Larry Doyle's Blog, page 16

February 4, 2014

Janet Yellen “Will Spot Asset Bubbles Before They Burst.” Can She Also Walk on Water and Cure Aging?

[image error]Do you ever get incoming e-mails that just leave you scratching your head and thinking, “Are you kidding me?”

I am going to guess that we all do and most would typically delete them in short order. I almost did that late yesterday when I saw an incoming message informing me that Janet Yellen, the new head of the Federal Reserve, possessed powers and vision that some might define as otherworldly. Let’s navigate as the Cornell University Media Relations Office released the following:

Robert C. Hockett, former Resident Consultant for the Federal Reserve Board, international finance expert and professor of Law at Cornell University, discusses how Janet Yellen will usher in a new era of a proactive Fed.

Hockett says:

“Today marks a milestone at the Fed in at least two senses.

“The obvious milestone is, of course, the one that everyone is talking about: for the first time in its 100-year history, the most influential central bank in the world and the most consequential government agency in the nation – the US Federal Reserve Board – is to be chaired by a woman.

“The less obvious milestone, however, although unremarked, is actually much more important: Dr. Yellen is the first Fed Chair in modern memory who is on the record – and has indeed long been on the record – in maintaining that the central bank can and should spot asset price bubbles while they are in the making, and that it can and should act to pre-empt them.

“This vision – that of a ‘proactive,’ or ‘macroprudential’ Fed – might seem unsurprising to lay persons, but in fact it has been missing from mainstream central bank theory and practice for over 30 years. Chair Yellen has long seen that this was a mistake, and her now taking the reins at the Fed is significant above all on that account.”

Pardon me for being cynical but, given that Ms. Yellen was the head of the Federal Reserve Bank of San Francisco from 2004 until 2010, why didn’t she use her supernatual, intergalactic-type vision to spot the housing bubble and pre-empt it?

Rather than merely swallowing Professor Hockett’s platitudes regarding our new Fed chair, let’s review exactly what Ms. Yellen had to say about our housing market in 2005 in a speech entitled Housing Bubbles and Monetary Policy:

In the U.S. as a whole, the share of residential investment in GDP is now at its highest level in decades, and this sector has been a key source of strength in the current expansion. The question for policy is: will this source of strength reverse course and become instead a source of weakness? Put more bluntly: Is there a house-price “bubble” that might deflate, and if so, what would that mean for the nation’s economy? What, if anything, should policy do beforehand? Fortunately, there is a large scholarly literature on asset price bubbles and monetary policy, and Haas faculty in finance, economics and real estate have made important contributions.

How, then, should monetary policy react to unusually high prices of houses—or of other assets, for that matter? As a starting point, let me note that the issue is not now (nor during the stock market boom) whether policy should react at all. As part of its analysis of demand in the economy, central bank models have long incorporated the wealth effect of house prices and other assets on spending; it is just one of many factors, including fiscal policy, exchange rates, and so on, that affect demand. The debate lies in determining when, if ever, policy should be focused on deflating the asset price bubble itself.

In my view, it makes sense to organize one’s thinking around three consecutive questions—three hurdles to jump before pulling the monetary policy trigger. First, if the bubble were to deflate on its own, would the effect on the economy be exceedingly large? Second, is it unlikely that the Fed could mitigate the consequences? Third, is monetary policy the best tool to use to deflate a house-price bubble?

My answers to these questions in the shortest possible form are, “no,” “no,” and “no.”

One, two, three strikes, she’s out.

For those who believe the exceptionally dovish Ms. Yellen can spot and pre-empt asset bubbles, can you offer any insights as to whether she can also walk on water and cure the aging process?

Navigate accordingly.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 3, 2014

Not Surprised by Size but Swiftness of Market Decline

Without trying to be a Monday morning quarterback, I am not at all surprised by the market’s decline.

Without trying to be a Monday morning quarterback, I am not at all surprised by the market’s decline.

I remain hard pressed to believe that our domestic economy and the global economy remain on sufficiently firm ground that would justify the fact that equity valuations belong even at current levels.

That said, I long ago gave up “fighting the Fed” and other global central banks that have been engaged in pumping liquidity into the system in order to prop the markets in the hope of stimulating the economy. So where should we look for a measure of support in the market?

I would look for the DJIA to retrace to the 15,000 level or very closely nearby so that the current pullback qualifies as a formal correction, that is a 10% decline from the market high that was put in at the 2013 year-end close of 16,576.

