Larry Doyle's Blog, page 5

July 14, 2014

Citi’s $7Bln Settlement: Truth and Justice Delayed Is Truth and Justice Denied

Running down the clock used to be a strategy employed by renowned North Carolina basketball coach Dean Smith to win many a game. College basketball ultimately employed a shot clock to keep the games going.

Running down the clock used to be a strategy employed by renowned North Carolina basketball coach Dean Smith to win many a game. College basketball ultimately employed a shot clock to keep the games going.

Perhaps the Department of Justice should also have some sort of effective ‘shot clock’ imposed upon it in certain circumstances. Why so?

Just look at the announcement today (July 14, 2014) that Citigroup is paying a $7 billion fine to settle an array of egregious practices involved in transactions the firm brought from 2003 to 2008. The WSJ offers that AG Eric Holder will provide the following details:

. . . that the bank engaged in “egregious” misconduct by covering up problems with loans it was packaging into securities and selling to investors.

“Despite the fact that Citigroup learned of serious and widespread defects among the increasingly risky loans they were securitizing, the bank and its employees concealed these defects,” Mr. Holder plans to say, according to a prepared copy of his remarks.

Mr. Holder plans to say that the bank’s misdeeds—which it admitted to “in great detail” as part of the settlement—allowed it to dupe investors and win market share. That, he said, hurt endowment and pension funds, municipalities and charities.

Let’s pause for a second and think this through. Oh how I wish I were at the press conference later today to hit Holder with the following points and questions:

1. In terms of the $2.5 billion in consumer relief within this settlement, how much of that is being truly paid by Citigroup and how much by mortgage investors who hold the securities that were originated and issued by Citigroup?

2. Given that this settlement covers transactions going back to 2003, what does that say about the regulators from the SEC and FINRA charged with monitoring Citi during that time period if not since then as well?

I’ll tell you exactly what it says. The regulators run the gamut from being inept, incompetent, captured, corrupted, and exposed as being In Bed with Wall Street.

3. Citigroup whistleblower Richard Bowen highlighted in early 2010 — yes, 2010 — over 4 plus years ago, that an overwhelming percentage of loans that had been originated and purchased by Citi for securitizations were ‘impaired.’ Bowen brought that info to the highest levels of the bank including none other than Robert Rubin. What happened to Bowen? His testimony to the Financial Crisis Inquiry Commission was muzzled and he was ultimately dismissed from the bank. Where is his justice?

What happened to Rubin? He took his $100+ million dollars paid out to him by Citigroup and went on with his life. Where’s his justice?

So today we will witness AG Holder and team take a victory lap and ‘hold out’ the stick that “the civil settlement doesn’t rule out future criminal charges against Citigroup or its employees.”

Really? Stop it Eric. You’re embarrassing yourself.

America wants to know why after 4 years from Bowen’s testimony and 6 years since Holder took office has NO SENIOR MANAGER — and yes, I mean NOBODY as in NO SINGLE INDIVIDUAL — been held to proper account for the institutional frauds perpetrated on Wall Street.

America knows that truth and justice delayed — as in this settlement with Citigroup coming on July 14, 2014 — is ultimately truth and justice denied.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

Part-Time America:Unemployment Rate of Little Value

If the employment situation in our nation has improved so markedly, then why isn’t our economy growing more rapidly? I mean with an unemployment rate of 6.1%, wouldn’t it make sense that our economy would be generating a higher level of GDP?

If the employment situation in our nation has improved so markedly, then why isn’t our economy growing more rapidly? I mean with an unemployment rate of 6.1%, wouldn’t it make sense that our economy would be generating a higher level of GDP?

If we were to simply rely upon the prognosis of those paid to spew a party line, then yes we should expect that lower unemployment levels would be highly correlated with an increased level of GDP. But when did we start to rely upon the party line to decipher what is truly happening as we navigate the economic landscape?

Not in the past, now, or in the future should we or will we take that tact at Sense on Cents.

So then why hasn’t the admittedly improved rate of the “officially” unemployed correlated to an improved rate of economic growth? A few specific reasons:

1. our overall labor force participation rate is at multi-generational lows.

2. part time labor is an increasingly larger percentage of our overall work force

3. overall growth in wages remains anemic

Let’s navigate as Mort Zuckerman puts some detail behind these points this morning in writing in The Wall Street Journal,

There has been a distinctive odor of hype lately about the national jobs report for June. Most people will have the impression that the 288,000 jobs created last month were full-time. Not so.

