Gennaro Cuofano's Blog, page 99

April 26, 2022

How Does Twitter Make Money? Twitter Business Model

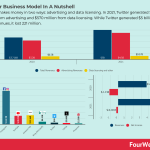

Twitter makes money in two ways: advertising and data licensing. In 2021, Twitter generated $4.5 billion from advertising and $570 million from data licensing. While Twitter generated $5 billion in total revenues, it lost 221 million. In April 2022, Elon Musk took over Twitter for about $44 billion.

Origin storyOdeo was a directory and search destination website for podcast publishing and aggregation. It was 2006 and the company was feeling the pressures of other giants at the time (Apple) were also competing for the same space.

Therefore, the founders of Odeo, decided it was time to “reboot” the company to move in a new direction.

Back in 2000, inspired by early blogging pioneer LiveJournal, Jack Dorsey thought about a service in which posts appeared in real-time and “from the road.”

As they broke the company into teams to brainstorm new ideas and figure out what to do next. In a brainstorming session, Jack Dorsey represented his idea to the other team members about “a service that uses SMS to tell small groups what you are doing.”

That idea made sense, so much, that by March 2006, a first test started out.

It was March 2006, Jack Dorsey was just setting up the idea he had brainstormed, which would initially be called twttr.

As the, Evan Williams, Jack Dorsey, and Biz Stone, who co-founded the company at the time knew they “wanted to have this instant mobile, SMS, tech-space thing,” and Twitter (which referenced nature, as Twitter is the sound that birds make) was the perfect name they had in mind.

However, a bird enthusiast already had registered the name twitter.com. So they had to use initially twttr.com. After six months after the project launch, they finally managed to get the domain twitter.com which would stick to these days.

The group could not easily explain the value of this new project to Odeo’s board, as the company was losing ground. Thus, eventually, a new corporation was set up just to manage the twttr project.

As the project launched, six months in, Jack Dorsey was one of the engineers working on what would be finally rebranded as Twitter.com. The interesting part though, people could not still get the value of a platform that enabled those SMSs when they still paid for them.

In short, at the time, tweeting something, meant having the phone billed for messages that conveyed what one was doing at that moment. For how entertaining it might be, it was not convenient.

To make things worse, there was no character limit, thus a long message would be split in multiple messages, which would only make the phone bill go up.

So the team figured, they needed to change the anatomy of the message. Indeed, to fit into what, at the time, was the character limit for a message (160), the Twitter.com team set the limit at 140 characters, so users had “room for the username and the colon in front of the message.”

From there, the official tweet was born (the character limit would be expanded only a decade later, from 140 to 280).

Twitter’s team was the main advocate of the platform, and Jack Dorsey would show the power of the tweet as a way to express opinions about the world, is a powerful way:

By 2007 Twitter gained traction and Jack Dorsey would become the company’s CEO. By December 2008, Twitter grew quickly, reaching 4.43 million unique visitors (a 752% growth over the previous year).

While Twitter was growing very quickly, its platform wasn’t stable and Jack Dorsey wasn’t considered able to stay in the CEO’s position. And by 2008, Dorsey had to leave the CEO position (kicked out from Twitter, in 2009 Dorsey would found Square).

Nonetheless, Twitter kept growing in 2009. That was also the year when Facebook had passed Myspace in traffic. By 2009, Twitter’s popularity grew to the point that celebrities like Ashton Kutcher, Britney Spears, Ellen DeGeneres, Barack Obama, and Oprah Winfrey all joined the platform.

By the end of 2010, the platform had more than 160 million users, and it started to monetize through ads. This model would stick, even though Twitter would become really profitable only by 2017-18.

In 2015 Jack Dorsey would return as Twitter’s CEO, splitting his time between Twitter and Square, ever since.

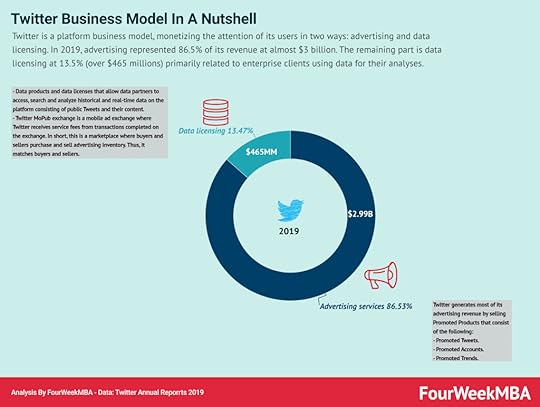

Twitter revenue model explainedTwitter generates revenues via Advertising and data licensing.

Twitter Advertising ServicesTwitter generates most of its advertising revenue by selling Promoted Products that consist of the following:

Promoted Tweets revenue streamLabeled as “promoted,” appear within a user’s timeline, search results, or profile pages just like an ordinary Tweet regardless of device, whether it be desktop or mobile. Using its proprietary algorithms, Twitter tries to understand the interests of each user and deliver Promoted Tweets that are intended to be relevant to a particular user. Promoted Tweets are pay-for-performance or pay-for-impression, priced through an auction

Promoted accounts revenue streamPromoted Accounts, labeled as “promoted,” provide a way for advertisers to grow a community based on pay-for-performance advertising that is priced through an auction

Promoted TrendsPromoted Trends, labeled as “promoted,” appear at the top of the list of trending topics or timelines for an entire day in a particular country or on a global basis. Promoted Trends are sold on a fixed-fee-per-day basis

Data Licensing and OtherData licensing and other revenues comprise:

Data licensing revenue streamThat allows data partners to access, search and analyze historical and real-time data on the platform consisting of public Tweets and their content

Twitter MoPub exchange revenue streamThis is a mobile ad exchange where Twitter receives service fees from transactions completed on the exchange. In short, this is a marketplace where buyers and sellers purchase and sell advertising inventory. Thus, it matches buyers and sellers

How big is Twitter’s advertising business?In 2021 the company made over $4.5 billion from advertising services alone.

Also, if we compare those numbers with Google and Facebook advertising revenues, we can understand the proportion of Twitter digital advertising cake back in 2021.

The digital advertising industry has become a multi-billion industry dominated by a few key tech players. The industry’s advertising dollars are also fragmented across several small players and publishers across the web. Most of it is consolidated within brands like Google, YouTube, Facebook, Instagram, Amazon, Bing, Twitter, TikTok, which is growing very quickly, and Pinterest.

The digital advertising industry has become a multi-billion industry dominated by a few key tech players. The industry’s advertising dollars are also fragmented across several small players and publishers across the web. Most of it is consolidated within brands like Google, YouTube, Facebook, Instagram, Amazon, Bing, Twitter, TikTok, which is growing very quickly, and Pinterest.What are the Twitter key metrics? The factors that affect Twitter’s growth

Each company has a few critical metrics to monitor on a daily, weekly, and monthly basis. Those are the metrics Twitter looks at for the success of its business:

The change in metrics, such as monthly and daily active users and change in ad engagement can cause the business. User growth trends reflected in the MAUs, changes in DAUs, and monetization trends reflected in advertising engagements are vital factors that affect Twitter revenues.

How does Twitter spend its money?To keep the technical infrastructure up and running the company spends money in data centers for co-located facilities, lease and hosting costs, and traffic acquisition expenses (to enable the advertisement placed on Twitter to be shown on third-party publishers’ websites). The company spent over $1.1 billion in 2019 (33% of its revenues).

