Christopher Steiner's Blog, page 2

November 14, 2017

The Top 10 Ski Resorts In North America For 2018

A fresh reworking of the PAF for a new season.

For most skiers, there is a touch of mystery preceding every ski season. The perennial ‘where to ski?’ question evokes the Internet sleuth in all skiers. Research and scouting is as much a part of the ski trip as the gear, the lodging and the weather watching.

It’s all part and parcel to the skiing experience. It’s something that beginners, experts and all those in between can enjoy with the same zeal.

Skiing gives us a way to embrace winter, a season derided by those who haven’t found their way to a silent stand of powder in the trees, a groomed cross-country trail in the woods, or that perfect game of pond hockey.

Those who have made it here to read this, however, know winter’s charms. Ski trips, we all know, are the best trips. But, again, where to go skiing?

This piece and this list will help skiers find answers to that question that has dogged the world since the dawn of the chairlift.

Further down, readers will find our top 10 North American ski resorts ranked for 2018. For the a complete ranking of more than 200 ski resorts in North America, skiers should consult ski trip booking site ZRankings, which crunches the numbers behind this list.

Parents: see the family ski resorts rankings.

Ski geeks: see ZRanking’s ski resort snow rankings.

Texans may want to check out our special list for skiers traveling from Texas.

As those who have read past versions of this list know, we rank ski resorts using an exacting measurement known as the Pure Awesomeness Factor.

PAF scores are the product of an algorithm that has been continually honed for nearly a decade. The inputs to that algorithm include a ski resort’s terrain, snow profile (quantity, quality, dependability), town ambience, ease of travel, lodging base, acreage, continuous vertical, plus the personal experiences of the ZRankings crew stationed out on the snow across the continent.

Heed the PAF. It guides all skiers toward enlightenment.

As always, our perspective on snow is helped along by input from Bestsnow.net’s Tony Crocker, who, unequivocally, knows more about snowfall at ski resorts in North America than any other person alive today.

Before diving into the rankings, we’d be remiss if we didn’t comment on last ski season, and the wild offseason that comprised the spring and summer of 2017.

Busy offseason, changes for skiers coming in 2019

As off-seasons go in the ski industry, this past summer’s was one of the more consequential. Just as the ski world had grown used to a single dominant company—Vail Resorts—whose reach seemed to expand with every year, there are now two of these companies.

A yet-to-be named company, fueled with cash coming from two entities—KSL Capital, a private equity company out of Denver, and the Crown family of Chicago, which controls Aspen Skiing Co.—made several purchases in an effort to form a rival to Vail. Its first was to buy Intrawest’s catalogue of ski resorts that included Winter Park, Steamboat, Mont Tremblant and others. After that, the company closed on Mammoth Mountain, California’s stalwart, along with Deer Valley and a smattering of smaller resorts that came along with those acquisitions.

The result is a resort colossus that doesn’t quite measure up to Vail, which earlier this year bought Stowe, but is in the same weight class.

Although Aspen’s four mountains are not part of the new company, it is expected that they will participate in a new umbrella ski pass for 2018-2018 that will compete with Vail’s Epic pass. It’s not yet known—probably by anybody—if Aspen will remain in the Mountain Collective, which to this point has been the main market counterweight to the Epic Pass.

This could be a win for skiers overall, but the development will likely continue a trend that has made things harder (more expensive) on skiers who take one big trip a year. The new resort company is following the blueprint created by Vail Resorts, which sold 600,000 Epic passes last year, which steers skiers toward buying a multi-mountain pass rather than single-day lift tickets, which are now approaching $200 at marquee Vail mountains. That works well for people and families taking multiple trips, but it can be hard to make the math work with a single trip of four to five days of skiing.

Last season – big snow totals in California, Wyoming

California does as only California can. The ski resorts of the Sierra continued to bolster their already-large standard deviations when it comes annual snowfall with a monster season that comes just a couple of years after a string of drought winters that left many major resorts closing early. Mammoth Mountain had to close lifts on more than one occasion because of the odd and wonderful problem of having too much snow.

Colorado’s season started off quickly, with a banner January that kept the slopes well clad in snow all the way through spring break into April.

