Larry Doyle's Blog, page 12

April 2, 2014

SEC ‘Failure to Regulate’ NYSE on HFT

The high frequency topic is all the rage these days and with good reason. Free market capitalism is dependent on free and fair markets.

The high frequency topic is all the rage these days and with good reason. Free market capitalism is dependent on free and fair markets.

Are our equity markets free and fair these days? By my definition they are not.

With people on both sides of this topic voicing their strongly held opinions, more and more of the onus is placed on those regulating the markets to see that the playing field is level for all participants. I think that is a huge part of the problem and wrote as much the other day in asserting, “The fact that the FBI states that it is working in concert with the CFTC, SEC, and FINRA in this investigation should be a cause of very real concern.”

A recent commentary in Crain’s Business highlights this very point:

In September 2012, the SEC said it found that the NYSE gave certain customers who used computer-driven trading strategies an early look at market prices. The glimpses lasted anywhere from single-digit milliseconds to several seconds. The agency added that the NYSE “did not take adequate steps to comply” with the rule barring early release of the data.

Wow, that sounds like a serious infraction. Several seconds is an eternity in the world of lightning-fast trading, plenty of time to jump ahead of others and force them to pay higher prices for stocks they want to buy.

Yes, plenty of time indeed to front run.

Yet however you want to describe how the SEC handled the matter, the term “crack down” doesn’t come to mind.

The agency fined the NYSE $5 million and ordered it to hire an independent consultant. It didn’t require an admission of wrong-doing. The NYSE said at the time that it fixed the identified problems and “the timing differentials stemmed from technology issues, not from intentional wrongdoing by the exchange or any of its personnel.”

No wrong doing and nothing intentional. No, of course not.

What’s that you say? Did somebody in the back of the room say “blowjob?”

In light of recent attention given high-speed trading, might not the SEC start taking a harder line? Don’t bet on it, said Sal Arnuk, co-founder of Themis Trading in Chatham, N.J.

“Doing so would be an admission that the SEC screwed up” on the recent NYSE case, he said.

Is it possible that the SEC could screw up, or is it more likely that the SEC wrote the NYSE a minor ticket, as meter maids are wont to do, and sent the NYSE on its way to continue just such practices or close iterations thereof?

Perhaps things will change. The SEC has said it is “conducting a comprehensive data-driven analysis” of high-speed trading and other market matters. The SEC division that oversees exchanges recently named a veteran regulator as its new chief, Steven Luparello. He’s the third person to hold the job in the past two years.

Another new sheriff on the job. Appointed to head this division less than two months ago, what can we learn about Mr. Luparello? From the SEC’s own web site:

Mr. Luparello comes to the SEC from the law firm of Wilmer Hale, where he has been a partner in its Washington, D.C. office, specializing in broker-dealer compliance and regulation, securities litigation, and enforcement. Mr. Luparello joined Wilmer Hale after a 16-year career at the Financial Industry Regulatory Authority (FINRA) and its predecessor, the National Association of Securities Dealers (NASD), where he most recently served as Vice Chairman of FINRA.

Can you say “Captured regulators revolving door meter maids in bed with wall street” three times fast?

Watch your wallets folks, and as always . . . navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

April 1, 2014

FBI Investigation of Wall Street HFT But “‘Big Boys’ Always Seem to Get Away with Murder”

[image error]News late yesterday that the FBI is investigating high frequency trading operations for potential securities violations including insider trading sent a shock wave through the industry.

As well it should.

All too much evidence from respected industry insiders over the last five years has painted a picture of massive front running via HFT disguised as providing liquidity. Front running and collusion are supposed to be illegal practices.

To think that these conspiratorial behaviors are the work of a few rogue traders or computer programmers is ludicrous. Yet I remain very suspect that we will be fed a diet of just such nonsense as an indication that the Feds are going to clean up this practice.

Why am I so suspect? A number of reasons, including:

1. the now for-profit equity exchanges themselves along with the major Wall Street banks are the key pillars and participants behind the development of the HFT platforms.

2. the Feds are all too familiar with a program of targeting selected industry lightweights for insider trading violations while allowing institutional frauds within practices such as HFT to be dealt with kid gloves and fines that amount to little more than a cost of doing business.