To keep the whole infrastructure and company evolving over time, Twitter also spends money on product development, engineering, and research. In 2019, Twitter spent $680 million on R&D.

Twitter also spent over $900 million (26% of its revenues) on sales and marketing. And in sales and marketing activities.

Twitter: from platform to a publisher?Back in May 2020, Twitter fact-checked a tweet from President Trump, thus opening up Pandora’s box.

Twitter explaining the reasons for fact-checking President Trump’s tweet.

Companies like Facebook and Twitter for years have been treated as communication platforms (at least in the US). That means that as they act as companies enabling communication but not the ones officially publishing it, it gave them wide space to let their platforms develop freely.

As the recent debate showed, if Twitter would be treated as a publisher, thus the one liable for all the offensive content published on it, this would also completely change its business model and the potential liabilities coming with that.

A new chapter: Elon Musk taking over TwitterIn April 2022, Elon Musk finalized the acquisition of Twitter, in one of the most controversial deals of business history.

Let’s review the timeline.

Musk placed, out of the blue, a bet to take over the whole company. It was April 14th, 2022:

The public records show the whole conversation of the offer Musk made to take over Twitter. Below is the main extract, of the conversation, between Musk and the Twitter’s board, as per SEC Filings, Musk had sent a message to Bret Taylor, Chairman of the Twitter’s board:

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

Elon Musk

In a follow-up text, Musk highlighted:

As I indicated this weekend, I believe that the company should be private to go through the changes that need to be made.

After the past several days of thinking this over, I have decided I want to acquire the company and take it private.

I am going to send you an offer letter tonight, it will be public in the morning.

Are you available to chat?

Elon Musk

As a final message to the Twitter’s board, Musk highlighted:

1. Best and final

a. I’m not playing the back-and-forth game.

b. I have moved straight to the end.

c. It’s a high price and your shareholders will love it.

d. If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder.

i. This is not a threat, it’s simply not a good investment without the changes that need to be made.

ii. And those changes won’t happen without taking the company private.

2. My advisors and my team are available after you get the letter to answer any questions

a. There will be more detail in our public filings. After you receive the letter and review the public filings, your team can call my family office with any questions.

Elon Musk

In short, Musk had offered to purchase Twitter, for $54.20 per share, a 54% premium, before Musk had started to buy Twitter shares.

While the offer was good from a valuation standpoint, the board tried to fight it. Also influential business commentators were against it.

As Cramer highlighted:

This is one of those where they are literally not doing their job, there’s no fiduciary responsibility if they just say, ‘you know what, we take it, there are times when individual directors are opened up for a level of lack of fiduciary that I think crosses the line. This crosses the line.

Similar comments came from Galloway:

I don’t think this is a serious offer and the market doesn’t think this is a serious offer.Throughout the deal, none expected it to go through so quickly. Indeed, given the controversy around Twitter, most business people thought this would have turned into a few months’ fight over Twitter’s ownership.

Yet, things tumbled very quickly. And by April 25th, 2022, the deal was officially announced!

As explained in the official press release:

Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing of the proposed transaction. The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter.

Bret Taylor, Twitter’s Independent Board Chair, highlighted:

The Twitter Board conducted a thoughtful and comprehensive process to assess Elon’s proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.

Parag Agrawal, Twitter’s CEO, highlighted on Twitter

Twitter has a purpose and relevance that impacts the entire world. Deeply proud of our teams and inspired by the work that has never been more important.

How did Elon Musk secure the funding to purchase the company?

He secured $25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21.0 billion equity commitment.

Where is Twitter going under Elon Musk?Below are some of the things Musk announced he would do:

Take the company private: so he’ll be able to execute changes fast, without getting into stock price wars. While this might be good in the short-term to implement changes that otherwise might never happen (the Twitter user base might be reduced substantially in the short-term if cleaned up from inactive accounts, spambots, and fake accounts), it would be great in the long run to have Twitter public, to make it as accountable as possible. Open-source the algorithm: in the early days, Twitter did work more like a protocol, where third parties could build apps and tools on top of the APIs. So making it open does sound like an interesting idea, as Twitter is a public square and it would be interesting to understand better how its algorithms work (right now it’s very opaque).Fight spambots: Twitter UX gets every day worse, due to the presence of a huge amount of spambots. This isn’t hard to fix from a technical standpoint. And the only thing that might have refrained the current management to do it, is the fact that a reduction in the user base might have caused a crash in the stock and made them get fired altogether. If Musk doesn’t care about that, those changes can be implemented quickly, thus radically improving the UX.Content moderation: this is the most complex issue. Content moderation is a very hard problem, with a lot of subtleties. This might be a problem to tackle in the long-term but very hard to solve in the short term. Even for Musk.Other hand-picked case studies:

What Is the Receivables Turnover Ratio?Amazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellThe Power of Google Business Model in a NutshellHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! The Google of China: Baidu Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Does Pinterest Work And Make Money? Pinterest Business Model In A NutshellSeven Amazon Statistics That Break Down Its Business ModelFastly Enterprise Edge Computing Business Model In A NutshellHandpicked popular content from the site:

Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedWhat Is Market Segmentation? the Ultimate Guide to Market SegmentationMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?The post How Does Twitter Make Money? Twitter Business Model appeared first on FourWeekMBA.

How to Begin Multi-Service Marketplace?

All of us have used Uber at least once in our lifetimes. You must have planned a holiday and reserved your accommodation using Airbnb. Haven’t you?

Okay, leave it all!

You might have ordered thousands of products from Amazon, eBay, and Alibaba. Similarly, Upwork, and Fiverr isn’t new to us. What do we call them? These are highly popular multi-service or multi-vendor marketplaces.

These exceptional platforms reflect the penetration of digitization into our lives. The brick-and-mortar-type businesses are no longer a hit among consumers. Multi-service marketplaces are all they need. Statistics reveal that 2.14 billion people prefer shopping online using these marketplaces.

A multi-service marketplace can open infinite possibilities for investors, business owners, and buyers. The overwhelming popularity of these platforms invites numerous business owners to tap into the digital world. Unfortunately, they all get trapped right at the beginning of going digital.

Yes, you’ve guessed it correctly!

“How to begin a multi-service marketplace?” – that’s the most significant pitfall.

Don’t worry anymore! Below you will understand the ABC measures of stepping into the marketplace game. Furthermore, we will walk you through some more subtle (and not-so-subtle!) aspects of these revolutionary platforms.

Stay tuned till the end!

Overview of Multi-Service MarketplacesA multi-service marketplace is an online platform where several business owners accumulate to offer their services to customers.

For example, Uber lets car owners list their vehicles on the platform and provide ride-sharing services to the customers. Similarly, Upwork allows service providers to mention their offerings and companies to hire them. The sky’s the limit regarding multi-service marketplaces. You can create a platform to attract sellers and offer pretty much everything to the customers online.

Typically, a multi-service marketplace encourages various vendors to join their platform, list their services, and benefit the buyers. In contrast, customers can browse the online marketplace to find the desired seller and access required services whenever needed.

What do these platforms have in store for the investors? The investors can charge a commission for each transaction from sellers, buyers, or both. Besides, several other monetization models generate massive revenues for the creators. We will discuss them later.

Moving on, let’s discuss various reasons to jump into the multi-service marketplace arena. Or, more precisely, it’s time to talk about the benefits you will get by developing such a platform.

Reasons to Develop Multi-Service Marketplaces

Successful multi-service marketplaces like Amazon have inspired many investors to play their cards in the sector. The giant multi-service marketplace has a whopping share of 45% in the US eCommerce market. However, fame and popularity aren’t everything. Developing these marketplaces has numerous benefits that you should know before doing anything. Let’s explore!

Massive MarketOnline is the best dwelling ground for businesses. These marketplaces witness optimum market, with numerous opportunities which weren’t accessible otherwise.

Are they more massive than physical marketplaces? Of course! A wider audience, better online visibility, and consumers’ willingness to shop online create an optimum field for multi-service marketplaces.

High Profitability ProspectsA wider consumer outreach brings more profitability prospects. The multi-service marketplace monetization schemes are successful. So, higher revenues are on their way.

As consumers have significantly more interest to shop online, your marketplace can get more customers. And more shoppers mean higher profit points for your business. The digital marketplace purchases will reach $6.17 trillion by 2023, reveal reports.

Consumer WillingnessOver time, consumers have shifted their inclination from physical to online businesses. Their interaction and buying behavior are optimum with multi-service marketplaces.

Apart from an impulse to try online marketplaces, customers love these platforms due to a higher degree of customization, browsing, and convenience.

Well-Established Business RoadmapsMulti-service marketplaces are tried and tested business models. So, you can easily access successful roadmaps to plan blueprints for your triumphant business.

All you need is to research a few successful strategies and find a survival plan for your marketplace on the Internet. Besides, you can easily implement changes to your roadmap as situations change in the long haul.

Undoubtedly, you cannot overlook these benefits for your business. Can you? You have been seeking them since eternity, after all!

So, it’s time to closely understand multi-service marketplaces before answering your mainframe question. Let’s take a better glimpse of the various types of multi-service marketplaces right below!

Types of Multi-Service Marketplaces

Multi-services marketplaces come in various shapes and sizes, each catered to different interests and demand patterns. Below are the classical types of multi-service marketplaces. Let’s study them together!

Target Market ParameterA multi-service marketplace can have multiple target markets. The most suitable market is predetermined before even chalking out a roadmap. Here are the worth-considering markets:

Horizontal MarketsA multi-service marketplace having diverse dealers selling various products online targets horizontal markets. For example, Amazon is a multi-vendor marketplace with a horizontal market of offerings of all types: personal care to commercial requirements and whatnot.

Vertical MarketsVertical markets are a slice of horizontal markets. Multi-vendor marketplaces targeting vertical markets have specific sellers dealing in only a particular product. For example, Etsy is a popular online marketplace selling products that resonate with handmade lovers.

Sold Products ParameterWe can classify multi-service marketplaces based on the type of products they sell. Depending on such a criterion, you can identify two types of marketplaces – physical and digital product/services platforms.

Physical Product MarketplacesThe most common multi-service marketplaces sell physical products that you can see, touch, and define. For instance, Amazon, eBay, and Etsy.

Digital Products/ServicesThe products without a well-defined existence are digital goods. Also, there can be multiple services offered digitally. These multi-service marketplaces deal in digital products/services. For example, Coursera, Udemy, Upwork, Fiverr, etc.

Relationships ParameterWe can classify multi-service marketplaces by identifying the type of audience interacting with each other on either side of the commercial platform.

Business-To-Business MarketplacesThe business-to-business marketplaces either deal in commercial products or have wholesale offers on any type of commodity. You can consider Alibaba as the perfect example.

Business-To-Customer MarketplacesThe business-to-customer marketplaces sell products to the end consumers. For example, Amazon, eBay, Walmart, etc.

Purpose ParameterApart from selling products like conventional marketplaces, these online platforms can serve different purposes. We can classify them based on the purpose parameter.

Auction MarketplacesAs the name suggests, these marketplaces enable customers to place their bids on various products during the auction tenure. For example, eBid is the perfect illustration for such multi-service marketplaces.

Crowdfunding marketplacesSome multi-service marketplaces take the game to the next level. They offer a crowdfunding platform to the customers allowing them to raise funds for their oh-so-unique business ideas. The best example of such an initiative is Kickstarter.

Monetization Models for Multi-Service Marketplaces

Setting up a multi-vendor marketplace isn’t a goodwill gesture. You are thinking of building such a platform to earn significant revenues. Aren’t you?

So, let’s spare some time to analyze the famous monetization models that populate the industry. Have a look below!

Subscription ChargesCharging subscription fees can be a brilliant monetization strategy for your multi-service marketplace. You can keep minimal services accessible to all, free and paid users. However, users paying the subscription fees can unlock more features for optimum online business. Indeed, it’s a successful and worth-considering scheme. Don’t you think so?

CommissionIt’s the classical and conventional monetization strategy for multi-service marketplaces. Any transaction happening on your platform owes you a commission in such a financial model. You can generate sure-shot revenues with every purchase from buyers, sellers, or both. Also, it’s the safest way to monetize your efforts and attract massive returns on your investment.

Listing FeesAny seller wishing to list their products on your platform has to pay you a fee. That’s the simplest way to define the listing fee, monetization model. Understandably, a seller approaches you with substantial product types. So, you have the best chances to generate a significant ROI. The listing fee is the underlying strategy behind a popular multi-service marketplace called ArtFire.

Promoted ProductsAnother successful monetization strategy for multi-service marketplaces is promoted product fees. You can offer an opportunity for sellers to bring their products to the center stage by paying you some charges. In return, you can display their products on top of the search result pages. It will allow the customers to engage more with such businesses and increase their revenue collection.

Selling Products YourselfApart from trying out the above monetization schemes, you can sell products yourself through your platform. So, you will become a seller on your marketplace and generate excess revenue from regular purchases. As you are the platform owner, you can promote your products and use advanced platform features without paying any fees!

AdvertisementsPlacing third-party advertisements on your multi-service marketplace is the simplest way to monetize your venture. However, it might not be simple to bring advertisements on your platform while you are new in the industry. Also, too many ads can irritate your audience. Consequently, they might get pushed away from your marketplace due to a degraded customer experience. So, it’s better to plan accordingly.

Now, you know about various monetization strategies for your multi-vendor marketplace. So, let’s move on to understanding the must-have features in your platform before going anywhere else.

Must-Have Features in a Multi-Service Marketplace

Features are the essential assets for your multi-service marketplaces. These functionalities differentiate your platform from others and help attract sellers and buyers.

So, let’s overview the must-have features to eye on for your one-of-a-kind multi-vendor marketplace.

Features for SellersSeamless RegistrationThe sellers can join your platform after a successful registration. Since you want the vendors to register with your multi-service marketplace, you should emphasize a seamless registration process. It will encourage them to use your platform to sell their products.

Product ListingOnce the sellers enter your platform, they can list their products on your marketplace for end consumers to find them online.

Seller ProfileA successful multi-service marketplace like Amazon maintains seller profiles for consumer transparency. Your sellers can create their profiles and edit them to make them more appealing to the audiences. Besides, their profile can carry information critical for users to establish trust in the vendors.

Seller DashboardLet’s agree to the fact that your sellers will list numerous products on your multi-service platform. Furthermore, they might require inspecting which products perform better in the marketplace and identifying strategies that work for their businesses. So, providing them with a detailed dashboard is necessary.

AnalyticsAn additional advantage for sellers on your platform is advanced analytics. The vendors can track multiple parameters, get detailed insights, and make better business decisions quickly.

Features of CustomersHassle-Free RegistrationYour users won’t spend considerable time registering with your platform. So, you should focus on making the registration process hassle-free and highly simplified for them. It will increase your marketplace’s popularity in the blink of an eye.

Booking FeatureThe booking feature is specific for multi-vendor marketplaces dealing in digital products or services. For example, you can build a marketplace selling courses. So, the platform should allow them to book the services whenever required.

Search Tools and CategorizationA massive catalog of products and services makes it impossible for customers to reach their desired offerings. Right here, an advanced search tool and navigable categorization can simplify the customers’ lives.

Seamless On-Site CheckoutsBuying or booking products and services require customers to transfer funds to sellers and marketplaces. The checkout process on your platform should be seamless, secure, and hassle-free.

FeedbackA multi-service marketplace has better success rates if you allow the users to share their feedback regarding your services and offerings. So, your platform should allow them to provide generous reviews and ratings to various products listed in your marketplace.

Admin PanelLike other marketplaces, your platform should have an admin panel to track various performance parameters, understand the demographics, and create improvisation strategies for your business. So, apart from seller and customer features, admin panels are a must-have for your multi-service marketplace.

By now, you are already familiar with all aspects of multi-service marketplaces. So, it’s the best moment to discuss the initial steps to enter the domain without worries.

Are you ready to discuss the initial measures? Let’s dive in if it’s a yes!

How to Begin a Multi-Service Marketplace?

Indeed, building a multi-service marketplace changes your destiny. These platforms are taking over the consumers more rapidly than you think. But, the question is, how to begin your journey in the industry.

Don’t worry; we’ve got your back!

All you need is to adhere to the following measures to step into the domain effortlessly.

1. Understand the AudiencesThe first checkpoint of any business journey is understanding what audiences expect from them. So, it’s better to understand the customers before setting up a multi-service marketplace. It will give you the right direction and assist you in deducing a profitable business strategy.

2. Choose the MVPWhile you are an absolute beginner in the domain, understanding the market and customer expectations can be challenging. You might continuously encounter second thoughts regarding if the industry will accept your products.

So, an MVP with minimal features can help you. Developing them won’t drain your pockets and you can stay on the safest side.

Begin by realizing the critical customer pain points and identify MVP features that will solve their problems. Develop the first product prototype and quickly launch it by keeping marketplace quality in the foreground. It can reduce the time for app development.

Also, keep collecting user feedback and improving your product from time to time.

3. Decide Your TypeNow, the next and most critical aspect of your journey is deciding the type of marketplace you wish to set up.

Remember the marketplace types discussed earlier? You can choose any of those models and chalk out a business strategy around the chosen type.

4. Pick a Monetization SchemeNow, you already know the class of your futuristic marketplace. What’s next?

Yes, you’re right!

It’s time to discuss the monetization scheme for your business. How do you wish to make money from the platform? Is it through indirect compensations, subscriptions, or something else?

It’s better to spend considerable time brainstorming the monetization part as it will decide the marketplace’s future.

5. Make a List of Platform FeaturesAt this point, most, if not all, hard work is done. Now, you can freely focus on the look and feel of your multi-service marketplace.

You can pre-decide the features you will offer to different parties using your multi-service marketplace: sellers, buyers, and admin.

Since we have already discussed the features, you can quickly create a massive list and build a successful marketplace from scratch.

6. Collaborate With a Development AgencyDiscussing marketplace development might create stress wrinkles on your forehead. You might be an excellent business person but developing a product from scratch is tedious.

It requires experience and tech expertise to build a unique multi-service marketplace. Right here, a development agency can help you.

You can find the best marketplace development company, collaborate with developers, and build the desired product in the shortest turnaround times.

7. Decide the Tech Stacks TogetherYou can spare some time to understand various technology stacks that your developers will leverage. It might give you an overview of the underlying architecture used in building your multi-service marketplace.

Also, you can ensure that your platform has the latest technologies and includes all the desired features. It’s an excellent way to maintain communication with your development company.

8. Product TestingOnce the developers create your multi-service marketplace and you approve their effort, the development agency will likely subject your platform to rigorous testing.

It will eliminate all possibilities of errors, glitches, and bugs. So, you can ensure that the multi-service marketplace delivers a consistent experience to sellers and buyers at any point in time.

9. Final LaunchingEnough of drums rolling! It’s the showtime now!

After successful development and product testing, your multi-service marketplace is ready to roll out in the market. It has all the essential features and functionalities required to attract the correct sellers and desired audiences.

Now, your investment will begin converting in almost no time. Get ready to welcome the massive venture success!

10. Marketing StrategiesYou can make your multi-service marketplace more visible to the sellers and customers using digital marketing strategies. These tactics target search engines, social media, and various devices to spread the word about your multi-vendor marketplace.

Before even launching the platform, you can strategize and create a buzz among your audiences. And once the product comes out in the market, you can work on optimizing the marketplace visibility.

The Bottom LineMulti-service marketplaces are all the rage these days. Surprisingly, the future has better avenues for all platform stakeholders.

Now that you know how to begin your journey in the industry, it’s time to strategize, build a feature-rich multi-service marketplace, and generate massive revenues from your venture.

The post How to Begin Multi-Service Marketplace? appeared first on FourWeekMBA.

What happened to Kik?

Kik Messenger, more affectionately known as Kik, is an instant messaging app that was developed by Canadian students at the University of Waterloo.

Kik was launched on October 19, 2010, and reached 1 million users 15 days later. The app then reached 200 million users in early 2015 with the company earning a billion-dollar valuation a few months later.

Despite hundreds of millions of users and several successful rounds of investment funding, co-founder Ted Livingston announced in 2019 that Kik would be shut down. The decision was ultimately reversed, but Kik was acquired by a holding company and, in the past few years, has faded into relative obscurity.

The story of Kik and its various missteps is told in the following sections.

Anonymity issuesWhile enormously popular, Kik has endured multiple controversies since it was launched because of its anonymity features. Users could easily sign up without having to provide their phone numbers, which made Kik unique among its peers.

As a result, the app became a haven for users with nefarious intentions, with a 2018 BBC report claiming Kik had been involved in over 1,100 cases of child abuse. To make matters worse, the company was known for not cooperating with law enforcement when information was requested to identify offenders.

Illegal token issuanceAmidst ongoing controversy over the safety of its users, Livingston decided to launch a coin under the name of Kin. In early 2017, ICOs were all the rage with companies sometimes raising hundreds of million dollars.

The ICO, which raised close to $100 million, was completed in August 2017. But difficulties arose when the U.S. Securities and Exchange Commission (SEC) claimed Kik’s ICO was illegal because it constituted the sale of unregistered securities. Kik denied the allegations, noting that its IOC was a token sale and that consumers purchased the tokens for their utility and not as a speculative investment.

Irrespective of which party was correct, the case dragged on for years and nearly bankrupted Kik in the process. Over $10 million was spent on legal fees, eventually forcing Livingston to announce in September 2019 that he would terminate 80% of his workforce.

Media Labs acquisitionFortunately for his employees, this decision was reversed after Livingston tweeted that he had found a buyer for his platform. The buyer was MediaLab, a holding company that was looking to expand its mobile app portfolio.

An exact price was never disclosed, but the sale of Kik’s messenger service freed up Livingstone to focus on his battle with the SEC and his cryptocurrency initiatives.

SEC settlementKik and the SEC eventually settled their case without going to trial for $5 million. Importantly, Kik would be allowed to keep what was left of its $100 million ICO.

Meanwhile, under the direction of MediaLab, the core messenger app was updated when required but lacked any new, innovative features that would create a buzz and maintain or increase user interest.

Business model pivots and monetizationOne of the platform’s earlier points of difference was the use of chatbots, which could be accessed in Kik’s Bot Shop and used to play games or interact with other companies. The company invested heavily in chatbots, and while they were useful under certain circumstances, the chatbot revolution never really came to fruition.

Livingston then decided to start a new company for his ICO, all the while dealing with the SEC and the constant problems associated with the unsafe app. His propensity to experiment with different business models was understandable because messaging apps are difficult to monetize – a fact compounded by Kik’s mostly under 18 user base. However, it could also be argued that these constant shifts diluted his focus to the point where it was detrimental to the platform.

Kik remains relatively popular today, but it pales in comparison to competitor services such as Telegram and WhatsApp.

Read Next: How Does Telegram Make Money, The History of WhatsApp, How Does WhatsApp Make Money.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Kik? appeared first on FourWeekMBA.

What happened to FarmVille?

FarmVille is a social network game where players engage in aspects of farm management such as planting, growing, harvesting, and tending to livestock. The game was launched in 2009 by American game developer Zynga.

FarmVille was an instant success on Facebook where it became the network’s most popular game for more than two years. Peak users topped out at around 84 million in March 2010 and from that point, FarmVille experienced a slow (but steady) decline in interest.

On December 31, 2020, FarmVille was officially killed off before somewhat of a renaissance in late 2021. Let’s chart some of the 13-year history of the game below.

Usability issues and Facebook relationshipFarmVille was an addictive game that required the constant attention of its users. If one did not frequently check on their crops, they would wither and die. Such was the level of commitment required that many would set their alarms and wake up in the middle of the night to maintain their farms.

Of course, Farmville was set up in such a way that a player could ask their friends and family to help them. This became a major source of annoyance for some because Facebook bombarded them with notifications and news feed updates.

Many complained to the social network who believed FarmVille was spammy. In response, Facebook reduced the degree to which game invites and updates were visible in user feeds. This ultimately meant less interest in the game and a reduction in new users.

Many others quit the platform as their farms became too large to manage, while others simply became bored of it after FarmVille’s high novelty factor wore off.

Negative publicityNegative publicity about FarmVille persisted as the number of users continued to decrease. Time Magazine called it one of the “50 Worst Inventions” in recent decades because of its addictive nature and gameplay which consisted of mindless, repetitive chores.

The gaming industry as a whole was also indifferent to FarmVille despite its obvious popularity. When it won an award at the Game Developers Conference, a company representative was booed on stage as he accepted it. Zynga co-founder Mark Pincus would also later note that it was difficult to recruit game developers because they believed their peers would not respect them for taking the position.

ShutdownZynga announced in 2020 that it would be shutting the game down by the end of the year. The news came as no great surprise to users since it was already known that Adobe was discontinuing Flash on December 31.

Nevertheless, it was a bitter pill to swallow for many who had spent over a decade working on their farms.

RebirthA new mobile-only version of the game called FarmVille 3 was launched in November 2021.

With FarmVille 3 a relative success, Zynga was acquired by Take-Two Interactive in January 2022 for $12.7 billion. It was hoped that the deal would combine Zynga’s mobile and next-generation platform expertise with Take-Two Interactive’s superior capabilities and intellectual property, which includes the popular Grand Theft Auto series.

Read Also: Gaming Industry, Epic Games Business Model, Free-To-Play, Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Solana, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to FarmVille? appeared first on FourWeekMBA.

What happened to Mt. Gox?

Mt. Gox was a bitcoin exchange that was created by programmer Jed McCaleb and based in Tokyo, Japan. The exchange was named after a site McCaleb created in 2006 to enable users to trade cards from Magic: The Gathering Online, an online fantasy game.

Launched in 2010, Mt. Gox was one of the first bitcoin exchanges and, four years later, was processing 70-80% of all bitcoin transaction volume. In February of 2014, however, Mt. Gox suffered a fatal blow and filed for bankruptcy in Tokyo two months later.

To find out what happened to this powerhouse exchange, please read on!

MismanagementBitcoin and its associated infrastructure proved to be the first viable way to revolutionize and decentralize international finance. But its development was largely driven forward by technology enthusiasts who were either unable or unwilling to learn how to run a business.

Mt. Gox CEO Mark Karpeles is one such individual. Karpeles, an avid programmer and bitcoin advocate, purchased the site from McCaleb after the latter realized that managing the platform was beyond his capabilities. He took a rather laissez-faire approach to leadership, famously enjoying the weekend off after the platform was hacked and taken offline in 2011.

Under Karpeles’s leadership, reports also surfaced that Mt. Gox did not use any form of version control software. This meant that any coder could overwrite the work of another employee if they were working on the same file. The company was also extremely complacent in introducing a test environment, which potentially would result in untested software changes released to users. And with Karpeles the only person who could approve changes to the source code, important security fixes languished for weeks before he would get around to looking at them.

Other former employees noted that Karpeles was not afraid to spend money, with $400 staff launches and $1 million spent on a new company café that was never finished. One insider would later note that: “Aside from the café, he liked to spend time fixing servers, setting up networks and installing gadgets… probably distracting himself from dealing with the real issues that the company was up against.”

Hacking and bankruptcyIn February 2014, Mt. Gox suspended trading after noting that it was experiencing an unexpected increase in withdrawal requests. The issue, the company claimed, was not limited to Mt. Gox and affected any transaction where bitcoins were sent to a third party.

A few days later, the site was shut down completely and rumors began circulating that Mt. Gox had been hacked for as many as 850,000 bitcoins. At the time, this equated to around $500 million in hard currency.

On February 28, Mt. Gox filed for bankruptcy in the Tokyo District Court. In a statement, Karpeles announced that most of the bitcoin was unrecoverable: “We had weaknesses in our system, and our bitcoins vanished. We’ve caused trouble and inconvenience to many people, and I feel deeply sorry for what has happened.”

The company then filed for bankruptcy protection in the United States to halt multiple lawsuits from customers.

Redistribution to creditorsAround a month after filing for bankruptcy, the company discovered a digital wallet containing 200,000 BTC. While 650,000 BTC was still owed to creditors, the soaring price of bitcoin over the next four years meant that enough could be salvaged to pay them back in full by March 2018.

In the interim, Karpeles was arrested by Japanese police for fraud, embezzlement, breach of trust, and data manipulation of accounts in the Mt. Gox computer system. The Tokyo District Court eventually found that he had inflated Mt. Gox’s holdings by $33.5 million and, as a consequence, received a suspended sentence of 30 months in prison.

It was also discovered in the aftermath that the funds from the initial hack were stolen over a period of three years. No one has been arrested over the hacking and subsequent theft, but Russian crypto exchange owner Alexander Vinnik is a prime suspect.

Read Next: Coinbase Business Model, History Of Bitcoin, Ethereum: The History of Ethereum.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Mt. Gox? appeared first on FourWeekMBA.

What happened to QuizUp?

QuizUp was a mobile trivia game not dissimilar in style to the popular board game Trivial Pursuit. The app was created by Icelandic company Plain Vanilla Games, itself the brainchild of entrepreneur Thor Fridriksson.

QuizUp was launched in November 2013 and, like most trivia-based apps, became an instant success. In the first six months of operation, it passed 20 million users and 1 billion matches between users in 197 countries. Such was the popularity of QuizUp that it entered into talks with NBC to produce a television show based on the app.

However, the success was not to last. Several rounds of employee terminations followed thereafter and the game was formally discontinued in March 2021.

So what happened to QuizUp?

Monetization issuesMonetizing mobile-based games is notoriously problematic, and, for QuizUp, it was no different. The company was bootstrapped for many years with the only way to drive revenue coming from users who could pay to receive more attempts.

A corporation version of the game was then launched in August 2015, with a web-based version enabling players to write their own questions following soon after. Despite these measures and with 70 million users, the company continued to find revenue generation difficult.

Failed television dealIn 2016 QuizUp penned a deal with NBC Television to produce a show with a 10-episode run. A pilot episode was planned for March 2017 and it was hoped the partnership would increase user numbers and make the company sustainable. In a vote of confidence, NBC also sold the rights for the show to British broadcaster ITV.

With interest in QuizUp starting to wane, however, the series was canceled before the show aired on either network. Without a critical source of capital, the writing was on the wall for Fridriksson.

Plain Vanilla Games shutdown

In August 2016, Plain Vanilla Games announced it would be ceasing operations in Iceland and that all 36 employees would be terminated.

While the company admitted that revenue had increased appreciably, the cost of maintaining a user base of 80 million in the face of the canceled TV deal proved to be too great.

Glu Mobile acquisition and shutdown

With dwindling user interest and in need of a new owner, Fridriksson sold QuizUp to Glu Mobile for $7.5 million in December 2016. The total sale amount stemmed from a prior round of investment funding from Glu Mobile that included an option to acquire Plain Vanilla Games at a pre-determined price.

After Glu Mobile also acquired the rights to QuizUp, the game ran more or less in maintenance mode for almost five years before an announcement in early 2021 that it would be shut down. While many were surprised by the move, history will show that the developers failed to adequately monetize the game with effective incentivization.

Many also posit that after Glu Mobile was acquired by Electric Arts a month later, it cut the game from its balance sheet to improve its acquisition price.

Read Also: Gaming Industry, Epic Games Business Model, Free-To-Play, Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Solana, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to QuizUp? appeared first on FourWeekMBA.

What happened to Popcorn Time?

Popcorn Time is a free software BitTorrent client that includes a media player where users can watch various television shows and movies. The platform was created by a team of anonymous Argentinian developers in 2014, with only one member, Federico Abad, so far identified.

Abad created Popcorn Time because he grew tired of having to wait six months after a cinematic release for a film to be available in his country. The platform was eventually launched in March 2014 with hundreds of thousands of users downloading it in the first two weeks.

Inevitably, however, Popcorn Time attracted the ire of movie producers and was shut down and reborn several times over a period of years.

Interested in learning more? Some of the story of what happened to Popcorn Time is told below.

First shutdownTwo weeks after launch, a team of lawyers assembled by the Warner Bros. film studio managed to find the developers and their respective LinkedIn profiles. Abad and his counterparts became nervous about an impending lawsuit similar to those experienced by the likes of LimeWire or Napster.

As a result, Popcorn Time was, at least in theory, shut down. But the open-source nature of the project meant that GitHub developers soon revived and relaunched it. Chief among them were members of popular torrent site YTS whose API the platform was utilizing.

From domain to domainIn much the same way as The Pirate Bay, Popcorn Time would be shut down and then re-appear on a different domain. The first relatively successful move was to time4popcorn.eu, which released an app for Android and jailbroken iOS devices. However, domain authorities in Europe shut the site down and Popcorn Time was moved to popcorn-time.se.

Another version, popcorntime.io, released a VPN in November 2014 and became one of the first forks to monetize the already illegal service.

Further regulation and dwindling trafficIn May 2015, the U.K. High Court ruled that several ISPs in the country would be required to restrict access to any page associated with Popcorn Time. As the year wore on, increasing numbers of film studios threatened to sue users on the platform, with Danish police also heavily penalizing two individuals for running an explainer site.

Ultimately, the fear of heavy fines and potential lawsuits caused traffic to decrease. Many forks suffered because of developer disagreements while others were simply abandoned altogether.

Emergence of streaming services and legal actionWhile the popular .io fork was still online in early 2016, the emergence of streaming services such as Netflix and Amazon Prime continued to take users away from Popcorn Time. The platform then became even less palatable in 2017 after reports surfaced that subtitle files were infected with malware.

The Movie Picture Association of America – instrumental in initiating lawsuits earlier in the piece – then sued GitHub for violating copyright. While the source code was taken down, it reappeared two weeks later because the code itself was not subject to copyright law.

Today, Popcorn Time continues to be available.

Read Next: What Happened to Napster, What happened to Sean Parker, Netflix Business Model, Spotify Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Popcorn Time? appeared first on FourWeekMBA.

April 25, 2022

Who Owns Twitter?

As of April 25th, 2022, Elon Musk owns Twitter. The company was purchased by Elon Musk for $54.20 per share, at about $44 billion. After, on April 14th, 2022, Elon Musk made an offer to purchase the whole company.

How was Twitter ownership distributed before Elon Musk purchased it?The largest individual shareholder is the company’s co-founder and CEO, Jack Dorsey, who, as of 2019 owned a 2.3% stake in the company’s stocks. Other non-individual, institutional shareholders comprise The Vanguard Group (with 10.33%), BlackRock (with 6.6%), and Morgan Stanley (with 5.86%).

The Beneficial Owners of Twitter, comprise both individual and institutional shareholders (Data Source: Twitter Proxy Statement).The timeline of Elon Musk’s acquisition of Twitter

The Beneficial Owners of Twitter, comprise both individual and institutional shareholders (Data Source: Twitter Proxy Statement).The timeline of Elon Musk’s acquisition of TwitterIn April 2022, Elon Musk finalized the acquisition of Twitter, in one of the most controversial deals of business history.

Let’s review the timeline.

Musk placed, out of the blue, a bet to take over the whole company. It was April 14th, 2022:

The public records show the whole conversation of the offer Musk made to take over Twitter. Below is the main extract, of the conversation, between Musk and the Twitter’s board, as per SEC Filings, Musk had sent a message to Bret Taylor, Chairman of the Twitter’s board:

I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy.

However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company.

As a result, I am offering to buy 100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced. My offer is my best and final offer and if it is not accepted, I would need to reconsider my position as a shareholder.

Twitter has extraordinary potential. I will unlock it.

Elon Musk

In a follow-up text, Musk highlighted:

As I indicated this weekend, I believe that the company should be private to go through the changes that need to be made.