Utah got its mojo back, with a big season all around. Skiers who happened to be around for Park City’s Sundance Film Festival—a great time to ski, as nobody is on the slopes—found themselves buried in 40 inches or so across a week.

Jackson Hole notched another good snow year, and it is showing itself to be a good outlet for dependable snow for the holidays.

The preamble has ended. Those who have read previous years’ versions of this list know what follows. It’s the product of going to places, skiing them and reporting back. It’s a simple formula that yields what we believe to be exquisite results.

These are the top 10 ski resorts in North America for 2018:

Jackson Hole, our 2018 No. 1 resort, provides both a raw and refined experience. Credit: Shuttershock.

1. Jackson Hole – PAF: 99.0

The stalwart of our rankings holds the vanguard position once again. Jackson can’t be denied, not after a banner winter that dumped 593 inches of snow, with a peak snow depth that reached 158 inches on the mountain, a record.

In addition to the fortuitous run of storms last season, the resort managed to improve on itself in a major way, opening the Sweetwater Gondola, which grabs skiers at the base, ferrying them up toward the tenderloin of Jackson’s intermediate terrain, most of which centers on the Casper Restaurant.

The new gondola greatly relieves what could be a pressure point on busy days in Jackson, when lines for the Tram and the Bridger Gondola could grow to the point of looking rather onerous. The new lift has absolved these troubles, and it keeps many skiers who prefer mellower blue runs off of Sundance, a trickier blue run that was previously the most popular route for those debarking from the top of Bridger Gondola to get to the Casper area.

The resort plans to build more infrastructure around the new gondola, including new installations for ski school and beginners further up the mountain, at the gondola’s mid-station, which will free beginners from being tethered to the absolute bottom of the resort. Those facilities will open during the winter of 2018-2019.

As great as all this building and self-improvement has been, along with the bumper crop of storms, the resorts still retains its most valuable asset: its steep countenance of terrain, etched into the Tetons in a way that exhorts skiers to point their skis down, and to be quick about it.

Jackson is a place that, more than any other in the United States, lets skiers barrel down the mountain without a care of running out of room. By the time a skier has reached the bottom of Jackson’s 4,139 feet of eminently continuous vertical, she is quite ready to step through the doors of one of its red tram cars, if just for a quick respite, to ride all the way to the top once again.

It doesn’t take long before the tram is passing the notch in the rock that forms Corbet’s Colouir, its north-facing snow almost always in the shadows, staying chalky for those who brave its keyhole entrance, the difficulty of which greatly varies with the year, the snowpack and the direction of the wind the night before. For those doubting the softness of the crux, it’s never unwise to listen to somebody else’s skis pass over it first—if a candidate can actually be found among the gapers bunched at the top of the run.

Those who skip this famous test will have plenty of other chances to find personal glory, from the wide shots in Herbie’s Bowl to the well-spaced trees of Washakie Glade off of the Teton Lift.

Jackson is a place that seems a bit wilder than other mainline resorts. But have no doubt that this is a playground for all kinds. Jackson inhabits a quirky niche where billionaire luxury—the ranches here are worth hundreds of millions, and there is a Four Seasons installed at the base—crosses with a crusty local skier culture that can only take root in a place where the terrain and snow prove so fertile.

Many places have one, but not the other. Jackson in a curious way that is all its own, has both. And that is why we love it.

Where to stay: Skiers can never go wrong at Hotel Terra—a 100-foot walk from the Mangy Moose (key information, this).

Where to eat: Persephone Bakery is good for a shot of espresso and some pie. Eat it.

Where to shop: Based in Jackson, Stio is a outwear brand that has been clawing its way up through the competitive world of shells and down fill. Browse its superb lineup at its flagship store in town.

The snow is almost always good at Alta.

2. Alta – PAF: 96.87

Alta is at once a time machine and a utopia that evokes what skiing was, and what it always should be. A quick look around at Alta tells skiers—there are no snowboarders here—that this place is different. Snow cakes everything here, from the road signs to the vertical rock faces.

