Steve Hely's Blog, page 17

April 5, 2024

Sysco

You’ve probably seen a Sysco truck around, they’re a massive wholesale food distribution company. They’re mentioned a few times in Kent Taylor’s book, so I looked into the company. Here’s their CEO:

I thought this was funny:

When you click:

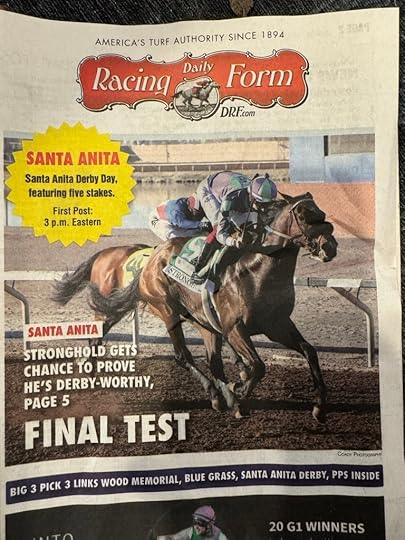

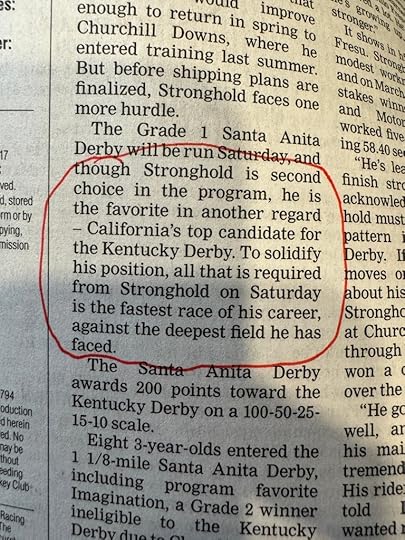

Santa Anita Derby

Tomorrow at Santa Anita an interesting Derby is shaping up.

Sort of a good vs evil thing against Bob Baffert’s Imagination

Plus we can’t rule out Wynstock.

March 30, 2024

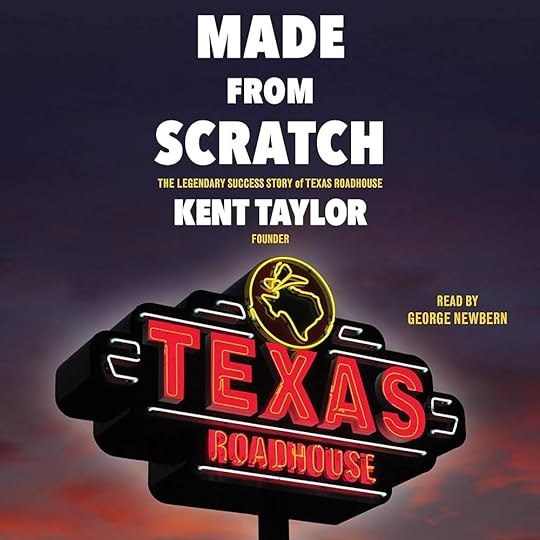

Kent Taylor, Made From Scratch

Kent Taylor was a spectator at the 1971 NCAA cross-country championships:

I will never forget [Steve] Prefontaine powering through that tough hilly course, challenging anyone to catch him as he picked up the pace on each rise, daring all comers to endure pain only he was capable of enduring. Steve won the race, no problem, and wore about him afterward an aura of extreme confidence that captivated me. Still, to this day, I can remember that look, as if he wanted his challengers to bring on whatever they had, and he’d find a way to bring that much more.

Kent Taylor was a skinny kid who was kicked off the football team by a coach who told him he might die out there. He went into track and cross country and drove himself to become better. One summer he trained by running over a thousand miles. He got good enough that with some persistence and luck he got a partial scholarship to UNC. There he ran the steeplechase, obstacle running complete with a water hazard.

Kent Taylor had drive. After college he moved back to Louisville, managed some nightclubs in Cincinnati, managed a Bennigan’s in Dallas for a bit, worked for KFC. What he wanted to do was launch his own concept for a restaurant: Texas Roadhouse.