While not being surprised by the current price action, I am mildly surprised by the swiftness of this correction. We have retraced close to 1000 points in less than ten trading days. That pullback has also come in the face of almost every analyst and strategist putting forth positive projections for the year.

The question that I think will now begin to run through the market is the age-old one, “Is there a surprise out there?” Specifically, is there a bank or a fund — likely within an emerging market — that is in trouble, and might it be facing liquidity concerns that would cause a ripple effect?

Will keep my ear to the ground and share whatever I might learn and would ask readers to do the same.

Navigate accordingly.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

NY Times Exposes Wall Street-Washington Revolving Door

[image error]There are very few issues in our nation today that can generate such a uniformly vehement reaction as the practices encompassed within the Wall Street-Washington revolving door.

The American public may often be duped by those politicians and lobbyists well schooled in the art of working backroom deals, but the blatant elitist crony style behaviors captured in yesterday’s New York Times article, Law Doesn’t End Revolving Door on Capitol Hill, should surprise nobody.

Laws written that would appear to mitigate the effect of influence peddling only to allow the cronies to navigate through easily drafted loopholes might seem to be the stuff of third world banana republics but are now standard operating procedure within a world unto itself, aka Washington DC.

The American public gets this as evidenced by the 175 overwhelmingly derisive comments generated by that article.

Having reviewed all of the comments, I believe there was only one that was accepting of the corrosive, corruptible status quo. The comments also confirm the fact, as recently laid out to me by an individual who runs an online “get out the vote” initiative, that right now the American public truly hates Washington and has little regard for Wall Street.

The issues connected to the revolving door are the ultimate in bipartisan politics. What sort of characters are we talking about who work their way through the revolving door? As evidenced in the article:

The rules allowed Mr. Lavender to join a behind-the-scenes effort to help JPMorgan avoid having to testify at a House hearing in 2012. The hearing focused on the collapse of MF Global, a major New York brokerage firm that was one of JPMorgan’s clients.

On a conference call with fellow lobbyists, one person briefed on the call recalled, Mr. Lavender took aim at the former colleagues who wanted to force JPMorgan executives to testify. The person briefed on the call, who spoke on the condition of anonymity, said that Mr. Lavender remarked about his former colleagues: “I should have fired them when I had the chance.”

That’s American business and politics circa 2014. Where is our modern day Ferdinand Pecora, he who exposed the crony corruption leading to the crash of 1929, when we need him?

So if transparency is the great disinfectant, the stench that is building on the other side of the revolving door is so overpowering that it is eroding the very foundation of our national fabric.

How might this ever change? To think that those lining their own pockets and engaged in associated practices will address the revolving door in private is naive. What then shall we do? A number of things but, in my opinion, the onus is truly on the media and the public to create overwhelming pressure so as to expose the people and practices involved. Who is doing just that? A bipartisan grassroots organization known as Represent.Us.

Just as 60 Minutes did an embarrassing expose on the practice of insider trading atop Capitol Hill, those working at Represent.Us are similarly engaged in bringing political corruption into the public arena. Only after the issues and individuals are fully exposed might we then start to promote and demand true reform without loopholes.

As a start, these reforms should include an Office of Whistleblower Protection so that corruption is exposed. Beyond that, I also believe we need a privately staffed and run Financial Regulatory Review Board that would bring real accountability to our financial cops, transparency to our legislators, and closure to this revolving door once and for all. Ultimately, though, our nation needs a constitutional amendment so as to overturn the Citizens United decision and bring about meaningful campaign finance reform.

What do you think?

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 1, 2014

Mary Schapiro Leaving Promontory Financial Hmmmmmmmmmmm…….

In the category of things that make you go hmmmm, we read a late Friday evening announcement that former SEC chair – and Sense on Cents Hall of Shame 2009 inductee — Mary Schapiro is leaving her role at Promontory Financial after a mere 9 months.

In the category of things that make you go hmmmm, we read a late Friday evening announcement that former SEC chair – and Sense on Cents Hall of Shame 2009 inductee — Mary Schapiro is leaving her role at Promontory Financial after a mere 9 months.

Let’s navigate as DealB%k reports, Former Chief of SEC to Shift Consulting Job:

Mary L. Schapiro spent four years as head of the Securities and Exchange Commission. Her next act was far shorter.

Just nine months after joining the Promontory Financial Group, a consulting firm that straddles the worlds of Wall Street and Washington, Ms. Schapiro is planning to leave her full-time role there.

Ms. Schapiro, a managing director and chairwoman of the governance and markets practice at Promontory, will instead become the vice chairwoman of the firm’s advisory board.