Alta is one of the few ski resorts in order to America that feels decidedly like the Alps, but with far more snow. There’s a rawness to the experience at Alta that, along with its best-in-the-world snow conditions, make it a unique destination for skiers.

What sets out apart everywhere, and what keeps it toward the top of this list year after year, is snow. Let this be clear: Alta gets more high quality snow than anywhere else—an average of 521 inches per year, with 51% of its months averaging more than 90”, an absurdly good ratio.

Yes, there are winters when Mount Baker or even spots in the Sierra get more snow, but the snow isn’t the same quality of stuff that falls at Alta., which gets the dry Rocky-variety snow that often eludes the coastal ranges of the West. In addition, Alta’s snow, and Utah’s snow in general, comes with a high degree of consistency.

The standard deviation of the mean snow year at Alta is quite low, whereas the standard deviations—and hence the threat of a real drought—is far higher at ski resorts with big average snowfall numbers in the Sierra and Pacific Northwest.

Consider that only 2% of winter months bring less than 30 inches of snow to Alta, compared with 25% at Squaw Valley.

Quite simply, Alta—properly pronounced ehl-tah, rather than ahll-tah, is the best place to ski for those who are focused on that one seminal factor: snow.

But Alta wins elsewhere, too. Skiers should count themselves lucky that the excellence of Alta’s snow is nearly matched by its terrain. Tree shots, bowls, and hidden lines pepper Alta’s acreage. To learn of all this ski resort’s gems is a decades-long endeavor.

For the intrepid, there is almost always a steep line of cold powder snow to be found somewhere at Alta. It might take a lot of sidestepping and a shimmy or two over some exposed scree, but good skiing—interesting skiing—and legitimate steep skiing can always be found at Alta.

Where to eat: Get the bison ribeye at Shallow Shaft Restaurant.

Where to stay: Alta’s Rustler Lodge has a location that, for skiers, is superior to all others in North America.

October 4, 2017

With The Swab Of A Cheek, This Company Knows When You’re Likely To Die

Jon Sabes’ GWG Holdings has plans to disrupt the life insurance industry.

The $635 billion life insurance business revolves around a staid set of practices that haven’t evolved much in 40 years, even as technology has upended so many other industries. The big inputs for writing a policy have remained the same: a simple questionnaire, results from a trip to the doctor, and a mortality table.

Human lives continue to last longer, but life expectancies, as an average, are easy to track. They change slowly, and certainly don’t require AI for analysis. But that’s because companies that work in the life insurance business—all sides of it—are typically only worried about the averages. They’re almost never examining their customers one by one on a granular basis.

One company in Minneapolis, however, has been seeking an edge on the rest of the market by trying to use predictive technologies based on a field called epigenetics to predict when, a given person may die. The science isn’t based on the genes a person is born with, but on things called methyl groups that may attach themselves to genes according to a person’s lifestyle—diet, sleep, exercise, stress. The data reveal something of an expiration date for a person, and it can be uncannily accurate.

That one of life’s great secrets—when will death come—has been pried open via cutting edge biotech methods by those who play in what is one of the most steady, and boring, industries around is an irony not lost on the man leading the charge.

“I would like to create Silicon Valley’s answer to the insurance industry,” says Jon Sabes, CEO of Life Epigenetics. “Epigenetic science will be the baseline for all of the predictive analytics in this space.”

Sabes started the parent company to Life Epigenetics, GWG Holdings, 11 years ago with $200 million in institutional investor money with the goal of building up a portfolio of life insurance policies by buying them from people who want to cash out or can no longer afford the premiums. GWG now holds $1.5 billion in policies. The company continues to pay premiums on the policies, and collects when the person for whom the policy was written dies.

GWG sells bonds and other financial instruments to investors based on expected outflows from the policies it holds. The shrewder the company can be when buying policies, the more margin it can create for its shareholders. GWG pays far more than insurance companies offer policy owners for their own policies. In the first quarter of 2017, the company paid $23 million for policies for which the original insurance companies had offered only $1.3 million. Insurers are generally loath to buy out policy owners, and therefore don’t pay out near what an economist would determine as the current value of a policy. Insurance companies would prefer that policyholders stay on, raising the likelihood of default.