My initial thought regarding Texas Roadhouse was to combine a rough and somewhat rowdy live music joint with a reasonably priced restaurant featuring steaks and ribs. I wanted to have the same quality of beef that Outback and Longhorn featured at the time, but with price points more similar to Chili’s and Applebee’s. I wanted to target the blue-collar segment of America (my peeps) who would be comfortable with jukebox country music and a casual and lively atmosphere with energetic servers in jeans and T-shirts. In short: Baby, if you want to dress up, then visit somewhere else; but if you want to dress down, we would welcome you with open arms and a warm smile.

Two of his first investors were Dr. Amar Desai and Dr. Mahendra Patel. The concept sparked but there were bumps. Kent opened the second restaurant in Gainesville, Florida 700 miles away from the first one because he had good memories of Gainesville. Three of the first five restaurants failed. But Kent Taylor and the Roadhouse team started to figure it out:

Another idea was to offer free rolls. We played around with giving out popcorn, something for people to munch on immediately, but realized we wanted the smell of rolls to hit our guests when they walked in. If we were going to offer them, though, I wanted to get the recipe perfect. I set my assistant kitchen manager, Rod, to driving all over town to buy as many types of flour and yeast as he could find. We then experimented. Rod and I would try this type of flour with this type of yeast, adding so much water, so much oil, and a dash of sugar and a few other ingredients for good measure. Then we tried again. We also experimented with dozens of variations to proof and bake the rolls. Nothing tasted right. I wanted a fairly sweet roll, but sugar and yeast fight each other, so I needed a flour that would work with both. The process of discovering the best Roadhouse rolls consumed our waking days for three weeks. I’m pretty sure it also consumed Rod’s sleep. He probably dropped off at night counting bags of flour. I was tormenting the poor guy with my relentless pursuit of the perfect roll. Finally, we hit it when we mixed a certain flour with another flour. The mix came together in no time and we created the rolls we use to this day. Our honey cinnamon butter followed a similar process, eventually finding positive results.

Kent had a vision for restaurants that was something like Wagner’s for opera*. He wanted immersive, overpowering. The word Legendary, that’s key. Legendary food, legendary service, legendary margaritas. Texas Roadhouse is full of wood and tin: Kent wanted it loud. Big neon signs on the places are the only advertising. Texas Roadhouses don’t open for lunch** because Kent Taylor envisioned one big, energized shift, almost a performance

We had the chargrills visible to the guests, a meat display case to view our freshly butchered steaks, and you could smell the steaks cooking and the freshly baked bread coming out of the oven. The six senses would come alive for our guests—sight, smell, taste, hearing, and touch. The sixth sense was a feeling of a warm and friendly vibe.

It worked. There are 741 Texas Roadhouse restaurants in 49 countries. The nearest one to LA would be either Rialto or Corona, CA. This makes sense: LA real estate is expensive and Texas Roadhouse knows to their customer every dollar matters. Being involved in the community is part of the business model and the Kent Taylor vision.

On a recent trip down the 10, we stopped at the Rialto location. It was just after opening time (3pm) and there was already a 20 minute wait. It was all there, just as Kent described. Friendly people, country music, wood and tin. The sweet rolls with the cinnamon honey butter are brought to your table as you sit down. Bag of peanuts waiting for you. No server has more than three stations so they’re on top of it. We signed up for the Texas Roadhouse VIP Club beforehand, which merits you a free appetizer: we got rattlesnake bites of course, delicious. Part of the popularity might be the $13.99 Early Dine Menu. You’re getting a steak dinner for under $14. Tried the Legendary Margarita, and it was a lot of fun. By the time we left every seat at the bar was occupied. There were big families, elderly couples, hard-work looking dudes having some cold ones.

Kent Taylor in this book comes through as such a boosterish, positive person that it’s hard to grapple with his end. From The Wall Street Journal, March 2021:

After coming down with a mild case of Covid-19, W. Kent Taylor found himself tormented by tinnitus, a ringing in the ears. It persisted and grew so distracting that the founder and chief executive of the restaurant chain Texas Roadhouse Inc. had trouble reading or concentrating.

Mr. Taylor told one friend he hadn’t been able to sleep more than two hours a night for months.

