Joe Withrow's Blog, page 2

October 7, 2024

Normal and not normal…

This past Saturday was Fall Fun Day up here in the mountains of Virginia.

Fall Fun Day is an annual festival featuring food, beverages, music, and a variety of outdoor games for adults and children alike. There are sack races… mummy wrap contests… hay rides… and I witnessed a little spontaneous karaoke as well.

Here’s a shot of a small gathering underneath an ancient elm tree:

There’s a long tradition of annual harvest festivals throughout America’s Appalachia region.

The autumn harvest itself may have lost significance since our conquest over food scarcity… but these annual celebrations are still rooted in the region’s agricultural heritage. It’s Thomas Jefferson’s vision for America actualized.

While Fall Fun Day has become a normal occurrence for us each year, there’s nothing normal about what’s happened to our economy over the past 16 years.

When we left off last week, we were talking about interest rates – where they are going and what it means. As we discussed, my conclusion is that rates are not going to fall as fast nor as far as people seem to expect.

Sure, the Federal Reserve (the Fed) will likely make additional cuts to its target interest rate benchmark the federal funds rate. But Fed Chair Jerome Powell has made it clear that “normalization” is still his aim.

Let’s talk about what normalization means this week. We’ll start with an abbreviated overview of how a normal economy functions…

It all starts with a market-based system and sound money.

Markets match up production with consumer demand… and they empower entrepreneurs to create innovative ideas that improve efficiencies and increase the availability of goods and services.

Meanwhile, sound money keeps the price system honest. And it enables everyone to save their purchasing power for future use. Those savings can then be used for investment in productive companies and projects which drive economic growth.

That economic growth strengthens the division of labor by creating jobs that didn’t exist before. This creates new opportunities for individuals while also increasing economic productivity. In turn, standards of living rise throughout the economy.

In a normal economy, this dynamic tends to result in the stock market rising in parallel. That increases savings… and those savings can then be invested directly in productive companies and projects to power continued economic growth.

This creates even more opportunities for entrepreneurs who create startup companies with ever-more lofty goals and ambitions. After getting their startup off the ground, these entrepreneurs can take their company public to raise growth capital. In a normal economy, this happens when the company is still quite small.

That growth capital empowers the startup to scale and potentially provide game-changing goods and services to consumers. At the same time, regular folks can invest in the startup’s stock when the company is still small – providing them with the potential for an outsized investment gain.

Amazon.com (AMZN) is a great example of this.

Amazon went public at an enterprise value (EV) of $375 million. That’s tiny when it comes to publicly-traded companies.

At the time, Amazon.com was just an online bookstore. Many analysts compared it to incumbents like Barnes and Noble and thought that Amazon was doomed from the start. “There’s no way this little online bookstore can compete with the big boys”, they said.

Fast forward to today and Amazon.com sells virtually everything online. It also sports the most advanced logistics and delivery ecosystem in the world – as well as one of the most advanced cloud computing architectures in the world.

Yet, regular investors had the chance to buy AMZN at $0.075 a share because it went public so early in its lifecycle. Anyone who did would have turned every $100 invested into over $242,000 at today’s price.

That’s only possible in a “normal” economy. More on why later this week…

Another facet of a normal economy is that only the best startups can attract the growth capital they need to scale. The bad companies – those that are inefficient and unproductive – eventually go bankrupt. Because nobody is willing to invest in them past a certain point.

This tends to happen in waves. That is to say, investors tend to become more cautious at the same time – withholding investment dollars from bad companies simultaneously.

This causes a wave of companies to go bust… which results in a lot of people losing their job at the same time. We call this a “recession”.

The Keynesian economists tell us that recessions are bad. But they aren’t. They are normal and necessary.

Recessions “clean out” the system. They liquidate malinvestment and pave the way for better companies to rise up – creating better jobs in the process.

In other words, recessions are temporary adjustments that ensure we can have continuous economic growth in a healthy, normal way. After a recession, we gradually see savings and investment rise—which starts the process all over again.

That’s what “normal” looks like in a nutshell. Tomorrow we’ll look at how every step in the process described above has been abnormal in recent years.

-Joe Withrow

P.S. Perhaps the best book for understanding the economy today is Per Byland’s How to Think About the Economy: A Primer. You can find it on Amazon right here.

Along the same lines, I also highly recommend Ludwig von Mises’ Economic Policy: Thoughts for Today and Tomorrow. It’s derived from a series of lectures that Mises delivered to students in Argentina in 1958… and his insights could not have been more prescient. You can find it on Amazon here: https://www.amazon.com/Economic-Policy-Thoughts-Today-Tomorrow/dp/1933550015/

The post Normal and not normal… appeared first on Zenconomics.

October 4, 2024

What I learned watching the bankers party

Today we’ll wrap up our talk on the Fed, interest rates, and the future…

When we left off yesterday, I mentioned that something telling happened right in my back yard. Michelle Bowman spoke at the 133rd Annual Convention of the Kentucky Bankers Association last week.