Even at the prices GWG pays for policies, their business is a fairly lucrative one. The company is picky about what policies it buys; it examines nearly 4,000 policies per year. But after spotting a Nature article on the field of epigenetics in 2015, Sabes thought his company could get even smarter about which policies to buy.

August 22, 2017

Deer Valley Gives New Ski Resort Group A Utah Anchor In Its Quest To Challenge Vail

Deer Valley, located in Park City, Utah, is a premier luxury ski destination. Credit: Shutterstock

Deer Valley, the upscale Utah resort regarded as one of the industry’s best operators, is the latest acquisition of the new ski resort group fronted by money from Denver’s KSL Capital and the Crown family, which owns the four Aspen area ski resorts.

It gives the yet-to-be-named company a vital anchor in Utah, and a direct counterweight to Vail Resorts’ Park City. Deer Valley and Park City actually share a boundary line, where Park City’s McConkey’s lift summits very close to the Empire Express lift of Deer Valley.

It’s another remarkable coup for the new company, which had already paid $1.2 billion for Intrawest, whose major ski resorts include Winter Park and Steamboat, and the company that owned Mammoth Mountain, the largest ski resort operator in California that has a large and loyal base of Southern California skiers.

KSL, a Denver private equity group that previously owned Squaw Valley, which has now been rolled into the new company, is following a blueprint drafted by Vail Resorts, which has used its broad base of top-tier ski resorts—Vail, Whistler, Park City, Beaver Creek, among others—to offer a popular season pass that covers all of its mountains.

The Epic Pass has proven quite popular at $859. Sales of the pass, which eclipsed 600,000 last year, have helped propel Vail Resorts’ stock price up nearly 300% during the last four years. The company is now worth $8.9 billion.

For the upcoming season, the KSL resorts will stick to existing covenants, and season pass deals will remain roughly the same as last year. Those mountains that belong to the Mountain Collective—Mammoth and Aspen—will remain part of it. And former Intrawest resorts in Colorado—Winter Park, Steamboat—will still be part of the Rocky Mountain Superpass.

It’s the following winter, 2018-2019, when things should get interesting for skiers. It’s worth noting that the four Aspen resorts are not part of the new company, so an agreement will have to be struck between KSL and the Crown family if they’re to be part of a new pass.

Assuming that Aspen somehow gets folded into a new pass, it would be a formidable challenger to Vail’s Epic Pass, with major properties in Colorado, California and Utah.

May 24, 2017

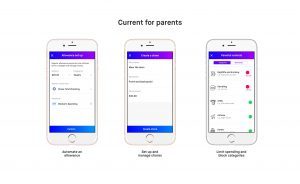

With Current, Parents Can Give Kids Money With Digital Strings Attached

Money… with strings.

Technology will soon solve the seemingly intractable dilemma of teenage driving that pits convenience against hazard: 16-year-olds are bad drivers, but it’s no fun being their chauffer. When Silicon Valley delivers self-driving cars to the public, parents will gain the convenience of letting their children drive without actually letting them do it.

Stuart Sopp wants to solve another one of those dogged riddles for parents: just how to give kids money—just enough—with true control and transparency on how it’s spent. Some parents still dole out cash allowances, some use re-loadable gift cards, and others find themselves handing over their own credit cards to sons and daughters with undeveloped prefrontal cortexes who would buy $50 of Sour Patch Kids given the chance.

Sopp’s Current, which has raised $3.6 million, allows parents to give children a debit card that draws straight from the parent’s bank account. Using the Current mobile or web application, parents can set limits on spending, and can automatically replenish the cash available to their child. Adults can receive push notifications on all purchases or just on those from certain stores. The card allows for ATM withdrawals, but those can be turned off.

Also through the app, parents can ban spending at specific stores, or they can make off-limits whole categories of stores, such as hotels or hookah shops.

For parents: fine-tuned control.

Banks aren’t interested in solving this problem, with good reason: kids don’t spend a lot, and when they do spend, they tend to do it in little increments: like 99 cents for a donut or $3.25 for a sugar-filled coffee shake at Starbucks. Current plans to make money by charging parents $3 per kid’s account per month.

“We’re unbundling the bank experience,” Sopp says, “by providing services and experiences that the bank doesn’t.”

May 3, 2017

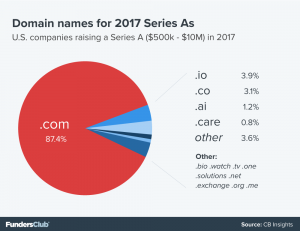

Most Startups Still Believe They Need A Dot-Com Domain, But That Is Changing

The latest Series A funded companies still heavily favor dot-com domains. But it’s different at Y Combinator.

Nearly every startup founder has undergone a torturous process that invariably includes whiteboards, hours of late-night bantering sessions, and days spent typing potential domain names into a browser. Even with all of that, startups often end up with names unfit for their industry or their purpose.

Why do lucid, reasonable people end pinning their companies with ridiculous monikers? Because most people feel that owning a dot-com domain for their company is non-negotiable. With that in mind, founders shoehorn their companies into all kinds of domains and names to make the dot-com requirement work.

Is this wise—would it be better to leave the desired dot-com domain to the squatter who is sitting on it and simply go with desiredname.io or some variation thereof?

There are differing opinions on this, and there are some indications that overall attitudes—which once tilted toward dot-com at any cost—are beginning to change.

Some people, including Paul Graham, who , still think that startups should prioritize getting a dot-com domain.

Not having a dot-com, he wrote back in August 2015, “signals weakness.”

He re-endorsed that point of view to me, via Twitter, recently. He added that a dot-com domain is probably even more important for SaaS and b2b companies because their mission is to look as legitimate as possible in a business setting, which is harder to do from an alternative domain.

Candace Caldwell, who leads up naming at Simple Truth, a creative marketing agency, thinks that startups are better off finding a memorable name that makes sense and fits the company’s business, even if it means settling for an alternative domain extension such as .io or .co.

At FundersClub, we dug up the domain names of U.S. companies that have landed Series A funding of between $500,000 and $10,000,000 during 2017. With the help of CB Insights’ database, we determined that 87.4% of this cohort had settled on a dot-com domain. That data is offered with my added comment that some of these names weren’t intuitive or subjectively good, they clearly had been conjured as a way to get a dot-com URL.

The stats at Y Combinator are a bit different, however.

You can see the downward progression of dot-com domains at Y Combinator in a piece at FundersClub. We also graphed out all the domain extensions for the Winter 2017 batch at YC.

April 19, 2017

Independent Ski Resorts Now Acquisition, Partnering Targets For Aspen, Vail

Oregon’s Mount Bachelor could be a partner for Aspen or Vail.

The focus of the ski resort merger and acquisition saga now shifts to the alpha resorts who aren’t part of either of the two major skiing conglomerates. Among others, that list includes Jackson Hole, Telluride, Snowbird, Copper Mountain, Mt. Bachelor and Sun Valley.

Aspen Skiing Company’s move to join up with private equity shop KSL Capital and buy Intrawest and its six ski resorts, including Steamboat and Winter Park, startled an industry that has seen Vail Resorts’ supremacy unchallenged for more than a decade. Vail had built a seemingly un-matchable portfolio, adding flagship resorts such as Heavenly, Park City and Whistler-Blackcomb to its ranks.

But now Vail has a true rival—one that is just as hungry to expand its resort umbrella across more key properties. Following Aspen’s $1.5 billion purchase of Intrawest, industry watchers immediately focused on the most coveted ski resorts that remained independent. Aspen struck quickly, snaring perhaps the best single property on the board in Mammoth Mountain, California’s behemoth resort that is the No. 1 big mountain destination for skiers in Southern California.

The move will give Aspen an edge in wooing Southern Californians to buy a season pass that covers all of its resorts—something that many expect to be made available for winter 2018-2019. Vail Resorts, which has successfully marketed its Epic Pass to skiers across the country, selling 650,000 last season at prices from $600 to $800, will still hold the edge for Northern California skiers, with three mountains in the Tahoe Region: Heavenly, Northstar, and Kirkwood.