In a statement, a Promontory spokesman attributed Ms. Schapiro’s decision to “her desire to devote more time to her outside activities.”

Not exactly the sort of statement typically utilized to heap praise upon a departing executive.

The spokesman, Christopher Winans, added that “Mary Schapiro is a public figure who is in high demand around the world.”

Ms. Schapiro said on Thursday that she had an array of university lectures, speaking engagements and corporate board work ahead of her. Her last day as a Promontory employee is Friday.

“Promontory is a great firm but I’ve learned over the last nine months that there are lots of things I’m interested in doing and this move frees me up to do them,” she said.

Even so, the departure capped a rare wrong turn through Washington’s revolving door. . . .

“There’s so much money to spin through the revolving door that it’s almost irresistible,” said Craig Holman, a government affairs lobbyist for Public Citizen whose report “A Matter of Trust” laid the groundwork for Mr. Obama’s executive order. “After appearing to have taken advantage of this, it now appears that Mary is resisting that very powerful temptation, and I applaud her for that.”

I would applaud Ms. Schapiro if she were to answer a whole host of questions regarding unsavory practices at FINRA and the real story as to why SEC whistleblower David Weber was fired prior to being vindicated and invited to return to the SEC.

Still, Ms. Schapiro will keep a foot in the private sector. She will continue to earn about $250,000 annually as a director at General Electric.

Oh, how nice.

Ms. Schapiro — who left Finra after 13 years with a payout of roughly $7 million that included pension and deferred compensation — will also collect compensation for serving on Promontory’s advisory board. She will join a who’s who of former regulators, including Alan S. Blinder, the former vice chairman of the Federal Reserve, and Arthur Levitt, one of Ms. Schapiro’s predecessors at the S.E.C.

Yes indeed, if only we might give Mary a double dose of truth serum and learn a lot of what she knows about the incestuous activity at the intersection of Wall Street and Washington.

Navigate accordingly, Mary.

I thank the regular reader who brought this story to my attention.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

January 30, 2014

What’s Going On: Market Pullback, Pump ‘n Dump?

The consensus opinion by most market strategists coming into the year was that our equity markets would follow up the 25-30% gains of 2013 with another 8-10% gain this year.

The consensus opinion by most market strategists coming into the year was that our equity markets would follow up the 25-30% gains of 2013 with another 8-10% gain this year.

The markets will have to experience a hellacious rally in the next two trading days or make an exception to an age old rule that January’s price action sets the direction for the year as a whole.

So what is going on with the markets? Are they simply experiencing a long overdue pullback? No doubt about that. Aside from a mild pullback last August and September of approximately 3-4%, the S&P 500 Index went straight up for the next 3 months to the tune of 12% to end the year with a 30% gain.

The 4% loss year to date certainly qualifies as a pullback but comes nowhere close to qualifying as a correction which market technicians define as a 10% decline. The S&P 500 would have to retrace another 110 points on top of the ~75 points it has lost year to date to meet that definition.

Although many holders of stocks might never like to see pullbacks or corrections, that is not the way markets work nor is it healthy. In order to build a stronger foundation so that the market can move to higher levels, it is not only good but, dare I say, necessary that the market retrace and ultimately retest prior levels that seemed to provide meaningful resistance prior to a market’s move higher. On this note, I think it is a good thing for our market as a whole if we do get a further decline.

But let’s take off the optimistic hat I was just wearing that is worn by most strategists on the street and ask, why is the market pulling back and will those factors continue to weigh heavily on the equity market?

We hear of dislocations and economic slowdowns in a variety of emerging markets from Argentina to Turkey to China. Did you know that these were coming? We hear of renewed anxieties and writedowns in the European banking system. Again, this news was not widely projected and hit the market as a surprise. We witnessed a mixed bag of earnings in the recent corporate releases on the heels of a weak employment report here at home. All of this news came to the market as disappointing developments, if not total surprises.

What is not a surprise and is certainly a huge factor in the market’s decline year to date? The Federal Reserve’s pulling back from its quantitative easing program. Ben Bernanke wants to go into the history books as having started the Fed’s winding down of the most aggressive central banking program likely — and hopefully ever — undertaken.

So while we do not know what the tarot cards might read for emerging markets, bank earnings, and our global economy going forward, what we do know right now is that the Federal Reserve intends on continuing to wind down its quantitative easing program over the balance of this year.

