John Cassidy's Blog, page 117

March 15, 2011

Foreign Investors Flee Japan

Not that it matters much in the scheme of things, but in the past two days the Japanese stock market has suffered the biggest fall in any major market since the Wall Street crash of October, 1987. The Nikkei—Japan's equivalent of the S&P 500 index—is down by more than sixteen per cent compared to where it was trading before the weekend. At one point today, it had fallen more than twenty per cent.

On any rational basis, this is a big overreaction. Even if Japan does suffer a Chernobyl-style radiation leak, it won't have much impact on the long-term earning power of companies such as Toyota, Sony, and Hitachi, some of which have announced they are suspending production at Japanese plants hit by power outages. But traders are not looking at the long term: they are looking at what is going to happen in the next few hours and days. And since they can't figure that out, their reaction is sell, sell, sell.

This is particularly true of hedge funds, which, for the first time in many years, had recently turned bullish on Japan. Overnight, there were reports of heavy selling of Japanese stock futures in the Singapore market—a pretty reliable sign that the selling was coming from foreign hedge funds. In Tokyo itself, trading wasn't particularly heavy—there weren't any buyers.

So hedge funds are abandoning ship, Japanese retirees with their money in the market have seen their wealth shaved by a sixth, and the rest of us, believe it or not, may be benefitting slightly from this natural and man-made disaster. Why is that?

In the past couple of days, the price of oil has fallen about ten per cent, unwinding some of the big runup seen in recent months. If this trend persists, fuel prices will come back down and worries of a big "commodity shock" derailing the global economic recovery will retreat. And that, perhaps, is why Wall Street is relatively calm today—so far, at least. (As of mid-morning, the U.S. market was down about two-and-a-half per cent.)

But why is the oil price falling? Some reports attribute it to the fact that a stricken Japan will need to import less oil, but that doesn't really make sense. If Japan's nuclear power stations are knocked out permanently, it will need to import more oil, not less.

What is really going on, I suspect, has little to do with the underlying forces of supply and demand: it is mainly about speculation. The same foreign investors who are dumping Japanese stocks are selling oil futures to hedge the big long positions they have been holding. They are also dumping gold—traditionally seen as a safe haven in uncertain times—and other commodities, such as copper, corn, and wheat. That means food prices, which have risen sharply over the past couple of years, are also likely to fall back—a boon to consumers, particularly poor ones.

Strange thing, global capitalism.

Read more from our coverage of the earthquake and its aftermath.

Photograph: Jacob Ehnmark, via Flickr.

March 13, 2011

Europe Gets It Wrong (Again)

With all the trouble in Asia and the Middle East, it is tempting to assume that the European debt crisis is over. It isn't—as this weekend's news of yet another "new deal" to resolve it makes clear.

The first rule—possibly the only rule—of fighting debt crises is that governments have to take dramatic and costly actions to clear up the mess and restore confidence. Until September, 2008, the Bush Administration resisted this historically proven maxim, at terrible cost to the global economy.

European leaders are now repeating the mistake. For almost two years now, they have been prevaricating about doing what is patently necessary: restructuring the debts of stricken periphery countries like Greece and Ireland. Instead of admitting that these nations have run up debts far greater than they can afford to pay off under any reasonable economic scenario—i.e., they are insolvent—policymakers have put together a series of short-term rescues and lending measures. All of these are designed to preserve the myth that with bit of time, and a lot of austerity, the debt-stricken countries can get back on their own two feet.

The deal reached over the weekend represents more of the same. It slightly reduced the interest rate that Greece is paying on the $150-billion bailout it received last year from the E.U. and extended the repayment period from six years to seven and a half. But it rejected one idea that might actually have provided a way to reduce Greece's overall debt burden: allowing the European stabilization fund to buy up Greek bonds on the open market, where they are trading at a big discount to their notional value. Ireland, with a new government in power, got nothing.

Even before this disappointing outcome, Portugal—the next country in the markets' firing line—was having to pay higher costs to issue debt. Market rates are also edging up for Spain and Italy. "No one has been paying attention, but the situation is more fragile than they think," Matt King, the head of credit strategy at Citigroup, told the Financial Times last week. Unfortunately, he may well be right.

March 10, 2011

Bike Lanes III: A Closing Word

When you play the game of épater le bourgeois you expect some outraged comments. Thanks to the cycling flash mob, plus some angry regular readers, for providing them. Before turning to more serious topics, I want to address the issue of externalities, which several people have raised, including Ryan Avent at The Economist. (This post is a bit wonky. If you registered merely to hurl some more abuse in the Comments section, feel free to skip it.)

As it happens, I do know a bit about externalities, or, as I prefer to call them, spillovers. I wrote a book entitled "How Markets Fail: The Logic of Economic Calamities," which was published in 2009. Primarily, it addressed the role faulty incentives and negative spillovers played in the financial crisis, but road traffic raises very similar issues. I even included a chapter about A. C. Pigou, the godfather of pollution and congestion taxes.

In the case of motor vehicles, there are several negative spillovers, the most obvious of which is pollution and the associated climate threat. As I said in my post, and as I've written many times before, I think gasoline taxes are too low in the United States, and I would happily pay higher ones to indulge my weakness for classic cars. If gasoline taxes were similar to those in the U.K., for example, I'd think twice before jumping into my gas-guzzler. (I'd probably still do it, but others wouldn't, and overall emissions would fall.)

A second issue is congestion, which is best tackled by providing proper public transport and discouraging lone drivers from using popular routes at peak hours. I ride the subway to and from work, and I abhor the budget cuts that are eliminating train and bus routes, particularly in the outer boroughs. I think bus lanes and carpool lanes that operate during the daytime are a fine idea. I don't think we need more new roads. And, to repeat, I support constructing bike lanes on popular routes, even if that means inconveniencing motorists. But New York already does all these things. As Avent points out, the proportion of commuters who travel to work by car is the lowest in any big American city. And, as he also notes, its per capita transportation emissions are "remarkably low among American cities."

Given these facts, where do we go from here? Some would say that reducing New York's carbon footprint is of such importance that we need to utilize bike lanes and other techniques to further inconvenience car drivers, even those that drive primarily in non-peak hours, when the roads are relatively clear. I haven't seen any cost-benefit analysis backing this up, and, frankly, I don't think such concerns are driving the debate. If global warming disappeared tomorrow, the bike lobby would still demand more bike lanes. That is why I say this is primarily a matter of interest-group politics.

In arguing that the concerns of cyclists should be balanced with those of motorists, I am merely suggesting that any further bike lanes be subjected to some sort of efficiency test beyond the rule of two wheels good, four wheels bad. Do the putative gains in convenience, safety, and fuel-economy from a particular bike lane outweigh the costs to motorists (and other parties, such as taxpayers and local businesses)?

When it comes to the controversial lane on Prospect Park West, my first inclination would be to say yes they do. Parks and bike lanes are complementary goods. It turns out, however, that there is already a popular bike lane that runs through the park close to the new lane. Does the new lane add a lot to the existing one? Does it hamper local traffic patterns in a big way or endanger pedestrians? Presumably, these are the questions that the State Supreme Court will address when Iris Weinshall's lawsuit comes to trial. Yet many bike activists object to the very idea of judicial review.

Pedestrian safety is another important issue. When a moving vehicle collides with a person on foot, this is a particularly costly and tragic form of traffic spillover. In recent years, the city has made a big effort to reduce road-related fatalities, and it has worked. In 2008 and 2009, deaths on the roads fell to their lowest level in a hundred years. But, despite the claims of some, the recent proliferation of bike lanes doesn't appear to have had much to do with this welcome development. In a press release announcing the latest drop in road fatalities, the Department of Transportation emphasized the enforcement of a 30 m.p.h. speed limit and a campaign to discourage drunk-driving, both of which I endorse.

Now may also be a good time to tackle the growing problem of cyclists terrorizing pedestrians—an externality that bike activists rarely dwell on. Yes, this is another anecdote rather than a peer-reviewed empirical study, but practically every New Yorker I know has a story of being hit, or nearly hit, by an out-of-control pushbike. It isn't just a pedestrian issue (no pun intended). Bikers themselves are at risk. Despite the rolling out of more bike lanes last year, the number of bicycle fatalities actually went up. Was this a result of declining riding standards? Were careless pedestrians to blame, or reckless motorists? I have no idea, but it is an intriguing question.

With a bit more goodwill on all sides (myself included), there is space for us all to coexist. Compared to other American cities, New York has an excellent public-transport network, a well-designed highway system, an easy to understand street grid (O.K., not in the Flatlands), and a growing number of bike lanes and walking paths. In figuring out how to utilize the city's transport network, the public interest should trump private ones. But when it comes down to one private user versus another—as it does in the construction of seldom-used bike lanes—a balance has to be struck, and there needs to be some independent review process.

March 9, 2011

Bike Lanes II: The Condemned Motorist Speaks

As I was saying about the bike lobby…

I am tempted to let the fury of the reaction to my mildly heretical piece speak for itself, but, before I get burned at the stake, a few specific points.

It seems to have escaped notice that I said I support the introduction of bike lanes, but not so many of them. Herewith: "So, by all means, let us have some bike lanes on heavily used and clearly defined routes to and from the city—and on popular biking routes within the city and the boroughs."

Some people like cars, some people like bikes, some people like both. Since there is a limited amount of space on city streets, trade-offs have to be made. In making such trade-offs, a democratic polity should take into account the preferences of motorists, who happen to be far more numerous, as well as cyclists. That is all I am saying.

I should probably also address a couple of specific comments, which have been widely linked to. I confess I don't quite get Felix Salmon's gotcha riff about my harmless play on the word "bipedalism," which even Paul Krugman has picked up on. (Lord forbid that Saint Paul should ever write anything challenging the nostrums of the faithful.) Last time I rode a bike, it was powered by my two legs.

Kudos to Felix for one thing, though. He freely admits that the ultimate aim of the bike lobby is to replace cars with bikes and other more "healthy, efficient, and effective" modes of transportation. This is a defensible policy argument, and one that many environmentalists would support. Surely, then, it should be put to a vote rather than being enacted via bureaucratic diktat. I look forward to the mayoral campaign in which a politician backed by the bike lobby proposes to eliminate on-street parking, or make it so expensive that only cyclists, buses, and corporate limos can afford to use the roads. In London, such a policy has, to some extent, already been enacted but with the explicit support of the voters. Go ahead, Aaron Naparstek: City Hall beckons.

Talking of Naparstek, a prominent bike activist who until recently edited Streetsblog, he and others make much of the fact that the little-used bike lane I was referring to in Brooklyn is on Third Avenue, not Fourth Avenue. Yes, that was a slip of the tongue—the sort of silly mistake that occasionally creeps into a rushed blog post. Please don't blame the vaunted New Yorker fact-checking department for letting it through: they don't vet our blog jottings. Once I noticed the mistake, I corrected it.

Free parking in Manhattan. I knew that one would get the blood boiling! Fact is, most of it has already been eliminated and replaced with meters or Pay-and-Display zones. That's the right policy. Space on the street is a valuable public resource, and motorists, unlike cyclists, regularly pay to use it. When the city introduces a bike lane on a given street, it reduces the number of paid parking spaces, thereby depriving it of revenue.

Finally, thanks to the commenters in general for providing me with a handy guide to the cultural politics of the twenty-first century. I'll keep a copy of it in my walnut glove compartment:

Bicyclist = Urbane, enlightened, sophisticate.

Car Driver = Suburban, reactionary, moron.

Maybe Aaron or his favored candidate could use this message on posters and bumper stickers. That should be sufficient to keep City Hall in Republican hands for another seventeen years.

March 8, 2011

Battle of the Bike Lanes

At the risk of incurring the wrath of the bicycle lobby, a constituency that pursues its agenda with about as much modesty and humor as the Jacobins pursued theirs, and which has found its heroine in transportation commissioner Janette Sadik-Khan, I say hats off to Iris Weinshall, the former transportation commissioner (and wife of Senator Chuck Schumer), who, together with some like-minded citizens, has filed a lawsuit challenging a bike lane on Prospect Park West.

Tuesday's Times said the lawsuit, which was filed Monday in State Supreme Court, calls on the city to remove the controversial green tarmac, citing a state law that allows citizens to challenge arbitrary and unfair actions by the government. The lawsuit concerns just one stretch of road. If successful, however, it could open the way to a broader challenge to City Hall, which sometimes seems intent on turning New York into Amsterdam, or perhaps Beijing.

I don't have anything against bikes. As a student, I lived in the middle of Oxford, where cycling is the predominant mode of transport, and I cycled everywhere. Twenty-five years ago, when I moved to the East Village, I paid a guy on Second Avenue thirty dollars for a second-hand racing bike (probably stolen). Of a Sunday afternoon, hungover from the previous night's carousing at neighborhood bars and clubs, I would pedal furiously up First Avenue, cross over to Park or Madison, continue up to Central Park and then race back down Fifth, all the way to Washington Square. In those days, there were few cyclists on the roads, and part of the thrill was avoiding cabs and other vehicles that would suddenly swing into your lane, apparently oblivious to your presence. When I got back to my apartment on East 12th Street, I was sometimes shaking.

Today, of course, bicycling is almost universally regarded as a serious, eco-friendly mode of transport, and cyclists want it easy. From San Francisco to London, local governments are introducing bike lanes, bike parks, bike-rental schemes, and other policies designed to encourage two-wheel motion. Generally speaking, I don't have a problem with this movement: indeed, I support it. But the way it has been implemented, particularly in New York, irks me to no end. I view the Bloomberg bike-lane policy as a classic case of regulatory capture by a small faddist minority intent on foisting its bipedalist views on a disinterested or actively reluctant populace.

The bitter rant of an angry motorist? Perhaps. Since 1989, when I nervously edged out of the Ford showroom on 11th Avenue and 57th Street, the proud leaser of a sporty Thunderbird coupe, I have owned and driven six cars in the city, none of which could be classed as a fuel-economy vehicle: the Thunderbird, a Mercedes E190, an ancient Oldsmobile Delta 88 that could have done double duty as a paddle steamer on the Hudson, two Cadillac Sedan de Villes, and (my current heap) an old Jaguar XJ6.

All of these vehicles I have used for work purposes and for domestic and leisure trips. Most of the time, I have parked them on the street, an urban custom the utility of which only becomes manifest when it is absent. Thanks to these four-wheel friends, I have discovered virtually every neighborhood of the city and its environs, and I would put my knowledge of New York's geography and topography up against most native residents—cycling members of the Park Slope food co-op included. Today, with two young children who need ferrying hither and thither, I still drive all over town—and take great enjoyment out of it.

Undoubtedly, during all those years, I should have been paying higher gas prices to cover the putative costs of cleaning up the carbon emissions I was creating, but that doesn't diminish an important point: Americans love their cars for good reason. They are immensely useful and liberating contraptions.

Part of my beef, then, is undoubtedly an emotional reaction to the bike lobby's effort to poach on our territory. But from an economic perspective I also question whether the blanketing of the city with bike lanes—more than two hundred miles in the past three years—meets an objective cost-benefit criterion. Beyond a certain point, given the limited number of bicyclists in the city, the benefits of extra bike lanes must run into diminishing returns, and the costs to motorists (and pedestrians) of implementing the policies must increase. Have we reached that point? I would say so.

A minor but not completely insignificant example. Like many New Yorkers who don't live in Manhattan, one of my favorite pastimes is to drive from Brooklyn, where I live, into the city for dinner and find a parking space once the 7 A.M.-7 P.M. parking restrictions have lapsed. Years ago, this was a challenge, but a manageable one. These days, especially downtown, it is virtually impossible. When the city introduces a bike lane on a given street, it removes dozens of parking places. All too often these days, I find myself driving endlessly up and down Hudson, or Sixth Avenue, or wherever, looking in vain for a legal spot—and for cyclists. What I see instead is motor traffic snarled on avenues that, thanks to bike lanes, have been reduced from four lanes to three, or three to two. As of old, I sometimes almost run into a delivery boy riding the wrong way down the street, but even the delivery boys don't seem to use the bike lanes for this purpose. (Perhaps they, too, are frightened of incurring the righteous rage of the helmeted.)

Mayor Bloomberg, who plays Robespierre to Sadik-Khan's Saint-Just, is forever claiming that, thanks to his enormously popular policies, bicycle usage has doubled, tripled, or quadrupled. Maybe that's true in some places—there are a lot of bikers in Prospect Park these days, I grant you—but in Midtown? The Village? The East Side? I don't see them. Even in Brooklyn, home to some of the most ardent bike activists, bike lanes have been overdone. Take Fourth Avenue in Gowanus, a thoroughfare that abuts the sacred Slope but which is itself still largely a commercial route. When I drive up and down Fourth Avenue, as I do often, what I usually see are cars and trucks inching along in single file (it's a two-way street) with an empty bike lane next to them. (On those rare occasions when I do happen across a cyclist, or two, he or she invariably runs the red lights.)

So, by all means, let us have some bike lanes on heavily used and clearly defined routes to and from the city—and on popular biking routes within the city and the boroughs. But until and unless there is a referendum on the subject—or a much more expansive public debate, at least—it is time to call a halt to Sadik-Khan and her faceless road swipers.

Just perhaps, in Weinshall, the unstoppable force has met an immovable object. As somebody who served in the very post Sadik-Khan holds for almost seven years (September 2000 to April 2007), Weinshall can hardly be described an as enemy of cyclists. During her tenure as transportation commissioner she oversaw a significant expansion of bike lanes, including routes to and from Brooklyn. But now, apparently, Weinshall has had enough. In her lawsuit, according to the Times, she is promising to expose the cozy relationship between officials and bike activists as well the dubious statistics that the city uses to justify its policies.

Like many New Yorkers, I will be quietly cheering her on!

Photograph: Spencer T., Flickr CC.

Battle of the Bike Lanes: I'm with Mrs. Schumer

At the risk of incurring the wrath of the bicycle lobby, a constituency that pursues its agenda with about as much modesty and humor as the Jacobins pursued theirs, and which has found its heroine in transportation commissioner Janette Sadik-Khan, I say hats off to Iris Weinshall, the wife of Senator Chuck Schumer, who, together with some like-minded citizens, has filed a lawsuit challenging a bike lane on Prospect Park West.

Tuesday's Times said the lawsuit, which was filed Monday in State Supreme Court, calls on the city to remove the controversial green tarmac, citing a state law that allows citizens to challenge arbitrary and unfair actions by the government. The lawsuit concerns just one stretch of road. If successful, however, it could open the way to a broader challenge to City Hall, which sometimes seems intent on turning New York into Amsterdam, or perhaps Beijing.

I don't have anything against bikes. As a student, I lived in the middle of Oxford, where cycling is the predominant mode of transport, and I cycled everywhere. Twenty-five years ago, when I moved to the East Village, I paid a guy on Second Avenue thirty dollars for a second-hand racing bike (probably stolen). Of a Sunday afternoon, hungover from the previous night's carousing at neighborhood bars and clubs, I would pedal furiously up First Avenue, cross over to Park or Madison, continue up to Central Park and then race back down Fifth, all the way to Washington Square. In those days, there were few cyclists on the roads, and part of the thrill was avoiding cabs and other vehicles that would suddenly swing into your lane, apparently oblivious to your presence. When I got back to my apartment on East 12th Street, I was sometimes shaking.

Today, of course, bicycling is almost universally regarded as a serious, eco-friendly mode of transport, and cyclists want it easy. From San Francisco to London, local governments are introducing bike lanes, bike parks, bike-rental schemes, and other policies designed to encourage two-wheel motion. Generally speaking, I don't have a problem with this movement: indeed, I support it. But the way it has been implemented, particularly in New York, irks me to no end. I view the Bloomberg bike-lane policy as a classic case of regulatory capture by a small faddist minority intent on foisting its bipedalist views on a disinterested or actively reluctant populace.

The bitter rant of an angry motorist? Perhaps. Since 1989, when I nervously edged out of the Ford showroom on 11th Avenue and 57th Street, the proud leaser of a sporty Thunderbird coupe, I have owned and driven six cars in the city, none of which could be classed as a fuel-economy vehicle: the Thunderbird, a Mercedes E190, an ancient Oldsmobile Delta 88 that could have done double duty as a paddle steamer on the Hudson, two Cadillac Sedan de Villes, and (my current heap) an old Jaguar XJ6.

All of these vehicles I have used for work purposes and for domestic and leisure trips. Most of the time, I have parked them on the street, an urban custom the utility of which only becomes manifest when it is absent. Thanks to these four-wheel friends, I have discovered virtually every neighborhood of the city and its environs, and I would put my knowledge of New York's geography and topography up against most native residents—cycling members of the Park Slope food co-op included. Today, with two young children who need ferrying hither and thither, I still drive all over town—and take great enjoyment out of it.

Undoubtedly, during all those years, I should have been paying higher gas prices to cover the putative costs of cleaning up the carbon emissions I was creating, but that doesn't diminish an important point: Americans love their cars for good reason. They are immensely useful and liberating contraptions.

Part of my beef, then, is undoubtedly an emotional reaction to the bike lobby's effort to poach on our territory. But from an economic perspective I also question whether the blanketing of the city with bike lanes—more than two hundred miles in the past three years—meets an objective cost-benefit criterion. Beyond a certain point, given the limited number of bicyclists in the city, the benefits of extra bike lanes must run into diminishing returns, and the costs to motorists (and pedestrians) of implementing the policies must increase. Have we reached that point? I would say so.

A minor but not completely insignificant example. Like many New Yorkers who don't live in Manhattan, one of my favorite pastimes is to drive from Brooklyn, where I live, into the city for dinner and find a parking space once the 7 A.M.-7 P.M. parking restrictions have lapsed. Years ago, this was a challenge, but a manageable one. These days, especially downtown, it is virtually impossible. When the city introduces a bike lane on a given street, it removes dozens of parking places. All too often these days, I find myself driving endlessly up and down Hudson, or Sixth Avenue, or wherever, looking in vain for a legal spot—and for cyclists. What I see instead is motor traffic snarled on avenues that, thanks to bike lanes, have been reduced from four lanes to three, or three to two. As of old, I sometimes almost run into a delivery boy riding the wrong way down the street, but even the delivery boys don't seem to use the bike lanes for this purpose. (Perhaps they, too, are frightened of incurring the righteous rage of the helmeted.)

Mayor Bloomberg, who plays Robespierre to Sadik-Khan's Saint-Just, is forever claiming that, thanks to his enormously popular policies, bicycle usage has doubled, tripled, or quadrupled. Maybe that's true in some places—there are a lot of bikers in Prospect Park these days, I grant you—but in Midtown? The Village? The East Side? I don't see them. Even in Brooklyn, home to some of the most ardent bike activists, bike lanes have been overdone. Take Fourth Avenue in Gowanus, a thoroughfare that abuts the sacred Slope but which is itself still largely a commercial route. When I drive up and down Fourth Avenue, as I do often, what I usually see are cars and trucks inching along in single file (it's a two-way street) with an empty bike lane next to them. (On those rare occasions when I do happen across a cyclist, or two, he or she invariably runs the red lights.)

So, by all means, let us have some bike lanes on heavily used and clearly defined routes to and from the city—and on popular biking routes within the city and the boroughs. But until and unless there is a referendum on the subject—or a much more expansive public debate, at least—it is time to call a halt to Ms. Sadik-Khan and her faceless road swipers.

Just perhaps, in Ms. Weinshall, the unstoppable force has met an immovable object. As somebody who served in the very post Ms. Sadik-Khan holds for almost seven years (September 2000 to April 2007), Ms. Weinshall can hardly be described an as enemy of cyclists. During her tenure as transportation commissioner she oversaw a significant expansion of bike lanes, including routes to and from Brooklyn. But now, apparently, Mrs. Schumer has had enough. In her lawsuit, according to the Times, she is promising to expose the cozy relationship between officials and bike activists as well the dubious statistics that the city uses to justify its policies.

Like many New Yorkers, I will be quietly cheering her on!

Photograph: Spencer T., Flickr CC.

February 24, 2011

What's Ailing Tiger Woods?

Yes, he's "pissed"—his word—about losing in the first round of the Accenture Match Play Championship, the first big tournament of 2011; his swing is inconsistent; his personal life is in ruins; and his etiquette is atrocious. (At least he didn't spit up on the green this week, although I think I did notice him honking a goober onto the 17th fairway).

But what's really ailing El Tigre? It's the putting, stupid!

Let's face it, going back five or six years now Tiger's long game hasn't been that great. Yes, he hit (and still hits) some wonderful shots that nobody else could pull off—c.f. a towering 5 wood over water into the wind at the eighteenth hole in Dubai a few weeks ago. But even when he was winning Majors he was missing a lot of fairways; sometimes missing the hazards, too, bombing spectators in the gallery; and occasionally overshooting even them. The big flare he hit into the desert on the first play-off hole yesterday wasn't an atypically poor shot. It was just that on this occasion, because of the way the course is designed, there was no gallery present to act as his personal safety net.

Until pretty recently, what separated Tiger from every other golfer on the planet (living and dead) was his mesmeric ability to get the ball in the hole. How many times have we seen it? Biff into the woods or deep rough. Gouge out into the fairway. Pitch shot or mid-iron to ten or fifteen feet. One putt for a par (or birdie if it's a par five). By a considerable margin, Tiger was the best scrambler and pressure putter the game has ever seen. (I hear you cry, What about Seve Ballesteros? Yes, I'm old enough to have seen him in his prime, and on occasion—comes to mind the 1989 British Open at Royal Lytham & St Anne's, where he hit nine fairways in seventy-two holes and won—his Houdini-like ability exceeded even that of Woods. But Seve couldn't keep it up tournament after tournament, year after year, in the way that Woods managed.)

Now, sadly, the magical touch appears to have deserted Woods. No, it hasn't gone completely. One down to genial old Thomas Bjorn (a.k.a. "The Great Dane") going into the closing stretch yesterday, he made a couple of old-style Woods hole-outs to drag himself into a play-off. Generally speaking, however, Tiger is no longer the short-game wizard he once was.

This was evident yesterday, and it was even more evident a couple of weeks ago at Torrey Pines, one of Tiger's favorite courses, where in 2008 he holed virtually everything to win the U.S. Open despite a week of sometimes shaky ball-striking. At Torrey this time, playing in the Farmers Insurance Open (formerly the Buick Invitational), Tiger took almost thirty putts a round, placing him 155th in the tour putting rankings. In his prime, he was almost always in the top five and often in the top three. Almost as shocking, he got up and down from around the green less than sixty per cent of the time, giving him a rank of 99th at scrambling. In the old days, he got up and down close to eighty per cent of the time.

So what's gone wrong? Tiger's story is he's been working so hard on his full swing that this short game is "rusty." If that is the case, his recent slump isn't a very big deal and he could still come back as strong as ever.

But there's another possibility. In December, Tiger turned thirty-five. In golf, it is generally (but not universally) true that putting deteriorates with age. (Ben Crenshaw and Loren Roberts are two modern-day counter-examples.) It may well be that mortality isn't just creeping up on Tiger's big joints and muscle groups (a year and a half ago, he had extensive knee surgery) but also on his hand-eye coördination. If that's the case, the days of him holing out automatically from ten feet and in, and semi-automatically from fifteen feet and in, may be gone for good.

The experience of Ernie Els, for years Tiger's closest rival, provides a sobering story of what can happen. In his twenties, Els was a wonderful putter—not as good as Tiger, but very impressive all the same. Then, in 2005, Els suffered a serious knee injury and missed most of the season. When he returned to the Tour, he took some time to recover his long game, but what never really came back was his putting. Time and again, he would get into contention only to miss two or three short putts and drop out of contention. Eventually, his confidence suffered, and he appeared to stop believing he was going to make them. These days, although he won a couple of tournaments last year, Els with a short stick in his hands sometimes looks like a nervous wreck.

Will this fate befall Tiger? Maybe not. He's always been more single-minded than the Big Easy, and in putting mental strength is three quarters of the battle (or perhaps more). But for years now the rest of Tiger's game hasn't been consistent enough to afford him room at all for slippage up close. As we saw at Torrey Pines, and elsewhere last season, if he doesn't chip and putt really well he doesn't even compete for victory.

And that, for somebody as competitive and monomaniacal as Tiger, is pure hell. Worse even than being monstered by the tabloids.

(For more details of Tiger's recent travails, see the accompanying video. It doesn't have his ungracious comments from yesterday, but keep watching to the forty-second mark for an "f-bomb" that took the NBC announcers by surprise.)

What's Ailing Tiger?

Yes, he's "pissed"—his word—about losing in the first round of the Accenture Match Play Championship, the first big tournament of 2011; his swing is inconsistent; his personal life is in ruins; and his etiquette is atrocious. (At least he didn't spit up on the green this week, although I think I did notice him honking a goober onto the 17th fairway).

But what's really ailing El Tigre? It's the putting, stupid!

Let's face it, going back five or six years now Tiger's long game hasn't been that great. Yes, he hit (and still hits) some wonderful shots that nobody else could pull off—c.f. a towering 5 wood over water into the wind at the eighteenth hole in Dubai a few weeks ago. But even when he was winning Majors he was missing a lot of fairways; sometimes missing the hazards, too, bombing spectators in the gallery; and occasionally overshooting even them. The big flare he hit into the desert on the first play-off hole yesterday wasn't an atypically poor shot. It was just that on this occasion, because of the way the course is designed, there was no gallery present to act as his personal safety net.

Until pretty recently, what separated Tiger from every other golfer on the planet (living and dead) was his mesmeric ability to get the ball in the hole. How many times have we seen it? Biff into the woods or deep rough. Gouge out into the fairway. Pitch shot or mid-iron to ten or fifteen feet. One putt for a par (or birdie if it's a par five). By a considerable margin, Tiger was the best scrambler and pressure putter the game has ever seen. (I hear you cry, What about Seve Ballesteros? Yes, I'm old enough to have seen him in his prime, and on occasion—comes to mind the 1989 British Open at Royal Lytham & St Anne's, where he hit nine fairways in seventy-two holes and won—his Houdini-like ability exceeded even that of Woods. But Seve couldn't keep it up tournament after tournament, year after year, in the way that Woods managed.)

Now, sadly, the magical touch appears to have deserted Woods. No, it hasn't gone completely. One down to genial old Thomas Bjorn (a.k.a. "The Great Dane") going into the closing stretch yesterday, he made a couple of old-style Woods hole-outs to drag himself into a play-off. Generally speaking, however, Tiger is no longer the short-game wizard he once was.

This was evident yesterday, and it was even more evident a couple of weeks ago at Torrey Pines, one of Tiger's favorite courses, where in 2008 he holed virtually everything to win the U.S. Open despite a week of sometimes shaky ball-striking. At Torrey this time, playing in the Farmers Insurance Open (formerly the Buick Invitational), Tiger took almost thirty putts a round, placing him 155th in the tour putting rankings. In his prime, he was almost always in the top five and often in the top three. Almost as shocking, he got up and down from around the green less than sixty per cent of the time, giving him a rank of 99th at scrambling. In the old days, he got up and down close to eighty per cent of the time.

So what's gone wrong? Tiger's story is he's been working so hard on his full swing that this short game is "rusty." If that is the case, his recent slump isn't a very big deal and he could still come back as strong as ever.

But there's another possibility. In December, Tiger turned thirty-five. In golf, it is generally (but not universally) true that putting deteriorates with age. (Ben Crenshaw and Loren Roberts are two modern-day counter-examples.) It may well be that mortality isn't just creeping up on Tiger's big joints and muscle groups (a year and a half ago, he had extensive knee surgery) but also on his hand-eye coördination. If that's the case, the days of him holing out automatically from ten feet and in, and semi-automatically from fifteen feet and in, may be gone for good.

The experience of Ernie Els, for years Tiger's closest rival, provides a sobering story of what can happen. In his twenties, Els was a wonderful putter—not as good as Tiger, but very impressive all the same. Then, in 2005, Els suffered a serious knee injury and missed most of the season. When he returned to the Tour, he took some time to recover his long game, but what never really came back was his putting. Time and again, he would get into contention only to miss two or three short putts and drop out of contention. Eventually, his confidence suffered, and he appeared to stop believing he was going to make them. These days, although he won a couple of tournaments last year, Els with a short stick in his hands sometimes looks like a nervous wreck.

Will this fate befall Tiger? Maybe not. He's always been more single-minded than the Big Easy, and in putting mental strength is three quarters of the battle (or perhaps more). But for years now the rest of Tiger's game hasn't been consistent enough to afford him room at all for slippage up close. As we saw at Torrey Pines, and elsewhere last season, if he doesn't chip and putt really well he doesn't even compete for victory.

And that, for somebody as competitive and monomaniacal as Tiger, is pure hell. Worse even than being monstered by the tabloids.

February 22, 2011

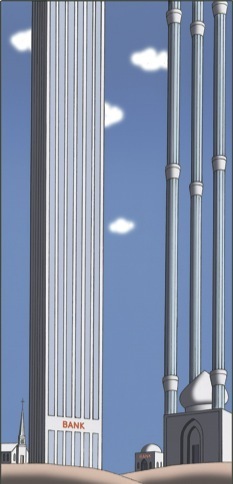

Max Weber and the Middle East

With Colonel Qaddafi busy making what will hopefully be his last stand in Tripoli, and an uneasy standoff continuing in Bahrain, this might be a good moment to sit back and reflect on the underlying realities of the Middle East. That's what I've been doing for the past few weeks, and the product of my research is an article in the new issue of the magazine about Islam and economics.

One of the pleasures of researching essays is the opportunity it affords for revisiting old classics, or, in some cases, reading them for the first time. Having decided to tackle such a controversial issue, I thought the best place to start was with Max Weber's "The Protestant Ethic and the Spirit of Capitalism," which famously made the argument that religion, and in particular the Protestant Reformation, played a key role in the rise of today's business world.

Like Marx's "Capital" and Smith's "The Wealth of Nations," Weber's 1905 tract is referred to far more often than it is read. Until a few weeks ago, I was one of the guilty parties. In my college days, I read several books that dealt with Weber at length, including Anthony Giddens's useful tome on capitalism and social theory, but, like many busy students, I couldn't be bothered to trek to the library and search out the primary source material.

When I finally got hold of a copy, I was glad I had done so. Unlike Marx and his philosophical predecessor Hegel, Weber eschews dialectics and writes in easily understood prose, thereby proving that great German thinkers don't have to be unreadable. In his introduction, for example, part of which can be read on Google Books, he states,

The impulse to acquisition, pursuit of gain, of money, of the greatest possible amount of money, has itself nothing to with capitalism. This impulse exists and has existed among waiters, physicians, coachmen, artists, prostitutes, dishonest officials, soldiers, nobles, crusaders, gamblers, and beggars. One may say that it has been common to all sorts of conditions of men at all times and in all countries of the earth, wherever the objective possibilities of it is or has been given. It should be taught in the kindergarten of cultural history that this naïve idea of capitalism must be given up once and for all. Unlimited greed for gain is not in the least identical with capitalism, as still less its spirit. Capitalism may even be identical with the restraint, or at least a rational tempering of this irrational impulse.

When somebody writes this clearly, it is tempting to agree with his (or her) arguments. In this case, I resisted that temptation, but in the process I learned a lot and also got a good deal of intellectual gratification. Others, particularly some Western students of the Middle East, have been more amenable to Weber's arguments. In his 1998 book "The Wealth and Poverty of Nations," David Landes, the eminent economic historian from Harvard, argued, "No one can understand the economic performance of the Muslim nations without attending the experience of Islam as faith and culture." After 9/11, Bernard Lewis, the Princeton Arabist, entered the fray on the side of Landes, and now, Timur Kuran, an economic historian at Duke, has published a new book entitled "The Long Divergence: How Islamic Law Held Back the Middle East."

In my piece, I refer to Landes and his followers as the new Weberians, because their argument is an inverted version of Weber's thesis about the protestant work ethic. For a number of reasons—the details vary from author to author—these scholars say that the legacy of Islam has proved the decisive barrier to modernizing the Middle East.

Ultimately, I rejected this argument. In my opinion, there is nothing inherent in Islam, or in the culture it has engendered, that is preventing countries such as Egypt, Tunisia, and even Libya from growing faster, improving the living standards of their people, and playing a growing role in the international trading system. The real problems are more concrete: the presence of rent-seeking élites, such as Colonel Qaddafi and his sons; a demographic bulge that is producing mass unemployment among the young; a resource curse (oil) that in some countries greatly distorts the economy; the legacy of colonialism; and, yes, the threat of violence from extremist groups, some of them religiously inspired. But the peaceful practice of Islam, and the lack of a Muslim Reformation? I don't believe these are the things holding back the Middle East.

Still, don't let that prevent you from picking up a copy of Weber's opus—or of any of the other books I mention in my piece. They are all interesting contributions to one of the great debates.

February 14, 2011

Obama Bets on the Bond Market

Now that the White House has finally released its much-leaked 2012 budget, attention will turn to the looming spending brawl on Capitol Hill, which will dominate domestic politics in the runup to next year's election. But keep your eye on Wall Street, where the so-called "bond vigilantes" could well determine what ultimately happens to spending and taxation.

To fund the deficit over the next decade, according to the White House projections, Uncle Sam needs to sell about $7.2 trillion in new Treasury bonds. Given the vast pools of capital that exist in places like China and Russia, and a welcome rise in the savings rate here in the United States, raising this huge sum shouldn't necessarily be a problem. But everything depends on international perceptions of the U.S. political system, and its ability to tackle the things that really drive the deficit, such as big defense and entitlement programs and the Republicans' stubborn refusal to countenance tax increases of any kind.

In proposing to trim the federal deficit by roughly $100 billion a year over the next decade, President Obama is basically saying to bond buyers: Look, the deficit problem is too big for me to fix now. Given high unemployment and partisan rancor in Washington, there is neither the capability nor the will to address it properly. So give me some more time. I'll do some modest things immediately—make sure the fiscal situation doesn't get any worse—and then I'll try and build bipartisan support for a Grand Bargain addressing entitlements, tax reform, and all the other controversial stuff, which I'll seek to push through Congress in my second term.

For those affected by the individual changes that the White House is proposing, which include modest cutbacks at the Pentagon and reductions in heating subsidies for the low paid, the budget proposals are very meaningful, of course. But with this year's deficit expected to come in at about $1.6 trillion, and with the overall federal budget fast approaching $4 trillion, the harsh truth is that $100 billion in additional cuts (or spending) amounts to little more than a rounding error.

When it comes to significantly altering the long-term trajectory of spending and revenues, this budget is basically a holding operation that doesn't do much either way—a fact Jack Lew, the budget director, has come close to conceding. "We know you have to stabilize where you are going before you can move on and solve all the rest of the problems," Lew said in a video posted on the White House Web site. "This budget does that."

The big question is whether the bond market will give Obama the time he is asking for. So far, foreign investors have basically given the United States a pass, as reflected in the low interest rates that the Treasury pays on ten- and thirty-year bonds. If investors really suspected that the U.S. was likely to mimic Greece or Ireland and go bust, they would be demanding much higher rates. In recent months, however, bond rates have been edging up. This partly reflects faster economic growth and expectations of the Fed raising the short-term interest rate, but it may also reflect growing nervousness over the U.S. fiscal outlook. (Last month, the credit rating agency Moody's warned it might cut the Treasury's AAA rating.)

Nobody can be sure how things will play out. The optimists (Paul Krugman) and pessimists (Niall Ferguson) both have valid points to make. Even now, the U.S. enjoys safe-haven status. Many investors tend to go along with Churchill's edict that after exploring all the other possibilities the politicians in Washington will eventually get their acts together. But confidence in the United States is by no means guaranteed. Financial crises, almost by definition, are unexpected.

My gut feeling is that Obama will get lucky, and the bond market will continue to be coöperative, at least for another couple of years. Most bond buyers are smart enough to know that the individual figures in the budget projections are unlikely to prove accurate. What they care about is the overall trend of spending and revenues: Are the two lines moving together or moving apart? For the next few years, the answer is that they will move together, largely because, as the economy recovers, tax revenues will grow considerably faster than spending.

Despite all the headlines about the White House embracing austerity, the White House is projecting that federal spending will increase from $3.7 trillion in fiscal 2012 to $5.7 trillion in 2021. In nominal terms, that is a fifty-four-per-cent rise; in inflation-adjusted dollars, it is a more modest seventeen-per-cent increase. On the other side of the ledger, however, revenues are projected to rise even more sharply—from $2.6 trillion in 2012 to $4.9 trillion in 2021. In nominal terms, this is a rise of eighty-eight per cent; adjusting for inflation, it is a forty-six-per-cent jump.

Put all these figures together and you get a budget deficit that falls from about eleven per cent of G.D.P. this year to 4.6 per cent in 2013 and to about three per cent from 2015 to 2020. That isn't as reassuring as it sounds—after 2020, the deficit starts to get much bigger again, largely because of higher spending on Medicare and Medicaid—but it's a big change from recent years. And even if the official projections are overly optimistic—they usually are—it doesn't look like the trajectory of a country about to be hit by a strike on the part of bond-buyers.

Of course, that could change—and change quickly. But for now, at least, I think the politicians in Washington will get a chance to try and deliver on the Grand Bargain.

John Cassidy's Blog

- John Cassidy's profile

- 56 followers