Joe Withrow's Blog, page 27

July 13, 2016

Cede Not the Power Within

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Cede Not the Power Within

July 13, 2016

Hot Springs, VA

“Our integrity sells for so little, but it is all we really have. It is the very last inch of us, but within that inch, we are free…. An Inch, it is small and it is fragile, but it is the only thing in the world worth having. We must never lose it or give it away. We must never let them take it from us…” – Valerie, V for Vendetta

The S&P closed out Tuesday at $2,152. Gold closed at $1,335 per ounce. Crude Oil closed at $46.80 per barrel, and the 10-year Treasury rate closed at 1.51%. Bitcoin is trading around $660 per BTC today.

Dear Journal,

I’m not exactly sure where this entry is going to go. As regular readers know, I sit down weekly to write about whatever is on my mind.

No script. No filter. No agenda other than the spreading of ideas.

I do try to tie these entries in with one of my books or finance courses for commercial purposes so I can tell wife Rachel that I did some work today, but I am not always successful in that endeavor.

What’s on my mind this week is power – personal power.

It is very clear to me that there is a concerted effort underway to destabilize the western world. The shooting in Dallas complete with racial undertones is the most recent example, but these supposedly ‘random’ events have been occurring regularly for a few years now.

In the U.S., it’s horrendous police brutality followed by riots and shootings. In Europe, it’s various acts of violence and a forced refugee crisis.

The media fuels fear, anger, and distrust after each attack, and there is an immediate attempt to push a political agenda. All the while blame is tossed about and the actual victims and their families are used as chess pieces in a sociopolitical game. Further, there is substantial evidence suggesting that nearly every one of these violent incidents is financed by and/or connected to a political organization of one stripe or another. Zero Hedge typically connects the dots in ways the television media will not for those who want to explore this statement further.

After the 24-hour media cycle blasts political spin regarding these events, you can check your Facebook feed or listen to the coffee-pot talk at work and see that plenty of people are very quick to take sides according to the public narrative. This collectivizes the issue and integrates an “us vs. them” mentality into the public psyche.

Instead of seeing a tragic and unnecessary act of violence, those who buy the spin see “conservative vs. liberal”, “black vs. white”, “Christian vs. Muslim”, or what have you. This perspective necessarily transfers power away from the individual and cedes it to the leaders of whichever group the individual happens to support.

That is collectivism, and it is what keeps the political class and the media in business. Instead of dealing with people as individuals, these institutions can only deal with people as collectives. They attempt to scoop everyone up into groups and then assign value, rights, and motives accordingly. Those who play their game perpetuate their fear and control paradigm.

The leaders of each group communicate the beliefs, feelings, policies, and actions that all members of the group must adopt as their own. Then people who are completely unconnected to the event take up the group’s cause as their own, necessarily subverting their own interests and manufacturing anger towards people who identify with other groups.

It is all an abstraction, and these acts of violence would stop if people stopped fueling the fire. Again, nearly all of these violent incidents are linked to political organizations pushing an agenda. The reason these organizations organize and finance violence is because they can count on the state-corporate media to push fear, anger, and confusion each and every time. People who are immersed in fear, anger, and/or confusion can be manipulated into believing and accepting certain agendas.

Suppose people ignored the propaganda instead of fueling it?

The aggressors would go to jail, the families of the victims would be able to cope with their loss in private, everyone else would continue on with whatever they were doing, and there would be very little incentive for future aggressors to act.

And human civilization would benefit from countless individuals using their personal power for good rather than ceding it to ego-maniacs, demagogues, politicians, and morally bankrupt individuals. Sorry for repeating myself…

Now I tend to be something of an idealist, but I don’t think there is an ounce of idealism in today’s entry. I am a young man, but I am old enough to know that personal power is real. It may be intangible, but it is not abstract.

I also know how easy it is to give away your personal power to someone else. Indeed, the entire system of industrialized education seems to be geared towards conditioning individuals to cede their power to one institution after another every step along the way, though not everyone falls victim to this conditioning.

I went through this system just like everyone else, and unfortunately I accepted the social conditioning to a large degree. At one point, I was a people-pleaser incapable of making independent decisions without considering what others – especially my “superiors” – wanted me to do. This was true of my immediate circle as well as the people in positions of power on television.

I know this sounds strange, but think about it: how many people actively support everything their chosen political party hands down to them? How many people center their moral compass around an external, arbitrary, and sometimes incoherent set of values because a television figure proclaims them to be right?

So I spent nearly all of my time traveling someone else’s road, not my own. I wasted an extraordinary amount of energy seeking the approval and acceptance of others every single day. I gave away all of my personal power freely, and a life of what Napoleon Hill called drifting was the result.

Then one day I woke up and decided it was time to walk my own path. What I discovered was that all of the power I had unwittingly given away became available to me at that point.

It was only when I learned to focus this personal power that my true growth as a human being began. It was only then that I became self-referential. That is to say, I was able to view my own thoughts and actions in light of their own merit regardless of what others thought about them. I became driven by internal forces rather than external influences.

So to bring this all together, the people who found their calling and achieved great success in this life each did so only by focusing their personal power intensely. This is true of great business leaders, as Think and Grow Rich famously documented, but it is equally true of social and spiritual leaders. I suspect this was why Jesus of Nazareth spent forty days in the desert before beginning his mission – to cut out all distractions and really focus his power.

What’s interesting is that very few of these great leaders claim any superiority; nearly all of them suggest that anyone could do what they have done if they just focused on it.

What’s also interesting is that the world – across time and place – always seems to oppose the great leaders who have accessed their internal power. To name the best examples: from Socrates to Jesus to Gandhi to Martin Luther King Jr…. the world always seems to rise up in opposition. The world also attempts to make an example out of these leaders so as to discourage others from following in their footsteps.

This is true of the innovators and disruptors in the business world too. I have read numerous stories detailing how people challenging the established business order were hit with absurd regulations and frivolous lawsuits designed to crush their spirit. But those destined for greatness always rise above.

Despite what the world may say, I firmly believe that every single person drawing breath has the capacity for greatness. The world constantly assaults us with distractions, road blocks, fear, anger, confusion, and injustice in an attempt to sway our personal power and impede our greatness.

Those who have tapped into their inner power just laugh in the world’s face…

More to come,

Joe Withrow

Wayward Philosopher

The June issue of the Zenconomics Report has gone out absolutely free to members of our email list. The Zenconomics Report covers market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends. We track a small portfolio of stocks according to the Beta Investment Strategy, and the June dispatch details how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out. To join the Zenconomics Report mailing list, simply subscribe at this link: http://www.zenconomics.com/report.

The post Cede Not the Power Within appeared first on Zenconomics - an Independent Financial Blog.

July 8, 2016

Become a Creator

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Become a Creator

July 8, 2016

Hot Springs, VA

“Let them be creators, not followers. Followers have a certain mentality, and independent creators a quite different mentality. We want creators – people who find solutions by themselves, who have their own conceptions of right and good, and who are capable of independent, righteous action. Followers don’t do that. To get the creator mindset, you have to get out of the way and let them rise to the occasion. Make sense? ” – Phillip Donson, A Lodging of Wayfaring Men

The S&P closed out Thursday at $2,097. Gold closed at $1,362 per ounce. Crude Oil closed at $45.14 per barrel, and the 10-year Treasury rate closed at 1.39%. Bitcoin is trading around $652 per BTC today.