That program had been injecting $85 billion a month into the market and totaled an increase in the Fed’s balance sheet of ~$3 trillion. Having informed the markets that it would only direct $75 billion into the market in January and just this week announced that it would commit $65 billion in QE for February, those in the markets who have enjoyed the liquidity provided by the Fed should be aware that it intends to wind this program down completely over the balance of this year.

Rule #1 in the markets: ‘Follow the Fed,’ or in similar fashion, ‘Don’t fight the Fed.’

Heavy cynics might equate the overall price action in the market akin to a pump and dump scheme, but those engaged in such practices (like the wolf of Wall Street) do not tell you their plans.

The Federal Reserve is telling us exactly what it intends to do. This is not to say that the Fed might not change those plans especially if the market pullback creates serious dislocations and is perceived as negatively impacting the economy. But is that a bet you are willing to make?

Add it all up and what do we have? A market dynamic that remains in uncharted waters. So while Mr. Alfred E. Neuman may not be concerned, as always around these parts, we should navigate accordingly.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

January 29, 2014

Eric Ben-Artzi: Another Whistleblower Who Was Fired

[image error]Recently Deutsche Bank surprised the markets by pre-releasing its earnings with a surprise loss of 1.5 billion Euros.

Do you think that the bank may have been previously mismarking positions or, in layman’s terms, ‘cooking the books’ and is just now playing catch up given that the stock price of the bank has rebounded? Does that sound like a practice that some might define as ‘pump and dump’? You think?

What happened to the individual who brought attention and exposure to Deutsche Bank’s financial chicanery? Let’s meet another whistleblower who received a pink slip, in this case Eric Ben-Artzi, who spoke recently at Auburn University.

This brief 3-minute clip highlights his story and the work of the Government Accountability Project to protect whistleblowers.

So let’s add Ben-Artzi’s name to the many other whistleblowers I highlight in my book who have been ignored, intimidated, or fired.

Think we might need a separate Office of Whistleblower Protection so that all these individual whistleblowers who have tried to do the right thing do not suffer at the hands of regulators and judicial officials who are in bed with the industry?

I do.

Navigate accordingly.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

January 28, 2014

Dennis Kelleher Calls Out President Obama on Mortgage Fraud

[image error]Do you plan on watching President Obama’s State of the Union address this evening?

Why do I think I hear many people who might read this blog say, “Why would I want to do that?”

In the midst of leaving an event last evening in New York City, a very informed pollster told me that the overwhelming sense in the nation today is that people are totally fed up with Washington and Wall Street. No surprise there, but why is that? Well, because all too often our politicians from both sides of the aisle over-promise and then under-deliver.

As an example of just that practice, I commend Dennis Kelleher, President of Better Markets, for releasing the following statement regarding the Obama administration’s promise he made two years ago in his State of the Union to bring real accountability to Wall Street.

As President Obama prepares to deliver the State of the Union Address tonight, it’s worth revisiting a key income inequality-related promise that the President made in his 2012 State of the Union Address:

“And tonight, I’m asking my Attorney General to create a special unit of federal prosecutors and leading state attorney general to expand our investigations into the abusive lending and packaging of risky mortgages that led to the housing crisis. This new unit will hold accountable those who broke the law, speed assistance to homeowners, and help turn the page on an era of recklessness that hurt so many Americans.”

Unfortunately, the President’s “special unit” turned out to be neither special nor a unit. With little formal structure, it appeared to be little more than window dressing for the ongoing work of the Justice Department and others. To date, the Justice Department and the “special unit” have yet to produce a single indictment or criminal prosecution of any of the “too big to fail” Wall Street banks or their top executives who caused the greatest financial crash since 1929 and the worst economy since the Great Depression.1

In fact, more than a year after the President’s announcement, the chair of the task force – New York Attorney General Eric Schneiderman – complained about the lack of activity and aggressiveness.

While Attorney General Holder recently suggested that prosecutions against Wall Street banks may be coming soon, he has said that before and the federal statute of limitations for fraud generally lasts five years. That means the Justice Department may have already missed its window of opportunity to bring prosecutions related to the 2008 financial crisis – a crisis which greatly increased income inequality by vaporizing trillions of dollars in wealth, throwing tens of millions out of work, forcing millions of homeowners into foreclosure and financial ruin, and triggering a recession that pushed millions of Americans into poverty. Altogether, the crisis is costing our economy an estimated $12.8 trillion.

While we welcome tonight’s focus on executive actions to combat income inequality, we regret that the actions promised in previous addresses haven’t yet materialized. Unless we continue to hold our leaders’ accountable, State of the Union promises can be fleeting and quickly forgotten. We hope that tonight will be different and that the recent causes of income inequality are attacked as vigorously as the long term causes.

