Larry Doyle's Blog, page 14

March 4, 2014

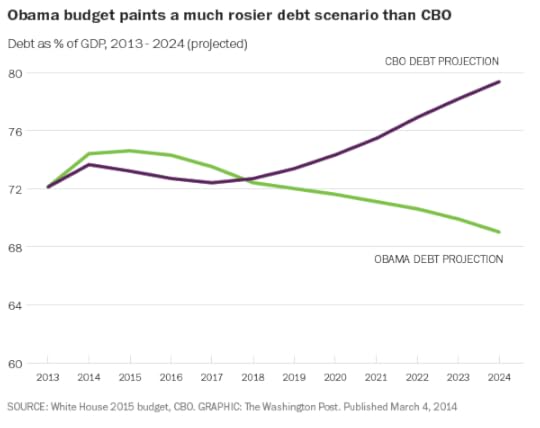

Deficit Projections Out To 2024

The Wall Street Journal addresses that widening gap between how the administration and the CBO view future deficits in writing:

The White House on Tuesday forecast the budget deficit would return to prerecession levels by 2018, completing the turnaround through higher taxes and improved economic growth.

President Barack Obama’s blueprint foresees more spending on mandatory programs, including Social Security and health care. It also calls for increased investment in areas such as roads and bridges to provide a boost to a long-struggling economy. Higher tax revenue would pay for part of that uptick.

Occupants of the White House typically rely on bullish economic projections and rosy policy outcomes to make their plans add up.

The latest outlook relies on spending caps already put in place and economic proposals that may never become law.

It is nothing new for the White House—or other forecasters–to miss the mark. Mr. Bush in his 2009 blueprint expected budget surpluses starting in 2009. Mr. Obama in his first budget expected only two years of $1 trillion deficits. Ultimately there were four, in part because the economy failed to break out into much quicker growth starting in 2011.

Indeed, deficits could fall faster if nothing changes in current law. The CBO in February said deficits would hit $514 billion in 2014 and $478 billion in 2015. But, in contrast to the White House, the office’s forecasts show a widening gap between revenue and spending starting in 2016, with shortfalls again topping $1 trillion in 2022.

The problem from both sides of the aisle is that politicians are so focused on delivering short term goods that they are negligent in worrying and attending to long term costs.

Future generations not only deserve better but just wait until they default on a whole host of obligations primarily within entitlement programs. Then what? Don’t think it won’t happen because it will and dare I say given the willful neglect of our politicians, it should.

Why should our children and children’s children have to clean up the mess and forsake quality of life because our current and recent pols run the government like a pack of drunken sailors?

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

Geographic and Strategic Importance of Crimea

With all eyes in the markets, if not the world, focused on the ongoing crisis developing in the Ukraine and its southern peninsula known as Crimea, let’s navigate and gain a greater understanding as to the geographic, economic, and political importance of this region.

Crimea is a short, 2 hour plus flight from Moscow or perhaps a daylong ride given that it is approximately 2300 miles/1400 km due south. More importantly than the proximity of Crimea to Moscow is its geographic location.

A brief view of this visual depicts the strategic importance of the region located right on the Black Sea and as a doorway into Russia.

[image error]

The immediate thoughts that come to mind when I look at this map are a mix of the Panama Canal and Miami Beach, Florida.

Is it any surprise that Russian President Vladimir Putin has occupied this region given its strategic importance? The question now begs what does the western world do and how will this standoff play out? Is it possible that Crimea will be annexed by Russia? I think it is more than possible. I would bet that it is likely.

It would seem that there is a little chill in the air and a “cold war” is unfolding. The accompanying political risks of retreating to focus more on domestic issues are increasing for our current administration. The market risks are also increasing for investors. Both factors strike me as further reason for our Federal Reserve and foreign central banks to remain accommodating in terms of providing liquidity to the markets and the global economy.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 3, 2014

Did Credit Suisse CEO Dougan Commit Perjury?

[image error]Perjury is a very serious offense or at least it is supposed to be.

If our system of justice and Congressional oversight do not uphold the law against those who commit or may have committed perjury, what does that say about the rule of law in our nation?

In my opinion, a situation in which perjury occurs and goes unpunished is another nail in the coffin holding the American ‘rule of law.’

To this end, let’s navigate and look a little deeper into a high profile case centered on Wall Street in which the immediate question begs whether Credit Suisse CEO Brady Dougan committed perjury in providing Congressional testimony last week.