Dear Journal,

Wife Rachel took it upon herself to take me out on a date earlier this week! She had recently discovered a picturesque country inn nestled in the heart of Virginia’s Blue Ridge Mountains, and she thought it was just the place for me. So we traveled an hour’s worth of winding country roads even deeper into the mountains of Virginia on a misty Tuesday night.

We were amazed at the sheer beauty of the 3,200 acre estate which was originally settled by frontiersmen in the 1750’s. The original farm house sits to the left of a long gravel road, surrounded by vegetable gardens, cattle, and horses in several enclosures. As the gravel road winds down towards the Cowpasture river, rustic log cabins come into view on each side of the road and a restored 1850’s grain silo juts up into the sky above the gravel parking lot.

winds down towards the Cowpasture river, rustic log cabins come into view on each side of the road and a restored 1850’s grain silo juts up into the sky above the gravel parking lot.

On the other side of the silo rests Buck’s Bar where Rachel and I ordered a traveler’s round of refreshments before following stone path to an elevated clearing immediately overlooking a pond with bare-faced mountains staring down at us in the distance.

On the other side of the pond we saw six deer slowly grazing in an open field. A faint splash drew our attention to the pond where a beaver was swimming with a bundle of sticks in his mouth – presumably carrying building material back to his shelter. With the beaver out of sight, a chorus of bullfrogs began to make their presence known from the abundance of lily pads lining the pond. All the while the bird’s sang and danced in the old elm trees overhead.

How serene, we thought. So far removed from all of the noise and nonsense that seems to dominate the modern world.

Fundamentally, the estate looked much like it did two centuries ago before the Industrial Revolution had fully integrated itself into American society – except everything had been upgraded and modernized. Here, all of the comforts of the modern world blended seamlessly with the beautiful complexity of nature.

The dinner bell rang, and we began walking back to Buck’s Bar and the  main dining hall. As we were seated, I couldn’t help but think that this was the type of place where traveler’s from a different era would gather out of necessity. Before the Internet, the telephone, the automobile, and even electricity, traveler’s would show up at these country inn’s hoping for a hot meal, a cold drink, and a vacant room.

main dining hall. As we were seated, I couldn’t help but think that this was the type of place where traveler’s from a different era would gather out of necessity. Before the Internet, the telephone, the automobile, and even electricity, traveler’s would show up at these country inn’s hoping for a hot meal, a cold drink, and a vacant room.

Today, Rachel and I show up for dinner and then drive home afterwards. Unlike the frontiersmen and pre-industrial travelers, we observe nature from a climate-controlled room with electrical lighting, cooking, and refrigeration. On the table in front of me lay a smart phone from which I can check my e-mail, my stock portfolio, precious metal prices, Bitcoin trading activity, and I can access virtually the entire sphere of accumulated human knowledge via the World Wide Web. Oh, and I can make phone calls if I choose to… but I rarely do.

The divine creation of the natural world meets the ingenious creation of human civilization.

We have the capacity to be more free and prosperous today than ever before in recorded human history. Given the space-age technology we now have access to, every individual has the power to create his or her own destiny.

How many recognize this?

As best I can tell, everyone in the developed world is handed the same lifestyle plan: go to school, get good grades, go to college, get a job, work hard, take some vacations, retire.

Every step in this plan subjects you to the authority and discretion of a third-party – teachers, professors, bosses, corporations, government… you name it. You are expected to follow the schedules, rules, processes, and systems handed down to you at all times. And of course there is nothing at all wrong with this if you like those third parties and their schedules, rules, processes, and systems.

But what if you want to break out of that world?

What if you don’t want to march to the beat of someone elses’ drum? What if you don’t want to follow a regimented schedule, fight rush hour traffic both ways, and sit under a fluorescent light all day with your telephone conversations monitored and your computer activity recorded?

What if you want to build something that will provide tremendous value to the people around you? What if you want to develop systems and networks capable of revolutionizing human civilization?

What if you want to build a custom-tailored life? What if you want to have time for your children and your spouse? What if you want to enjoy a robust cup of coffee from your front porch at 8:00 am on a crisp Autumn morning while the rest of the world rushes off to work? What if you want to take your dog hiking at 3:00 pm on a Tuesday afternoon while the rest of the world powers through two more hours at the office?

You must become a creator.

The only way out is to create your own reality. There is a universal law of prosperity, and it is as follows: you must produce more than you consume and save the difference if you want to be prosperous. This is true of individuals, and it is true of society in aggregate. If you do not save the difference between production and consumption then you will never get ahead. If you consume more than you produce then you will reduce your future standard of living.

The surplus production in excess of consumption is capital. Learn to create and deploy capital and you will learn to create the life of your choosing. That’s your ticket out of the rat-race, and I don’t think there are any short-cuts. As much as I love the work of Henry David Thoreau, I don’t think a secluded life in the wilderness is sustainable over the long-term.

We discussed a number of different ways to become a creator in the digital age in our Zenconomics Guide to the Information Age.

We also outlined our strategy to build a small fortune in the next 3-5 years by capitalizing on a prominent macroeconomic trend in the June issue of the Zenconomics Report. You can get that issue here: June Dispatch. We will send out a copy of the Zenconomics Guide to the Information Age to all new subscribers as well.

I have come to the conclusion that most of the stress and hardships we experience are self-inflicted, at least in the developed world. Everyone has the ability to create a meaningful and prosperous life for themselves should they choose to do so.

Become a creator and set yourself free.

More to come,

Joe Withrow

Wayward Philosopher

The June issue of the Zenconomics Report has gone out absolutely free to members of our email list. The Zenconomics Report covers market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends. We track a small portfolio of stocks according to the Beta Investment Strategy, and the June dispatch details how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out. To join the Zenconomics Report mailing list, simply subscribe at this link: http://www.zenconomics.com/report.

The post Become a Creator appeared first on Zenconomics - an Independent Financial Blog.

June 28, 2016

The Zenconomics Report June Issue

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Zenconomics Report June Dispatch

June 28, 2016

Hot Springs, VA

The S&P closed out Monday at $2,000. Gold closed at $1,330 per ounce. Crude Oil closed at $46.71 per barrel, and the 10-year Treasury rate closed at 1.46%. Bitcoin is trading around $650 per BTC today.

Dear Journal,

There will be no official entry today. Instead, I would like to invite you to subscribe to the Zenconomics Report in time to receive our first official issue. We will be sending out the monthly dispatch on June 30 to members of the Zenconomics Report mailing list.

The Zenconomics Report will cut through all of the noise, clap-trap, hoop-la, misinformation, and propaganda circling the financial markets. The financial media typically analyzes the markets from a binary perspective of “good versus bad”, often with an underlying agenda to push. This does seekers of financial information a major disservice, and it sets them up to crash and burn when the next Black Swan makes its appearance.

The digital age has made information nearly free for everyone with an internet connection, but this created an unforeseen problem. With the flood gates of information open, how do you know what information is good and what information is not so good?

The ability to ‘sift’ and ‘aggregate’ information becomes all-important within this paradigm, and that’s where the Zenconomics Report comes in.

We are monitoring the markets all day, every day. We watch the developing public narratives as they come to fruition, and we assess how these narratives factor into the big picture. More importantly, we diligently evaluate thousands of dollars worth of financial analysis – more than ten premium financial publications in total – on a routine basis.

