went through the pandemic, Netflix has been spiking up prices for its subscriptions, which worked pretty well in terms of revenue generation.

For one thing, it shows how much people love Netflix, as they kept the subscription, nonetheless these price spikes. Yet, this strategy doesn’t work well, especially when the macroeconomic scenario isn’t as good.

As Netflix CEO, Reed Hastings has highlighted, on arstechnica:

“Those who follow Netflix know I’ve been against the complexity of advertising and a big fan of the simplicity of subscription, but as much as I’m a fan of that, I’m a bigger fan of consumer choice, and allowing consumers who would like to have a lower price and are advertising-tolerant get what they want makes a lot of sense.”

And Hastings further highlighted, in relation to the ad-supported plan:

“I think it’s pretty clear that it’s working for Hulu. Disney’s doing it; HBO did it. I don’t think we have a lot of doubt that it works. You know that all those companies have figured it out. I’m sure we’ll just get in and figure it out as opposed to test it and maybe do it or not do it.”

How would this work?

Hastings explained: “it would be a plan layer like it is at Hulu so if you still want the ad-free option, you’ll be able to have that as a consumer. And if you’d rather pay a lower price and you’re ad-tolerant, we’re going to cater to you also.” While the ad-supported service is tempting, is also worth highlighting that it might run at very tight margins for the company if the underlying content is primarily licensed content (just like for Spotify, the more you stream licensed content, the more content royalties costs go up).

Instead, such a model might work, if Netflix were to do it to offer its own content, but with the caveat of pacing that out.

In short, when a new series comes out, instead of enabling ad-supported subscribers to binge-watch it, content would be paced out. And if they want to watch it all, at once, they would need to pay for a full subscription plan.

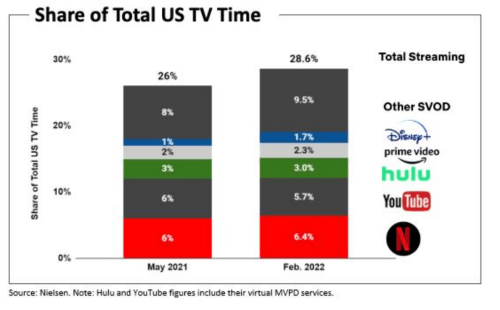

3. New streaming services have also been launched. Competition in the streaming market has gotten very rough, and more platforms compete for the same type of attention:

Based on that, Netflix will further ramp up the investments in content, to produce new hits and originals.

4. Macro factors, including sluggish economic growth, increasing inflation, geopolitical events such as Russia’s invasion of Ukraine, and some continued disruption from COVID are likely having an impact as well.

Here there is not much control if not keep focusing on re-growing the subscribers base.

What do I think should Netflix do instead?

First, we need to reassess competition, and where it’s coming from.

Is the competition really between TV and streaming only?

Attention is not an asset, which is easy to control.

And while Netflix is assessing its competition, linearly, in reality, the threat might be coming from unexpected places.

The main mistake I believe Netflix is doing is on assuming that the main competitors are TV and streaming services. There is more to it!

Beyond streaming, attention is a fluid asset

As Anand from CB Insights has highlighted “Maybe TikTok is what is killing Netflix?”

I think this is a great point to start with:

In fact, attention is a very fluid asset, which moves beyond traditional definition. And across platforms. In 2017, Netflix CEO, Reed Hastings highlighted:

“You get a show or a movie you’re really dying to watch, and you end up staying up late at night, so we actually compete with sleep, and we’re winning!”

Yet, today most of the attention is moving to other platforms. And the interesting part, is that, while platforms like TikTok offer natively short-form content. Many people end up spending hours on the platform.

So below are some of the things, I believe Netflix should do:

1. Vertical integration: Netflix managed to build an incredible brand over the years. It’s still an app, either on a Smart TV or on a mobile marketplace. The main company’s asset is its content. Not even the licensed content (that can be taken away from it, anytime), but its own content (the Netflix original series and movies). Thus, in order to build a long-term advantage, Netflix should also focus on bringing to market a successful device for consuming content.

As the story goes, back in 2007, Netflix was looking into building its own hardware. Indeed, its set-top box (it would enable to stream movies from the Netflix catalog) was ready for launch! Yet, at the very last minute, CEO, Reed Hastings canceled the project.

As reported by The Verge, Hastings’ fear was that “if the company released its own hardware, it would be seen as a competitor to the very companies with which it hoped to partner.”

Hastings has been quoted as saying: “I want to be able to call Steve Jobs and talk to him about putting Netflix on Apple TV, but if I’m making my own hardware, Steve’s not going to take my call.”

This shaped the company for years. Yet, what if Netflix got into the hardware game again? Instead of a Smart TV, Netflix could build a VR device to watch its series in high definition. Or perhaps a projector, smart theater device, to project Netflix anywhere in the house!

The company could sell it at cost while offering its subscription services within the device. In this way, if successful, over time, it can control the overall customer experience.

2. Reassess the content development strategy.

In the last years Netflix has produced great series, and important hits, yet, it shifted on quantity vs. quality. The content development efforts instead should be more skewed toward coming up with new content formats, innovating those formats, and raising the bar again (just like Netflix did in 2013 with House of Cards).

3. A hybrid between binge-watching and scheduled releases. Binge-watching has been a disruptive content format, which has helped define Netlfix as a brand. Yet, one thing was to enable binge-watching, back in 2013, and toward the pandemic. Another is to ask, whether binge-watching is still a competitive format today.

In fact, binge-watching worked as an incredible flywheel in the early years. The rhythm it demands might not be sustainable over time, from a business standpoint.

While in the past, as a Netflix subscriber, once you had binge-watched your way through a series, you could still wait for the next series. Now, you have way more choices and options. And the need to jump on another series might drive you out of the platform.

Paradoxically then, in this scenario, it might make sense to start testing out some hybrid forms of content consumption. For instance, why not give the ability to binge-watch only for higher-tier plans? In short, binge-watching has been a defining feature of Netflix, in the early days. Might become a feature to discern between basic to more advanced plans.

4. Content formats that go beyond series.

Netflix has been testing, for a few months, new short-form content formats, such as Kids Clips and Fast Laughs. Fast Laughs, in particular, is a TikTok-like platform where clips of popular shows on Netflix are hosted, and shown with a continuous scroll, and at full screen. In short, it tries to replicate TikTok’s successful formats.

Indeed, as Netflix highlighted: Fast Laughs offers a full-screen feed of funny clips from our big comedy catalog including films (Murder Mystery), series (Big Mouth), sitcoms (The Crew), and stand-up from comedians like Kevin Hart and Ali Wong.

Of course, this can be a powerful strategy to attract young users from platforms like TikTok, and Netflix has the data to understand what content on Netlfix makes sense to translate into short-form clips.

Yet to make those sorts of platforms successful, Netlfix should plug in user-generated content. In short, it should enable mechanisms on its platform that enable users to cut the clips they find most interesting and interact with the content.

This new, user-generated content, can become new formats, that can also serve as a way for the company to create new types of content, that are able to attract future generations.

Read Next: Netflix Business Model.

The post An Ad-Supported Netflix? appeared first on FourWeekMBA.

April 20, 2022

How Does Airbnb Make Money? Airbnb Business Model Analysis – Updated 2022

Airbnb is a peer-to-peer platform collecting a “platform tax” by charging guests a service fee between 5%-15% of the booking and hosts 3%. In 2021, Airbnb generated $6 billion in service fees by charging an average of 13% on an average booking value of $156.