For those who may have missed it, Credit Suisse CEO Brady Dougan went in front of Congress last week to testify regarding the bank’s practices that allowed US citizens to illegally evade taxes. Dougan offered the following standard Wall Street excuse:

The American-born CEO told a U.S. Senate subcommittee on Wednesday that he and other top managers were not aware a small group of Credit Suisse private bankers had helped U.S. customers evade taxes with offshore accounts.

“The evidence showed that some Swiss-based private bankers went to great lengths to disguise their bad conduct from Credit Suisse executive management,” Dougan told the senators.

Simply a few rogue bankers in a far off branch going to great lengths to disguise bad conduct? Does that sound similar to Wall Street management’s singling out a few rogue traders for the manipulation of Libor or other markets including various currencies and commodities? It certainly does to me.

Not widely disseminated in these parts, the folks in Switzerland had a strong reaction to his pointing the finger at the ‘small group of private bankers.’

. . . staff at Credit Suisse and other Swiss banks reacted with astonishment to Dougan’s comments, saying it was “hardly credible” that the bank’s bosses knew nothing of the practices.

“It was common knowledge that tax evasion was the strategy, a business model pursued by many banks for a long time,” the Schweizerischer Bankpersonalverband said in a statement.

It said Dougan’s comments “vilify lots of employees that had nothing to do with offshore U.S. banking”, and demanded he apologize to the bank’s 46,000 staff.

The comments may have been motivated by efforts to lessen the bank’s penalties in the United States, but Dougan still owes staffers an explanation, the employee group said.

More than 22,000 Americans were using Credit Suisse to park combined assets of $12 billion at one time, according to a report released by the U.S. Senate ahead of Wednesday’s hearings.

While the Swiss may want an apology, the question I ask is whether Congress wants the truth.

Will Congress reconvene and call Dougan and staff both on the carpet simultaneously and try to get to the truth, that is the virtue upon which our nation’s laws rest? Does Congress have any appreciation that the ongoing degradation of the rule of law has a meaningful impact in terms of eroding any measure of trust and confidence in our markets, economy, and social fabric? Or is Dougan’s testimony merely another example that in order to occupy the corner office in a Wall Street bank you have to be a sociopath?

All great questions but regrettably it strikes me that it is blatantly obvious that the truth holds little standing when it comes to matters such as these.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 2, 2014

My Talk at Baruch: In Bed with Wall Street

[image error]I thank the countless number of individuals who have introduced me to various media representatives (print, radio, and TV) throughout the country to discuss my work both here at Sense on Cents and in my book In Bed with Wall Street. In the hope that even more media doors might open, I would like to link to a talk I gave earlier this week at Baruch College.

I thank the individual whom I have not met and do not know for having captured my remarks and posted them online. In my talk, I touch upon a host of topics addressed in my book including serious allegations and evidence connected to the misappropriation of funds and insider trading within Wall Street’s self-regulatory organization FINRA, abuse of whistleblowers, sham protection provided by SIPC, and much more including my proposed reforms.

Confident that more than one door to media outlets will be opened by my posting these remarks, I thank those who might share this link with friends and colleagues both inside and outside of the world of media.

Transparency remains the only true disinfectant.

Thank you.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to listen to this clip and to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 28, 2014

PBS Frontline: Secrets of The Vatican

I could not possibly recommend more strongly the viewing of this recently released documentary on PBS Frontline. The issues addressed are almost too numerous to properly categorize, but at the core is scandal and corruption at the highest level of the Catholic Church.

I will pray for Pope Francis that he is successful in cleansing the church of those deeply ensconced within it who have engaged in corruptible practices.

The comments attached to this documentary are also worth reviewing. I found this one to be of particular interest:

A remarkable program about the Vatican. We need a similar one on Wall Street, the US Congress and the United Nations.

I thought of INTOXICATION stemming from SEX, MONEY, SUBSTANCES, POWER, RELIGION and KNOWLEDGE. It would be a mistake to see all that this great Television exposed without some introspection on intoxication and what we encounter before a mirror.

The documentary runs for about 80 minutes. I hope those navigating these parts will find the time to view it and share it.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to view this video and to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 26, 2014

Geithner: “We Saved The Economy, Lost The Country”

[image error]Given the steady stream of platitudes put forth by many past and present political and financial figures in and around Washington, I find myself typically dismissing much of what is said as simply “more of the same.” In the process, I usually scan headlines and quickly move on to review news or issues that I find more meaningful.

Yesterday I paused, though, upon seeing a headline in The Wall Street Journal that caused me to want to look a little deeper. The headline, Geither: ‘We Saved The Economy . . . We Lost The Country.’ This I had to read.