This gives us a unique perspective on what is actually taking place within the financial markets, and indeed within the financial system itself. This gives us the ability to cover market updates as they occur, remain abreast of prominent events in the financial markets, keep pace with the continued evolution of monetary policy, and ultimately develop a targeted strategy for positioning our finances to benefit from developing macroeconomic trends.

And we will share our thoughts on all of this with you for free.

We also track a small portfolio of stocks according to our Beta Investment Strategy. Lest we be accused of talking our book, we do not personally own any of the stocks we monitor in the Report, but we do believe very strongly in their merit.

The Zenconomics Report is 100% independent, and all opinions are our own. We are in a position to process huge amounts of financial and economic information, and we analyze this data in light of our understanding of Austrian free market economics. What comes out the other side, we think, is a logical and practical perspective that can give you a leg-up in structuring your own finances and affairs to be ahead of the curve.

Please join our network – all we need is a first name and an email address in the form below. We will also send you two free reports as a ‘thank you’ for subscribing.

Assess, Mitigate, Implement, and Prosper is a report detailing the concept and implementation of asset allocation.

The Zenconomics Guide to the Information Age is a 28 page report covering money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future.

We will zero-in on some very important developments in the June issue of the Zenconomics Report. We are going to examine the state of the sovereign debt markets, including the spread of negative interest rates globally. We are going to assess the recent developments in central bank monetization activity, and we are going to highlight the response from prominent financial insiders and major financial institutions. We are going to analyze the “Brexit” outcome, its relevance, and future possibilities. We are going to outline a strategy for capturing these major macroeconomic trends and building a small fortune over the next several years. Finally, we are going to begin to build our Zenconomics Report Model Portfolio by assessing a handful of stocks with tremendous upside potential.

The Zenconomics Report will only be available to subscribers; it will not be posted publicly. For access simply sign-up using this form:

The post The Zenconomics Report June Issue appeared first on Zenconomics - an Independent Financial Blog.

June 22, 2016

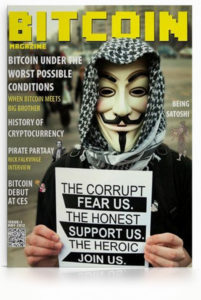

Bitcoin and the Crypto Revolution

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Bitcoin and the Crypto Revolution

June 22, 2016

Hot Springs, VA

“Bitcoin is the beginning of something great: a currency without a government, something necessary and imperative. ” – Nassim Taleb, Author of Antifragile: Things That Gain from Disorder

The S&P closed out Monday at $2,088. Gold closed at $1,271 per ounce. Crude Oil closed at $48.95 per barrel, and the 10-year Treasury rate closed at 1.70%. Bitcoin is trading around $670 per BTC today.

Dear Journal,

Bitcoin flirted with $800 last week before dropping all the way down to $630. Today it is hovering around $670. Such volatility is usually feared by the general public, and it is often cited as one of Bitcoin’s weaknesses. To me, this volatility is a beautiful example of price discovery in one of the freest markets on Earth.

Of course it is worth mentioning that we are discussing this price volatility in terms of the U.S. dollar conversion rate which is hardly a fixed measurement of value. Much of the global economy is accustomed to pricing goods and services in dollar terms which gives the illusion of price stability, but the U.S. dollar has fallen tremendously in purchasing power over the past several decades. I suspect the day will come when the global economy routinely prices goods and services in bitcoin terms rather than dollars.

Before we begin this entry, I need to emphasize my opinion that Bitcoin is not mutually exclusive. Bitcoin is not a replacement for physical cash, gold, or silver. This isn’t the one ring to rule them all. Instead, Bitcoin is the crest of a Hayekian wave of competing currencies.

There are already hundreds of cryptocurrencies in existence, and a handful of these maintain material market capitalizations. Bitcoin is by far the most popular cryptocurrency at this time, but it is still small potatoes in terms of both market acceptance and economic activity.

This is going to change, and it is going to change drastically. The reason: Blockchain technology.

Hundreds of millions of dollars in venture capital has poured into the Bitcoin ecosystem since the start of 2015, and much of this capital is focused on the development of Blockchain technology. Even the mega banks are now working on integrating the Blockchain into their legacy financial system in an effort to remain relevant.

When they talk about this on television and in the financial publications, they are very quick to state that they are not interested in Bitcoin as a currency; they are only interested in the Blockchain technology. This is obviously a psychological ploy to discourage the consumers of mainstream financial media from exploring Bitcoin.

Here’s a little secret: you can’t effectively separate Bitcoin from the Blockchain because Bitcoin is the unit of account that enables the proof-of-work consensus mechanism within the global Blockchain ledger. The two are a package deal.

You could replace Bitcoin with a proprietary unit of account, and the mega banks will, but you instantly lose the global proof-of-work consensus upon doing so. Then your Blockchain becomes a closed-source ledger that is no longer immutable or censorship-resistant… at which point it becomes vastly inferior to the open-source, borderless, transnational, immutable, incorruptible, censorship-resistant Blockchain ledger known as Bitcoin.

Now the mega banks’ Blockchain project is pretty much irrelevant as far as I am concerned – I mention it only to emphasize the inseparability of Bitcoin and the Blockchain before we talk about the really exciting applications for Blockchain technology.

One of the most important yet overlooked social mechanisms in the developed world is the institution of private property and the accompanying systems for titling land and real estate.

Private property is the foundation of commerce, yet a huge swath of economic activity occurs in places where no effective system for titling property exists. Even in the developed world, the process for obtaining proper deeds and titles is subject to centralization and counterparties which brings with it fees, costs, and taxes that skim off of every transaction.

One of the most fundamental uses for Blockchain technology would be to create a global standard for titling land and real estate. This would literally bring private property to billions of people all over the world who live in countries with corrupt, inadequate, or non-existent land titling systems.

Not only would this be a feel-good story for the liberated individuals, but it could also bring a flood of dead capital into the global marketplace. There is very little incentive to improve property in places where it is virtually impossible to obtain a legal title of ownership. Further, it is impossible to pledge this property as collateral to obtain the capital necessary to create or expand productive enterprises.

The Blockchain can provide cheap access to a land titling system for billions of people around the world which will inevitably drive commerce, spur production, and create wealth in places where very little currently exists.

Moving the land-titling function onto the Blockchain in the developed world would serve to dis-intermediate both governments and settlement attorneys which would make the transfer of these assets much cheaper.

The costs to transfer real estate are very small relative to the value of each real estate transaction, but the economic effect is cumulative. If you add up all of the fees, costs, and taxes from every real estate transaction then you will find that a very significant amount of money is siphoned off of real estate transactions on an annual basis. Put that money back into the economy instead of into the hands of the intermediaries and I think you would see good things happen.

Mind you, I don’t have a major issue with the real estate transaction fees as they currently exist. Recording and protecting private property is one of the few defined roles of government in the industrial world. We would all be much wealthier if governments had been mostly limited to this function over the past few centuries. Needless to say, I won’t lose too much sleep over Bitcoin reducing the role of government in everyone’s life.

As for settlement attorneys, I have found them to be most pleasant on every occasion, and they certainly deserve a fee for providing trusted escrow services. But I also found the people who used to pump your gas for you at full-service gas stations to be most pleasant also… that didn’t stop technology from rendering their job obsolete.