Key Financial Facts (Analysis by FourWeekMBA)2021Gross Booking Value$46.9 BillionRevenue$6 BillionNights and Experiences Booked$300.6 MillionAverage Service Fee12.78%Average Value per Booking$155.94According to the FourWeekMBA Analysis, in 2021, Airbnb charged an average 12.78% service fee, at an average value per booking of $156.

Key Facts Total Revenues in 2021$5.99 BNet Losses in 2021-$352 MillionFoundersBrian Chesky, Nathan Blecharczyk, Joe GebbiaYear & Place FoundedAugust 2008, San Francisco, CAAirbnb’s first investorY Combinator, on January 2009Year of IPODecember 10, 2020IPO Price$146.00Total Revenues at IPO$2.5 billion as of Nine Months Ended on September 30, prior to the IPOAirbnb Employees6,132 employees in 27 cities around the worldRevenues per Employee$977,129.81Airbnb business model short breakdownAirbnb is a peer-to-peer platform business model, leveraging two-sided network effects and making money by charging guests a service fee between 5% and 15% of the reservation, while the commission from hosts is generally 3%.

For instance, on a $100 booking per night set by a host, Airbnb might make as much as $15, split between host and guest fees.

In 2021, Airbnb generated $5.99 billion in service fees on $46.9 billion Gross Booking Value through the platform.

We describe the Airbnb business model via the VTDF framework developed by FourWeekMBA.

Airbnb Business ModelDescriptionValue Model: Expanding the hospitality industry, at scale.Airbnb’s mission is to “create a world where people can belong through healthy travel that is local, authentic, diverse, inclusive and sustainable.” A peer-to-peer platform enables hosts to easily list and monetize their real estate and guests to find alternative locations across the world. Airbnb created a whole new category for travel, expanding the industry and making it viable at scale.Technological Model: Peer-to-peer platform. Two-sided network effects.As a peer-to-peer platform, Airbnb enjoys two-sided network effects. The more hosts join the platform, the more it becomes valuable to guests, who can find alternative locations at various price points, depending on their experience. On the other hand, the more the community of guests is thriving, the more hosts are incentivized to invest back in their locations, making Airbnb the go-to location for travel worldwide.Distribution Model: Brand, Growth Engine, Continous Improvement, Community Building.Airbnb has built a strong brand over the years, thanks to its seamless platform and support to hosts. The company’s main growth asset is the community of guests and hosts that interact, making the whole platform thrive long-term. In addition, the platform is fast in releasing new features, testing them out, and trying to figure out new ways for hosts and guests to connect (as Airbnb shows throughout the pandemic).Financial Model: Platform Tax.Airbnb makes money by charging a service fee on top of each booking. Thus making money as more bookings go through it repeatedly. In 2021, Airbnb generated $5.99 billion in service fees.Airbnb business model evolutionIt was 2007, Brian Chesky and Joe Gebbia were trying to make extra income to pay their rent. Chesky and Gebbia, friends from design school, saw a big opportunity when back in 2007, a large international design conference was about to be hosted in San Francisco.

It wasn’t unusual to have all hotels sold out during these large conferences. However, at that time, Chesky and Gebbia swiftly built a website, which they called AirBedandBreakfast.com (their guests would sleep on air beds), and surprisingly rented it to three designers that were attending the conference.

As Chesky and Gebbia recalled, at the time, most people thought the idea was crazy as strangers would have never accepted to “stay in each other’s homes.”

And yet, that first weekend, something interesting happened. As the three designers had rented the air beds at Chesky and Gebbia apartment, they realized the potential of offering an experience as a local to someone coming from out of town.

Indeed, that was one of the key elements that would make Airbnb different, from the traditional Hotel. It wasn’t just a room, but potentially a whole end-to-end experience that made guests feel like locals, and hosts become the ambassadors of their own local community while building their own entrepreneurial journey.

That event made Chesky and Gebbia continue with this experiment and by 2008, software engineer, Nathan Blecharczyk joined the two co-founders, to focus on the UX of the platform, to solve what would become the central problem for Airbnb, that of “making strangers comfortable enough to stay in each other’s homes.”

Some of the elements that would make this possible combined a platform with:

Host and guest profiles.Integrated messaging.Two-way reviews.And secure payments.Over the years, other key elements were added to the platform, that helped gain further traction (like hiring professional freelance photographers to enrich the visual experience on the platform, or like adding experiences on top of the stay).

Each of those elements would help Airbnb achieve a larger and larger scale until the pandemic hit, and Airbnb had to figure out how to make its business model even more sustainable, to survive.

Image Source: Airbnb Financial Prospectus

As Airbnb went through the pandemic, it had to shift its business model.

Brian Chesky highlighted the “pivot” (in startup lingo the change of direction) Airbnb went through:

Yet as Airbnb managed to go through the pandemic.

It is also managing to trhive, as the short-term travel industry is bouncing back many times over:

The history of AirbnbWhile the concept of short-term vacation rentals is certainly nothing new, Airbnb was the first company to see the potential of home sharing in the accommodation industry.

To profit from this potential, however, the company had to face and then overcome various obstacles with a combination of determination, ingenuity, hard work, and a bit of luck. The early history of Airbnb is a borderline rags-to-riches story with the ability to inspire millions of people from all walks of life.

Airbedandbreakfast.comIn essence, the idea for Airbnb was born from a need to simply pay the rent. When San Francisco-based designers Joe Gebbia and Brian Chesky were struggling to make ends meet, they were forced to come up with a novel way to support themselves.

After noticing that a design conference caused many of the city’s hotels to become booked out, the pair offered accommodation in the form of three air mattresses to any attendee that needed a place to sleep. Gebbia and Chesky launched the site airbedandbreakfast.com in August 2008 with a belief that Craigslist was a little too impersonal.

For their efforts, the pair received $80 for hosting three designers over the duration of the conference.

FundraisingSensing they were onto something, the pair enlisted the help of computer science graduate Nathan Blecharczyk to build a more functional website that allowed other users to share their homes online. To validate their idea, the company targeted users in the Denver area with the Democratic National Convention causing a similar shortage in hotel rooms. While the campaign was successful, the co-founders were still losing money and could not secure investment funding after meeting with 15 separate angel investors.

To raise cash and keep the fledgling company afloat, Gebbia and Chesky decided to take advantage of the imminent 2008 US election. Using their design skills, they created custom-made cereal boxes based on the two presidential candidates Barack Obama and John McCain. The pair sold 750 boxes at $40 each, netting them a total of $30,000.

Y CombinatorIn January 2009, computer programmer Paul Graham invited the pair to a winter session of the renowned Y Combinator startup accelerator where they received training and $20,000 in cash in exchange for a small slice of the company.

The first few months of 2009 were spent perfecting the product, with the co-founders using some of the cash to travel to New York where most Airbnb users lived. In the city, they spent time building deep relationships with hosts by staying with every single one of them on the platform, leaving a review, and taking professional photographs of their accommodation. In March, the company officially became known as Airbnb and secured a $600,000 seed investment from Sequoia Capital in April.

Growth and further fundingOver the next couple of years, Airbnb secured further rounds of funding to be a profitable company with a global reach. By 2011, over 1 million nights had been booked on the platform in 89 countries.

After a Series B funding round led by Andreessen Horowitz in mid-2011, Airbnb then became a unicorn with a valuation of $1.3 billion.

The rest, as they say, is history.

Key takeaways from Airbnb’s story:The idea for Airbnb was born from a need to simply pay the rent. When designers Joe Gebbia and Brian Chesky noticed that a design conference booked out many of the hotels in San Francisco, they decided to host attendees with air mattresses on the floor of their apartment.To raise cash and keep the company afloat long enough to receive sufficient interest, the co-founders sold custom cereal boxes based on the presidential candidates of the 2008 U.S. election. Eventually, Y Combinator co-founder Paul Graham took notice and provided training and $20,000 in funding.Gebbia and Chesky traveled to Airbnb hotspot New York City in 2011 to stay with each Airbnb host, leave a review, and take professional photographs of their listing. The platform’s popularity grew quickly that year and boasted over 1 million nights booked across 89 countries. The company also became a unicorn in 2011 after a Series B funding round.Airbnb’s early success? Make it into a storyboard A storyboard is a linear sequence of illustrations used in animation to develop a broader story. A storyboard process is now used also in business to understand and map customers’ experience and enable the growth of the company using that process.Storyboarding in business can help in many other cases like: Uncover customer experience.Align on a longer-term vision.Pitch a broader project idea.And more.

A storyboard is a linear sequence of illustrations used in animation to develop a broader story. A storyboard process is now used also in business to understand and map customers’ experience and enable the growth of the company using that process.Storyboarding in business can help in many other cases like: Uncover customer experience.Align on a longer-term vision.Pitch a broader project idea.And more.It’s no secret that Brian Chesky is a huge fan of Walt Disney. And as the story goes, he was on a short vacation from Airbnb, as he dived into Disney’s biography. There he figured out about storyboarding and how to leverage this process for Airbnb’s growth:

An example of storyboarding the guest journey, from smashingmagazine.com

It was 2011, Brian Chesky, co-founder of Airbnb, over the Christmas vacation had picked up a biography of Walt Disney. In there he found a technique that Walt Disney used. As the story goes, during a passage of Walt Disney biography, Chesky noticed how, during the production of the movies “Snow White and the Seven Dwarfs” in the 1930s, Disney used storyboards, a technique invented by a Disney animator a few years earlier. Chesky felt that when Disney had used this technique, he was in a similar situation, that Airbnb was facing at the time. Thus, Chesky with the other co-founders had an animator from Pixar design the storyboard for the three key processes: The host process.The guest process.And the hiring process.Those storyboards brought in the Airbnb headquarter had the purpose of aligning everyone in the organization around the critical elements of the customers’ experiences.As Nathan Blecharczyk, co-founder and CSO at Airbnb pointed out on Sequoia blog:

One thing that’s really helped is a storyboard we created that depicts the different steps someone goes through from the time she first hears about Airbnb to the time she leaves post-visit feedback. We have 15 pictures that cover the guest journey and 15 more that show the journey for the host.

And he further highlighted:

What the storyboard made clear is that we were missing a big part of the picture—the offline experience—that’s an even more meaningful part of using Airbnb than booking a property.

From there, Airbnb’s redesigned the whole UX for the platform.

When Airbnb reached ramen profitability Serial entrepreneur and venture capitalist Paul Graham popularized the term “Ramen Profitability.” As he pointed out “Ramen profitable means a startup makes just enough to pay the founders’ living expenses.”

Serial entrepreneur and venture capitalist Paul Graham popularized the term “Ramen Profitability.” As he pointed out “Ramen profitable means a startup makes just enough to pay the founders’ living expenses.”Ramen profitability is a key moment in a startup’s life. It marks the moment when the startup revenues can pay up at least for the founders’ living expenses.

As venture capitalist (among the first investors in Airbnb) Paul Graham pointed out in a piece called “The Airbnbs:”

Ramen profitability is not, obviously, the end goal of any startup, but it’s the most important threshold on the way, because this is the point where you’re airborne. This is the point where you no longer need investors’ permission to continue existing. For the Airbnbs, ramen profitability was $4000 a month: $3500 for rent, and $500 for food. They taped this goal to the mirror in the bathroom of their apartment.

To become “ramen profitable” Airbnb’s co-founders had to focus on a subset of the whole potential market. They started with New York. Indeed, as they further narrowed down their market, suddenly numbers started to grow quickly and in a few weeks, they reached ramen profitability.

Source: Paul Graham Twitter

This was the initial bootstrapping journey for Airbnb, what gave it initial traction, and also what gave it credibility for further investment rounds, later on!

How much money does Airbnb make?The digitalization that happened in the last two decades has facilitated the creation of peer-to-peer platforms in which business models disrupted the hospitality model that was created in the previous century by hotel chains like Marriott, Holiday Inn, and Hilton.

As a platform, Airbnb makes money by enabling transactions on the peer-to-peer network of hosts and guests. And it charges both for the successful transaction that happened through the platform.

As Airbnb went through the pandemic, its revenue decreased by $1.2 billion, or 32%, for the nine months ending in September 2020 compared to the same period in 2019.

This revenue decrease was primarily driven by a 42% decrease in the number of check-ins related to Nights and Experiences as a result of the pandemic.

Yet, as of 2021, not only did Airbnb go back to the pre-pandemic level, its revenues reached about $6 billion.

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. On 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, $155.94.

In 2021, Airbnb generated enabled $46.9 Billion in Gross Booking Value, and it generated $6 Billion in service fee revenues. On 2021, there were $300.6 Million Nights and Experiences Booked, ad an average service fee of 12.78%, at an Average Value per Booking, $155.94.Airbnb’s key stats, in 2021, reaching about $47 billion in gross bookings throuhg the platform.

Breaking down the economics of an Airbnb bookingAs a peer-to-peer platform, once the transaction between host and guest goes through, Airbnb will collect a fee from both key players. As an example from a $100 booking per night set by the host, Airbnb might collect $3 as a hosting fee. While it might increase the price for the guest at $116 ($16 above the price set by the host) to collect its guest fees of $12 and taxes for the remaining amount.

Therefore, for a similar transaction, Airbnb will collect $15, the host will make $97 from an initial set price at $100, and the guest will pay $116 (tax comprised).

Image Source: Airbnb Financial Prospectus

How much is Airbnb worth?In March 2017 the company was valued at $31 billion. As of that date, the company had $5 billion at the bank, and it rejected an investment offer by SoftBank. Airbnb was among the largest potential tech unicorns.

Then, in 2020 the COVID pandemic hit particularly the travel industry which had to adapt. And at the time of the Airbnb IPO, the company might be valued around $20 billion. Of course, as Airbnb went public its price and valuation changed quickly. In fact, as the company IPOed it reached a hundred billion dollars market cap.

Today Airbnb is worth more than a hundred billion!

Airbnb mission and visionAirbnb’s mission is to create a world where people can belong through healthy travel that is local, authentic, diverse, inclusive and sustainable.

This is how Airbnb describes its mission. And it continues:

Airbnb uniquely leverages technology to economically empower millions of people around the world to unlock and monetize their spaces, passions and talents and become hospitality entrepreneurs.

The key element of a platform and peer-to-peer business model like Airbnb is the creation of a viable ecosystem. In this case, Airbnb becomes a platform for other entrepreneurs or aspiring hospitality entrepreneurs:

What are the key partners for Airbnb?Airbnb’s people-to-people platform benefits all our stakeholders, including hosts, guests, employees and the communities in which we operate.

There are three key strategic partners:

Hosts.Guests.Local communities.In the initial traction stage, freelance photographers also played a key role in the growth of the platform.

Guests (travelers) can easily find hosts (pretty much anyone with a private home for rent) through the Airbnb marketplace.

Also, Real estate agencies that have vacant units can use Airbnb as a way to rent the excess properties they were not able to rent on the market. Instead, freelance photographers can earn a living by joining Airbnb as independent contractors.

But let’s look at what makes Airbnb platform compelling for each of those key partners.

Airbnb value proposition to its key partnersThere are several value propositions for both hosts and guests. And for freelance photographers.

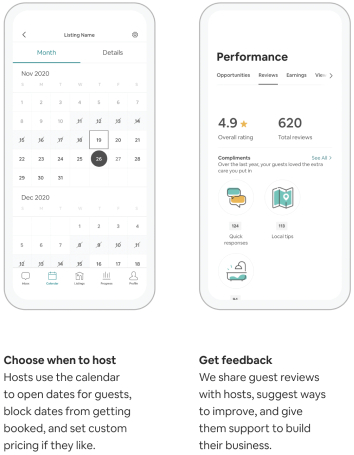

Hosts

The Airbnb hosts’ platform, as shown in its prospectus.

Hosts can earn an extra income stream by renting additional space they have at home.Hosts can also turn into entrepreneurs by renting multiple locations with longer-term leases and making money with short-term rentals or by buying properties and generating a higher income with short-term rents. Hosts also have a set of tools for pricing, scheduling, payments, and more, which makes it easier for them to handle their customers without having to invest in proprietary technology. Hosts are also provided with insurance and liability coverage, the “Host Protection Coverage.”Trust, indeed, is a key element of the platform. In part, Airbnb’s success is given by its effort to make transactions as smooth as possible on its peer-to-peer marketplace.

Guests

The Airbnb guests’ platform, as shown in its prospectus.

The booking process is straightforward and the digital platform very effective.Travelers find affordable prices.Guests can also benefit from different experiences compared to the traditional hotel. Indeed, the host can act as a local touchpoint for the guest in the new community. For both hosts and guestsThe review system for both hosts and guests guarantee standards of quality.A secure payment system. A set of tools for them to connect, and to design experiences beyond the traditional stay.What is the revenue generation model?

Airbnb makes money in two ways:

1. It collects a commission from property owners, which is generally 3%. While it collects a commission fee from the same owners offering experiences, which is generally 20%.

2. It collects a transaction fee from guests of between 5% and 15% of the reservation subtotal

What are two key challenges to Airbnb’s success and further scale?There are two main issues Airbnb has to face:

TrustWhen hosts are listing their rooms and homes, they’re trusting the platform to put them in touch with good people. The same applies to guests. Would this trust be eroded over time so will be the value of the marketplace.

How does Airbnb tackles that? There are several buit-in features, developed over the years within Airbnb’s marketplace to enable trust at scale. As explained it its prospectus some of them are:

Reviews: user-generated reviews both for hosts and guests are the underlying factor enabling both parties to deal with each other. Secure messaging and account protection.Risk scoring through predictive analytics and machine learning to evaluate hundreds of signals to flag and investigate fraudulent accounts.Secure payments.Watchlist and background checks (for hosts and guests based in the United States).Cleanliness (become extremely important during the pandemic to make environment COVID-free).Fraud and scam prevention.Insurance and protections.Booking restrictions.Urgent Safety Line.24/7 Neighborhood Support Line.Guest refund policy.Customer retentionTravelers nowadays have plenty of options. If they revert back to hotels or other solutions, Airbnb loses momentum. Also, another risk might be that of losing guests that make friends with hosts. In fact, they might choose to organize their next transaction privately.

The paradox then is that Airbnb rather than strong incentive tie between hosts and guests. It has to create an experience so that both parties can trust each other enough to make the transaction but not so much to get out of the Airbnb marketplace.

Airbnb through the pandemicAirbnb has been among the most hit companies though the pandemic, as its business model was fine-tuned around global travel, and short-term stays and experiences.

In May 2020, this is how Brian Chesky, CEO, and co-founder of Airbnb explained the current scenario:

Let me start with how we arrived at this decision. We are collectively living through the most harrowing crisis of our lifetime, and as it began to unfold, global travel came to a standstill. Airbnb’s business has been hit hard, with revenue this year forecasted to be less than half of what we earned in 2019. In response, we raised $2 billion in capital and dramatically cut costs that touched nearly every corner of Airbnb.

He also explained how uncertain the situation is at a global level:

We don’t know exactly when travel will return. When travel does return, it will look different.Airbnb which was among the companies that most surfed the change in the travel and real estate industry, of the last decade, can also give us a better perspective of what might happen in the coming years for this industry.

Airbnb new business strategy based on a sustainable cost modelTravel in this new world will look different, and we need to evolve Airbnb accordingly. People will want options that are closer to home, safer, and more affordable. But people will also yearn for something that feels like it’s been taken away from them — human connection. When we started Airbnb, it was about belonging and connection. This crisis has sharpened our focus to get back to our roots, back to the basics, back to what is truly special about Airbnb — everyday people who host their homes and offer experiences.

As Airbnb moves forward in this new normal, it looks at a few core elements:

Local travelSafetyAffordabilityAt the same time, the company is focusing back on its core, and yet converting from physical experiences to online experiences.

Airbnb stretching its business model In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling the whole new problems for new customers (reinvent mode).

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling the whole new problems for new customers (reinvent mode).As Airbnb knows the travel industry might not look as it used to, it’s now trying to redefine the boundaries of its business model, by leveraging on its tech platforms, an existent global audience, that used to be interested in physical experiences.

By stretching and extending its business model, Airbnb is trying to diversify it while the global pandemic will be over:

Example of the new section available on the Airbnb platform: Online Experiences

By leveraging on its audience Airbnb can test quickly a new product:

Example of an online experience where the “digital hosts” provide the format of the experience and the “digital guests” take part to it.

The online experience can take also the form of a private group where a limited number of “digital guests” can join by paying a premium price.

Will this platform be able to supplant, and integrate part of Airbnb’s revenues while the pandemic is over and the company can redesign also physical travel experiences?

Key lessons in redefining travel experiences and changing a whole business strategy, fast!Back in March 2017, Airbnb was valued at $31 billion. Then by May 2020, due to the pandemic, the company valuation fell to $18 billion.While its core business model is still sustained by two key strategic partners: hosts, guests. Airbnb has been also testing the expansion of its business model toward online experiences.In an interview in late June 2020, Airbnb’s CEO remarked a few key findings for the future of the company and of the overall travel industry.

He explained how he learned “not to try to get in the business of predicting the future.” And the only way to do that is to run a super lean organization (Airbnb cut over a billion in marketing expenses throughout the pandemic).

This key lesson came as Airbnb risked to lose it all in the space of a few weeks. While Airbnb’s CEO remarked the trend in travel was still very strong. He also explained how things had changed for Airbnb.

Safety comes first, this makes still people concerned about getting on planes or traveling to crowded cities. Instead, as he explained, “they are willing to do is to get in a car and drive a couple hundred miles to a small community where they are willing to stay in a house.”

Airbnb’s CEO explained how “one trend that is going to happen is that travel as we knew it is over. It doesn’t mean travel is over, just the travel we knew is over… and it’s never coming back. It’s just not.”

And he continued, “Instead of the world’s population traveling to only a few cities and staying in big tourist districts we are going to see a redistribution of where people travel. They’re going to start traveling because they are going nearby to thousands of local communities.”

That changes the whole Airbnb strategy. Skewed more toward digital experiences and local expansion, rather than just growing quickly in large crowded cities.

How the Airbnb product changed throughout the pandemicAs the company highlighted in its financial prospectus, it had to adjust its whole platform servicing to fit what its users needed at that moment, and how the global economy had been temporary shifted.