Perhaps not surprisingly, former Treasury Secretary Geithner is writing a book to be released this coming May entitled Stress Test: Reflections on Financial Crises. I will definitely read this book given Geithner’s position within the inner circle during the most challenging financial and economic crisis since the Great Depression. In his promotional preview, he offers the following:

The financial crisis was a stress test of our nation, an extreme real-time challenge of a democracy’s ability to act when the world needed creative, decisive, politically unpalatable action. At times, the failures of our political system imposed tragic constraints on our ability to make the crisis less damaging and the recovery stronger. We made mistakes, it was messy, and the damage was devastating and long-lasting. And yet, at the moments of most extreme peril, the United States was able to design and execute a remarkably effective strategy.

I will grant him the only thing worse than bailing out our banks would have been not bailing out our banks.

The small group of key policy makers worked together surprisingly well, arguing, agonizing, sometimes agreeing to disagree, but mostly trying to get the right answer and minimize the time wasted on bureaucratic conflict. We saved the economy from a failing financial system, though we lost the country doing it.

I find this last statement in the paragraph absolutely fascinating, and I give Geithner real credit for issuing it. Perhaps he may want to use this line as a hook for selling his book, but it is worth serious review.

I completely agree with him that those involved in making public policy and pursuing appropriate judicial actions since the onset of what I believe is our ongoing economic crisis have, in fact, lost the country in doing so. Given that Americans are an overwhelming forgiving people, how is it that those in Washington and by extension on Wall Street lost the country?

In my opinion, America will forgive but always wants meaningful accountability that only comes from revealing the truth. Geithner writes that he hopes his “book will help answer some of the questions that still linger about the crisis. Why did it happen, and how did we let it happen?”

I asked myself the very same questions prior to writing my own book.

I think there are many reasons why the crisis happened, with the common denominator being excessive greed on the part of many folks along the food chain that ran from the point of mortgage origination through Washington to Wall Street and back and forth in repeated fashion.

In regard to how did it happen, I eagerly await reading Geithner’s work to see if he will provide cover for those at the intersection of Wall Street and Washington charged with protecting the public interest.

There are few individuals in the world more well-positioned than Tim Geithner to expose the incestuous, if not corruptible, dynamic that defines the Wall Street-Washington relationship. I am not expecting Geithner would dare cross the likes of Robert Rubin, Hank Paulson, Stephen Friedman and so many more political and financial elites who have come to define the element that our nation now truly detests and identifies as the cabal that took our nation down and never paid a price for it.

We shall see.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 25, 2014

Wall Street’s Greatest Racket: FINRA’s ‘Meter Maids’

In 2013 the six largest banks on Wall Street generated profits of $76 billion.

Last year, Wall Street’s primary self-regulatory organization FINRA imposed fines of $57 million.

Anybody still wondering why Wall Street likes being a self-regulated industry? Is Wall Street this clean or are the regulators little more than meter maids as I have long maintained? Well, thanks to the folks at Sutherland Asbill & Brennan let’s look at the fines imposed by FINRA last year and over the last 9 years (including the years prior to FINRA’s formation in 2007 as a result of the merger of the NASD and the regulatory arm of the NYSE):

Numbers don’t lie.

The folks at FINRA might like to spin it that they provide a lot of data and material for their brethren at the SEC to pursue. Yet a mere few weeks ago SEC commissioner Kara Stein offered these insights in regard to the industry-funded private police, aka FINRA,

. . . we must better understand and clarify the role of the FINRA, which has taken on more and more regulatory functions. In recent years, through private contracts, FINRA has come to run many critical market surveillance functions, from monitoring for insider trading, to looking for cross-market manipulations. While this may be one way to deal with increasing market complexity, it arguably has also created new challenges: including how to effectively oversee a very important, but private regulator. We need to be thinking about the interactions between FINRA and its customers, other market participants, the Commission, and regulators and participants in related markets.

$76 billion in profits for the 6 largest firms alone vs $57 million in fines across the entire industry. Those fines represent less than one tenth of one per cent of Wall Street’s bottom line.

Who is FINRA really protecting? Can you say In Bed with Wall Street?

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 24, 2014

Upcoming Book Events

I typically use Facebook and Twitter to promote events relating to In Bed with Wall Street, but a few readers who do not use social media have requested that I post upcoming events here on the blog. I will do so every once in a while for events that are open to the public.

I typically use Facebook and Twitter to promote events relating to In Bed with Wall Street, but a few readers who do not use social media have requested that I post upcoming events here on the blog. I will do so every once in a while for events that are open to the public.

Wednesday night, February 26th: I will be speaking at Baruch College in Manhattan. The event is co-sponsored by the New York Chapter of the National Investor Relations Institute, and is free and open to the public. Doors open at 6pm, with my presentation beginning at 6:15pm. Pre-registration is required. For more information, please go to the Baruch College calendar highlighting this event.

For those in the Greater Boston area, I have two upcoming book signings which will also include a discussion of the book and what led me to write it. If your schedule allows, please stop by to say hello.

Thursday, March 6th at 7pm: Barnes & Noble in Framingham, MA

Tuesday, April 8th at 7pm: WellesleyBooks in Wellesley, MA

Back in the NYC-metro area . . .

Thursday, April 10th at 7pm: Very pleased to be invited by Book Revue in Huntington, NY.

I’d like to also mention that many of my television and radio appearances are archived under the Television/Radio tab. The media discussions cover a range of topics from my book to the Federal Reserve to structural issues in our economy, and so on.

If you’d like to begin following me on Facebook or Twitter, the links are:

Sense on Cents/Facebook

In Bed with Wall Street/Facebook

Sense on Cents & In Bed with Wall Street/Twitter

As always, thank you for your support.

Larry Doyle

Federal Reserve Minutes Reveal “Ignorance”

[image error]I know of few descriptive terms more harsh than classifying an individual or organization as being ignorant.

Yet that is exactly how The New York Times labels the most powerful institution in the world, that being the Federal Reserve, after reviewing the recently released minutes from the Fed’s meetings back in 2008.

The hundreds of pages of transcripts, based on recordings made at the time, reveal the ignorance of Fed officials about economic conditions during the climactic months of the financial crisis.

Serving as a Fed official is not a part time role akin to committing one’s time for a local civic organization. In fact, perhaps not fully appreciated by many in our nation, the Federal Reserve not only serves as our nation’s monetary authority but also as a primary regulator for our banking system.

Given the Fed’s prominent position in our nation and the global economy, the following questions regarding the Fed’s “ignorance” are screaming to be addressed:

[image error]

1. Was the Fed’s ignorance due to a lack of basic intellect and understanding of the degree of leverage that had built up in the system after the net capital rules on Wall Street had been relaxed?

2. Was the Fed then and still now so closely aligned to the major banks in our nation so as to lack the proper perspective and oversight of these institutions?

3. Was the Fed hoodwinked, manipulated, or possibly outright lied to by the banks it is charged with overseeing?

4. What about the Fed’s interaction with other banking regulators, including the OCC and SEC primarily? Was there a failure to communicate between these regulatory bodies?

5. In summation, is the Federal Reserve simply another regulatory body captured by Wall Street?

These questions need answers. Who is charged in getting them? Congress. Will they or have they? Never.

We all pay an enormous price as a result.

I strongly maintain that a full five years after the crisis that crippled our global economy, the lack of transparency on the topics referenced within these questions remains one of our nation’s greatest problems. The crux of the problem centers on the fact that the same ‘ignorant’ folks who failed to perform and protect our nation pre-crisis have been in place since then.

Little wonder why such little trust and confidence continues to permeate our nation.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

February 21, 2014

5 Years Later, ‘TBTF’ Elephant In America Remains

[image error]A slew of minutes and commentary related to Federal Reserve meetings held during the crisis of 2008 are just now being released.

While many of the minutes provide a riveting look at the topics on the table at that point in time, I found the following highlighted in a synopsis at The Street.com to be particularly meaningful.

Federal Reserve Bank of Dallas President Richard Fisher expressed concern that the Washington Mutual and Wachovia deals would serve to heighten systemic risk by increasing the concentration of banking assets and deposits to the largest U.S. banks.

While noting that the emergency meeting was not the time for discussions on limiting the “too-big-to-fail” problem, Fisher said, “I’d just like at some point to have a conversation on that matter,” while adding that he was “not objecting” to the Citigroup/Wachovia deal.

Bernanke agreed with Fisher, saying that once the crisis passed, “it’s very important, as we look toward restructuring our financial regulatory system, to develop good resolution mechanisms and to think about the issues of concentration and too big to fail.”

These two paragraphs are so meaningful because I strongly believe that we have never had the requisite conversations to properly address the restructuring of our financial regulatory system and eliminate the too big to fail risk still facing the American public.

As I told one journalist this morning, the American public is treated like a pile of mushrooms by those in Washington and in our media who gorge themselves on the do-re-mi provided by an array of cronies. Meanwhile, the public is fed a healthy serving of dung and largely kept in the dark.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.