The Obama administration and much of the media trumpeting the figure overlooked that the government numbers didn’t distinguish between new part-time and full-time jobs. Full-time jobs last month plunged by 523,000, according to the Bureau of Labor Statistics. What has increased are part-time jobs. They soared by about 800,000 to more than 28 million. Just think of all those Americans working part time, no doubt glad to have the work but also contending with lower pay, diminished benefits and little job security.

On July 2 President Obama boasted that the jobs report “showed the sixth straight month of job growth” in the private economy. “Make no mistake,” he said. “We are headed in the right direction.” What he failed to mention is that only 47.7% of adults in the U.S. are working full time. Yes, the percentage of unemployed has fallen, but that’s worth barely a Bronx cheer. It reflects the bleak fact that 2.4 million Americans have become discouraged and dropped out of the workforce. You might as well say that the unemployment rate would be zero if everyone quit looking for work.

Last month involuntary part-timers swelled to 7.5 million, compared with 4.4 million in 2007. Way too many adults now depend on the low-wage, part-time jobs that teenagers would normally fill.

No surprise that in the face of this reality that increasing numbers of our fellow citizens are relying on payday lenders, student loans, and car title loans in an attempt to make ends meet.

The Obamacare mandate that employers provide healthcare to all those working more than 30 hours may not be the only reason for the increase in part time vs full time employment but there is no doubt that it is a very real factor.

What is the ultimate consequence? People look at the 6.1% rate of unemployment and dismiss it as being of little real value in assessing the overall health of our economy.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 10, 2014

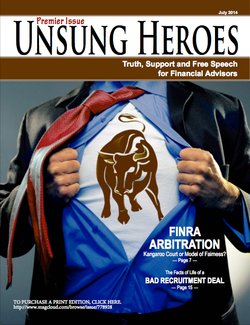

Hot New Magazine: Unsung Heroes: Truth, Support and Free Speech for Financial Advisors

Information is everything.

Information is everything.

The other day a reader left a comment with the following inquiry:

I would love to join any other advisors who have issues with FINRA. I am a former CPA.PFS financial advisor with Morgan Stanley. I too went through a long and expensive FINRA process.

In addition, we filed two whistle blower cases to expose MSSB’s unfair and unethical business practices. The difference, we have over thirty thousand pages of material collected in our case, including some damning e-mails. It is time that someone stood up to these firms who apparently believe that because they have unlimited access to shareholder money, they can always get their way. Let’s come up with some ideas on how to use the legal system if we can, and social media if we cannot, to educate the public on this travesty of a business model. One that cannot even tell its’ own clients that it will “act in their best interest.”

Any takers?

I am confident there are many takers, including those who have collaborated on a new magazine entitled Unsung Heroes: Truth, Support, and Free Speech for Financial Advisors: >>>>>>>>>>>>

It is a bi-monthly digital publication for financial advisors and a community forum for intelligent conversation about subjects that, until now, have rarely been covered. In addition to content that will help advisors make a secure, safe move, we will detail FINRA abuses and criminal acts as we shine a light into the dark corners of the industry. We will put honest, ethical and hardworking financial advisors — who have done no wrong — in the limelight.

Industry writers, reporters, and experts will bring you a series of revealing interviews that other publications are not brave enough to publish. Unsung Heroes will present opinion pieces, Point/Counterpoint articles, educational stories, and arbitration cases in detail. Resources and referrals will soon be available. We are also creating an emergency relief fund for advisors who are in need after losing in arbitration and facing bankruptcy.

There is certainly strength in numbers and in sharing information. I commend Sydney LeBlanc, editor-in-chief of Unsung Heroes, and the board members for this initiative. I welcome providing a link to the Premier Issue.

If you are an advisor and thinking about moving your practice or might be facing FINRA arbitration, this is an absolute must read. Even if you’re not thinking of moving or facing arbitration currently, knowledge is power and forewarned is forearmed. In the spirit of full disclosure, I am grateful that the producers of the magazine felt my book, In Bed with Wall Street, worthy of being highlighted on page 4.

Truth, support, free speech? Yes, with virtues such as those on the masthead, Unsung Heroes deserves and receives a special place in the Sense on Cents Hall of Fame.

Read it. Retain it. Share it.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 9, 2014

Will It Take Another Crisis for Real Reform?

“Our current cronyism is not the property of one political party or the other. As with any cancer, it does not care who it attacks or where it spreads. In the process of unearthing and exposing these crony Wall Street- Washington paths, we have come to learn that large numbers from both political parties, their well-heeled financial benefactors, and many of our financial regulators, all sit on one side of the table while the general investing, consuming, and taxpaying public — along with a large percentage of Wall Street’s own employees — sit on the other.”

“Our current cronyism is not the property of one political party or the other. As with any cancer, it does not care who it attacks or where it spreads. In the process of unearthing and exposing these crony Wall Street- Washington paths, we have come to learn that large numbers from both political parties, their well-heeled financial benefactors, and many of our financial regulators, all sit on one side of the table while the general investing, consuming, and taxpaying public — along with a large percentage of Wall Street’s own employees — sit on the other.”

page 187, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy

A full 6 years from the onset of our ongoing economic crisis, I remain convinced that our nation’s markets and economy remain burdened by the cancer that metatstatized from the corrupt Wall Street-Washington dynamic.

I stated as much in my book as quoted above.

Many have asked me if the current crisis was not enough to excise this cancer what might it take. Another crisis?

Sad to say, yes.

Not if but when we get another market meltdown might those within the media, public office, and regulatory system begin to truly uphold their mandate to protect the public interest rather than simply providing cover and/or benefiting as they enable the current cancer to spread.

If only our nation had an individual with the courage and fortitude of Pope Francis who took the scalpel out so as to aggressively cut the cancer that had infiltrated the operations of the Vatican Bank.

Wishful thinking on my part? Perhaps. Oversimplifying the situation? Perhaps.

I can hear critics of my commentary saying that comparing the largely unilateral powers possessed by Pope Francis to the balance of powers here in the US makes for a bad analogy.

Yet what is the main point of my referencing Pope Francis and his work as detailed by the FT, Pope Cuts Scandal-Prone Vatican Bank Down to Size.

LEADERSHIP!!

I strongly maintain that our nation lacks the real leadership necessary to address the corruption that remains rife within our financial-political-regulatory menage-a-trois. When those who benefit from maintaining a status quo are charged with reforming it, little of meaningful substance will change.

Dodd-Frank was not and is not the answer.

Who within the halls of power consistently stands up and speaks out against the cancerous corruption that remains so prevalent? Some credit should accrue to Senator Elizabeth Warren but aside from her, is there really anybody else who is willing to speak the truth in forceful fashion regardless of the professional price attached?

Anybody . . . anybody . . . Bueller?

It strikes me that the standards set and allowed both on Wall Street and in Washington are so low as to be pathetic. We all pay a very steep price in the process.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 8, 2014

The DOJ’s Double Standard

Let’s see here.

Let’s see here.

The public at large rails on those in Washington for going easy on our ‘too big to fail’ banks for a host of clearly criminal practices.

Uncle Sam — that is the SEC, other regulators, and ultimately the Department of Justice — try to talk tough and hit an array of institutions with sizable fines but little really changes.

The public continues to see through the facade and lets Uncle Sam know it.

The ‘old man’ decides he needs to really get tough and begins to mandate that institutions admit guilt as part of the settlement process. The first guilty party is Credit Suisse, then next up is BNP Paribas.

Now we awake this morning to see that Germany’s second largest lender, Commerzbank, is likely next in the crosshairs. Do you detect a pattern here? Bloomberg provides further color in reporting:

Commerzbank AG (CBK), Germany’s second-largest lender, will probably be the next bank to resolve alleged U.S. sanctions violations, a person with knowledge of the matter said.

The Frankfurt-based firm may incur penalties of at least $500 million as part of a deferred-prosecution agreement with authorities as soon as summer in the U.S., the person said, asking not to be identified because the talks are confidential. Such agreements spare companies a felony conviction.

The probe is part of a U.S. crackdown on financial institutions for handling funds linked to blacklisted nations that led to a record $8.97 billion fine against BNP Paribas SA. (BNP) France’s Credit Agricole SA (ACA) and Societe Generale SA (GLE), Germany’s Deutsche Bank AG (DBK)and Italy’s UniCredit SpA (UCG) are among other lenders being investigated by U.S. authorities.

The U.S. has brought at least 22 cases against financial firms since 2009 for doing business or handling funds linked to sanctioned countries, according to announcements on government websites.

Last week’s $8.97 billion fine against BNP dwarfs the combined $4.9 billion levied against 21 other banks since U.S. President Barack Obama took office. Most of those cases targeted overseas banks, with less than $90 million in fines imposed on U.S. firms. In 2011, New York-based JPMorgan Chase & Co. paid $88.3 million to settle allegations over transactions involving Cuba, Iran and Sudan.

What is going on here?

Now certainly many US institutions have been fined for violations primarily within the securitization and distribution of shady mortgage transactions. But are we to think that our large domestic banks have not also been engaged in what ultimately appears to be money laundering practices to facilitate trade with rogue nations?

Really? Then explain this from a few years back.

How a Big US Bank Laundered Billions from Mexico’s Murderous Drug Gangs

The bank in question? Wachovia which is now part of Wells Fargo. The story?

Criminal proceedings were brought against Wachovia, though not against any individual, but the case never came to court. In March 2010, Wachovia settled the biggest action brought under the US bank secrecy act, through the US district court in Miami. Now that the year’s “deferred prosecution” has expired, the bank is in effect in the clear. It paid federal authorities $110m in forfeiture, for allowing transactions later proved to be connected to drug smuggling, and incurred a $50m fine for failing to monitor cash used to ship 22 tons of cocaine.

More shocking, and more important, the bank was sanctioned for failing to apply the proper anti-laundering strictures to the transfer of $378.4bn – a sum equivalent to one-third of Mexico’s gross national product – into dollar accounts from so-called casas de cambio (CDCs) in Mexico, currency exchange houses with which the bank did business.

“Wachovia’s blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations,” said Jeffrey Sloman, the federal prosecutor. Yet the total fine was less than 2% of the bank’s $12.3bn profit for 2009. On 24 March 2010, Wells Fargo stock traded at $30.86 – up 1% on the week of the court settlement.

The conclusion to the case was only the tip of an iceberg, demonstrating the role of the “legal” banking sector in swilling hundreds of billions of dollars – the blood money from the murderous drug trade in Mexico and other places in the world – around their global operations, now bailed out by the taxpayer.

At the height of the 2008 banking crisis, Antonio Maria Costa, then head of the United Nations office on drugs and crime, said he had evidence to suggest the proceeds from drugs and crime were “the only liquid investment capital” available to banks on the brink of collapse.

Looks like Uncle Sam had little to no interest in getting truly tough with the domestic banks that he had bailed out but is now willing to play hardball with foreign institutions.

Can you say double standard? Is this any way to run a justice system let alone a country?

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 7, 2014

Bill Isaac Embraces The Rule of Law

The overarching theme both at this blog and in my book is the need for our nation to embrace the rule of law as the prerequisite to healing our economy and leading to better days ahead.

The overarching theme both at this blog and in my book is the need for our nation to embrace the rule of law as the prerequisite to healing our economy and leading to better days ahead.

Flouting the rule of law is regrettably an all too common pursuit by those engaged in crony and corrupt practices. Our nation suffers badly as a result.

While all too many politicians from both sides of the aisle spout forth messages that do little more than distract, the future of our country depends on finding new leaders who care nothing for cronyism and embrace the rule of law. I personally believe that in the recent Republican House race in Virginia Dave Brat slaughtered former House Speaker Eric Cantor with this very approach.

I will keep the commentary brief today but a smile crossed my lips this morning as I read an editorial in today’s Wall Street Journal by a Sense on Cents favorite Bill Isaac. This former chair of the FDIC wrote about the manner in which Uncle Sam has abused the rule of law in the process of managing our nation’s housing finance behemoths that go by the name of Fannie and Freddie.

Isaac concludes his commentary with similar pearls of wisdom that I used in writing the concluding chapter of my book. He writes,

. . . there should be no disagreement about the law. Capital follows the rule of law, and if investors can’t count on that in the U.S. and in the housing markets, they will put their money elsewhere.

I fully concur.

Regrettably, though, Uncle Sam’s current administration shows little regard for the rule of law; subsequently, our nation’s markets and economy have become dependent on the mother’s milk provided by the Federal Reserve. The cost of that milk may be advertised as a zero per cent rate of interest for our nation’s banks but the real costs absorbed by average citizens especially within the middle class are increasingly expensive.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 3, 2014

Journalist Sues SEC To Get Naked Short Selling Files

Selling counterfeit stock would seem to be a nefarious undertaking worthy of meaningful exposure.

Selling counterfeit stock would seem to be a nefarious undertaking worthy of meaningful exposure.

It is.

A recent suit against the SEC under the Freedom of Information Act looks to do just that. Let’s navigate as the law offices of highly acclaimed and widely respected SEC whistleblower Gary Aguirre recently released the following statement:

Lawsuit seeks to tear down SEC’s veil of secrecy

Journalist Mark Mitchell has filed a lawsuit under the Freedom of Information Act against the Securities and Exchange Commission (SEC) to obtain the agency’s investigative files relating to more than a dozen aborted investigations and cases involving naked short selling.

In a genuine short sale, the seller borrows stock and delivers it to the buyer. According to a federal court, “‘naked short-selling’ occurs when traders sell shares they do not own or borrow, or ever intend to own, and never deliver the ‘borrowed’ securities that they sell.”

According to the Mitchell complaint, naked short selling has flourished over the past decade because of regulatory loopholes designed by Wall Street and embedded into law by the SEC. The complaint describes the frightening history of naked short selling in the global markets. Although the SEC created a regulation in 2005—Regulation SHO—that was supposed to stop the practice, the SEC’s Enforcement Division rarely enforced the regulation. The phony short sales introduce phantom or counterfeit stock into the markets, which depresses the price of the genuine stock.

Regulators assumed that Reg SHO had contained naked short selling until the financial crisis fully blossomed in 2008. As the stock prices of the nation’s biggest investment banks, such as Lehman Brothers and Morgan Stanley, collapsed, their CEOs claimed that naked short selling—which had flooded the market with counterfeit stock—was to blame. Mitchell’s complaint tells how the SEC then frantically issued a half a dozen emergency orders and revisions to Reg SHO in 2008 and 2009 to stop naked short selling.

The SEC has also opened multiple investigations and filed a few administrative cases focusing on naked short selling, but has released little information regarding its findings in those investigations. The few cases which the SEC has filed for naked short selling involve minor market participants or trivial violations by major financial institutions.

The SEC has never made public the results of its investigations of the naked short selling of Bear Stearns, Lehman Brothers, Merrill Lynch, Morgan Stanley or Goldman Sachs, the big banks that collapsed or nearly collapsed during the financial crisis. Mitchell’s complaint also points to the massive violations of Reg SHO committed by UBS Securities and Credit Suisse Securities, which became public in 2011 when the Financial Industry Regulatory Authority (FINRA) released its settlements with those two banks.

The naked short sales by UBS were “in the tens of millions,” according to FINRA, and had the potential to undermine the integrity of the capital markets. The Credit Suisse violations of Reg SHO were in the same ballpark, with approximately 10 million violations, according to FINRA.

Although the releases of FINRA’s settlements confirmed that hundreds of other market participants were involved in these violations, none were identified. Nor did FINRA identify any of the public companies that were victimized by the naked short selling. Nor did the FINRA identify any executives or employees of the banks that participated in these violations.

The Mitchell complaint seeks the SEC investigative files relating to more than a dozen SEC investigations or filed cases involving naked short selling. This complaint seeks to cut through the veil of secrecy that surrounds naked short selling in US capital markets, and to enable the public to understand just how great a risk this form of market manipulation poses to the US capital markets.

Mitchell is represented by Gary Aguirre, a former Senior Counsel in the SEC’s Enforcement Division. In 2006, Aguirre testified before the Senate Judiciary Committee that naked short selling was one of the types of market abuse plaguing the capital markets that the SEC was ignoring. Mr. Aguirre is being assisted by Hal Wood of Horwood Marcus & Berk Chartered in Chicago.

Mark Mitchell is an investigative journalist who publishes on www.deepcapture.com, a website that has published some of the most in-depth investigative reports on the extent to which naked short selling pervades the US capital markets. The website further documents the SEC’s complicity in allowing naked short selling to remain an ongoing threat to the capital markets, through ineffective enforcement of existing rules, through non-prosecution of the worst offenders, and through the basic corruption that results from the “revolving door” that permeates American regulatory circles at the expense of the American public.

Given that transparency is the great disinfectant, here’s hoping this suit leads to the release of meaningful information so the stench that continues to persist from within the financial-political-regulatory menage-a-trois might be somewhat aerated to the public’s benefit.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 2, 2014

Chuck Lewis on Moyers: 935 Lies, A National Crisis Must Watch Video

How unsettling that as we approach the anniversary of our nation’s independence that we find ourselves a nation in crisis.

How unsettling that as we approach the anniversary of our nation’s independence that we find ourselves a nation in crisis.

What is at the core of our crisis? Very simply, the truth, or dare I say the lack thereof. If the truth is fundamental to our national well being — and I for one think it is — then listen to what the highly acclaimed investigative journalist Chuck Lewis recently said to Bill Moyers:

“We really have a problem here. If we don’t know what the truth is in this country, then we don’t have a country. It’s end of story. It’s not our country anymore. This is fundamental.”

I fully concur.

I could not possibly more highly recommended a video than this. As a Washington insider and investigative journalistic giant, Lewis provides a chilling perspective and indictment of so much that transpires in our nation’s capital and those who inhibit the truth from making its way across our land.

Lewis takes us back to LBJ, provides a stinging rebuke of the Bush 43 administration, and castigates President Obama for waging a war on truth-seekers and truth-tellers. He provides little comfort for a complicit media as well.

Take the mere 25 minutes to watch this clip and gain a perspective that will last a lot longer than that.

I am currently reading Lewis’ book, 935 Lies. As one who very much appreciates learning the truth wherever I may find it and whatever I may learn, Lewis’ book is a great read.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

July 1, 2014

Buy Used Car from Barclays, BNP Paribas, GM, et al?

In light of recent developments I am compelled to wonder why anybody might care to deal with the following organizations:

In light of recent developments I am compelled to wonder why anybody might care to deal with the following organizations:

1. Barclays: New York Attorney General Eric Schneiderman lays out detailed allegations showing the bank to have engaged in a ‘pernicious fraud’ and lied to customers regarding the operation of its equity dark pool. In the process, Barclays allowed high frequency trading firms to act in a predatory fashion against other clients.

2. BNP Paribas: as Reuters details:

The bank essentially functioned as the “central bank for the government of Sudan” (LD’s edit: Sudan has long been regarded as a state sponsor of terrorism), concealed its tracks and failed to cooperate when first contacted by law enforcement, U.S. authorities said.

They also found BNP Paribas had evaded sanctions against entities in Iran and Cuba, in part by stripping information from wire transfers so they could pass through the U.S. system without raising red flags. With its Sudanese clients, the bank admitted it set up elaborate payment structures that routed transactions through satellite banks to disguise their origin. BNPP banked on never being held to account for its criminal support of countries and entities engaged in acts of terrorism and other atrocities . . .

3. General Motors: after having stood idly by as faulty ignition switches led to multiple deaths, the entity some now call Government Motors continues to recall millions of vehicles. USA Today highlights:

General Motors announced six new safety recalls Monday — including its single largest this year — involving a total of about 7.55 million vehicles in the U.S. The company also announced that it would increase its second-quarter charges to pay for recalls to $1.2 billion, up from the previous announced $700 million. With the latest recalls, GM now has called back 25.68 million vehicles in the U.S. this year for safety-related repairs — a record for GM and, equal to more than two years of the company’s total output.

The list could go on and on as to why individuals might prefer to stay away from dealing with a host of organizations including:

>>JP Morgan: banked Bernie Madoff for decades.

>>HSBC: activities similar in nature to those ascribed to BNP Paribas above.

>>The cartel of banks which would seem to include all the Wall Street firms that engaged in a host of collusive behaviors in manipulating Libor, various commodities, and currencies.

In light of all the illegal and unsavory practices as detailed above, I guess it only makes sense for people to look to engage those within community banks, credit unions, and elsewhere when trying to find an entity and individual whom you can trust will treat you fairly while also engaging in strictly honest business practices overall.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

June 30, 2014

Letter to Editorial Board of The New York Times: “Real Cause Is Regulatory Capture/Corruption”

I sent a copy of this letter to the members of the Editorial Board of The New York Times this morning.

I sent a copy of this letter to the members of the Editorial Board of The New York Times this morning.

To the Editorial Board of The New York Times

Re: Sunday Editorial, The Dark Pool Iceberg: Lawsuit Against Barclays Shows Need for More Scrutiny

Dear Mr. Rosenthal, et al,

I was pleased to read your editorial in this past Sunday’s New York Times regarding the recent lawsuit brought by New York Attorney General Eric Schneiderman against Barclays for engaging in a ‘pernicious fraud’ within its equity division and specifically in the operation of its dark pool.

The allegations made by AG Schneiderman are supported by information provided by whistleblowers who had previously worked at Barclays. The outrage by investors and the public should be justifiably long and loud. The erosion of trust and confidence in Wall Street broadly speaking will continue to undermine our economy. We all suffer in the process.

I fully concur with your assertion,

“There is no reason to believe that this kind of wrongdoing is limited to Barclays.”

As you certainly well know, you never find just one mouse. You conclude your editorial by writing:

“In a financial system that is presumably built on the integrity of its public markets, banks should not be entitled to operate increasingly in the shadows, where even large and savvy clients can get mugged. Financial regulators need to force more order and transparency on the system, and to prosecute the wrongdoing that comes to light in the process. Mr. Schneiderman has shown the way, but he can’t do it alone.”

You are correct in this summation. But let’s stop right here and ponder that this editorial is being written in June 2014, a full 6 years past the onset of the economic crisis and a full 4 years since the passage of Dodd-Frank, legislation promoted as reforming Wall Street. How is it that the practices alleged in this lawsuit might come to pass and would seem to have persisted for a number of years?

I will tell you.

Lying, fraud, self-dealing, blatant misrepresentations and more as laid out in this lawsuit against Barclays are symptoms of a Wall Street that remains out of control. What is the cause that needs to be addressed, exposed, and rectified? A financial regulatory system that covers the spectrum of being ill-equipped, incompetent, captured, and corrupted.

While those within the regulatory system itself all too often cry for more funding in order to provide meaningful investor protection, let’s not be so naive as to think that merely throwing money at regulators who have shown themselves to be ineffectual, captured, and corrupted will solve our problems.

While some might think that painting our financial regulators with a bright red “C” for being corrupted is overly aggressive, two of America’s most highly acclaimed financial whistleblowers used that very term to do just that.

On February 4, 2009, renowned Madoff whistleblower Harry Markopolos in the midst of Congressional testimony proclaimed that Wall Street’s self-regulator FINRA was deserving of an A+ in corruption. On January 7, 2014 upon the release of my book (In Bed with Wall Street; Palgrave MacMillan), SEC whistleblower Gary Aguirre is quoted on page 144 as saying:

“I saw how SEC management would create a fictional rationale for not pursuing the investigation against John Mack . . . Somewhere between the third and fourth fictionalized account, I understood just how deeply the corruption was embedded in the (SEC) Enforcement’s management.”

I concur with you again in your assessment that Mr. Schneiderman can not clean up Wall Street on his own. The simple fact is monitoring Wall Street is the purview not primarily of AG Schneiderman but rather the SEC, FINRA, and other financial regulators including the Federal Reserve and CFTC.

Interestingly enough, in January 2013 FINRA itself made a public vow that it would shine a light on the nefarious activities that have been shown to transpire within Wall Street’s dark pools. Yet, despite this public proclamation, FINRA has done little to provide meaningful protection against the ‘pernicious fraud’ alleged by AG Schneiderman.

For those who look closely, the evidence of regulatory capture and corruption is screaming. Having written the aforementioned book that details and documents significant examples of lying, fraud, misrepresentation, and self-dealing within these regulators, I call on you to shine the wide-angled lens of transparency that comes from your elevated position on the editorial board of The New York Times into these regulators and also upon our public officials atop Capitol Hill.

If you want a host of starting points, I am more than happy to have my publisher send each member of the editorial board a copy of my book. The index alone will provide plentiful material and referenced documents to begin the process of rooting out the cause that allows symptoms such as Barclays shark-filled dark pool to perpetuate.

Those within the power bases on Wall Street and Washington certainly would prefer to have firms such as Barclays pay token fines while maintaining the captured and corrupted status quo. But as you well know, Wall Street and Washington are not representative of America.

I exhort you to uphold your mandate to pursue, promote, and protect the public interest with a full blown expose of our captured and corrupted financial regulators and public officials. In doing so, you will also need to expose their cronies on Wall Street who welcome them on the other side of the revolving door and fill their campaign coffers with funds that strike most Americans as little more than payoffs that ultimately allow ‘pernicious frauds’ to continue.

I look forward to your response and welcome the opportunity to engage you in this pursuit.

Sincere regards,

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via syndicated outlet or by e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.