Joe Withrow's Blog, page 26

October 20, 2016

Transcending Politics

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Transcending Politics

October 20, 2016

Hot Springs, VA

“Just as the technology of printing altered and reduced the power of medieval guilds and the social power structure, so too will cryptologic methods fundamentally alter the nature of corporations and of government interference in economic transactions… And just as a seemingly minor invention like barbed wire made possible the fencing-off of vast ranches and farms, thus altering forever the concepts of land and property rights in the frontier West, so too will the seemingly minor discovery out of an arcane branch of mathematics come to be the wire clippers which dismantle the barbed wire around intellectual property. Arise, you have nothing to lose but your barbed wire fences!” – Timothy C. May

The S&P closed out Wednesday at $2,144. Gold closed at $1,270 per ounce. Crude Oil closed at $51.72 per barrel, and the 10-year Treasury rate closed at 1.75%. Bitcoin is trading around $630 per BTC today.

Dear Journal,

Today is little Maddie’s birthday! I still remember, two years ago to the day, witnessing her first breath of life. I can see it in my mind’s eye just a clearly as I see the computer screen in front of me. She has become a fantastically sweet and clever young lady in two years time, and her father’s cup runneth over with pride and joy.

Due to scheduling constraints, we actually celebrated her birthday on Tuesday. A few months back I asked Madison what she wanted to do for her birthday. “I want to ride Leo the horse!”, she responded without hesitation. So that’s exactly what we did.

In addition to basic sustenance and security, I see it as my responsibility to share in the discovery of Maddie’s interests and, if possible, help bring them to life for her. This was my first real opportunity to do so, and the smile on her face was the greatest reward a father could receive.

Shifting gears… we are now less than three weeks away from yet another ‘most important election’ in U.S. history. In fact, this election will determine the fate of human civilization… or so we are told.

To me, if you will excuse my being blunt, this is just another mass-ritual dedicated to an obsolete institution designed during the bronze age in the third millenium BC. I look around this world and I see very few things less important than this election – or any election for that matter. The fact of the matter is: top-down politics is an idea whose time has passed; it’s just not that important for your personal well-being. I believe that very firmly.

My reasoning is simple – you do not need politics or its promises. In fact, they are all false promises in the first place. Politics produces nothing and its institutions have nothing to give. All politics can do is force productive people to fund uneconomical programs using the threat of excessive fines and ultimately imprisonment to coerce compliance.

Maybe that’s not how they put it on the campaign trail, but that’s what they are championing: mandatory social programs by means of force, coercion, and violence.

Oh, and those funds they do receive via this means are then funneled through layer upon layer of bureaucracy and special interests. What comes out the other side in the form of useful services is very disproportionate relative to what went in.

Now this is nothing groundbreaking – people have been decrying government inefficiencies ever since the modern nation-state model took form in the late 1800’s. But their solution has always been to reform government and reshape political programs according to their own ideas regarding equality and necessity. If we just had the right people in office…, they say.

Usually those ‘right people’ never show up. Occasionally they do, yet the just reforms they promised fail to be so just. So everyone dutifully marches back out to the voting booth when the next election rolls around.

I offer these observations as merely that – observations. It is not my place to tell others what to do or how to live. That’s their business. I would prefer, however, that they not use politics to take income away from my family to finance programs that I see as unjust, unnecessary, and as a consequence will never use. I would also prefer that they not use politics as a means of initiating force, coercion, and violence against innocent people.

But I have learned that the world very rarely consults me about my preferences, so the best I can do is take care of my own affairs. And getting back to my earlier point, it was in the act of taking care of my own affairs that I came to realize you simply don’t need politics for anything.

Every single civil service function currently performed by governments can now be performed much better and much more equitably by local communities, private businesses, private charities, mutual aid organizations, religious organizations, families, concerned individuals, and decentralized systems based on Blockchain technology – all without requiring force, coercion, and violence as a means of funding and enforcement.

Let me explain with just a few examples.

There has been a major fuss for years now about health insurance, which politics misidentifies as “healthcare”. Politics has been meddling in this area for quite some time now which has led to rising costs and diminishing returns over time. Politics offered you its latest “healthcare” program in 2009, and it will offer you another when this one blows up.

You don’t need it. You can participate in a health cost-sharing network right now and get far better coverage for a substantially lower monthly expense. I mean substantially lower.

Liberty Healthshare is the most prominent network that I know of, but there are others. These cost sharing networks each will have their own policies and underwriting guidelines, but all that means is there are opportunities for people who don’t like what’s currently available to create their own networks. A successful blueprint already exists.

Before we move on, I should mention that “healthcare” has nothing to do with insurance; it is what you do for yourself. Eat well, exercise regularly, get adequate sleep, avoid stress… that type of thing.

Let’s move on to education. Many still consider schooling to be a function of the State and thus subject to political involvement. Once again, you don’t need their education. In fact, I would suggest that their education actually is a net-negative. Sure, it provides basic reading, writing, and arithmetic… but it also fails miserably to prepare kids for the world that awaits them upon graduation.

You can build a world-class education that educates, inspires, and empowers your children by pairing online resources with local homeschooling meet-ups and real world experiences. I have written about alternative models of education extensively.

And how about retirement? A cornerstone of Otto von Bismarck’s model nation-state, upon which all modern nation-states are based, was a national pension system. The idea was to force workers to contribute to the national system for their entire working lives and then provide a monthly income to them once they retired. Of course the average life expectancy wasn’t much more than fifty years old at the turn of the 20th century, so Otto didn’t think the State would have to pay for retirees too long.

So national pension systems – Social Security in the U.S. – have become a fixture, but you don’t need them. Demographics and a lack of real actuarial work have created a scenario in which inflation-adjusted monthly income from these systems will necessarily diminish over time – very significantly in places where extreme unfunded liabilities have accrued like the U.S.

There are plenty of alternative options here, but I have shared how one single strategy requiring no more than $250 per month for 15 or 20 years can become a million dollar pension system. That’s without delving into the financial markets or any complex investment vehicles. Anyone can do this. Pair this strategy with a sensible asset allocation model and you will really be set for life.

The last item I will touch on is my favorite: money.

Bitcoin has divested monetary issuance and control from the State and the central banking cartel and transferred it to a borderless, transnational, immutable, incorruptible, and censorship-resistant currency network that is distributed in nature and completely decentralized.

Bitcoin offers participants complete payment freedom, and it makes every user the President and CEO of his or her own bank while eliminating identity theft, fraud, charge-backs, and eradicating fees in the process.

Further, the underlying Blockchain technology is fantastically useful for a whole host of civil service functions. The Blockchain could perform these services far more effectively, far cheaper, and without the possibility for gaming, corruption, lobbying, or special interests – quite contrary to its political counterpart. I have written about some of these possibilities here.

Want something more tangible? Goldmoney is a company that offers gold-backed financial accounts which makes it possible to transact in gold very easily. Goldmoney provides multiple accounts to cater to a range of needs, be they reliable savings, international payments, business transaction processing, or long-term wealth protection.

So when I say that you don’t need politics for anything, I mean it quite literally. This isn’t philosophical or theoretical, the technology and infrastructure to replace politics already exists. These are just a few examples, but there are many others.

The necessary decentralized systems and networks are being built as we speak, and they are being built while the rest of the world fixates on Trump versus Hillary. Nobody is asking for permission to build or join these Gamma systems, and by the time they are taken seriously by the reactionary bronze-age political institutions seeking to protect their monopoly, it will be way too late. By then, any aggressive attempts to attack these systems will trigger the “Streisand effect” which will speed up the process of widespread adoption.

I suppose I should add that the decentralized nature of these systems makes them immune to censorship or shut-down because there is no single point of failure. There’s no CEO to shake down, no central office to raid, no central server to shutter… everything is distributed across a global network. There’s just no way to kill software that runs on millions of computers across the globe simultaneously.

If everyone were to opt-in to these Gamma systems causing politics to fade into obscurity, the cost savings would total in the trillions and those trillions would be left in the economy to spur productivity, innovation, and wealth creation. Today those trillions are siphoned off by administrative bureaucracy and special interest groups, never to be seen again. Everyone would benefit tremendously from this, but those currently underserved by the existing status quo would benefit the most because they would finally have an even playing field.

But of course everyone is not going to immediately opt-in to these systems and politics is not going to immediately fade into obscurity. Instead, most people will go along with whatever politics says they should go along with, and politics will continue on about its business… for now. Come back in twenty years and I bet you will see a completely different picture, however.

What is happening right now, just beneath the gaze of most, is the formation of an alternative world. Instead of hierarchy, power, and monopoly, this new world is based on voluntary association, mutual collaboration, and participatory networks. Instead of seeking to dominate and control individuals, this new world seeks to empower them.

This brave new voluntary world will not be forced upon anyone, but all will be welcomed. Nor will the new world forcefully replace its bronze-age counterpart, but it will eventually make it obsolete. As public debt continues to grow, unfunded liabilities continue to accrue, geo-political tension continues to build, and as the institutional foundation of the industrial world continues to crumble, more and more people will seek out alternatives to the status quo. When they are ready, these Gamma systems will be waiting for them.

Lest I send the wrong signal, the future is not homogeneous nor is it particularly orderly. I am not proclaiming a coming utopia. I don’t mean to suggest that voluntary human association will always and everywhere triumph over the force, coercion, and violence of politics. What I am suggesting is that opting out of politics will finally be a viable option. Indeed, it already is.

Arise, you have nothing to lose but your barbed wire fences!

More to come,

Joe Withrow

Wayward Philosopher

We are offering an advanced digital copy of The Individual is Rising: 3rd Edition absolutely free to members of the Zenconomics Report. The book is focused on actionable strategies to transcend the industrial order and build a prosperous custom-tailored life utilizing Information Age technology, tools, and networks.

Here are some examples of what The Individual is Rising: 3rd Edition delivers:

How the monetary system evolved over the last century to pave the way for mass centralization

An examination of the greatest Ponzi scheme ever attempted and what happens when it implodes

The truth about the Social Security Trust Fund

What prominent macroeconomic trends mean for the global financial system

How Industrial Age solutions have morphed into Information Age problems

Why the conventional road to success is now a dead end

A practical vision for education in the digital age

Why the institutional foundations of the industrial world are crumbling all around us

The future of money, commerce, and jobs – and how to capitalize on these trends

Information Age tips and tricks, including how to secure your digital communications

Why the digital economy is facilitating decentralization and a new opportunity for individual liberty

How to use asset allocation to build an antifragile investment portfolio

How to build and manage an equity portfolio

How to build a position in Bitcoin utilizing proper good practices and risk management

How to implement the Beta Investment Strategy

How to achieve Financial Escape Velocity

How to utilize the Infinite Banking Concept to shatter the industrial world’s glass ceiling

The two fundamental means of acquiring wealth

Learn a generational financial strategy capable of financing your child’s education with no student loans or bank loans necessary

How to be more self reliant than 99% of the population

Why distributed Gamma systems are rendering centralized civil service functions obsolete

How the Crypto Revolution is set to liberate trillions worth of dead capital within the global economy and spark a second Renaissance

Welcome to the Information Age!

To join the Zenconomics Report mailing list and receive a digital copy of the book, simply subscribe below or at http://theindividualisrising.com/:

#af-form-1783859745 .af-body .af-textWrap{width:98%;display:block;float:none;}

#af-form-1783859745 .af-body .privacyPolicy{color:#64635E;font-size:11px;font-family:Verdana, sans-serif;}

#af-form-1783859745 .af-body a{color:#094C80;text-decoration:underline;font-style:normal;font-weight:normal;}

#af-form-1783859745 .af-body input.text, #af-form-1783859745 .af-body textarea{background-color:transparent;border-color:#C7C7C7;border-width:1px;border-style:solid;color:#000000;text-decoration:none;font-style:normal;font-weight:normal;font-size:24px;font-family:Verdana, sans-serif;}

#af-form-1783859745 .af-body input.text:focus, #af-form-1783859745 .af-body textarea:focus{background-color:#FFFFFF;border-color:#030303;border-width:1px;border-style:solid;}

#af-form-1783859745 .af-body label.previewLabel{display:block;float:none;text-align:left;width:auto;color:#030303;text-decoration:none;font-style:normal;font-weight:normal;font-size:12px;font-family:Verdana, sans-serif;}

#af-form-1783859745 .af-body{padding-bottom:15px;padding-top:15px;background-repeat:no-repeat;background-position:inherit;background-image:none;color:#64635E;font-size:11px;font-family:Verdana, sans-serif;}

#af-form-1783859745 .af-header{padding-bottom:9px;padding-top:9px;padding-right:30px;padding-left:30px;background-color:#FFFFFF;background-repeat:no-repeat;background-position:inherit;background-image:none;border-width:1px;border-bottom-style:none;border-left-style:none;border-right-style:none;border-top-style:none;color:#64635E;font-size:16px;font-family:Verdana, sans-serif;}

#af-form-1783859745 .af-quirksMode .bodyText{padding-top:2px;padding-bottom:2px;}

#af-form-1783859745 .af-quirksMode{padding-right:30px;padding-left:30px;}

#af-form-1783859745 .af-standards .af-element{padding-right:30px;padding-left:30px;}

#af-form-1783859745 .bodyText p{margin:1em 0;}

#af-form-1783859745 .buttonContainer input.submit{background-image:url("https://forms.aweber.com/images/auto/... left;background-repeat:repeat-x;background-color:#0057ac;border:1px solid #0057ac;color:#FFFFFF;text-decoration:none;font-style:normal;font-weight:normal;font-size:14px;font-family:Verdana, sans-serif;}

#af-form-1783859745 .buttonContainer input.submit{width:auto;}

#af-form-1783859745 .buttonContainer{text-align:center;}

#af-form-1783859745 body,#af-form-1783859745 dl,#af-form-1783859745 dt,#af-form-1783859745 dd,#af-form-1783859745 h1,#af-form-1783859745 h2,#af-form-1783859745 h3,#af-form-1783859745 h4,#af-form-1783859745 h5,#af-form-1783859745 h6,#af-form-1783859745 pre,#af-form-1783859745 code,#af-form-1783859745 fieldset,#af-form-1783859745 legend,#af-form-1783859745 blockquote,#af-form-1783859745 th,#af-form-1783859745 td{float:none;color:inherit;position:static;margin:0;padding:0;}

#af-form-1783859745 button,#af-form-1783859745 input,#af-form-1783859745 submit,#af-form-1783859745 textarea,#af-form-1783859745 select,#af-form-1783859745 label,#af-form-1783859745 optgroup,#af-form-1783859745 option{float:none;position:static;margin:0;}

#af-form-1783859745 div{margin:0;}

#af-form-1783859745 fieldset{border:0;}

#af-form-1783859745 form,#af-form-1783859745 textarea,.af-form-wrapper,.af-form-close-button,#af-form-1783859745 img{float:none;color:inherit;position:static;background-color:none;border:none;margin:0;padding:0;}

#af-form-1783859745 input,#af-form-1783859745 button,#af-form-1783859745 textarea,#af-form-1783859745 select{font-size:100%;}

#af-form-1783859745 p{color:inherit;}

#af-form-1783859745 select,#af-form-1783859745 label,#af-form-1783859745 optgroup,#af-form-1783859745 option{padding:0;}

#af-form-1783859745 table{border-collapse:collapse;border-spacing:0;}

#af-form-1783859745 ul,#af-form-1783859745 ol{list-style-image:none;list-style-position:outside;list-style-type:disc;padding-left:40px;}

#af-form-1783859745,#af-form-1783859745 .quirksMode{width:100%;max-width:505px;}

#af-form-1783859745.af-quirksMode{overflow-x:hidden;}

#af-form-1783859745{background-color:#FFFFFF;border-color:#CFCFCF;border-width:1px;border-style:solid;}

#af-form-1783859745{display:block;}

#af-form-1783859745{overflow:hidden;}

.af-body .af-textWrap{text-align:left;}

.af-body input.image{border:none!important;}

.af-body input.submit,.af-body input.image,.af-form .af-element input.button{float:none!important;}

.af-body input.text{width:100%;float:none;padding:2px!important;}

.af-body.af-standards input.submit{padding:4px 12px;}

.af-clear{clear:both;}

.af-element label{text-align:left;display:block;float:left;}

.af-element{padding-bottom:5px;padding-top:5px;}

.af-form-wrapper{text-indent:0;}

.af-form{text-align:left;margin:auto;}

.af-header{margin-bottom:0;margin-top:0;padding:10px;}

.af-quirksMode .af-element{padding-left:0!important;padding-right:0!important;}

.lbl-right .af-element label{text-align:right;}

body {

}

Subscribe to the Zenconomics Report for our monthly dispatch on money, markets, and finance and we will send you a digital copy of the The Individual is Rising: 3rd Edition absolutely free!

Name:

Email:

We respect your email privacy

The post Transcending Politics appeared first on Zenconomics - an Independent Financial Blog.

September 29, 2016

The Only Debate Topic That Matters

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Only Debate Topic That Matters

September 29, 2016

Hot Springs, VA

“Loading up the nation with debt and leaving it for the following generations to pay is morally irresponsible. Excessive debt is a means by which governments oppress the people and waste their substance. No nation has a right to contract debt for periods longer than the majority contracting it can expect to live. ” – Thomas Jefferson

The S&P closed out Wednesday at $2,171. Gold closed at $1,327 per ounce. Crude Oil closed at $47.12 per barrel, and the 10-year Treasury rate closed at 1.57%. Bitcoin is trading around $605 per BTC today.

Dear Journal,

Nearly one-third of all Americans – almost 100 million people – tuned in to watch the first presidential debate earlier this week. This represents an increase in viewership by nearly 40% from the 2012 presidential debates, and it almost rivaled television’s biggest draw – the Super Bowl – which received 112 million viewers last year. Apparently the debate was aired on television throughout Europe as well.

I see these numbers and the first thing that pops into my head is a question: how in the world do the ratings agencies know how many people are sitting on the couch in front of a given television?

I didn’t spend too much time with this, but all of the numbers I have seen reference “viewers” and “people”, not “households”. They are very specific about this.

I can’t help but think about poor Winston in George Orwell’s 1984 – he sits down in front of his telescreen and while he is watching it, it is also watching him…

In any case, I am happy to report that I am in the two-thirds majority of people who did not tune in for the first presidential debate. I did skim through the highlights, however, and I was not surprised to see that the single most important issue which will impact hundreds of millions of people negatively was not discussed.

That issue is the U.S. government’s accrual of $200 trillion in unfunded liabilities.

This number is not carried anywhere on the books, but it is very real. In short, these are future financial commitments that have been made to citizens for which there is no revenue support and no real asset backing. The bulk of these unfunded liabilities are related to Social Security and Medicare, but this will have a widespread impact that spreads well beyond those two programs.

Demographics show that 10,000 people in the United States are turning 65 every single day for the next ten years. All of those people have been taxed their entire working lives to fund Social Security and Medicare with the expectation that they will be made whole upon reaching retirement age themselves.

But both of these programs already run deficits to the tune of tens of billions of dollars every year, and that deficit is only going to grow as all of the people reaching retirement age sign up for Social Security and Medicare. Project this dynamic out, along with numerous other insolvent programs, and that’s where the $200 trillion in unfunded liabilities comes from.

How can the U.S. government finance any of the expenditures that the presidential candidates called for on Monday night when it is already on the hook for $200 trillion to the very people who’s productive efforts have supported it for the past 40 or 50 years?

Do you think Uncle Sam will tell the nice elderly couple next door that he has to cut back on their Social Security payments? Do you think he will tell them that he cannot cover their medical expenses anymore?

I doubt it.

Instead, I suspect Uncle Sam will do what he has always done when he came up a little short. He will create some Treasury Bonds and try to sell them to foreign central banks with the promise to tax everyone in his sight perpetually to service the debt. Then when foreign central banks only buy a very small fraction of the bonds he needs to sell, Uncle Sam will call up his friends at the Federal Reserve and ask them to buy the rest. The folks at the Fed will then create a few journal entries on their computer and – voila! – they now have the dollars necessary to buy the bonds. So Uncle Sam sends the bonds over to the primary dealer who delivers them to the Fed. The Fed delivers the money to the primary dealer which keeps a cut for itself and then delivers the rest to Uncle Sam.

So the Feds get their bonds, Uncle Sam gets his money, the Bank gets its cut, and the nice couple next door get their Social Security check. Everybody is happy!

But there is a limit to this magic money machine… the devil is in the details.

This is a bit of a simplification, but as the new dollars work their way into the general economy, they necessarily reduce the value of all dollars in existence. We see this in the form of rising prices on goods and services. This effect is not instantaneous nor is it equally distributed, and there are other factors at play, but over time the act of inflating the money supply raises costs of living across the board. So the elderly couple next door still get their Social Security check every month, but their dollars don’t stretch as far when they go to the grocery store.

Further, because Treasury Bonds are a debt instrument, Uncle Sam is now deeper in debt; debt that he must pay interest on. This means Uncle Sam needs even more money to consistently meet his obligations.

So the act of creating new money also created new debt which created a future need for even more money… uh oh!

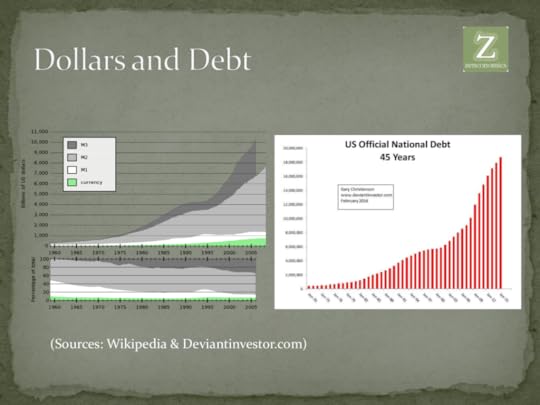

Take a look at these two charts comparing the expansion of the money supply on the left to the growth of U.S. national debt on the right. You can see the two go hand-in-hand.

As the debt grows, the declining marginal utility of credit expansion diminishes since more and more new money is required for debt-service. The monetization of government debt locks the system into a death spiral.

To me, this is the only debate topic that truly matters because this alone has the power to drastically reduce the standards of living of hundreds of millions of people regardless of what happens with any other issue.

But of course you can’t talk about the inner workings of a debt-based monetary system and still produce the riveting sound bites necessary to keep nearly 100 million people glued to their television screen. It took me all morning just to write about it, partly because it is so boring that I kept thinking about all of the other things I could be doing with my time.

I suppose the fact that there is no true political solution to this problem is a factor also. It’s hard to stand up and tell people its broke and unfixable, and then say: Vote for me!

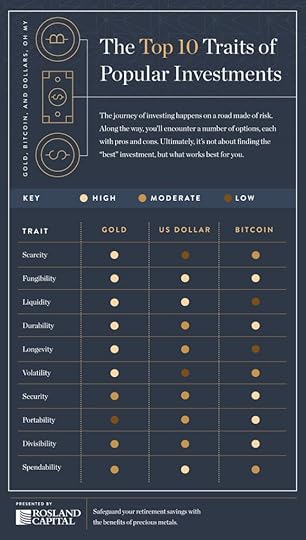

Fortunately, you don’t need political solutions… you can create your own solution. Take a look at this graphic created by Rosland Capital from some information on their gold IRA page.

This graphic illustrates why both gold and Bitcoin are superior to the U.S. dollar, both as a monetary instrument and as an asset class.

One of the first steps towards creating your own solution to the inevitable problems associated with the unfunded liabilities is to build a healthy position in both gold (and silver) and Bitcoin as part of an antifragile asset portfolio. For me, I think precious metals should make up at least 10% of an asset portfolio. For Bitcoin, I think 3-5% is a good benchmark.

As the dollar continues to devalue, I think we can absolutely expect to see higher prices for both gold and Bitcoin in dollar terms. So we are basically shielding our capital from the ill-effects of Uncle Sam’s debt binge and the Fed’s monetary inflation.

Gold and Bitcoin are the only two financial assets that are not simultaneously someone else’s liability. More accurately, they are the two financial assets that hold no counterparty risk. Compare this to the U.S. dollar, whose primary counterparty is $19 trillion in debt with accrued liabilities totaling $200 trillion.

Currencies come and go, but the precious metals are constant. J.P Morgan himself testified before Congress in 1912: “Gold is money. Everything else is credit”. I suspect the day will come when that statement will apply to Bitcoin as well.

We offer a primer on asset allocation to all members of the Zenconomics Report, including how to acquire and manage these assets. Additionally, our monthly newsletter is focused on how to leverage these macroeconomic trends in your favor to build a small fortune over the next 3-5 years.

You don’t have to be a victim to the monetary madness that is playing out in real time. Educate yourself, master your finances, build an antifragile asset portfolio, work towards financial escape velocity, secure your digital communications, and utilize participatory Gamma systems where relevant, and I think you can create a brilliant future for yourself regardless of what the rest of the world does. These are all items we cover in the Zenconomics Report.

Ralph Waldo Emerson wrote: “The good news is that the moment you decide that what you know is more important than what you have been taught to believe, you will have shifted gears in your quest for abundance. Success comes from within, not from without.”

It’s your call…

More to come,

Joe Withrow

Wayward Philosopher

For out-of-the box coverage of market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends, please join the Zenconomics Report!

We also track a small portfolio of stocks according to the Beta Investment Strategy, and the monthly newsletter explains how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out.

As a bonus, we include a report detailing everything you need to know about managing an investment portfolio in our Assess, Mitigate, Implement, and Prosper, and we also include a 28-page guide to the Information Age with all new subscriptions.

To join the Zenconomics Report mailing list, simply subscribe below or at http://www.zenconomics.com/report:

#af-form-303128095 .af-body .af-textWrap{width:98%;display:block;float:none;}

#af-form-303128095 .af-body .privacyPolicy{color:#000000;font-size:11px;font-family:Verdana, sans-serif;}

#af-form-303128095 .af-body a{color:#880303;text-decoration:underline;font-style:normal;font-weight:normal;}

#af-form-303128095 .af-body input.text, #af-form-303128095 .af-body textarea{background-color:#FFFFFF;border-color:#919191;border-width:1px;border-style:solid;color:#000000;text-decoration:none;font-style:normal;font-weight:normal;font-size:12px;font-family:Verdana, sans-serif;}

#af-form-303128095 .af-body input.text:focus, #af-form-303128095 .af-body textarea:focus{background-color:#FFFAD6;border-color:#030303;border-width:1px;border-style:solid;}

#af-form-303128095 .af-body label.previewLabel{display:block;float:none;text-align:left;width:auto;color:#880303;text-decoration:none;font-style:normal;font-weight:normal;font-size:12px;font-family:Verdana, sans-serif;}

#af-form-303128095 .af-body{padding-bottom:15px;padding-top:15px;background-repeat:no-repeat;background-position:inherit;background-image:none;color:#000000;font-size:11px;font-family:Verdana, sans-serif;}

#af-form-303128095 .af-footer{padding-bottom:20px;padding-top:20px;padding-right:75px;padding-left:10px;background-color:transparent;background-repeat:no-repeat;background-position:top right;background-image:url("//forms.aweber.com/images/forms/pointer..., sans-serif;}

#af-form-303128095 .af-header{padding-bottom:22px;padding-top:1px;padding-right:10px;padding-left:75px;background-color:transparent;background-repeat:no-repeat;background-position:inherit;background-image:url("//forms.aweber.com/images/forms/pointer..., sans-serif;}

#af-form-303128095 .af-quirksMode .bodyText{padding-top:2px;padding-bottom:2px;}

#af-form-303128095 .af-quirksMode{padding-right:10px;padding-left:10px;}

#af-form-303128095 .af-standards .af-element{padding-right:10px;padding-left:10px;}

#af-form-303128095 .bodyText p{margin:1em 0;}

#af-form-303128095 .buttonContainer input.submit{background-image:url("https://forms.aweber.com/images/auto/... left;background-repeat:repeat-x;background-color:#ac0000;border:1px solid #ac0000;color:#FFFFFF;text-decoration:none;font-style:normal;font-weight:normal;font-size:14px;font-family:Verdana, sans-serif;}

#af-form-303128095 .buttonContainer input.submit{width:auto;}

#af-form-303128095 .buttonContainer{text-align:center;}

#af-form-303128095 body,#af-form-303128095 dl,#af-form-303128095 dt,#af-form-303128095 dd,#af-form-303128095 h1,#af-form-303128095 h2,#af-form-303128095 h3,#af-form-303128095 h4,#af-form-303128095 h5,#af-form-303128095 h6,#af-form-303128095 pre,#af-form-303128095 code,#af-form-303128095 fieldset,#af-form-303128095 legend,#af-form-303128095 blockquote,#af-form-303128095 th,#af-form-303128095 td{float:none;color:inherit;position:static;margin:0;padding:0;}

#af-form-303128095 button,#af-form-303128095 input,#af-form-303128095 submit,#af-form-303128095 textarea,#af-form-303128095 select,#af-form-303128095 label,#af-form-303128095 optgroup,#af-form-303128095 option{float:none;position:static;margin:0;}

#af-form-303128095 div{margin:0;}

#af-form-303128095 fieldset{border:0;}

#af-form-303128095 form,#af-form-303128095 textarea,.af-form-wrapper,.af-form-close-button,#af-form-303128095 img{float:none;color:inherit;position:static;background-color:none;border:none;margin:0;padding:0;}

#af-form-303128095 input,#af-form-303128095 button,#af-form-303128095 textarea,#af-form-303128095 select{font-size:100%;}

#af-form-303128095 p{color:inherit;}

#af-form-303128095 select,#af-form-303128095 label,#af-form-303128095 optgroup,#af-form-303128095 option{padding:0;}

#af-form-303128095 table{border-collapse:collapse;border-spacing:0;}

#af-form-303128095 ul,#af-form-303128095 ol{list-style-image:none;list-style-position:outside;list-style-type:disc;padding-left:40px;}

#af-form-303128095,#af-form-303128095 .quirksMode{width:100%;max-width:225px;}

#af-form-303128095.af-quirksMode{overflow-x:hidden;}

#af-form-303128095{background-color:#CFCFCF;border-color:transparent;border-width:1px;border-style:solid;}

#af-form-303128095{display:block;}

#af-form-303128095{overflow:hidden;}

.af-body .af-textWrap{text-align:left;}

.af-body input.image{border:none!important;}

.af-body input.submit,.af-body input.image,.af-form .af-element input.button{float:none!important;}

.af-body input.text{width:100%;float:none;padding:2px!important;}

.af-body.af-standards input.submit{padding:4px 12px;}

.af-clear{clear:both;}

.af-element label{text-align:left;display:block;float:left;}

.af-element{padding-bottom:5px;padding-top:5px;}

.af-form-wrapper{text-indent:0;}

.af-form{text-align:left;margin:auto;}

.af-header,.af-footer{margin-bottom:0;margin-top:0;padding:10px;}

.af-quirksMode .af-element{padding-left:0!important;padding-right:0!important;}

.lbl-right .af-element label{text-align:right;}

body {

}

Monthly Market Analysis and a Model Stock Portfolio – Free Newsletter!

Build a small fortune in 3-5 years by capturing this major macroeconomic trend!

First Name:

Email:

We respect your email privacy

The post The Only Debate Topic That Matters appeared first on Zenconomics - an Independent Financial Blog.

September 20, 2016

Maximize Capital; Minimize Crap

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Maximize Capital; Minimize Crap

September 20, 2016

Hot Springs, VA

“He achieved success who has lived well, laughed often, and loved much;

Who has enjoyed the trust of pure women, the respect of intelligent men and the love of little children;

Who has filled his niche and accomplished his task;

Who has never lacked appreciation of Earth’s beauty or failed to express it;

Who has left the world better than he found it,

Whether an improved poppy, a perfect poem, or a rescued soul;

Who has always looked for the best in others and given them the best he had;

Whose life was an inspiration;

Whose memory a benediction…

To know that even one life has breathed easier because you have lived,

This is to have succeeded.” – Bessie Anderson Stanley

The S&P closed out Monday at $2,139. Gold closed at $1,316 per ounce. Crude Oil closed at $43.80 per barrel, and the 10-year Treasury rate closed at 1.70%. Bitcoin is trading around $608 per BTC today.

Dear Journal,

The first leaves of Autumn have begun to fall, and each new morning is now accompanied by a light breeze. Little Maddie seems to share her father’s love of the season, as she enthusiastically gathers black walnuts from the yard to feed the squirrels.

Here, squirrel, squirrel, squirrel… I have an apricot for you!

Yeah, she calls the walnuts apricots. I am not sure where that came from.

Madison has also been debriefed on the proper way to carve a jack-o-lantern, and I test her knowledge daily.

“Maddie, what’s the first thing we have to do to make a jack-o-lantern?”

“We have to carve the top and get the gunk out!”

“And what are we going to do with the gunk?”

“We are going to throw it on mommy!”

“…I think you are ready, kiddo.”

It is truly the simple things that make this life worth living.

We spend most of our time in these journal entries and especially in the Zenconomics Report discussing complex topics within the world of money, finance, and economics, but that is only because we want to be able to enjoy the simple things.

You just can’t enjoy the simple things if you have to spend most of your time and energy struggling to get by financially, and the only way to avoid struggling financially is to understand how the game works… which may be the world’s best-kept secret.

I have been working to complete the third edition of The Individual is Rising, and I am quite pleased with how it is turning out. The first two editions were loaded with information, but not nearly as practical and actionable as they should have been. The third edition is far superior in this regard so today I would like to share an excerpt from the chapter titled Maximize Capital; Minimize Crap.

By the way, we will be offering an advanced digital copy of the book absolutely free to members of the Zenconomics Report. Please join our network here to receive your advanced copy before the book hits the shelves.

Maximize Capital; Minimize Crap is the mantra that guides me daily.

There are plenty of people in this world who work hard, day after day, in pursuit of success… without defining what success is. To me, success is freedom – freedom to do what I want, when I want, and with whom I want. Such a desire is incompatible with working a traditional job all day, but it is also incompatible with being broke.

I know my definition of success may sound petty on the surface, but I am almost entirely uninterested in entertainment. I am interested in financial freedom specifically to work on meaningful projects which I think can make this world a more dynamic place. My observations suggest to me that most of those who achieve financial freedom share this view – they prefer meaningful work to mindless entertainment.

Now there is one way, and only one way to achieve this type of freedom. If you want to be free in this world then you must produce more than you consume and save the difference. Doing so will build a growing pool of capital which can then be used for investment. At the same time, you must minimize the acquisition of items void of utility. This does not require you to be cheap, but it does require delayed gratification.

Production–>Saving–>Capital–>Investment. This is the only way freedom works which is why every single political intervention in the economy fundamentally curtails freedom for somebody.

Studies show that people who are able to willfully forego instant gratification in favor of longer-term goals are much more successful than those who are not. Conspiracy theories aside, this is the primary secret of Old Money, and it is why most fortunes are lost within one or two generations.

While genetics almost certainly factor into one’s ability to delay gratification, psychologists have found it is the development of will-power through actual use that plays the most prominent role. This suggests to me that parents have an important duty to help their children develop will-power. Of course adults have a duty to themselves to practice delayed gratification even if they never received early parental support.

Some geo-theorists actually believe this very concept can explain why certain cultures are very rich relative to other cultures. There seems to be a hint of truth to this…

Switzerland is one of the richest nations in the world, but it is nearly void of natural resources entirely and it is very difficult to grow food in Switzerland. In contrast, most African nations are very poor despite teeming with natural resources and arable farmland.

If you take a look at the map, this is a common pattern. Generally speaking, cultures that developed in colder climates with fewer natural resources tend to be more successful than others. Geo-theorists suggest this is because those cultures developed a patient, forward-looking mindset out of necessity. In other words, those cultures became very good at delaying gratification.

I suspect this cultural emphasis on delayed gratification is fading in our modern era of fiat currency capitalism, but this does not have to be the case for you. Whenever you are making a financial decision just remember the mantra: Maximize Capital; Minimize Crap. It will guide you well.

So how does one go about maximizing capital and minimizing crap? I think one must first acknowledge several painful truths:

Our monetary system is dishonest; it is used to transfer wealth from the masses to the central bankers and the politicians.

Our money is dishonest; it constantly loses purchasing power and it is backed by nothing but an $19,000,000,000,000 (and growing fast) debt.

Our educational system is dishonest; it is designed to produce compliant workers accustomed to taking orders uncritically.

Mainstream personal finance is dishonest; it is designed to maximize Wall Street’s profits by steering individuals exclusively into proprietary, heavy-commission paper equities.

The accepted conventional wisdom held by most people is wrong when it comes to the above mentioned subjects.

Now, do not allow these painful truths to anger you. This book points them out not to encourage you to fight against them, but rather to encourage you to understand them and formulate your financial plan accordingly.

It is unlikely that anyone will be able to change these dishonest systems by fighting against them directly. But fighting simply is not necessary in the Information Age; technology provides you with all of the tools necessary to transcend these dishonest systems.

So if you can accept and come to terms with these painful truths then you will be able to formulate a plan for maximizing capital. Unfortunately, those around you will not understand why in the world you are executing that plan… get used to that. Conventional wisdom considers any plan other than working hard and following mainstream personal finance to be risky or weird.

The reason so many people firmly believe in the conventional wisdom of personal finance is because it appeals to their educated common sense. Work hard, get raises, buy stuff, and invest disposable income in managed mutual funds through an IRS qualified retirement vehicle is a sensible plan for those who went through the educational system without doing any of their own research. After all, everyone does it this way!

As such, I feel it is prudent for this book to spend a little more time demonstrating why conventional personal finance is not only flawed, but also very dangerous. And I think the best place to begin is with the discussion of money.

So what is money?

We know what money does – it purchases goods and services. But can we define it?

Is it a green piece of paper with numbers, words and symbols printed on it? Is it a card with your name, a string of numbers, and a bank logo on it? Or is that just a piece of paper and a piece of plastic?

The short answer is that money is a unit of account that serves as a medium of exchange. But this is an incomplete view. In order to be sustainable, money must have several definitive characteristics:

Money must be durable. It should be able to serve as a store of value over long periods of time.

Money must be portable. It should be practical to settle transactions with – either in person or electronically.

Money must be divisible. It should be easy to break money down into consistent smaller units that add up to consistent larger units. This is to say that you should be able to make change out of monetary units.

Money must be fungible. It should be interchangeable; each unit of money should be consistently the same.

Money must possess value. Truthfully, this one is a bit tricky because all value is subjective. That is to say, something is valuable only when people assign value to it.

As such, value is not really intrinsic, but an item’s utility does prompt the assignment of value. When it comes to money, the most important facet is that it be relatively scarce and limited in quantity – otherwise people would be less interested in trading goods, services, or labor in exchange for it.

This being said, I hope you immediately recognize the flaws with using fiat currency as money. Fiat currency is certainly portable, divisible, and fungible so it has been able to serve as money, but fiat currency is not durable and it is certainly not limited in quantity. Governments and central banks have created more than ten trillion worth of fiat currency on a global scale, out of thin air, in just the past eight years alone.

This is why so many people struggle financially today. They simply do not understand that their struggles have much more to do with the abusive money system they are forced to use and not so much their own inability to manage their lives and earn a living.

My grandfather raised five children solely on a railroad worker’s salary. Assuming the job still existed, this would be nearly impossible today. The reason: inflation-adjusted wages have been stagnant since the 1970’s, but costs of living have exploded ever-higher. The corruption of the monetary system is the primary culprit.

So let’s talk about specific solutions…

More to come,

Joe Withrow

Wayward Philosopher

For out-of-the box coverage of market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends, please join the Zenconomics Report!

We also track a small portfolio of stocks according to the Beta Investment Strategy, and the monthly newsletter explains how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out.

As a bonus, we include a report detailing everything you need to know about managing an investment portfolio in our Assess, Mitigate, Implement, and Prosper, and we also include a 28-page guide to the Information Age with all new subscriptions.

To join the Zenconomics Report mailing list, simply subscribe below or at http://www.zenconomics.com/report:

The post Maximize Capital; Minimize Crap appeared first on Zenconomics - an Independent Financial Blog.

September 5, 2016

The Gamma Phenomenon

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

The Gamma Phenomenon

September 5, 2016

Hot Springs, VA

“Humanity in our time remains in infancy. We are essentially unlimited creatures, yet we have been wallowing in abject poverty – physically, mentally, and spiritually. We have natures that are suited to high adventure, yet we remain stagnant. Why? Because we’ve been conditioned only to exist, not to live.” – Prester John, A Lodging of Wayfaring Men

The S&P closed out Friday at $2,180. Gold closed at $1,329 per ounce. Crude Oil closed at $44.25 per barrel, and the 10-year Treasury rate closed at 1.60%. Bitcoin is trading around $605 per BTC today.

Dear Journal,

Little Madison is approaching her second birthday, and somehow she has already picked out her own birthday gift. “I want to ride Leo the horse…”, she says with a hopeful sparkle in her inquisitive blue eyes.

Naturally, her father considers all of the things that could possibly go wrong in such a scenario. Do you want to mommy or daddy to ride with you?

No! I want to ride all by myself.

As best I can tell, to observe a toddler is to observe human nature in its purest form… before all of the social conditioning, group-think, and peer pressure begin to alter behavior.

Assuming this is correct, the need for high adventure, exploration, and excitement seems to be embedded into the core of human nature. Madison possesses a zeal for life, and she does not tolerate any restrictions on her freedom to play and explore. Any curtailment, indeed even the threat of curtailment, is met with fierce resistance and extreme displeasure.

While it can be inconvenient at times, wife Rachel and I respect this, and we intervene only when necessary for health or safety reasons. We strive to be honest and consistent in our parenting, and we hope this approach will set a good example for Madison. After all, it strikes us as hypocritical to tell Madison it is wrong to use force or coercion against others, only to turn around and use force and coercion against her as a convenient means of behavior modification.

But then I look out at the world beyond my front door, and I can’t help but notice that the bulk of industrial civilization is built around the use of force and coercion as a means of behavior modification…

This seems to be a common topic that finds its way into much of my unscripted writing, and for quite some time I didn’t really know why.

Why do I take issue with the coercive model of top-down social organization when most people – including the people most harmed by the political policies forced upon them – do not? Sure, most people favor a particular political party and they despise the other, but very few question the model in its entirety.

So why do I… is it a character flaw? After all, this state-centric model does work to achieve a certain degree of order and stability albeit with certain injustices built in. Sure, it could be a lot better… but it could also be much worse. Why does it bother me so?

I found my answer within one of Doug Casey’s periodic essays that come to me via email from Casey Research. In this particular essay, Casey detailed a sociological experiment conducted on lab rats by scientists in a controlled environment.

What the experiment demonstrated matched up rather well with what the scientists expected: the rats created a top-down social structure with a few ‘Alpha’ rats asserting dominance over a large number of ‘Beta’ rats. The Alphas established territories, claimed choice mates, and basically lorded their dominance over the Betas. Amongst the Betas, a few seemed to help enforce the Alphas’ territorial claims while the vast majority were content to simply follow the rules and do the best they could under the circumstances.

The scientists were surprised to find a few rats that exhibited a third personality type, however. These rats seemed to exhibit some Alpha traits in that they staked out territories and assertively chose mates, but what puzzled the scientists was the fact that these rats appeared completely uninterested in competing with the Alphas or dominating the Betas. These rats were not submissive, but neither were they authoritarian. This was a break from what the scientists expected, and they called this the ‘Gamma’ personality type.

While nobody will compare humans to lab rats, it is pretty obvious that the personality types from this experiment translate over into a human equivalent. In fact, I would wager that you immediately thought of people you know who match up with these different personality types quite well.

It is clear that some people aggressively strive to reach the top of the social ladder, and they don’t mind flashing their status or asserting their dominance once they do. It is equally clear that other people are rule-followers who do not think themselves qualified for top positions, but they do legitimize the rules set by people in high places. And of course some people just aren’t much interested in playing, and no amount of scolding or ridicule can change their mind.

With lab rats these characteristics appear to be purely genetic in nature, but I suspect environment and experiences – especially during childhood – play a significant role in the development of human personality traits. These personality types aren’t absolute in humans, but instead we possess certain traits and tendencies which blend these personality types together.

Whatever the reasons, I suppose I possess a heavy dose of Gamma traits, which is why I cannot approve of force and coercion as a means of social organization.

Once this came to my attention, I began to notice that the Gamma personality is not as rare as I originally thought… it’s just that many Gammas have never been exposed to philosophy that gives life to their core personality. Instead, their social conditioning has presented to them an Alpha-Beta world in which they could never really fit in.

As such, I suspect most Gammas feel like loners in this world to a large degree. Their personality traits tend to make them fiercely independent, somewhat introverted, slow to talk about themselves, uncomfortable in large groups, and notoriously bad at social organization; so they are slow to meet and network with people of like mind.

The fact that the Gamma personality is an affront to both Alphas and Betas doesn’t help, either. To the Alphas, the Gamma is a weak underachiever because he refuses to aggressively seek positions of power and status. To the Betas, the Gamma is a deviant with no respect for rules or customs because he seeks to distance himself from the established order.

For the Gamma, the Information Age is a light in the darkness. For the first time in history, the Gamma can build and join alternative systems and participatory networks capable of existing in parallel with the Alpha-Beta status quo. This sounds quite strange to people not familiar with the topic, but there now exist Gamma systems capable of providing core services and functions previously monopolized by monolithic state-corporate institutions. Here are a few examples:

Bitcoin (and a whole host of smaller cryptocurrencies) completely separates money from the state and the central banking cartel, and it makes every man the CEO of his own bank. Further, Bitcoin dis-intermediates the middle men and enables people to send money to anyone, anywhere, at any time almost instantly, almost for free, with no restrictions whatsoever.

Open Bazaar is a distributed, decentralized digital marketplace that directly connects buyers and sellers on a global scale. Open Bazaar is similar to digital marketplaces like eBay, except it cuts eBay out of the picture entirely because it is a network, not a company. Instead of central servers, middle man fees, and third party oversight, Open Bazaar’s network enables each individual user to act as his or her own server. In addition to cutting out fees, this model also eliminates censorship and restrictions on trade.

Demon Saw is a secure and anonymous information sharing platform that enables users to chat, message, and share files with one another in a completely private manner. Popular social media platforms and standard file storage platforms capture and store all of your data and communications, thus violating your privacy and exposing you to security risks. For example: as this journal entry is being published, a hacker is selling data from 68 million Dropbox accounts on the dark web. Demon Saw solves these problems and enables people of like-mind to network, organize, and share data in a way that is both private and secure.

Maid Safe is building a network capable of decentralizing the Internet. This project is very much in its infancy, but it pools the computing resources of users to create a global network that cuts out the third parties and centralized servers which currently store, monitor, and monetize virtually all data.

BitNation: Governance 2.0 is a platform that enables individuals to literally create their own nations and pool their resources to provide core civil functions including identification services, security services, emergency response services, educational networks and information exchanges, global employment exchanges, and Bitcoin debit card services. BitNation even has its own space agency currently working to develop rockets, balloons, and drone technology. BitNation also provides notary services to record marriage contracts, wills, birth certificates, child care contracts, land titles and business deals, and similar items on the Blockchain public ledger. Additionally, BitNation enables the establishment of embassies and consulates, though this requires the acceptance of other nations.

If this sounds too crazy to be true, established geographic nations such as Estonia and Liberland already offer e-citizenship to people from anywhere in the world. Of course there is an application process, and e-citizenship does not include physical residency, but it does provide useful services – especially for entrepreneurs.

This competition between nations for citizens was predicted back in the 90’s in one of my favorite books titled The Sovereign Individual by James Dale Davidson and the late William Rees Mogg. The authors speculated that the rise of the digital economy would make it difficult to maintain territorial monopolies by force and coercion alone, thus creating an environment in which governments had to actually provide useful services in an efficient manner in order to keep their most productive citizens.

I have already written about how land-titling and real estate transfer functions, as well as trading and securities settlement in the capital markets can – and eventually will – be moved to the Blockchain public ledger so I won’t spend any additional time on those topics.

Also, this is just an abbreviated list. No single person can realistically keep up with all of the decentralized networks, platforms, and applications currently under development.

The world is changing, and it is changing fast.

The beauty in all of this is that these networks, platforms, and applications are 100% voluntary – they are Gamma systems. No one is forced to join any of them, but all are welcomed. If you like your current system, you can keep your current system. If you would like to be a part of this brave new voluntary world that is forming, you are free to choose your own level of involvement.

The future is yours to create…

More to come,

Joe Withrow

Wayward Philosopher

For out-of-the box coverage of market updates, major events in the financial markets, the evolution of monetary policy, and how to position your finances to benefit from developing macroeconomic trends, please join the Zenconomics Report!

We also track a small portfolio of stocks according to the Beta Investment Strategy, and the monthly newsletter explains how we think anyone can build a small fortune over the next several years by catching a major financial trend that is just now beginning to play out.

As a bonus, we include a report detailing everything you need to know about managing an investment portfolio in our Assess, Mitigate, Implement, and Prosper, and we also include a 28-page guide to the Information Age with all new subscriptions.

To join the Zenconomics Report mailing list, simply subscribe below or at http://www.zenconomics.com/report:

The post The Gamma Phenomenon appeared first on Zenconomics - an Independent Financial Blog.

August 31, 2016

The Zenconomics Report August Issue

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Zenconomics Report August Dispatch

August 31, 2016

Hot Springs, VA

The S&P closed out Tuesday at $2,176. Gold closed at $1,314 per ounce. Crude Oil closed at $46.42 per barrel, and the 10-year Treasury rate closed at 1.57%. Bitcoin is trading around $573 per BTC today.

Dear Journal,

The August issue of the Zenconomics Report has gone out to members of our network. In this issue:

Low trading volumes and little volatility in the financial markets this month… The state of the sovereign debt markets… Two large banks pass on negative interest rates to clients… The latest on monetary-financed fiscal programs in Japan… Global investment demand for gold the highest on record for the first half of 2016… All eyes on the Federal Reserve next month… A quiet change to IMF’s special drawing right currency… A correction hits the gold stocks sector… the Zenconomics Report Model Portfolio updates… Two new additions to our model portfolio

This month we added two new positions to our model portfolio which is constructed according to the Beta Investment Strategy. This portfolio is designed to capitalize on the prominent macro trends in the world of finance, and it is built to be fluid and flexible when trends change.

The Zenconomics Report is 100% independent, and all opinions are our own. It is also 100% free, though it is only available to members of our network. For access, simply sign-up using the form below or at http://www.zenconomics.com/report.

New members receive access to all previous monthly issues, and we will also send you two free reports as a ‘thank you’ for subscribing.

Assess, Mitigate, Implement, and Prosper is a report detailing the concept and implementation of asset allocation. Asset allocation is about strategically spreading your capital out across several different asset classes, and it is a critical part of the Beta Investment Strategy. This report also covers the ins-and-outs of managing an investment portfolio, including the risk management techniques that everyone should understand before putting a dime into the stock market.

The Zenconomics Guide to the Information Age is a 28 page report covering money, commerce, jobs, Bitcoin wallets, peer-to-peer lending, Open Bazaar, freelancing, educational resources, mutual aid societies, the Infinite Banking Concept, peer-to-peer travel, Internet privacy, and numerous other Information Age tips and tricks with an eye on the future. This guide is designed to be very practical – each section is loaded with action items – but it is also written to be entertaining as well.

To financial freedom!

The post The Zenconomics Report August Issue appeared first on Zenconomics - an Independent Financial Blog.

August 23, 2016

Monetary History in Ten Minutes

submitted by jwithrow.

Click here to get the Journal of a Wayward Philosopher by Email

Journal of a Wayward Philosopher

Monetary History in Ten Minutes

August 23, 2016

Hot Springs, VA

“Money, moreover is the economic area most encrusted and entangled with centuries of government meddling. Many people – many economists – usually devoted to the free market stop short at money. Money, they insist, is different; it must be supplied by government and regulated by government. They never think of state control of money as interference in the free market… If we favor the free market in other directions, if we wish to eliminate government invasion of person and property, we have no more important task than to explore the ways and means of a free market in money.” – Murray Rothbard

The S&P closed out Tuesday at $2,183. Gold closed at $1,343 per ounce. Crude Oil closed at $46.81 per barrel, and the 10-year Treasury rate closed at 1.58%. Bitcoin is trading around $585 per BTC today.

Dear Journal,

Little Maddie is rapidly approaching her second birthday, and I swear she is going on twelve. Like her mother, Madison is quite adept at the art of talking, and she communicates with us very well. This makes life so much easier when she tells us exactly what she wants for dinner; it makes life just a touch more difficult when she wakes up in the wee hours of the morning and tells us she wants to watch Mickey Mouse.

While this seems terribly inconvenient to her parents now, I can only imagine how immaterial it will seem when Maddie is a teenager and we just hope she comes home before the wee hours of the morning. Nevertheless, it all makes perfect sense when she looks up at us with her blue eyes shining bright and says I love you sooo much!

Moving on to finance…

Today’s journal entry is actually an excerpt from The Individual is Rising. Along with watching Mickey Mouse episodes at 5:00 in the morning, I have been working to complete the third edition of the book which will be published this Autumn. I am excited about how this edition has shaped up because it is loaded with practical philosophy, opportunities, and actionable financial strategies; more-so than the first two editions.

We will be offering an advanced digital copy of the book absolutely free to members of the Zenconomics Report before it hits the shelves at Amazon. Simply enter your name and email address into the form at the end of this entry to join our network and receive an advanced copy.

What’s so important to understand about the evolution of the monetary system is the fact that it has directly shaped the very world in which we live. Money is half of every transaction thus half of the entire economy, and most people spend most of their time working for money. Like it or not, this dynamic makes money one of the single most important items in everyone’s life. As such, we would be wise to know its story. Here’s a brief monetary history:

Prior to the rise of central planning, most of the world operated on the gold standard through which international trades were settled in gold.

While not perfect, the classical gold standard kept nations mostly honest in their financial dealings with each other. It also forced nations to live within their means because large trade deficits had to be settled in gold which drained gold from the nation’s reserves. Conversely, when a nation ran a trade surplus it received additional gold to add to its reserves. Such a system placed limits on national debt and encouraged sound finance because the incentives were properly aligned.

World War I effectively put an end to the classical gold standard. To finance the war effort, the countries involved looked to currency inflation to expand their money supply and they suspended trade settlement in gold. Most of these nations attempted to go back to the gold standard once the war was over, but the excessive money-printing distorted valuations and the necessary economic corrections were not politically desirable, so the classical gold standard was never re-implemented.

During the same time period, the shift towards central planning in America led to the creation of the Federal Reserve System in 1913. It is important to note here that the Federal Reserve (the Fed) is not a government agency, but rather a quasi-private central bank (actually a consortium of banks that act as one unit) exclusively chartered by the U.S. government to centrally manage the banking system.

Not coincidently, two centralizing amendments to the U.S. Constitution were passed in that same year. The 16th Amendment created the national income tax which brought the IRS to power. The 17th Amendment established the direct election of U.S. Senators whom were previously elected by state legislatures. This effectively snuffed out any remaining sparks of States’ rights that had survived President Lincoln’s water hose.

Though the foundation had already been set, the year Nineteen Hundred and Thirteen ramped up the centralization process and set the stage for the greatest economic boom ever witnessed. As we have seen throughout history, centralization can lead to a tremendous boom in the short term, but it is always followed by either an epic bust or a long march down the road to serfdom.

Upon opening its doors, the Federal Reserve monopolized control over the currency supply and it functioned as a banker’s bank – as the lender of last resort. Naturally this created moral hazard within the banking system as the banks were free to pyramid large amounts of debt on top of capital reserves with the Fed ready to step in and provide them with liquidity should their increasingly riskier financial bets go bad.

With the Fed’s banking cartel established, member banks could lever up their balance sheets for outsized profits with the knowledge that the Fed would print money for them to prevent bank runs. This was sold as a progressive feature of the system, but in reality it incentivized unsound lending practices and credit expansion en masse. We are still living with the effects of this moral hazard today, and we saw in 2008 that significant losses within the banking sector will be socialized to perpetuate the system.

The Fed quickly took on additional functions as America moved further towards coerced collectivism in 1933 with the onslaught of the New Deal. To support the myriad of New Deal welfare programs, Franklin Delano Roosevelt (FDR) issued an executive order that closed the domestic gold window and criminalized the private ownership of gold by American citizens. This was done because the domestic gold window limited inflation since Americans could redeem paper dollars for gold at any time. This direct redemption of dollars for gold served to contract, or deflate, the money supply which limited the Fed’s ability to monetize government debt.

With Americans no longer free to redeem their dollars for gold, the Fed could backstop the New Deal programs by inflating the currency supply with little resistance. Foreign central banks were still allowed to redeem dollars for gold, however, which served as a partial constraint to the inflationary regime.

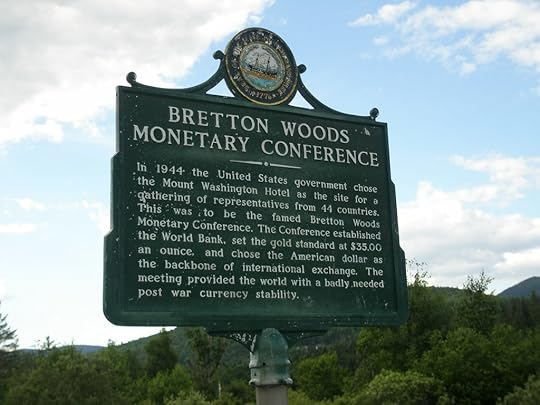

In 1944, representatives from 44 nations of the world met in Bretton Woods, New Hampshire to discuss a new international monetary system needed to replace the classical gold standard which had been dismantled by the world wars. The agreed upon ‘Bretton Woods System’ established the U.S. dollar as the international reserve currency.

As the world’s sole reserve currency, the dollar replaced gold as the medium for international trade settlement. This meant that all international goods would be bought and sold in U.S. dollars no matter which nations were doing the buying and selling. The dollar would remain pegged to gold at $35 per ounce and other nations could redeem their dollars for gold through the ‘gold window’.

The dollar’s convertibility into gold on demand was to serve as a ‘check’ on the United States to prevent excessive currency inflation. This greatly accelerated the adoption of the Bretton Woods System as the gold window served as a promise to the international community that the U.S. would maintain the value of the dollar.

The Bretton Woods System bestowed an enormous privilege upon the United States as it created a global demand for dollars. Since all international trades would be settled in dollars, all nations would need to hold U.S. dollars to facilitate foreign trade.

This dynamic rendered trade deficits irrelevant for the U.S. Under the gold standard, trade deficits necessitated an outflow of gold from reserves. Under Bretton Woods, trade deficits necessitated an outflow of paper dollars created from nothing. In other words, the U.S. was in the advantageous position of swapping fiat scrip for tangible foreign goods and electronics.

This artificial global demand for dollars is what powered the United States’ “guns and butter” campaign which ramped up in the 1950’s.

The Great Society programs expanded upon the domestic welfare state and the undeclared wars in Korea and Vietnam launched the warfare state and the rise of the military-industrial complex. As you can imagine, a policy of welfare and warfare is not cheap and it must be financed.

The United States financed its guns and butter by selling Treasury Bonds and inflating the currency supply. Under Bretton Woods, other nations were happy to buy U.S. debt because they needed to increase their dollar holdings. And the United States was able to run trade deficits with other nations without hindrance because they could send newly created dollars overseas rather than gold from reserves.

The Federal Reserve began to function more and more as a big government financier during this time period as it ramped up the currency inflation to support the welfare/warfare state. The United States did not experience drastic price increases domestically, however, as most of the inflation was in effect exported overseas due to the international demand for dollars.

As the undeclared war in Vietnam continued and the Great Society programs expanded, other nations began to fear that excessive currency inflation in the United States would lead to a re-valuation of the dollar to gold. They recognized that the dollar was now overvalued at $35 per ounce of gold because of the Fed’s activities so foreign nations began to increasingly exchange dollars for gold through the gold window. Here’s former French President Charles de Gaulle in 1965:

“The fact that many countries accept as principle, dollars being as good as gold, for the payment of the differences existing to their advantage in the American balance of trade… this fact leads Americans to get into debt and to get into debt for free at the expense of other countries… We consider necessary that international trade be established as it was the case before the great misfortunes of the world, on an indisputable monetary base, and one that does not bear the mark of any particular country. Which base? In truth no one sees how one could really have any standard criterion other than gold!”

As a result of this run on the dollar, the United States’ total foreign reserve gold coverage had diminished to 22% by 1971.

On August 15, 1971, President Richard Nixon closed the international gold window and implemented domestic wage and price controls in the United States. Nixon assured the world that the gold window would only be closed temporarily and that the dollar would be redeemable in gold again at some point in the near future.

“Your dollar will be worth just as much tomorrow as it is today.” Nixon proclaimed on television with a straight face. “The effect of this action, in other words, will be to stabilize the dollar.”

Prior to closing the gold window, Nixon and his Secretary of State Henry Kissinger struck a deal with the Saudi Royal Family. The agreement was that the Saudis would price all international oil sales exclusively in U.S. dollars and they would refuse settlement in all other currencies. In return the United States would provide military protection for Saudi Arabia and supply the Saudis with military-grade weapons. By 1975 all OPEC nations, not just the Saudis, had agreed to settle oil trades exclusively in dollars.

This deal effectively kept the U.S. dollar as the world’s reserve currency, even with the breakdown of the Bretton Woods System, as all other countries needed to obtain dollars in order to purchase oil from the largest oil producing nations in the world. Of course the gold window was never re-opened, and the United States’ welfare/warfare state has exploded with the removal of the last honest restraint on money-printing.

So this is where we stand today – in the midst of a global fiat monetary experiment.

Since 1971 the U.S. dollar and all other currencies have been fiat currencies backed by nothing and created from nothing. With all ties to gold removed, the U.S. and many other nations have been ferociously inflating their currency supply which has resulted in the explosion of prices across the board. This is why you could purchase a hamburger for a quarter in 1971, but you are lucky if you can purchase a cheap gumball for a quarter today.

The deliberately obscured fact is that this is not a case of rising prices, but rather of your dollars becoming worth less and less, thus requiring more dollars to buy the same item of value. We have been conditioned to believe rising prices are a good thing, or at least normal. But prices do not naturally rise year after year; especially as increased productivity, automation, and mass production lower the costs of manufacturing and distribution. Price inflation is ultimately an artificial monetary event and not a natural process.