3. let’s not forget that the administration sold the American public a bill of goods in stating that the DOJ would hold those engaged in fraud within the mortgage industry to proper account. How did those investigations play out? Just a few weeks ago, the DOJ’s own Inspector General exposed that investigation as little more than a token effort replete with a host of lies. (DOJ Lies, Lies, and Damn Lies re: Mortgage Fraud; March 14, 2014)

How convenient for the FBI to come out with word of this investigation into HFT on the same day as the release of Michael Lewis’ book and a day after Lewis said the market was rigged. Additionally, the fact that the FBI states that it is working in concert with the CFTC, SEC, and FINRA in this investigation should be a cause of very real concern.

The real problem that needs to be meaningfully exposed is that these very regulators are captured and serve at the behest of the industry rather than upholding their mandate to protect the public interest. Those who do not think so should read my book. I define our financial regulators, especially those at FINRA, as little more than meter maids. On page 104 of my book, noted securities attorney Richard Greenfield stated:

“Both agencies (SEC and FINRA) were effectively Keystone Cops . . . they were running around in circles and didn’t know what they were doing. I would have expected more from the SEC, which has a bigger budget and far greater competence than the NASD or what is now known as FINRA, where the mindset has never been on major league enforcement. It has always been on relatively picayune broker-dealer violations and even then the violations were very much more technical in nature than they were real. The ‘Big Boys’ always seem to get away with murder.”

In light of all we have learned over the last 5-plus years, is there any doubt that Greenfield is spot on in his assessment of our financial regulators?

Where is our modern day Ferdinand Pecora to hold the bankers, regulators, and pols that have promoted and profited from institutional frauds such as HFT to proper account?

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 30, 2014

Michael Lewis on HFT: “It’s All A Scam”; Here’s the Cause and Effect

Major props to renowned writer Michael Lewis for directing the light provided by his enormous platform on the scam that has come to define our equity markets under the construct of high frequency trading.

As Lewis states, the scam is not restricted to the HFT activity but rather the market as a whole has become a scam. Powerful words and worth the minute to listen to the video clip below.

But let’s go deeper than that.

I very much look forward to picking up a copy of Lewis’ book when it comes out tomorrow. Yet based on what we learned this evening on 60 Minutes, the expose laid out has largely been known for the better part of the last 5 years thanks to industry insiders Joe Saluzzi and Sal Arnuk at Themis Trading, Eric Hunsader at Nanex, and the widely followed blogger Zero Hedge.

While the scam within the markets is caused by high frequency trading, let’s make no mistake that the HFT activity itself is more an effect driven by other causes. I do not doubt that many individuals and firms both inside the industry and out might now look to take on the mantel of reformists so as to alleviate some pressure brought about by Lewis’ book. Yet, in my opinion, the effect of HFTvery much stems from the following causes:

1. self-regulation on Wall Street as overseen by the meter maids at FINRA allowing the large Wall Street banks to answer to nobody but themselves

2. captured regulators both within the aforementioned self-regulator and the SEC

3. the Wall Street oligopoly that allows the banks and exchanges to hoard information (such as equity orders) if even for just milliseconds to generate profits in the multi-billions of dollars

4. equity exchanges that have adopted a for profit model overseen by captured regulators

HFT is receiving the attention currently thanks to Lewis’ book and 60 Minutes but other forms of market manipulation and investor abuse have been ongoing within the currency, commodity, interest rate markets, and elsewhere.

What is the right way to go about addressing all of these scams? Certainly the large, powerful, well financed interests on Wall Street will fight tooth and nail to maintain the status quo. Real change never comes from addressing the effects or symptoms. To bring truly corrective measures so as to eradicate corruptible practices such as HFT, the causes need to be aggressively addressed and exposed. From there the effects can be amended and corrected in due course.

So how do we address the causes? Just as I lay out in chapter 12 of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy, we need to bring enormous public pressure on Congress by exposing the real corruption in the system (as I stated the other day on Bloomberg) so we can pursue the following:

1. end the self-regulatory model on Wall Street

2. implement a Financial Regulatory Review Board to oversee a sole financial regulator housed within the SEC

3. BREAK UP THE ‘TBTF’ Banks by reinstituting Glass-Stegall.

Thank you Michael Lewis and 60 Minutes. Get on board and let’s bring real transparency not just to HFT but to corrupted regulators and public officials who have ushered in this specific scam and so many more.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to view this video clip and to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 27, 2014

Wall St ‘Too Big to Fail’ Subsidy: You Pay, They Play

In the midst of your morning routine, you can probably lay out a number of situations in which you reach into your pocket to pay people or vendors for services/products provided. I would imagine that many reading this blog pay for a daily coffee and newspaper, perhaps a periodic shoe shine, a highway toll, or train and bus fare.