Bowman is one of the 12 voting members of the Fed. She occupies a seat representing America’s community banks. That’s why she was invited to speak at the Kentucky Bankers’ event.

The convention took place at the historic Homestead Resort up here in Hot Springs, VA. As fate would have it, my in-laws came to visit us the same weekend… and we put them up in a room at the Homestead. We were there on Sunday as the conference attendees were getting settled in.

I met a few Kentucky bankers at the pool that afternoon. And we could see their opening reception from the balcony of my in-law’s room. It took place out on the lawn.

Here’s a picture I took as they were setting up:

Here we can see the grounds crew setting up tables and chairs for the event. This entire lawn was packed with bankers enjoying food, beverages, and live music a few hours later.

I’m not sure if Michelle Bowman participated in the festivities, but her talk on Tuesday was memorable.

Bowman told attendees that she voted for a 25-point rate cut, and that she disagreed with the Fed’s decision to cut 50 basis points. For a few reasons…

Bowman said she was afraid the 50-point cut would send a message that the Fed sees “fragility” in the economy. She also fears that the market will come to expect large rate cuts in the months to come, but those large cuts “might not happen”.

So both Powell and Bowman implied that they don’t expect interest rates to move dramatically lower in the months to come.

While rates may come down a little bit, “normalization” is still Powell’s chosen course. We’ll talk about that more next week.

-Joe Withrow

P.S. We’re in the early stages of planning out an investment webinar for later this month. It’s still preliminary, but I think we’re going to call it “The 4.5 Things You Need for Financial Freedom”.

I don’t have any details to share with you today… just putting the idea on your radar for now. More to come on this in a week or two.

Have a great weekend!

The post What I learned watching the bankers party appeared first on Zenconomics.

October 3, 2024

Breaking ranks…

Yesterday we discussed an odd dynamic – US Treasury rates went up after the Federal Reserve (the Fed) cut its target interest rate by 50 basis points two weeks ago.

That being the case… what happens next? Is the Fed going to slash rates aggressively from here?

When we left off yesterday, I mentioned that Fed Chair Jerome Powell said two things in his talk that I found telling. First, he emphasized that he remains focused on “normalization”.

When a Wall Street Journal reporter asked Powell if rate cuts were a signal that the Fed would also start buying Treasury bonds again, the answer was a clear ‘no’.

Powell told him that this isn’t even a point of discussion right now. He added that “you can have the balance sheet shrinking but also be cutting rates”.

Here’s why that’s important…

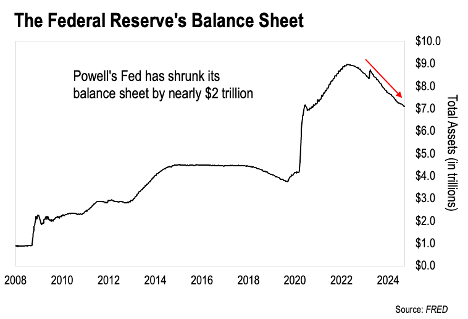

The Fed purchased over $8 trillion dollars’ worth of Treasury bonds from 2008 to 2022. They created money from nothing to buy those bonds… which pumped liquidity into the financial system and helped drive interest rates down to zero.

When they were Fed Chair, both Ben Bernanke and Janet Yellen made it a habit to buy more Treasury bonds whenever the Fed’s existing bonds matured. That kept the cheap money game going for longer than otherwise would have been possible.

Powell broke ranks and reversed course with his quantitative tightening (QT). This chart tells the story:

As we can see, Powell has allowed nearly $2 trillion worth of Treasury bonds to mature without buying more. This effectively drains liquidity from the financial system. That, in turn, puts upward pressure on interest rates.

The big takeaway here is that maintaining QT will partially offset direct cuts to the federal funds rate… especially with regards to longer-term interest rates. We already see that happening with the bear steepener formation in place as we discussed yesterday.

And Powell more or less confirmed this dynamic in his talk. He stated explicitly that the Fed is not going to cut rates nearly as deeply during this cycle. He said he thinks the ‘neutral rate’ is considerably higher than where it was from 2008 to 2021.

When Powell talks about the neutral rate, he’s referring to the rate which the Fed sees as neither stimulative nor restrictive to economic growth. This is more Keynesian folly. But it’s to be expected. The Fed is fundamentally a Keynesian institution.

Keynesian theory still dominates Academia and American politics… though that is changing rapidly. The seeds of an Austrian awakening have already been sowed. But that’s a story for another day.

The key here is that Powell told us directly that rates aren’t going back to where they were. As I’ve harped on before – the Age of Paper Wealth is over.

And then something interesting happened right in my back yard that seems to confirm this. More on that tomorrow…

-Joe Withrow

The post Breaking ranks… appeared first on Zenconomics.

October 2, 2024

The Fed Cuts… Rates Go Up

When we left off yesterday, we were talking about interest rates… and hoping it didn’t put everybody to sleep.

All the talk in the financial world (geopolitics aside) has been the Fed’s 50-point rate cut.

Does it signal that the easy money days are coming back again? Are small-cap stocks finally going to catch a bid? Are 3% mortgages coming back?

Before we project too far, I think it’s important to point out that the Fed can only influence short-term interest rates with its monetary policy decisions. It cannot magically “set rates” throughout the economy.

As evidence – both the 10-year and the 30-year Treasury bond rates went up after the Fed’s 50-point rate cut.

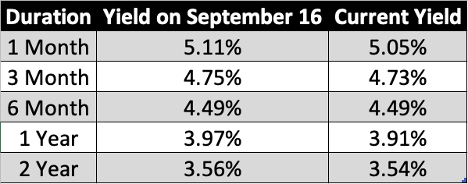

The 10-year Treasury rate was 3.62% on September 16th – two days before Powell’s announcement. By September 23rd, the 10-year rate had jumped to 3.75%. It increased 13 basis points.

The 30-year Treasury rate was 3.93% on September 16th. It spiked to 4.13% in the days after the Fed’s rate cut. That’s a move of 20 basis points.

Meanwhile, shorter duration Treasuries have hardly moved since the Fed’s rate cut.

Source: Bloomberg

This shows us that the Fed’s rate cut was already priced into the market. Short term Treasury rates have not fallen much since the big announcement.

Yet, long-term rates have risen materially. In financial lingo, this is known as the “bear steepener”.

The term “steepener” refers to long-term rates rising faster than short term rates. And “bear” refers to the fact that this movement typically happens when the market expects higher inflation and/or slowed economic activity in the near future.

This is especially true when the bear steepener move results in an un-inverted yield curve… which is what we’re seeing right now. And that brings me to my thoughts on Powell’s 50-point rate cut…

I’ve seen quite a few articles floating around the “alternative finance” space suggesting that Powell caved to the Deep State and that he’s trying to influence the election. I’ve also seen suggestions that the Fed is going to slash rates aggressively from here.

I don’t think any of that is true.

Powell said two things in his talk this month that I found interesting. And if we take Powell at his word, his comments are quite telling for what’s to come.

More on that tomorrow…

-Joe Withrow

P.S. My running thesis is that Jerome Powell’s Federal Reserve is fundamentally different from the Fed under his predecessors Janet Yellen and Ben Bernanke. In fact, I’m confident in saying that the Fed’s monetary policy was not independent previously.

But a silent coup occurred within the Eccles building in 2018… and that set into motion a 4-year plan to liberate US monetary policy. And I must say – it certainly appears this plan has gone off without a hitch. That’s what’s so interesting about Powell’s tenure as Fed chair.

For more on that silent coup… how the plan unfurled… and how we should view our only finances accordingly, see my book Beyond the Nest Egg. You can get it on Amazon right here: https://www.amazon.com/Beyond-Nest-Egg-Financially-Independent/dp/B0CGG5G6XH/

The post The Fed Cuts… Rates Go Up appeared first on Zenconomics.

October 1, 2024

What the Fed’s rate cut actually means…

Let’s talk interest rates this week.

In a normal world, interest rates would be the least interesting subject one could possibly bring up. Who cares?

But we don’t live in a normal world… so the markets fixate upon interest rates.

On September 18th, Federal Reserve (Fed) Chairman Jerome Powell announced that the Fed would cut the federal funds (fed funds) rate by 50 basis points (0.50%).

The federal funds rate is the Fed’s target interest rate benchmark. It is the rate at which banks lend money to each other overnight.

Banks are required to maintain a certain amount of reserves, and sometimes they need to borrow money from other banks to meet their requirements. The federal funds rate is the rate they pay for those short-term loans.

For this reason, the fed funds rate serves as a benchmark for other short-term interest rates in the economy. This includes rates on commercial and consumer loans as well as savings and money market accounts.

According to Keynesian economic theory, cutting the fed funds rate should lead to lower interest rates throughout the economy—which in turn will encourage businesses and consumers to borrow money and engage in increased economic activity.

In other words, the Keynesians believe rate cuts “stimulate” the economy. Will that be the case this time around?

I’ll share my thoughts on that with you later. But first I have to admit that I’m a little disappointed.

Several US senators wrote a letter to Jerome Powell two days ahead of his announcement. Elizabeth Warren is the most notable signatory. The letter’s dated September 16th and it urged Powell to cut the fed funds rate by 75 basis points.

Here’s the first and last paragraph of the letter:

We write today to urge the Federal Reserve (Fed) to cut the federal funds rate, currently at a two-decade-high of 5.3 percent, by 75 basis points (bps) at the Federal Open Market Committee (FOMC) meeting on September 17 and 18, 2024. Given the Fed’s confidence in inflation moving towards its target of 2 percent and data indicating slower job growth, now is the time to swiftly move forward with rate cuts…

If the Fed is too cautious in cutting rates, it would needlessly risk our economy heading towards a recession. A number of economists have warned of this risk since July. Former president of the Federal Reserve Bank of New York, Bill Dudley, wrote, “dawdling now unnecessarily increases the risk.” The Committee must consider implementing rate cuts more aggressively upfront to mitigate potential risks to the labor market.

Thank you for your attention to this matter.

I chuckled when I read this. The idea that three career politicians could possibly know what the ideal interest rate should be is the definition of F.A. Hayek’s fatal conceit.

As Hayek argued so vigorously, knowledge is distributed throughout society. When left free, markets aggregate the sum of that knowledge in real-time and thus inform dynamic interest rates that accurately balance the availability of savings with the demand for borrowing throughout the economy.

No single person or groups of people can possibly know enough about what’s happening in the economy to determine what interest rates should be… Or to centrally plan any other aspect of economic activity, for that matter.

So I must admit – when I read Warren’s letter, I couldn’t help but imagine Powell trotting out there and announcing a 75-point rate hike.

You know – just to send a message… and to accelerate the bankruptcy and liquidation of any institution who foolishly relies on cheap money for survival.

Alas, no such luck.

Getting back to practical matters – what does the 50-point rate cut mean? How should we think of it? And what’s likely coming next?

Answers to come tomorrow…

-Joe Withrow

P.S. My son turned six years old today. Gosh, they grow up so quick. I vividly remember the first journal entry I wrote about him shortly after his birth.

Here’s the picture I posted of him back then. And next to it is a picture of him after opening a gift this morning.

I gave him his first gold chain necklace – made of real gold. I hope it’s something he will look back on 40 years from now and remember how much his Dad loved him.

The post What the Fed’s rate cut actually means… appeared first on Zenconomics.

September 30, 2024

The world’s moving fast – let’s catch up

Dear friends,

Hello and happy Monday to you!

Joe Withrow here. It’s been quite a while since I’ve written you. Nearly six months, in fact.

A lot has happened over these past six months. It seems like everything in the world of money and markets is moving faster than ever before.

So with your permission, I would like to start writing to you weekly once again.

If that’s okay – stay tuned! But if you would prefer to opt out of these emails, you can simply unsubscribe using the button below. No worries…

I’m reaching out today because we’ve been having some robust discussions inside the Phoenician League investment membership. We’ve been plugged into what’s playing out on the macroeconomic front these past few months… and it occurred to me that I should share some of these thoughts more widely. Actually, it was Tom Woods who kicked me into gear, so to speak.

For those who know ol’ Woods, Tom hosts weekly calls as part of his entrepreneur mastermind program. He mentioned to us on a call last week that hardly anybody “in our circle” maintains a mailing list these days.

Tom mails his list daily. And he named two other people who do the same… and that’s about it.

Ironically, it used to be that mailing lists were the only way for people of like-mind to connect back before the internet.

That’s how guys like the late Dr. Gary North got their start—by sending physical newsletters to people in the mail. That was the only way to communicate “alternative” ideas about economics and politics back then.

That practice gave rise to the entire financial newsletter industry. I suspect it’s the only thing that kept gold bugs and proponents of Austrian economics sane prior to the internet.

So I would like to do my part in carrying on that old tradition going forward… if you’ll have me. Our topic this week: the Fed’s rate cut – what it means and what it doesn’t mean.

More tomorrow…

-Joe Withrow

P.S. The financial war that I detailed in my book Beyond the Nest Egg is coming to a head right now. I believe the series of events that occur over the next six months or so will determine the course of the next decade. That’s how fast everything is moving.

I view everything happening on the macroeconomic stage through this lens. If you’d like to get up to speed on the covert financial war (including who the major players are), you can get Beyond the Nest Egg on Amazon right here: https://www.amazon.com/Beyond-Nest-Egg-Financially-Independent/dp/B0CGG5G6XH/

The post The world’s moving fast – let’s catch up appeared first on Zenconomics.

April 17, 2024

The Magic of Technology

Today we’ll wrap up our discussion on building an all-weather portfolio.

Looking back over the past two weeks, we have covered:

BitcoinGoldWorld-Class Insurance StocksTop-Tier Energy StocksGold Royalty StocksConsumer Inflation HedgesThat leaves us with deepest and most diverse investment theme: high-technology stocks. They will be our topic for today.

And we have to start with one of my favorite quotes…

Any sufficiently advanced technology is indistinguishable from magic.

This quote comes from the late technologist Arthur C. Clarke. It’s in his book Profiles of the Future: An Inquiry into the Limits of the Possible… which published in 1962. Talk about prescient.

Here’s the thing – we all use space-age technology every single day and think nothing of it.

Text messages fly across the country. We send 2.4 billion emails every single second. Satellites bounce data all across the globe.

We all walk around with a device in our pockets that can access the entire store of accumulated human knowledge instantly, from pretty much anywhere.

This device allows us to do video chats with each other – just like the old Jetsons cartoon envisioned. And it can do almost anything else we ask it to.

It can give us navigational directions. It can tell us the weather forecast. It can send money to a friend. It can play music and movies. There’s an app for almost everything. Oh, and it allows us to make old fashioned phone calls too if we want.

If that weren’t enough, we can now buy virtually any item made anywhere in the world online, including food, and it will show up in a box at our door step in short order. That’s thanks to advanced logistics technology.

All of this would look like magic to my grandfather who died in 1994. Yet, we take it for granted today.

But very few of us understand how modern technologies like our smart phones work. And we certainly don’t consider that for every given technology, there are often countless other technologies working together behind the scenes to make it all go.

What’s more, we always tend to underestimate the impact new technology will have on our world.

Looking back 30 years… I still remember news anchors trying to grapple with this thing called “electronic mail” (email). In one segment I distinctly remember several anchors just trying to figure out what the @ symbol meant. They spent three or four minutes just on that.

At the same time, prominent economists told us that the internet wasn’t a big deal. One economist said it would have roughly the same impact as the fax machine.

Fast forward to today and our civilization would come to a grinding halt if something happened to the internet. We depend on it for everything.

Power production and distribution… money and banking… shipping and logistics… and lots more. Nearly everything is dependent on the internet and the technologies that enable it.

My point is this – a technology that very few understood or considered important 30 years ago has completely reshaped our world. That’s the power of sufficiently advanced technology.

And with every new technology, there are always numerous companies that advance it forward. Or leverage the tech into an incredible product. Those companies inevitably become great investments.

This is why we want to maintain an allocation to high-technology stocks.

That said, the tech sector is deep and nuanced. Of all the investment themes we’ve discussed, tech is by far the most difficult to analyze. And it’s subject to bouts of volatility.

As such, we need to treat our high-technology stocks differently.

We should think of these stocks as a play on long-term trends in the technology space. They are much more akin to early stage private investments in that they can be risky… but they offer outsized upside potential.

-Joe Withrow

P.S. Are you worried about how interest rates and inflation will impact your investments?

There’s a big secret hidden in plain sight that the mainstream press, government officials, and even our public universities don’t want you to know.

It all stems from the great economic divide we see happening today. And make no mistake about it – the rules of money are changing.

For more on what’s happening… and what it means for your finances – just go right here.

The post The Magic of Technology appeared first on Zenconomics.

April 15, 2024

How to Combat Inflation

Let’s continue our discussion on building an all-weather portfolio this week. As a reminder, the seven areas that I think are worth considering today are:

BitcoinGoldWorld-Class Insurance StocksTop-Tier Energy StocksGold Royalty StocksConsumer Inflation HedgesHigh-Technology StocksIf we allocate a little capital to each of these areas every time we get paid, we’ll have an automated system for building wealth. Consistency is the name of the game.

You can find our coverage of Bitcoin, gold, world-class insurance, top-tier energy, and gold royalty stocks at the links above. Today let’s talk about consumer inflation hedges.

For the last two generations, the success plan was clear.

Go to school –> get good grades –> go to college –> get a good job. If one followed that plan and had a good work ethic, a successful middle-class life would come easy.

And for those more ambitious, there were very few roadblocks to starting a business. Opportunity was everywhere.

That was the American dream. It’s what inspired countless hard-working immigrants to create a new life in this country in the 19th and 20th centuries.

But that dream is fading.

The traditional success plan – go to school, get good grades, get a job – it no longer guarantees success. Colleges today load students up with debt. Some also push destructive ideologies.

Meanwhile, the Administrative State peppers small businesses with all kinds of regulatory burdens. That makes starting and growing a traditional business difficult.

And to top it off, reckless government spending has driven up everybody’s cost of living. They financed this spending with printed money. And that created consumer price inflation.

The impact inflation is having upon us is clear. I see it when our grocery bill comes due each week. And I can’t take my family of four out to a nice dinner any more for less than $100.

I also see inflation’s insidious effects inside my investment real estate portfolio.

I have several properties where the rent came in on time every month like clockwork for years. Until recently.

Now the rent comes in several weeks late most of the time. We even had to lower the rent for one of our properties so a good tenant could renew the lease for another 12 months.

It’s all because many households find themselves running month to month thanks to inflation. Their income hasn’t kept up with rising costs of living.

It’s clear. Inflation is destroying the average family’s disposable income.

This doesn’t bode well for companies selling higher-end goods. Luxury cruises… high-end cars… overpriced fashion brands – these businesses and many like them are going to struggle in the years to come.

At the same time, there are certain goods the American consumer will always buy – regardless of how tight the monthly budget is.

For example, people will still go to the supermarket regularly. They’ll buy their food, soda, snacks, candy, personal care products, and household cleaners… just like they always have.

Many families will still go out to eat as well. The convenience is hard to beat.

Except instead of going to a nice restaurant, many will choose fast food because it’s cheaper. There’s a reason why certain fast food chains are among the world’s best businesses.

And I don’t think we will kick our addiction to coffee and sweet drinks any time soon. So Starbucks and similar companies are likely to remain popular in the years to come as well.

And what about discount stores like Walmart and Dollar General?

They will continue to offer consumers every-day goods at low prices. These “lower end” stores will likely gain new customers as inflation wreaks havoc on disposable income.

The point is, the American consumer isn’t going away. But his spending habits are likely to shift to lower-price alternatives.

There are some publicly-traded companies that will benefit from this shift in consumer spending. Their stocks can serve as inflation hedges for us.

And here’s the thing – some of these companies are fantastic businesses. They are capital-efficient and shareholder friendly. That’s exactly what we’re looking for in a great investment.

The key is that we must buy these companies when they trade at a reasonable valuation. That’s true of all investments.

If we’re patient enough, we can add these inflation hedges to our portfolio at a great price. Then we can reinvest the dividends to compound our investment for years to come.

-Joe Withrow

P.S. For a deeper dive into what’s happening with the economy – and how to bulletproof our finances accordingly – please see my book Beyond the Nest Egg.

It’s available on Amazon right here: https://www.amazon.com/Beyond-Nest-Egg-Financially-Independent-ebook/dp/B0CG7VYRV7/

The post How to Combat Inflation appeared first on Zenconomics.

April 11, 2024

The End of History and Saving the Current Financial System – a Developing Thesis

“What we may be witnessing is not just the end of the Cold War, or the passing of a particular period of post-war history, but the end of history as such… That is, the end point of mankind’s ideological evolution and the universalization of Western liberal democracy as the final form of human government.” -Francis Fukuyama

I’d like to pause our discussion on building an all-weather portfolio today in favor of a big-picture idea.

It’s an idea that’s been rattling around in the back of my head… and I’ve made some investment decisions based on it. But I’ve never fleshed the idea out on paper before.

So please forgive me if the idea isn’t completely formed yet. Sometimes you just have to start writing with what you have and then the rest will come to you…

The quote from Mr. Fukuyama above comes from an essay he wrote in 1989. He titled it The End of History?.

Fukuyama’s essay suggested that the collapse of the Soviet Union marked the end of history. With the communists defeated, Fukuyama said that humanity’s ideological evolution was complete. Thus, the Western liberal democracy as it then existed would last forever.

At the time Fukuyama’s suggestion made a fair amount of sense. It had become clear for the world to see that market-based economies are superior to socialist ones.

After all, it was “morning in America”. The economy was humming. The labor market was strong. And household incomes were on the rise.

Meanwhile, technological developments were powering forward.

American households were getting personal computers for the first time in history. And a gentleman named Steve Jobs was putting the finishing touches on the Macintosh Classic to accelerate this trend.

Jobs took the Classic to market in 1990. It became the first computer available for less than $1,000. That made personal computing affordable for a wider range of households than ever before.

So it certainly looked like Fukuyama’s idea had merit. What system could possibly be better than the one driving so much innovation and prosperity?

Fast forward to today and the global financial system is fracturing right before our eyes.

Geopolitical tensions are as high as they’ve been since the Cold War. And as we discussed yesterday, most of the world’s liberal democracies are now drowning in debt.

But now that interest rates have normalized, that debt is quickly becoming unmanageable. The annual interest expense is starting to crowd out other spending… which will force countries to make a difficult choice. Budget cuts and austerity? Or accelerated inflation?

That got me thinking… how did we get to this point?

Obviously the global financial system is incredibly complex—far too complex for anybody to understand all the nuances and the moving pieces in real time. So I don’t pretend to have a complete answer here. But a big piece of the puzzle revolves around our choice of global reserve assets…

Gold was the developed world’s primary reserve asset for centuries prior to 1971.

We can trace this all the way back to 1717. That’s when Sir Isaac Newton fixed the gold content of the pound sterling – creating a variation of the gold standard that would persist for the next 200 years.

The world abandoned the gold standard during World War I. But even then the new monetary system used gold as the underlying reserve asset.

That changed in 1971 when President Nixon closed the gold window. From that point forward the US dollar became the world’s reserve currency.

And this created a dynamic by which US Treasury bonds became the de facto reserve asset. That’s because economic actors didn’t want to hold their reserves in government currency. Instead, they parked their dollars in Treasury bonds to generate a yield.

So we swapped out gold for US government debt as the world’s reserve asset. That’s the core issue.

Today all major countries, central banks, and corporations hold US Treasury bonds on their balance sheets. Some international trade deals are secured using US Treasury bonds as collateral as well.

We can see how this created a perverse incentive for the US government to go deeper and deeper into debt by selling Treasury bonds to the world.

And then the government had to do something with the proceeds it received from selling those bonds… so it began spending money on every kind of program imaginable. That’s how the US government came to be such a massive behemoth.

Of course, other national governments didn’t sit idly by. They employed the same model of selling bonds to finance increased government spending. It became something of an arms race. In some cases quite literally.

It all stems from our choice of global reserve asset. There are many other nuances at play here… but if we want to point to a single thing, that’s it.

Gold as a reserve asset encourages fiscal responsibility. Government debt as a reserve asset incentivizes irresponsible government spending for its own sake.

The problem is, a system of perpetually growing debt isn’t sustainable. And we’re rapidly approaching the end of the road.

That said, I can see a clear path towards salvaging the current system. It’s just a matter of shoring up broken balance sheets. Here’s one possible path…

There’s a reason why all major central banks still own gold today – even though it hasn’t been part of the financial system for over fifty years now. And it’s the same reason why central banks bought record amounts of gold in 2022 and 2023.

Perhaps ironically, the central banks could use gold to save themselves and the current banking system.

The US government still owns 8,133 metric tons of gold. That’s worth about $612 billion with gold trading around $2,340 an ounce as I write.

At the same time, the Federal Reserve’s (the Fed’s) balance sheet now stands at $7.4 trillion. The bulk of that consists of US Treasury bond holdings.

This puts the ratio of gold to Treasury bonds on the Fed’s balance sheet at 1-to-12 in dollar terms. To my way of thinking, this means the Fed is leveraged 12X when it comes to its real underlying collateral.

Now let’s suppose that gold is allowed to rise to, say, $10,000 an ounce. That would make those 8,133 metric tons worth $2.6 trillion.

Suddenly the Fed’s balance sheet would only be levered up by about 2.8X. That’s far more sustainable.

And at that point it would open the doors to addressing the US national debt and its unfunded liabilities in some creative ways. That’s assuming the Fed maintains normalized interest rates and Congress agrees to cut government spending.

Based on my analysis, I’m very confident that the Fed will hold firm on interest rates. I’m not at all confident that Congress will cut spending… but that’s what would have to happen to salvage the current system.

With that in mind, I’ve noticed something curious.

There’s been chatter out there about the US dollar collapsing and the US government going bust for years now.

That chatter projects current trends out to their logical conclusion… but it ignores the fact that these trends could change. And they need to change if the people empowered by the current banking system want to stay in power.

And notice how it’s always the US dollar in the crosshairs. I can’t recall coming across any doom and gloom commentary about the Euro or the European Union (EU) being at risk. But the fact is that the Euro and the EU are in a far more precarious situation.

If we’re staring down a global debt crisis in the Western world – the US is in the best position by far. Because of its massive gold hoard.

In a crisis, confidence is the name of the game. And gold equals confidence.

I think that’s why gold has been on a tear this year.

The gold market is sniffing out the fact that we may see a debt crisis thanks to normalized interest rates. That’s why gold is hitting all-time highs even as rates have risen.

And there’s one more angle to this story that may seem counter-intuitive…

If I’m right that gold could be used to salvage the current financial system… and if I’m right that saving the current system is the Fed’s true goal – I could make a case that this is also bullish for US stocks looking forward. Because it’s all about global capital. Capital is going to flow to where it’s treated best.

In the short-term I still think the US stock market is overextended and due for a correction. I also think a recession is inevitable. Fourteen years of zero-bound interest rates fueled a lot of malinvestment, and that malinvestment needs to be liquidated.

These are the things that the financial news screeches and squawks over. They tell us corrections, recessions, and government budget cuts are bad. But in my mind’s eye, they sure look like the path forward to me.

I’m still trying to piece this all together into a true thesis that I can clearly articulate. I don’t think I’m there yet. There are still some pieces rattling around in the back of my head trying to find their way out.

But I do know that the investment themes we’ve been discussing this week stand to do very well thanks to this complicated economic dynamic. We’ll finish that discussion next week.

-Joe Withrow

P.S. Everything we’re seeing play out on the macro stage is converging to create what I’m calling The New Rules of Money. For a deeper dive on how this all impacts finance and investing – and how we should get ahead of it – just go right here.

The post The End of History and Saving the Current Financial System – a Developing Thesis appeared first on Zenconomics.

April 10, 2024

Generating Consistent Cash Flow From Gold

We’re talking about the investments that form an all-weather portfolio in the current macroeconomic climate this week. The idea is that we can allocate a little chunk of money to these investments every time we get paid to automate a system for building wealth.

As a reminder, the seven areas that I think are worth considering today are:

BitcoinGoldWorld-Class Insurance StocksTop-Tier Energy StocksGold Royalty StocksConsumer Inflation HedgesHigh-Technology StocksPlease note that I’m omitting investment real estate and other income-producing assets here. That’s only because we can’t buy those assets in small increments. They require a larger commitment. And we should only consider them after we’ve built a strong financial base – which is what this consistent wealth strategy will do for us.

We discussed our first four investment themes in previous issues. You can access those by clicking the links above. As for today…

The legacy financial system is fracturing right before our eyes.

Here in the United States, our government has run up a national debt that’s greater than $34 trillion. That alone is an unfathomable amount of money. You and I couldn’t come close to spending $34 trillion in our lifetime.

Even worse, much of this debt is short-term. In fact, roughly 40% of the federal debt is coming due over the next three years. That’s somewhere around $13 trillion.

Obviously the US government can’t pay this debt off outright. It’s set to run annual deficits well in excess of $1 trillion per year over the next ten years.

That means the debt coming due will need to be rolled over. The Treasury will need to issue new bonds to pay off the old bonds.

This practice of rolling debt forward has never been a problem before. But that’s only because interest rates fell consistently from 1982 to 2022.

That enabled the Treasury to issue new debt at lower and lower rates… which in turn kept debt service costs low. Up to this point the interest payments owed on the debt have been manageable.

To quantify this, the average interest rate on the US government’s outstanding debt is just under 3%. And the Treasury spent $659 billion on net interest costs last year.

But the days of ever-lower interest rates are over.

As I write, the 2-year Treasury bond yields just under 5%. That’s the interest rate the US Treasury would need to pay on new short-term debt going forward.

And that means the US government’s net interest costs are going much higher.

The Congressional Budget Office (CBO) projects that interest expense will be the second biggest line item on the federal budget in 2025. That’s second only to Social Security and Medicare.

This sets the stage for a massive budget crisis. As the interest expense rises, the US government will either need to cut spending in other areas or it will need to borrow and print more and more money.

Meanwhile, the debt problem isn’t specific to the US. Name any major western country and you can be sure that its debt-to-gross domestic product (GDP) ratio has ballooned in recent decades. In fact, many countries now service a debt that’s near or greater than 100 percent of their GDP.

To illustrate this, here’s an abbreviated list of debt-to-GDP by country as of the end of 2022:

These numbers are unprecedented historically. Never before have so many countries run up a debt that equals or exceeds their gross domestic production.

This is only possible in a world where central banks can create new base money from thin air.

And I believe this is why central banks have been buying gold hand-over-fist in recent years, as we discussed last week. They know the days of printing fiat money from nothing are numbered. Because public trust is evaporating.

And that brings us to a big investment opportunity…

Gold Royalty Stocks

If we find ourselves in a world where trust in government currency fades and central banks look to back their systems with gold again to restore confidence – what do we think would happen to the price of gold?

It would go much higher, much faster than expected. This is why I believe the stage is set for a continued bull run in gold over the next several years.

These macroeconomic conditions (along with geopolitical tensions) are now in the driver’s seat when it comes to gold’s price. We’ve seen that clearly with gold breaking out to new all-time highs above $2,300 even as interest rates moved higher.

And that means it’s time to build exposure to the best gold equities on the market.

We discussed the need to own physical gold when we talked about reserve assets last week. Building some exposure to gold equities as well can add some real pop to our gold holdings.

I’m most partial to the best gold royalty companies right now. These are firms that finance gold mining companies. They provide the capital necessary to go out and build new gold mines.

In exchange, royalty companies receive royalty and streaming rights on all gold produced from the mines they finance.

In other words, royalty companies get paid for the work the mining companies do. As such, royalty companies have far fewer operating costs than gold miners.

That makes their income far more stable… especially as they build diversified portfolios of royalty and streaming rights across many different mines in operation.

This allows gold royalty companies to pay consistent dividends. We can reinvest those dividends to put the power of compound interest to work for us.

Here’s what I love about gold royalty stocks, as opposed to gold mining stocks:

Low operating costs: A gold royalty company’s primary expense is the cost of financing. And this is often a one-time upfront cost. Then the royalty company generates passive income from all future production.

Scalability: The royalty business model allows the company to scale its operations simply by acquiring new gold royalties and streams over time. The company doesn’t have to find or develop the mines itself. All it has to do is strike a royalty deal with those mining companies who do.

Diversification: The company’s diverse portfolio of gold royalties provides exposure to various geographic regions and mining companies. This reduces the impact of any single mine’s performance on the company’s overall results.

Cash flow predictability: A royalty company’s cash flow comes from long-term royalty and streaming agreements. These are rigid contracts that spell everything out up front. That allows management to predict future cash flow with a reasonable degree of certainty. And this makes it easier to plan for future growth and investments.

Relative capital efficiency: Royalty companies do not need to invest heavily in mining operations or other capital-intensive activities. This allows them to allocate capital more effectively and focus on acquiring new assets to grow their portfolio.

Inflation resistant: Because this primary business is financing, it’s largely insulated from inflation. That’s because royalty companies do not have a costs of goods sold expense that will increase with inflation.

Consistent dividends: All of these factors enable royalty companies to pay a regular dividend. The dividend yield won’t wow us… but it allows us to gradually compound our investment over time.

As with all stocks, the key is to only buy the best gold royalty companies when they are trading at attractive valuations.

-Joe Withrow

P.S. Have you heard of The Purple People?

They were an ancient tribe that left a legacy of innovations that we still use today. And they passed down an ancient business and investing secret that still applies to our modern world.

I’ve studied this secret extensively… and I can say with confidence that it works. I’ve used it myself.

If you would like to learn more about this ancient tribe and how to use their secret, just go here.

The post Generating Consistent Cash Flow From Gold appeared first on Zenconomics.