Joe Withrow's Blog, page 28

April 20, 2016

The Future of Commerce

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Future of Commerce

April 20, 2016

Hot Springs, VA

“Commerce, by its very nature, is born free. And more than this, it forever fights to remain free. At almost every time and place, commerce evades regulations and controls; it serves its own will, not the wills of rulers. Markets spontaneously emerge at every opportunity, even when they are outlawed and punished. Commerce seems to have an existence of its own, like an independent organism.” – Paul Rosenberg

The S&P closed out Tuesday at $2,100. Gold closed at $1,252 per ounce. Crude Oil closed at $42.46 per barrel, and the 10-year Treasury rate closed at 1.78%. Bitcoin is trading around $437 per BTC today.

Dear Journal,

The institutional foundation of the Industrial world is crumbling all around us. Governments are broke. Social welfare programs are severely underfunded. Unions are broke. Pension plans are underfunded. National currencies have been trashed. Blue-collar jobs in the developed world have been lost to low-wage countries. Low-wage jobs have been lost to robotics and automation. Many of the jobs just disappeared entirely. Everyone’s retirement account is propped up by the constant creation of money out of thin air required to keep the financial markets afloat.

Welcome to the Information Age!

In truth, these are all great things. The seeds of a second Renaissance for human civilization have already been sown. These seeds will blossom as civilization continues to move away from the Industrial Age model and its dominant/submissive paradigm.

Think about it this way: technology is conquering scarcity and reducing the need for centralization.

It required 40% of the U.S. population to work in agriculture in order to produce enough food to meet demand in the year 1900. Today that number is around 2% and food is more available than ever before. You can find milk, eggs, fresh fruits, vegetables, and all kinds of other food items at your local grocery store year-round.

Also, thanks to technological development, oil and gas are now more abundant and cheaper than ever. This has reduced the costs of production and distribution significantly, and it has created competition for the oil cartels and monopolies that have had a strangle-hold on the industry for decades.

As a result of this drastic reduction in scarcity, the average person today is far wealthier in standard of living terms than the wealthiest people alive one hundred years ago. Take a few minutes to walk around your house and catalogue your furniture, appliances, electronics, gadgets, widgets, and stuff. Most of what you take for granted every single day was not available to your forefathers a short one hundred years ago.

Here’s the point: the world is not going to hell in a hand basket; the institutionalized industrial model is.

Those jobs that were lost? They simply are not needed. The developed world has more than enough water, food, energy, tools, and trinkets to live comfortably without those jobs. We also have the capacity to get this surplus water, food, energy, tools, and trinkets to the undeveloped world, but this will require the dissolution of corrupt governments and adoption of a market-based system.

You see, the problem is not the loss of the jobs, the problem is that jobs have been converted into an industrial panacea. The job gave everyone a regimented schedule and a sense of purpose. The job provided a paycheck, a retirement plan, health insurance, life insurance, dental insurance, and numerous other perks in some cases.

Your job made you eligible for your national social insurance program, and the gamut of other welfare programs. If you lost your job then government unemployment benefits would take care of you. If you got hurt and couldn’t work then government disability benefits would take care of you. When you finally retired then government old-age programs would take care of you.

The job was made to be central to everyone’s life.

We don’t need more jobs, we need more understanding. If you solve this centralized job problem then you solve many of the economic problems currently plaguing western civilization.

Speaking of problems: all of the world’s governments are going broke at the same time… do you know what that means? They are obsolete!

Centralized government is not needed for the world that is being created. Decentralized governance will rout out cronyism and place an unbelievably large amount of capital back into the global economy. Centralized governments have been skimming at least 50% of production right off the top for quite some time now. Let the people who earned it keep that money and the global economy will boom like it has never boomed before.

This would eliminate the need for mandatory social welfare programs because people will have the resources to handle mutual aid themselves.

Don’t believe me? I recently participated in a GoFundMe.com mutual aid campaign for a young teenager who was tragically paralyzed. I didn’t know the kid or his family, but the story found me on the Internet and I was touched by it. So I kicked in one hundred bucks and wrote a nice note.

Do you know how much money this campaign raised for medical expenses? Over $17,000 – mostly in little 2-to-3-digit contributions from people who somehow came across the story online. I believe this $17,000 was matched by a private enterprise with ties to the family as well.

By the way, this money was to cover deductibles and co-pays in addition to the catastrophic insurance coverage.

What’s government’s disability check? 900 bucks a month? I’ll take mutual aid any day.

The purpose of this journal entry is not to solve the world’s problems, however. Instead, let’s dust off our crystal ball and gaze into the future of commerce…

Did you know that people – individuals – are making $10,000 a month as we speak by selling physical products online that they never lay a hand on?

Here’s how they do it: they buy the product in bulk very very cheaply from Chinese manufacturers, and they have those manufacturers ship the product to one of Amazon’s fulfillment warehouses. Amazon takes customer orders, ships the product, and handles customer service functions. The only thing these clever individuals do is negotiate with the manufacturers, brand the products, and create the online listings. Then they collect a check from Amazon at the end of the month.

How cool is that?

Now I know there are some people who will take the mercantilist position and say it’s wrong to buy foreign products from cheap labor markets. “Only support your domestic manufacturers!”, they say.

The first thing I would ask those people to do is to gather all of the items they own that say ‘Made in China’ or ‘Made in Vietnam’ and immediately return them to the country of origination. The second thing I would ask those people to do is to find some new hobbies very quickly because they no longer have any televisions, computers, or tablets in their home.

Please don’t get caught up with the mercantilist mania. When Adam Smith wrote The Wealth of Nations, he was specifically arguing against mercantilist policies. Free market capitalism does the most good for the most folks, he said.

If those Chinese and Vietnamese manufacturing plants did not exist then those laborers would be out in the fields earning far less than they do now. And the rest of the world would be paying much higher prices for the same goods. That is a lose-lose model. Let’s stick with the model where everybody wins.

Don’t worry, working conditions in cheap labor markets will continue to gradually improve as standards of living rise. Then one day robotics and automation will replace those cheap laborers in Asia entirely. Let’s allow commerce to lift them out of poverty so they are free to pursue more advanced endeavors when the robots eventually swoop in.

Here’s another fun story: there’s a homeschooled teenager in New Hampshire who used his time not stuck in a classroom to take up Blacksmithing. The kid now earns an annual income that is greater than most starting salaries by selling the fruits of his labor on Etsy. He’s not even 18 years old yet.

There are countless other success stories about people using Amazon, Overstock, Ebay, Etsy, Craig’s List, or even their own ecommerce sites to make a living. The central theme is decentralization. Wait… is that an oxymoron?

Simply put, the standard “go to school, get good grades, go to college, get a good job” advice is quickly becoming obsolete for many people. Now there will always be a need for advanced education in the highly-specialized fields, but the centralized model of education may actually be holding many kids back.

Commerce can be traced back to the very beginnings of human civilization. In fact, the current job-based model is more or less an anathema from the historical perspective. Originally “working a job” meant that you had a very specific function to perform in exchange for money. Once your function was completed, your job was done. Then you went to the tavern for some mead and more job leads.

It was the modern industrial model that centralized jobs, tied them to a single employer, and made them semi-permanent. I do not think this model will survive in the Information Age.

We can’t conclude a discussion on the future of commerce without talking about the first completely distributed, decentralized marketplace: Open Bazaar.

Open Bazaar is like Amazon, Overstock, Ebay, Etsy, and Craig’s List in that it connects buyers and sellers, but the difference is Open Bazaar takes the middle-man out of the picture entirely.

Open Bazaar is not a company; it is a network. The aforementioned web sites are housed on centralized servers and managed by the respective company. All information touching those marketplaces is stored on centralized servers. Though not common, this exposes users’ personal information to risk.

Also, there are certain restrictions on trade and payment with those centralized sites, and the companies charge a fee – up to 10% in some cases – on each transaction for their involvement.

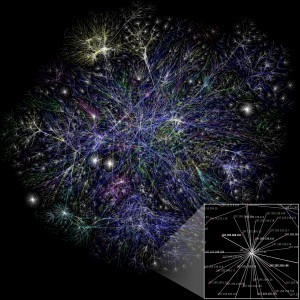

Guess what? Open Bazaar doesn’t do any of that. Instead of a centralized server, the Open Bazaar platform is run on individual nodes in the network. In other words, traders connect to the network by running the software on their computer, and this connects them directly to everyone else operating in the Open Bazaar marketplace. Information travels directly from buyer to seller, never touching a centralized server.

All transactions are settled with Bitcoin so traders reveal only the personal information they choose. Traders are disconnected from the network when they close the software.

This is the nature of a distributed system; it is 100% decentralized which makes for an extremely resilient model.

The Open Bazaar marketplace just opened for business in April of 2016, so it is very much in its infancy as I pen this entry. The potential is absolutely amazing, however.

Imagine a network of millions of traders buying and selling physical goods, information products, and digital services directly from one another using market-based cryptocurrency. The peer-to-peer nature of both the marketplace and the currency wipes out fees, identity theft, censorship, and political risk.

We are talking about a modern Hanseatic League!

People who live in the developed world where the rule of law is upheld at least to some degree may discount the need to circumvent censorship and political risk, but commerce and free trade are what move poor nations up the economic ladder. The power to control and restrict commerce is the power to subjugate entire populations.

Decentralized money and marketplaces are the bane of politics. They cannot be shut down because there is no CEO to shake down, no building to raid, no company to sue, and no centralized server to shutter.

Individuals can pop onto the marketplace at anytime, and then they can disappear entirely by closing the platform. That platform is not centrally located – it exists on each individual computer running the software. So unless you can shut down millions of individual computers all over the world, you cannot get rid of the commercial platform.

Traders can store their bitcoins on flash drives or on hard drives disconnected from the Internet so their money can enter the marketplace and then disappear instantly in a secure fashion as well. This can be especially effective if they employ some of the privacy tips and tricks we cover in the Zenconomics Guide to the Information Age.

Corrupt governments seeking to restrict commerce will be stuck chasing ghosts. This opens up parts of the world to free trade that have been dark for decades. That in-and-of-itself is a boon for human civilization.

Go to https://openbazaar.org/ to see first-hand what Open Bazaar is all about!

More to come,

Joe Withrow

Wayward Philosopher

We have just released the Zenconomics Guide to the Information Age to members of the Zenconomics Report email list. This guide is 28 pages in length, and it discusses: money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. We are offering a free copy to all new mailing list subscribers at this link: http://eepurl.com/bXyrQ1.

The post The Future of Commerce appeared first on Zenconomics - an Independent Financial Blog.

April 15, 2016

A Golden Reset?

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

A Golden Reset?

April 15, 2016

Hot Springs, VA

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” –Thomas Jefferson

The S&P closed out Thursday at $2,082. Gold closed at $1,226 per ounce. Crude Oil closed at $41.50 per barrel, and the 10-year Treasury rate closed at 1.78%. Bitcoin is trading around $430 per BTC today.

Dear Journal,

Last week we examined a potential path to the Great Reset triggered by the global adoption of negative interest rate policies (NIRP). The entry was not just speculation, however, but it was prompted by a report outlining a meeting in Manhattan between some major players in the world of finance and a source sitting at the nexus between government policy and the financial industry.

This meeting was not about the possibility of negative interest rates in the U.S., however. The unnamed source assumed NIRP was already baked into the cake. According to him it was not a matter of ‘if’, but ‘when’.

Instead, the meeting was about a plan that top monetary officials in the U.S. were considering as a means to regain control of the financial system should negative interest rates cause a run on paper currencies, including the U.S. dollar.

That plan, according to this source, was to re-establish the dollar’s convertibility to gold which would be accomplished by swapping the U.S. Treasury’s gold stock (248 million ounces) for all of the Treasury bonds on the Fed’s balance sheet ($2.4 trillion)… a golden reset.

Here’s the (paraphrased) reported justification:

The fiat monetary system is unraveling due to the extreme levels of sovereign debt that have accumulated globally, and the only way to prevent a collapse of the banking system is to impose negative interest rates. Negative interest rates will almost certainly cause major institutional investors to flee the system, however; indeed this is already happening. Many of those institutional investors are already taking significant positions in physical cash and gold. The only way to re-establish financial order is to integrate gold back into the system, but so much money has been created out of thin air that the price of gold will necessarily skyrocket. The source went on to suggest that governments would likely enact policies to severely curtail the ability of citizens to buy gold when the panic hits.

The report went on to calculate the new dollar-to-gold ratio necessary for the Fed to swap out its balance sheet for the U.S. Treasury’s gold: roughly $10,000 per ounce of gold. Curiously, I believe this valuation matches up directly with the numbers presented in Jim Rickards’ new book: The New Case for Gold. I haven’t yet read the book, though, so I may be wrong on this.

Now to be honest, I was a bit skeptical after reading this report. Not that I doubt the fiat monetary system is coming unglued. I wrote in The Individual is Rising that I didn’t expect the system to survive the decade. But I was thinking that governments would try to save the monetary system by integrating the IMF’s “Special drawing rights” (SDR) in some capacity.

The SDR is basically just a currency “basket” consisting of a percentage of the top reserve currencies of the world: the U.S. dollar, the European Euro, the Japanese Yen, and the British pound. The Chinese yuan is slated to be accepted into the SDR basket as well, and this was a big international news story in 2015.

Such an international monetary system would very much resemble the “bancor” system John Maynard Keynes championed at the Bretton Woods Conference in 1944. Such a system would maintain the currency “elasticity” which enables central banks to manipulate the money supply and monetize government debt. I assumed top central bankers and top government officials would fight, scratch, claw, and screech to hold on to this power over the money supply.

A return to some semblance of a gold standard would take away the monetary punch bowl almost entirely. Currency could not be created from thin air nor could governments run up massive debt. A return to gold would seemingly render the SDR, and maybe even the entire IMF obsolete. That type of thing never seems to happen – which is why I am still a bit skeptical of the golden reset plan coming to fruition.

But the report takes a look around the finance world and points out that institutional power players are already moving towards gold:

Munich Re, one of the world’s largest reinsurers, is reportedly hoarding physical cash (tens of millions) and gold (nearly 300,000 ounces) as a means of avoiding negative interest rates.

Prominent hedge fund manager Stanley Druckenmiller has moved roughly 30% of his personal portfolio into gold. David Einhorn has put more than $100 million into gold stocks. Paul Singer is on the record saying gold is the only real money. Ray Dalio, founder of the largest hedge fund in the world, has said: “If you don’t own gold, you know neither history nor economics.”

Wall Street has grown so fantastically large, wealthy, and powerful specifically because the fiat monetary system has featured constant credit expansion which really started to ramp up in the 1980’s. Much of the continuous credit expansion has flowed directly to Wall Street for more than thirty years now.

Now all of a sudden some of Wall Street’s top players are talking up gold’s role within the monetary system? Something is going on here!

Re-establishing the U.S. dollar’s convertibility to gold would be preferable to the 100% fiat system we currently have, but there are still plenty of short-to-intermediate term problems that this would not address.

The biggest: what happens to the $210 trillion or so in unfunded government liabilities? That’s 21 billion ounces of gold even if gold jumps to $10,000 per ounce. I believe there’s only about 5 billion ounces of gold in existence…

Ultimately, a centralized monetary system is not needed within the Information Age economy. While I would certainly prefer a gold dollar to a fiat dollar, I would much prefer a world of decentralized gold currencies, silver currencies, cryptocurrencies, and any other type of currency people in the market would deem useful.

Cryptocurrencies like Bitcoin already solve many problems inherent in the financial system simply because of their distributed peer-to-peer functionality. We have the technology necessary to create digital precious metals-based currencies that could operate in a similar way while also providing a physical medium of exchange. Companies like BitGold already do this in a limited fashion.

Companies like Ethereum are developing Blockchain technology capable of running secure smart contracts and decentralized identity and reputation management systems on a shared global infrastructure. This means that digital currency systems can operate without the possibility of downtime, censorship, fraud, or third party interference.

Pair decentralized market-based currencies with smart contracts and reputation management systems and you have rendered the entire central banking system obsolete. You can get rid of the contradictory incentives, fraud, and massive overhead expenses inherent in the central banking system pretty much over night. And you can prevent governments from ever again running up the massive unfunded liabilities that are going to cause major unrest within western civilization over the next decade or two.

Then you can watch the second Renaissance play out as the global economy booms like it has never boomed before.

More to come,

Joe Withrow

Wayward Philosopher

We have just released the Zenconomics Guide to the Information Age to members of the Zenconomics Report email list. This guide is 28 pages in length, and it discusses: money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. We are offering a free copy to all new mailing list subscribers at this link: http://eepurl.com/bXyrQ1.

The post A Golden Reset? appeared first on Zenconomics - an Independent Financial Blog.

April 6, 2016

The Path to the Great Reset

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Path to the Great Reset

April 6, 2016

Hot Springs, VA

But if government manages to establish paper tickets or bank credit as money, as equivalent to gold grams or ounces, then the government, as dominant money-supplier, becomes free to create money costlessly and at will. As a result, this ‘inflation’ of the money supply destroys the value of the dollar or pound, drives up prices, cripples economic calculation, and hobbles and seriously damages the workings of the market economy.

–Murray Rothbard

The S&P closed out Tuesday at $2,045. Gold closed at $1,229 per ounce. Crude Oil closed at $35.89 per barrel, and the 10-year Treasury rate closed at 1.78%. Bitcoin is trading around $423 per BTC today.

Dear Journal,

I began writing a book titled The Individual is Rising back in 2013. The first edition was published in the summer of 2014, and then the updated, expanded, and revised second edition was published in August of 2015.

The central thesis of the book was that a financial “Great Reset” was on the horizon specifically due to the gross abuse and mismanagement of the monetary system that grew progressively more blatant over the course of the past century.

Gold has been money for most of recorded human history. Industrial capitalism operated on a global gold standard up until the world wars shredded Europe’s economy. In 1933, President Roosevelt criminalized private gold ownership using an executive order, and the U.S. government forced citizens to sell their gold at a below-market valuation. This gold was melted down into bricks and shipped to Fort Knox where KPMG says it still sits to this day.

The Bretton Woods Agreement was executed in 1944 which pegged the U.S. dollar to gold at $35 per ounce and installed the dollar as the world’s reserve currency. Under Bretton Woods, all other national currencies were pegged to the dollar, and foreign central banks could exchange dollars for gold at the fixed rate.

The Bretton Woods Agreement required the U.S. government to maintain the dollar-to-gold exchange ratio, but that didn’t happen. The U.S. government instead ramped up the printing presses to power its “Guns and Butter” campaigns in the fifties and sixties. Eventually foreign central banks caught on and began to exchange their dollar reserves for gold through the gold window. Gold steadily flowed out of the U.S. Treasury until August 15, 1971 when President Nixon unilaterally closed the gold window and ended the U.S. dollar’s direct convertibility to gold.

This action thrust the entire world onto a fiat monetary standard where all currencies floated in value against one another. The word “fiat” is defined as: an arbitrary order or decree, and the word very literally means “let it be done” in Latin. Fiat money is simply money that comes into existence and derives its value exclusively from government decree.

Free market economists, specifically those of the Austrian school, decried this move immediately. Fiat money had been used on a national level on numerous occasions throughout history, they said, and each time it led to economic disaster. Now you want to try it on a global scale? You are asking for a catastrophe!

Many of the Austrians didn’t think the fiat system would even survive the decade.

The reason being is really just common sense: if you give a select group of people the ability to create money out of thin air then they are going to do just that. And they are going to keep on doing just that in greater quantities, especially when they discover that they can funnel the new money to their own friends and business partners. Here’s the kicker: each new monetary unit that comes into circulation – whether its dollars or pounds or yen – necessarily steals value from all of the other monetary units in existence.

This is just basic economics, but French economist Richard Cantillon noticed something especially nefarious about this dynamic way back in the early 1700’s. When such a fiat money system is employed, the people who receive the new money first – always the politically connected and financial elite – become fantastically wealthy while everyone else becomes poorer over time. In other words, Cantillon said, this system actively transfers purchasing power away from everyone who holds money, and it funnels this purchasing power directly to the few people who are on the receiving end of the printing presses!

This came to be known as the Cantillon effect, and it is the sole reason for the massive wealth disparity that has come to exist in the U.S. over the past four decades. There is a reason why the suburbs surrounding Washington, DC have become the wealthiest counties in the country. The Federal Reserve has been systematically transferring the nation’s wealth to Washington (and New York) for forty years now.

The fiat monetary system has fundamentally transformed how the economy operates as well. Free market purists, of which I am one, can list numerous reasons as to why the Bretton Woods System was a crony fractional gold standard that was riddled with problems right from the start, but it did serve to restrict the creation of currency and credit to a certain degree.

Gold was the restrictive mechanism. The amount of currency and credit in circulation was tied directly to the amount of gold in the vaults. Though the system was imperfect, credit could only come from real savings which could only come from real production prior to 1971.

Contrast this to the creation of credit today. Banks are required to hold a fraction of deposits in reserve in order to issue credit. This reserve number is roughly 10%.

In other words, banks can issue a $1,000 loan for every $100 on deposit with a simple journal entry. But the $1,000 created by the loan typically finds its way back into the banking system. Very few people take out a loan and stuff the cash in their mattress; they usually use it to purchase something. The business or person on the receiving end of that transaction typically deposits the proceeds from the sale into their bank account. At that point there is an extra $1,000 floating around in the system… which means banks can now issue additional loans up to $10,000 on top of the new $1,000 deposit.

Now it may not be the same bank with the additional $1,000 deposit, but all of the banks are tied together via the central banking system so the net effect for the entire system is the same. The credit expansion feeds itself and self-perpetuates.

The U.S. national debt was effectively restricted by gold as well, as the Feds found out when French President Charles de Gaulle began shipping dollars back to the U.S. Treasury in exchange for gold.

Gold was like the fuddy-duddy who collected everyone’s car keys at the door of the college party. He would let you have a little bit of fun, but he drew a distinct line in the sand.

So what has happened to the economy since 1971 is not a mystery – everything can be traced back to the fact that we went from using real money to using money created from thin air. The data very clearly shows the results of this:

The U.S. money supply has exploded since 1971.

The cost of living has risen dramatically because of this monetary expansion.

The U.S. national debt has exploded by a factor of 10 – it has quite literally doubled more than three times in forty years.

Unfunded government liabilities have exploded all around the world – eclipsing $210 trillion in the U.S.

Household debt has exploded significantly, and household debt-to-income has now surpassed 130%.

Interest rates have been pushed negative around the world, and to near-zero in the U.S. which has prevented seniors and conservative investors from earning any real returns on their savings.

Real money and savings have been replaced by credit – the entire economy has been hooked on cheap credit.

The perpetuation of this system depends entirely on continued credit expansion. The house of cards will fall as soon as the credit dries up. By the way, this is not exclusive to the United States. The entire world faces similar problems because the fiat monetary system is now global.

Here’s the funny thing about this: the Baby Boomers have spent all of their adult lives immersed in this system. Their children have spent their entire lives in this system. This monetary system is abnormal from a historical perspective and it is completely unsustainable, but most people alive today consider it absolutely normal. They have known nothing else.

I wrote about the problems inherent in the fiat monetary at length in The Individual is Rising, and I opined that the system was not sustainable for any extended period of time. But I was writing purely on economic theory and high personal conviction; I did not have a concrete vision as to what could bring the Great Reset to fruition.

That changed last weekend when I received a report from one of the largest independent financial publishing companies in the world. I have followed this company’s investment analysis for several years now, and they had never before sent out anything like what I received over the weekend.

The report could not dive into specifics, but it presented the highlights from a meeting in Manhattan between this company’s owner, along with several others, and a man who sits squarely at the nexus between government policy and the top tiers of the financial industry. This is a man who has worked several stints in the highest levels of the federal government and now serves as an advisor to some of the country’s wealthiest and most influential people. The man’s identity was not revealed, but it was made clear that you would likely recognize his name. He is on CNBC quite frequently.

Here’s an overview of what was discussed in this meeting:

Policymakers in Japan and Europe have already pushed sovereign interest rates into negative territory. Chinese policymakers, as of last week, have done the same. This is capitalism flipped upside down. Instead of receiving a rate of return on their capital, savers actually must pay interest to purchase government bonds or to keep their money in the bank.

Think about what this means for large institutional investors. Are they really going to deploy their capital in a way that guarantees a loss?

What about insurance companies? Millions of people and businesses around the world have bought insurance policies to protect their homes, businesses, property, and even entire cities. These insurance companies must maintain a huge cash reserve in order to honor their guarantees as claims come in. Are these companies going to keep their cash reserves in accounts that steadily eat away at their capital because of negative interest rates?

You could ask the same question about pension funds.

And how about individuals all around the world? Are people going to keep their money in the bank and watch their account steadily dwindle month in and month out? Aren’t deposit accounts supposed to protect capital in a liquid manner?

A general rule of thumb is that capital flows to where it is treated best. Right now, that place is the United States. With the rest of the world descending into negative interest rate territory, the Federal Reserve has actually been talking about raising interest rates.

It is only logical to expect huge amounts of capital to rush into the U.S. credit and financial markets to escape the ills of negative interest rates. But this would drive Treasury yields down and send the U.S. dollar skyrocketing relative to all other currencies which would cause massive imbalances in the global economy.

Here’s just one example: emerging market debt has exploded by more than 600% in the last ten years alone. This debt is denominated in dollars, but the emerging market debtors earn money in their own currencies. This means they must convert their currencies to dollars to service this debt. If the dollar-to-emerging market currency exchange ratio is too extreme then these debts simply cannot be paid. Then problems in the credit markets really start to cascade.

Notice how this all goes back to the fiat monetary system.

So the thesis from this meeting was that the Federal Reserve would be forced to follow the world into the realm of negative interest rates simply to prevent the dollar from soaring and shaking up the global economy.

But then all of those economic actors mentioned above would have no safe haven to run to within the financial system. So what would they do?

Maybe they would just take it on the chin and let their capital gradually decay. Or, much more likely, they would move into physical cash and gold as a means to preserve their capital thus triggering a global bank run – something long thought conquered in the age of central banking.

Oh, and this is more than just a theory… a number of power players are already starting to do just that – hoard cash and gold.

Could the Great Reset be at hand?

Nobody knows for certain. Prominent Austrian economists thought the fiat monetary system would crash and burn a long time ago. They have been wrong for decades on this. Maybe they will be wrong for decades more… or maybe they will finally be proven right. Stay tuned….

More to come,

Joe Withrow

Wayward Philosopher

I will be hosting a webinar on April 10 at 8:00 pm EDT for anyone interested in these macroeconomic issues. We will discuss the major threats to your retirement, and what you can do financially to not only insulate yourself, but possibly even leverage major economic trends to grow your capital. You can find out more about the webinar at the registration page. Seating is limited so please do not hesitate to reserve your spot today!

The post The Path to the Great Reset appeared first on Zenconomics - an Independent Financial Blog.

March 23, 2016

Of Life and Entropy

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Of Life and Entropy

March 23, 2016

Hot Springs, VA

“Everything that is really great and inspiring is created by the individual who can labor in freedom.”

–Albert Einstein

The S&P closed out Tuesday at $2,049. Gold closed at $1,248 per ounce. Crude Oil closed at $41.22 per barrel, and the 10-year Treasury rate closed at 1.94%. Bitcoin is trading around $415 per BTC today.

Dear Journal,

For all of recorded history man has pondered the meaning of life.

I remember grappling with the question myself as a youngster a few short decades ago. Back then I was fully immersed in institutionalized society. That is to say, the majority of my time and energy was spent satisfying the demands and requirements of institutions – a public school in my case.

I distinctly remember the painful bite of the alarm clock going off each morning before the sun had risen and before a growing boy had received adequate rest. I remember dragging myself out of bed and into the shower with only one thought running through my head: I wish it were Saturday! I remember the stress that came with assembling the day’s clothing knowing full-well that I would be judged heavily according to my appearance.

I remember the monotony of each morning’s commute as I was transported to a place in which my freedoms would be curtailed and my day would be regimented. The only thing I looked forward to each morning was the feeling of liberation that would come with the afternoon’s dismissal bell.

I remember the feeling of anxiety as I was herded around the school according to a predetermined schedule to which I had no input, always under the suspicious gaze of patrolling faculty and resource officers – some of whom were rather friendly while some were focused on their own position of authority.

I remember the boredom that came with the mandatory ‘memorize and regurgitate’ method of schooling. Most of my school work struck me as piecemeal and arbitrary, but the teachers were quick to remind us that the material was required by the standardized tests we would be subjected to at the end of the year. I remember thinking that a more comprehensive understanding would come to me later on in the curriculum if I just faithfully went about my work. So I did… it didn’t.

I remember the feelings of confusion and sorrow as I witnessed other children verbally abused and bullied, always for petty reasons typically associated with physical appearance or personality type. Should I intervene according to my conscious or should I laugh with the bullies to improve my own social standing?

More often than not I simply chose the safe middle ground and turned a blind eye to the injustice. This was the diplomatic choice – I could justify my own inaction to injustice by applauding the fact that I did not participate. It was only decades later that I realized the middle ground was a place for cowards in the image of Pontius Pilate.

I remember the feeling of horror I experienced as I witnessed the barbarism of physical violence up close and in person. I still remember the dreadful thud of a fist striking flesh rising above the coarse grunts and moans of two human beings engaged in violence. I was shocked at how some kids were willing to physically harm other kids with seemingly no remorse. I was even more horrified by the fact that most of my schoolmates would cheer on the violence, and the crowd always seemed to root for a favorite.

Yet I was led to believe that this institution held the key to my future. So I quietly and unquestioningly complied with all institutional requirements each week until Saturday brought with it the blessings of Liberty once again. After all, I needed good grades to get into a good college. And I needed to get into a good college to get a good job. And I needed to get a good job to have a successful life. It was pretty simple – all I needed to do was comply.

Within this institutionalized environment I could not find an answer to the meaning of life question. In fact, I came to the conclusion that there was no real meaning. There were only obligations and requirements to be met in order to move on to the next level within the system. First grade led to second grade. Elementary school led to middle school. Middle school led to high school. High school led to college. College led to work. Life was a set of hurdles to be jumped in order to get to the next set of hurdles.

In hindsight I realize now that this lack of defined purpose is what led most students to adopt social status as their life’s mission. The lack of defined purpose is almost certainly why some students turned to drugs and alcohol. It is probably why some students were quick to engage in bullying and violence as well. Napoleon Hill’s Outwitting the Devil is a great resource for anyone interested in expanding their thinking on this subject. Personally, I spent the majority of my free time on the Internet as a means of escape from institutionalized reality.

My philosophic inquiries and critical thinking capacity had receded by the time I was able to drive a car, however. I simply stopped searching for meaning and took my place within the institutional structure… adopting its rules as my own.

It took me about a decade to wake up from this institutionalized slumber, and it took another half-decade to dig myself out of the mental, emotional, spiritual, and financial hole that came with it.

I now understand why I could not grasp life back in my school days. It’s basic thermodynamics, really. A closed system – a system isolated from its surroundings – evolves toward a state of maximum entropy; entropy being the amount of energy not available for work.

The system of compulsory education, which has been thrust upon nearly everyone for one hundred years now, is a closed system… it promotes maximum entropy. It promotes maximum entropy because it leaves students with very little time and energy to explore their own talents, interests, skills, ideas, and passions. In fact, the system directs students away from their own talents, interests, skills, ideas, and passions in many cases. So in effect, the system siphons energy away from work most valuable to the student, and redirects that energy toward work of very little value.

If you are not free to explore your own consciousness, how can you know yourself? How can you internalize a system of personal values and principles? If you are not free to develop your own talents, how can you envision a future of your own choosing? How can you create the life that resonates with your core being?

The answer is you can’t. So you adopt institutional values as your own and you live the institutionalized life. And by ‘you’, I don’t mean you… I mean me. That’s what I did. I only assume there are many others who have done the same thing under the same circumstances.

A closed system evolves toward a state of maximum entropy. Life reverses entropy.

This can be observed fundamentally at the primal level: living organisms extract nutrients from their environment and they internally assemble and deploy these nutrients in a manner necessary to sustain their life. Every time you take a breath you are reversing entropy; you are taking idle oxygen from the air and employing it to nourish your blood. In a similar manner the acts of eating and drinking are acts of entropy reversal.

Does this mean the meaning of life is to reverse entropy? I don’t know… maybe. I don’t really dwell on the question. I think it is more important to focus on what life is.

And what life is, is a celebration of creation. I think this is true both of life in nature and of life within human civilization. Creation is everywhere, and it is beautiful.

From my front porch you can watch anywhere from ten to twenty deer gradually emerge from the woods at dusk to explore the fields. There are always fawns energetically hopping out of the woods behind the adult deer. I originally enjoyed watching all manner of birds graze from two bird feeders hanging on a dual-sided pole from my front porch as well. Then a family of bears – a momma and three cubs – knocked down the pole and raided the bird feeders. Creation is beautiful, but I stopped feeding the birds.

My daughter, sweet Madison, was born directly into my hands in the comfort of our home nearly two years ago. I watched her smack her lips for the very first time. I watched her take her very first breath of life. Wife Rachel did the heavy-lifting, of course, but I was intimately involved in the birth process. Creation is beautiful.

Look at the amazing power of creation behind human civilization. Two hundred years ago nearly everyone had to be a farmer just to survive. Then came the Industrial Revolution. Then the Information Revolution. Today, people of even the most modest means in the developed world are far wealthier in standard of living terms than the richest of the rich one hundred years ago. Indoor plumbing, HVAC systems, advanced cooking and refrigeration systems, and all manner of entertainment devices make this no comparison.

Today, everyone carries around a computer in their pocket that is more powerful than computers that filled an entire room several decades ago. These pocket computers enable people to access the entire pool of accumulated knowledge instantaneously. Oh, and they also make phone calls.

The space-age technology we live with today would have been considered magic by our farming ancestors two hundred years ago. Creation is beautiful.

Everyone observes and experiences creation on a daily basis. Art, literature, cinema, symphony, music concerts, trade shows, festivals… they all represent creation. To play on a beautiful golf course is to experience creation. Tasting a robust craft beer is experiencing creation. So is bringing a new product to market. And fine-tuning an email marketing campaign. Cosmetologists, beauticians, and manicurists all deal in the art of creation everyday. Creation is everywhere.

I am especially excited about the digital revolution, peer-to-peer commerce, open source technology, Bitcoin, Ethereum, and Open Bazaar. These all represent creation, but they also enable individuals to move away from institutionalized entropy and towards the celebration of life.

Creation promotes life. Life reverses entropy and celebrates creation. It’s a beautiful dynamic.

I can’t tell you the meaning of life, but I can say with confidence that my life has been much happier, more meaningful, and much more prosperous since I ceased promoting entropy and began to promote life.

I can also say this with confidence: cracks are beginning to form within many institutional systems. A few people can see this already, but most can feel it.

These institutional systems will continue to devolve as we move further into the Information Age, and competing systems will emerge as a result. Indeed, they are already emerging quietly.

This transition will be confusing, painful, and messy; and the Establishment will use heavy-handed measures to prop up its institutions. But the competing systems will prove more successful and gain traction over time for one primary reason: they are constructed to promote life – not entropy.

The seeds of the Second Renaissance are being sowed as we speak, but remember: the Revolution will not be televised…

More to come,

Joe Withrow

Wayward Philosopher

Human systems either promote life or they promote entropy. Find out how to master your finances, gain financial freedom, and structure your affairs in a way that promotes life by enrolling in Finance for Freedom: Master Your Finances in 30 Days today. Over 2,900 people have enrolled in this course and the average rating is 4.8 out of 5.

The post Of Life and Entropy appeared first on Zenconomics - an Independent Financial Blog.

March 17, 2016

The Moral Value of Money

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Moral Value of Money

March 17, 2016

Hot Springs, VA

The S&P closed out Wednesday at $2,027. Gold closed at $1,264 per ounce. Crude Oil closed at $38.50 per barrel, and the 10-year Treasury rate closed at 1.94%. Bitcoin is trading around $415 per BTC today.

Dear Journal,

Last week we examined the majesty of mindfulness, and we suggested that politics was the bane of human civilization. There are many reasons for this, but at the core is this: politics is based on coercion. Politics rests upon the notion that those who gain political power have the right to force people to do things against their will using the police power of government. This is always a zero-sum game: one side wins and the other loses.

The U.S. federal government collects roughly $3 trillion in taxes annually. The civics textbooks tell us that taxes are the price we pay for civilization, but I have to ask: where does all of this money go?

The textbooks tell us that taxes go to maintain our roads and fund our schools, our police and fire departments, our courts, our legal record-keeping systems, and our libraries. Taxes are just part of this social contract, the textbooks say. But if you actually dig a little deeper you will notice something striking: all of these items are primarily funded by state and local governments. In fact, the federal government, through federal grants, only contributes 4% of its budget to transportation related items, 2% to education related items, and only 1% to other governmental items such as police departments. That leaves roughly $2.79 trillion dollars going to something other than core civil services.

So where does it all go?

81%, or roughly $2.26 trillion, goes to maintaining social welfare programs, financing a global military empire, and paying interest on the national debt. These are all wealth-destroying operations. Instead of being reinvested, capital is extracted from the productive economy and funneled into domestic consumption, overseas militarism, and killed off via debt service. And you can bet that much of this money is filtered through layer upon layer of bureaucracy and siphoned off by special interests every step of the way.

That is politics in action.

Back in 1908 German sociologist Franz Oppenheimer, in his book The State, suggested that there are two fundamentally opposed organizing principles of social life. The first is what he called the economic means: the voluntary exchange of goods and services in the marketplace. The second is what he called the political means: the appropriation and redistribution of goods and services via the political mechanism – the State.

Henry Hazlitt expanded upon this concept in 1946 with his classic: Economics in One Lesson. This is the very first book anyone interested in learning economics should read.

The point is civilization can be structured according to production and persuasion, or it can be structured according to politics and coercion. This is just as true for a simple farming village as it is for an advanced technological society. We have seen examples of each in history.

Free market economists have also discovered that if you want to know where a civilization is on the persuasion-coercion spectrum, all you need to do is examine the morality of its money. Now I use the word morality to refer to virtuous conduct rather than adherence to an arbitrary set of rules. In other words, morality refers to the extent to which positive inputs lead to positive outcomes.

Feudalism was the means of social organization prior to the development of the market economy. Feudalism was land-based in that various kingdoms claimed ownership of all land within a geographic territory. The king gifted land – manors – within the kingdom to nobles. Manors typically consisted of a village, a church, a mill, a wine press, and agricultural land. Nobles permitted vassals to live on their manor in exchange for their labor. Vassals would work the fields, grind the grain, and give a portion of the harvest to the nobles.

Money was not involved in this relationship whatsoever. Vassals were permitted relative freedom to live, play, and marry on the manor in exchange for a portion of their production. This tied vassals both to the land and to their station – they had very limited means of advancing beyond their social class.

The market system changed this dynamic.

Feudalism was gradually phased out as market capitalism developed during the sixteenth and seventeenth centuries. Where feudalism was based upon fixed social stations and coercive hierarchal relationships, market capitalism was based on equality of opportunity and voluntary exchange. Where feudalism dealt in favors and privilege, the market economy dealt in money.

Money became the means not only for survival, but for progress. In a market-based system, the only way to make money is to provide goods or services that other people want. In other words, to make money you have to provide value for your fellow man in some capacity. To make a lot of money you have to think about what others want, then you have to find better, faster, and cheaper ways of delivering it to them. This is where the supply-demand and profit-loss functions come into play.

Money represents the reality that every individual is the owner of his mind and his labor. In the market society, everyone is free to engage in work of their own choosing thanks to the division of labor, and everyone has an opportunity to improve their lot in life according to their own productivity and ingenuity. Money is the driving force behind this individual empowerment.

Along with empowering individuals, money also advances human civilization. Prior to the development of market capitalism, production did not significantly exceed consumption over any extended period of time. Production was primarily agricultural in nature, thus any surplus was systemically saved to compensate for future deficits – there was no capital investment mechanism. This is famously depicted by Joseph’s interpretation of the Pharoah’s dream in the book of Genesis.

Market capitalism increased production tremendously which enabled people to produce significantly more than they consumed for the first time in recorded history. This led to the formation of the financial markets as a means of investing surplus capital.

I think it is fair to say that the financial markets built western civilization. The major undertakings of the Industrial Revolution – the heavy machinery, factories, tools, textiles, steam engine technology, iron production processes, chemical manufacturing processes, gas lighting utilities, and the construction of roads, railways, and canals – required huge investments of private capital. The financial markets provided this capital in exchange for future financial compensation for investors in the form of money. Money was the driving force.

People understood the high moral value of money back in those early days of market capitalism. Money was a store of value and it represented honest work and mutual cooperation. Money represented prudence and voluntary exchange. Money represented the values of human civilization. A man who had money was a man who had provided value to his community.

Money’s moral value is directly linked to the stability of its purchasing power. We have seen this all throughout history. Wherever an honest day’s pay could support a quality life, people have been willing to put in an honest day worth of work in exchange. Wherever investing a capital surplus has yielded reasonable returns, people have been willing to produce more than they consume. Wherever hard work and delayed consumption has led to higher standards of living, people have been willing to take care of themselves and their communities accordingly.

This is why money was originally gold. There is nothing particularly special about gold, but it possesses qualities that make it an exceptional form of money. It is consistent, divisible, durable, nonreactive, and malleable. Most importantly, gold is limited in quantity, difficult to obtain, and cannot be created from nothing.

These properties enabled money to consistently maintain its purchasing power year-after-year. As a result, prices did not rise continuously. In fact, history shows that prices had a tendency to gradually decline within a gold-based monetary system.

Over the past one hundred years we have witnessed a monetary shift from gold to gold-backed currency to 100% fiat currency. Money became less restricted, easier to create, and more politicized with every step of this transformation.

As money became more politicized and easier to create it began to flow more to those who employed Oppenheimer’s political means, and those who employed the economic means began to get the short end of the stick. As a result, cronyism and political favors became the easiest means to making a lot of money in a short period of time. This has had a tremendous impact on the morality of money, thus a tremendous impact on the morality of human civilization.

This dynamic exploded once the cat was out of the bag. Within a few short decades artificial legislation and regulations were piled to the ceiling, debt was piled to the moon, K-Street was overflowing with lobbyists, money could purchase a fraction of what it used to, consumption cannibalized production, wealth was demonized, and a large percentage of the populace was clamoring for more of other people’s money in the form of government redistribution programs.

The moral value of money had been destroyed.

All of a sudden an honest day’s pay could not guarantee a quality life. All of a sudden investing surplus capital could no longer generate a reasonable return on investment without exposing it to considerable risk. All of a sudden hard work alone could barely cover living expenses, much less lead to a higher standard of living.

The reason for this is simple: the money supply has artificially exploded over the past century. Creating money from thin air drives the value of money down and prices up. This is especially true when the system is used to nefariously funnel freshly created money to special interests.

It now costs 1.7 cents to make a penny and 8 cents to make a nickel. Putting these coins into production costs the taxpayers tens of millions of dollars every year. You can walk around any city in the U.S. and find these coins littering the street. Millions of people walk right past them with little regard because they are worthless. They have been reduced to simple tokens, doomed for the dustbin of history. Yet there are still people alive who remember using these coins to purchase desired goods on a daily basis.

This is why the cost of living has skyrocketed – because the value of money has been destroyed. One dollar today is the equivalent of two cents in 1913. The U.S. dollar has lost 21% of its value since 2002 alone.

This trend will not turn around. Donald Trump cannot change it. Bernie Sanders cannot change it. They do not even understand it. The U.S. government has accumulated more than $200 trillion in unfunded liabilities on top of its $19 trillion national debt. These obligations cannot be honestly met so we can expect the requisite money to be created out of thin air – further destroying the value of the money.

This is why it is so important for you to structure your finances in a way that accounts for the nature of the current monetary system. I put together an online course called Finance for Freedom: Master Your Finances in 30 Days for this reason. You can access the course landing page from this link. We will be running a free webinar to go over some of the vitals within the next few weeks as well.

I am reminded of a quote from the Old Millionaire in Mark Fisher’s The Instant Millionaire: “Keep this well in mind: external circumstances are not really relevant. All the events in your life are a mirror image of your thoughts.”

There are always opportunities to rise above the external obstacles in your path. Knowledge is the key.

More to come,

Joe Withrow

Wayward Philosopher

For more information on how to master your finances in the Information Age, please see the online course: Finance for Freedom: Master Your Finances in 30 Days. Over 2,900 people have enrolled in this course and the average rating is 4.83 out of 5.

The post The Moral Value of Money appeared first on Zenconomics - an Independent Financial Blog.

March 11, 2016

The Majesty of Mindfulness

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Majesty of Mindfulness

March 11, 2016

Hot Springs, VA

“What if you could be more than you ever thought you could be? To be better than you thought you could be? Would you do it?”

– Paul Rosenberg, A Lodging of Wayfaring Men

The S&P closed out Thursday at $1,989. Gold closed at $1,273 per ounce. Crude Oil closed at $37.84 per barrel, and the 10-year Treasury rate closed at 1.93%. Bitcoin is trading around $412 per BTC today.

Dear Journal,

The 2016 presidential election cycle is now in full-force here in the United States. The yard signs are out, the politicians are demagoguing, the talking heads are raving, and the neighbors are arguing.

“We need a socialist in office!”, some say. “We need to stick it to the Chinese!”, say others. “We need a knowledgeable leader who can get things done!”, others chime in. “We need more irish creme in my coffee!”, says I.

In my view, politics is a distraction for individuals at the micro level and the bane of human civilization at the macro level. Politics runs on fear, anger, hatred, envy, and intolerance – the emotions that bring out the absolute worst in people.

Though I pay no attention to the media coverage, I am quite sure this presidential election has been dubbed “the most important ever”. As was 2012… and 2008… and 1912… and 1824… and 1789. We are always just one election away from Utopia.

So I am dipping into this archives today in honor of this most important election cycle. What follows is an essay I wrote nearly two years ago as I contemplated the world from the perspective of a soon-to-be father. This essay ran on Zero Hedge at the time so it is a little longer than my normal entries – sorry Rachel!

Mindfulness is a rare quality in our world today. There is little need for Mindfulness within the halls of the great and mighty institutions of society. There is little time for Mindfulness within modernity due to the demands of the rat-race, the allure of consumerism, and the overload of electronic stimuli. There is outright disdain for Mindfulness from the ruling class sitting atop the collectivist pyramid.

Yet Providence smiles favorably upon the Mindful.

Mindfulness is neither flashy nor fashionable and its power is not of worldly nature. Mindfulness does not presume superiority and it does not seek recognition. Mindfulness seeks only harmony – harmony of body, mind, and spirit.

Mindfulness is careful, but not timid. Mindfulness is confident, but not arrogant; strong, but not domineering.

The one who is Mindful understands the power of consent and thus does not consent to anything that disrupts the harmony of Mindfulness. The power of consent is derived from the fact that one’s reality is ultimately a construct of one’s choices. The Mindful one recognizes that he has dominion over his thoughts, emotions, and actions. Reality is merely an intersection of the three.

Because he is aware of the power of consent, the one who is Mindful chooses everything; he is not swayed by external forces. The one who is Mindful takes great measures to avoid all manner of toxins that would serve to disrupt his harmony. He avoids toxic food, toxic drugs, toxic thoughts, toxic words, toxic schools, toxic music, toxic television programming, toxic news, toxic people, and toxic politics.

The one who is Mindful embraces self-education, self-reliance, and self-governance and he rejects those who would seek authority over him. The Mindful one recognizes the hubris and the ignorance of those who claim worldly authority over others. He knows what they do not – that this life is not a trivial event in search of fame, fortune, and power. Nay, this life is an interconnected part of the very fabric of the Universe through which the human spirit has an opportunity to grow in transcendent wisdom. It is an opportunity to observe a very small section of Space-time within this massive Universe.

Those who seek power and dominion over Mindfulness are the same ones who seek power and dominion over the human spirit. They claim authority over the Mindful one and seek to govern every aspect of his life. They ultimately seek to convert the Mindful one’s infinite potential into blind servitude.

Look back through history and you can see that they who seek power over humanity have been at it for a very long time. The dominion-seekers are responsible for all of the wars that have raged since the dawn of human civilization, for the institution of overt slavery that existed for most of human history, and for the modern institution of covert slavery that is perpetuated by central banking and fiat currency. It is they who murdered the most enlightened of the Mindful throughout history, from Socrates to Gandhi, and even the one called Christ. The power seekers revel in fear and servitude and they cannot tolerate individuals who practice the art of Mindfulness.

Despite this, Mindfulness remains calm and centered. Mindfulness understands that worldly power is irrelevant in the bigger scheme of the eternal Cosmos. Mindfulness recognizes that external worldly conflict is but a reflection of the battle that rages within each sovereign individual. It is the inner battle that matters, for the external conflict will fade from existence once inner peace is achieved. Mindfulness quietly focuses on winning this inner battle without any need of praise or recognition.

To the worldly onlooker, Mindfulness appears weak, callous, and cold. Mindfulness offers no refute or explanation to these charges, but the Mindful one is fully aware of the strength that flows within and the flame of love that burns at the core. The Mindful one understands that the same flame burning eternally within him also burns eternally in others. Mindfulness knows that all of life is interconnected; that each individual is nothing less than an eternal spirit of humanity manifesting in a gloriously unique way.

The Mindful one recognizes that there is no ‘left’ or ‘right’; there is only Liberty or Tyranny.

Liberty leaves the individual free to wander in whatever direction calls out to his spirit. Liberty recognizes the individual’s right to discover and cultivate his passion, whatever that may be. Liberty respects the sacredness of human life and presumes no superiority over the human spirit. Liberty leaves the individual free to discover his destiny and ascend to a higher state of being.

Tyranny sets forth to funnel the individual into worldly systems of control, and to regulate all manner of individual activity. Tyranny sees the individual and presumes to know what’s best for him. Tyranny looks upon the infinite human spirit with disdain and seeks to cage and dominate it. Tyranny attempts to inundate and distract individuals with all manner of worldly fear, power, and entertainment so as to disconnect the individual from the spirit. Tyranny places all individuals into collective groups, labels them accordingly, and then proclaims that individuals are meaningless outside of the collective. Individuals who fall for this deceit then see themselves as part of a group and they see other groups as their enemy.

Mindfulness cuts through Tyranny like a fiery blade and the Mindful one sees right through these distractions and deceits. Mindfulness knows that Liberty is required for harmonious human interaction. Mindfulness maintains amor fati – a love of fate.

This is why Tyranny holds an eternal hatred for Mindfulness: it cannot exist where Mindfulness is present. Tyranny understands it actually has no power; it must be chosen by individuals. Thus Tyranny must convince individuals of its ability to deliver a better future. History shows that Tyranny is fairly adept at selling this illusion, at least until Mindfulness rises in opposition. History also shows that Tyranny is never capable of delivering the better future as promised. Instead, Tyranny disrupts the lives and plans of countless individuals, families, and friends – always for its own benefit and not theirs. Tyranny disrupted or ended the lives and plans of billions of individuals in the twentieth century alone.

Tyranny, for the life of itself, cannot understand the Mindful one. Despite being in touch with his tremendous individual power, the Mindful one does not use this power against others. Nor is the Mindful one ever interested in negotiating with Tyranny; he simply refuses to stray from his chosen path. Tyranny is befuddled when the Mindful one refuses all manner of bribes, deals, and kickbacks. Tyranny is frustrated when the Mindful one is not deterred by slander and ridicule and it is enraged when the Mindful one does not respond to intimidation and threats of force.

Through it all the Mindful one stands tall, confident in the validity of his principles. Tyranny has learned there is very little it can do to deter the Mindful one other than kill him. But the eternal spirit of Mindfulness can never die.

Tyranny comes in different sizes, shapes, and colors and these different forms often compete with one another in the political arena. Politics is simply the art of Tyranny, and a clever one at that. Many an individual has strayed from the Mindful path for the allure of politics; often with good intentions.

Mindfulness understands, however, there are no political solutions to political problems. Political solutions always begin with “we must” or “you must” but this is a dead-end road. “We must” and “you must” are unsustainable because they are not grounded in Mindfulness; they are grounded instead in some combination of self-interest, short-sightedness, ignorance, fear, and/or exploitation.

All true solutions must stem from “I must” first. That solution is then amplified if multiple “I musts” come together in harmony. This is the network effect. But the inspiration has to come from within first – from the “I must”.

The Majesty of Mindfulness is the solution to the major problems of our time. Mindfulness is simply a choice and anyone can choose to put on its mantle. Mindfulness cannot be forced upon others, however, as free will is a vital part of the Universal code. Thus, Mindfulness is latent within each individual seeking to unlock its power for himself.

The first step to awakening the Mindfulness within is an honest assessment of the System.

We are told at a very early age that the key to success in this life is to master the System’s power game. We are herded into schools to pledge allegiance to the System and learn how to play by its rules. We then mindlessly rush off to college to further our education on how to succeed inside the System. From there we either take our place within the rat-race, or we pursue an advanced degree from an accredited university. The advanced degree, we are told, is the key to unlocking and gaining entry to the higher tiers of the System. Similarly, each corporate job is a platform to prove our ability to operate within the System so we can get raises, bonuses, and then move up to the next rank within the System. And there is always a higher rank in the System.

This is not the Mindful path.

There is nothing inherently wrong with pursuing this path within the System, but it is much more likely to lead to stress, confusion, short-sightedness, small-mindedness, physical exhaustion, mental atrophy, family problems, and depression than it is to enlightenment. I know this from first-hand experience.

Now there are certainly those who have achieved self-defined success and happiness from within the System. There are plenty of people who have used the System to provide a quality life for themselves and their families. But past experiences are not indicative of future results and the System is becoming more and more fragile by the day as the Information Age continues to disrupt the established industrial order.

The System was easy to support in its adolescence as there was ample room for growth to mask the ill-effects of exponentially expanding credit-based money. The hockey-stick graph of credit expansion has now eclipsed the rate of economic growth, however, and the System is teetering as a result. The owners of the System must now resort to iron-fisted measures to keep it from tipping. If you follow the System’s predefined path, your every move will be subject to restrictions, licenses, regulations, taxes, and prohibitions. This is not a formula for success, and it is certainly no way for a sovereign individual to live.

An honest assessment of the System will likely lead you to conclude that you would be better served by exiting it, but you will probably be unable to immediately make your get away. Unless you have a tremendous amount of resources at your disposal, you will have to distance yourself from the System one step at a time. This is not easy for someone who has spent their entire life doing the “right” things – getting an education, working hard, and saving some money for retirement. It is very difficult to accept the fact that the System has been structured to plunder the honest people who follow the predefined path and it is normal for this realization to lead to depression or anger, or both.

But Mindfulness cannot coexist with depression or anger. The next step to awakening Mindfulness is to learn to be calm and accept the worldly injustices for what they are – an opportunity for growth. Liberty and Tyranny swing on a pendulum. As do Justice and Injustice. One or the other is inescapably present at all times in all places. There is a fundamental balance that seems to exist in the Universe which suggests that opposite and contrary forces are always interconnected. In order to know one you must also know the other. This is expressed as the yin and yang principle in Eastern philosophy.

The System currently represents Tyranny and Injustice but it is becoming extremely fragile and one day the pendulum will swing back towards Liberty. And later the pendulum will reverse course once again. There is nothing we can do to change this process at the macro level. All we can do is learn how to move away from the System and become a positive force in our local reality – our families, friends, communities, businesses, associations, and online networks.

The Mindful one does not seek to change the world; he seeks to change himself. The end goal is admirable, but it is the journey that is most important. The obstacle is the path.

Opportunities for earning income outside of the corporate cubicle arise as Mindfulness grows. This income is still subject to the regulations and taxation of the System, but some of it can be legally sheltered before the System gets to it. One must develop these meaningful sources of income in order to move away from the System. Yes this means paying taxes that the System will use against you. Yes this means accepting dishonest fiat currency that is used to transfer wealth from the outsiders to the owners of the System. But what other options are there currently? It is difficult to grow in Mindfulness if one’s life is a constant struggle just for sustenance.

As your non-wage income grows you will need Mindful strategies for protecting and investing your money. The System suggests you trust government approved retirement plans and government licensed mutual fund managers to handle your asset management needs. Those moving away from the System prefer some combination of a more diversified approach: gold in the attic to hedge against currency collapse, specially structured high-cash-value life insurance to hedge against future bail-ins and wealth taxes, domestic real estate, farm land and other locally-controlled hard assets that cannot be inflated away, offshore real estate to hedge against domestic political risk, a decentralized Bitcoin wallet to participate in the peer-to-peer renaissance, and/or a contrarian approach to the stock market based upon investment analysis from the perspective of Austrian Economics. And of course it is prudent to keep a little cash on the sidelines for the times when assets are dramatically oversold due to herd-mentality investors rushing for the exits.

Mindful investments are not based on greed or on the hopes of future luxury; they are made to sustain individual freedom and build human civilization. Mindful investing is not about making money; it is about converting money into income streams and hard assets so as to be free from the need to work as a wage slave for basic necessities. The specifics differ with each individual but the idea is the same: to blend Mindfulness with practical self-reliance so as to strengthen the synergy between body, mind, and spirit. This approach enables you to get rid of ‘life pockets’ and adopt a more holistic approach to living – instead of having a ‘work life’, ‘social life’, and ‘family life’ you just have ‘life’.

The Mindful path is steep and rugged with lots of twists, turns, and forks. Rumor has it the path also has no defined end. But those who choose to walk the Mindful path find that their problems seem to fade from relevance with each additional step taken. So they trod on, confident in the validity of their journey and respectful of the eccentricity of the Universal code.