Matthew Yglesias's Blog, page 2247

July 11, 2011

Locked Out NBA Players Should Use The Leverage Available To Them

Something about sports-related labor disputes seems to make people go insane, which I think is the best possible explanation for Stephen A Smith's argument that it's "selfish" of Deron Williams to agree to play basketball for money in Turkey and that his doing so will damage the players' unity and undermine their bargaining position. The truth is quite obviously the reverse.

As a reminder, the situation is that NBA teams are owned by rich businessmen who would like to become richer. They believe they can enrich themselves by paying their workers less. So with the current collective bargaining agreement expiring, they're refusing to pay anyone or play any basketball games until players agree to accept a smaller share of NBA revenue. Williams would, I'm confident, be thrilled to play basketball for money as an employee of the New Jersey Nets, but currently the owners are refusing to let him do so. Agreeing to play basketball for money as an employee of a non-NBA professional basketball team is no more or less selfish than any other course of action available to him. Meanwhile, the ability to go play abroad is an important source of leverage for the players. NFL franchises are essentially monopsony purchasers of professional basketball labor. The NBA, while by far the most lucrative professional basketball league in the world, is just one of many. Every player who responds to the lockout by making alternate working arrangements is strengthening the bargaining position of the union by emphasizing that though payers would obviously prefer to play in the NBA, they're not in a position of total dependence on the owners.

Breakfast Links: July 11, 2011

— Expiring jobless benefits to further reduce aggregate demand.

— Bachmann overtakes Romney in Iowa polls.

— I think David Brooks is going Frum on us.

— The madness of Fred Hiatt.

— Even a brief "technical" default would cost taxpayers tens of billions of dollars in long-term higher interest rate costs.

— New firms are creating fewer jobs.

— The lonely outpost of actual Chinese people in DC's Chinatown.

— Title IX and international soccer.

— Reality check: Thatcher and Reagan both raised taxes.

July 10, 2011

The Democratization Of Knowledge

Ta-Nehisi Coates is back up at The New York Times with a reminiscence of music fandom before the digitial age:

The march toward universal music extends back to the days of Edison. But I recall, with a perverse fondness, the latter days of the 20th century, when the franchise was still the exclusive property of record pools and radio. Only the Fates could compel your local station to deliver "Fresh Is the Word" or "Sucker DJs." This was before the lords of FM took to bragging "All hip-hop, all the time," when, outside of the five boroughs, rap was midnight music for the urban avant-garde.

Kids with substantive allowances could purchase actual records, but the rest of us, trapped in prudent homes, had only Memorex tapes to save our favorite jams from the yawning void beyond the memory of playlists. Who knew how long it would be before we again beheld the splendor of "Cold Gettin' Dumb"? Even the artists were ethereal. There was no Vibe or XXL to confirm the death of the Human Beat Box or Scott La Rock, or explain why UTFO faded away. Overrun by mystery, you had only divination and hours upon hours of deciphering cover art, hoping to confirm that the great Humpty Hump really was Shock G.

My version of this is simply about the knowledge stovepipes. I remember in the earliest days of my music purchasing life being in love with Dookie being sold on Kerplunk and 1039 / Smoothed Out Slappy Hours and then Rancid's Let's Go. The exploration of a genre or a scene was a very intensive process and required specific guidance. For whatever reason, until I was sixteen or so none of my friends had an older sibling so I was basically stuck with what I was told at the record store. Then I made some new friends, some of whom had older brothers, and that changed things again. Somehow nobody at the store had ever made me listen to "Monkey Gone To Heaven".

The old, painstaking ways of acquiring knowledge definitely had their charms, and now that I'm thirty I claim license to be randomly nostalgic for the 20th century. But there is a tremendous democratizing potential in opening the gates of knowledge to anyone able to get his hands on an internet connection. Somehow it was possible in 1996 for "Pepper" to be a huge hit without this shedding much in the way of mainstream light on the rest of the Butthole Surfers' extensive career. Now if you're interested, you'll know.

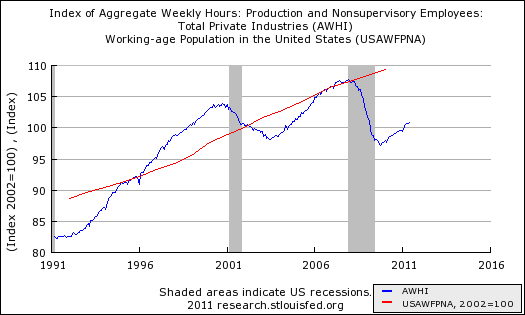

An Idleness Chart

Inspired by Mike Konczal here's a chart showing the aggregate quantity of hours of work done in the USA versus the size of the working age population. Both are indexed to 2002:

As you can see, the population has a "slow and steady" growth path. Aggregate hours work is more of an up-and-down thing driven by the business cycle, but with an upward trend since the number of working age people rises over time. And now we have this amazing gap. It's a staggering waste of the most precious resource we have: Human beings and their potential.

The Plight Of The Super-Tall Basketball Player

In general, taller NBA players have longer careers, but as Yao Ming's retirement reminds us there are limits to this:

However, too much size turns out to be a bad thing. The curve inverts at 6-foot-10; that's the optimal size for a career length, but at greater heights the injury risk outweighs the benefit of increased height. We see this somewhat with 7-footers, but it's players of Yao's size that really drive the point home.

Players who are 7-3 or taller just aren't destined to have nice, orderly 15-year careers. Despite the size advantage that these players possess, not one of them has managed to have a 1,000-game NBA career. Eaton, at 875, came the closest.

Generally, they have back, knee or ankle problems after a few years, and from there it's a war against their bodies. Smits and Ilgauskas were able to fight their feet to a draw and make a reasonable go of it; Yao, unfortunately, could not.

I used to love watching Yao play in his prime. Just such an unusual game.

Nonprofit Money Making, Golf Edition

With a pay package of $5.1 million in 2009, PGA Tour Commissioner Tim Finchem leads our list of the highest-paid golf-association executives. The PGA Tour, a tax-exempt organization, reported revenue of $954.5 million in 2009, according to its latest tax return. Its three tours (PGA, Champions and Nationwide) played 115 tournaments in 2009 and distributed $337.9 million in prize money and raised $109 million for charity.

In 2009, the PGA Tour had six different people earning over $1 million in annual salary.

John Boehner Wants To Scale Down Debt Talks

The collapse of negotiations around $4 trillion in debt reduction and House Speaker John Boehner's preference to scale the scope of discussion back to $2 trillion in hopes that will somehow generate a deal with no tax increases isn't surprising. But it is, again, a useful reminder of where the American conservative movement is at. There's been a fair amount of discussion recently about why it is that the GOP is so uncompromising in pursuit of its ideological goals, much of it very enlightening. What's strange, though, is how narrowly focused those goals are.

The nature of legislative compromise, after all, is that you accommodate someone else's objectives in order to obtain your objectives. A movement that actually believed that reducing federal spending was extremely important would, it seems to me, be quite willing to make concessions in order to obtain large quantities of spending cuts. Viewed in that light, it's not obvious to me that backing away from a $4 trillion deal primarily composed of spending cuts constitutes a "more conservative" option than saying yes. You're seeing that very little has changed in practice from the Bush years, when the GOP agenda consisted of aggressive tax cutting made palatable by refusing to pair the cuts with spending reductions. Now, ostensibly, cutting spending is the order of the day. But the bargaining strategy is entirely built around a tax-focused goal rather than a spending-focused one.

July 9, 2011

Paul Ryan's $350 Bottle of Wine

At first glance, I was skeptical that there was any meaningful policy point to be made about Rep Paul Ryan's taste for expensive wine but I've actually reconsidered that view. Consider.

The essence of Paul Ryan's political agenda is to reduce spending on domestic social programs in order to create budget headroom for reduced taxation of high-income individuals. One obvious critique one could make of this agenda is that it will seriously imperil the welfare of the least fortunate. But it's also worth noting that Ryan's agenda is likely to accomplish much less to improve the welfare of the most fortunate than you might think at first glance. After all, why would a bottle of wine cost $350 to buy? In part, that's because fine wines are costly to produce. But that doesn't explain the really really expensive wines of the world. It's not like the grapes are fertilized with diamond dust or something. Very expensive wines are very expensive for the same reason that beachfront land and original copies of the Magna Carta are expensive. They're rare. This has important implications. If you move to Hollywood and become a rich movie star, you'll suddenly be able to buy beachfront property in Malibu. But if movie stars as a whole get richer, this doesn't change the fact that there's only so much beach in Malibu. All that happens is it gets more expensive.

But the same token, if every rich Manhattanite gets a tax cut from Paul Ryan there will be some increased overall consumption by rich Manhattanites. But you may find that there's surprisingly little. You're going to see an awful lot of bidding up of the price of supply-constrained commodities. Suddenly, the same bottle of wine is selling for $425. The main real world consequence of this is going to be to make it more difficult for middle class families to engage in the occasional splurge purchase. Like most people, I every once in a while go out and do something expensive that someone richer than me might do frequently. If the rich people all get richer, then they'll bid up the price of those rich guys activities and put them further out of the reach of the middle class.