In early March, he met friends at his home in Naples, Fla., and led them on a yacht cruise in the Bahamas. Some of those friends thought he was finally getting better. Then his tinnitus “came screaming back in his head” last week, said Steve Ortiz, a longtime friend and former colleague.

On Thursday, March 18, Mr. Taylor died by suicide in his hometown of Louisville, KY.

Very sad. But his vision lives on. I predict Texas Roadhouse will continue to succeed as long as they remember the lessons of founder Kent Taylor. He’d seen what happens when you lose that:

The decline of Bennigan’s was another wake-up call to keep our standards sky-high and not slip into corporate-think. Thankfully, our company is run by people who have grown up in actual restaurant operations and many were eyewitnesses to either Chi-Chi’s or Bennigan’s’ demise.

* not that Kent would use this comparison. He preferred: Willie Nelson, Three Doors Down, Keith Urban, Kenny Chesney, Aerosmith, etc. Mentioning who played at which corporate celebrations is a big part of the book

** some of them do open for lunch one day a week, usually Friday or Saturday

March 23, 2024

A lunch in Florida

Not sure we’ve ever seen the kind of shade on a restaurant as Harriet Agnew provides in the latest Lunch w Financial Times, with Nelson Peltz, at his own restaurant:

It’s the proprietor’s prerogative — Peltz’s 19-year-old investment firm, Trian Partners, owns the building and the Italian restaurant is their de facto canteen. Soon the elevator-style music quietens down and we settle at our table on the outdoor terrace

Peltz declines wine – always a bad sign in Lunch FT:

As we begin our starters — slightly flavourless mozzarella and tomato in need of seasoning, with roasted peppers — Peltz tells the story of Triangle Industries, his focus in the 1980s. Fuelled by the junk bonds of his friend Michael Milken, he and his business partner Peter May built it into the largest packaging company in the world, before selling it. They later bought and lucratively sold the Snapple beverage business.

They talk about Peltz’s campaign to win a contested fight for some board seats at Disney (asked if he would fire Kevin Feige, who masterminded like 60 winning Marvel movies, he doesn’t say yes but expresses displeasure):

By now our main course has arrived: filleted snapper in a gloopy artichoke, mushroom, tomato and white wine sauce, served with sautéed spinach.

In terms of lunch, it doesn’t seem billionaires have it that much better. Here’s a link.

March 22, 2024

Publicly traded American restaurant groups

Bloomin Brands (ticker symbol: BLMN) owns Outback Steakhouse and Fleming’s. There were 50 new Outback Steakhouses opened in Brazil since 2021.

There are 3,427 Chipotles (CMG) in the United States, with 97,660 employees. Here’s Slate recently on Chipotle’s dominance:

But despite that backlash, the fact remains that for a lot of Americans, from San Diego to New Haven and everywhere in between, Chipotle has become effectively synonymous with good Mexican eating. When the Wall Street Journal interviewed Mary Hawkins, the mayor of Madison, Mississippi—one of the tiny population centers Chipotle has in its sights—she said the town had recently polled its citizenry about the brands it would most like to see take up residence on its streets. Chipotle, perhaps unsurprisingly, came in first, and Arellano does not see that trend slowing down.

“It’s like Galactus from Marvel Comics. It’s eating up burrito cultures from across the country,” he said. “Chipotle taught an entire generation of Americans to eat a very specific style of burrito. If they want a burrito, they’re going to want the one they grew up with and neglect the other styles.”

McDonald’s (MCD) of course is the king, with 42,000 stores. Here’s Ian Borden, McDonald’s CFO, being interviewed at a UBS conference:

Dennis Geiger

That’s great. Want to go over to core menu. And you just talked about some of the opportunities at chicken I think in particular. As we think about beef, chicken and coffee and some of the biggest opportunities to kind of further your advantages on core menu anything else to kind of highlight there across those key equities?

Ian Borden

Yes. Sure. Well look I talked about core is critically important. 65% of our global system-wide sales, $17 billion brands across that core categories and I think a few headlines under each of those three. Beef obviously we’re by far the largest player in beef globally. We’ve gained share since 2019 pretty consistently across our markets. I think a couple of the key things from an opportunity standpoint in beef. Best Burger which is just a series of what I’ll call small changes in how we cook and prepare our core beef products that’s been out to about 70 markets. It’s going to be in the rest of the system by end of 2026. It’s driving significant improvements in taste and quality. Taste and quality are the two biggest drivers of consumer visits to our restaurants. So that’s impactful.