I suspect settlement agents will share similar obsolescence. All this means is that those individuals will have to reinvent themselves and their business, as will many others in the digital age. Nothing stays the same forever. The good news is that the world will have extra money with which to demand additional goods and services thanks to their real estate cost savings with Blockchain technology. This creates entrepreneurial opportunities.

Now let’s turbo-charge these cost savings.

Governments in the developed world are currently extracting tens of billions of dollars from their populations, and they are sending those funds to governments in the developing world as foreign aid. Since we just used the Blockchain to bring private property and the means for wealth creation to billions of people in the developing world, there would be no more excuses for foreign aid to corrupt and ineffective governments. What if we take those tens of billions of dollars and leave them in the hands of the people who earned them? I imagine economic activity would shoot through the roof…

So at this point Bitcoin has demonstrated that it can perform the money function and the land-titling function better than those currently providing these services. Let’s now set our sights on the enforcement of contracts and dispute settlement.

Because the Blockchain provides a permanent public ledger that cannot be altered or controlled, it is a terrific mechanism for recording and enforcing contracts.

Because the Blockchain provides a permanent public ledger that cannot be altered or controlled, it is a terrific mechanism for recording and enforcing contracts.

Enter: ‘smart contracts’.

Smart contracts are self-executing contracts, stored on the Blockchain, that use access to external data feeds and a cryptocurrency payment network to emulate the logic of contractual clauses. Here’s how this works:

Party A contracts Party B to perform a service for 3 BTC with delivery required within 1 month’s time. The terms of the agreement are input into a smart contract which is placed on the Blockchain and party A puts 3 BTC in escrow.

If the agreed upon terms are completed prior to the expiration date and then recorded as verified in the Blockchain then the smart contract will be triggered to release the escrow funds to Party B. If the terms are not completed by expiration then they will be recorded as failed on the Blockchain and the smart contract will be triggered to release the escrow funds back to Party A. This dis-intermediates expensive attorneys from the equation entirely.

Now if the contracting parties would like to have a concrete mechanism for dispute settlement in addition to their smart contract, they can hire a moderator to provide arbitration services should the need arise. This would be built into the smart contract right up front as the moderator would be required to decide who gets the funds in escrow if the terms were not recorded as completed. The moderator would take a small fee if his or her service were required.

Now Party A and Party B have dis-intermediated the government court-system from the equation as well. Just like earlier, the net cost-savings effect of this is cumulative. What if you took a huge portion of all attorney fees as well as costs related to the court system and you put that money back into the economy instead?

This list certainly isn’t definitive – there are some 180-odd applications suggested for the Blockchain – but let’s look at one more application in the interest of brevity.

Patrick Byrne, the CEO of Overstock.com, gave the keynote speech at the Mises Institute’s Austrian Economics Research Conference last year. In his talk, Patrick asked the audience members to raise their hands if they owned any stock… many hands went up.

“Every single one of you with your hand up is incorrect – none of you own any stock. That’s not how the system works.”

Patrick went on to explain how the system of securities settlement in the U.S. has divorced the transfer of money from the transfer of securities.

Anyone invested in the stock market has a broker – either full-service or discount online broker – who handles settlement for them. Most people think that these brokers just move money and stock around between the accounts of buyers and sellers. Indeed, that’s how the system did work prior to 1973 when brokers would transfer physical stock certificates and keep real-time ownership records.

Everything changed in 1973 with the creation of The Depository Trust & Clearing Corporation (DTCC). Settlement for securities transactions in the U.S. is now centralized within the DTCC, and all brokers involved in U.S. financial markets are plumbed into this private organization. So money and securities do not actually move between the accounts of buyers and sellers; they move between accounts housed centrally within the DTCC.

But the system takes centralization one step further. U.S. stocks are registered in the name of an organization called Cede & Co., which is a subsidiary of the DTCC. This means that Cede & Co. is the legal owner of the vast majority of all U.S. equities.

Unless you take the necessary steps to register the stock in your name, you do not technically own it. What you own is a contractual right, or I.O.U., to that stock.

Actually, it is even more complicated than that. Because there are several layers of counterparties, you really own a contractual right (your broker) to a contractual right (DTCC) to a contractual right (Cede & Co) of the stock that appears in your brokerage account.

Now this was all set-up during a time when records were not kept in computer databases, but on pieces of paper in filing cabinets. Record keeping in the financial markets had become extremely costly, inefficient, and problematic when this system was established. That’s why this system was set up.

Regardless, this system deliberately separates investors from their ownership rights which is antithetical to what a market-based society stands for. Not to mention, this system is extremely inefficient and fragile by our standards today as it is based upon forty-year old technology at its core.

Additionally, this separation of money and securities settlement is what enables the high-frequency trading machines to thrive in the equity markets. These are high-powered computers that run sophisticated algorithms programmed to move in and out of equity positions very rapidly over and over again aiming to profit from very small price movements – sometimes one cent or less per transaction. By all accounts, high-frequency trading has become a very large segment of all market volume. I have seen estimates placing high-frequency trading as high as 90% or so of all volume in the U.S. stock market.

Is this wrong?

Probably… High-frequency trading certainly boosts liquidity, but it also distorts market fundamentals. It seems to me that if you only acquire stocks with strict limit orders, and if you only base your stop-losses on closing prices then you can effectively cut through most of the high-frequency trading noise. But those retail investors who are still buying stocks with market orders and fretting over intra-day moves in prices are probably being fleeced by the high-frequency traders pretty consistently.

Well guess what? Securities settlement – both in the equity markets and the bond markets – is a fantastic application for the Blockchain. The Blockchain can return securities ownership directly to investors and enable peer-to-peer settlement in which the buyer sends money directly to the seller who delivers the security directly to the buyer. Peer-to-peer settlement on the Blockchain renders high-frequency trading, front-running, and market manipulation impossible.

Sounds pretty good right? Here’s the kicker – if you move the financial markets onto the Blockchain then you cut most of Wall Street right out of the picture and you make the SEC, FINRA, and most of the financial regulatory apparatus obsolete. There’s nothing for them to regulate because the Blockchain cannot be gamed or corrupted.

If you cut out the intermediaries and the regulators then you also cut out most of the commissions, fees, taxes, and overhead associated with the financial markets. Again, these costs are relatively minor for each individual transaction, but the cumulative total is gargantuan. If the Wikipedia entry on the DTCC is accurate, the company settled nearly $1.7 quadrillion in value worldwide in 2011. Even if total settlement costs including taxes average one quarter of one percent per transaction, we are still talking about more than $4 trillion in cumulative commissions, fees, and taxes.

Imagine what the world looks like if that $4 trillion worth of investable capital is left in the markets rather than siphoned off by Wall Street and government’s regulatory complex!

So we have just taken Blockchain technology and used it to provide a number of core civil service functions in a way that is vastly superior to what exists currently. We have saved trillions of dollars worth of fees, costs, and taxes in doing this, and those trillions of dollars will be left in the economy to drive economic growth – including in previously under-served areas.

You can only do these things if you have a global ledger that is open-source, borderless, transnational, immutable, incorruptible, and censorship-resistant. Right now that means Bitcoin is the only option. One day there may be a better open-source cryptocurrency option, but there will never be a better closed-source proprietary option.