The goal for both companies is lure and lock up lucrative destination skiers from across North America. Most coveted are skiing families who take more than one big trip a year, perhaps one at Christmas in Park City and one on spring break in Aspen. A family that buys Vail’s Epic pass would likely take all of its ski trips to Vail Resorts’ properties, bringing along all the revenue that comes with: lodging, ski rentals, meals and ski lessons. With its new collection of resorts, Aspen will be seeking the same effect.

As the two companies vie for skier dollars, there remain other interesting pieces available, among them two smaller independent collections of resorts, Powdr Corporation and Boyne Resorts.

Powdr’s ski resorts:

Killington, Vermont

Pico Mountain, Vermont

Copper Mountain, Colorado

Eldora Mountain Resort, Colorado

Mt. Bachelor, Oregon

Soda Springs Moutain Resort, California

Boreal Mountain Resort, California

March 7, 2017

The Flourishing Startup Making Skis At 10,000 Feet In Colorado

Wagner designs the skis, but customers often supply the art.

There have always been entrepreneurs nipping at the edges of the ski industry, trying to find ways to fit in, to merge their preeminent passion and their professional life into one. It’s the ultimate ski bum-turned serious person fantasy.

With so many people pursuing this track, we get outerwear brands that pop up and disappear almost annually, a new kind of ‘healthier’ energy bar on a weekly basis, and dozens of new players producing ‘revolutionary’ insulating layers every ski season.

It’s not incredibly difficult, apparently, to contract a factory in China to make a new brand of polyester underwear.

But hardware is tougher. Skis, boots, bindings, snowboards, goggles, helmets—the lineup of serious manufacturers in skiing doesn’t change much. If anything, it has consolidated, as once-independent brands have been merged and rolled up.

There’s a significant amount of domain knowledge equity required to make a binding, a boot, a ski. Distributing hardware is difficult, too. The selling cycle is longer; consumers don’t replace their skis every year.

There’s a newer cast of custom ski makers, however, who have found traction with their craft and enough willing skiers who want a ski or board that was shaped and built just for them.

Almost all of these upstarts can trace their heritage to Pete Wagner, a mechanical engineer, who, in a dingy building outside of Telluride 11 years ago, started using the kinds of tech and advanced manufacturing that first permeated the golf industry—Wagner once worked for Penley Sports, a maker of high-tech shafts for golf clubs—to make a better ski.

February 17, 2017

The Best Summer Internship For College Students: Working For Nobody

The best gigs don’t come from job fairs. Photographer: Patrick T. Fallon/Bloomberg

The title of this piece isn’t entirely accurate. The best summer internship isn’t the one in the employ of nobody, but in the employ of the student herself.

For students, there are five ways to attack the summer:

1. Summer school – keep earning those hours, get out of school in 3.5 years, limit debt

2. Traditional internship, big company

3. Internship at a startup, or very small company

4. Random job in retail, or at a summer camp, beach, pool, etc.

5. Start your own startup- Working 12-14 hours a day for three months.

Most students spend their college summers—including the one leading into their freshman year—fulfilling the duties involved in one of these first four options.

Most students, however, would be well served by taking one of their summers and dedicating it to their own project, a startup that germinated in their head, reared to life by their own hands and, in some rare cases, sustained as a real business going forward.

It should be acknowledged that not every student can do this. The summer months offer that one break when students can bring in a significant amount of cash to help them get through the school year. Some people depend on the earnings from the summer, and can’t put those earnings at risk by trying to build a startup that may never turn a single dollar of revenue.

For those who can do this, however, the rewards can be rich.

The benefits of spending a summer on a startup are broken out in greater depth in a piece at FundersClub.

Students shouldn’t underplay the value of working on something of their own for a summer, not only for the test of experience and learning it offers, but also for the resume building aspect. As somebody who has hired more than a dozen people, I view this kind of experience as the most valuable sort.

If a student can start a summer with close to nothing and produce a significant application, or any kind of business, that’s found traction or a unique way of solving a problem, it’s a sign of several things:

The student is self-motivated

Has superior focus

Possesses a knack for finishing off and completing projects

Has the versatility to handle nearly anything involved in a job

As an employer, these are some of the most valuable things that any employee can have, whether they’re writing code as an engineer, laying out operations as project manager or working to get a company more leads and close more sales.

