Matthew Yglesias's Blog, page 2249

July 8, 2011

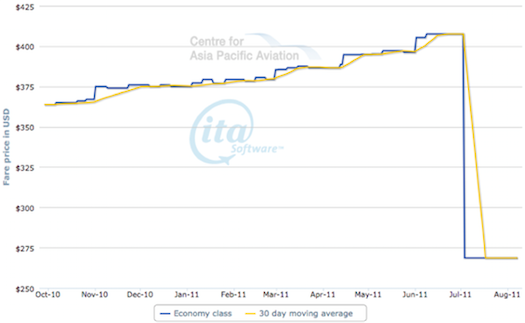

Beijing/Shanghai HSR Link Leads To $175 Drop In Airfare

Via James Fallows, a chart of airfare between Beijing and Shanghai:

Truncating the Y-axis in this way exaggerates the impact of the new high-speed rail link, but it's still there. Over the medium term, the likely impact is fewer daily flights between Beijing and Shanghai. This is, I think, one of the most undersold benefits of high-speed rail construction. Space at airports is scarce. And for many purposes — flying from Beijing to Tokyo, or from Shanghai to Seoul — air travel is absolutely indispensable. But absent high-speed rail, the objective incentives point toward the use of a lot of runway space for things like flights from Seattle to Portland or Philadelphia to Boston. Even mid-speed rail has a beneficial impact on the demand for DC-NYC and NYC-Boston air travel. What's more, obviously, the train makes intermediate stops so the existence of the DC-NYC train route makes it feasible to go Baltimore-Philadelphia or Wilmington-New York.

Stimulus Second-Guessing

I got a question yesterday over Twitter about leaving the size of the stimulus aside, I had any criticisms about the design of the American Recovery and Reinvestment Act. I've actually got a bunch of criticisms, but the one that I think is the most clear-cut and underappreciated had to do with how ARRA handled grants to state and local governments. To make a long story short, ARRA made this complicated. They made it complicated because the bill's authors had specific ideas about what they thought would be the best uses of the funds. This had an obvious cost in terms of the speed with which funds could be disbursed, but it was supposed to have a lot of upsides as well.

One of the things we've learned over the past two years is that those upsides were largely illusory. Governors and state legislatures turned out to be pretty damn good at finding ways to make all the conditional grants fungible after all. Thus, even though ARRA tried to specifically boost state infrastructure spending, infrastructure spending didn't actually go up. It's too bad that this happened, but if Congress had simply accepted it as inevitable and had doled the money out as unconditional grants, then the money could have at least been spent more quickly. What's more, going the conditional grants route wound up creating a fair amount of inadvertent stimulus in the consulting and grant application writing sectors, even though the kind of experienced, BA-holding professionals who are eligible for that sort of work were hit much less hard by the recession.

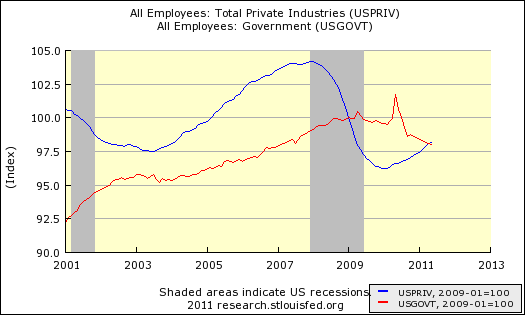

Public And Private Employment

Here's another look at the fates of the public and private sectors during the recession. Since the overall scale of private sector employment is much larger than the government sector (and rightly so), it's difficult to get a chart that shows anything if you look at the raw numbers. So instead, this lines indexes both sectors to where they were in January 2009 when Obama took over:

What you see is that if you look at the private sector you see a fairly "normal," albeit severe, recession. Private sector employment tumbles precipitously for a while, then hits bottom, and then starts growing consistently. And for a while, the public sector also behaves "normally," growing at the same slow and steady trend it was growing at before the recession and providing a kind of countercyclical stabilizer. Thus, during the final year of George W Bush's administration we actually saw a substantial rebalancing away from private sector work and toward public sector work. But since sometime in early 2009, the trend level of government employment has been sharply downward. That's a trend that was interrupted by the census, but now looks very clear. It reflects the fact that the federal government hasn't provided adequate aid to states and localities and the fact that conservative governors have preferred layoffs to tax increases. But even if the governors had different policy preferences, the macroeconomic impact of state/local policy would still have had to have been toward contraction and austerity.

But the federal government could have avoided this. Many policymakers seem to be consoling themselves with the Reinhardt/Rogoff finding that recovery from severe financial crises are typically very slow. But I've always thought the correct interpretation of that finding is that the policy response to severe financial crisis is typically inadequate. State and local governments are engaged in austerity budgeting because they're not getting the federal aid they need. But the federal government isn't running in to some kind of objective borrowing constraint.

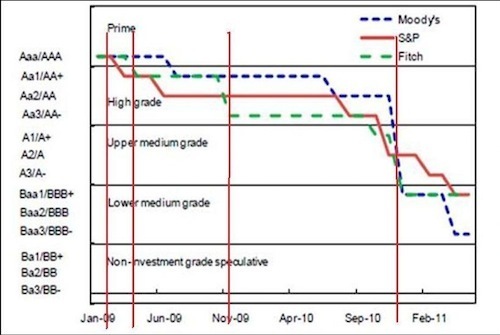

On Fiscal Policy Eurozone Periphery Is, In Fact, Damned If They Do And Damned If They Don't

Niamh Hardiman spies malfeasance amongst the ratings agencies in their evaluation of European public policy:

Evidence from Ireland bears this out – there seems to be no consistency in the way the ratings agencies evaluate the decisions of governments in the Eurozone periphery. Governments are put under pressure to engage in 'orthodox' fiscal retrenchment, in line with the EU's excessive deficit procedures, and as required of Greece, Ireland and Portugal in line with their IMF-EU loan programmes. But as soon as they take relevant action, they find their ratings downgraded on the 'heterodox' grounds that taking money out of the economy will damage growth potential. Two bodies of economic theory seem to be at work here: 'expansionary fiscal contraction' when the aim is to enforce cuts, Keynesian counter-cyclical policy when the objective is to punish excessive contraction. Damned if you do and damned if you don't.

The red lines there indicate episodes of fiscal contraction. I don't, however, think this actually reflects funny business on the part of the raters. Rather, it reflects the fact that Ireland is screwed. Imagine if there were no Euro and Ireland still used the Irish Pound. Now imagine that the Central Bank of Ireland had a policy of completely ignoring economic data about Ireland when making decisions about Irish monetary policy. Instead, it focused primarily on German data, relying to an extent on French, Dutch, Belgian, and Austrian information. Well, nobody would be surprised if this turned out poorly for Ireland. But by the same token, nobody would be that crazy.

And yet here's Ireland on the Euro with its monetary policy set in Frankfurt by a European Central Bank that evidently doesn't care about Irish conditions. So Ireland can't tighten fiscal policy and hope for monetary expansion to offset it. But Ireland also can't avoid fiscal tightening. They're damned if they do, damned if they don't, and that reflects the reality of the situation, not the prejudice of the ratings agencies.

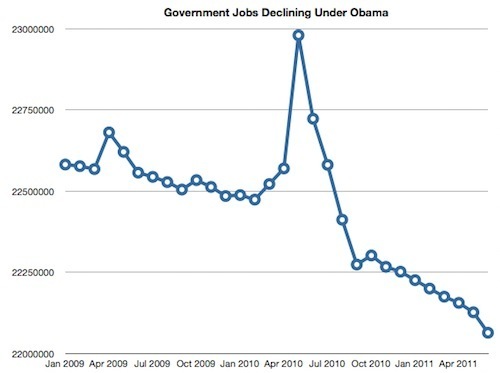

CHART: Over 500,000 Government Jobs Lost Since Obama's Inauguration

So should we blame today's bad jobs numbers on Barack Obama's big government policies? Again, I doubt it. What we continue to see are decent—though not great—private sector job numbers offset by tumbling public sector employment:

For a while temporary census-related jobs masked the underlying trend, but we've been steadily shedding government work. Maybe you think that's a good thing. Certainly most of President Obama's critics from the right claim to believe it's a good thing. But what happens when you shed public sector jobs amidst an already weak economic climate is the sharply reduced incomes of the former teachers and whatnot lead to them spending less in their local communities. In total, we have about 500,000 fewer people working for the government since Obama's inauguration even though the national population is larger than it used to be.

Breakfast Links: July 8, 2011

— Michele Bachmann pledges to ban pornography.

— Microsoft's Android shakedown.

— Instead of fixing its over-long names, Metro will .

— Viltrumite David Weprin to run for Tony Weiner's vacated House seat.

— Deron Williams says he'll play in Turkey if there's a lockout.

— History's greatest monster LeBron James raising money for poor kids' education.

— Private jet industry mobilizes to defend tax subsidy for private jets.

— Fareed Zakaria defends Obama's relatively ad hoc foreign policy.

— Lawrence Tribe says the debt ceiling is perfectly constitutional. Of course the real issue what the president can get away with.

— Paul Tough is very wise.

July 7, 2011

Recruiting International Students Should Be About More Than Just Revenue

By Matthew Cameron

There's definitely something to be said for the idea of increasing out-of-state enrollment at public universities. In today's Los Angeles Times, however, the paper's editorial board raises a red flag that is worth considering:

As an advisory panel recommended, the university [University of California] must not accept out-of-state and foreign students who do not meet high admissions criteria. The extra money might be tempting, but lower standards would reduce UC's reputation, the very thing it is trying to prevent by enrolling nonresidents.

This concern is particularly relevant in light of an ongoing controversy about colleges' use of commission-based recruiting agencies to attract international students to their campuses. The problem with this model is that it encourages agents to recruit as many international students as possible, regardless of their academic or cultural fit at a particular university. So a Malaysian student with an interest in engineering might end up at a New England liberal arts school rather than a science- and technology-based institution on the West Coast.

This isn't a good approach, but Ben Wildavsky correctly pointed out last week that eliminating commission-based agents wouldn't necessarily lead to a system that is free of perverse incentives. If admissions officers were pressured by deans to recruit more international students whose tuition could plug budget gaps, then they still would run the risk of enrolling students who would be better off elsewhere. Moreover, admissions offices at cash-strapped universities might not have the resources to develop strong recruiting presences abroad.

It seems like private recruiting agencies can remain a part of the system if a few changes are made to how they operate. First, standards should be put in place to ensure that agencies don't misrepresent their client schools or charge prospective students and their families for their services. Just as important, though, are the reforms that are needed to the payment model. Agents should be paid a flat fee and any bonus they receive should only be paid out once their recruits graduate. That way, agents will be rewarded for helping kids obtain degrees rather than for simply helping universities collect more tuition money.

Rent-Seeking And Inequality

Kenneth Rogoff argues that rising inequality is likely to be a self-limiting trend since the bigger the skill premium gets, the stronger the economic incentive to find ways to conserve purchases of high-skill labor.

As an abstract model, that makes sense. But it seems to me that Rogoff ends up implicitly discounting the extent to which inequality is being driven by rent-seeking factors. Most notably, of course, you've got the financial system, which in various complicated ways is very much a creature of the state rather than a competitive labor market. But you've also got the fabulous world of intellectual property and the health care system. The Rogoff model would seem to make sense if inequality was, say, primarily a model of architects earning a growing wage premium over carpenters. Then would-be builders would start finding ways to economize on the need for architect-labor, and wages would return to equilibrium. This may even apply to China, where in-country inequality is skyrocketing in the context of rapidly rising overall prosperity. But that doesn't really describe much of the inequality trends we're seeing in the developed world, where growing inequality is paired with very sluggish growth and a seeming decline in overall productivity.

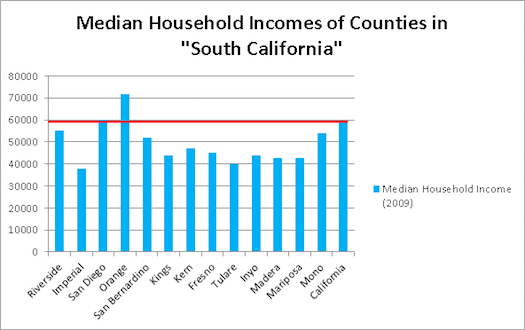

Conservative Californians Ponder Scheme To Impoverish Themselves By Seceding From The Wealthy Coast

Riverside County supervisor Jeff Stone has had enough of the welfare cheats and such in the more left-wing parts of California stealing the hard-earned money of his constituents, so he's plotting secession:

"California was once the world's fourth largest economy and now struggles to hold on to eighth place," Stone said. "Our taxes are too high, our schools don't educate our children well enough, unions and other special interests have more clout in the Legislature than the general public. It has to change."

Stone will explore his proposal more in-depth at the July 12 Board of Supervisor's meeting.

In his announcement on Thursday, he suggested the counties of Riverside, Imperial, San Diego, Orange, San Bernardino, Kings, Kern, Fresno, Tulare, Inyo, Madera, Mariposa and Mono be asked to consider forming the State of South California. Boards of supervisors and city councils within those counties would be invited to meet and discuss the feasibility of secession from California, Stone said.

Dividing California into two states is probably a good idea, albeit an unconstitutional one, but as a reality check, note that the proposed state of South California would be much poorer than the existing state of California:

California is blessed with two of the ten richest metro areas in the United States — San Francisco and San Jose — and any political scheme that hinges on people detaching themselves from those engines of prosperity is pretty strange.

America's Crisis Of Governance

Taking a page or two from Juan Linz (PDF) and Bruce Ackerman (PDF) my latest TAP Online column develops the idea that the debt ceiling standoff is just one part of a broader gathering crisis of governance of the sort that have traditionally plagued Madisonian political systems outside the United States:

This is probably the best way to understand the Obama administration's otherwise odd theory that the ongoing war in Libya doesn't constitute "hostilities." It's also the best explanation of the amazing surge of interest in the previously obscure argument that Section 4 of the 14th Amendment makes the statutory debt ceiling unconstitutional. Ultimately, if House Republicans prefer default to reaching a compromise with the Obama administration, the country as a whole will find that it prefers a novel constitutional theory—one that lets the president take the reigns when Congress gets out of hand—to defaulting on the national debt.

This would be a good deal better than a coup. But it certainly looks like a step down the road toward lawlessness and breakdown. What's more, though many liberals have criticized Obama's assertions of executive authority in certain specific contexts, the preponderance of left-wing criticism of the president has been about his failure to act as a sufficiently zealous partisan and fully wield the powers of office. Rep. Luis Gutierrez (D-IL) and other immigration-reform advocates urged Obama to unilaterally halt deportations of students who would be legalized by the DREAM Act if it passed. Environmentalists urge Obama to aggressively deploy the Environmental Protection Agency to halt carbon-dioxide emissions. Gay-rights advocates laud the decision to stop fighting for the Defense of Marriage Act in court. This all makes sense, just as it makes sense for people to be urging serious consideration of the constitutional objections to the debt ceiling. But add it all together, and you've got the somewhat frightening spectacle of a president consistently and forcefully doing end arounds to evade Congress. When the political system stops working, that becomes the only path available to activists. But at some point, the underlying crisis in governance itself deserves to become the center of attention.

Matthew Yglesias's Blog

- Matthew Yglesias's profile

- 72 followers