What this means is that Bitcoin would be the unit of account for the Blockchain titling network, the Blockchain contract and dispute settlement network, and – probably most important for pricing – the Blockchain financial markets network. Essentially, the market value of everyone’s financial assets (stocks and bonds) would be priced in Bitcoin in this scenario. I am sure there would be conversion services available, but Bitcoin would be the default currency.

This alone tells me that Bitcoin’s potential for mass adoption and thus massive price appreciation is huge. Which is why I am buying the dips, and I am very bullish for the long-term future of human civilization despite all of the immediate challenges…

More to come,

Joe Withrow

Wayward Philosopher

We will be sending out the first issue of the Zenconomics Report next week absolutely free to members of our email list. The Zenconomics Report will cover market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends. We will track a small portfolio of stocks according to the Beta Investment Strategy, and the June dispatch will detail how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out. To join the Zenconomics Report mailing list, simply subscribe at this link: http://www.zenconomics.com/report.

The post Bitcoin and the Crypto Revolution appeared first on Zenconomics - an Independent Financial Blog.

June 14, 2016

What America Forgot

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

What America Forgot

June 14, 2016

Hot Springs, VA

“Think about this, Frances: For the past several thousand years of recorded history, humans lived at the edge of starvation, usually in abject poverty, perpetually at risk. But in just the past few centuries, and primarily in only one or two parts of the world, we suddenly develop medical science, cars, telephones, airplanes, refrigeration, central heating, electrical power, computers, and spaceships. Why here? And why now?” – James Farber, A Lodging of Wayfaring Men

The S&P closed out Monday at $2,079. Gold closed at $1,286 per ounce. Crude Oil closed at $48.56 per barrel, and the 10-year Treasury rate closed at 1.61%. Bitcoin is trading around $705 per BTC today.

Dear Journal,

As I mentioned in last week’s entry, wife Rachel and I just celebrated our third wedding anniversary, and this one may have been the best yet. There were no gifts, no fancy dinners, no nights out… Rachel didn’t even get me a card! I was so proud of her!

It reminded me of the Christmas following our engagement a number of years ago. With the wedding looming, we agreed not to give each other gifts for just one Christmas holiday in the interest of saving money.

Believing very strongly in contractual agreements, I followed through diligently on my end of the deal… Rachel did not. I found myself receiving several gifts from her on that Christmas morning, and I didn’t have even the tiniest trinket to offer in return. She was devastated!

I tried to plead my case: But I thought we agreed not to give each other gifts!?

Yeah, [sob] but I didn’t think you would actually not get me anything!

Oh, how far we have come. We spent the bulk of our third anniversary cleaning the house – something always needed with a 19-month young lady around.

After the work was complete, we found time to take the kayaks out onto the pristine Jackson River for the first time this season. There’s nothing capable of decluttering your mind like a peaceful afternoon float with no one else around except the geese and the otters…

the pristine Jackson River for the first time this season. There’s nothing capable of decluttering your mind like a peaceful afternoon float with no one else around except the geese and the otters…

On a slightly more exciting note – look at Bitcoin’s current price!

If you haven’t been following along with my market updates, Bitcoin is up 54% on the month, and 202% on the year! Of course we have seen this show before, but the case for Bitcoin is getting stronger by the day. Fortunately, I was finally able to talk wife Rachel into letting me buy a little BTC for her at the start of the year. I think I will keep the price appreciation a secret until I need a “get out of the doghouse” card.

I want to write more about some revolutionary uses of Bitcoin and the Blockchain in a later entry, but for today my inspiration lies elsewhere…

I should start by admitting that this title is 100% click-bait, by the way.

What America Forgot… come on! America is an Italian word referring to the geographic landmass dominated by the largest government in the history of mankind, and geographic landmasses are incapable of mental capacity.

Of course if one pays attention to the election cycle then one may confuse America for a statist beehive in which the masses are expected to labor unconditionally for the benefit of the queen bee who will then somehow provide for all the wants and needs of 320 million people with backgrounds, beliefs, cultures, work, incentives, desires, concerns, and lifestyles as diverse as the Earth is round.

The notion that a single bureaucratic policy or program could benefit millions of unique people strikes me as ridiculous, but it is clear that we have one – maybe two – generations of people in this country who have been brought up to believe that government is a cure-all for any problem, real or perceived.

What’s been forgotten is that government does not produce anything therefore it has nothing of its own to give. Before government can give anything to anybody, it must first take it from somebody else. What government takes from one to give to another is almost always used for consumption; not investment or production. Such a dynamic makes government the single leading destroyer of capital, production, and wealth the world has ever seen.

From the U.S. perspective, government largesse really only ramped up in the 1960’s with LBJ’s guns (Vietnam War) and butter (Great Society) campaigns. Of course you can point to the New Deal programs of the 30’s… or the Federal Reserve/Income Tax/Direct Election of U.S. Senators in 1913… or the War Between the States in the 1860’s… or the overthrow of the Articles of Confederation in 1789… as the roots of the problem, but the American spirit of commerce and independence really did not begin to wane until the welfare/warfare state became entrenched in the 1960’s.

My great-grandfather immigrated to the U.S. from Lebanon back in the early 1900’s in search of stability and opportunity. Lebanon was devastated by World War I and the Allied powers, upon victory, appropriated and redistributed land, rewrote historical borders, and asserted influence in the formation of new governments in a number of places, including Lebanon.

I can only assume that great-grandfather wanted nothing to do with any of that political foolishness. By the accounts retold to me, he was an industrious man seeking nothing but the freedom to build a quality life for his family by the sweat of his brow.

Along with several other Lebanese families, great-grandfather settled in a small city called Covington in the highlands of Virginia. Reportedly, the mountainous region reminded him of his homeland. He went on to open a restaurant heavily featuring Mediterranean-style cuisine, and I am told it was his restaurant, not an Italian counterpart, that served the first pizza in Covington.

Great-grandfather built a brick home on the top of “town hill” in Covington in 1930, and he tiered the side of the mountain behind the home into a Lebanese-style tiered garden to grow fresh vegetables. I grew up having Sunday lunch in this home, and it remains in our family to this day. I am fascinated by the architecture – including the majestic white columns adorning the spacious front porch as well as the old coal room in the basement.

Unlike the houses lining the suburban sprawl that has encompassed the U.S. over the past several decades, these old brick homes from the 20’s and 30’s were obviously built to last for generations.

There are undoubtedly hundreds of thousands of immigrant stories just like this one recounted by families all over the continental U.S. It was that commercial spirit and fierce independence that raised many families and communities to lives of comfort and stability. It was that same spirit which also could be counted on to aid the downtrodden in communities across the land.

Mutual aid societies were very prominent in the early 20th century. These were nonpartisan organizations, often structured in a non-hierarchical and non-bureaucratic fashion, dedicated to advancing mutualism, self-reliance, thrift, leadership, business training, and self-government. Mutual aid societies were 100% voluntary in that only those who wanted to join did so, but the organizations were not mutually exclusive.

Each society charged membership dues to cover costs, but they did much more than simply redistribute money to members in need. These societies actually built their own hospitals, orphanages, job exchanges, homes for the elderly, and they created scholarship programs. Many of these societies even employed their own doctors on a full-time basis!