So the product and platform focused on:

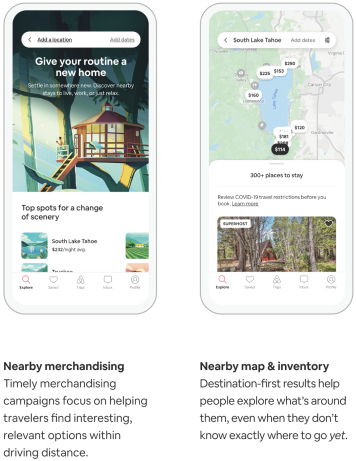

Local travel

Above the example of the Airbnb platform changes to fit the local experiences.

Support for hosts and guestsAirbnb kicked off an hosts fund to support them through the pandemic. While the fund itself ($250 million + $17 million for Superhosts) was a small contribution in comparison to the loss many hosts experienced. It was at least a minimum release for some hosts.

Enhanced cleaning services

To enable more people to keep traveling, at least locally, during the pandemic, cleaning services to make environments COVID-free became a built-in features of the platform.

Online experiences

Airbnb also launched the online experiences platform, to help hosts to keep offering part of their services online.

Airbnb and how the future of travel is changingBy 2021, as Arbnb finally managed to go back to its pre-pandemic levels, it also found out how the world of travel is changing.

In fact, Airbnb had the most profitable quarter ever. Even better than 2019 Q3 revenue of $2.2 billion was its highest ever—36% higher than Q3 2019. Some realizations from Airbnb were:

People can travel anytime. People are traveling everywhere: Travel isn’t anymore toward cities but rather to rural destinations. Over 40% of gross nights booked in Q3 2021 were within 300 miles of home, up from 32% in Q3 2019, while gross nights booked to rural destinations increased more than 40% in Q3 2021 from Q3 2019.People are living on Airbnb: Long-term stays of 28 days or more remained Airbnb fastest-growing category by trip length and accounted for 20% of gross nights booked in Q3 2021, up from 14% in Q3 2019.More people are interested in hosting.In a tweet on November 9, Brian Chesky further explained:

Airbnb first-ever pitch deck

1. I think we’re on the verge of a revolution in travel

2. Before the pandemic, most people were tethered to the place they worked because they had to go into an office

3. The pandemic accelerated the mass adoption of technologies (like Zoom) that allowed millions of people (not everyone, but a large chunk) to work from home

4. Suddenly, they were untethered from the need to work in specific places at specific times

5. Millions of people can now travel anytime, anywhere, for any length — and even live anywhere

6. All you have to believe is that Zoom is here to stay to believe this trend is here to stay

7. This newfound flexibility is bringing about a revolution in how we travel

8. In recent months, some of the largest companies in the world, like Amazon, P&G, Ford, and PwC, have announced increased flexibility for employees to work remotely, and I expect more companies to follow

9. We’re seeing this in our own data

10. Travel anytime: Monday’s and Tuesday’s are our fastest growing days of the week for families to travel

11. Travel anywhere: over 100,000 towns & cities had a booking on Airbnb during the pandemic (6,000 places had their 1st booking)

12. Live anywhere: between July and September, 1 in 5 nights booked were for a month or longer. This is our fastest growing category by trip length

13. So basically, people aren’t just traveling on Airbnb, they’re now living on Airbnb

14. Okay, last tweet… to respond to this moment, I’ll share some updates to the Airbnb service at 8am pst tomorrow on our homepage (I have a short demo that I’ll share)

Handpicked related articles:

Types of Business Models You Need to KnowVTDF FrameworkHow Does PayPal Make Money? The PayPal Mafia Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessThe Google of China: Baidu Business Model In A NutshellAccenture Business Model In A Nutshell Salesforce: The Multi-Billion Dollar Subscription-Based CRMHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedRelated To Airbnb Business ModelMulti-sided Platform Business Model

A multisided platform business model is a company that leverages multisided network effects (coming from two or more sides of the network). Therefore, when one side of the network grows, this makes the overall platform more valuable for the other side of the network and vice-versa, triggering exponential growth for the platform business.

A multisided platform business model is a company that leverages multisided network effects (coming from two or more sides of the network). Therefore, when one side of the network grows, this makes the overall platform more valuable for the other side of the network and vice-versa, triggering exponential growth for the platform business. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. The virtuous cycle is a positive loop or a set of positive loops that trigger a non-linear growth. Indeed, in the context of digital platforms, virtuous cycles – also defined as flywheel models – help companies capture more market shares by accelerating growth. The classic example is Amazon’s lower prices driving more consumers, driving more sellers, thus improving variety and convenience, thus accelerating growth.OTAs Connected Business ModelsBooking

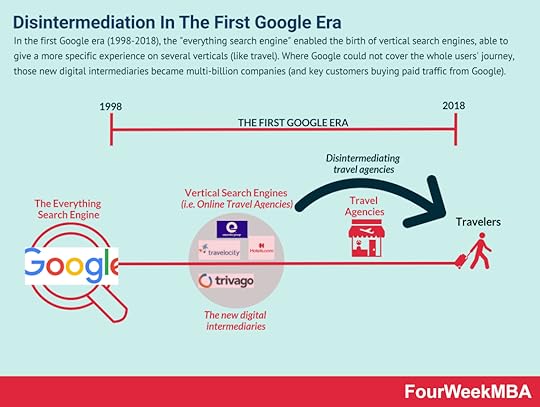

The virtuous cycle is a positive loop or a set of positive loops that trigger a non-linear growth. Indeed, in the context of digital platforms, virtuous cycles – also defined as flywheel models – help companies capture more market shares by accelerating growth. The classic example is Amazon’s lower prices driving more consumers, driving more sellers, thus improving variety and convenience, thus accelerating growth.OTAs Connected Business ModelsBooking Booking Holdings is the company the controls six main brands that comprise Booking.com, priceline.com, KAYAK, agoda.com, Rentalcars.com, and OpenTable. Over 76% of the company revenues in 2017 came primarily via travel reservations commissions and travel insurance fees. Almost 17% came from merchant fees, and the remaining revenues came from advertising earned via KAYAK. As a distribution strategy, the company spent over $4.5 billion in performance-based and brand advertising. Expedia

Booking Holdings is the company the controls six main brands that comprise Booking.com, priceline.com, KAYAK, agoda.com, Rentalcars.com, and OpenTable. Over 76% of the company revenues in 2017 came primarily via travel reservations commissions and travel insurance fees. Almost 17% came from merchant fees, and the remaining revenues came from advertising earned via KAYAK. As a distribution strategy, the company spent over $4.5 billion in performance-based and brand advertising. Expedia Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.Google (Google Travel)

Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.Google (Google Travel) Born in 1996 as a travel platform of Microsoft, it would be spun off later on. Expedia became among the largest online travel agencies (OTAs) which comprise a set of brands that go from Hotels.com, Vrbo, Orbits, CheapTickets, ebookers, Travelocity, Trivago, and others. The company follows a multi-brand strategy.Kayak

Born in 1996 as a travel platform of Microsoft, it would be spun off later on. Expedia became among the largest online travel agencies (OTAs) which comprise a set of brands that go from Hotels.com, Vrbo, Orbits, CheapTickets, ebookers, Travelocity, Trivago, and others. The company follows a multi-brand strategy.Kayak Kayak is an online travel agency and search engine founded in 2004 by Steve Hafner and Paul M. English as a Travel Search Company and acquired by Booking Holdings in 2013 for $2.1 billion. The company makes money via an advertising model based on cost per click, cost per acquisition, and advertising placements.OpenTable

