John Cassidy's Blog, page 115

June 28, 2011

Bachmann's Bounce: The View from Brooklyn

Three men sitting in a bar off Atlantic Avenue. The Lanigan, sporting a new beard, which gives him a vaguely Falstaffian aspect, gets all red-faced and serious-eyed. "Did you see the piece by Nate Silver on the Republican primary field?" he huffs. "He had Michele Bachmann as one of the first-tier candidates. How can he get away with that stuff?"

One of his fellow drinkers doesn't respond. The other one, a lean bird with crooked teeth, sets down his Pils and offers that he hasn't seen the Silver post, but he's not a bit surprised at its contents because Bachmann is obviously a serious contender. "She's Sarah Palin with an I.Q.," he avers. "There's even a bit of Mrs. T. about her."

Coughing and spluttering into his pint glass, the Lanigan manages to get out a few words like "moron," "religious," and "nutcase." You do know she referred to being gay as enslavement, he says when he catches his breath. Maybe she's a bit smarter than Palin, but the idea of her winning the nomination is crazy.

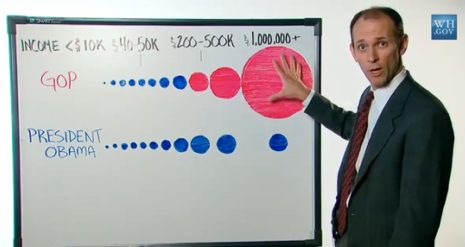

Perhaps it is. But on Sunday an opinion poll in the Des Moines Register showed Bachmann in a statistical tie with Mitt Romney among Iowa voters, and on Monday, after she officially launched her bid for office, saying, "We can't afford four more years of Barack Obama," the President's reëlection campaign was moved to issue a statement describing her as a captive of Big Oil, a defender of the idle rich, and a menace to the middle-class.

Now, if the Lanigan is right about Bachmann's chances (and most commentators agree with him), Obama's campaign managers should be trying to build her up, on the grounds that she is unelectable. However, it seems that David Axelrod and the rest of the boys in Chicago, where the Obama 2012 campaign is based, are in the dissident camp. Evidently, they believe Bachmann is enough of a threat that she has to be taken down now.

Why is that? My guess is that, having themselves swept from nowhere to the White House on a wave of public disgust at the Bush Administration, the Obama strategists recognize a potentially dangerous rival. On the face of it, Bachmann is a classic right-wing protest candidate. But in centering her announcement speech on a critique of President Obama's economic record, and stating baldly that he can be beaten, she was signalling that she intends to be more than that.

To be sure, much of what she says about the economy and many other subjects doesn't add up. For now, that doesn't matter much. In courting the grass roots of the Republican Party, she inhabits an alternative universe to the one where many of her critics live: Bible-bashing, Fox News-watching white America, a land where all too many eagerly accept the notion that East Coast élites are busy selling hard-working Americans down the drain for the price of a Wall Street campaign contribution or a hat-tip from George Clooney.

Bachmann's America has its own values, its own schools (she attended O. W. Coburn School of Law, which is now part of Oklahoma's Oral Roberts University), and its own version of history—one light on facts and heavy on Apocalypticism. "Americans agree that our country is in peril today and we must act with urgency to save it," Bachmann said in Waterloo, Iowa, the town of her birth. And she went on: "My voice is part of a movement to take back our country, and now I want to take that voice to the White House."

From National Socialism to Poujadism to the Tea Party, the suggestion that the motherland needs reclaiming from alien forces has been central to populist right-wing movements. This was clearly what Bachmann was driving at when she commented in 2008 that President Obama "may have anti-American views," and, even though she's since expressed the wish she had expressed herself differently, her supporters get the message loud and clear.

Could Bachmann really win the nomination? As a Tea Party supporter, an evangelical Christian, a crusader against gay marriage, a critic of virtually all government programs save the military, and a rabid anti-taxer, she clearly has a message that resonates with several wings of the Republican Party. And with Palin seemingly intent on sitting out the race, Bachmann has the opportunity to become the "not-Mitt" candidate.

The Republican Party's more moderate supporters (there still are some of them, presumably) and its financial backers will be looking for a leader to beat Obama. This is where Bachmann's wider appeal, or the lack thereof, will come into play. If she can persuade the Party's hierarchy of her ability to seduce independents and disgruntled Democrats, the money and mojo could swing in her favor. If she can't, she will remain a fringe candidate.

So, can Bachmann appeal to folks who aren't obsessed with God, gays, and taxes? Like many pundits of the bar stool and salaried varieties, I have some doubts about her ability to make the necessary pivot, and to avoid making major gaffes, but she does have three things in her favor.

She's a woman.

She's attractive.

She's running as a "Reagan Democrat."

Being female not only sets Bachmann apart from the field, it partially inoculates her against the charge that she's an extremist. When Glenn Beck and Rush Limbaugh rave about Obama and the Democrats being godless, anti-American socialists, they come across as what they are: angry middle-aged white men. Bachmann can say equally incendiary things, but coming from the mother of four (and the foster mother of twenty-three) it doesn't have quite the same impact.

(That is one reason Bachmann reminds me of Mrs. Thatcher. Back in the seventies, when the Iron Lady was blaming the Labour Party for wrecking the U.K. economy and implying that it got its marching orders from Moscow, she packaged this subversive message as homespun common sense familiar to every housewife. Bachmann has the opportunity to position herself in a similar manner. Of course, Mrs. T. wasn't a religious zealot, and she had much more experience than Bachmann, so the comparison shouldn't be taken too far.)

Bachmann's appearance can't be ignored. In a Republican field that resembles a police lineup for a C.E.O. suspected of embezzling corporate funds, the camera immediately seeks her out, and so does the viewer. At the first debate for Republican candidates, and again today at her campaign announcement, she surpassed expectations. She speaks fluently; she is pretty—but not too pretty; and she has a smile that guarantees her the endorsement of the American Dental Association. In an election that will take place largely on television, such trifles cannot be dismissed.

On matters of substance, she hits Obama where he is weakest, exploiting the widespread (and mistaken) perception that his policies, and the economic philosophy they are based on, have failed. But perhaps the most interesting aspect of Bachmann's speech was her appeal to disgruntled supporters of the opposing party. "I grew up a Democrat," she said. "My first involvement in politics was working for Jimmy Carter's election in 1976. But when I saw the direction President Carter took our country, how his big spending liberal majority grew government, weakened our standing in the world, and how they decreased our liberties, I became a Republican. "

This passage was a straight lift from Ronald Reagan, who was forever saying that the Democratic Party left him rather than vice-versa. It can be no coincidence that Ed Rollins, who masterminded Reagan's 1984 landslide, recently signed on with Bachmann. At sixty-eight, Rollins is getting on a bit, but he still knows how to run a populist Presidential campaign aimed at swing voters in states like Ohio, Pennsylvania, and Michigan.

No wonder Obama's campaign team is paying attention.

Photograph by Glen Stubbe/AP.

June 24, 2011

What Budget Impasse?

Hold the front page!

"Republicans Walk out of US budget talks over taxes " (Reuters)

"Budget Talks Near Collapse as G.O.P Leader Quits" (New York Times)

"Budget talks reach an impasse" (Marketplace)

Clearly something important is happening down in D.C. Or is it?

Checkpoint 1: What is the date? Eric Cantor, the House Majority Leader, staged his exit from negotiations with Vice-President Biden and other Democrats on Thursday, June 24th. The deadline for an agreement on raising the debt ceiling is midnight on Tuesday, August 2nd, which is almost six weeks away. Is there is anybody in Washington who expected an agreement before August 1st at the earliest?

The real negotiations haven't even begun yet. The White House announced on Friday that President Obama and Vice-President Biden will meet next week with Mitch McConnell, the Republican leader in the Senate, to discuss "the status of the negotiations to find common ground on a balanced approach to deficit reduction." Shortly after that, the President will doubtless call up his golfing buddy John Boehner, the Speaker of the House, and get down to business.

Checkpoint 2: What budget impasse? In his statement explaining why he had it on his toes, Cantor said he and the negotiators on the Democratic side had already identified "trillions in spending cuts," which means they are more than halfway to their target of four trillion dollars in deficit reduction over the next decade. The White House wants some of the remaining shortfall to be made up with revenue increases, such as eliminating federal subsidies for oil companies and cutting back tax breaks for wealthy individuals. If you really thought that Cantor, the No. 2 banana in a House Republican Party that is dominated by the hard right, was going to sign on to such a deal at this stage, you need to stand in a corner and repeat to yourself a hundred times: "Grover Norquist says 'No New Taxes.' "

Checkpoint 3: Have you brushed up on your game theory recently? If you haven't, I suggest you go out and buy an elementary text, such as the excellent "Thinking Strategically," by Avinash Dixit and Barry Nalebuff. It's got an entire chapter on brinkmanship, which is what the next six weeks are going to be all about. "The essence of brinksmanship is the deliberate creation of risk," Dixit and Nalebuff explain. "This risk should be sufficiently intolerable to your opponent to induce him to eliminate the risk by following your wishes."

From the perspective of Republicans, the essence of the game is to persuade the White House that they are just crazy enough to cause the U.S. Treasury to default on its financial obligations, with who knows what consequences, rather than accept revenue (tax) increases of any kind. From the White House's end, the trick is to persuade the Republicans that if they don't go along with some revenue increases, President Obama will walk away and blame the Republicans for their intransigence.

How will things play out? At the end of the process, I'm pretty sure there will be a deal—and one that includes some revenue increases. Given what happened to the Republican Party in 1998 after Newt Gingrich shut down the federal government rather than accept President Clinton's budget, I regard the House Republicans' threat to vote down an agreement that includes any tax increases as an incredible one, which ultimately they will be unable to carry out. (For those of you who need one, Dixit and Nalebuff also have a primer on "credible commitments.")

But between now and August 2nd, there is going to be a lot of gamesmanship on the banks of the Potomac.

Photograph by Alex Wong/Getty Images.

June 20, 2011

U.S. Open: Rory Strolls Into the History Books

The most impressive aspect of his victory was how uneventful, predictable, even a little dull, it seemed. Truly great sporting performances are sometimes like that. At the very pinnacle of his (or her) powers, the athlete has mastered his discipline to such an extent that he makes what he is doing look not just easy but preordained. The gaping distance between him and his supposed competitors robs the event of competitive tension, and the only rooting interest is in how many records he can accumulate.

When Rory McIlroy tapped in at the eighteenth for a two-under par sixty-nine on Sunday, he had broken or tied twelve scoring records at the U.S. Open, including lowest four-round total (268) and lowest score in relation to par (-16). Yes, the rain-softened Blue course at Congressional was playing easier than any layout in recent Open history, but the manner of McIlroy's victory wasn't just emphatic: it was serene.

The first two holes defined what was to follow. At the four-hundred-and-two-yard first, Rory hit a three wood twenty-five yards past Y. E. Yang's drive, knocked a short iron to five feet and holed out to go fifteen under par. On the long par-three second, he left himself seven, maybe eight, feet for par and calmly rolled the putt into the middle of the hole. This was not going to be another Augusta. Not once did he look like giving anybody else the hint of a chance to catch him.

By the middle of the back nine, he was strolling home. In winning this tournament in this style at the age of twenty-two years and one month (another record), the likable Northern Irish mophead served notice that a sporting superstar has arrived. The headline in Monday's Belfast Telegraph wasn't just hometown boosterism: "Rory McIlroy's genius has us all gasping."

How good was Rory's eight-shot victory? It perhaps doesn't rank in the very highest echelon of sporting achievements. It can't compare to the sprinter and long jumper Jesse Owens in 1935 breaking three world records and tying another in just forty-five minutes; Secretariat winning the 1973 Belmont Stakes (and Triple Crown) by thirty-one lengths and setting a speed record that still stands, or even Tiger Woods' leaving the field fifteen shots behind at Pebble Beach in the 2000 U.S. Open.

But Rory's performance fits just one classification down—in the ranks of super achievements by young athletes. He can be legitimately compared to the twenty-two-year-old Cassius Clay scoring a T.K.O. over the fearsome Sonny Liston in 1964; Boris Becker winning the 1985 Wimbledon title at seventeen; the fourteen-year-old gymnast Nadia Comaneci, at the 1976 Olympics, scoring the first-ever perfect ten, in the uneven bars. (As the games went on, Comaneci recorded another six perfect scores—a performance that does rank up there with Owens and Secretariat.)

And all this from a homemade golf swing that relies heavily on tempo and raw talent. As Barry Power, a noted Irish golf instructor, explains in this video, Rory's head moves a good distance off the ball during his backswing, and before impact he rotates his shoulders dramatically to the left. Neither of these moves are to be found in the golf textbooks and, according to Power, if the average amateur tried them he could wind up in the emergency room. What makes them work for Rory is his youthful athleticism, plus his timing and balance, which, when he is playing well, are close to perfect.

Like Tiger in his youth (and Johnny Miller and Tom Watson early in their careers), he makes a mighty swipe, involving lots of moving parts, that is so well synchronized it looks like one flowing, effortless movement. Such swings demand a lot from the body and the motor system: generally, they don't last forever. (Watson may be the exception that proves the rule.) But for a time they can produce amazing results. Power reckons Rory's swing could last another six or eight years, by which time he may well be chasing Woods and Jack Nicklaus in the league table of majors won.

Much will depend on his putting. After working with putting guru Dave Stockton, he has altered his set-up slightly, firmed up his left wrist, and solidified his stroke. In the past, he was known as something of a streaky player on the greens. This week, he didn't make a three-putt until near the end of his last round, when he was so far ahead it didn't matter. If he keeps putting like this, he could very well go on and win the British Open next month, which is what Tiger did following his victory at Pebble Beach.

On this form, who could stop him?

June 17, 2011

U.S. Open Day 2: All Hail to Rory

Clearly, it's time for me to shut up and let Rory McIlroy's clubs do the talking. Courtesy of the P.G.A. Tour, here is a list of U.S. Open records he has established with his two-round start of 65-66.

Rory's two-round total of 131 is the lowest score after 36 holes in the 111-year history of the U.S. Open. (The previous record was 132, set by Ricky Barnes in 2009 at Bethpage Black.)

At 11 under, Rory's score is also the lowest in relation to par after two rounds. (Woods in 2000 and Barnes in 2009 were 8 under through 36 holes.)

With Y. E. Yang at minus 5, Rory's six-shot lead ties Tiger Woods's six-shot lead at Pebble Beach in 2000 as the biggest ever after two rounds.

After making birdie at the seventeenth hole, Rory was 13 under par. That breaks the record held by Woods and Gil Morgan for the lowest score in relation to par at any point in a U.S. Open.

Rory became the fastest player to reach double digits under par when he got to 10 under through his first twenty-six holes.

He became the first player to play his first thirty-five holes without a bogey. (At the eighteenth, Rory hit the ball in the water and suffered a double bogey, bringing his score back to minus 11.)

So, is Rory the new Tiger? Or is he the new Bobby Clampett, another curly-haired wonder boy, who had had a five-shot lead after two rounds of the 1982 British Open and finished tenth? Having predicted on the eve of McIlroy's final round at the Masters that he would win easily, I don't want to jinx him again.

For what it's worth, the British bookies think he's a virtual shoo-in. At William Hill, the odds on his winning are 1 to 3, which means you would have to bet thirty dollars on him to win ten.

(As for my "Rick ratings," the top-placed player on the list is Phil Mickelson, who is tied for 23rd at plus 1, twelve shots behind McIlroy.)

U.S. Open Day 1: Rory Stripes It; Phil Hacks It

So much for my "rick ratings." Of the eight players I highlighted as possible winners in my pre-tourney handicap sheet, precisely none made the top twenty on the leaderboard at the end of day one. To make matters worse, my four "implausibles"—Donald, Fowler, Els, and Scott—outscored my "respectables"—Mickelson, Westwood, Stricker, and Watney. Mickelson, my pick as the winner, hit the ball sideways all day and was lucky to reach the clubhouse a mere nine shots behind the leader, Rory McIlroy. By way of consolation, Mickelson commented: "I can't hit it any worse."

Golf tournaments are played over seventy-two holes rather than eighteen, but still. Evidently it is I rather than Rick Hertzberg who wouldn't know a gap wedge from a garden hoe. About the only thing I can say in my defense is that the 80-to-1 shot Angel Cabrera, whom I selected as one of my "eccentrics," is just outside the top twenty at even par, and so is Bubba Watson, another of my picks. There is an old saying at the U.S. Open that when you are shooting even par you are in contention. As the greens firm up over the weekend and the pin placements get more fiendish, that truism is likely to hold up.

For now, though, the story is McIlroy, the Northern Irish phenom, who struck the ball beautifully and scored a six under par 65 to establish a three shot lead. (And he's building that lead so far this morning on the front nine in Round 2.) One hole from his round, the five hundred and fifty-five yard par five sixth, sticks in mind particularly. After pounding a drive three hundred and twenty-five yards, or so, he hit an uphill three iron that headed for the green like a cruise missile, rolled right past the flag and ended up on the back fringe. It was the sort of iron shot that Tiger Woods used to play when he was McIlroy's age—twenty-two—and served to remind why Ernie Els and other sound judges have identified Rory as "the next Tiger."

I unwisely omitted Rory from my picks for two reasons. Firstly, like most everybody else, I assumed that his epic collapse on the final day of the Masters, when he shot eighty having started the day with a four-shot lead, would scar him, at least for a while. Apparently it didn't. One thing that marks out McIlroy is his attitude. Rather than skulking around after the Masters, or mouthing sports-psychologist babble about "taking positives" from the ordeal, he said he had messed it up, expressed the hope he would learn something, and flew to his next tournament.

But despite my awe at McIlroy's ball striking, and my respect for his character, I won't be taking the being offered on him overnight by William Hill. That is because of the second reason I didn't pick him up front: I'm not fully convinced of his ability to hole out putts under the highest pressure. Even in Round 1, when he made the rest of the game look ridiculously easy, he missed some makeable putts. When all is said and done, it was Tiger's ability to get the ball in the hole, rather than his long game, which separated him from everybody else. If Tiger in his prime had played McIlroy's round today from tee to green, he would have shot 61 or 62, established a six or seven shot lead, and gone on to win comfortably.

I dearly hope that Rory does the same thing, proves me wrong again, and demonstrates that the comparison with Tiger is an apt one. He needs the lift. So does Northern Ireland. And as my colleague Lee Ellis pointed out yesterday, so too does the business of golf.

Rory McIlroy in May. Photograph by Photo by Ed McDonald, Flickr CC.

June 16, 2011

U.S. Open at Congressional: Rick-Rating the Hopefuls

A Republican Presidential debate the week of the U.S. Open? Forgive me, but that's a bit much to take, especially since this isn't even a year divisible by four. Surely, the G.O.P. politicians could do the decent thing and leave the summer months for their proper uses: playing or watching ball games, drinking outdoors, cultivating melanomas, and whining about global warming—or the absence thereof if it rains through your one week of vacation.

But perhaps I am complaining too much. After all, what could be more Republican than a major sporting event that takes place at an exclusive country club—this year it's Congressional, in Bethesda, just outside Washington, D.C.—and is "brought to you" by IBM, Lexus, American Express, and Rolex?

To get into the spirit of things, I've decided to swipe my friend and esteemed colleague Hendrik Hertzberg's "Rick ratings," which he developed to sift the diamonds from the muck among the many G.O.P. candidates for 2012, and apply them to the main contenders in this week's tourney. I suspect Rick wouldn't know a gap wedge from a garden hoe. But a tripartite classification system—"respectables," "eccentrics," and "implausibles"—flexible enough to encompass incendiaries like Sarah Palin, John Bolton, and Donald Trump ("The Hairdo" was still in the race when Rick wrote his original piece) as well as stuffed shirts likes Mitt Romney and Tim Pawlenty, can certainly accommodate a bunch of monomaniacal, charisma deprived (for the most part) twenty-thirty-and forty-somethings clad in bright colored pants and t-shirts emblazoned with corporate logos.

In the absence of Tiger Woods, who is still on the disabled list, many commentators have described this as the most open Open in many years. Since Tiger's collapse, golf has joined the N.F.L. in an age of parity, which implies that any one of forty or fifty players could win. (A quick quiz: name the last four major winners.)

But sorting through the field is not necessarily a hopeless pursuit. The eighteen holes at Congressional will be playing to more than seventy-five hundred yards, which is very, very long. Some of the greens will run as fast as fourteen on the Stimpmeter (a measuring device), which is very, very quick. Logic would suggest that the winner will be a powerful hitter who putts well on treacherous surfaces. Actually, the list of players who satisfy both of these requirements isn't very long.

So, here goes with a quick once-over of four leading contenders of the Romney-Pawlenty stamp, four talented and unpredictable Michele Bachmann-Rick Perry types that shouldn't be dismissed, and four popular but ultimately unlikely candidates of the Sarah Palin school. (The odds listed in parentheses are from William Hill, the British bookie.)

The Respectables:

Phil Mickelson: Recently afflicted with rheumatism, family illnesses (his wife and mother both have breast cancer) and an unusually balky putter, "Phil the Thrill" still can't be written off. He has finished second (or tied for second) five times in this event, most recently at Bethpage in 2009. He still hits the ball a mile. His recovery skills are unparalleled. And, as he showed at this year's Shell Open, he hasn't forgotten how to win. (Odds: 12/1)

Lee Westwood: Ranked No. 2 in the world and boasting a shiny new set of gnashers to replace his crooked English fangs, Westwood hits it long and straight, plays well in the majors, and is a decent putter. His weakness is chipping from around the green, but when his iron game is on he doesn't need to do much of that. (Odds: 12/1)

Nick Watney: Of the young American contenders, he's perhaps the most solid all-round player. Ranked in the top twenty in driving distance and in the top ten in putting, the thirty year-old Californian should contend providing he can keep the ball in play. (Odds 30/1)

Steve Stricker: Along with Westwood, Stricker is vying for the title of best player never to win a major. An excellent chipper and putter, he's long enough off the tee, plus he's the form pick. Two weeks ago, he won Jack Nicklaus's tournament, the Memorial, which is held on a similarly long and tough course. (Odds 22/1)

The Eccentrics:

Bubba Watson: One of the longest hitters in the field, Watson can work the ball both ways, and he's a streaky putter. If he can handle Congressional's greens and keep his hot temper in check, he could make up for his disappointment at last year's final major, the PGA Championship, where the German Martin Kaymer beat him in a playoff. (Odds: 45/1)

Dustin Johnson: Another prodigious ball striker, Johnson should have won at least one major in 2010. In the U.S. Open, he led by three shots going into the final round only to shoot an eighty-two. In the PGA Championship, he lost his lead on the seventy-second hole, where he was penalized two shots for grounding his club in a fairway bunker. (Odds: 25/1)

Angel Cabrera: Maybe the most underrated player in the world, the big-hitting Argentine is a deceptively good putter and he's already bagged two majors—the 2007 Masters and the 2009 US Open. A genial but mercurial chain-smoker, "El Pato," as he is known, seldom wastes his talent on winning minor tournaments, and he is showing signs of hitting form. (Odds 80/1)

Paul Casey: Rounding out the foursome of big hitters, the Englishman is built a bit like Popeye—and sometimes putts like him. His recent form is atrocious, but that means expectations of him are low, which might be a plus. He's still ranked number ten in the world, and on his day is close to unbeatable. (Odds 40/1)

The Implausibles:

Luke Donald: With pro golf rapidly joining other sports as a pursuit for buffed up (juiced up?) Brobdingnagians, it's refreshing to see a 5 feet 9 inch, a hundred and sixty pound waif making his way to the top of the world rankings. Donald has the best short game on tour, he's mentally tough, and I'd love to see him win a major, but I doubt he's long enough off the tee to make this the one. (Odds 12/1)

Rickie Fowler: With Tiger in eclipse, the networks, the PGA tour, and Puma, which sponsors his garish outfits and oversize cap, will be praying for a breakthrough by the long-haired, twenty-two-year-old Californian. He's a big hitter, an aggressive shot maker, and a very respectable putter. But he's yet to win a PGA tour event or finish in a top ten in a major. (Odds 50/1)

Ernie Els: The Big Easy won the last Open played at Congressional, in 1997, since when he's suffered numerous setbacks, many of them at the hands of Tiger. Still a player of enormous natural talent, he is currently suffering with the putting tremors and sometimes appears to be on the verge of losing interest. One good week on the greens could change that, but that seems unlikely to materialize. (Odds 80/1)

Adam Scott: Another excellent ball striker who struggles with the flat stick, Scott appeared to have overcome his putting woes at this year's Masters, where, sporting a new belly putter, he finished tied for second. Since then, though, he hasn't played well, and he's still languishing at 181st in the overall putting rankings. (Odds: 40/1)

My pick: Mickelson.

(Answer to the quiz: Graeme McDowell—the U.S. Open; Louis Oosthuizen—the British Open; Martin Kaymer—the PGA Championship; Charl Schwartzel—the Masters.)

Phil Mickelson in 2007. Photograph by Craig O'Neal, Wikimedia Commons.

June 10, 2011

U.K. Economy Returns to 1930s; I.M.F. Applauds

With all the talk of a possible double-dip recession in the U.S. economy—here's my own little contribution—it's surprising (and somewhat scandalous) that more attention isn't being paid to what is happening in Britain, where a second economic downturn began last fall and shows few signs of relenting.

About a year ago, with the British economy seemingly recovering fairly well from the financial crisis of 2008, David Cameron's Conservative-Liberal coalition embarked on a vigorous policy of deficit reduction, raising taxes and cutting government spending in an effort to balance the budget by 2015. How this experiment in pre-Keynesian economic policy turns out obviously has important implications for the fiscal debate on this side of the Atlantic.

So far, the results aren't looking very favorable. In the four months from October to January, the U.K.'s G.D.P. actually fell. Since then, it has edged up slightly. But according to a new report from the non-partisan National Institute for Economic Research, in London, in the three months to May the economy expanded, but by just 0.4 per cent—a miserly rate of growth.

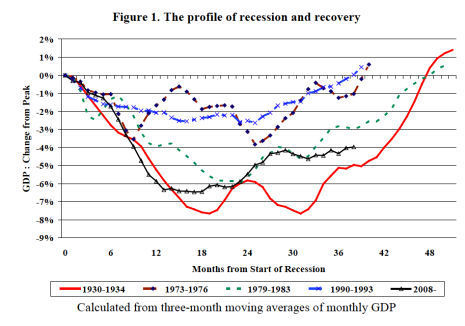

Unlike other influential bodies, the N.I.E.S.R. hasn't hesitated to label the current period as a "depression," which it defines as a lengthy period in which an economy fails to surpass the previous peak in G.D.P. The economic downturn in the U.K. began more than three years ago, and G.D.P. is still about four per cent below the level it reached in early 2008. As the chart above shows, the current slump seems set to last at least as long as the downturns of 1930-1934, a.k.a. The Great Depression, and the savage "Thatcher Recession" of 1979 to 1983, during which large swaths of Britain were effectively de-industrialized.

The N.I.E.S.R. is not expecting output to pass its previous peak until 2013 at the earliest, and even this may well prove optimistic. The independent Office of Budget Responsibility, which the government set up last year to stop the Treasury from cooking the books, is forecasting growth of 1.7 per cent this year and 2.5 per cent in 2012. These figures might sound pretty modest, but with the government busy retrenching and consumers still digging themselves out of debt, they hinge on an upturn in exports and business investment that seems unlikely to materialize. Realistically, G.D.P. growth of one per cent this year and two per cent next year seems about the best that can be hoped for, and, absent a policy change, an even worse outcome can't be ruled out.

Before my Conservative-leaning fiends start howling (and yes, I do have some), I am not suggesting that the current recession is quite as deep or devastating as what befell the U.K. in the nineteen-thirties, or even the nineteen-eighties. The chart clearly shows that G.D.P. fell further in the nineteen-thirties. Compared to the nineteen-eighties, the current recession is slightly deeper in terms of G.D.P. What is very different this time is the pattern of unemployment. In the summer of 1932, the U.K. unemployment rate hit twenty-eight per cent, and in some depressed regions, such as Wales, it was considerably higher. Unemployment in the nineteen-eighties wasn't nearly as bad, but the jobless rate did reach twelve percent, prompting outraged calls for a policy u-turn and eliciting Mrs. T's most famous bon mot: "The lady's not for turning."

Currently, the British unemployment rate is 7.7 per cent, considerably lower than the rate in the U.S., but this number prompts many questions. During the past thirty years, U.K. governments from both parties have repeatedly massaged the official job figures. For example, many millions of able-bodied British adults are now classed as "disabled," which enables them to claim disability benefits and disappear from the jobless rolls. A more meaningful measure of the labor and human potential going to waste is the fact that almost one in four Britons aged sixteen to sixty-four are now classed as "inactive" in the labor market.

Given this situation, you might think that concerned international bodies, such as the International Monetary Fund, would be urging Cameron and George Osborne, his whey-faced Chancellor, to consider adopting a Plan B. But there you would be wrong. Earlier this week, the I.M.F., after completing its annual inspection of the U.K. economy, issued a statement that looked suspiciously like it had been drafted in Downing Street.

"Aided by the implementation of a wide-ranging policy, the post-crisis repair of the U.K. economy is under way," it began. "However, the weakness in economic growth and rise in inflation over the last several months was unexpected."

Without pausing to answer the question of unexpected by whom—certainly not Lord Skidelsky and other Keynesian economists who warned all along that Osborne's plan could well derail the British recovery—the I.M.F./Downing Street communiqué went on.

"This raises the question of whether it is time to adjust macroeconomic policies. The answer is no…. Strong fiscal consolidation is under way and remains essential to achieve a more sustainable budgetary position."

And so, the great experiment continues, with sixty-two million Britons cast in the role of guinea pigs.

June 7, 2011

Obama Badly Needs a New Economic Spokesman

Austan Goolsbee's decision to leave the White House Council of Economic Advisers this summer marks the end of President Obama's original economics team. In the past nine months, Larry Summers and Christina Romer have both quit, and so has Jared Bernstein, who was Vice-President Biden's top economic adviser.

Some reports about Goolsbee's departure have speculated that he is leaving out of frustration at the lack of influence he was having on policy (Huffpo) or that he is abandoning a sinking ship (Fox). Absent some better sourcing for these suggestions, I am content to accept the official explanation that Goolsbee is returning to Chicago to safeguard his professorship at the Booth School of Business.

I hope Goolsbee will eventually provide his own account of his four years advising Obama, from the campaign to the White House. Even at this stage, there is much that remains murky about Obamanomics, beginning with the President's own economic thinking and continuing on to the relationship among his various advisers. (For more on this see below.)

For now, though, the big question is how the White House will fill Goolsbee's job. With the modest recovery showing alarming signs of petering out, and with the budget and debt battle on Capitol Hill only getting going, the White House badly needs a top-notch economist to advise the President and take on the Andrew Mellon crowd, which thinks deficit-reduction is the answer to every economic ill.

Of course, the deficit hawks are most vocal (and self-deluding) in the Republican Party. But lately some Democrats, and even the President himself, have been pivoting to deficit reduction. As long as the economic recovery seemed to be moving towards a self-sustaining trajectory, this was a defensible shift, politically and economically. Now that the economy is again in peril, it could prove disastrous.

Far from embracing Republican calls for immediate cuts in federal spending, the White House should be looking at crafting another stimulus package. With the Fed having abandoned its policy of quantitative easing, the onus is on the White House and Capitol Hill to head off the possibility of a double-dip recession, which would, among other things, send the deficit soaring even further.

Who has the stomach and intellectual heft to stand up to the deficit hawks? Gene Sperling, the head of the National Economic Council, is a hard-working, well-meaning fellow, and a very able Washington operator, but he doesn't have the gravitas of a Summers, or even a Goolsbee. Jason Furman, Sperling's deputy, is another Washington insider—and the holder of a Harvard Ph.D—but he, too, lacks standing.

Who else is there? It is unlikely that the Senate would confirm Paul Krugman or Joseph Stiglitz, the two liberal icons and Nobel Laureates. Given their criticisms of the Administration, it is also doubtful that either one would pass muster with Obama. Janet Yellen, who held Goolsbee's job in the Clinton Administration, is now at the Fed. Other possibilities, I suppose, are Laura Tyson, Alan Blinder, Brad De Long, David Romer (Christina's husband) and Alan Krueger. Some of these people probably aren't interested in the job, and others I've overlooked may well be better choices.

But the point is that somebody has to do the job, and the White House needs to get on the case.

Now back to insider baseball.

From my own reporting, I got the impression that Summers, Romer, and Goolsbee got on rather better than other accounts have suggested. Of course, there were tensions—personal and political. (In which White House were they absent?) Nobody, not even Larry Summers, has ever said that working with Summers is a picnic. But on most issues that came up the three advisers eventually settled on policy recommendations they could each live with.

Over the years, I have taken some shots at Summers—particularly for his enthusiastic support of financial deregulation. But I think it is misleading to suggest that Big Bad Larry singlehandedly (or double-handedly, with Tim Geithner) prevented Goolsbee and Romer from imposing a much more progressive agenda on the White House. The basic policy lines, Obama set down himself. From the end of 2008, when he overlooked Goolsbee, his campaign adviser, for the job of heading the National Economic Council, and appointed Summers and Geithner, it was pretty clear his Administration was going to disappoint the left. And so it proved.

Even if Goolsbee had taken the top job, would things have been so very different? All three senior advisers—Goolsbee, Summers, and Romer—are centrist neo-classical economists who combine an underlying faith in free markets (remember Goolsbee's support of NAFTA?) with a recognition that market failures do happen. On some issues, such as the size of the 2009 stimulus package and the need for far-reaching financial reform, Goolsbee and Romer were somewhat to the left of Summers. But on the auto bailout, for instance, Goolsbee was a more skeptical voice, at least initially.

One of Goolsbee's most notable contributions, which he accomplished in late 2009 together with Jared Bernstein, was in bringing Paul Volcker back into the fold. This complicated maneuver took place over the objections of Summers and Tim Geithner, and it led to the inclusion in the Dodd-Frank bill of a (somewhat watered down) "Volcker Rule," which barred depository institutions from proprietary trading. That was a very worthwhile addition, for which Goolsbee deserves credit, but its radicalism shouldn't be exaggerated.

Obama is a centrist and cautious politician, and he surrounded himself with advisers he felt comfortable with.

June 2, 2011

Will Lloyd Blankfein End Up in the Dock?

What to make of today's news that the Manhattan district attorney's office has issued a subpoena to Goldman Sachs relating to its activities in the market for subprime securities?

In one sense, it comes as no surprise. Back in April, the Senate's Permanent Subcommittee on Investigations issued a blistering report about Wall Street's role in the credit crisis, claiming to have unearthed a "financial snake pit rife with greed, conflicts of interest, and wrongdoing." Those were the words of Carl Levin, the Michigan Democrat, who forwarded his six-hundred-page report to the Justice Department with the recommendation that it look into prosecuting Lloyd Blankfein and other Goldman bigwigs.

Attorney General Eric Holder and Cyrus Vance, Jr., the Manhattan D.A., wouldn't be doing their jobs if they didn't take Levin's allegations seriously. (It

isn't clear yet whether Vance is acting independently or in concert with the Justice Department. My bet is it's the former.) The issuing of subpoenas indicates that the government's investigation is still at an early stage, and there is little, as yet, to suggest that Blankfein or any other Goldmanites will end up in the dock. Indeed, from what we know now the most likely outcome is that they won't.

Levin made two charges against Goldman: that the firm misled its clients into purchasing mortgage securities at the same time that the firm was shorting them on its own account; and that Blankfein and some of his colleagues misled Congress about Goldman's activities. Turning either of these accusations into criminal charges wouldn't be at all easy.

The Securities and Exchange Commission, in its investigation into the notorious Abacus deal, has already trawled through the first area and evidently decided that it couldn't make the charges stick in court. Why else would it have settled with Goldman for a mere $550 million? I still think the S.E.C.'s decision to settle prematurely was a serious error, especially since it didn't involve any admission of wrongdoing on Goldman's part. But proving that the firm committed a criminal fraud on its clients would present a very major challenge, should Vance and his colleagues move in that direction.

The same would be true of attempting to show that Blankfein deliberately lied to Congress when he averred—to Levin's great annoyance—that during 2007 and 2008 Goldman didn't maintain a big short position in subprime mortgage securities. Blankfein admitted that one branch of the firm—the prop trading desk—did at various times sell short a lot of junky mortgage bonds, but he claimed that other parts of the firm—the distribution arm, presumably—had a big long position in the same or similar securities, and that the two positions largely offset each other. If this is true, and surely it must be or Blankfein wouldn't keep repeating it, the issue comes down to one of semantics: When is a short a short? Maybe I am being dim, but I struggle to see this as the basis of a criminal case.

Still, the issuing of subpoenas is undoubtedly more bad news for the embattled firm. There is never any knowing where a criminal investigation will lead. If Vance and, or, the Justice Department are seriously intent on making a case against Goldman, they have plenty of leads to follow up, and a strong political incentive to take a hard line. Three years after the start of the financial crisis, most Americans are convinced that Wall Street got off too lightly. A successful prosecution of Blankfein would launch Vance on the career path of Rudolph Giuliani and bury the notion that the Obama Administration is just another arm of Government Sachs.

For now, though, I just don't see it.

(Endnote: Brad Hintz, a well-known Wall Street banking analyst, has put forward another reason to doubt that the government will eventually indict Goldman. Bringing criminal charges against a securities firm can effectively destroy it, just as it destroyed Drexel Burnham back in 1989-90. But Goldman, unlike Drexel, is "too big to fail": its collapse could well cause a rerun of September, 2008. Said Hintz: "If an alleged violation is identified during a Goldman investigation, we expect a reasoned response from the Justice Department. In a worst case environment, we would expect a 'too big to fail' bank such as Goldman to be offered a deferred-prosecution agreement, pay a significant fine and submit to a federal monitor in lieu of a criminal charge.")

Photograph by Chris Kleponis/AFP/Getty Images.

May 26, 2011

Leaders Fiddle While Europe Smolders

Springtime in Deauville: What could be better? For the hundreds of journalists, diplomats, and Administration officials who are attending the G8 meeting on the coast of Normandy, not much could be. Pretty beaches, grand hotels, rich local cuisine—and hardly any real work to do.

An annual event that started out in 1975 as a serious meeting devoted to international economic issues long ago degenerated into a photo-op for world leaders, and a quick getaway for their political and media hangers-on. Count me one of the guilty. In 1989, when I "worked" for the Sunday Times of London, I spent a thoroughly pleasant weekend in Paris at the fifteenth G7 Summit—Russia joined in 1997, making it the G8—which, to mark the two-hundredth anniversary of the Revolution, was held at the Grande Arche in La Defense, Francois Mitterrand's austere monument to liberté, égalité, fraternité.

Besides providing a temporary boost to Parisian hotels and restaurants, the summit achieved nothing at all, at least as far as I recall. But perhaps my mind is playing tricks with me. According to Wikipedia, the assembled leaders—quick memory quiz: Can you name them?—called for the "adoption of sustainable forest management practices, with a view to preserving the scale of the world's forests." I must have missed that declaration. I think I was busy dining on the Rive Gauche with my editor, who had flown over from London for this urgent occasion.

Enough. You get the idea. Even world leaders deserve the odd weekend off, especially when not very much is happening. Unfortunately, though, this isn't such an occasion. As Sarkozy, Merkel, Cameron, Obama, et al., gather under the rubric of "New World, New Ideas"—yes, the French did come up with that slogan—the European economy is stumbling toward an eminently avoidable disaster.

I am referring, of course, to the sovereign debt issue. What began as a problem of overspending and over-borrowing in the appropriately named PIGS—Portugal, Ireland, Greece, Spain—is rapidly turning into a full-blown political and economic crisis that threatens the entire eurozone, and, in turn, the global economic recovery.

For two years now, the major European governments have adopted a band-aid approach, lending money first to Greece, then to Ireland, and most recently to Portugal so that these countries could continue to service their debts. In return for these "bailouts," the debtor countries were forced to adopt austerity policies—spending cuts plus tax increases—which have accentuated their economic slumps and outraged their citizens.

So far, so predictable. From an economic perspective, what will eventually have to happen is pretty plain. The PIG countries (but perhaps not Spain) need to restructure their debts, write some of them off, and start anew, much as Mexico did in the late nineteen-eighties and Argentina did in 2002. As of now, though, such an option remains a non-starter—largely because it would force banks and taxpayers in the big European countries, especially Germany and France, to bear some of the costs.

Wearing my optimist's cap, I had long assumed that the Europeans would do what they usually do: play for time, bicker, prevaricate, and eventually get things together and take the necessary measures. Now I am not so sure. In Germany and in France, the political and financial establishments, backed by popular opinion, seem determined to stick with a failed strategy. "Restructuring is not a solution; it's a horror show," Christian Noyer, the head of the Bank of France, declared earlier this week. Sounding ominously like a First World War general, he said the Greeks had no choice but to stick with austerity and wage cuts. "When we're in a monetary union and you need to restore your competitiveness, it is necessary to have the equivalent of an internal devaluation. Cut production costs. There is no other solution."

Now, Noyer is a central banker, and, as such, part of his job is to parrot the financial orthodoxy, however obtuse. In a crisis, it is the task of politicians to recognize reality, override the bankers, and impose a new orthodoxy. Which brings us back to Deauville. Behind the scenes, one would hope, the European leaders, with the vigorous encouragement of President Obama, are reviewing their options and preparing a Plan B.

Perhaps they are. But I wouldn't bet on it.

(Answer to the quiz: George H. W. Bush, Margaret Thatcher, François Mitterrand, Helmut Kohl, Ciriaco de Mita, Brian Mulroney, Sosuke Uno, and Jacques Delors—the latter representing the European Commission.)

Photograph by Patrice Le Bris / OT Deauville.

John Cassidy's Blog

- John Cassidy's profile

- 56 followers