The second thing on beef that I think is worth highlighting is the opportunity we see around large burger. And it’s a good example of how I think we are more precisely understanding consumer need and then getting after that consumer need and I’ll call it a one-way approach. So we’ve tried to get after this opportunity for a number of years because we thought the opportunity was about premium burger which was wrong. And we — so we didn’t — we weren’t successful. We now understand what the opportunity is for a large more satiating-type burger. That opportunity is significant. It’s consistent across many of our large markets.

And we have innovated a couple of products that we’re in the process of piloting. We’re going to pilot those products in two or three what we call market zeros. We’re then going to — if those products work we’re then going to scale one solution to that opportunity globally where in the past you would have seen us probably try and get after that opportunity in 20 different markets in 20 different ways and then you don’t have the ability to build a global equity that you can drive at scale. So that’s a little bit about beef.

McDonald’s is essentially a real estate company with a system they can plop on the real estate and then turn over to franchisees.

The Darden Group (DRI) owns: Ruth’s Chris Steak House, Eddie V’s and The Capital Grille, Olive Garden Italian Restaurant, LongHorn Steakhouse, Bahama Breeze, Seasons 52, Yard House and Cheddar’s Scratch Kitchen. Until July 28, 2014, Darden also owned Red Lobster. Darden has more than 1,800 restaurant locations and more than 175,000 employees, making it the world’s largest full-service restaurant company. (says Wikipedia). There are 77 Ruth’s Chris and 562 Longhorn Steakhouses.

Brinker (EAT) has Chili’s and Maggiano’s Italian Grill. They’re having a killer year, surprising to me to learn, as the local Maggiano’s is closed and troughs of Italian slop don’t seem in fashion. But my heart still warms at the thought of Chili’s.

Dine (DINE) owns IHOP (1,787 restaurants), Applebee’s (1,654) and Fuzzy’s Taco Shop (137 branches). The local IHOP near me is closing. A few years ago I tried an Applebee’s and was dissatisfied with the experience. I’ve never even seen a Fuzzy’s. As for pancakes, feels like they peaked as a food in like 1880?

Domino’s has 20,197 franchises. Their stock (DPZ) over the last twenty years returned investors something like 2,600% (vs 239% for the S&P 500). The key is the easy to use app.

Restaurant Brands International (QSR) has Burger King, Tim Horton’s, Popeyes, and Firehouse Subs, for a total fo 30,375 franchises. Noted investor and Harvard administration gadfly Bill Ackman has a big position in QSR, as well as Chipotle. In his recent Lex Friedman podcast he noted that some of his biggest wins have been in restaurants.

Shake Shack (SHAK) has expanded very fast, they now have 440 stores. I remember going to the very first branch in the summer of 2009, before starting my new job on 30 Rock. Who was in line behind me but Scott Adsit?!

Texas Roadhouse (TXRH) is booming, returning 738% for investors since founding. The story of founder W. Kent Taylor is worthy of its own post, when I have the time. I listened to a couple podcasts, one with Jerry Morgan, current CEO and one with VP of communications Travis Doster, and they project a “fun with purpose” coherent and vigorous company culture inspired by Kent Taylor’s vision.

Starbucks (SBUX) has 10,628 company owned stores and 18,216 licensed. Personally I consider that a drug dispensary rather than a restaurant.

Wendy’s (WEN) has 7,095 restaurants worldwide. Their new CEO Kirk Tanner made some noise recently with his comments about AI order-taking and flexible pricing, which the company then walked back. It sounded kinda fun to me (what if you could get a deal at an off hour or something) and made for many a meme. Wendy’s big play at the moment is expanding into breakfast.

Wingstop (WING) is growing fast: 1,996 restaurants. The stock has doubled in the last year. The people love wings!

Yum Brands (YUM) with KFC, Pizza Hut, Taco Bell, and Habit Burger is on another level. They opened 4,754 new units last year.

Jack in the Box (JACK) swallowed Del Taco a few years ago. Here’s CEO Darin Harris speaking about the culture of servant leadership. I like what I hear!