Via the mutual aid model, people voluntarily pooled their capital and reinvested it right back into their community to increase health, compassion, commerce, and education.

Such a model was completely apolitical. Those who wanted to belong to a particular mutual aid society were free to do so, and they were free to leave whenever they wanted if they changed their mind later. Those who were not interested in joining any society were free to opt out entirely. No one was forced to do anything against their will within the mutual aid model. That’s called liberty.

Despite the obvious superiority of the mutual aid model in terms of effectiveness and non-coercion, governments at home and across the globe will not willingly give up their welfare states because welfare is what gives them moral cover for all of the wars, militarism, bureaucracy, corporatism, and cronyism that they also engage in. Give those up and what power do they have left?

In fact, the welfare model in every country today is based on the work of Otto von Bismarck, the Prussian President and 1st Chancellor of Germany, in the late 1800’s. Bismarck designed the welfare state specifically to capture the working man’s political support and make a large portion of the population dependent upon the central government so that it could expand its power and wealth without citizen push-back. Welfare was nefarious, not benevolent, by design.

Needless to say, Bismarck’s model has worked everywhere it has been tried.

The good news, for those who still possess the old American spirit of liberty, commerce, independence, non-coercion, and non-intervention, is that technology, Bitcoin, and the crypto revolution are enabling individuals to bypass the existing model of coercive social organization, and build systems, networks, and organizations capable of so much more on a voluntary basis. Perhaps that will be a topic for next week…

More to come,

Joe Withrow

Wayward Philosopher

We have just released the Zenconomics Guide to the Information Age to members of the Zenconomics Report email list. This guide is 28 pages in length, and it discusses: money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. We are offering a free copy to all new mailing list subscribers at this link: http://www.zenconomics.com/report.

The post What America Forgot appeared first on Zenconomics - an Independent Financial Blog.

June 7, 2016

Markets and Economic Calculation

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Markets and Economic Calculation

June 7, 2016

Hot Springs, VA

“Monetary calculation is not the calculation, and certainly not the measurement, of value. Its basis is the comparison of the more important and the less important. It is an ordering according to rank, an act of grading (Cuhel), and not an act of measuring.” – Ludwig von Mises

The S&P closed out Monday at $2,109. Gold closed at $1,247 per ounce. Crude Oil closed at $49.71 per barrel, and the 10-year Treasury rate closed at 1.72%. Bitcoin is trading around $585 per BTC today.

Dear Journal,

Wife Rachel and I will commemorate our third wedding anniversary tomorrow! When she asked me what I would like to do to celebrate, I naturally suggested that we could do anything in the world she wanted. Her response:

I would kind of like to do something fun, but I would settle for a major house cleaning day…

Does that mean we are officially marriage pro’s?

Moving on… I think this is a fascinating time to be alive. Based on what I know about recorded human history, I doubt there has ever been a more interesting point in time to be a keen observer of civilization. How lucky we are!

As I have reckoned on before, human civilization is currently transitioning from the Industrial Age and into the Information Age. Pre-Internet society was drastically different from post-Internet society, and indeed all of modern civilization has been made dependent upon a functioning Internet. This dynamic will only deepen as all of the Big Data and Internet-of-Things trends continue to play out.

While the Internet was a major inflection point, it was more-or-less integrated into the existing societal structure dominated by State power and centralized methods of social organization. I suspect we are speeding towards a second inflection point that very well may spawn structures, systems, networks, and organizations capable of bypassing the State-centric societal model. Maybe Bitcoin, Blockchain technology, and decentralized autonomous organizations (DAO) will be the catalyst.

I have been speculating quite a bit about the future in these journal entries recently, and every now and then someone calls out my soothsaying. “No one can predict the future!”, they say.

And I absolutely agree. The future, as far as I know, is unknowable – but it isn’t completely random either. We can observe the trajectory of prominent macroeconomic trends to get a general idea of future possibilities… assuming we are correct in our assessment and understanding of the observed trends.

Here’s the thing: the future will be directed by what works. If we see something that doesn’t work then we can reasonably project that it won’t exist at some point in the future. Conversely, if we see something that works extremely well then I think it has a great chance of being a prominent factor in the world of the future. I feel very comfortable with these statements, but I will add that the timeline for change seems impossible to project.

Which brings me to the next point of interest. Simultaneous to the expanding Information Age trends, we are rapidly approaching the end of the road for the current monetary system. With the break from gold in 1971, the global monetary system became an entirely different animal from that which had existed for most of civilized society previously.

It’s not very difficult to see that the fiat monetary system brought with it one-sided trends. All one has to do to confirm this is look at the data for the global reserve currency: the U.S. dollar.

The money supply has absolutely exploded since 1960:

Purchasing power has declined significantly as a result of this monetary expansion:

Interest rates have been declining steadily since the early 80’s, and they have been held at zero in the U.S. for more than seven years now thanks to the Fed’s interventions:

It doesn’t take much more than a basic understanding of economics and a little common sense to realize that these trends will not continue forever. One day these trends will reverse… although you can count on the “authorities” to fight off that day with everything they have. When that day comes, it is pretty easy to intuit that the massive public debt and unfunded liabilities which have accrued under this easy-money system will not be serviced honestly.

That’s a pretty bearish reality which keeps me up some nights. I don’t know exactly how much of the economy has become dependent on government liabilities, but I suspect it’s a very significant portion.

What happens if all Social Security beneficiaries and welfare recipients see their monthly benefits drastically reduced in terms of purchasing power? In other words, what happens if across the board a $1,200 benefit only buys $600 worth of goods and services?

I am very very concerned about this possible future.

But then other nights I think about all of the liberating technologies, systems, and networks currently in development and my perspective shifts to bullish.

It’s a tale of two cities in many ways.

As if this all weren’t interesting enough, a craft beer revolution – likely fueled at least in part by cheap credit – has placed some really interesting brews into the hands of philosophers, observers, and Bernie Sanders supporters everywhere. You can’t really appreciate the beauty and complexity of human civilization until you’ve done so with a “Dogfish Head” IPA in your hand.

There is one other fascinating societal dynamic that I observe and ponder with my Dogfish friend in hand, and that is the modified and modernized resurgence of Marxism in the western world.

Unlike the 19th and 20th century version Marxism, the modernized Marxists do not seem to advocate pure socialism including overt nationalization of the means of production or the abolition of private property. Instead, they seem to advocate increased taxation, regulation, wealth redistribution, and wage/price controls while pointing to the major wealth disparity between the power elite and the average worker as justification for government intervention.

They don’t seem to want to kill off private sector commerce, but they certainly advocate more centralized top-down control when it comes to social organization and the allocation of resources. Thomas Pikkety probably deserves a great deal of credit for the modernized Marxist revival.

I don’t think many people outside of Academia actually believe in socialism as an economic model anymore. Even the professed “Democratic Socialist” running for President in the United States doesn’t actually believe in socialism per its true definition. Professed socialists, including Mr. Sanders, would probably be better labeled – not that I particularly care for labels – as ‘New’ New Dealers.

What seems to be missed here is the verifiable fact that most of the wealth disparity that currently exists between the power elite and Main St. is due exclusively to the fiat monetary system and inflationary abuse by governments and central banks.