After the past several days of thinking this over, I have decided I want to acquire the company and take it private.

I am going to send you an offer letter tonight, it will be public in the morning.

Are you available to chat?

Elon Musk

As a final message to the Twitter’s board, Musk highlighted:

1. Best and final

a. I’m not playing the back-and-forth game.

b. I have moved straight to the end.

c. It’s a high price and your shareholders will love it.

d. If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder.

i. This is not a threat, it’s simply not a good investment without the changes that need to be made.

ii. And those changes won’t happen without taking the company private.

2. My advisors and my team are available after you get the letter to answer any questions

a. There will be more detail in our public filings. After you receive the letter and review the public filings, your team can call my family office with any questions.

Elon Musk

In short, Musk had offered to purchase Twitter, for $54.20 per share, a 54% premium, before Musk had started to buy Twitter shares.

While the offer was good from a valuation standpoint, the board tried to fight it. Also influential business commentators were against it.

As Cramer highlighted:

This is one of those where they are literally not doing their job, there’s no fiduciary responsibility if they just say, ‘you know what, we take it, there are times when individual directors are opened up for a level of lack of fiduciary that I think crosses the line. This crosses the line.

"I don't think this is a serious offer and the market doesn't think this is a serious offer," @profgalloway says

— Brian Stelter (@brianstelter) April 15, 2022

Our complete special report about Elon Musk's bid for Twitter is streaming here: https://t.co/F0bGzt9bXJ pic.twitter.com/IfqsepkxVt

Throughout the deal, none expected it to go through so quickly. Indeed, given the controversy around Twitter, most business people thought this would have turned into a few months’ fight over Twitter’s ownership.

Yet, things tumbled very quickly. And by April 25th, 2022, the deal was officially announced!

The announcement of Twitter’s board, accepting the offer from Elon Musk to buy the company.

The announcement of Twitter’s board, accepting the offer from Elon Musk to buy the company.As explained in the official press release:

Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing of the proposed transaction. The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter.

Bret Taylor, Twitter’s Independent Board Chair, highlighted:

The Twitter Board conducted a thoughtful and comprehensive process to assess Elon’s proposal with a deliberate focus on value, certainty, and financing. The proposed transaction will deliver a substantial cash premium, and we believe it is the best path forward for Twitter’s stockholders.

Parag Agrawal, Twitter’s CEO, highlighted on Twitter

Twitter has a purpose and relevance that impacts the entire world. Deeply proud of our teams and inspired by the work that has never been more important.

How did Elon Musk secure the funding to purchase the company?

He secured $25.5 billion of fully committed debt and margin loan financing and is providing an approximately $21.0 billion equity commitment.

A Glance at Twitter Business Model Twitter is a platform business model, monetizing the attention of its users in two ways: advertising and data licensing. In 2019, advertising represented 86.5% of its revenue at almost $3 billion. The remaining part is data licensing at 13.5% (over $465 million) primarily related to enterprise clients using data for their analyses.

Twitter is a platform business model, monetizing the attention of its users in two ways: advertising and data licensing. In 2019, advertising represented 86.5% of its revenue at almost $3 billion. The remaining part is data licensing at 13.5% (over $465 million) primarily related to enterprise clients using data for their analyses. According to eMarketer, in the US alone, digital advertising spending will be around $129 billion. Within this market, the most significant players are companies like Google ($116 billion in 2018 from search advertising), Facebook (over $55 billion in advertising revenues in 2018), Amazon (over $10 billion in 2018 from product advertising), Twitter (with $2.6 billion in advertising in 2018), and Microsoft’s Bing (search advertising for about $7 billion in 2018)

According to eMarketer, in the US alone, digital advertising spending will be around $129 billion. Within this market, the most significant players are companies like Google ($116 billion in 2018 from search advertising), Facebook (over $55 billion in advertising revenues in 2018), Amazon (over $10 billion in 2018 from product advertising), Twitter (with $2.6 billion in advertising in 2018), and Microsoft’s Bing (search advertising for about $7 billion in 2018) Read Also: Twitter Business Model, Digital Business Models, Platform Business Models, Attention-Based Business Models.

Related to Elon Musk Elon Musk is one of the richest people in the world, with his main ownership in Tesla, making him worth more than a hundred billion dollars. The companies founded by Elon Musk range from electric vehicles and renewable energies, with Tesla, rockets, with SpaceX, infrastructure, with The Boring Company, and neurotechnology with Neuralink.

Elon Musk is one of the richest people in the world, with his main ownership in Tesla, making him worth more than a hundred billion dollars. The companies founded by Elon Musk range from electric vehicles and renewable energies, with Tesla, rockets, with SpaceX, infrastructure, with The Boring Company, and neurotechnology with Neuralink.  Elon Musk, an early investor and CEO of Tesla, is the major shareholder with 21.7% of stocks. Other major shareholders comprise investment firms like Baillie Gifford & Co. (7.7%), FMR LLC (5.3%), Capital Ventures International (5.2%), T. Rowe Price Associates (5.2%), and Capital World Investors (5%). Another major individual shareholder is Larry Ellison (co-founder and CEO of Oracle), with a 1.7% stake.

Elon Musk, an early investor and CEO of Tesla, is the major shareholder with 21.7% of stocks. Other major shareholders comprise investment firms like Baillie Gifford & Co. (7.7%), FMR LLC (5.3%), Capital Ventures International (5.2%), T. Rowe Price Associates (5.2%), and Capital World Investors (5%). Another major individual shareholder is Larry Ellison (co-founder and CEO of Oracle), with a 1.7% stake. Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, and eventually turned into a mass manufacturing electric car maker.

Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, and eventually turned into a mass manufacturing electric car maker.  The PayPal Mafia describes a group of former PayPal employees and founders who have since become involved with other tech companies. While most know SpaceX founder Elon Musk’s association with PayPal, the company also has links with YouTube, LinkedIn, and Yelp, among many others. In addition to founding these generation-defining companies, the members of the PayPal Mafia are some of the richest men in Silicon Valley.

The PayPal Mafia describes a group of former PayPal employees and founders who have since become involved with other tech companies. While most know SpaceX founder Elon Musk’s association with PayPal, the company also has links with YouTube, LinkedIn, and Yelp, among many others. In addition to founding these generation-defining companies, the members of the PayPal Mafia are some of the richest men in Silicon Valley.  Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.

Tesla is vertically integrated. Therefore, the company runs and operates the Tesla’s plants where cars are manufactured and the Gigafactory which produces the battery packs and stationary storage systems for its electric vehicles, which are sold via direct channels like the Tesla online store and the Tesla physical stores.  – SpaceX is a space transportation service and manufacturer of space rockets and other transport vehicles. It was founded by Elon Musk in 2002. – SpaceX makes money by charging both governmental and commercial customers to send goods into space. These goods include ISS supplies and infrastructure, but also people and satellites for various purposes. – SpaceX is also in the process of creating its Starlink network, designed to give every citizen access to fast and affordable internet.

