Matthew Yglesias's Blog, page 2245

July 12, 2011

Bankers vs Bank Managers

Steve Randy Waldman has a great post explaining why for banks more so than for most firms accounting is destiny. That's because what a bank is allowed to do depends in great deal on its accounting status, and what it's allowed to do has real impacts on various stakeholders:

Whether or not a bank takes a capital hit has no bearing on whether a principal reduction will increase the realizable cash-flow value of the loan.

But accounting is destiny. The economic value of a bank franchise, both to shareholders and managers, is intimately wound up with its accounting position. A bank whose books are healthy may distribute cash to shareholders and managers, while a bank whose capital position has deteriorated will find itself constrained. A well-capitalized bank is free to take on lucrative, speculative new business, while a troubled bank must remain boringly and unprofitably vanilla. The option to distribute and the option to speculate have extraordinary economic value to bank shareholders and managers.

Consequently, there can be principle write-downs that have no impact on the realizable cash-flow value of loans that it would be socially beneficial to undertake but still contrary to the interests of bank managers and bank owners.

Read the whole post for the full argument. But this is an important reminder that throughout the crisis, political discussion has failed to adequately distinguish between banks, bank managers, and bank owners. A policy that looks at a trouble bank, forces full write-downs of bad loans, injects taxpayer capital to make the bank sound again, and then reprivatizes the newly healthy bank is very friendly to the bank qua brand. There may be a huge "bailout" that involves a vast sum of taxpayer money going "to the bank." At the same time, such a process of nationalization and re-privatization would likely involve all the bank's top executives getting fired. It would involve the pre-nationalization equity owners of the bank losing their shirts. By contrast, a policy that refused to deliver the bailout but instead offered wink-nod regulation could allow the bank to recapitalize through profits. This policy is worse "for the bank," but it's much better for the CEO of the bank. When the story of the Little Depression is written, I think we'll see that ironically bailout backlash has proven to be cover for harmful policies that serve the interest of bankers.

Market Demand For Low Calorie Food

USA Today reports on a trend toward major national chains developing lower calorie meals often with smaller portions and marketing them as such:

In the midst of an obesity epidemic, fewer calories would seem to be a good thing. But one nutritionist wonders if consumers haven't lost the ability to judge how much to eat — so they're letting foodmakers do it for them. "Americans don't want to think about it," says Carolyn Costin, a food psychologist. "We'd like to be able to stop in a place and have our food made, packaged and certified for us as just enough."

I don't see any reason to get scoldy about this. The essence of an advanced economy is that you pay people to do things for you. The division of labor works. I think if you want to be optimistic about calorie labeling regulations, this is where to look. It's less in very short-term consumer response to existing options than it is in the way firm-level response to the new environment may change the overall marketplace.

Mobile Broadband Paves The Way For The Poor

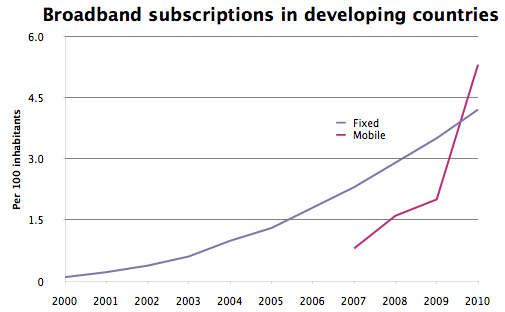

Cecilia Kang writes about how for many low-income Americans, the smartphone and mobile broadband plan are the primary means of internet access. What's interesting is that this is even truer if you look at the global poor. Matt Cameron threw together the relevant datasets from the International Telecommunications Union and offers this chart:

The conventional interpretation I've heard of this global data is that it reflects the difficulty of building wired infrastructure in countries with dysfunctional governments. The popularity of wireless broadband among the low income domestic U.S. population casts, I think, a bit of doubt on that. It just seems to be the case that even though computer-with-internet-connection was invented before smartphone-with-broadband-plan, income-constrained consumers who want to pick one prefer the phone.