New York hot dog chain Nathan’s and Chicago hot dog chain Portillo’s are both public companies, NATH and PTLO respectively. I’m not bullish on the future of hot dogs myself.

I’ve never seen a Kura Sushi, but some investors appear to be optimistic about the technology-enabled Japanese sushi concept – the stock (KRUS) is up 41% this year.

Casey’s (CASY) runs some 2,500 gas station pizza joints in the Midwest. The Casey’s in Corning, Iowa was the only place to eat one Sunday night last summer. It was not bad at all!

Flanigan’s is a Florida chain famed for their dolphin sandwich (don’t stress, it’s actually mahi mahi). Why it’s publicly traded doesn’t make sense to me, but there you go.

Some amateur investor types love Rick’s (RCI), a chain of strip clubs, on the thesis that it’s kind of hard to launch a new strip club, as nobody wants ’em in their neighborhood.

Anyone been to a Chuy’s (CHUY)?

On May 31, 2001, then President George W. Bush’s twin daughters, Jenna Bush and Barbara Bush, were cited for using fake IDs at the Barton Springs Road Chuy’s, which put Chuy’s in the national spotlight

Next time in Austin maybe.

And of course, Cheesecake Factory (CAKE), much mocked, but enduring.

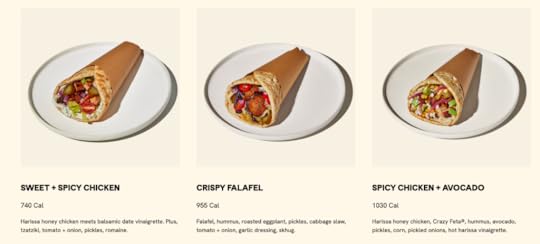

CAVA is a new Mediterranean restaurant concept from the East Coast. A new one appeared here in LA and I tried it. Kinda salty?

The stock seems to excite investors, possibly because everyone is looking for “the next Chipotle.” Appears to be up 5% just today! I checked in with one of my Vibes Reporters:

i have had cava once. ok but didnt feel the need to go back

Kinda how I felt? The pita chips are fun. I just don’t think Mediterranean food will have quite the appeal of Chipotle.

Sweetgreen (SG) is a salad deal, I’ve tried that one. Somehow, I always feel gross afterwards.

On the other end of the spectrum is Cracker Barrel (CBRL) serving Southern-inspired slop to old people. Valueline reports:

Macroeconomic factors have impacted Cracker Barrel Old Country Store’s sales. Elevated inflation, though now apparently easing, has stressed the company’s customers. Many of these customers are in the 65-and-older demographic, commonly characterized as a fixed-income category. Management is working to bring in more of a younger crowd into Cracker Barrel restaurants and in-location retail shops,

Good luck guys, but this looks to me like the past, not the future:

Then again, Cracker Barrel has (had?) their loyalists:

From 1977 to 2017, married couple Ray and Wilma Yoder drove a combined total of more than 5 million miles (an average of 342 miles per day) to visit 644 Cracker Barrel locations. When the company opened their 645th restaurant, in Tualatin, Oregon, in August 2017 (on Ray Yoder’s 81st birthday), it flew the Yoders out for the grand opening and presented them with custom aprons and rocking chairs, among other gifts.[52][53]

Yoshiharu (YOSH) is a Southern California ramen concept I have yet to try. There’s also Noodles & Company (NDLS). Why is their ticker symbol not NOOD? The noodles game seems too competitive to me, talk about low margins.

But then again look at the big winners here: MCD, DPZ, CMG. Burgers, pizza, burritos. You couldn’t come up with businesses with more competition, no barriers to entry. And yet these three systematized delivery and managed quality control in such a way as to create unstoppable empires.

I began this post as I was reading Value Line’s restaurant issue and enjoying contemplating the massive scale of these restaurant chains. As an occasional restaurant consumer I can engage with these places and sense their vibe, it’s a sector I can know in a way I can’t know, say, semiconductors or industrial products. So it’s an engaging, practical and delicious topic for our continued education in business.

Restaurant Business might be the next frontier to explore. They have a daily podcast!

Growing at exactly the right pace and to exactly the right size seems like the key for restaurant stocks. On his Invest Like The Best podcast, Patrick O’Shaughnessy interviewed Capital Management’s Anne-Marie Peterson. She talked restaurants:

So restaurants are different from retail because it’s not as easy to scale. There aren’t a bunch of large cap restaurant chains unlike retail. The franchise model is pretty powerful and what Chipotle has done is pretty powerful, too. But the similarities are like real estate matters, the store experience matters. But in a tight labor market, it’s tough.

And what’s interesting about McDonald’s — I have such an affection for that company. It works everywhere. They have one concept. I think it’s 60% or 70% of their operating income is from rent. They’re a landlord. They control the real estate. The others didn’t, so that’s why they’ve endured. They had a big insight about like let’s own the real estates so our franchisees don’t get whipped around with pricing, and we can co-invest with them in the experience.

And now digitals. The mobile ordering is enhancing the productivity and reducing even those kiosks. That need for labor and in a tight labor market, it’s big. The little guys can’t invest. They have some external dynamics now that are contributing to scale. But it’s really interesting.

Rory Sutherland brought up McDonald’s automated screens on Rick Rubin’s Tetragrammaton podcast. He wondered if they might allow for customers to make certain shameful orders they feel bad about saying to a person. I’ve tried out the automated screens, they work great at getting you your junk, but they make the world a little less human.

Remember when Eric Schlosser’s book Fast Food Nation came out in 2001? Absolutely everybody seemed to be reading it. They even made a movie (pretty good! Richard Linklater). Yet here we are, almost twenty five years later, eating more fast food than ever.

I was reading The Lorax to baby and it reminded me of Schlosser.

Here’s a more comprehensive list of restaurant stocks as I’ve skipped a few, notably Denny’s (DENN, slumping), Red Robin (RRGB, hopeless), El Pollo Loco (LOCO, stop trying to make citrus-marinated chicken happen), BJs, a few others.

“Treat” shops such as Krispy Kreme are beyond the scope of this post.

March 20, 2024

Black Swan vs Sarco

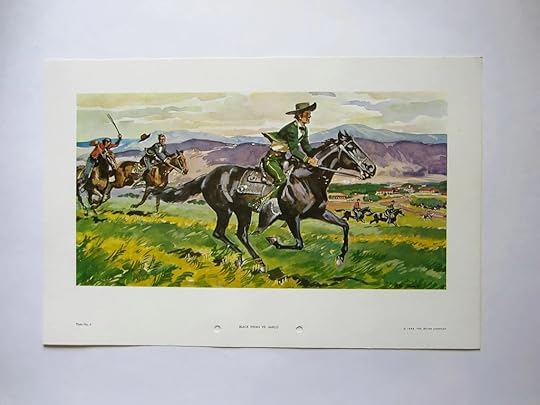

Black Swan was a mare, a horse in Australia whose reputation reached Jose Antonio Andres Sepulveda all the way in California.

The Sepulveda family was Southern California aristocracy, landowners whose holdings ranged from what is now Newport Beach to Santa Monica.

Sepulveda bought Black Swan sight unseen and had her sent to San Francisco:

When the fragile creature stepped off the gangplank in San Francisco in late 1851, along with her traveling companion, a gray gelding named Ito, she was unsteady, gaunt and sickly. Onlookers were not impressed.

Sepulveda turned the horse over to Yankee trainer Bill Brady.

Communicating with his gentle touch instead of force, Brady took her over winding paths, carefully avoiding sharp stones and other hazards that might injure her.

As he waited, Sepulveda hatched a plan that turned into a bonanza. His purse was still fattening with the enormous profits he began reaping three years earlier, when the discovery of gold had driven up the price of beef, and he delighted in racing and gambling.

Sepulveda challenged Pio Pico to pit his stallion Sarco in a race against Black Swan.

[Sepulveda] made sure that a crowd, among them Pico, was in Los Angeles when Brady rode into town on Black Swan. Seeing the mangy and emaciated mare only confirmed Pico’s and his cronies’ opinion that the majestic, cinnamon-colored Sarco was invincible.