January 27, 2017

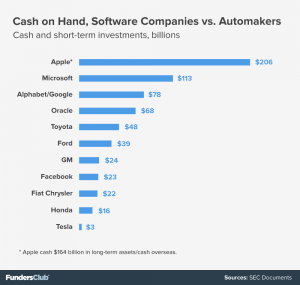

Google, Apple, Tech Giants Can Find Major Growth In One Place: Cars

Google parent Alphabet, in its earnings release yesterday, showed that its non-advertising revenue was growing at a pace, 62%, more than three times as fast as its traditional source of sales. But advertising still comprises 87% of the company’s revenue.

The company got dinged by some analysts for missing the consensus number for earnings per share, but many observers were buoyed by the growth of non-advertising revenue sources.

Apple, of course, while more diversified than Google, is fighting some of the same pressures: the company has become primarily a phone maker and its sales are tethered to the fortunes of its iPhone franchise. Both companies, as well as other tech giants, have long been watching what most consider the next big platform in tech: cars.

It’s an evolution that makes sense, as the rising generation of great hardware companies have proven themselves to be, first and foremost, great software companies first.

It seems as if Alphabet has abandoned any plans of actually making cars, but Alphabet’s Waymo division seeks to take all of the learnings from the Google Car project and turn them into the guts of the next generation of cars. In this strategy, Alphabet seeks to be Delphi rather than GM.

But that doesn’t mean that other tech giants, notably Apple, and perhaps Uber, aren’t eyeing the possibility of stamping their logos into a car grille.

Tech companies are flush. Credit: Eli McNutt, FundersClub

There isn’t anything that compares to the potential and size of a future car market that’s infused with automation and software that, by and large, replaces human drivers and enables the car experience to be so much more than what it is currently.

Five of the top six companies by market cap are tech companies—Apple, Alphabet, Microsoft, Amazone and Facebook—and three of them have had IPOs during the last 20 years. It’s not easy to grow at big clips for companies already worth half a trillion dollars. The car market is one of the few places that’s big enough to make a difference, however, so it will continue to be scrutinized and sized up by these keystone tech companies.

I did a deep dive on this topic with FundersClub, for which we gathered insight from all over the car and tech industries. Many experts’ conclusions were intriguing.

There are other ways for these companies to grow outside of vehicles, of course, but none of them hold the same potential. Google, like many in Silicon Valley, has been focused on growth through the cloud. It’s happening, but it’s still behind others. Google doesn’t break out its cloud revenue, but it looks to be squarely lagging both Amazon and Microsoft, whose cloud businesses are both on annual revenue run rates north of $14 billion.

November 17, 2016

The Top 10 Ski Resorts In North America For 2017

The exercise of picking a ski resort, of where to spend a ski trip, offers travelers a unique problem to solve. All manners of things enter a skier’s decision: snow, terrain, lodging, airports, prices and, of course, the novelty of experience. So picking a ski resort for spring break 0r the New Year’s holiday is similar to picking any vacation destination in that some locations may be valued for their newness, their untapped potential, or for widely-spread reputations.

But ski resorts are different from cities and other destinations in that so much can hinge on weather and the state of the mountain upon arrival, something that’s built out of weeks and months of earlier climate activity. So in this way, people booking ski trips make bigger leaps of faith than those merely visiting a city or a region. For that reason, travelers putting ski trip itineraries together should consult more diverse sets of inputs and better data sources when planning their winter adventure.

It is with this in mind that we again produce this examination of the best ski resorts in North America. We consult diverse data points, updated statistics, and our own constantly renewed expert reviews of individual resorts to make the job of skiers, at least when it comes to narrowing where to take their ski trip, easier. This is the most comprehensive and in-depth ski resort list of its kind.

To go past the top 10, head to ZRankings.com for a complete ranking of the 220 best ski resorts in North America.

Where you ski isn’t as important as where you go to college or where you decide to live. In many ways, it’s not important at all. But, like skiing in general, deciding where to go ski is quite fun. The anticipatory exercise is as enjoyable as many parts of the trip itself.