In the midst of your morning routine, you can probably lay out a number of situations in which you reach into your pocket to pay people or vendors for services/products provided. I would imagine that many reading this blog pay for a daily coffee and newspaper, perhaps a periodic shoe shine, a highway toll, or train and bus fare.

In addition to these fees, how do you feel about reaching into your pocket on a daily basis to pay a surcharge to support banking institutions on Wall Street that are deemed ‘too big to fail?’ How does that feel? Not very good, does it? I did not think so.

Yet, make no mistake, that daily banking toll you pay, and the subsidy the banks receive, are very much a reality in America circa 2014.

A few years back, Bloomberg News had identified this banking subsidy as being worth $80+ billion dollars annually (that is 3 cents on every tax dollar collected!!) to Wall Street’s ‘too big to fail’ banks. Now, none other than the Federal Reserve Bank of New York provides further substance to this subsidy accruing to the largest banks in our land in a recently released report entitled, Special Issue: Large and Complex Banks; Evidence from The Bond Market on Banks’ “Too Big to Fail Subsidy.” The author Joao Santos writes:

In my investigation, I focus on the primary bond market, but I take a different approach to the existing studies that have looked for evidence of a too-big-to-fail subsidy in bond spreads. I test whether investors perceive the largest banks to be too big to fail by investigating whether these banks benefit from a larger cost advantage (relative to their smaller peers) when compared to the similar cost advantage that the largest firms in other sectors of activity may also enjoy when they raise funding in the bond market.

I find that the top five banks by assets pay on average 41 basis points below the smaller banks’ bond spreads, after controlling for bond characteristics, including the credit rating, maturity and amount of issue, and the overall conditions in the economy at the time of issue.

While legislators and regulators may like to promote that Dodd-Frank has implemented charges and put mechanisms in place to deal with the possible unwind of these megabanks if they were to run into trouble, those costs are only further incentive for these very banks to get that much larger and take even greater risks so as to offset those costs.

Who is calling the shots here? The Federal Reserve? The Office of the Comptroller of the Currency? The SEC? Congress?

No, no, no, and most definitely, NO!!

Wall Street banks and their exceptionally powerful lobby ultimately carry the day, and they are collecting a toll from you, me, and every other taxpaying American on a daily basis.

Call it what you want: crony capitalism . . . corporate welfare . . . reality. Do not forget that the five largest banks (Citigroup, JP Morgan, Bank of America, Wells Fargo, and Goldman Sachs) hold 95% of the approximate quadrillion (that’s a thousand trillion folks!!) dollars worth of derivatives contracts. And we are supposed to believe that the Federal Reserve or some other entity might be able to manage an orderly unwind within that viper’s den?

What is the only way that this toll — er subsidy — might end so that we are never again faced with the need to bail out these institutions?

Break up these banks!

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 26, 2014

Taking Stock on Bloomberg: Expose the Corruption

I thank Bill Cohan, Carol Massar, and those at Bloomberg for having me on the show Taking Stock yesterday afternoon to address my take on the recent guilty verdict handed down in the Madoff employees case, corruption within the financial-political-regulatory system, and recent developments within the executive offices at JP Morgan.

Those who have read my book In Bed with Wall Street: The Conspiracy Crippling Our Global Economy will understand exactly what I mean when I say in this 5-minute interview that we need to “expose the corruption.”

For those who have not yet read the book — I hope you will — but would like to know more specifically what I am referring to when I make the statement that we need to “expose the corruption,” I am speaking of the following all of which is voluminously detailed in the book:

investor abuse within what I define as Wall Street’s largest scam, the ARS market; kangaroo courts within the arbitration process on Wall Street; misappropriation of funds and lies within the merger process that formed Wall Street’s self-regulatory organization, FINRA; sham investor protection within SIPC (Securities Investor Protection Corporation); whistleblowers being violated and abused by Wall Street banks, the SEC, and FINRA . . . and more.

All of these corruptible practices go straight to the integrity of the regulatory oversight of our markets and the protection of your investments and retirement funds.

I hope those who view this clip might care enough about exposing corruption so as to share this video with your friends and colleagues. Be confident and rest assured that this material does work its way back to those within the regulatory offices on Wall Street and in Washington.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to view this video clip and to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 25, 2014

Madoff Verdict Further Indicts JPM, SEC and FINRA

If the guilty verdict rendered yesterday in the trial of Madoff employees qualifies as full and fair justice in our nation, then we need to rethink our justice system.

If the guilty verdict rendered yesterday in the trial of Madoff employees qualifies as full and fair justice in our nation, then we need to rethink our justice system.

Now, do not get me wrong. I do not have any sympathy for the sorry looking lot of defendants found guilty yesterday. In my opinion, they deserve what they get and were likely integral in aiding and abetting the massive fraud perpetrated by the swindler Bernard Madoff.

Are we to think, though, that the decades long scam perpetrated by Bernie and his rag tag team began and ended strictly inside his offices?

Folks, let’s not be so naive.

As The Wall Street Journal reports:

One juror, Craig Parise, said Monday that there was no “smoking gun,” but the totality of the evidence was “just overwhelming.” Mr. Parise, a 39-year-old teacher from Westchester County, N.Y., said that the tens of thousands of documents shown during the trial underscored the depth of the fraud. “I did not realize the enormity of it,” he said.

Tens of thousands of documents? The depth and enormity of the fraud?

So the US attorneys trying this case are able to compile and lay out a mountain of evidence to convict a pack of employees who might be challenged to understand the inverse relationship between price and yield, yet somehow Bernie’s bankers at JP Morgan were not similarly aware of what was going on, and the bank walks away with merely paying a fine for its own failures to “know your customer.”

If that is not justice misdirected so as to be denied, then I do not know what is.

But there is more.

Ponder once again Mr. Parise’s quote:

. . . the totality of the evidence was “just overwhelming.”

Yet the SEC and Wall Street’s own self-regulatory organization FINRA did not look at the same evidence in the course of their monitoring this den of thieves? You think that is strictly incompetence? I don’t.

The regulators from the SEC and FINRA have never been held to a full and proper independent accounting for their failure to supervise and regulate Madoff’s scam.

Never.

How does that happen? The Feds protecting their own and an abuse of the absolute immunity privilege accorded to those within government and regulatory offices.

What is absolute immunity without total transparency? Nothing more than a license to steal.

Without a full and proper accounting of the regulators charged with overseeing Madoff’s operations, a sense of full, fair, and proper justice has been stolen from the American public. The resulting double standard further erodes the rule of law in our nation while cementing the cronyism and corruption between Wall Street and Washington that lie at the very foundation of this entire fiasco.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 18, 2014

AG Holder Owes America Answers on Mortgage Fraud

[image error]Are you sick of being lied to?

Seriously.

At what point do we as a nation say ENOUGH to the lies and scandalous practices within and around Washington?

I am referring to the lies — and yes, they are lies — that were put forth by the Attorney General’s office in the investigation of mortgage fraud. If you do not think Eric Holder, Lanny Breuer, and others intentionally misrepresented — er, lied — regarding the efforts of the DOJ to the American public, I beg to differ.

Let’s not give President Obama a pass on this front. Recall that the president formulated a Financial Fraud Enforcement Task Force in late 2009 to actively and aggressively pursue those involved in mortgage fraud and related activities. What does President Obama have to say about the recent IG report that skewers the DOJ’s pathetic efforts to investigate mortgage fraud on behalf of the American public?

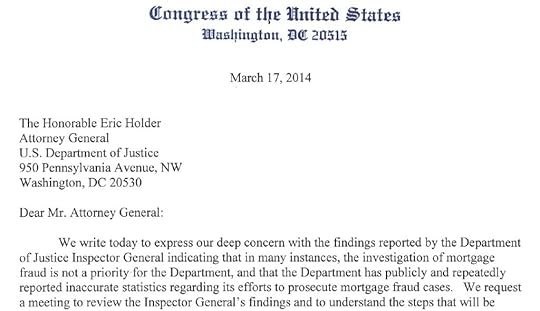

Thankfully, a few members of Congress are willing to call Attorney General Holder on the carpet. Regardless of what people may think of Elizabeth Warren, Maxine Waters, and Elijah Cummings, we owe them a debt of gratitude for calling Holder to account on the charade perpetrated by his office at the behest of President Obama. Where are the Republicans in Congress to join this call?

If anybody wanted further confirmation as to how the Obama administration, Congress, and our major financial regulators are still very much ‘in bed with Wall Street,’ then read on and review the letter released today by the three aforementioned members of Congress that details:

The FBI Criminal Investigative Division ranked Complex Financial Crimes as the lowest of the six ranked criminal threats within its area of responsibility, and ranked mortgage fraud as the lowest subcategory threat within the Complex Financial Crimes category . . .

The Inspector General also reported that the data collected regarding the Department’s mortgage fraud prosecutions were not reliable . . .

The Inspector General also reported that the Department has publicly reported inaccurate and inflated data to the public . . .