Atlantic Jobs Quasi-Debate

I'm participating in a "Great Jobs Debate" at the Atlantic sponsored by McKinsey. The exercise is supposed to be to answer the question, "What is the single best thing Washington can do to jumpstart job creation?" I perhaps took the question a little too literally and offered the actual single best thing Washington can do to jumpstart job creation, namely adopt a higher inflation target. Carl Schramm's proposal for increased immigration of high-skill workers is a very good idea, and would create jobs, though not as many as my idea. Rick Hess wants to overhaul career and technical education which I think is also an excellent idea, but it would have basically no short term impact on jumpstarting job creation. I don't think making the R&D tax credit permanent would do much of anything, since it's de facto permanent currently, but it's still a fine idea.

Thus far, then, it's really not much of a debate, more like a jobs symposium. After all, there's no reason the government should be picking one unique job creation lever and sticking with it.

People's Bank Of China Has Golden Opportunity To Turn The PRC Into A Basketball Superpower

Today came the news that despite inflationary pressure, the Chinese government continues to subsidize its export sector via massive accumulation of foreign currency reserves:

China's foreign exchange reserves, already the world's biggest, soared again in the second quarter, adding to inflationary pressure and highlighting the risks in Beijing's policy of holding down the value of its currency. Reserves are a key indicator of central bank intervention in the currency market because they reflect how much foreign exchange it has purchased in order to stabilise the renminbi. After jumping $197bn in the first quarter, reserves were up another $153bn in the second quarter.

The first-best response would be for China to stop doing this. China has a inflation problem and the United States has a depressed jobs and output problem. If China allowed its currency to appreciate more rapidly and accumulated fewer foreign currency reserves, that would help solve both problems.

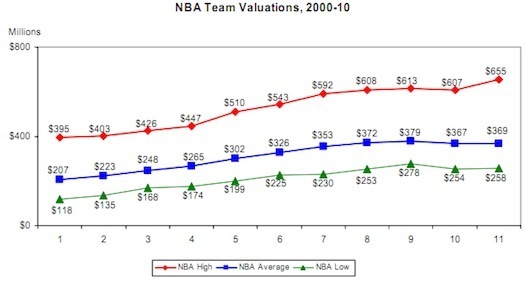

That said, it also seems clear that interest group politics inside the PRC militate against them reducing these kind of subsidies. So at a minimum, let me suggest that they should do something wackier with their money. For example, Chinese people are known to be basketball fans. I saw people lining up for Bruce Bowen's autograph. At the same time, the owners of NBA franchises are refusing to pay professional basketball players to play basketball. Based on TrueHoop's salary data, the PRC could hire all the NBA players at their current salaries for something like $1.5 billion. That's a lot of money, to be sure, but it's less than one percent of what the People's Bank of China is spending per quarter on foreign exchange purchases. It's true that the PBOC is accumulating assets with resale value, but everyone knows that China is going to take meaningful capital losses on these investments. By contrast, hiring the entire NBA would reinforce the image of a rising China in contrast to America's hapless fading superpower.

Alternatively, if the PBOC insists on only purchasing dollar-denominated investment assets, they could buy all 30 NBA teams for something like $11 billion. This would obviously be a much less liquid investment than China's typical moves. But it's a pretty trivial amount of money compared to the total, and a large sovereign like China can afford some illiquid investments. What's more, by purchasing the NBA and ending the lockout, China could obtain some much-needed soft power.

Bush Tax Cuts In The Balance In Debt Ceiling Talks

One point that's not always being made clear in discussions of the debt ceiling talks is that the revenue increases Barack Obama is demanding are increases relative to current policy rather than relative to current law. This is important because the Bush tax cuts are currently set to expire in 2012, and these tax cuts are extremely expensive. The upshot is that if Obama obtains bipartisan agreement on taxes, revenue will be much lower than where it would be if he simply promised to veto extension of the tax cuts.

Recall that the Bush tax cuts come in two pieces. One piece, the more expensive one, is composed of broad-based, highly regressive tax cuts. Political convention calls these "middle class" tax cuts because middle class individuals do indeed receive them. And because middle class people outnumber rich people, the largest share of the money goes to middle class people. But rich people actually receive much larger cuts than do middle class people. Another piece, cheaper but still very expensive, is composed of super-duper regressive tax cuts that only very high income people get. The current negotiating posture of the White House is to say that they favor permanent extension of the very expensive broad-based regressive tax cuts but do not favor permanent extension of the expensive rich people only super-regressive tax cuts. And the current negotiating posture of congressional Republicans is to say that they will vote against extension of the very expensive broad based regressive tax cuts unless they're paired with permanent extension of the expensive rich people only super-regressive tax cuts. One of the things Obama has proposed in the negotiations is to settle for even less revenue than his proposal for partial extension would raise.

