Gennaro Cuofano's Blog, page 97

September 6, 2022

9 Decision-Making Methods For Business

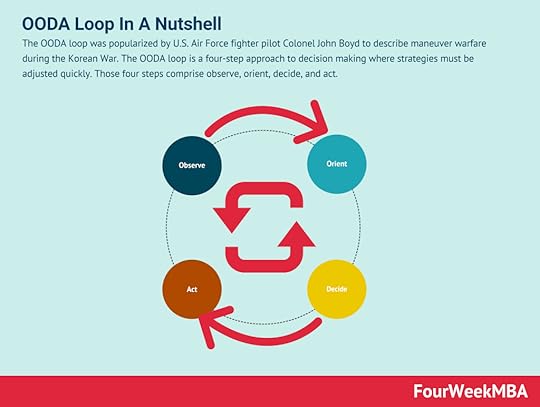

The OODA loop was popularized by U.S. Air Force fighter pilot Colonel John Boyd to describe maneuver warfare during the Korean War. The OODA loop is a four-step approach to decision making where strategies must be adjusted quickly. Those four steps comprise observe, orient, decide, and act. Take-The-Best

The OODA loop was popularized by U.S. Air Force fighter pilot Colonel John Boyd to describe maneuver warfare during the Korean War. The OODA loop is a four-step approach to decision making where strategies must be adjusted quickly. Those four steps comprise observe, orient, decide, and act. Take-The-Best The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.Decision Matrix

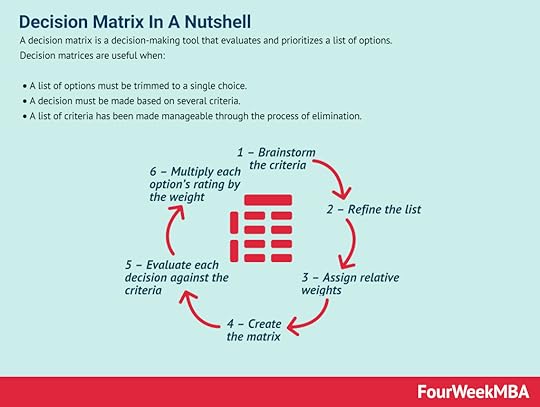

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.Decision Matrix A decision matrix is a decision-making tool that evaluates and prioritizes a list of options. Decision matrices are useful when: A list of options must be trimmed to a single choice. A decision must be made based on several criteria. A list of criteria has been made manageable through the process of elimination.Cost-Benefit Analysis

A decision matrix is a decision-making tool that evaluates and prioritizes a list of options. Decision matrices are useful when: A list of options must be trimmed to a single choice. A decision must be made based on several criteria. A list of criteria has been made manageable through the process of elimination.Cost-Benefit Analysis A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives.Go/No-Go Decision

A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives.Go/No-Go Decision In general, terms, go/no-go decision making is a process of passing or failing a proposition. Each proposition is assessed according to criteria that determine whether a project advances to the next stage. The outcome of the go/no-go decision making is to assess whether to go or not to go with a project, or perhaps proceed with caveats. Speed-Reversibility

In general, terms, go/no-go decision making is a process of passing or failing a proposition. Each proposition is assessed according to criteria that determine whether a project advances to the next stage. The outcome of the go/no-go decision making is to assess whether to go or not to go with a project, or perhaps proceed with caveats. Speed-Reversibility  Asymmetric Betting

Asymmetric Betting Growth Matrix

Growth Matrix In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Revenue Streams Matrix

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Revenue Streams Matrix In the FourWeekMBA Revenue Streams Matrix, revenue streams are classified according to the kind of interactions the business has with its key customers. The first dimension is the “Frequency” of interaction with the key customer. As the second dimension, there is the “Ownership” of the interaction with the key customer.

In the FourWeekMBA Revenue Streams Matrix, revenue streams are classified according to the kind of interactions the business has with its key customers. The first dimension is the “Frequency” of interaction with the key customer. As the second dimension, there is the “Ownership” of the interaction with the key customer.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDistribution ChannelsMarketing StrategyPlatform Business ModelsNetwork EffectsThe post 9 Decision-Making Methods For Business appeared first on FourWeekMBA.

Business Development Frameworks For Business Traction

Business Development

Business Development

Business development comprises a set of strategies and actions to grow a business via a mixture of sales, marketing, and distribution. While marketing usually relies on automation to reach a wider audience, and sales typically leverage a one-to-one approach. The business development’s role is that of generating distribution.

Marketing vs. Sales

Business development comprises a set of strategies and actions to grow a business via a mixture of sales, marketing, and distribution. While marketing usually relies on automation to reach a wider audience, and sales typically leverage a one-to-one approach. The business development’s role is that of generating distribution.

Marketing vs. Sales

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.

Business Model Framework

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.

Business Model Framework

An effective business model has to focus on two dimensions: the people dimension and the financial dimension. The people dimension will allow you to build a product or service that is 10X better than existing ones and a solid brand. The financial dimension will help you develop proper distribution channels by identifying the people that are willing to pay for your product or service and make it financially sustainable in the long run.

Tech Business Model Template

An effective business model has to focus on two dimensions: the people dimension and the financial dimension. The people dimension will allow you to build a product or service that is 10X better than existing ones and a solid brand. The financial dimension will help you develop proper distribution channels by identifying the people that are willing to pay for your product or service and make it financially sustainable in the long run.

Tech Business Model Template

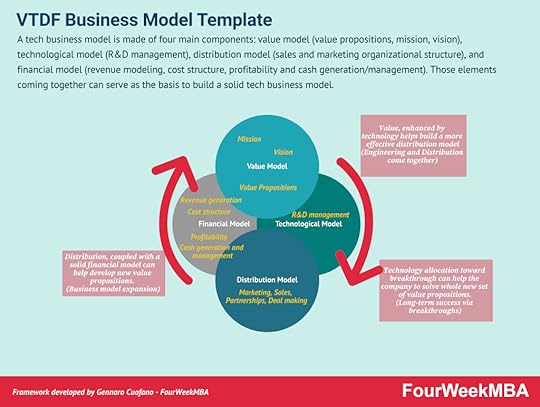

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

Digital Transformation

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

Digital Transformation

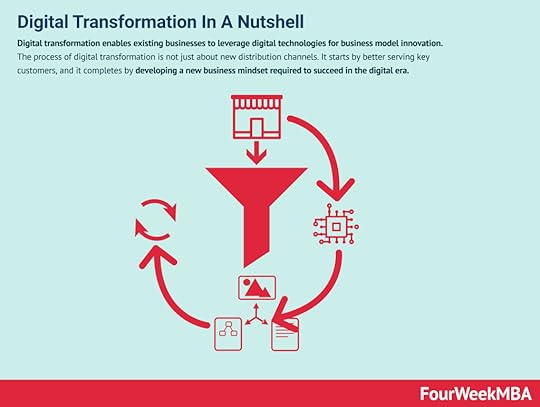

Digital transformation enables existing businesses to leverage digital technologies for business model innovation. The process of digital transformation is not just about new distribution channels. It starts by better serving key customers, and it completes by developing a new business mindset required to succeed in the digital era.

Business Storytelling

Digital transformation enables existing businesses to leverage digital technologies for business model innovation. The process of digital transformation is not just about new distribution channels. It starts by better serving key customers, and it completes by developing a new business mindset required to succeed in the digital era.

Business Storytelling

Business storytelling is a critical part of developing a business model. Indeed, the way you frame the story of your organization will influence its brand in the long-term. That’s because your brand story is tied to your brand identity, and it enables people to identify with a company.

Business storytelling is a critical part of developing a business model. Indeed, the way you frame the story of your organization will influence its brand in the long-term. That’s because your brand story is tied to your brand identity, and it enables people to identify with a company. The 3C Analysis Business Model was developed by Japanese business strategist Kenichi Ohmae. The 3C Model is a marketing tool that focuses on customers, competitors, and the company. At the intersection of these three variables lies an effective marketing strategy to gain a potential competitive advantage and build a lasting company.

GE McKinsey Matrix

The 3C Analysis Business Model was developed by Japanese business strategist Kenichi Ohmae. The 3C Model is a marketing tool that focuses on customers, competitors, and the company. At the intersection of these three variables lies an effective marketing strategy to gain a potential competitive advantage and build a lasting company.

GE McKinsey Matrix

The GE McKinsey Matrix was developed in the 1970s after General Electric asked its consultant McKinsey to develop a portfolio management model. This matrix is a strategy tool that provides guidance on how a corporation should prioritize its investments among its business units, leading to three possible scenarios: invest, protect, harvest, and divest.

McKinsey 7-S Model

The GE McKinsey Matrix was developed in the 1970s after General Electric asked its consultant McKinsey to develop a portfolio management model. This matrix is a strategy tool that provides guidance on how a corporation should prioritize its investments among its business units, leading to three possible scenarios: invest, protect, harvest, and divest.

McKinsey 7-S Model

The McKinsey 7-S Model was developed in the late 1970s by Robert Waterman and Thomas Peters, who were consultants at McKinsey & Company. Waterman and Peters created seven key internal elements that inform a business of how well positioned it is to achieve its goals, based on three hard elements and four soft elements.

AIDA Model

The McKinsey 7-S Model was developed in the late 1970s by Robert Waterman and Thomas Peters, who were consultants at McKinsey & Company. Waterman and Peters created seven key internal elements that inform a business of how well positioned it is to achieve its goals, based on three hard elements and four soft elements.

AIDA Model

AIDA stands for attention, interest, desire, and action. That is a model that is used in marketing to describe the potential journey a customer might go through before purchasing a product or service. The AIDA model helps organizations focus their efforts when optimizing their marketing activities based on the customers’ journeys.

Pirate Metrics

AIDA stands for attention, interest, desire, and action. That is a model that is used in marketing to describe the potential journey a customer might go through before purchasing a product or service. The AIDA model helps organizations focus their efforts when optimizing their marketing activities based on the customers’ journeys.

Pirate Metrics

Venture capitalist, Dave McClure, coined the acronym AARRR which is a simplified model that enables to understand what metrics and channels to look at, at each stage for the users’ path toward becoming customers and referrers of a brand.

Freemium Business Model

Venture capitalist, Dave McClure, coined the acronym AARRR which is a simplified model that enables to understand what metrics and channels to look at, at each stage for the users’ path toward becoming customers and referrers of a brand.

Freemium Business Model

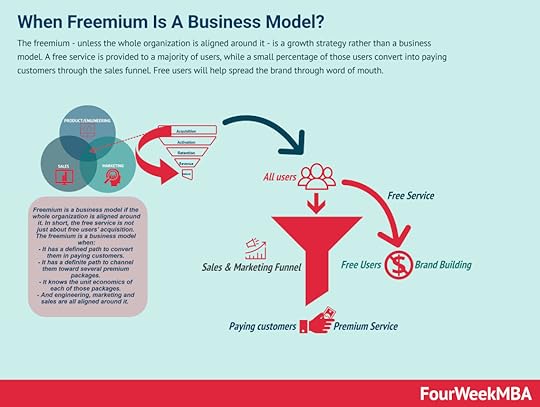

The freemium – unless the whole organization is aligned around it – is a growth strategy rather than a business model. A free service is provided to a majority of users, while a small percentage of those users convert into paying customers through the sales funnel. Free users will help spread the brand through word of mouth.

Freeterprise

The freemium – unless the whole organization is aligned around it – is a growth strategy rather than a business model. A free service is provided to a majority of users, while a small percentage of those users convert into paying customers through the sales funnel. Free users will help spread the brand through word of mouth.

Freeterprise

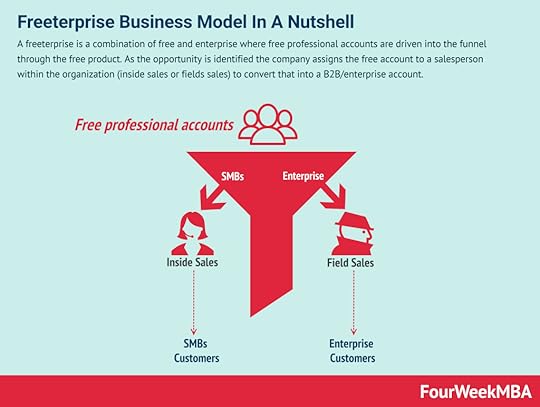

A freeterprise is a combination of free and enterprise where free professional accounts are driven into the funnel through the free product. As the opportunity is identified the company assigns the free account to a salesperson within the organization (inside sales or fields sales) to convert that into a B2B/enterprise account.

Go-To-Market Strategy

A freeterprise is a combination of free and enterprise where free professional accounts are driven into the funnel through the free product. As the opportunity is identified the company assigns the free account to a salesperson within the organization (inside sales or fields sales) to convert that into a B2B/enterprise account.

Go-To-Market Strategy

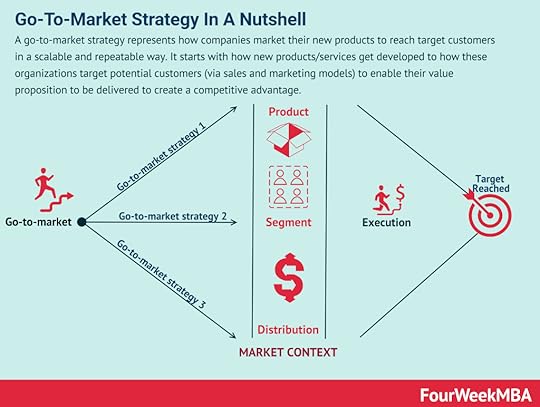

A go-to-market strategy represents how companies market their new products to reach target customers in a scalable and repeatable way. It starts with how new products/services get developed to how these organizations target potential customers (via sales and marketing models) to enable their value proposition to be delivered to create a competitive advantage.

Customer Segmentation

A go-to-market strategy represents how companies market their new products to reach target customers in a scalable and repeatable way. It starts with how new products/services get developed to how these organizations target potential customers (via sales and marketing models) to enable their value proposition to be delivered to create a competitive advantage.

Customer Segmentation

Customer segmentation is a marketing method that divides the customers in sub-groups, that share similar characteristics. Thus, product, marketing and engineering teams can center the strategy from go-to-market to product development and communication around each sub-group. Customer segments can be broken down is several ways, such as demographics, geography, psychographics and more.

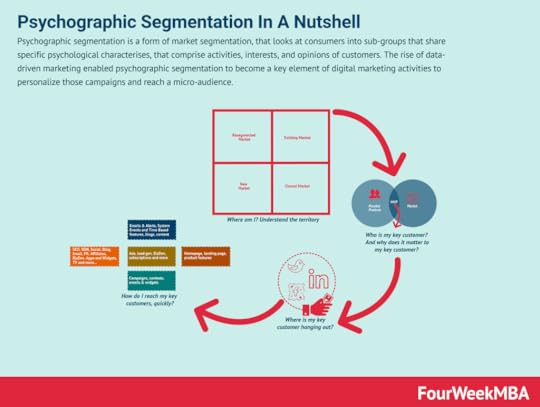

Psychographic Segmentation

Customer segmentation is a marketing method that divides the customers in sub-groups, that share similar characteristics. Thus, product, marketing and engineering teams can center the strategy from go-to-market to product development and communication around each sub-group. Customer segments can be broken down is several ways, such as demographics, geography, psychographics and more.

Psychographic Segmentation

Psychographic segmentation is a form of market segmentation, that looks at consumers into sub-groups that share specific psychological characterizes, that comprise activities, interests, and opinions of customers. The rise of data-driven marketing enabled psychographic segmentation to become a key element of digital marketing activities to personalize those campaigns and reach a micro-audience.

Psychographic segmentation is a form of market segmentation, that looks at consumers into sub-groups that share specific psychological characterizes, that comprise activities, interests, and opinions of customers. The rise of data-driven marketing enabled psychographic segmentation to become a key element of digital marketing activities to personalize those campaigns and reach a micro-audience.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDistribution ChannelsMarketing StrategyPlatform Business ModelsNetwork EffectsThe post Business Development Frameworks For Business Traction appeared first on FourWeekMBA.

Organizational Frameworks To Unlock Business Growth

Kotter’s 8-Step Change Model

Kotter’s 8-Step Change Model

Harvard Business School professor Dr. John Kotter has been a thought-leader on organizational change, and he developed Kotter’s 8-step change model, which helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

Nadler-Tushman Congruence Model

Harvard Business School professor Dr. John Kotter has been a thought-leader on organizational change, and he developed Kotter’s 8-step change model, which helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

Nadler-Tushman Congruence Model

The Nadler-Tushman Congruence Model was created by David Nadler and Michael Tushman at Columbia University. The Nadler-Tushman Congruence Model is a diagnostic tool that identifies problem areas within a company. In the context of business, congruence occurs when the goals of different people or interest groups coincide.

McKinsey’s Seven Degrees of Freedom

The Nadler-Tushman Congruence Model was created by David Nadler and Michael Tushman at Columbia University. The Nadler-Tushman Congruence Model is a diagnostic tool that identifies problem areas within a company. In the context of business, congruence occurs when the goals of different people or interest groups coincide.

McKinsey’s Seven Degrees of Freedom

McKinsey’s Seven Degrees of Freedom for Growth is a strategy tool. Developed by partners at McKinsey and Company, the tool helps businesses understand which opportunities will contribute to expansion, and therefore it helps to prioritize those initiatives.

Mintzberg’s 5Ps

McKinsey’s Seven Degrees of Freedom for Growth is a strategy tool. Developed by partners at McKinsey and Company, the tool helps businesses understand which opportunities will contribute to expansion, and therefore it helps to prioritize those initiatives.

Mintzberg’s 5Ps

Mintzberg’s 5Ps of Strategy is a strategy development model that examines five different perspectives (plan, ploy, pattern, position, perspective) to develop a successful business strategy. A sixth perspective has been developed over the years, called Practice, which was created to help businesses execute their strategies.

COSO Framework

Mintzberg’s 5Ps of Strategy is a strategy development model that examines five different perspectives (plan, ploy, pattern, position, perspective) to develop a successful business strategy. A sixth perspective has been developed over the years, called Practice, which was created to help businesses execute their strategies.

COSO Framework

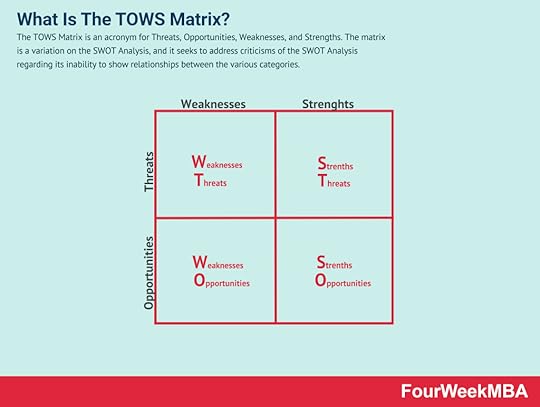

The COSO framework is a means of designing, implementing, and evaluating control within an organization. The COSO framework’s five components are control environment, risk assessment, control activities, information and communication, and monitoring activities. As a fraud risk management tool, businesses can design, implement, and evaluate internal control procedures.TOWS Matrix

The COSO framework is a means of designing, implementing, and evaluating control within an organization. The COSO framework’s five components are control environment, risk assessment, control activities, information and communication, and monitoring activities. As a fraud risk management tool, businesses can design, implement, and evaluate internal control procedures.TOWS Matrix The TOWS Matrix is an acronym for Threats, Opportunities, Weaknesses, and Strengths. The matrix is a variation on the SWOT Analysis, and it seeks to address criticisms of the SWOT Analysis regarding its inability to show relationships between the various categories.

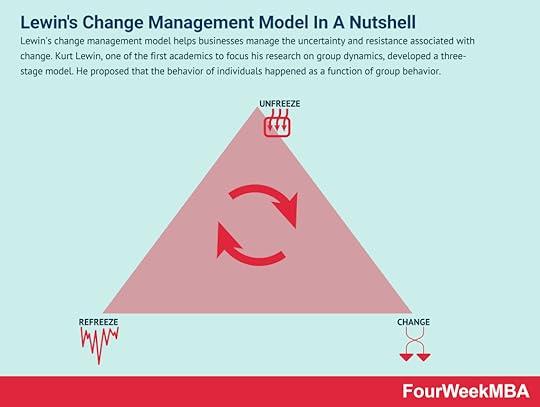

Lewin’s Change Management

The TOWS Matrix is an acronym for Threats, Opportunities, Weaknesses, and Strengths. The matrix is a variation on the SWOT Analysis, and it seeks to address criticisms of the SWOT Analysis regarding its inability to show relationships between the various categories.

Lewin’s Change Management

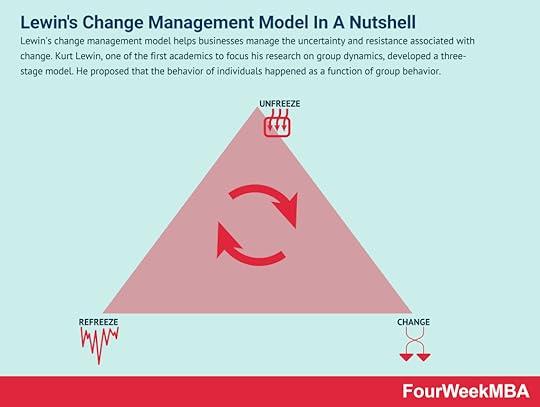

Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

Standard for Portfolio Management

Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

Standard for Portfolio Management

The Standard for Portfolio Management (SfPfM) describes a suite of portfolio management processes concerning programs, projects, and organizational strategy. The Standard for Portfolio Management is a creation of the Project Management Institute (PMI).

Change Management

The Standard for Portfolio Management (SfPfM) describes a suite of portfolio management processes concerning programs, projects, and organizational strategy. The Standard for Portfolio Management is a creation of the Project Management Institute (PMI).

Change Management

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Organizational Structures

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Organizational Structures

An organizational structure allows companies to shape their business model according to several criteria (like products, segments, geography and so on) that would enable information to flow through the organizational layers for better decision-making, cultural development, and goals alignment across employees, managers, and executives. Organizational Structure Case Studies

An organizational structure allows companies to shape their business model according to several criteria (like products, segments, geography and so on) that would enable information to flow through the organizational layers for better decision-making, cultural development, and goals alignment across employees, managers, and executives. Organizational Structure Case StudiesAirbnb Organizational Structure

Airbnb follows a holacracy model, or a sort of flat organizational structure, where teams are organized for projects, to move quickly and iterate fast, thus keeping a lean and flexible approach. Airbnb also moved to a hybrid model where employees can work from anywhere and meet on a quarterly basis to plan ahead, and connect to each other.