– SpaceX is a space transportation service and manufacturer of space rockets and other transport vehicles. It was founded by Elon Musk in 2002. – SpaceX makes money by charging both governmental and commercial customers to send goods into space. These goods include ISS supplies and infrastructure, but also people and satellites for various purposes. – SpaceX is also in the process of creating its Starlink network, designed to give every citizen access to fast and affordable internet. Dogecoin’s conception was in 2013 as a satire on the flourishing altcoin sector. No one expected that the small community built around a coin inscribed with the famous Shiba Inu “doge” meme would grow as it did. Presently, eight years later, the satirical comment of a coin has and is still pumping in value, aggressively thriving in the ever-competitive altcoin world. And things only got even more interesting, when Elon Musk started to tweet more and more frequently about that.

Dogecoin’s conception was in 2013 as a satire on the flourishing altcoin sector. No one expected that the small community built around a coin inscribed with the famous Shiba Inu “doge” meme would grow as it did. Presently, eight years later, the satirical comment of a coin has and is still pumping in value, aggressively thriving in the ever-competitive altcoin world. And things only got even more interesting, when Elon Musk started to tweet more and more frequently about that. First-principles thinking – sometimes called reasoning from first principles – is used to reverse-engineer complex problems and encourage creativity. It involves breaking down problems into basic elements and reassembling them from the ground up. Elon Musk is among the strongest proponents of this way of thinking.

First-principles thinking – sometimes called reasoning from first principles – is used to reverse-engineer complex problems and encourage creativity. It involves breaking down problems into basic elements and reassembling them from the ground up. Elon Musk is among the strongest proponents of this way of thinking.Read Next: Tesla Business Model, Tesla Competitors, Tesla Mission.

The post Who Owns Twitter? appeared first on FourWeekMBA.

Virgin Organizational Structure

Virgin, formally known as Virgin Group Ltd., is a British multinational that was founded by the enigmatic billionaire entrepreneur Richard Branson in 1970. The company was named for Branson and colleague Nik Powell, who described themselves as virgins in business after opening a mail-order record shop.

Today, Virgin is a vast company with varied interests in air travel, space travel, hotels, financial services, music, fitness, and telecommunications. These diverse interests under the leadership of Branson have resulted in a somewhat unique organizational structure.

To learn a bit more about the internal framework of Virgin, please read on!

Keiretsu business structureTo date, Virgin Group Ltd. is comprised of more than 300 branded companies operating in 30 countries around the world. It’s important to note that each of these companies operates independently with their own assets, employees, products, and services.

Nevertheless, each company in the group has a financial interest in every other company, which means all 300 members work to further and advance Virgin Group’s interests.

This arrangement is known as keiretsu, a Japanese business structure that became predominant in the aftermath of World War II. In essence, the term can be used to describe any set of companies with interlocking shareholdings or other business relationships. In many modern Japanese contexts, one is these companies is a bank or insurance company that provides financial services to each member of the group.

For Virgin, the keiretsu approach has several benefits:Takeover resistance – since every company has shares in the other, this shields an individual company from a hostile takeover. If a takeover seems likely, stronger companies raise their respective shareholdings in the weaker, target company.Finance – member companies can provide finance to others, which reduces the need to borrow externally. As we noted earlier, one of these companies is usually a bank which, in Virgin’s case, is Virgin Money. This bank funds other company operations and can also serve as a guarantor if a group member does need to borrow elsewhere.Information access – every member of the keiretsu has access to fast, updated, and readily available information. Consumer data from visitors to Virgin.com, for example, is shared with all Virgin Group companies to gain or maintain a competitive edge. While strategy and operating procedures are set out by a central headquarters, these companies nevertheless have the freedom and flexibility to make most decisions without consulting Branson beforehand.Product-based divisionsVirgin Group structures its over 300 companies according to the products and services they offer. This may seem an obvious point to make, but it should be noted that product-based divisions are also a characteristic of the keiretsu approach.

Some of these companies include:

Virgin Records – music.Virgin Atlantic – aviation services.Virgin Orbit – a launch service for small satellites.Virgin Hotels, andVirgin Pulse – a digital health and engagement company.Geographic divisionsWithin each Virgin company, there may exist geographic divisions that help it account for the various characteristics of regional markets.

Consider the chain of Virgin Active health clubs, for example, which has the following geographic divisions:

Virgin Active Australia.Virgin Active Italy.Virgin Active Singapore.Virgin Active South Africa.Virgin Active Thailand, andVirgin Active UK.Main Free Guides:

Business ModelsBusiness Model InnovationProduct-Market FitDigital Business ModelsSales And Distribution LessonsBusiness DevelopmentMarket SegmentationMarketing vs. SalesDistribution ChannelsThe post Virgin Organizational Structure appeared first on FourWeekMBA.

Whole Foods Organizational Structure

Whole Foods Market is a multinational supermarket chain with a focus on organic products that are free from artificial preservatives, colors, and flavors. The company was founded in 1980 by John Mackey, Renee Hardy-Lawson, Mark Skiles, and Craig Weller.

Whole Foods Market employs a divisional organizational structure but with a few characteristics and additional elements that make its composition different from other companies.

Let’s have a look at the nuances of this structure below.

Four-tier global hierarchyWhole Foods Market’s global hierarchy features four different tiers:

Global Headquarters.Regional Officers. Facilities Employment, andStore Employment.Spread across these tiers is a clear chain of hierarchical command. In other words, store managers report to facility managers, and facility managers report to regional officers who have direct access to company headquarters in Austin, Texas.

Geographic divisionsWhole Foods has 12 broad geographic divisions for its operations across the United States, United Kingdom, and parts of Canada. Most divisions incorporate multiple states or provinces and each is led by a President.

These include:

Pacific Northwest – Oregon, Washington, British Columbia, and Alberta.Northern California – this also covers northern Nevada.Southern Pacific – Hawaii, Arizona, and parts of Southern California and Nevada.Midwest – most midwestern U.S. states plus the Canadian province of Ontario.Southwest – Texas, Oklahoma, Arkansas, and Louisiana.North Atlantic – encompassing much of New England.South – with states such as Mississippi, Alabama, and South Carolina.Florida. Mid-Atlantic – such as Washington, D.C., Virginia, Delaware, and Maryland.Northeast – New Jersey and Philadelphia.Rocky Mountain – a vast division incorporating Colorado, Utah, Wyoming, and New Mexico, among other states.United Kingdom.Functional structuresEach geographic division is responsible for adapting its business activities to the particularities of the region in which it operates. This is achieved with a functional structure that assembles employee skills and experience into the following groups:

Legal Affairs and Secretary.Global Culinary Procurement & Operations.Center Store Merchandising.Growth and Development.Marketing.Operational Finance. Supply Chain & Retail Operations.Team Member Services.TeamsWhole Foods Market also likes to incorporate teams into its organizational structure. This is most evident at the store level, where teams are assembled for different product departments and business functions. In some cases, store teams are afforded more autonomy in deciding what to order and how to price items, with many also competing in intra-store competitions to see which team can drive the most revenue.

Less visible is the way the notion of teams is applied further up the chain of command. Each store leader in a given geographic division collectively forms a team, while each of the company’s regional presidents is considered likewise.

Read Next: Who Owns Whole Foods?, Amazon Subsidiaries, ALDI Business Model, Amazon Business Model.

Main Free Guides:

Business ModelsBusiness Model InnovationProduct-Market FitDigital Business ModelsSales And Distribution LessonsBusiness DevelopmentMarket SegmentationMarketing vs. SalesDistribution ChannelsThe post Whole Foods Organizational Structure appeared first on FourWeekMBA.