Congestion Pricing: Still a Good Idea

This Economist look at a new bus pricing scheme in Singapore is fascinating, but at the end it went in a direction I'm unhappy with:

Rewards-based schemes are more politically appealing than punitive charges. Several cities have tried to implement congestion charges (fixed fees to drive into crowded areas) but most have failed. Such charges are seen as little more than additional taxes, and if there is only one tariff, they hit the poor the hardest. Rather than fuel resentment, incentive schemes could encourage commuters to change behaviour voluntarily, and even gladly.

Conventional journalistic wisdom seems to me to have arbitrary biases around politically unpopular idea. Unrestricted unsubsidized free trade in agricultural commodities, for example, is not very popular and has failed politically in all major countries. But I don't think you'd ever see an Economist article just dismissing the idea as unworkable. The idea is to keep working toward a better world!

On this particular idea of it being better to do subsidies than penalties, I think you run into the same problem as with the idea that it's better to do clean energy subsidies than carbon taxes. The reason the alternatives to taxation are more popular is that people don't like taxes. But if you're going to spend money, you wind up needing to raise taxes to pay for it. The right issue to analyze is policy packages. Not "tax peak-time commuters" vs "subsidize off-peak commuters" but "tax peak-time commuters and cut sales taxes" vs "hike sales taxes and subsidize off-peak commuters." And the same point recurs for the distributive issue. A congestion charge could be regressive in impact depending on what you did with the money. But since many poor people don't own cars (cars are expensive) a congestion charge offset by lower sales taxes would be a very poor-friendly policy on net.

Nonprofit Property Tax Bias

When I made the case that property tax codes shouldn't exempt non-profits, the response I got was mainly from irate conservatives. I gather that the reason for this was that my example of unjustly untaxed landowners was churches. That was my example because I believe that in the vast majority of municipalities churches do, in fact, account for the bulk of untaxed nonprofit ownership of land and structures. But obviously churches are something that conservative valorize culturally, and conservatives also dislike taxes, so when they hear that some heathen liberal wants to start taxing churches they get upset.

So to take another cut at the issue, I see Reihan Salam touting a Vance Fried Cato paper (PDF) calling for reduced subsidization of college tuition that involves, among other things, trying to persuade us that even non-profit institutions have profits:

How can a nonprofit have profits? Simply put, it happens when the revenue the nonprofit derives from providing a service exceeds the cost of providing that service. This might seem obvious, but it is often assumed that putatively "nonprofit" schools, by virtue of their designation, never make a profit from providing a particular service. In addition, such schools never report that they have realized profits, even when the profits happen to be large. Why? Because profits are reported as expenses.

Without endorsing Fried's particular policy conclusions about higher education (I haven't even read the whole paper) that's exactly right. And of course it applies in general to the concept of diversified nonprofits. The synagogues I'm familiar with treat High Holy Day services as profit centers, selling tickets and generating funds to subsidize other activities. Some of those activities are worthy social endeavors, but many constitute something like a private benefit for congregation leaders, rabbis, etc. Not that there's anything wrong with that. It makes perfect sense for organizations to feature bundled services, cross-subsidization, etc. And it also makes perfect sense for the United States to offer a variety of forms of corporate organization, including a nonprofit designation.

But we should really think harder about the implications of writing a major preference into the tax code for ownership of land and structures by firms with a non-profit organizational form. Probably the least enlightening way of thinking about this is to focus on the short-term fact that absent the tax preference, non-profits would have higher expenses in the form of tax payments. That, in turn, would allow for lower levels of residential or commercial property tax or lower sales taxes or whatever. The larger issue, however, is the long term one. Failing to tax non-profit ownership of land and structures encourages non-profits to invest their revenue in ownership of land and structures. This ends up reducing the amount of space available for residences and commercial ventures, but also reduces the extent to which non-profits will actually recycle their revenues into programming. A school faces a choice at the margin between hiring more professors and building fancier buildings. A church faces a choice at the margin between serving more lunches to poor people and building a fancier church. Exempting schools and churches from property taxes encourages them to choose to invest in buildings. Why do that?

As I understand it, churches really are the main issue here since substantial universities can usually be coerced/cajoled into making PILOT payments by determined municipalities. But conservatives may be more comfortable with this idea if they think of it in Fried's terms as a call for less valorization of nominal nonprofits in general.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers