Joe Withrow's Blog, page 25

August 3, 2022

Where I Went Wrong

I have had something of a revelation over the last year or so.

Many of us have seen the decline of civil society in America coming for years now. In fact, this is something I’ve been concerned about for nearly a decade.

Of course, this view didn’t win us any friends at backyard barbeques. At best we were labeled unpatriotic. At worst, conspiracy theorists.

Fast forward to today and the decline is evident to anybody who is even half paying attention.

Even those who enthusiastically supported the Covid regime at first – the masks, the lockdowns, the experimental injections – many of those people are starting to wake up. They have seen things that they can’t unsee.

In many ways this is validation for the concerns I’ve had for years. But I’ve also realized that I got something very important wrong.

Simply insulating yourself from the decay isn’t a solution. And thinking that somehow a better society will blossom from the rubble by itself is likely a fantasy. The late Gary North’s words ring in my ears here:

You can’t replace something with nothing.

That’s where I went wrong. I thought the game was simply to ride out the storm from safety and isolation. But that’s not living.

Have you noticed that society is rapidly self-segmenting, right before our eyes?

Trump people shun anyone who isn’t a Trump person. Radical woke socialists despise anyone who isn’t a radical woke socialist.

And then we’ve got the World Economic Forum (WEF) elitists who seem to hate all humans. Or at least all humans who can’t afford to fly on a private jet to “climate change” conferences.

This is a phenomenon that Neal Stephenson predicted in his science fiction novel The Diamond Age.

He envisioned a society in which phyles were the dominant social structure. Phyles being groups of people who banded together according to cultural commonalties or shared values.

And the reason people organized themselves into phyles was for security, trusted information, and mutual aid. These are each items that are critical to human flourishment… and they make life much easier for everybody.

I presume this is why we are seeing our society segment itself right now. But it leaves the question…

What do you do if you reject the hyper-politicization that is the Trump/woke socialist paradigm? And what do you do if you want to ensure that the WEF sociopaths can’t destroy our basic way of life?

Well, you certainly can’t live a life of isolation… as I once aspired to.

Instead, I look to the old mutual aid societies of 19th century America as a great model. Perhaps the solution is to build parallel structures that support one another.

Once I came to this realization, I started to notice that people are in fact trying to do this right now. Some form of the old mutual aid model is gradually coming into being.

Except it’s happening in quiet circles. So you only stumble upon these projects if you’re already plugged in.

One of the best of these efforts is Tom Woods’ School of Life.

Tom has been a big voice in libertarian and Austrian economics circles for well over a decade now. Up until this point his work has focused mostly on theory and academic matters.

But given the state of the world today, Tom realized he needed something more practical. And that thought is what has become the School of Life.

The school is a private network of like-minded people.

We collaborate on projects and businesses, and we share information on all kinds of subjects. Business, investing, health, fitness, alternative medicine, personal development, homeschooling, and strategic relocation are among the most popular topics. More than a few members have even used the network to escape Covid tyranny in places like Canada, California, and New York.

We also have smaller accountability and mastermind groups that have formed around some of these areas. These are great resources for people who may not have a large circle of friends and colleagues personally.

I’m sharing this with you because Tom’s program only opens to new members twice a year, and the doors are open right now if you care to check it out. I’ve found membership to be a tremendous benefit for me… and fun. I look forward to my mastermind group sessions every week now.

So if this is something you might want to consider, you can get more information at https://tomschooloflife.com/.

As I’m sure you expect, there is a membership fee to join. But it’s more than reasonable. And Tom reinvests the proceeds back into the project.

We’ve got our own chat and forum software running on private servers – away from the prying eyes of Google and the NSA. We even have a Zoom-like application running on these servers. Private video calls are in fact possible.

Tom also hires accomplished folks to do presentations and Q&A’s for our network periodically as well. Doug Casey, Joel Skousen, Mark Skousen, Doc Anarchy, Joanne Ozug, and the Art of Charm team are among those with a large following that we’ve heard from.

So the membership fees are put to good use.

That said, I don’t have any financial incentives here. I don’t have an affiliate link, and I won’t receive any commissions from sales. I’m just sharing the project in case it’s of interest to you.

If you’d like more information, Tom talks about it in detail right here: https://tomschooloflife.com/.

But please check it out soon. The doors close to new members tomorrow.

The post Where I Went Wrong first appeared on Zenconomics.

The post Where I Went Wrong appeared first on Zenconomics.

July 25, 2022

Hope For the Green Revolution

If you’ll permit me, I am trying something new here.

I am following up last Friday’s communication – my first journal entry in over three years – with a light-hearted piece of a different format.

I’ve been about as unplugged as one can be for the last five years. I would skim through the headlines on Zero Hedge… and I would update the plug-ins for Zenconomics.com, but that’s about it.

For all other extents and purposes, I have been disconnected from the world.

In fact, one of my crowning achievements came a year or so ago when my publishing network asked me to interview a gentleman they were considering hiring as an analyst.

After I agreed to do so, I guess they wanted to give this guy some background on me. Apparently, the common protocol for this is to send over LinkedIn profiles ahead of time.

I don’t think this way, but it makes sense. They figured this gentleman should have a basic picture of who he would be speaking with. And LinkedIn would provide that picture.

Except they couldn’t find me anywhere on LinkedIn. Or Facebook. Or any other mainstream social media platform.

So when I get on the call with this guy he gave me the full scoop. “Yeah, they said they were going to send me your LinkedIn info, but they couldn’t find it. They told me you must be pretty dark. I wasn’t sure what to make of that.”

I was so proud.

The joke’s on them though. Had they searched MeWe, they would have found me.

Anyway, I wanted to follow-up last Friday’s journal entry on the secret of green energy.

I am a big fan of solar as a means of personal energy independence. I also like the idea of electric vehicles (EVs). That’s because there are no belts, hoses, or fluids. And there are very few moving parts.

Logically, I have to think that means the car shouldn’t wear our or break down. The battery needs to be replaced every so often… but there shouldn’t be many other repairs necessary.

I reserve the right to be wrong about this. It’s not something I’ve researched extensively. But the concept makes sense to me.

That said, I find it laughable that .gov has this idea that it can force everybody to switch to EVs over the next eight or ten years.

Think about this – charging an EV requires roughly twenty-five times more energy than running a refrigerator.

So if we force millions of people to switch to electric cars… and if we assume an average of two cars per household… well, that’s the equivalent of every house running fifty refrigerators at the same time.

Good luck, power grid.

That is, unless nuclear fusion hits the scene. There’s an immense amount of R&D happening around fusion technology right now. And it has been funded almost exclusively with private capital.

Nuclear fusion involves taking two separate nuclei and combining them to form a new nucleus within a special reactor. This creates a plasma reaction that produces an enormous amount of energy.

And unlike nuclear fission, fusion reactions produce very little radioactive waste. In fact, certain approaches generate no waste at all. It’s 100% clean energy.

What’s more, fusion reactors are much smaller than their traditional counterparts. They could create a decentralized power grid with each reactor fueling 100,000 homes or so. That would make the grid far more robust than it is today.

And there are future investment implications here…

One company to keep an eye on in this space is Tae Technologies. This start-up has raised big money – over $650 million in private capital over the last eighteen months. And among its backers are Chevron and Google.

Clearly, Tae must be onto something. Perhaps there’s hope for their green revolution after all…

The post Hope For the Green Revolution first appeared on Zenconomics.

The post Hope For the Green Revolution appeared first on Zenconomics.

July 22, 2022

The Secret of Green Energy

submitted by

jwithrow

.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Secret of Green Energy

July 22, 2022

Hot Springs, VA

“By their fruits shall you know them.” – Jesus of Nazareth

The S&P closed today’s trading session at $3,961. Gold closed at $1,721.50 per ounce. Crude Oil closed at $94.65 per barrel. The 10-year Treasury rate closed at 2.78%. Bitcoin is trading around $22,625 per BTC today.

Dear Journal,

It has been over three years since I’ve last written… and boy does the world look different.

In fact, I would wager that 2019 feels like a lifetime ago for many of us. It seems like we’ve experienced a fundamental shift since then.

For example, Bitcoin was trading around $8,000 when I last penned a journal entry. And we were seeing signs that momentum was picking up.

Fast forward to today and Bitcoin has crashed by over 70%. In just eight months. It now trades at just $22,625.

Imagine that headline three years ago: “Bitcoin crashes to $20k!”.

Yes, dear journal, the world sure is different these days. And I have great news – what they call “green” energy is now viable. Check it out:

The Solar Shed is locked and loaded

The Solar Shed is locked and loadedThat’s right – I now have my home office fully outfitted with solar energy. I call it the solar shed.

And it’s 100% off the grid. We are producing all of our own electricity up here. Pretty cool.

What’s more, this process taught me a thing or two about electrical systems. I shadowed the brilliant gentleman who installed it for me… and it’s really not as complicated as it appears. Though don’t expect me to do it myself.

Here’s a look at the power center that makes it all go:

The power station manages the energy produced by the panels

The power station manages the energy produced by the panelsHow’s that for beautiful? Green energy at its finest.

Now, my motivation with this project was simple. I wanted to see if I could take a step towards personal energy independence.

My thinking was that if we could learn the ropes and take the office off-grid with a small solar system, it’s just a matter of scaling up to get the whole house off the grid.

Granted, it would take a whole lot of scaling to get there. But I can envision a home powered by solar energy with a propane generator back-up.

A 500 gallon storage tank could provide enough propane for thirty days’ worth of power. That should be plenty. Especially if the propane company will top off the tank frequently.

To me, this is the big secret of “green” energy. It can in fact provide energy independence at the household level. At least to an extent.

But there is one more secret as well. This one a little darker.

There’s nothing “green” about it.

See those solar panels up on the roof? They are made using all kinds of metals and materials that have to be mined out of the Earth and manufactured in a lab.

And check out these lithium-ion batteries:

Lithium-ion batteries store the energy produced by the panels

Lithium-ion batteries store the energy produced by the panelsThese are the key to the entire system. But again, it’s the same story.

These batteries are loaded with rare Earth metals that must be mined from the ground. And some of them are mostly found in remote places. For example, the Congo is home to the largest cobalt reserve on Earth.

Plus, the panels and the batteries will likely only have a useful life of twenty years. What happens to them then?

There are a few companies working to develop recycling processes for both panels and lithium-ion batteries… but I don’t think it’s terribly economical yet.

If they can’t make it economical, it won’t work. And if they don’t… well, I’m very confident in saying that these things aren’t biodegradable.

The point is, “green” energy is largely a myth right now. But I’m sure excited about it.

More to come,

Joe Withrow

Wayward Philosopher

The post The Secret of Green Energy first appeared on Zenconomics.

The post The Secret of Green Energy appeared first on Zenconomics.

June 7, 2019

The Moral Value of Money

submitted by jwithrow.

Click

here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Moral Value of Money

June 7, 2019

Hot Springs, VA

“No action can be virtuous

unless it is freely chosen.”

– Murray Rothbard

The S&P closed today’s trading session at $2,873. Gold closed at $1,345 per ounce. Crude Oil closed at $54.10 per barrel. The 10-year Treasury rate closed at 2.08%. Bitcoin is trading around $8,034 per BTC today.

Dear Journal,

Spring is in full bloom here in the mountains of Virginia.

The forest is green and lush. The wildflowers sprawl out, claiming their territory. The cardinals sing overhead… While the blue jays scrounge for sunflower seeds below. And the forest critters emerge, in search of a quick meal…

Yes, nothing brings perspective quite like spring in the mountains.

As you observe nature, you realize it doesn’t care much for your thoughts or plans. In fact, your plans look rather silly to it.

For example, we thought our bird feeders were just for birds. Nature didn’t care.

That’s because nature operates in

survival mode. The only thing that matters is the next meal.

If the history books are to be trusted, humans once operated that way too. We hunted and gathered what we needed to survive… Often competing violently with other humans in the process.

But that gradually changed as we

developed technology. Fire… the wheel… farming… irrigation… money… capital

markets… steam power… electricity… cars… the internet… Bitcoin…

Each jump in technology took us away

from the scarcity of survival mode. That’s because each jump helped us produce

more. And work together more efficiently.

That’s what separates us from nature.

Voluntary action and mutual exchange. They are the engine of human civilization.

And money is the lubricant. It makes

all the pieces go.

Money gets a bad rap today… But it’s

really a moral process.

To earn money, you must provide something

of value to your fellow man. You must produce a good or provide a service he is

willing to pay for. Or you must offer your time and labor to a company that provides

desired goods and services.

In other words, you must serve your

neighbors.

That’s it. That’s the only way for an

honest person to make money. But it’s not a one-way street.

Your neighbors pay you money for what you provide to them. Then they serve you by producing different goods and services… And you pay them money in return.

People serving people serving people, in other words.

And guess who makes the most money? The

person who provides the most value. The person who figures out the best way to

serve his fellow man.

That’s the moral value of money.

Now, those who make more money than

they need to survive can save it. That savings is called capital.

And that capital can be pooled with other people’s capital to do some really great things. It can be used to develop new technology or medical therapies… renovate old buildings on Main Street… finance young entrepreneurs… create new educational systems for children… establish mutual aid networks… convert idle farms into solar power hubs… build blockchain systems to bring property rights to the Third World… and anything else the brilliant human mind can think of.

All of which improves the lives of individuals. And makes the world a better place to live.

It’s a virtuous cycle. The more

value you provide… the more money you earn… the more value you are able to provide.

A gentleman observed this virtuous

cycle and gave it a name a few hundred years ago. Capitalism, he called it.

I know its popular to decry

capitalism today. Especially during election season.

But at its heart, capitalism is

about production and service. It’s about voluntary action and mutual exchange.

The problem is that we still have a

few who are stuck in the past. Instead of production and service, they rely on

coercion, theft, and violence. That’s how they make their living.

That’s not capitalism. It’s politics…

And it’s still popular in Washington and on Wall Street.

But politics is obsolete. And I

promise you, those systems based on coercion, theft, and violence will

ultimately collapse in on themselves.

After all, if the history books are

to be trusted, such systems always do.

Regardless, those who understand the

moral value of money will continue to produce, serve, and create. And our world

will become better and better as a result.

More to come,

Joe Withrow

Wayward Philosopher

P.S. My Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever…. Including everything you need to know to buy, trade, and store Bitcoin securely.

Want to know why Bitcoin went from being worth $0.01 in 2010 to around $8,000 today… And why that’s just a drop in the bucket compared to where it is going? Learn more at newly revamped https://financeforfreedomcourse.com/.

The post The Moral Value of Money appeared first on Zenconomics - an Independent Financial Blog.

May 23, 2019

Ban Bitcoin?

submitted by jwithrow.

Click

here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Ban Bitcoin?

May 23, 2019

Hot Springs, VA

“Bitcoin is the most subversive

technology on the planet. This is a system that is growing around the entire

world. But Bitcoin is just math. The government, no matter how many guns they

draw, cannot change a mathematical problem. They can point their guns at 2+2

but it’s always going to equal 4.”

– Erik Vorhees

The S&P closed today’s trading session at $2,822. Gold closed at $1,283 per ounce. Crude Oil closed at $58.12 per barrel. The 10-year Treasury rate closed at 2.29%. Bitcoin is trading around $7,819 per BTC today.

Dear Journal,

Spring gradually gives way to summer up here in the mountains of Virginia.

And while the outside world frets over geopolitics… trade wars… wealth gaps… elections… and whatever else the news puts in front of them, I quietly admire the brilliance of nature.

You see, the seasons represent

change. Unstoppable change. They turn with nature’s cycles whether we want them

to or not.

Each season comes with its own

beauty. And its own drawbacks.

The choice we have to make is whether to focus on the good… or the bad. That’s it.

And I believe that choice is what determines the course of our life.

Contentment or anger… love or hate…

success or failure… it’s all in how we view the world.

Einstein said that there are only

two ways to live. One is as though nothing is a miracle. The other is as though

everything is.

Was he right? I don’t know. But I

bet there’s some wisdom in there somewhere.

And speaking of wisdom, U.S. Congressman Brad Sherman urged Congress to ban Bitcoin and cryptocurrencies last week.

His statement tells me that, after calling Bitcoin a “crock” previously, he finally gets it. Here’s Sherman:

“I look for colleagues to join with me in introducing a bill to outlaw cryptocurrency… so that we nip this in the bud.

An awful lot of our international power comes from the fact that the U.S. dollar is the standard unit of international finance and transactions. Clearing through the New York Fed is critical for major oil and other transactions. It is the announced purpose of the supporters of cryptocurrency to take that power away from us, to put us in a position where the most significant sanctions we have… would become irrelevant.”

Notice how the veil has been lifted.

They used to say that Bitcoin was a scam that would trick naïve investors and rob Grandma of her retirement funds… All while empowering criminals. They wanted you to believe that their crusade against Bitcoin was just to protect innocent people.

But Mr. Sherman reveals what this is really about: power.

Bitcoin has always been about empowering individuals on a global

scale. From those of us living in the wealthy developed world… To the billions

of people living without bank accounts in the Third World.

Bitcoin gives all of us an honest and transparent monetary

system… For the first time in human history. And I promise you, that will unlock

wealth and unleash human creativity upon the world to a degree never seen before.

But it will take power away from those who want to control

others by force. Those who want to influence everyone’s behavior… skim from

their transactions… monitor their activities… and herd them into top-down societal

models where force, coercion, theft, and violence are the lynchpins human organization.

That’s the Bronze Age model. And as I mentioned last week…

it’s dead.

The season is turning. The 20th century is giving

way to the 21st.

And Bitcoin is the blooming cherry blossom. It’s how you

know summer is almost here.

Bitcoin is the gateway to a society governed by unbridled human ingenuity, voluntary collaboration, and reputational systems that incentivize good actors and lock bad actors out entirely. A society where abundance is unrestrained by corruption, bureaucracy, lobbying, and waste… Because they are rendered impossible by technology.

A society where human beings finally realize their full potential.

Too utopian? Perhaps. It won’t all be roses.

But the new season is coming

nevertheless… And I choose to focus on the good.

More to come,

Joe Withrow

Wayward Philosopher

P.S. My Finance for Freedom course

series pulls back the curtain on how money and finance really work. And it

covers expert financial strategies to increase income, build wealth, and

shatter the glass ceiling forever…. Including everything you need to know to

buy, trade, and store Bitcoin securely.

Want to know why Bitcoin went from being worth $0.01 in 2010 to nearly $8,000 today… And why that’s just a drop in the bucket compared to where it is going? Learn more at newly revamped https://financeforfreedomcourse.com/.

The post Ban Bitcoin? appeared first on Zenconomics - an Independent Financial Blog.

May 17, 2019

The Truth About Education

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Truth About Education

May 17, 2019

Hot Springs, VA

“The journey of a thousand miles begins with a single step.” – Lao Tzu

The S&P closed today’s trading session at $2,859. Gold closed at $1,277 per ounce. Crude Oil closed at $62.70 per barrel. The 10-year Treasury rate closed at 2.39%. Bitcoin is trading around $7,126 per BTC today.

Dear Journal,

It has been nearly two years since I’ve written. And time goes

by fast.

As I write to you today, nothing has changed about my

outlook or philosophy. Yet, everything has changed about my world.

My knowledge of financial markets continues to grow. As does

my understanding of where finance is going.

Your neighbors haven’t noticed yet… But we are on the brink

of historic change.

Traditional institutions are crumbling. Traditions and

customs are being questioned. Entrenched hierarchy is being challenged. The old

way is fading into the new…

In truth, this is two decades late in coming. The 20th

century ended nearly twenty years ago… But it refused to die.

The dawn of the Information Age in the late 90s brought with

it evolutionary change. Nobody needed the internet in 1995. Today, we each

spend most of our time online. Indeed, our entire civilization depends on it.

From the way we manage our money… To the way we shop… To the

way we communicate… To the way we find solutions… It has all changed.

Yet, our entrenched civic institutions have not. They fiercely resist change.

Because of that, the way we manage our communities is

largely the same today as it was one hundred years ago.

Think about it… How are important decisions made?

It’s the same today as it was in 1919. People in privileged positions meet behind closed doors. Then they issue centralized orders for everyone else to follow.

There are many layers to that story. But most important to

me is education.

The classroom-based model that we use today was created in

Prussia in the late 1800s. It was designed to create loyal soldiers for the

Prussian army. And loyal employees for the Prussian economy.

That’s what “education” meant. It had nothing to do with

inspiring and empowering young people.

How did it work?

Kids were sealed off from the world and segregated by age, so they had limited exposure to outside ideas. Then they were regimented into groups and herded from one classroom to the next according to a strict schedule. One class ended, and another began, when the bell rung. That meant dropping everything and moving on within the system. No time for further exploration. No time for introspection.

And each child was to listen to teachers and obey school officials unquestioningly. Teachers were the experts. School officials were the bosses.

To get good grades, children were to memorize and repeat exactly what the teacher told them. Of course, good grades were praised and rewarded. Bad grades were shamed. That was designed to stamp out free will.

Children were to raise their hand and ask for permission

when they wanted to speak, ask a question, or just go to the restroom.

Everything was forbidden without explicit permission. That’s what hall passes were

for. This was to stamp out independence.

Lastly, children were assigned hours of homework each night. Failure to do homework was punished and shamed. That was to keep kids from seeking knowledge on their own. They always needed to be under the school’s thumb.

The result?

Loyal soldiers and loyal employees who would act upon orders without question. They saw themselves as inferior to their institutions. And, absent the ability to seek their own meaning in life, they sought comfort in their institutions. To belong to an institution was to be a part of something “bigger than” themselves.

This system came to the U.S. in the mid-1910s… And it was

forced upon the populace by compulsory education laws. They said every parent

must send their kids to public schools or go to jail.

And we use that same model today. Complete with the threat of jail time.

What’s more, we are giving our kids the same advice. Go to

school… Get good grades… Go to college… Get a job…

Does that make sense?

It’s the factory model. And it’s dead.

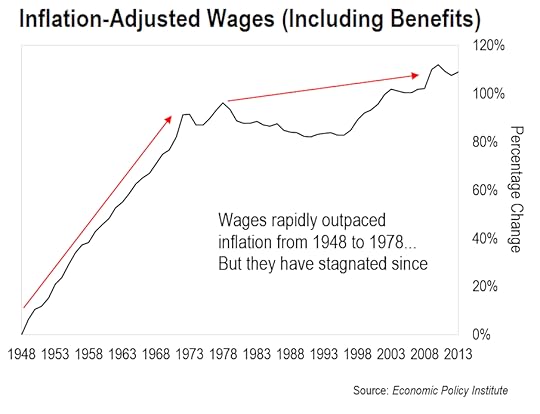

Inflation-adjusted wages have been stagnant for nearly fifty years.

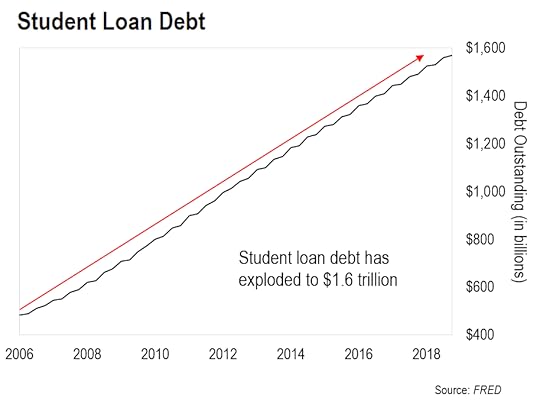

Yet, student loan debt has exploded to $1.6 trillion… From basically nothing in the 1970s.

So, if you go back to the mid-1900s, wages were rising, and

debt was non-existent. Today, wages are stagnant, and debt is exploding.

Yet, we are telling our kids to keep doing the same exact things.

Does that make sense?

As old readers know, I became passionate about education

when my daughter was

born nearly five years ago.

My passion has doubled since then as a brand-new human came to us last October.

His name is Isaiah. And his spirit radiates with

intelligence and purity.

I have watched Madison and Isaiah every day. Just trying to

learn. And understand.

The more I watch, the more I am convinced that human beings are brilliant by nature. Children don’t need to be “educated” by force. They certainly don’t need to be herded about classrooms like cattle.

They just need someone to light their candle and get out of

the way. And maybe expose them to new ideas from time to time.

Maybe things were different one hundred years ago. Maybe

scarcity made the Prussian education model necessary. I don’t know.

But I do know this… We find ourselves in a world of abundance today. Technology has conquered scarcity.

As such, loyal soldiers and loyal employees are obsolete.

And that means it’s time we change how we think about education.

More to come,

Joe Withrow

Wayward Philosopher

P.S. My Finance for Freedom course series pulls back the curtain on how money and finance really work. And it covers expert financial strategies to increase income, build wealth, and shatter the glass ceiling forever. Learn more at newly revamped https://financeforfreedomcourse.com/.

The post The Truth About Education appeared first on Zenconomics - an Independent Financial Blog.

September 23, 2017

The Future of Banking

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Future of Banking

September 23, 2017

Hot Springs, VA

“The biggest disruption of Bitcoin is that banks are no longer needed. Every major financial institution has made this technology its focus… but they say Bitcoin is a fraud. It’s the blockchain, they proclaim. They can utilize the technology ‘behind Bitcoin’ to make themselves smarter, better, faster, bigger. But Bitcoin’s fundamental use-case is to remove the banking function entirely from the equation. When banks come to terms with this, they will contact their congressmen and spend millions… maybe billions to slander Bitcoin.” – Erik Voorhees

The S&P closed yesterday’s trading session at $2,502. Gold closed at $1,300 per ounce. Crude Oil closed at $50.66 per barrel. The 10-year Treasury rate closed at 2.26%. Bitcoin is trading around $3,780 per BTC today.

Dear Journal,

I have ventured back down to south Florida to see what Irma left behind… and maybe do a little more work in the publishing arena.

I have been flying back-and-forth between Florida and Virginia for several months now, but I do have a vehicle in Delray to get me around town… which I had left parked conveniently beside the largest palm tree I have ever seen.

I am happy to report that palm trees are quite hardy – which was a surprise to me. But the palm branches… not so much. So, my vehicle survived the hurricane. But you will find many naked and deformed palm trees hanging around south Florida now.

Speaking of naked and deformed, I spent the flight down thinking about Bitcoin, banking, and the nature of disruptive technology.

As you recall, the CEO of JP Morgan called Bitcoin a fraud last week… and we had a little fun at his expense.

In reality, the banking sector is where the fraud is. Money laundering… rigging LIBOR… robo-stamping foreclosures… ripping off “muppets”… fraud has run rampant in the banking sector for more than a decade now.

That is why Bitcoin has been so successful. It is a timely solution.

But Bitcoin is not a new idea. The Cypherpunks were working on cryptocurrencies all the way back in the 80s.

It took thirty years for the idea to stick because the world was not ready for them. People didn’t know they needed independent money yet. They still trusted the System.

Bitcoin Will Change the World

But remember, Bitcoin is not just a solution to the banking problem.

Bitcoin is a disruptive technology. Disruptive technologies change everything. There will be no going back.

Agriculture was the disruptive technology 15,000 years ago. Agriculture made us farmers. We didn’t go back to being hunter/gatherers.

Capital markets were the disruptive technology 500 years ago. Markets made us an industrial society. We didn’t go back to feudalism.

The automobile was the disruptive technology 100 years ago. The world became smaller as transportation improved. And we didn’t go back to horse and buggies.

The internet was the disruptive technology 20 years ago. The world became connected… and we didn’t go back to paper records and post offices.

And Bitcoin is the disruptive technology today. Bitcoin makes all of us custodians of our own money. We won’t go back to banking.

Jamie Dimon may not know this yet… but some banks do.

The Future of Banking

Capital One just opened a new bank branch here in Delray Beach – right on Atlantic Avenue.

“That’s just stupid,” I thought to myself. “Their rent is at least $20,000 a month… but physical bank branches are completely obsolete. Why open a new one? Their best chance of surviving the next decade is to leverage mobile banking as far as it will take them.”

It turns out they aren’t as dumb as I thought. A friend filled me in a few days after the new branch opened:

“The new Capital One is awesome… it’s the best bank I have ever been in! You walk in and they have catchy music playing. And it looks like an upscale lounge… nice décor… comfortable furniture.

You look around and there are no bankers in sight. Instead, the one guy working there is selling expensive hipster coffee. And he will give you a tablet to open a Capital One account online if you want.

He told me that they are catering to the local business community. Businesses can rent the place out for meetings… or lunches… or parties… whatever they want. And the bank will sell them all the hipster coffee they can drink!”

So, there you have it – the future of banking!

Little Maddie will never have a bank account. She will never have to wait for her check to “clear”. Or wait 2 or 3 business days for her deposit to post.

Instead, she will handle all of her financial affairs herself, within the crypto economy.

But if she’s lucky, there will still be a local bank nearby to sell her all the hipster coffee she wants…

More to come,

Joe Withrow

Wayward Philosopher

P.S. My new Bitcoin course teaches you everything you need to know to buy, trade, and store bitcoins securely. So far, the course boasts a 4.9 rating from active users. You can get it here.

The post The Future of Banking appeared first on Zenconomics - an Independent Financial Blog.

September 14, 2017

Of Bitcoin, Bankers, and Tulip Bulbs

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Of Bitcoin, Bankers, and Tulip Bulbs

September 14, 2017

Hot Springs, VA

“At its core, bitcoin is a smart currency, designed by very forward-thinking engineers. It eliminates the need for banks, gets rid of credit card fees, currency exchange fees, money transfer fees, and reduces the need for lawyers in transitions… all good things.” – Peter Diamandis

The S&P closed yesterday’s trading session at $2,498. Gold closed at $1,326 per ounce. Crude Oil closed at $49.34 per barrel. The 10-year Treasury rate closed at 2.20%. Bitcoin is trading around $3,616 per BTC today.

Dear Journal,

“I just want you to know that I actually like my Bitcoin shirt!”, wife Rachel said to me after reading my last journal entry.

“Have you worn it in public yet?”

“Well, no…”

Keeping with our Bitcoin theme, the honourable Jamie Dimon – CEO of JP Morgan Chase – shared his thoughts at an event hosted by Barclays this week:

“It’s worse than tulip bulbs. It won’t end well. Someone is going to get killed… it will blow up.”

I chuckled at the news.

I suppose if anyone knows when something is about to blow up, it is Dimon. After all, his bank needed $25 billion in taxpayer bailout money to stay afloat during the 2008 financial crisis.

But comparing Bitcoin to a flower strikes me as incredibly stupid.

Obviously, he is referring to the 17th century tulip mania that led to tulip bulbs exploding in price. But tulip bulbs have exactly zero utility. They are not useful… for anything.

The Most Robust Network in History

Bitcoin, on the other hand, is the most robust network the world has ever seen.

Bitcoin is both a currency and a payment network wrapped in one. It is the dollar and PayPal combined. Except bitcoins are better than dollars… and the Bitcoin payment network is better than PayPal. Here’s why:

Bitcoins are incredibly scarce. Only 21 million will ever exist… and nearly 17 million of those are already here. By comparison, the Federal Reserve creates hundreds of billions of new dollars every single year… making them not so scarce.

You see, dear reader, that’s why one bitcoin is currently worth 3,600 dollars…

And the Bitcoin payment network is open, transparent, borderless, and censorship-resistant. Bitcoin transactions cannot be altered, frozen, or reversed. You have 100% control of your bitcoins at all times, and in all places.

By comparison, PayPal is a closed system within which the company has total control of your funds… including the ability to restrict or freeze your transactions.

Put it all together and you have something that is remarkably useful to people all over the world, from many different walks of life. You could never say that about tulip bulbs.

Value Is In the Eye of the Beholder

Basic economics tells us that an item must be relatively useful and relatively scarce to have value. The more useful… and the more scarce… the more valuable.

In other words, value is subjective. People assign value based on how much they want or need the item in question.

People assigned a lot of value to tulip bulbs in the 17th century… until they realized flowers were not terribly useful for anything.

In just the same way, people are assigning a lot of value to Bitcoin today. But I suspect they are underestimating just how scarce and useful it really is.

The CEO of JP Morgan says Bitcoin could go to zero. I think it is much more likely to go $7,000… by Christmas.

My advice is to buy more bitcoins while they are still cheap.

More to come,

Joe Withrow

Wayward Philosopher

P.S. My new Bitcoin course teaches you everything you need to know to buy, trade, and store bitcoins securely. So far, the course boasts a 4.9 rating from active users. You can get it here.

The post Of Bitcoin, Bankers, and Tulip Bulbs appeared first on Zenconomics - an Independent Financial Blog.

September 12, 2017

A Season for Change

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

A Season for Change

September 12, 2017

Hot Springs, VA

“To every thing there is a season, and a time to every purpose under the heaven… Wherefore I perceive that there is nothing better, than that a man should rejoice in his own works; for that is his portion: for who shall bring him to see what shall be after him?” – Ecclesiastes 3

The S&P closed yesterday’s trading session at $2,487. Gold closed at $1,335 per ounce. Crude Oil closed at $48.07 per barrel. The 10-year Treasury rate closed at 2.06%. Bitcoin is trading around $4,288 per BTC today.

Dear Journal,

It has been ten months since I have last written to you… and this world is far different from what it was before.

For starters, Little Maddie is no longer a toddler. She is a little lady. And like all ladies, Maddie knows best… about everything.

“Daddy, that’s not how you do it!”, she exclaims with absolute confidence. “Here, let me show you! Okay, daddy. You try…”

Her father just smiles and obeys… but his mind wanders in amazement. There was no Maddie four years ago. She didn’t exist.

Today, Maddie runs… jumps… laughs… sings… dances… and teaches her father how to finger paint. How amazing is that?

For my part, I have been busy building the flexibility I will need to give Madison the education she deserves.

I still peddle my online courses (see my new Bitcoin course here). And I have been working with several of the Agora companies publishing from south Florida as well.

For her part, wife Rachel has been busy keeping us in line. It’s not easy with two children in the house.

She also sells and services weddings at the local mountain resort. And she is very proud of the relationships she develops with the young brides – presumably by telling them exactly what to expect from their husbands several years down the road. Stubborn… unresponsive… bitcoin t-shirts for your birthday… no, I don’t know of any way to stop it…

A Sea Change in Bitcoin

Another sea change that took place since I have last written was in the world of Bitcoin.

When we last spoke, one bitcoin was worth $630 and the media wanted to tell you about how it was only useful for criminals.

Today, that same bitcoin is worth $4,300. And the media wants to tell you whether the price will go up or down.

Ignore the media… that part has not changed.

What has changed is Bitcoin’s place within the global financial system. Bitcoin’s utility is no longer theory… it is battle-tested. Look at this chart:

As you can see, money has poured into Bitcoin in each instance of global financial stress. It has quickly become the world’s premier safe haven asset.

That is because Bitcoin exists outside of the financial system. Governments cannot manipulate it. Banks cannot freeze it. Regulators cannot regulate it.

Bitcoin flies across borders as if they didn’t exist… it is ghost money.

But Bitcoin is so much more than just a safe haven asset. Bitcoin is a disruptive technology that is driving a degree of innovation that we have not seen since Europe’s High Renaissance. Its utility as a safe haven is simply the catalyst for further development… it is how Bitcoin proved itself.

We have covered Bitcoin extensively in the past four issues of the Zenconomics Report. You can catch up here.

Change and Paradox, dear reader. They are baked right into the universal cake. Best to enjoy the ride…

More to come,

Joe Withrow

Wayward Philosopher

P.S. My new Bitcoin course teaches you everything you need to know to buy, trade, and store bitcoins securely. So far, the course boasts a 4.9 rating from active users. You can get it here.

The post A Season for Change appeared first on Zenconomics - an Independent Financial Blog.

November 18, 2016

The Individual is Rising – Third Edition

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Individual is Rising – Third Edition

November 18, 2016

Hot Springs, VA

Dear Journal,

A specter is haunting the modern world…

Society has undergone a massive change over the past several decades – the type of change from which there is no return. This change has been the transition from the Industrial Age to the Information Age; a transition which is still in its infancy. Most people may not know this yet, but they can feel it.

The rules have changed, and many are rapidly falling behind because they still cling to the old paradigm. Yet a world of opportunity awaits those who understand what is taking place.

Never before has information been more prevalent.

Never before have people been able to connect with one another instantaneously on a global scale to communicate, collaborate, organize, and share ideas.

Never before have people been able to ditch their job and make tons of money right from the comforts of their own home office.

Never before have people been able to build and manage a global asset portfolio from anywhere in the world, using the same research that was previously reserved for only the wealthiest of the wealthy.

Never before have people had at their fingertips all of the tools they needed to build a custom-tailored life of freedom, wealth, and fulfillment in which they and they alone chose where they lived, what they did, and who they interacted with on a daily basis.

Never before has Financial Escape Velocity been available to any who would seek it…

Are you ready to discover what most have missed? Are you ready to see the opportunities staring you right in the face? Are you ready to break free of the industrial rat-race and achieve the financial success you need to live a life of true freedom? Are you ready to learn how average people are doing just that on a daily basis?

Are you ready to discover what most have missed? Are you ready to see the opportunities staring you right in the face? Are you ready to break free of the industrial rat-race and achieve the financial success you need to live a life of true freedom? Are you ready to learn how average people are doing just that on a daily basis?

Are you ready to find out how The Individual is Rising… absolutely free?

What You Will Learn:

Though still an infant, the Information Age is here, and we are living within its early stages. There is no going back.

The institutional foundation of the industrial world is crumbling all around us. Governments are broke. Social welfare programs are severely underfunded. Unions are broke. Pension plans are underfunded. National currencies have been trashed. Blue-collar jobs in the developed world have been lost to low-wage countries. Low-wage jobs have been lost to robotics and automation. Many of the jobs just disappeared entirely. Everyone’s retirement account is propped up by the constant creation of money out of thin air required to keep the financial markets afloat.

Welcome to the Information Age!

In truth, these are all great things. The seeds of a second Renaissance for human civilization have already been sown. It is a Renaissance based on decentralization, voluntary association, markets, enterprise, commerce, distributed systems, participatory networks, and individual self-empowerment. All of these things are already flourishing in small pockets.

Read on to find out why… the individual is rising.

Here is what you will be able to do after reading The Individual is Rising: 3rd Edition:

Understand how the monetary system evolved over the last century to pave the way for mass centralization

Analyze the greatest Ponzi scheme ever attempted… and what happens when it implodes

Assess the prominent macroeconomic trends unfolding in real time… and envision what they mean for the global financial system

Examine how Industrial Age solutions have morphed into Information Age problems

Discover why the conventional road to success is now a dead end

Assess a practical vision for education in the digital age

Learn why the institutional foundations of the industrial world are crumbling all around us

Envision the future of money, commerce, and jobs… and how to capitalize on those trends

Implement a portfolio of Information Age tips and tricks, including how to secure your digital communications

Understand how the digital economy is facilitating decentralization and a new opportunity for individual liberty

Learn how to use asset allocation to build an antifragile investment portfolio

Learn how to build and manage an equity portfolio, including the three most important risk management techniques

Learn how to build a position in Bitcoin utilizing proper good practices and risk management

Learn how to drive returns with a focused trends-investing strategy called the Beta Investment Strategy

Learn how to automate income and asset growth to achieve Financial Escape Velocity

Utilize the Infinite Banking Concept to shatter the industrial world’s glass ceiling

Discover the two fundamental means of acquiring wealth

Implement a generational financial strategy capable of financing your child’s education with no student loans or bank loans necessary

Internalize strategies to be more self reliant than 99% of the population

Analyze how distributed Gamma systems are rendering centralized civil service functions obsolete

Discover how the Crypto Revolution is set to liberate trillions worth of dead capital within the global economy and spark a second Renaissance

Break free of the industrial rat-race and teach your friends and family how to thrive in the Information Age!

Claim your copy today at http://theindividualisrising.com/ and learn everything you need to know to transcend the industrial order and prosper in the digital age!

If you have read an earlier edition, the 3rd edition has been updated, expanded, and re-focused. I think both the tone and the focus are materially different in this edition. Also, this edition presents far more actionable information, tools, and strategies that anyone can adopt as their own.

Like the earlier editions, this book is available on Amazon in both paperback and Kindle format, but I want to offer the digital copy to Journal readers as a free download.

If you prefer the convenience of your Kindle app, we will be publishing the book on the Kindle platform for 99 cents… almost free!

If you have any problems with the download, or if you have any questions, comments, or suggestions please feel free to reach out to me. I will answer all emails personally.

Again, claim your copy at: http://theindividualisrising.com/

Thank you for your continued interest in my work, and have a lovely weekend!

More to come,

Joe Withrow

Wayward Philosopher

The post The Individual is Rising – Third Edition appeared first on Zenconomics - an Independent Financial Blog.