1. To be clear, the Justice Department has taken action in a few civil matters and reached settlements with fines and other monetary penalties for some of these “too big to fail” financial institutions. But, criminal charges have only been filed against individual mortgage brokers and a number of other relatively small time players, as well as against one Wall Street bank for activities subsequent and unrelated to the 2008 financial crisis. To date, not a single criminal charge has been filed against the “too big to fail” Wall Street banks for their activities which directly caused the greatest financial collapse since the Depression.

Well done, Mr. Kelleher.

Mr. President, what say you?

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

January 27, 2014

Mortgage Foreclosure Abuse: The Fight Continues

I wish I had the silver bullet to address and fix the rampant abusive practices that have transpired within the mortgage servicing entities of many of our large banks and elsewhere.

I wish I had the silver bullet to address and fix the rampant abusive practices that have transpired within the mortgage servicing entities of many of our large banks and elsewhere.

I don’t.

That said, the ongoing problematic issues within mortgage servicing practices remain prevalent. How do I know? I hear from people entangled in this mess on an ongoing basis.

In my opinion, these issues go right to the core of what I believe is the problem with the structure of our banking industry in America today. That problem centers on the fact that we have a few banks (e.g., JP Morgan Chase, Bank of America, Wells Fargo) that dominate the market, especially within the mortgage realm.

As many longtime readers of my blog are aware, this economic structure known as an oligopoly allows, if not promotes, the following abusive type practices:

1. price controls, if not outright market manipulation, via collusion

2. little to no competition

3. hoarding of information and charging excessive prices to those who want or need access to it

4. banks acting in their own self-interest rather than on behalf of their customers

Regrettably, far too many of our fellow citizens still dealing with these institutions in terms of addressing the servicing of their mortgages find themselves caught in this web. What is one to do?

I have heard from so many people who have exhausted countless hours in an attempt to get some degree of satisfaction with little to show for it. Little doubt why many are questioning the spirit of fair dealings and justice in our nation today when they are not able to get satisfaction on this front. The only issue that I might even possibly compare this frustration to is the anguish felt by so many in attempting to address their healthcare coverage. So what might one do? My tact on addressing issues of this sort is three fold:

1. I always look for somebody inside an organization, in this case the mortgage servicer, to whom I can go and make them “own” my case. This can certainly be a challenge and I do not pretend it is easily accomplished. I do think it is far better to spend time and effort in this pursuit than circuitously navigating a servicer in what likely feels like a merry go round.

2. Take the same tact with your elected officials, those being your attorneys general, congressmen and congresswomen, and people within the newly launched Consumer Financial Protection Bureau. Get very specific and demand that an individual stand up to “own” your case and fight on your behalf.

3. How to hold these individuals and entities accountable? Public pressure via writing about your experience and getting very specific in terms of names and details via blogs and other social media outlets. Inform the individuals up front as to the fact that you are taking your case and fight into the public arena. They will not appreciate this fact but that is too bad.

Having engaged countless investors and consumers who have been abused on a variety of fronts, ultimately I believe these steps as laid out above are the best way to go about trying to get some satisfaction.

I would certainly welcome hearing from individuals with personal experience in this space.

I will be addressing these topics on February 9th in an interview on Blogtalk Radio.

Navigate accordingly.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

January 24, 2014

Market Warning Signs

When everybody is on one side of a ship that vessel will tend to list and often has a hard time continuing to move in the same direction.

When everybody is on one side of a ship that vessel will tend to list and often has a hard time continuing to move in the same direction.

This navigating analogy is used very often on Wall Street and strikes me as very applicable a mere three weeks into trading for calendar 2014. Let’s get more specific in terms of what exactly I mean.

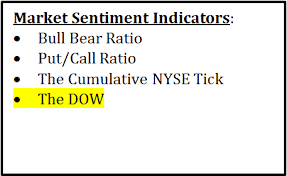

Sentiment indicators on Wall Street are defined as,

A graphical or numerical indicator designed to show how a group feels about the market, business environment or other factor. Sentiment indicators can be used by investors to see how optimistic or pessimistic people are to current market conditions.

Not surprisingly after a major market move higher as experienced in 2013, many investors are feeling much more comfortable about wading into the water, that being the market. Are too many people feeling too comfortable and might the tide move out leaving people feeling overly exposed? I believe so.

Not that bullish sentiment cannot trend higher or merely correct by having the market tread water, that is move sideways, but as many prognosticators have highlighted the overall bullish sentiment coming into this year is in the vicinity of 80%. Again, with so many people on one side of the ship, the ship may start to bob and weave if not actually take on some water. I believe we are seeing exactly this kind of price action in the market over the course of the last few weeks.

What is causing our ship, that is our market, to list? Concerns about economic slowdown within emerging markets, specifically China. Concerns within the European banking system, specifically a surprise announcement by Deutsche Bank of a billion-plus Euro loss. Our domestic economy has fits and starts but remains fragile and the Fed seems focused on lessening the spike in the punch bowl by tapering its quantitative easing program. Add it all up and no surprise that our equity market is retreating somewhat.

For those with an even keener interest in this topic and wondering why there is such a massive disconnect between bullishness on Wall Street and general consumer concerns on Main Street, I highly recommend you review Figure 17 in this attached chart from Yardeni Research: Stock Market Research: Fundamental, Sentiment, and Technical. This chart highlights the bullishness within our equity market as measured by a Bull/Bear Ratio overlapped against a chart of Consumer Confidence.

If a picture, in this case a chart, paints a thousand words, then Figure 17 encompasses a volume of works within a financial library. Well worth a look and then navigate accordingly.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

January 23, 2014

Reader Reviews: In Bed with Wall Street

[image error]I thank those who have not only read my book but taken the time to leave their thoughts on the book’s page at Amazon. I welcome sharing some selected comments in the hope that they might stimulate others to want to pick up the book.

Author Larry Doyle has written a book that you simply cannot put down. It is a page-turner and each page is a thriller that takes you on an adventure like you’ve never been on. Larry was unafraid to step up to the plate and tell America all of the ugly details behind the conspiracy and the collusion among Wall Street bigwigs, insiders, and so-called admired top brass as well as the politicians, and the regulators.

Buy two copies, one for yourself and one for your Congressman.

This amazing book is becoming the needed bridge between the ‘regular, small’ guy and the honest part of Wall Street.

This is a great read and goes into great detail that anyone, even someone who is not familiar with financial markets, can understand. In Bed with Wall Street should be required reading for every high school student in this country.

This is the first book that truly pulls the curtain back on how the average investor gets fleeced by Wall Street. This is a must read for everyone who would like a fair system of capitalism in this country. It’s perhaps one of the most truthful books on this topic I’ve ever read.

Recommend that anyone with an IRA account, investments in stocks or wondering why their CDs are only paying 1% read this book.

Mr. Doyle brings fresh insight and understanding to current day complex (& profitable) relationship between Wall St and Washington DC. His careful and supported case studies are lucid, analytical and scary. I consider his book the freshest & possibly the most important summary of the last ten years of our economy to date.

Larry has produced an impressive work that reads like a thriller novel but is based on corroborated facts complete with a historical perspective making the story he tells of a tilted playing field and the facade of regulation difficult to argue with. He takes the high road avoiding partisan politics but instead focuses on the interplay between Wall Street, politicians, and regulators pulling no punches along the way.

The real life stories are chilling to even the most seasoned veteran. Larry’s writing skills and the sobering reality and implications of the subject matter make this a book that you won’t want to put down.

Larry Doyle’s first book is a masterpiece. Without the usual partisan spin associated with most media Doyle creates a very well researched history of how our capital markets came very close to ruin. Having read virtually all the “tell all” books about the demise of Lehman Brothers, Bear Stearns, etc, I came away from this book with a much clearer understanding of where blame lies.

Doyle not only demonstrates how failed the concept of a self regulated Wall Street is, in the last chapter he offers some real solutions that can once again restore investor confidence in our capital markets. This is a hard hitting, exceptional piece of investigative journalism reminiscent of Michael Lewis’ works.

As Larry has helped educate the public over the past five years using his blog as a vehicle to deliver his message, Larry once again, in plain English, helps to deliver a message that many in the main stream media refuse to address. If you like Larry’s blog you are going to love his book. It is a must read for every American. Well done Larry.

I’m not aware of any investigative journalism over the past five years that has been able to so effectively untangle the web of deceit and corruption that permeates the money game.

You read this book and you wonder why no one in Congress or the media has been willing or able to call a spade a spade. With the publication of “In Bed With Wall Street,” the ruse is laid bare.

I guess these readers liked it. I hope others might as well and will offer their thoughts in whatever open forum they may like so the book and its message are delivered as broadly as possible.

Thanks.

Larry Doyle

Please order a copy of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.