Recklessly, Angelenos wagered their life savings on Sarco. Carrillo family members bet their last $400. The total bet in the $50,000 match race: $25,000 each in octagon-shaped gold slugs, in addition to 500 horses, 500 mares, 500 heifers, 500 calves and 500 sheep.

Sepulveda, Brady and Sepulveda’s son-in-law, Tom Mott, had three months to condition Black Swan. While building up her weight, they exercised her with discretion, running her after dark when no one could see her.

Pico and his hard-core betting pals were confident that Sarco was the better horse and therefore needed no training–an unbeatable mount, powerful and ready for a race at any moment.

As the date–March 20, 1852–drew near, the excitement and the bets grew higher. The Avilas and Duartes, who were friends of Sepulveda, bet a “bottle of brandy, two broken horses and $5.” For others just as low on cash, every animal imaginable–cattle, horses, goats, pigs, chickens–was fodder for a wager, along with land and furniture.

Families from as far away as San Francisco and San Diego arrived for the race, which began at what is now 7th and San Pedro streets.

The track extended 4 1/2 miles south to a wooden stake, where the horses and their riders turned around and headed back to the start.

Springtime mustard plants growing 10 feet tall lined the roadway, making it difficult to see. Bystanders stood in their wagons and climbed trees, gates and rooftops of the occasional house.

As the tension mounted, Sepulveda’s wife, Francisca, arrived in her carriage, holding a fortune in gold coins. Unwrapping her handkerchief, she ostentatiously handed each of her servants and many bystanders a shiny $50 gold piece to bet on the race.

A gasp of astonishment went up when Black Swan appeared, no longer looking like a sickly nag, but sleek with a shiny blue-black mane. Mounted on her back, sitting in a lightweight English saddle, was a small black man, dressed in bright clothing with a small cap turned backward on his head. Atop Sarco sat a hefty Mexican youth in a heavy Western saddle.

…

With so many animals made nervous by the crowds, the starter began the race not with a gunshot but with the cry of “Santiago!”

Sarco jumped out to an early lead, and all those betting on him breathed a sigh of relief. Many leaped to their own horses and followed, tearing through the mustard plants. But the fleet horses soon lost them, and the spectators headed back to watch the finish.

Frenzy gripped the crowd at the halfway mark when Black Swan pulled ahead. Sarco strained every muscle to keep up with the speedy little foreigner.

Nineteen minutes, 20 seconds from start to finish, Black Swan crossed the finish line five lengths ahead. She was bleeding from her nose and flanks from the spurs, and foaming from her mouth.

Racing fans stood around in stunned silence, as others broke down and cried. While Sarco tasted his first defeat, Black Swan, in her moment of triumph, wiped out entire family fortunes. The race contributed to the downfall of Pico, who lost $25,000 and who, more than four decades later, would die penniless.

All that from a 2001 LA Times piece by Cecilia Rasmussen. Not sure her sources, they sound vivid!

The Bowers Museum has a portrait of Sepulveda riding Black Swan:

Sepulveda’s son-in-law and a witness to the race wrote later that not much of it could be seen except for the start and the finish because the wild mustard plants stood ten feet high on both sides of the road. Soon after the race Sepulveda took Black Swan to El Refugio, the elaborate adobe home and acreage he had purchased from Domingo Yorba about 1854. El Refugio was located near present day First and Sullivan Streets in Santa Ana. It has been said the family used to feed the horse sugar from the veranda.

A walk beginning at Seventh and San Pedro might be one of the worst nine mile explorations you could make in LA, that’s the butt end of Skid Row.

The poet Fred D’Aguiar took the race as

For the Unnamed was originally entitled ‘For the Unnamed Black Jockey Who Rode the Winning Steed in the Race Between Pico’s Sarco and Sepulveda’s Black Swan in Los Angeles, in 1852′. That title provided the full narrative in a nutshell: we know the names of the owners of the two horses, we know the horses’ names, the place and date of the race. But apart from his colour, and his victory, we know nothing about the jockey who made the whole thing happen.

(cheers to reader Raj V for putting me on to this tale).