Kayak is an online travel agency and search engine founded in 2004 by Steve Hafner and Paul M. English as a Travel Search Company and acquired by Booking Holdings in 2013 for $2.1 billion. The company makes money via an advertising model based on cost per click, cost per acquisition, and advertising placements.OpenTable OpenTable is an American online restaurant reservation system founded by Chuck Templeton. During the late 90s, it provided one of the first automated, real-time reservation systems. The company was acquired by Booking Holding back in 2014, for $2.6 billion. Today OpenTable makes money via subscription plans, referral fees, and in-dining with its first restaurant, as an experiment in Miami, Florida.Oyo

OpenTable is an American online restaurant reservation system founded by Chuck Templeton. During the late 90s, it provided one of the first automated, real-time reservation systems. The company was acquired by Booking Holding back in 2014, for $2.6 billion. Today OpenTable makes money via subscription plans, referral fees, and in-dining with its first restaurant, as an experiment in Miami, Florida.Oyo OYO’s business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.Tripadvisor

OYO’s business model is a mixture of platform and brand, where the company started primarily as an aggregator of homes across India, and it quickly moved to other verticals, from leisure to co-working and corporate travel. In a sort of octopus business strategy of expansion to cover the whole spectrum of short-term real estate.Tripadvisor TripAdvisor’s business model matches the demand for people looking for a travel experience with supply from travel partners around the world providing travel accommodations and experiences. When this match is created TripAdvisor collects commission from partners on a CPC and CPM basis. The non-hotel revenue comprises experiences, restaurants, and rentals.Trivago

TripAdvisor’s business model matches the demand for people looking for a travel experience with supply from travel partners around the world providing travel accommodations and experiences. When this match is created TripAdvisor collects commission from partners on a CPC and CPM basis. The non-hotel revenue comprises experiences, restaurants, and rentals.Trivago Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.

Trivago is a search and discovery travel platform part of Expedia Group. Trivago is widely known as a trusted hotel comparison service. Trivago doesn’t charge based on bookings but rather through a cost-per-click (CPC) model, monetized when a hotel searcher clicks one of its advertiser listings. This referral revenue comprises most of Trivago’s income. Trivago also has another minor revenue stream via subscriptions to its Business Studio, a tool that helps hoteliers track impression and click data associated with their properties.The post How Does Airbnb Make Money? Airbnb Business Model Analysis – Updated 2022 appeared first on FourWeekMBA.

April 19, 2022

How Does Spotify Make Money? Spotify Freemium Business Model In A Nutshell

Spotify is a two-sided marketplace where artists and music fans engage. Spotify has a free ad-supported service and a paid membership. Founded in 2008 with the belief that music should be universally accessible, it generated €9.66 billion in 2021. Of these revenues, 87.5% or €8.46 billion came from premium memberships, while over 12.5% or €1.2 billion came from ad-supported members.

Spotify two-sided marketplace founded on the belief in universal music with streaming accessSpotify is a place where both artists and people who want to listen to music can get together. When Spotify launched its service, back in 2008, the music industry wasn’t living a good moment. That was also due to the growth in piracy and digital distribution, which were allowing people to listen to music, while artists were losing control of monetizing their music.

As pointed on its prospectus, Spotify “set out to reimagine the music industry and to provide a better way for both artists and consumers to benefit from the digital transformation of the music industry.“

In addition to that Spotify was founded on the “belief that music is universal and that streaming is a more robust and seamless access model that benefits both artists and music fans.“

How Does Netflix Make Money? Netflix Business Model Explained

Spotify mission statementOur mission is to unlock the potential of human creativity by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by these creators.

This mission is critical as it also drives the business model behind Spotify. Indeed, as a two-sided marketplace, Spotify’s success depends on its ability to match the music offered by artists with their music fans’ preferences. The more this match is successful, the more Spotify will be able to retain and grow its membership base, thus substantially increasing its revenues.

Spotify key partners and its challenge to gatekeepersThe principal partners of Spotify are:

employeesusersthe creative communitybrandsinvestorsIts primary challenge is to fight the old model where artists had to be signed to a label to have access to a recording studio, mainly when the radio was critical to achieving success. Spotify’s mission is to allow artists to produce and release their own music.

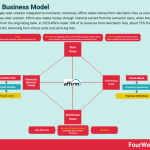

Spotify monetization strategy: the ad-supported service as a funnel forSpotify’s monetization strategy is based on two primary services:

Premium memberships and Ad-Supported ServicesThe Premium and Ad-Supported Services work independently yet they are critical to each other. The ad-supported service is what allowed Spotify to scale and it is also the crucial ingredient in the paid members’ acquisition in Spotify.

That’s because the ad-supported serves as a funnel, which drives more than 60% of Spotify total gross added Premium Subscribers. At the same time, the ad-supported service is a viable stand-alone product.

Premium service monetization explainedSpotify service provides Premium Subscribers with unlimited online and offline high-quality streaming access to its catalog.

Premium Services, include standard plans, Family Plans, and Student Plans. The aim of each package is thought to appeal to Users with different lifestyles and across various demographics and age groups.

Also, in some markets where subscription services are not yet the norm, Spotify offers prepaid options.

Spotify counted over 71 million Premium Subscribers in 2017. Those members are activated via several marketing channels:

by getting converted from the ad-supported services platform by engaging ad-supported users by highlighting the critical features of paid plansvia product links, campaigns targeting existing Users, and performance marketing across leading social media platformsAd-supported services monetization explainedThe ad-supported service has no subscription fees, but it offers limited on-demand online access to the Spotify catalog. The ad-supported service is a critical ingredient to Spotify funnel in terms of the acquisition of paid members. At the same time that represents a viable option for users that can’t afford the paid plan.

On the ad-supported service, Spotify monetizes from the sale of display, audio, and video advertising delivered through advertising impressions.

The revenues comprise primarily the number and hours of engagement of Spotify Ad-Supported Users and their ability to provide innovative advertising products. A key ingredient is Spotify’s demographic segment primary made of users between 18 and 34 years old, which represents a massive opportunity for monetization via advertising:

Source: Spotify prospectus

Spotify evolving business model: membership or ad-supported?The Spotify business model is still evolving. Even though its revenues primarily come from paid members, the company might try to push more on its ad-supported services, and enter more and more into the digital advertising space. Therefore, a business model that is subscription-based might become advertising-based in the long run. As of now (2017) over 10% of Spotify revenues come from ad-supported services, while the remaining, about 90% comes from membership services.

Spotify acquisition costsEach company needs to tap into a distribution strategy that guarantees a stream of users to have a sustainable business model. Much of Spotify’s costs are based on royalty and distribution costs related to content streaming. Those are paid to specific music record labels, publishers, and other rights holders, for the right to stream music to Spotify Users.

Of course, the revenue generated on lower-priced plans (such as the Family and Student Plan) carries a lower cost compared to other plans.

The acquisition costs also depend on targets which can include measures such as:

the number of Premium Subscribers, the ratio of Ad-Supported Users to Premium Subscribers, and/or the rates of Premium Subscriber churnSome of the licensing agreements that impact Spotify costs include Universal Music Group, Sony Music Entertainment, Warner Music Group, and Merlin.

Spotify key metricsUnderstanding the metrics that an organization looks at to evaluate the growth of its platform, in a way also highlights the vision that the company has about its users, its business model, and what it’s important for its financial success. A set of metrics that Spotify looks at comprises:

MAUs (monthly average users)premium subscribersad-supported MAUspremium ARPU (average revenues per user)premium churncontent hours MAUsSpotify tracks MAUs as “an indicator of the size of the audience engaged with its Service.” This is defined as the total count of Ad-Supported Users and Premium Subscribers that have consumed content for greater than zero milliseconds in the last thirty days from the period-end indicated.

In 2021, Spotify had 406 million monthly active users. Growth compared to 2020 345 million monthly active users.

Premium SubscribersPremium Subscribers are users that have completed registration with Spotify and have activated a payment method for Premium Service.

Premium Subscribers were 180 million in 2021, compared to the 155 million premium subscribers in 2020. The plan that most contributed to Spotify’s revenue growth was the Family Plan. While the Spotify free service kept enabling the upgrade from free to paid, which also helped the company grow its revenues.

Ad-Supported MAUsThat is the total count of Ad-Supported monthly active users that have consumed content for greater than zero milliseconds in the last thirty days.

Ad-Supported MAUs were 236 million in 2021, compared to 199 million in 2020.

Premium ARPUThis monthly metric shows the revenue recognized in the quarter indicated divided by the average daily Premium Subscribers in that quarter, divided by three months.

As Spotify increased the growth of its revenues by enabling more people to join its Family Plan, the ARPU, or average revenue per user declined in 2019. Overall this had a positive effect on revenues, as Spotify tries to covert more free accounts to paid users, getting them into the basic plan, and over time, making users switch to higher-paying plans.

Premium ChurnThat represents the premium members’ cancellations in the quarter indicated divided by the average number of daily Premium Subscribers in that quarter, divided by three months.

We have old data about the churn, which in 2017 was 5.5%, compared to 6.6% in 2016. The churn is a critical metric in the subscription-based business model. Indeed, when the churn rate is growing over time this creates a sort of “leaky bucket syndrome” for the company, which it doesn’t matter how much effort is placed to bring in new customers. Those are burned over time, as the churn rate speeds up.

What affects the churn rate? There are several factors that can affect it. From products issue, like bad onboarding, unclear UX/UI, bad support, or low quality of the offered service. It’s important to diagnose what’s causing a growing churn, to prevent the subscription-based business to lose traction, slowing down, and potentially lose its core customer base.

Content HoursThat represents the aggregate number of hours. Users spent consuming audio and video content on Spotify.

We have interesting past data (Spotify isn’t sharing this anymore), that shows, users were spending an average of 40.3 hours per year on the platform, more than doubling, compared to 17.4 hours spent in 2015.

Spotify user-generated contentIt’s easy to think of Spotify as a modern tech achievement, made of automated algorithms able to find out any taste a music fan has. Yet an exciting aspect of Spotify is its user-generated content, in which music listeners can easily and quickly curate and save their playlists to share with other Users. As of 2017, Spotify had over 3.2 billion User-generated playlists, which generated over 500 million streams daily and accounted for approximately 36% of Spotify’s monthly Content Hours!

Source: Spotify financial prospectus

personalized playlists, automatically created by Spotify technology accounted for approximately 17% of its monthly Content Hours.

Curated Playlists by Spotify editorial team which carefully curates them that allow Users to listen to music in specific genres account for approximately 15% of our monthly Content Hours.

Spotify marketing strategySpotify marketing is based on four main strategies:

Brand marketing: made of online and offline brand marketing campaigns Marketing for artists: Spotify artist marketing program uses billboards, other forms of traditional media, and digital outlets to highlight artists and their workPremium Service discounts: Spotify offers bi-annual campaigns discounting its subscription offerings with a three-month subscription to the Premium Service. Those campaigns have proven very effective in driving the growth of paid membershipsConversion Marketing: Ad-supported users get the highlight of key features that encourage conversion to its subscription offerings. These include product links, internal campaigns and user emails, and performance marketing across leading social media platforms. The Ad-Supported Service is the main funnel that drives more than 60% of Spotify added Premium Subscribers!How licensing affects Spotify’s business model Spotify licensing deals affect its business model. The company runs on both a free service, which is ad-supported and a subscription premium service. They have different economics.

Spotify licensing deals affect its business model. The company runs on both a free service, which is ad-supported and a subscription premium service. They have different economics.The ad-supported business had a 10% gross margin in 2021, compared to 29% of the subscription-based business. That’s because the more the content gets streamed on the platform, the more that increases royalty costs for Spotify. That is also why the company invested in developing its content. Thus, in part transitioning from platform to brand.Spotify licensing deals affect its business model. The company runs on both a free service, which is ad-supported and a subscription premium service. They have different economics. From platform to brand

Source: open.spotify.com/

Started primarily as a platform the company has also in part transitioned into a production house. This is part of the transition to becoming a strong consumer brand. But it has also to do with a business model evolution.

Where the licensing model makes Spotify’s future costs to monetize its users, too volatile. The company has also been trying to develop content, which makes its costs more scalable as the platform keeps growing. This is what I define as the transition from platform to brand.

Spotify during pandemic times

During the pandemic, music and entertainment have become among the areas with the largest growth, where all else is falling. Indeed, Spotify kept growing in the first quarter of 2020, by adding six million premium subscribers and ten million ad-supported/free accounts, for a total of 286 million members.

Podcasting as a key driver for future growthAnother key driver for Spotify’s growth is podcasting. As the company keeps investing in this trajectory. Indeed, 19% of the Total MAUs engage with podcast content, and as reported by Spotify consumption grew at triple-digit rates year over year.

Summary and conclusionsSpotify started in 2008 as a freemium service whose aim was to create a two-sided platform that connected artists with music fans without having artists go through the traditional distribution channels and gatekeepers.In 2021 Spotify made over €9.6 billion in revenues.Even though the company primarily makes money via its paid subscription members, it also has an ad-supported service.The ad-supported free service has played a key role, as an additional revenue stream in 2021, as it drove more than 12.5% of its sales and also a critical sales funnel that drove 60% of added premium members in 2019.Even though Spotify made over nine billion euros in revenues, the company reported a net loss of €34 million in 2021. Spotify’s business model is still evolving, and it might well emphasize more and more on its ad-supported service to grow its revenues.An interesting aspect is that even though Spotify is driven by AI, one of the most popular features – that drives most of the content hours on the platform – is the user-generated playlists that represented about 36% of monthly content hours back in 2017! (When Spotify still reported these numbers).Read: Who Owns Spotify, Spotify Competitors, How Does Spotify Pay Artists?

Handpicked related articles:

How Does Netflix Make Money? Netflix Business Model ExplainedSuccessful Types of Business Models You Need to KnowWhat Is a Business Model Canvas? Business Model Canvas ExplainedThe Power of Google Business Model in a NutshellHow Does Google Make Money? It’s Not Just Advertising!Baidu Vs. Google: The Twins Of Search ComparedHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedThe Google of China: Baidu Business Model In A NutshellHow Does PayPal Make Money? The PayPal Mafia Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Amazon Makes Money: Amazon Business Model in a NutshellThe post How Does Spotify Make Money? Spotify Freemium Business Model In A Nutshell appeared first on FourWeekMBA.

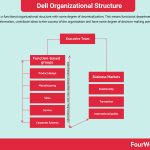

Dell Organizational Structure

Dell has a functional organizational structure with some degree of decentralization. This means functional departments share information, contribute ideas to the success of the organization and have some degree of decision-making power.

IntroductionDell is an American company that sells PCs, servers, data storage devices, software, peripherals, and consumer electronics from other brands, among other things.

Dell is perhaps best known for its direct-sales business model where consumers purchase made-to-order computers. However, parent company Dell Technologies has made several acquisitions in recent years to support the company’s new focus on analytics, cloud computing, and information security.

How is Dell structured?Dell has a functional organizational structure with some degree of decentralization. This means functional departments contribute ideas to the wider success of the organization and have some level of autonomy in terms of decision-making.

However, the company is less decentralized than it has been in the past. In the 1990s, Dell’s information technology systems were highly fragmented. With most of the company’s applications developed independently across different departments, management lacked the necessary information to make even the most basic of decisions.

Dell realized that this way of doing business contradicted its organizational structure of centralized, functional groups reporting directly to headquarters in Austin, Texas. As the company entered the 2000s, it developed a system called Information to Run the Business (IRB). This system gives all Dell managers basic indicators such as financial performance, product margins, and product quality.

Today, these are managers of function-based groups such as:

Product design.Manufacturing.Sales.Service.Corporate systems.Business marketsFunction-based groups are further defined by three different business markets:

Relationship – Dell’s largest or enterprise clients.Transaction – consumers and small businesses.International/public – this includes all non-US markets, SMEs, government, healthcare, and educational institutions.Each of the markets is supported by applications that are contained within some (or all) of the five functional groups listed above.

Geographic regionsDell operations are also organized around three geographic regions. These include:

Americas.Asia-Pacific and Japan, andEurope, Middle East, and Africa (EMEA).In the United States, which is one of Dell’s premier markets, the Americas was further divided into three sub-regions: West, Central, and East.

The initiative was designed to limit the time Dell sales reps were spending on the road, with some having to drive over 150 miles to visit a single client.

Hierarchical leadership structureMichael Dell is the founder, chairman, and CEO of Dell.

In 2016, the hierarchical leadership structure was altered after Dell acquired computer-storage corporation EMC for $67 billion. In the process, a new company called Dell Technologies was born, with 14 top executives reporting directly to Dell himself.

Some of the members of this executive group are in charge of Dell Technologies companies that run independently. These include Virtustream, VMware, and Secureworks.

Dell also has two COOs beneath him in addition to Chief Officers for customers, marketing, services, human resources, global sales, operations, and finance.

Key takeaways:Dell has a functional organizational structure with some degree of decentralization. This means functional departments share information, contribute ideas to the success of the organization and have some degree of decision-making power.Function-based groups are considered in the context of three business markets, with each market supported by functions from some or all groups. The company is also structured according to three broad geographic regions and three within the Americas to improve sales efficiency.Dell’s leadership structure changed somewhat after it acquired Dell Technologies in 2016. Michael Dell returned to the CEO position with a cohort of 14 executives who report directly to him.Read Next: Organizational Structure.

Read Also: History of The Internet: From The Internet to Web3

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Dell Organizational Structure appeared first on FourWeekMBA.

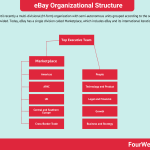

eBay Organizational Structure

eBay was until recently a multi-divisional (M-form) organization with semi-autonomous units grouped according to the services they provided. Today, eBay has a single division called Marketplace, which includes eBay and its international iterations.

eBay Origin StoryFounded in 1995 as AuctionWeb, the online marketplace now known as eBay became one of the earliest success stories on the internet. Two years after it launched, the platform sold its millionth item and an IPO soon followed in 1998.

While eBay’s premier online marketplace is now available in 180 countries, it’s important to mention that the company has also acquired various ancillary products and services over the years. These were once reflected in eBay’s organizational structure and served to streamline processes and management between the company and its subsidiaries. However, in recent times, the company has returned to its roots and its composition has changed accordingly.

So how is eBay structured, exactly? Let’s begin.

Multi-divisional operationseBay was until recently a multi-divisional (M-form) organization. This meant that the company was split into several semi-autonomous units that were ultimately guided and controlled by headquarters.

eBay’s divisional units were grouped according to the services they provided and consisted of Marketplace, StubHub, Payments, and Classifieds.

Today, it is thought that a sole divisional unit remains:

Marketplace – the most profitable division for the company which includes eBay.com and its various international sites.As part of a move to focus on its C2C and B2C business, eBay either sold or spun-out companies across its other divisions between 2015 and 2020.

Perhaps the most high-profile of these was PayPal, which became an independent company in 2015 after thirteen years as an eBay subsidiary. StubHub was also sold for $4.05 billion in 2019 and the entire Classifieds unit – which once included Craiglist and Kijiji – was divested in 2020.

Geographic divisionsIn 2019, eBay announced it would be placing the company’s geographic divisions in a new structure under the leadership of Jay Lee, Senior Vice President and General Manager of Markets.

This new structure consists of the following regions:

Americas.APAC (Asia-Pacific). UK.Central and Southern Europe, andCross-Border Trade.Leadership of function-based unitseBay has a hierarchical leadership structure with the current President and Chief Executive Officer Jamie Iannone at the helm.

Before eBay divested most of its divisions, it was noted there that was a duplication of many management, administration, and staff activities.

Today, the company is smaller and arguably more efficient. Senior vice presidents manage the following functional areas for the company’s Marketplace division:

People.eBay Europe.Legal.Growth.Business and Strategy.International.Financial.Technology, andProduct.Board of DirectorseBay’s Board of Directors consists of 13 individuals who comprise four different committees:

Audit Committee.Compensation & Human Capital Committee.Corporate Governance & Nominating Committee.Risk Committee.Key takeaways:eBay was until recently a multi-divisional (M-form) organization with semi-autonomous units grouped according to the services they provided. Today, eBay has a single division called Marketplace, which includes eBay and its international iterations.In 2019, eBay announced it would be placing the company’s geographic divisions in a new structure under the command of SVP Jay Lee. eBay has a hierarchical leadership structure with various senior vice presidents in charge of function-based groups. There is also a 13-member Board of Directors responsible for audits, compensation, human capital, corporate governance, and risk.Read Next: Organizational Structure.

Read Also: eBay Business Model.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post eBay Organizational Structure appeared first on FourWeekMBA.

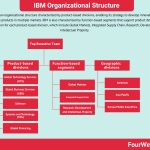

IBM Organizational Structure

IBM has an organizational structure characterized by product-based divisions, enabling its strategy to develop innovative and competitive products in multiple markets. IBM is also characterized by function-based segments that support product development and innovation for each product-based division, which include Global Markets, Integrated Supply Chain, Research, Development, and Intellectual Property.

IntroductionIBM is an American multinational technology corporation that was founded in 1911 by Charles Ranlett Flint as the Computing-Tabulating-Recording Company (CTR).

IBM is a manufacturer and seller of various products, such as computer software, middleware, and hardware, nanotechnology, and hosting and consultancy services. IBM is also a serious innovator, filing more patents than any other company for a record 30 consecutive years between 1992 and 2022.

Over this time, some of IBM’s notable inventions include the ATM, hard disk drive, magnetic stripe card, SQL programming language, and dynamic random-access memory (DRAM).

With these various interests in mind, let’s analyze the company’s organizational structure.

Product-based divisionsIBM has an organizational structure characterized by product-based divisions. This allows the company to carry out its strategy of developing innovative and competitive products across multiple markets.

To that end, the company’s major operations consist of five divisions:

Global Technology Services (GTS) – mostly consisting of IT infrastructure and business process services.Global Business Services (GBS) – this division focuses on delivering client value via consultancy in areas such as cloud, mobile, social business, enterprise applications, analytics, and smart eCommerce. Software – middleware and operating systems software. Systems and Technology (STG) – encompassing any business solution that requires advanced storage capabilities or computing power.Global Financing – IBM also offers lease and loan financing to end-users and internal clients. This division also includes commercial financing to dealers and remarketers of IT products.In some instances, GTS and GBS are collectively known as Global Services.

Function-based segments and geographic divisionsTo a lesser extent, IBM’s structure is characterized by function-based segments and geographical divisions. These are explained below.