Airbnb follows a holacracy model, or a sort of flat organizational structure, where teams are organized for projects, to move quickly and iterate fast, thus keeping a lean and flexible approach. Airbnb also moved to a hybrid model where employees can work from anywhere and meet on a quarterly basis to plan ahead, and connect to each other.  eBay was until recently a multi-divisional (M-form) organization with semi-autonomous units grouped according to the services they provided. Today, eBay has a single division called Marketplace, which includes eBay and its international iterations.

eBay was until recently a multi-divisional (M-form) organization with semi-autonomous units grouped according to the services they provided. Today, eBay has a single division called Marketplace, which includes eBay and its international iterations. IBM has an organizational structure characterized by product-based divisions, enabling its strategy to develop innovative and competitive products in multiple markets. IBM is also characterized by function-based segments that support product development and innovation for each product-based division, which include Global Markets, Integrated Supply Chain, Research, Development, and Intellectual Property.

IBM has an organizational structure characterized by product-based divisions, enabling its strategy to develop innovative and competitive products in multiple markets. IBM is also characterized by function-based segments that support product development and innovation for each product-based division, which include Global Markets, Integrated Supply Chain, Research, Development, and Intellectual Property. Sony has a matrix organizational structure primarily based on function-based groups and product/business divisions. The structure also incorporates geographical divisions. In 2021, Sony announced the overhauling of its organizational structure, changing its name from Sony Corporation to Sony Group Corporation to better identify itself as the headquarters of the Sony group of companies skewing the company toward product divisions.

Sony has a matrix organizational structure primarily based on function-based groups and product/business divisions. The structure also incorporates geographical divisions. In 2021, Sony announced the overhauling of its organizational structure, changing its name from Sony Corporation to Sony Group Corporation to better identify itself as the headquarters of the Sony group of companies skewing the company toward product divisions.Facebook Organizational Structure

Facebook is characterized by a multi-faceted matrix organizational structure. The company utilizes a flat organizational structure in combination with corporate function-based teams and product-based or geographic divisions. The flat organization structure is organized around the leadership of Mark Zuckerberg, and the key executives around him. On the other hand, the function-based teams based on the main corporate functions (like HR, product management, investor relations, and so on).

Facebook is characterized by a multi-faceted matrix organizational structure. The company utilizes a flat organizational structure in combination with corporate function-based teams and product-based or geographic divisions. The flat organization structure is organized around the leadership of Mark Zuckerberg, and the key executives around him. On the other hand, the function-based teams based on the main corporate functions (like HR, product management, investor relations, and so on).Google Organizational Structure

Google (Alphabet) has a cross-functional (team-based) organizational structure known as a matrix structure with some degree of flatness. Over the years, as the company scaled and it became a tech giant, its organizational structure is morphing more into a centralized organization.

Google (Alphabet) has a cross-functional (team-based) organizational structure known as a matrix structure with some degree of flatness. Over the years, as the company scaled and it became a tech giant, its organizational structure is morphing more into a centralized organization. Tesla Organizational Structure

Tesla is characterized by a functional organizational structure with aspects of a hierarchical structure. Tesla does employ functional centers that cover all business activities, including finance, sales, marketing, technology, engineering, design, and the offices of the CEO and chairperson. Tesla’s headquarters in Austin, Texas, decide the strategic direction of the company, with international operations given little autonomy.

Tesla is characterized by a functional organizational structure with aspects of a hierarchical structure. Tesla does employ functional centers that cover all business activities, including finance, sales, marketing, technology, engineering, design, and the offices of the CEO and chairperson. Tesla’s headquarters in Austin, Texas, decide the strategic direction of the company, with international operations given little autonomy. McDonald’s Organizational Structure

McDonald’s has a divisional organizational structure where each division – based on geographical location – is assigned operational responsibilities and strategic objectives. The main geographical divisions are the US, internationally operated markets, and international developmental licensed markets. And on the other hand, the hierarchical leadership structure is organized around regional and functional divisions.

McDonald’s has a divisional organizational structure where each division – based on geographical location – is assigned operational responsibilities and strategic objectives. The main geographical divisions are the US, internationally operated markets, and international developmental licensed markets. And on the other hand, the hierarchical leadership structure is organized around regional and functional divisions. Walmart Organizational Structure

Walmart has a hybrid hierarchical-functional organizational structure, otherwise referred to as a matrix structure that combines multiple approaches. On the one hand, Walmart follows a hierarchical structure, where the current CEO Doug McMillon is the only employee without a direct superior, and directives are sent from top-level management. On the other hand, the function-based structure of Walmart is used to categorize employees according to their particular skills and experience.

Walmart has a hybrid hierarchical-functional organizational structure, otherwise referred to as a matrix structure that combines multiple approaches. On the one hand, Walmart follows a hierarchical structure, where the current CEO Doug McMillon is the only employee without a direct superior, and directives are sent from top-level management. On the other hand, the function-based structure of Walmart is used to categorize employees according to their particular skills and experience.Microsoft Organizational Structure

Microsoft has a product-type divisional organizational structure based on functions and engineering groups. As the company scaled over time it also became more hierarchical, however still keeping its hybrid approach between functions, engineering groups, and management.

Microsoft has a product-type divisional organizational structure based on functions and engineering groups. As the company scaled over time it also became more hierarchical, however still keeping its hybrid approach between functions, engineering groups, and management. Read Next: Organizational Structure

Read Also: Business Model

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post Organizational Frameworks To Unlock Business Growth appeared first on FourWeekMBA.

Lean Frameworks To Grow Your Business

AIOps

AIOps

AIOps is the application of artificial intelligence to IT operations. It has become particularly useful for modern IT management in hybridized, distributed, and dynamic environments. AIOps has become a key operational component of modern digital-based organizations, built around software and algorithms.

Agile Methodology

AIOps is the application of artificial intelligence to IT operations. It has become particularly useful for modern IT management in hybridized, distributed, and dynamic environments. AIOps has become a key operational component of modern digital-based organizations, built around software and algorithms.

Agile Methodology

Agile started as a lightweight development method compared to heavyweight software development, which is the core paradigm of the previous decades of software development. By 2001 the Manifesto for Agile Software Development was born as a set of principles that defined the new paradigm for software development as a continuous iteration. This would also influence the way of doing business.

Agile Project Management

Agile started as a lightweight development method compared to heavyweight software development, which is the core paradigm of the previous decades of software development. By 2001 the Manifesto for Agile Software Development was born as a set of principles that defined the new paradigm for software development as a continuous iteration. This would also influence the way of doing business.

Agile Project Management

Agile project management (APM) is a strategy that breaks large projects into smaller, more manageable tasks. In the APM methodology, each project is completed in small sections – often referred to as iterations. Each iteration is completed according to its project life cycle, beginning with the initial design and progressing to testing and then quality assurance.

Agile Modeling

Agile project management (APM) is a strategy that breaks large projects into smaller, more manageable tasks. In the APM methodology, each project is completed in small sections – often referred to as iterations. Each iteration is completed according to its project life cycle, beginning with the initial design and progressing to testing and then quality assurance.

Agile Modeling

Agile Modeling (AM) is a methodology for modeling and documenting software-based systems. Agile Modeling is critical to the rapid and continuous delivery of software. It is a collection of values, principles, and practices that guide effective, lightweight software modeling.

Agile Business Analysis

Agile Modeling (AM) is a methodology for modeling and documenting software-based systems. Agile Modeling is critical to the rapid and continuous delivery of software. It is a collection of values, principles, and practices that guide effective, lightweight software modeling.

Agile Business Analysis

Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed.

Business Model Innovation

Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed.

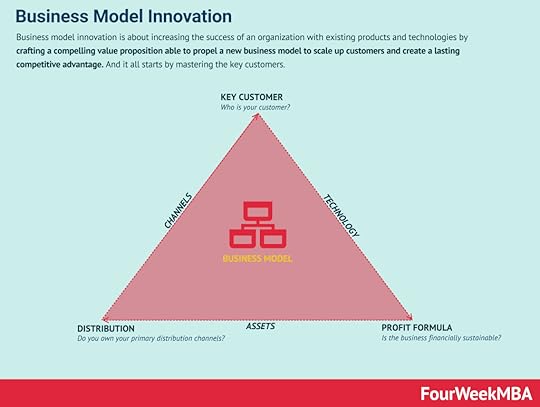

Business Model Innovation

Business model innovation is about increasing the success of an organization with existing products and technologies by crafting a compelling value proposition able to propel a new business model to scale up customers and create a lasting competitive advantage. And it all starts by mastering the key customers.

Continuous Innovation

Business model innovation is about increasing the success of an organization with existing products and technologies by crafting a compelling value proposition able to propel a new business model to scale up customers and create a lasting competitive advantage. And it all starts by mastering the key customers.

Continuous Innovation

That is a process that requires a continuous feedback loop to develop a valuable product and build a viable business model. Continuous innovation is a mindset where products and services are designed and delivered to tune them around the customers’ problem and not the technical solution of its founders.

Design Sprint

That is a process that requires a continuous feedback loop to develop a valuable product and build a viable business model. Continuous innovation is a mindset where products and services are designed and delivered to tune them around the customers’ problem and not the technical solution of its founders.

Design Sprint

A design sprint is a proven five-day process where critical business questions are answered through speedy design and prototyping, focusing on the end-user. A design sprint starts with a weekly challenge that should finish with a prototype, test at the end, and therefore a lesson learned to be iterated.

Design Thinking

A design sprint is a proven five-day process where critical business questions are answered through speedy design and prototyping, focusing on the end-user. A design sprint starts with a weekly challenge that should finish with a prototype, test at the end, and therefore a lesson learned to be iterated.

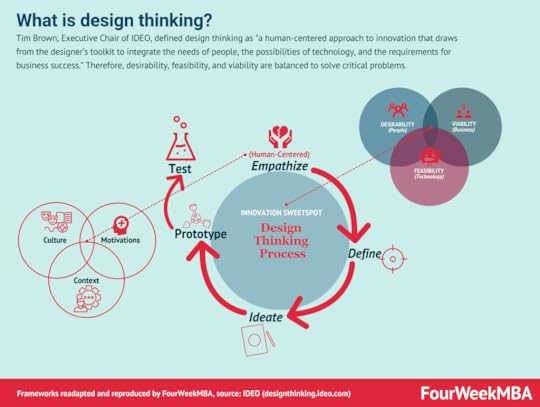

Design Thinking

Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.

DevOps

Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.

DevOps

DevOps refers to a series of practices performed to perform automated software development processes. It is a conjugation of the term “development” and “operations” to emphasize how functions integrate across IT teams. DevOps strategies promote seamless building, testing, and deployment of products. It aims to bridge a gap between development and operations teams to streamline the development altogether.

Dual Track Agile

DevOps refers to a series of practices performed to perform automated software development processes. It is a conjugation of the term “development” and “operations” to emphasize how functions integrate across IT teams. DevOps strategies promote seamless building, testing, and deployment of products. It aims to bridge a gap between development and operations teams to streamline the development altogether.

Dual Track Agile

Product discovery is a critical part of agile methodologies, as its aim is to ensure that products customers love are built. Product discovery involves learning through a raft of methods, including design thinking, lean start-up, and A/B testing to name a few. Dual Track Agile is an agile methodology containing two separate tracks: the “discovery” track and the “delivery” track.

Feature-Driven Development

Product discovery is a critical part of agile methodologies, as its aim is to ensure that products customers love are built. Product discovery involves learning through a raft of methods, including design thinking, lean start-up, and A/B testing to name a few. Dual Track Agile is an agile methodology containing two separate tracks: the “discovery” track and the “delivery” track.

Feature-Driven Development

Feature-Driven Development is a pragmatic software process that is client and architecture-centric. Feature-Driven Development (FDD) is an agile software development model that organizes workflow according to which features need to be developed next.

eXtreme

Programming

Feature-Driven Development is a pragmatic software process that is client and architecture-centric. Feature-Driven Development (FDD) is an agile software development model that organizes workflow according to which features need to be developed next.

eXtreme

Programming

eXtreme Programming was developed in the late 1990s by Ken Beck, Ron Jeffries, and Ward Cunningham. During this time, the trio was working on the Chrysler Comprehensive Compensation System (C3) to help manage the company payroll system. eXtreme Programming (XP) is a software development methodology. It is designed to improve software quality and the ability of software to adapt to changing customer needs.

Lean vs. Agile

eXtreme Programming was developed in the late 1990s by Ken Beck, Ron Jeffries, and Ward Cunningham. During this time, the trio was working on the Chrysler Comprehensive Compensation System (C3) to help manage the company payroll system. eXtreme Programming (XP) is a software development methodology. It is designed to improve software quality and the ability of software to adapt to changing customer needs.

Lean vs. Agile

The Agile methodology has been primarily thought of for software development (and other business disciplines have also adopted it). Lean thinking is a process improvement technique where teams prioritize the value streams to improve it continuously. Both methodologies look at the customer as the key driver to improvement and waste reduction. Both methodologies look at improvement as something continuous.

Lean Startup

The Agile methodology has been primarily thought of for software development (and other business disciplines have also adopted it). Lean thinking is a process improvement technique where teams prioritize the value streams to improve it continuously. Both methodologies look at the customer as the key driver to improvement and waste reduction. Both methodologies look at improvement as something continuous.

Lean Startup

A startup company is a high-tech business that tries to build a scalable business model in tech-driven industries. A startup company usually follows a lean methodology, where continuous innovation, driven by built-in viral loops is the rule. Thus, driving growth and building network effects as a consequence of this strategy.

Kanban

A startup company is a high-tech business that tries to build a scalable business model in tech-driven industries. A startup company usually follows a lean methodology, where continuous innovation, driven by built-in viral loops is the rule. Thus, driving growth and building network effects as a consequence of this strategy.

Kanban

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Rapid Application Development

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Rapid Application Development

RAD was first introduced by author and consultant James Martin in 1991. Martin recognized and then took advantage of the endless malleability of software in designing development models. Rapid Application Development (RAD) is a methodology focusing on delivering rapidly through continuous feedback and frequent iterations.

Scaled Agile

RAD was first introduced by author and consultant James Martin in 1991. Martin recognized and then took advantage of the endless malleability of software in designing development models. Rapid Application Development (RAD) is a methodology focusing on delivering rapidly through continuous feedback and frequent iterations.

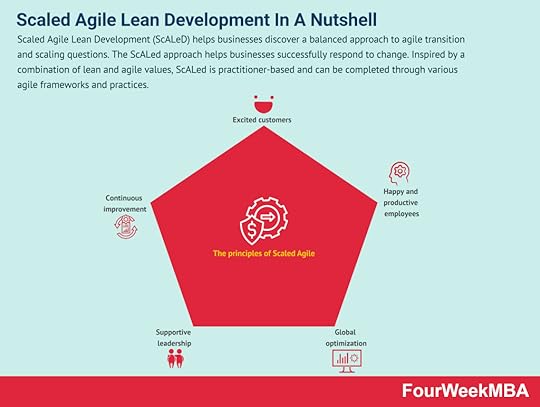

Scaled Agile

Scaled Agile Lean Development (ScALeD) helps businesses discover a balanced approach to agile transition and scaling questions. The ScALed approach helps businesses successfully respond to change. Inspired by a combination of lean and agile values, ScALed is practitioner-based and can be completed through various agile frameworks and practices.

Spotify Model

Scaled Agile Lean Development (ScALeD) helps businesses discover a balanced approach to agile transition and scaling questions. The ScALed approach helps businesses successfully respond to change. Inspired by a combination of lean and agile values, ScALed is practitioner-based and can be completed through various agile frameworks and practices.

Spotify Model

The Spotify Model is an autonomous approach to scaling agile, focusing on culture communication, accountability, and quality. The Spotify model was first recognized in 2012 after Henrik Kniberg, and Anders Ivarsson released a white paper detailing how streaming company Spotify approached agility. Therefore, the Spotify model represents an evolution of agile.

Test-Driven Development

The Spotify Model is an autonomous approach to scaling agile, focusing on culture communication, accountability, and quality. The Spotify model was first recognized in 2012 after Henrik Kniberg, and Anders Ivarsson released a white paper detailing how streaming company Spotify approached agility. Therefore, the Spotify model represents an evolution of agile.

Test-Driven Development

As the name suggests, TDD is a test-driven technique for delivering high-quality software rapidly and sustainably. It is an iterative approach based on the idea that a failing test should be written before any code for a feature or function is written. Test-Driven Development (TDD) is an approach to software development that relies on very short development cycles.

Timeboxing

As the name suggests, TDD is a test-driven technique for delivering high-quality software rapidly and sustainably. It is an iterative approach based on the idea that a failing test should be written before any code for a feature or function is written. Test-Driven Development (TDD) is an approach to software development that relies on very short development cycles.

Timeboxing

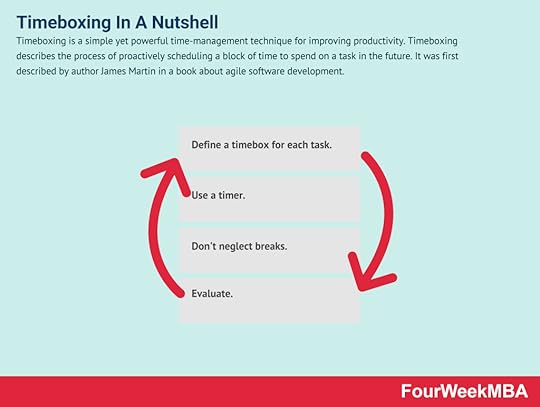

Timeboxing is a simple yet powerful time-management technique for improving productivity. Timeboxing describes the process of proactively scheduling a block of time to spend on a task in the future. It was first described by author James Martin in a book about agile software development.

Scrum

Timeboxing is a simple yet powerful time-management technique for improving productivity. Timeboxing describes the process of proactively scheduling a block of time to spend on a task in the future. It was first described by author James Martin in a book about agile software development.

Scrum

Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity.

Scrum Anti-Patterns

Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity.

Scrum Anti-Patterns

Scrum anti-patterns describe any attractive, easy-to-implement solution that ultimately makes a problem worse. Therefore, these are the practice not to follow to prevent issues from emerging. Some classic examples of scrum anti-patterns comprise absent product owners, pre-assigned tickets (making individuals work in isolation), and discounting retrospectives (where review meetings are not useful to really make improvements).

Scrum At Scale

Scrum anti-patterns describe any attractive, easy-to-implement solution that ultimately makes a problem worse. Therefore, these are the practice not to follow to prevent issues from emerging. Some classic examples of scrum anti-patterns comprise absent product owners, pre-assigned tickets (making individuals work in isolation), and discounting retrospectives (where review meetings are not useful to really make improvements).

Scrum At Scale

Scrum at Scale (Scrum@Scale) is a framework that Scrum teams use to address complex problems and deliver high-value products. Scrum at Scale was created through a joint venture between the Scrum Alliance and Scrum Inc. The joint venture was overseen by Jeff Sutherland, a co-creator of Scrum and one of the principal authors of the Agile Manifesto.

Scrum at Scale (Scrum@Scale) is a framework that Scrum teams use to address complex problems and deliver high-value products. Scrum at Scale was created through a joint venture between the Scrum Alliance and Scrum Inc. The joint venture was overseen by Jeff Sutherland, a co-creator of Scrum and one of the principal authors of the Agile Manifesto. Read Next: MVP, Lean Canvas, Scrum, Design Thinking, VTDF Framework.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post Lean Frameworks To Grow Your Business appeared first on FourWeekMBA.

20+ Entrepreneur Frameworks You Should Know

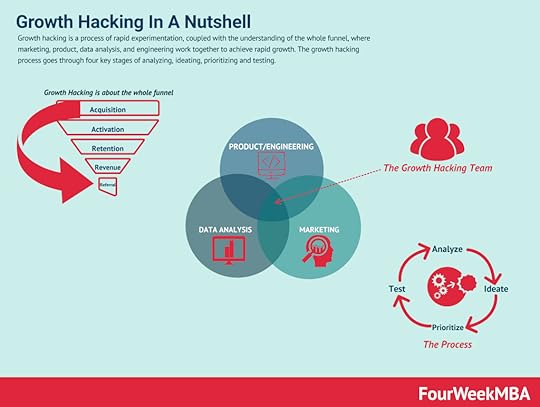

Growth Hacking

Growth Hacking

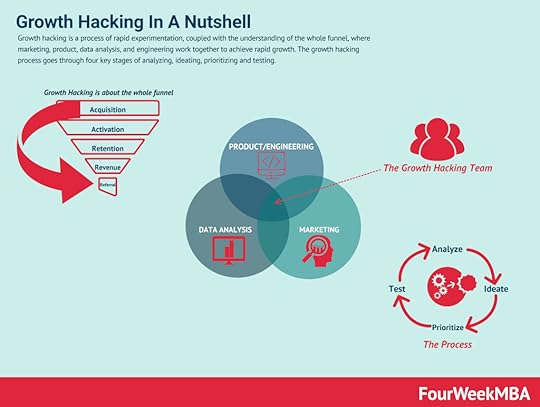

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

Scrum

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

Scrum

Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity.

Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity. As pointed out by Eric Ries, a minimum viable product is that version of a new product that allows a team to collect the maximum amount of validated learning about customers with the least effort through a cycle of build, measure, learn; that is the foundation of the lean startup methodology.

Continuous Innovation

As pointed out by Eric Ries, a minimum viable product is that version of a new product that allows a team to collect the maximum amount of validated learning about customers with the least effort through a cycle of build, measure, learn; that is the foundation of the lean startup methodology.

Continuous Innovation

Leaner MVP

Leaner MVP

A leaner MVP is the evolution of the MPV approach. Where the market risk is validated before anything else

Engines of Growth

A leaner MVP is the evolution of the MPV approach. Where the market risk is validated before anything else

Engines of Growth

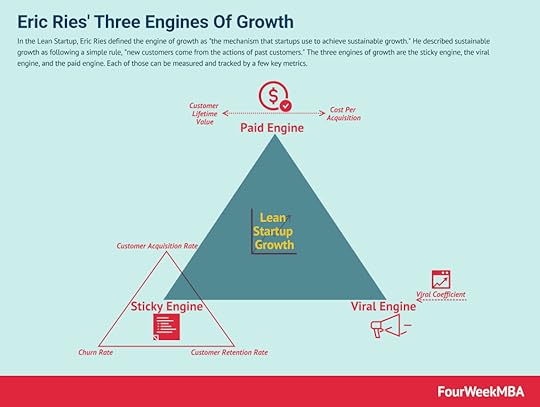

In the Lean Startup, Eric Ries defined the engine of growth as “the mechanism that startups use to achieve sustainable growth.” He described sustainable growth as following a simple rule, “new customers come from the actions of past customers.” The three engines of growth are the sticky engine, the viral engine, and the paid engine. Each of those can be measured and tracked by a few key metrics.

Lean Startup Canvas

In the Lean Startup, Eric Ries defined the engine of growth as “the mechanism that startups use to achieve sustainable growth.” He described sustainable growth as following a simple rule, “new customers come from the actions of past customers.” The three engines of growth are the sticky engine, the viral engine, and the paid engine. Each of those can be measured and tracked by a few key metrics.

Lean Startup Canvas

The lean startup canvas is an adaptation by Ash Maurya of the business model canvas by Alexander Osterwalder, which adds a layer that focuses on problems, solutions, key metrics, unfair advantage based, and a unique value proposition. Thus, starting from mastering the problem rather than the solution.

The lean startup canvas is an adaptation by Ash Maurya of the business model canvas by Alexander Osterwalder, which adds a layer that focuses on problems, solutions, key metrics, unfair advantage based, and a unique value proposition. Thus, starting from mastering the problem rather than the solution. The lean methodology is a continuous process of product development to meet customers’ needs. It was in part borrowed by the auto industry and its roots are found in the Toyota Production System, which was heavily influenced by Henry Ford’s assembly line system. The lean methodology is, therefore, an evolution from lean manufacturing, based on continuous improvement.

Kanban

The lean methodology is a continuous process of product development to meet customers’ needs. It was in part borrowed by the auto industry and its roots are found in the Toyota Production System, which was heavily influenced by Henry Ford’s assembly line system. The lean methodology is, therefore, an evolution from lean manufacturing, based on continuous improvement.

Kanban

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Business Engineering

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Business Engineering

Tech Business Model Template

Tech Business Model Template

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

Web3 Business Model Template

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

Web3 Business Model Template

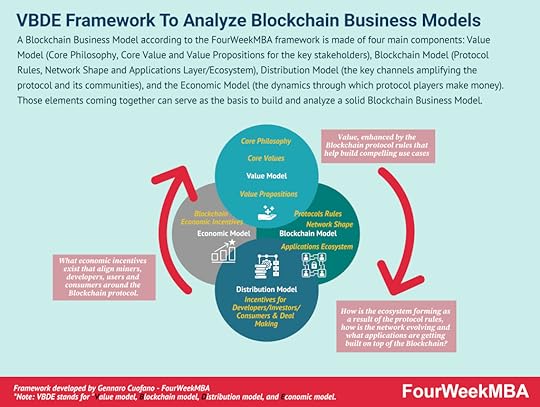

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

Asymmetric Business Models

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

Asymmetric Business Models

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.

Business Competition

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.

Business Competition

In a business world driven by technology and digitalization, competition is much more fluid, as innovation becomes a bottom-up approach that can come from anywhere. Thus, making it much harder to define the boundaries of existing markets. Therefore, a proper business competition analysis looks at customer, technology, distribution, and financial model overlaps. While at the same time looking at future potential intersections among industries that in the short-term seem unrelated.

Technological Modeling

In a business world driven by technology and digitalization, competition is much more fluid, as innovation becomes a bottom-up approach that can come from anywhere. Thus, making it much harder to define the boundaries of existing markets. Therefore, a proper business competition analysis looks at customer, technology, distribution, and financial model overlaps. While at the same time looking at future potential intersections among industries that in the short-term seem unrelated.

Technological Modeling

Technological modeling is a discipline to provide the basis for companies to sustain innovation, thus developing incremental products. While also looking at breakthrough innovative products that can pave the way for long-term success. In a sort of Barbell Strategy, technological modeling suggests having a two-sided approach, on the one hand, to keep sustaining continuous innovation as a core part of the business model. On the other hand, it places bets on future developments that have the potential to break through and take a leap forward.

Transitional Business Models

Technological modeling is a discipline to provide the basis for companies to sustain innovation, thus developing incremental products. While also looking at breakthrough innovative products that can pave the way for long-term success. In a sort of Barbell Strategy, technological modeling suggests having a two-sided approach, on the one hand, to keep sustaining continuous innovation as a core part of the business model. On the other hand, it places bets on future developments that have the potential to break through and take a leap forward.

Transitional Business Models

A transitional business model is used by companies to enter a market (usually a niche) to gain initial traction and prove the idea is sound. The transitional business model helps the company secure the needed capital while having a reality check. It helps shape the long-term vision and a scalable business model.

Minimum Viable Audience

A transitional business model is used by companies to enter a market (usually a niche) to gain initial traction and prove the idea is sound. The transitional business model helps the company secure the needed capital while having a reality check. It helps shape the long-term vision and a scalable business model.

Minimum Viable Audience

The minimum viable audience (MVA) represents the smallest possible audience that can sustain your business as you get it started from a microniche (the smallest subset of a market). The main aspect of the MVA is to zoom into existing markets to find those people which needs are unmet by existing players.

Business Scaling

The minimum viable audience (MVA) represents the smallest possible audience that can sustain your business as you get it started from a microniche (the smallest subset of a market). The main aspect of the MVA is to zoom into existing markets to find those people which needs are unmet by existing players.

Business Scaling

Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale.

Market Expansion Theory

Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale.

Market Expansion Theory

The market expansion consists in providing a product or service to a broader portion of an existing market or perhaps expanding that market. Or yet, market expansions can be about creating a whole new market. At each step, as a result, a company scales together with the market covered.

Speed-Reversibility

The market expansion consists in providing a product or service to a broader portion of an existing market or perhaps expanding that market. Or yet, market expansions can be about creating a whole new market. At each step, as a result, a company scales together with the market covered.

Speed-Reversibility

Asymmetric Betting

Asymmetric Betting Growth Matrix

Growth Matrix

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

Revenue Streams Matrix

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

Revenue Streams Matrix

In the FourWeekMBA Revenue Streams Matrix, revenue streams are classified according to the kind of interactions the business has with its key customers. The first dimension is the “Frequency” of interaction with the key customer. As the second dimension, there is the “Ownership” of the interaction with the key customer.

Revenue Modeling

In the FourWeekMBA Revenue Streams Matrix, revenue streams are classified according to the kind of interactions the business has with its key customers. The first dimension is the “Frequency” of interaction with the key customer. As the second dimension, there is the “Ownership” of the interaction with the key customer.

Revenue Modeling

Revenue model patterns are a way for companies to monetize their business models. A revenue model pattern is a crucial building block of a business model because it informs how the company will generate short-term financial resources to invest back into the business. Thus, the way a company makes money will also influence its overall business model.

Pricing Strategies

Revenue model patterns are a way for companies to monetize their business models. A revenue model pattern is a crucial building block of a business model because it informs how the company will generate short-term financial resources to invest back into the business. Thus, the way a company makes money will also influence its overall business model.

Pricing Strategies

A pricing strategy or model helps companies find the pricing formula in fit with their business models. Thus aligning the customer needs with the product type while trying to enable profitability for the company. A good pricing strategy aligns the customer with the company’s long term financial sustainability to build a solid business model.

A pricing strategy or model helps companies find the pricing formula in fit with their business models. Thus aligning the customer needs with the product type while trying to enable profitability for the company. A good pricing strategy aligns the customer with the company’s long term financial sustainability to build a solid business model.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post 20+ Entrepreneur Frameworks You Should Know appeared first on FourWeekMBA.

Management Frameworks For Business Growth

Change Management

Change Management

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Kotter’s 8-Step Change Model

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Kotter’s 8-Step Change Model

Harvard Business School professor Dr. John Kotter has been a thought-leader on organizational change, and he developed Kotter’s 8-step change model, which helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

McKinsey’s Seven Degrees

Harvard Business School professor Dr. John Kotter has been a thought-leader on organizational change, and he developed Kotter’s 8-step change model, which helps business managers deal with organizational change. Kotter created the 8-step model to drive organizational transformation.

McKinsey’s Seven Degrees

McKinsey’s Seven Degrees of Freedom for Growth is a strategy tool. Developed by partners at McKinsey and Company, the tool helps businesses understand which opportunities will contribute to expansion, and therefore it helps to prioritize those initiatives.

McKinsey 7-S Model

McKinsey’s Seven Degrees of Freedom for Growth is a strategy tool. Developed by partners at McKinsey and Company, the tool helps businesses understand which opportunities will contribute to expansion, and therefore it helps to prioritize those initiatives.