March 19, 2024

Scale

Sometimes I’m struck by how jarring a transition in scale has occurred in human life in the last few hundred years. Sure, there’ve been all kinds of massive changes in information speed, travel speed, etc. But don’t ignore simple scale of size. What was considered a big, grand, monumental building in 1776 is now dwarfed by even a mundane office building. Or take the Rainier Club in Seattle:

A good list to review:

https://en.wikipedia.org/wiki/List_of_tallest_structures_built_before_the_20th_century

March 16, 2024

New Podcast

We’ve discussed the book of Mark in the past. Probably (?) the oldest gospel, it’s not very long, about 11,000 words. It was written in Greek, which was a second language to many of the people encountering it. So the language is simple. It tells the story of the life, teachings, and death of Jesus. A sort of afterward that was possibly tacked on later adds a bit about the resurrection.

Much to consider, in short. I teamed up with my pal Brett Vanderzee, pastor of The Springs church in Edmond, Oklahoma to discuss this book chapter by chapter in a new podcast. I try to take a look at the book as a narrative/story, and figure out why this story keeps getting told 2,000 years later. Brett comes at it from a deep background in Bible study. Along the way we have a number of interesting guests from the worlds of both Hollywood and Bible scholarship. Join us won’t you?

Available on Apple podcasts and should be up wherever you get podcasts (some listeners report they can’t find it on Spotify, looking into it).

And do rate and review if you enjoy!

https://podcasts.apple.com/us/podcast/episode-1-mark-1/id1734809962?i=1000648968238

March 12, 2024

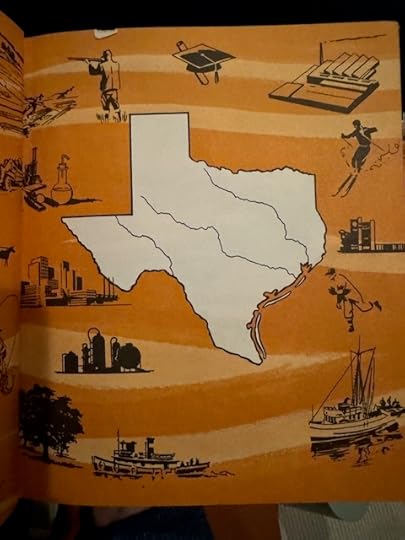

Texas

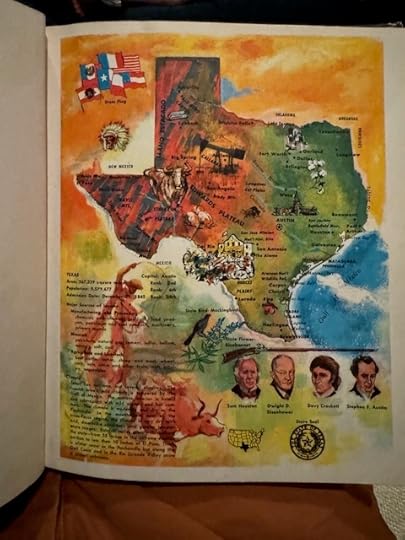

Can you name these major rivers of Texas? from this excellent book my wife got at the thrift store:

I’ve been reading it to my daughter (she finds it somnolent).

Pretty map:

March 11, 2024

S

In the book’s preface, Smil writes that most growth processes—“of organisms, artifacts, or complex systems”—can be plotted on a so-called S-shaped, or sigmoid, growth curve, meaning that the rate of change increases slowly at first, then increases rapidly, then levels off. An error that humans make with similarly predictable regularity is to assume that the nearly vertical middle segment of an S-shaped curve can continue at that angle indefinitely (the price of Dutch tulips in the seventeenth century, the price of bitcoin in the twenty-first). One of his conclusions is that the steady, unceasing economic expansion that economists and politicians dream of is not sustainable, and that the relentless pursuit of growth is environmentally disastrous. Smil has often said that he doesn’t make forecasts—“a pathetically and inexorably ever-failing endeavor on any level,” he told me—but predictions of a kind are implicit in much of his work. In “Growth” ’s coda, he writes, “Continuous material growth, based on ever greater extraction of the Earth’s inorganic and organic resources and on increased degradation of the biosphere’s finite stocks and services, is impossible”—a principle that, in various forms, animates almost all his work, beginning with his undergraduate thesis.

from The New Yorker’s profile of Vaclav Smil. I got much value from his book on natural gas, still working on How The World Really Works.