The number of Americans who have been the victims of mortgage fraud is unknown and the Inspector General’s report indicates that the Department’s own data are unreliable indicators of the extent of the Department’s efforts to identify and prosecute those responsible for illegal lending schemes. This report calls into question the Department’s commitment to investigate and prosecute crimes such as predatory lending, loan modification scams, and abusive mortgage servicing practices.

Based on this review one might think the DOJ was not really even trying to hold those engaged in mortgage fraud to proper account. Well, that would be accurate. The ineffectual efforts by the DOJ on this front strike me as eerily similar to the ‘all bark no bite’ put forth by the DOJ on other similar fronts including the manipulation of markets, money laundering, investor abuse, and more.

The degradation of the rule of law that stems from the crony capitalism on display here is central to the breakdown of a civil and democratic society.

Are you listening Mr. Holder and Mr. President?

For those who care to read the two page letter signed by Warren, Waters, and Cummings, I welcome sharing it (click on image below to access).

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 17, 2014

A Great Day for The Irish: Happy St. Patrick’s Day!!

[image error]It seems only fitting that, with a surname like Doyle, on the 17th of March I should take a break from the daily navigation of the economic landscape, show off my ancestors’ breastplate, and spread a wee bit of Irish hopefulness to all who come here. On that note, I welcome sharing this Irish blessing:

Wishing you a rainbow

For sunlight after showers—

Miles and miles of Irish smiles

For golden happy hours—

Shamrocks at your doorway

For luck and laughter too,

And a host of friends that never ends

Each day your whole life through!

With best wishes and Godspeed, I also hope people might take just a few minutes to enjoy this Irish classic:

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 16, 2014

Rolling Stone Interview: Bill Gates Is Clueless on US Government Corruption

[image error]Bill Gates did not become one of the wealthiest individuals in the world by accident. Gates is a visionary, exceedingly charitable, and clearly ‘scary smart’.

All this said, Gates is neither perfect nor infallible. In fact, on some of the most critically important topics of the day, I think he is downright clueless. Let’s navigate.

I thank the readers who shared a recent interview Gates had with Rolling Stone in which there was the following ‘must read’ brief exchange:

RS: In the past, you have sounded cynical about the role that government can play in solving complex problems like health care or reforming anti-poverty policies.

BG: Not cynicism. You have to have a certain realism that government is a pretty blunt instrument and without the constant attention of highly qualified people with the right metrics, it will fall into not doing things very well. The U.S. government in general is one of the better governments in the world. It’s the best in many, many respects. Lack of corruption, for instance, and a reasonable justice system.

The best government in the world in terms of lack of corruption and a reasonable justice system?

Think again, Bill! You are not only wrong, but you are not even close with your assessment.

As I recently highlighted, the World Justice Project recently released the standing of the USA and other nations on a whole host of metrics in terms of promoting the rule of law.

Bill, check out the following rankings for the USA:

So Bill, with all due respect, the United States of America is not the best government in the world when it comes to lack of corruption and a reasonable justice system. In fact, relative to nations of a similar income rank, the USA is not even mediocre with a standing in the bottom third for these critically important standards.

I hope somebody out there in the blogosphere who might have a connection to Mr. Gates would bring this data to his attention. I have no interest in any sort of ad hominem attack on Mr. Gates, but he should be challenged when he makes statements such as these.

Wouldn’t it be great if he made exposing crony corruption within our government and the accompanying double standard within our justice system as two of his major causes?

Come on, Bill. You clearly are great with numbers. Do ratings of 21 out of 30 on corruption and 25 out of 30 and 22 out of 30 on the justice front trouble you? They certainly trouble me and a whole lot of folks navigating these parts.

How about you use your bully pulpit and call out the folks in Washington to end these rackets? Perhaps you might even want to join forces and support the efforts of those at Represent.Us working on addressing systemic corruption in our political system.

I hope everybody reading this will share it with your own networks so this real time data works its way back to Mr. Gates.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 15, 2014

Congress: Telemarketing Central USA

[image error]Do you get annoyed by telemarketing calls coming into your home at all hours? Imagine, instead of a pitchman for just another product you would never need, that the individual on the other end of the line is your US Congressman. Ridiculous? Think again.

Have we sunk so low that our elected officials now spend endless hours literally ‘dialing for dollars’? Indeed they do.

Represent.Us, a grassroots organization you will hear a lot more of in the coming years, highlights a brief 3-minute clip so we can watch and learn as Lawrence Lessig, a professor at Harvard Law School and highly acclaimed political activist, spoke on just such a topic with Bill Moyers:

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.