McKinsey 7-S Model

The McKinsey 7-S Model was developed in the late 1970s by Robert Waterman and Thomas Peters, who were consultants at McKinsey & Company. Waterman and Peters created seven key internal elements that inform a business of how well positioned it is to achieve its goals, based on three hard elements and four soft elements.

Lewin’s Change Management

The McKinsey 7-S Model was developed in the late 1970s by Robert Waterman and Thomas Peters, who were consultants at McKinsey & Company. Waterman and Peters created seven key internal elements that inform a business of how well positioned it is to achieve its goals, based on three hard elements and four soft elements.

Lewin’s Change Management

Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

ADKAR Model

Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

ADKAR Model

The ADKAR model is a management tool designed to assist employees and businesses in transitioning through organizational change. To maximize the chances of employees embracing change, the ADKAR model was developed by author and engineer Jeff Hiatt in 2003. The model seeks to guide people through the change process and importantly, ensure that people do not revert to habitual ways of operating after some time has passed.

Force-Field Analysis

The ADKAR model is a management tool designed to assist employees and businesses in transitioning through organizational change. To maximize the chances of employees embracing change, the ADKAR model was developed by author and engineer Jeff Hiatt in 2003. The model seeks to guide people through the change process and importantly, ensure that people do not revert to habitual ways of operating after some time has passed.

Force-Field Analysis

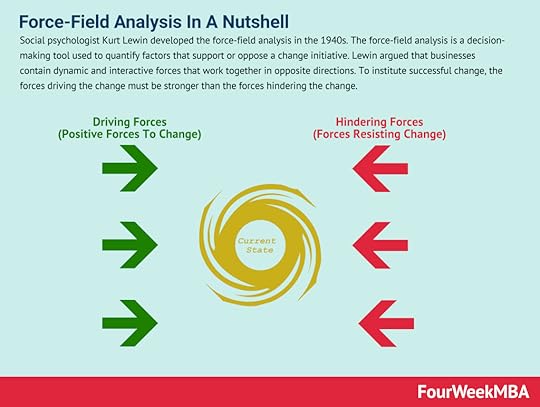

Social psychologist Kurt Lewin developed the force-field analysis in the 1940s. The force-field analysis is a decision-making tool used to quantify factors that support or oppose a change initiative. Lewin argued that businesses contain dynamic and interactive forces that work together in opposite directions. To institute successful change, the forces driving the change must be stronger than the forces hindering the change.

Business Innovation Matrix

Social psychologist Kurt Lewin developed the force-field analysis in the 1940s. The force-field analysis is a decision-making tool used to quantify factors that support or oppose a change initiative. Lewin argued that businesses contain dynamic and interactive forces that work together in opposite directions. To institute successful change, the forces driving the change must be stronger than the forces hindering the change.

Business Innovation Matrix

Business innovation is about creating new opportunities for an organization to reinvent its core offerings, revenue streams, and enhance the value proposition for existing or new customers, thus renewing its whole business model. Business innovation springs by understanding the structure of the market, thus adapting or anticipating those changes.Posci Change Management

Business innovation is about creating new opportunities for an organization to reinvent its core offerings, revenue streams, and enhance the value proposition for existing or new customers, thus renewing its whole business model. Business innovation springs by understanding the structure of the market, thus adapting or anticipating those changes.Posci Change Management According to Prosci founder Jeff Hiatt, the secret to successful change “lies beyond the visible and busy activities that surround change. Successful change, at its core, is rooted in something much simpler: how to facilitate change with one person.”

According to Prosci founder Jeff Hiatt, the secret to successful change “lies beyond the visible and busy activities that surround change. Successful change, at its core, is rooted in something much simpler: how to facilitate change with one person.”Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post Management Frameworks For Business Growth appeared first on FourWeekMBA.

April 30, 2022

How does Gemini make money?

Gemini is a cryptocurrency exchange registered in the state of New York where users can buy, sell, and store digital assets such as bitcoin. It was first announced in 2013 by brothers Tyler and Cameron Winklevoss.

The Winklevoss twins are famous for coming up with the idea of Facebook at Harvard University and having it stolen by fellow student Mark Zuckerberg. Using some of the $65 million they received in compensation, the twins started investing in cryptocurrency around 2012. But, at the time, they noticed there were very few safe and trusted places to do so. Many exchanges were used to launder money, while others such as Mt. Gox filed for bankruptcy after most of its bitcoin was stolen by hackers.

Gemini was then born out of a desire to create a safe, easy, and regulated way for everyday consumers to invest in bitcoin and other cryptocurrencies. The brothers’ total purchases of bitcoin over the years had allowed them to own 1% of all bitcoin in circulation and, in the process, they became advocates of cryptocurrency in general. But as revolutionary as the twins believed Gemini to be, it was not above financial regulation.

After a year or so of wrangling with New York state authorities, Gemini was finally unveiled to the public in October 2015. The initial response to the platform was lackluster since Gemini charged fees to both the makers and takers in a transaction. A change in fee structure helped grow the user base in 2016, with bitcoin’s bull run in 2017 accelerating growth.

Today, Gemini offers a diverse range of products including credit cards, trading accounts, digital wallets, pay facilities, and the ability to earn interest on crypto balances. The platform raised $400 million in November 2021 as part of its first outside financing round to be worth around $7.1 billion.

Gemini revenue generationGemini has a diverse revenue generation strategy consisting of transaction, transfer, interchange, interest, and custodial fees.

Let’s now explain these in more detail.

Transaction feesMost Gemini revenue comes from transaction fees that the company charges for facilitating trades on the exchange. On mobile, there is 99 cent fee for any order amount under $10. This increases to $1.99 for trades between $25-50 and 1.49% for trades over $200.

Gemini also collects maker and taker fees for any order that is placed by more sophisticated traders using its API or ActiveTrader tools. Here, fees are variable. The more trades a user places, the more the fees decrease.

Transfer feesDeposit and withdrawal fees are also applicable for moving money into and out of a user’s Gemini account. Cryptocurrency and Gemini dollar deposits are free, as are wire transfer deposits. Debit card transfers, on the other hand, attract a 3.49% fee.

Withdrawal fees are more variable and depend on the type of customer and token involved.

Interchange feesAs noted earlier, Gemini offers a credit card to enable customers to make real-world purchases.

This allows the company to earn interchange fees, which are paid by the participating merchant and then split between Gemini and the card issuer MasterCard.

Interest

Gemini customers can also earn interest on the crypto balance and even lend it out to others. To make money in this scenario, Gemini lends out this balance to borrowers who then pay interest on those loans.

In conjunction with lending partner Genesis Global Capital, the two companies split and then pocket the difference between the interest rate paid by the borrower and the interest rate Gemini must pay to its customers.

Custody feesGemini offers custodial services for its more exclusive clients and can store over 50 different tokens including Bitcoin and Ethereum.

The custody fee is 0.4% of the total balance, with a $125 fee for administrative withdrawals.

Read Next: Non-fungible Tokens, How to make money with NFTs, NFT Games: What Are NFT Games And How Do They Work?, How Does OpenSea Make Money?, How Does Axie Infinity Work And Make Money?

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How does Gemini make money? appeared first on FourWeekMBA.

How does Noon make money?

Noon is an eCommerce platform that was founded by Mohamed Alabbar in 2016 and is headquartered in Riyadh, Saudi Arabia.

Noon was started with a vision to create a dynamic digital economy for consumers and businesses in the Middle Eastern eCommerce market. The market, which encompasses the United Arab Emirates, Saudi Arabia, and Egypt, is home to around 440 million wealthy consumers with a high internet and smartphone penetration rate.

Despite the impressive size of the market, Middle Eastern consumers have been much slower to warm to eCommerce as a way to purchase goods and services. Even with the pandemic moving more of them online, eCommerce only accounts for around 2.5% of all sales in the Middle East compared to around 22% in the USA, for example.