So milk it for everything you can and read on.

We use something called the Pure Awesomeness Factor—PAF—to grade out ski resorts. Think of the PAF like you think of a kilogram, a liter or a degree Celsius. It’s a scientifically significant measurement. Just as we keep a master kilogram locked up in a vault, against which we calibrate the world, PAF is our guide for judging all things ski.

The metric system, while an excellent set of units, was always supposed to be something more. Its creators aspired for the greatness that has been realized with PAF, which doesn’t measure arbitrary things like mass, distance and temperature, but instead measures that most inscrutable, yet definitely existent property of awesomeness.

The difference, rather conveniently for all of us, is that PAF is a dynamic measurement that changes year to year. It doesn’t change radically, of course, but its makeup changes enough that an annual reprise is a necessary exercise.

And it all runs on an algorithm.

If you don’t have to plan way ahead, of course, don’t. This is the best way to ski. It’s why we’ve added an amazing new feature at ZRankings that we call Powderfares. When a big storm is predicted for a major resort within the next five days, we search out airfares to that resort from 15 major metro areas and post those round-trip airfares to the ski resort’s page. The fares are designed to get skiers in right before the storm and out after skiing a couple days of powder. Skiing last-minute might not be possible for everybody, obviously, as it takes flexibility in work and life. But if you’re flexible, keep your eyes on the Powderfares.

And as always, we’ve also applied our stringent metrics and eyes to spotting the best new gear for winter 2017 – amazing ski and non-ski boots, plus insulation, luggage, shell pants and a new way to make yarn from wool.

But first, we review the season that just passed.

An exemplary season for ski trips

Skiers who ventured out west last winter were rewarded with good conditions for much of the season. Tahoe came back to life, following a two-year drought, and Utah, Colorado and Wyoming all fared very well, with big snow events sprinkled well throughout the winter. Even Taos had an excellent early season, and Aspen locals will be talking about last winter for years.

Overall, it was a heartening swing after the previous winter, which was one of the worst for skiers, unequivocally, in decades.

None of this should be viewed as affecting how the upcoming winter will go or how the future of skiing weather will unfold in general. Such trends, as they exist, have to be viewed in decades or longer stretches to be taken as significant. As the earth’s ambient temperature rises, and it is rising, we can’t predict with any certainty how it will affect certain regions and their snowfalls.

Last month, I caught up with Joel Gratz, the founder of OpenSnow, which provides the best snow forecasting in the business, over pancakes in Chicago (the heart of skiing, didn’t you know). He addressed some of the hype that other people are giving the upcoming winter.

“If you push me to say something about 2016-2017, I’ll say that I agree with most forecasters that there will be some form of a ridge over the west coast and a trough over the east coast. This generally means periods of warmer and drier weather over the west and some periods of very cold and snowy weather over the northeast. But, the exact position of the ridge and trough is what controls where and when snow falls, and we can’t predict this.”

Gratz sums it up like this: “Seasonal forecasts are not accurate. No weather forecaster, from academic researcher to highly-paid meteorologists working for commodity companies, can consistently make accurate 1-6 month forecasts.”

So stop fretting or getting over-amped about the winter.

As always, skiers are best off banking on the ski resorts that attract higher average snowfalls and lower standard deviations as the best places for powder-seeking trips. See ZRankings’ comprehensive snow data for true average ski resort snowfalls—not made up marketing numbers—and the full snow data for 220 ski resorts.

Biggest news in ski industry in 20-plus years

Vail Resorts, the public company that owns many of the alpha ski resorts in the west—and three ‘urban’ ski hills outside of Minneapolis, Detroit and now Chicago—purchased Whistler-Blackcomb this past summer for $1.3 billion.

It’s remarkable in that Whistler was undoubtedly the most popular ski resort in North America that *wasn’t already* in the Vail fold. And now it is. The Epic pass for 2018 will be a hot item; so many flagship resorts, so much vertical, so many regions. To fully take advantage of it, however, one needs to be unemployed, underemployed or living the dream as some kind of ski writer/code shipper. Those jobs, as so described, are few.

Christopher Steiner's Blog

- Christopher Steiner's profile

- 21 followers