Scroll back up and look at the monetary expansion chart – all of that money had to go somewhere. And that “where” was government, their favored institutions (Wall Street, Defense Contractors, etc.), and special interest groups. The cronies closest to the new money that flowed to these institutions are the people who are now fantastically wealthy despite providing very little of value in return.

That’s not pure capitalism in action, and it’s certainly not a facet of the market system. It’s institutionalized theft and corruption. Further squeezing the market economy and shifting more power and wealth to the State will augment the problem, not solve it.

Markets work because they are a tool for economic calculation and the effective allocation of resources. Markets are not a tool for exploitation, as the Marxists suggest, but rather they are a tool for human progress.

The only way for a business to be successful in the marketplace is to provide satisfactory goods and/or services to people who want them. People do not purchase goods or services they don’t want, nor do they purchase goods or services that fail to meet their quality standards… at least not after reputations have been determined.

Profit is the measure of success. A business must be profitable to be successful, and it can only be profitable if it satisfies consumer needs and wants in a satisfactory way. In effect, and assuming no outside intervention, profits align the interests of business owners with the interests of consumers. The businesses that harm or defraud people will go out of business very quickly in a true market economy, thus minimizing their negative impact. There would be no subsidization or bail-outs for defunct businesses of questionable integrity.

Profits are determined by the price mechanism which ultimately determines how resources are allocated. Markets are not places where prices are ‘set’; they are places of constant price discovery.

Despite what the central bankers say on television, market corrections are necessary and welcomed features of a market-based system because they curtail shortages and surpluses. When something is scarce in availability but high in demand, human actors in the marketplace will value it very highly thus its price will be high. The businesses operating in that industry will derive substantial profits due to the high price which entices other entrepreneurs to launch competitive businesses in the same space. Typically this serves to increase availability over time which results in lower prices and ultimately lower profits which tends to deter marginal producers and entrepreneurs from allocating anymore resources to the particular industry.

Such is the self-regulating feature of the market system. Markets work because they auto-correct for scarcity, surplus, and demand via the price mechanism and the profit motive. The more markets are free to direct resources to areas of high demand, the more prosperous a civilization will become. Coincidentally, the most prosperous civilizations throughout history are always the most peaceful as well.

I tend to think that most people want peace and prosperity, at least for their self and their family. Some days I worry that this is the thought of a naive idealist as I have encountered a few people over the years who seemed to only want conflict and destruction. But then a story of amazing human achievement will come to my attention and my faith is restored.

Such is just the nature of human civilization, I suppose. The book of Matthew advised on this very dynamic some 2,000 years ago: Give not that which is holy to dogs; neither cast ye your pearls before swine, lest perhaps they trample them under their feet, and turning upon you, they tear you.

So assuming most people actually want peace and prosperity, a market-based society in which people are free from top-down control is the best road to get there. Markets work specifically because they enable economic calculation and efficient allocation of resources. U.N. commissions, congressional committees, communal politburos, and other top-down structures all fail because they make calculations and allocation decisions based on arbitrary judgment and politically-based opinions.

What’s beautiful about this is the fact that it is 100% in line with the Golden Rule and the core tenets of western civilization. Don’t kill. Don’t steal. Don’t harm others. Respect the property of your neighbors. Honor your contractual agreements. These are the rules of a market-based system.

Governments may claim to stand for these same things with egalitarian rhetoric mixed in, but in reality they are the largest sponsors of murder, theft, destruction, fraud, deceit, inequality, and cronyism the world has ever known.

I know such a statement upsets the apple cart, but I don’t see how this can honestly be refuted.

Governments across the globe killed hundreds of millions of people over the course of the 20th century. In the U.S. alone governments confiscate roughly $4 trillion from the people they allege to serve every single year. They pass arbitrary laws for victimless “crimes” by the thousands annually, and they will send agents with guns to arrest you if you fail to comply with their edicts. All across the globe, governments and central banks create trillions in new money every single year and they use this money to expand their power and wealth at the expense of everyone else.

In addition to the horrendous moral implications, all of this cronyism and State intervention gums up the wheels of commerce, destroys the purchasing power of the currency, and renders human civilization less wealthy and far less advanced than it otherwise would be.

If you ever sit up at night wondering about what happened to the “good old days”…. there’s your culprit. Markets and decentralized networks are your answer.

More to come,

Joe Withrow

Wayward Philosopher

We have just released the Zenconomics Guide to the Information Age to members of the Zenconomics Report email list. This guide is 28 pages in length, and it discusses: money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. We are offering a free copy to all new mailing list subscribers at this link: http://eepurl.com/bXyrQ1.

The post Markets and Economic Calculation appeared first on Zenconomics - an Independent Financial Blog.

May 27, 2016

Breaking the Authoritarian Cycle

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Breaking the Authoritarian Cycle

May 27, 2016

Emerald Isle, NC

“Are you for peace? The great test of your devotion to peace is not how many words you utter on its behalf. It’s not even how you propose to deal with people of other countries, though that certainly tells us something. To fully measure your “peacefulness” requires that we examine how you propose to treat people in your own backyard. Do you demand more of what doesn’t belong to you? Do you endorse the use of force to punish people for victimless “crimes”? Do you support politicians who promise to seize the earnings of others to pay for your bailout, your subsidy, your student loan, your child’s education or whatever pet cause or project you think is more important than what your fellow citizens might personally prefer to spend their own money on? Do you believe theft is OK if it’s for a good cause or endorsed by a majority? If you answered yes to any of these questions, then have the courage to admit that peace is not your priority. How can I trust your foreign policy if your domestic policy requires so much to be done at gunpoint?” – Lawrence W. Reed

The S&P closed out Thursday at $2,090. Gold closed at $1,222 per ounce. Crude Oil closed at $49.48 per barrel, and the 10-year Treasury rate closed at 1.82%. Bitcoin is trading around $474 per BTC today.

Dear Journal,

We have spent this past week on North Carolina’s beautiful “Crystal Coast”. As I look around at the rows of beach houses lining the island, I can’t help but imagine what this place looked like back in the early 1700’s when the legendary Blackbeard roamed these islands on the Queen Anne’s Revenge.

What secrets have been covered up by mass-development? How many hidden coves have been forgotten as we marvel over heated swimming pools by the sea with pool tables and mini-bars nearby? What drove commerce on these islands before tourism, seafood restaurants, and ice cream parlors?

Not that I am opposed to development. The market system has created wealth unimaginable by the pirates and fishermen who inhabited these islands three centuries ago.

Where they, I suspect, lived a simple life barely above sustenance, we sit on 3-story decks overlooking the sea with cold drinks in our hand.

Where plunder was a profitable venture for everyday folks like Blackbeard and his crew in the pre-capitalist world, only governments and their cronies are able to carve out a quality lifestyle via plunder today.

Where Blackbeard’s raids were periodic and limited to small fishing villages, governments are able to raid the wealth of entire nations today over and over again… and we still maintain a superior quality of life!

That’s how much wealth the market system has created in just a few short centuries.

At 19 months old, little Madison has different thoughts on her mind as she experiences sand between her toes for the first time in her life. Seemingly an individualist like her father, Madison strays from the group of children splashing, digging, and screaming to explore the beach on her own terms. She trudges through the dry sand ten or so steps at a time, then she bends down to examine the variety of sea shells waiting to be discovered.

Her father, careful not to disturb her exploration, follows slowly at a distance. He gazes out at the vast sea, seemingly infinite in scope and power, then he gazes back down at his little girl immersed in exploration… and he can’t help but notice the same scope and power within her. Then he turns his gaze back to the world at large, and his mood evens. It’s going to be an uphill battle…

Authoritarianism is everywhere today. The notion that it is a moral responsibility for individuals to unconditionally obey worldly authority is constantly propagated at seemingly every level of institutional society. This has created a world which seeks to curtail and control the infinite power and creativity inherent in every single human being.

Sadly, authoritarianism is thrust upon humans at a very young age by their parents. While Peaceful Parenting principles are growing in popularity, the dominate-and-control model of parenting is still widely employed.

This parenting model typically seeks to control and modify behavior by means of force and coercion. Proper action is rewarded with praise and treats; unacceptable action is punished with scorn and threats.

This model makes it decisively clear to children that they are to obey the edicts of their parents without question, no matter how arbitrary the edicts are. When they ask ‘why’, the children are likely to receive an emphatic “Because I said so!”. Parents employing this model will say things like:

“Do ‘this’ or you can’t do ‘that’!”

“Adults are talking – leave me alone and go play!”

“If you don’t share your toys then no one gets to play with them!”

“Stop crying or you will go to time-out!”

“Always do what your teachers say!”

I am so saddened when I witness this style of parenting because I know it is gradually eating away at the child’s willpower and creativity. It is setting them up to be compliant cogs in the institutional wheel, content to spend their entire lives following the orders of their superiors without question.

I know this sounds harsh, but I am confident that it is true for many children. I also know that the parents who employ this model do so because they think it is best for their children. Indeed, if they are going to subject their kids to the ills of a public school then such a model very well may be in their best interest so that they are not endlessly bullied and tormented for being non-conformists.

Which brings us to the next level of authoritarian programming: the public school system. I have written about this numerous times here, here, here, here, and here so I won’t commit any more detail to the topic in this entry. Suffice to say, the public school system was set up by governments to mold a compliant populace. Don’t take my word for this, take theirs.

Of course most kids mechanically go to an institution of “higher education” upon completing the K-12 system which serves to complete the authoritarian conditioning.

After sixteen years of state-sanctioned education, the idea that “might makes right” and “everyone must participate” is firmly entrenched in most young people. This is true on both sides of the modern political spectrum. The principles of voluntarism and non-coercion are nothing but a dreamer’s ideal or a radical’s credo in this environment.

But it looks like the tide is turning on the authoritarian paradigm. Socio-cultural conditions tend to move in cycles, and these cycles change when the economics of the existing paradigm changes. In other words, cycles change when the current model no longer pays.

Prior to capitalism, the fastest way to amass wealth was to take it from someone else by force. This is why Blackbeard roamed and pillaged the coast of North Carolina – it was much more profitable than small-scale fishing.

Market capitalism changed the economics of coercion and theft. Within the market system, the fastest way to amass wealth was to create goods and services that other people wanted. The capital markets and voluntary exchanges that developed enabled the scalability of production and distribution to make this profitable.

In just the same way, the economics of authoritarianism are very clearly changing right before our eyes.

For the past one hundred years or so, it has paid for the average person to submit to the authoritarian model. There was an unwritten and unspoken deal that made submission worthwhile. In exchange for obedience, governments would offer free primary education, free or highly-subsidized higher education, a strong job-market, social safety nets and welfare programs, and retirement programs capable of providing a decent standard of living in old-age.

For your part, all you had to do was go to school, get good grades, go to college, graduate with a decent GPA, take your place in the workforce, and vote for one of the two acceptable political parties in each election.

These promises are crumbling rapidly.

The quality of public education at all levels is likely as low as it has ever been. I suspect the value of public education is negative in many cases. The industrial job-market is being hollowed out by technology, automation, and robotics which is leading to large unemployment rolls. The welfare state is speeding towards a collapse as governments all over the world continue to rack up unsustainable debt and unfunded liabilities.

Only empty rhetoric and subtle propaganda keep public confidence in these promises from disappearing, but cracks are widening in the authoritarian model at every level.

Parents are gradually realizing that they can craft a world-class education for their children outside of the traditional school system. They are starting to understand that they can implement simple strategies for their children to make the welfare state completely obsolete. Parents are starting to realize that encouraging a fundamental understanding of money, economics, and finance is far more beneficial to their children than the memorization of meaningless facts.

People are beginning to realize that they have all the tools necessary to engage in commerce and earn a living without needing permission or approval from anyone else. They can now transact using money that is completely outside of State control. People are beginning to realize that their government confiscates a huge portion of their earnings while providing very little real value in return. And they are beginning to see that politics is already dead.

The authoritarian cycle may linger on for a while longer as the trends continue to play out, but I suspect its days are numbered.

More to come,

Joe Withrow

Wayward Philosopher

We have just released the Zenconomics Guide to the Information Age to members of the Zenconomics Report email list. This guide is 28 pages in length, and it discusses: money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. We are offering a free copy to all new mailing list subscribers at this link: http://eepurl.com/bXyrQ1.

The post Breaking the Authoritarian Cycle appeared first on Zenconomics - an Independent Financial Blog.

May 18, 2016

The Future of Money

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Future of Money

May 18, 2016

Hot Springs, VA

“Just like the Internet gave information back to the people, Bitcoin will give financial freedom back to the people. But that’s only the first step… Bitcoin will allow us to shape the world without having to ask for permission. We declare Bitcoin’s independence. Bitcoin is sovereignty. Bitcoin is renaissance. Bitcoin is ours. Bitcoin is.” – Julia Tourianski

The S&P closed out Tuesday at $2,047. Gold closed at $1,280 per ounce. Crude Oil closed at $48.54 per barrel, and the 10-year Treasury rate closed at 1.759%. Bitcoin is trading around $457 per BTC today.

Dear Journal,

Wife Rachel: Honey, look! Madison has a pet caterpillar in this jar! She put leaves and twigs in there so it can eat and turn into a butterfly…

Philosopher Joe: Oh… why does it look like all of the oxygen has been sucked out of the jar?

Wife Rachel: What do you mean…?

Philosopher Joe: Did you punch holes in the top to let air in?

Wife Rachel: Wha… oh crap.

Spring is in full swing here in the mountains of Virginia. The caterpillars are crawling, the butterflies are flying, the wildflowers are blooming, and the all-encompassing green foliage is a bright celebration of new life!

Pretty soon it will be time to dust off the kayaks and enjoy the serenity that is the crystal-clear waters of the Jackson River as it snakes through the highlands of the Virginia-West Virginia border. Not too long after that, the leaves will light up the sky with majestic shades of red, orange, and yellow, and the crisp morning air of Autumn will breeze in.

I don’t think I appreciated the changing seasons much in my younger days. At least I didn’t think much about them. Today, I marvel at the spontaneous order of nature’s cycles. They remind me that there is a time and a place for everything. They also remind me that nothing lasts forever.

The concept of complete impermanence is a difficult one for humans to accept. We tend to suffer from the normalcy bias – the notion that tomorrow’s world will be the same as today’s.

But impermanence is everywhere. Each of us are alive on this Earth for a very short period of time, and our entire world is constantly changing while we are here. We grow up, strike out on our own, watch our parents age, have children, and watch them grow. Then our children grow up, leave the house, and watch us age. Like nature, life is cyclical.