There are a few ways to interpret this series of events. One of them (about which more later) is simply that to an extent few realize, the Democratic Party has locked itself into a conceptual box around taxes, which is going to destroy progressive politics. Another is that a lot of the juice in the debt ceiling talks is less about what happens than about what people can make other people vote for. Republicans don't just want to cut Medicare, they want Democrats to vote to cut Medicare and Democrats don't just want more tax revenues, they want Republicans to vote for tax hikes. American political institutions create a lot of incentives for this kind of accountability-evading behavior.

Mary Cheh Unveils Gas Station Subsidy Plan

Mike DeBonis reports that Ward 3′s Mary Cheh has managed to come up with a worse idea than Marion Barry's bizarre ban on rental apartments. Cheh wants to make it more difficult for people who own gas stations to sell the land to people who want to turn it into something other than a gas station:

A bill that Mary M. Cheh (D-Ward 3) introduced earlier this year was relatively limited — prohibiting a gas distributor, or "jobber," such as [Joe] Mamo, from also operating retail stations. That would affect a small portion of Mamo's stations where he directly contracts with operators to run the stations. What Cheh's committee sent to the full council Monday is quite a bit broader. It gives franchise operators of gas stations the right of first refusal to buy their station if their landlord (i.e. Mamo) were to sell it. This is crucial because many gas stations sit on valuable property ripe for development. Giving the operators a chance to buy their stations stands to complicate or prevent any transaction.

Why on earth would we want to intervene in the market to ensure a large quantity of gas stations? Various proposals to do this seem to keep cropping up on the DC Council. But the tendency of a city's gas stations to vanish in favor of higher value uses is just a sign of a city getting richer. It's also good for the environment, etc.

Apple/HTC Front Opens In Mobile Patent Wars

Everyone is suing everyone: "Apple has accused the smartphone maker HTC of infringing its patents, in the latest phase of the legal battle between phone and tablet PC makers." This is apparently separate from the patent infringement suit Apple brought against HTC last year. That one, inevitably, brought counter-claims from HTC, so presumably this one will as well. A world in which all electronics makers are perpetually suing each other for patent violations is a very good one for patent lawyers.

The Future Deficit Can Inherently Exists In The Future

Kicking the can down the road is generally understood to be a bad thing. But it's crucial to note that in the context of discussion of America's long-term structural deficit, the can in question inherently exists in the future. It's true that politicians can decide in 2011 to cut Medicare spending in 2017. But the 2017 deficit exists in 2017. In the future. And what the deficit in 2017 actually is will inherently be decided by politicians in 2016 and 2017 rather than politicians in 2011.

This is one reason why I always think it's worth reminding people that if congress doesn't do anything, the median-term problem goes away. Current law stipulates that, thanks to the expiration of the Bush tax cuts, the non-indexation of the Alternative Minimim Tax, and the implementation of Sustainable Growth Rate adjustments to Medicare doctor payments, the budget will go back into balance. The Congressional Budget Office also produces a "current policy" baseline, which reflects the fact that politicians are unlikely to allow those things to happen. I don't dispute their judgment. But all that changing current law can do is change what current law says about the future. And currently, current law already says the fiscal gap will close. People think it won't close because they think the law will be changed. And they may be right. But that same problem occurs no matter what you do.

Recall that in 2000, we were projected to have budget surpluses, and this fact became a key argument for the Bush tax cuts.

Breakfast Links: July 12, 2011

— Ahmed Wali Karzai, half-brother of Hamid, shot and killed by a close family associate.

— AWK's ties to the CIA.

— AWK's ties to the heroin trade.

— The Karzai family's domination of economic rents from control of the Afghan government.

— How to be an expert on Afghanistan.

— Italian debt troubles threaten rich country financial apocalypse.

— Consumer surplus from the internet.

— We don't want more inbound foreign capital.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers