Larry Doyle's Blog, page 13

March 14, 2014

DOJ Lies, Lies, and Damn Lies re: Mortgage Fraud

When people knowingly misrepresent critically important information to you and do so on a repeated basis, why would you ever trust them?

When people knowingly misrepresent critically important information to you and do so on a repeated basis, why would you ever trust them?

Human nature being what it is, you would not.

That is exactly the quandary the Department of Justice finds itself in currently. How so? Let’s navigate and review a recently released report from none other than the Inspector General’s Office of the Department of Justice which outlines how the DOJ repeatedly delivered grossly exaggerated information to the American public regarding mortgage fraud investigations.

I draw attention to this embarrassing reality in my book. I pay props in the book and here to the folks at Bloomberg and specifically the fabulous journalist Jonathan Weil, who writes:

It has been 17 months since U.S. Attorney General Eric Holder held a news conference to tout the successes of a high-profile task force on mortgage fraud. And it has been seven months since the Justice Department admitted that the crime statistics he trumpeted there were grossly overstated.

How bad was it? At the carefully scripted October 2012 media event, Holder said the department’s Distressed Homeowner Initiative had resulted in charges against 530 criminal defendants, including 172 executives. The actual number of defendants was 107, or 80 percent less, and the department hadn’t tracked how many of them were executives. Similarly, Justice originally said the losses to homeowners were $1 billion. It later cut that figure to $95 million, while the number of victims was revised to 17,185 from 73,000.

Bloomberg News published an article shortly after Holder’s news conference pointing out that the government’s numbers included cases that occurred before the initiative began in 2011. I wrote about the cooked numbers, too, both before and after the Justice Department corrected them.

The department’s Office of the Inspector General released today a 52-page audit report examining Justice’s efforts to address mortgage fraud.

The DOJ’s release of significantly flawed information at a highly publicized press conference in October 2012 regarding the purported success of the [Financial Fraud Enforcement Task Force's] and the DOJ’s recent mortgage fraud initiative reflects the lack of accurate data maintained by the department regarding its mortgage fraud efforts, as well as the department’s serious failure to adequately vet information that it was presenting to the public.

Only days after the press conference the department had serious concerns over the accuracy of the reported statistics, yet it was not until August 2013 when the department informed the public that the October 2012 reported statistics were indeed flawed. Moreover, during those 10 months, the department continued to issue press releases publicizing statistics it knew were seriously flawed. We believe the department should have been more forthright at a much earlier date about this flawed information.

Ponder that information folks. If that is not the definition of scandalous activity if not outright lying to the American public I do not know what is.

In a response letter, Deputy Attorney General James Cole said: “While the errors associated with the data in the initial [Distressed Homeowner Initiative] announcement were related to the unique nature of that effort, the department has committed to putting robust measures in place to help ensure correct reporting of future data in press releases and conferences.”

Same old garbage. Government officials lie to the American public in repeated fashion, issue a token mea culpa, and life goes on.

Is this what our country has come to?

He said the department concurred with the audit report’s recommendations regarding data collection and reporting.

There are some important questions the report failed to address: Were any officials at Justice or the FBI deliberately trying to inflate the numbers? And did anyone there turn a blind eye to their falsity before the numbers were released publicly? The report makes the errors out to be some sort of bureaucratic bungle — “breakdowns in the process” it called them — caused by ill-informed government workers who didn’t know the proper way to collect data.

“Breakdowns in the process?”

ROFLMAO.

Is that what repeated and intentional misrepresentations are called in and around Washington DC?

Where I come from, this sort of activity is referred to as “Lies, lies, and damn lies.”

Trust Uncle Sam?

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 13, 2014

State of The Union: 55 Things You May Not Know . . . but Should

Every now and then there are selected commentaries brought to my attention that just scream, “SHARE THIS!” To that end, I thank the reader who sent along the following article with voluminous links.

Every now and then there are selected commentaries brought to my attention that just scream, “SHARE THIS!” To that end, I thank the reader who sent along the following article with voluminous links.

Think our society is not in distress and decline? I compel you to take a few minutes to review a listing of 55 items compiled by Michael Snyder of The American Dream. Please let me know which of these items most disturb you and what you think of the “state of our union.” Let’s navigate.

#1 We are supposed to have a government “of the people, by the people, for the people”, but only 25 percent of all Americans know how long U.S. Senators are elected for (6 years), and only 20 percent of all Americans know how many U.S. senators there are.

#2 Americans spend more on health care per capita than anyone else in the world by far, and yet we only rank 35th in life expectancy.

#3 Only one state in the entire country has an obesity rate of under 20 percent. 11 states have an obesity rate of over 30 percent.

#4 Of all the major industrialized nations, America is the most obese. Mexico is #2.

#5 Back in 1962, only 13 percent of all Americans were obese, but it is being projected that 42 percent of all Americans could be obese by the year 2030.

#6 According to a new report from the U.S. Department of Agriculture, 31 percent of all food in the United States gets wasted. In case you were wondering, that amounts to approximately 133 billion pounds of food a year.

#7 America has the highest incarceration rate and the largest total prison population in the entire world by a wide margin.

#8 In America, we even put 81-year-old women in prison for feeding the birds.

#9 According to a Newsweek survey taken a few years ago, 29 percent of all Americans could not even name the vice president.

#10 Americans spend more time sitting in traffic than anyone else in the world.

#11 60 percent of Americans report feeling “angry or irritable”. Two years ago that number was at 50 percent.

#12 36 percent of Americans admit that they have yelled at a customer service agent during the past year.

#13 Incredibly, one survey found that 30 percent of all Americans cannot remember in what year the 9/11 attacks happened.

#14 There are more “deaths by reptile” in America than anywhere else in the world.

#15 Right now, 29 percent of all Americans under the age of 35 are living with their parents.

#16 Average SAT scores have been falling for years, and the level of education that our kids are receiving in most of our public schools is a total joke.

#17 According to a study conducted by the Mayo Clinic, nearly 70 percent of all Americans are on at least one prescription drug. An astounding 20 percent of all Americans are on at least five prescription drugs.

#18 Americans spend more than 280 billion dollars on prescription drugs each year.

#19 According to the Centers for Disease Control and Prevention, doctors in the United States write more than 250 million prescriptions for antidepressants each year.

#20 Children in the United States are three times more likely to be prescribed antidepressants than children in Europe are.

#21 In the United States today, prescription painkillers kill more Americans than heroin and cocaine combined.

#22 America has the highest rate of illegal drug use on the entire planet.

#23 According to the federal government, the number of heroin addicts in the United States has more than doubled since 2002.

#24 It is hard to believe, but 56 percent of all Americans now have “subprime credit”.

#25 America exports more weapons to other countries than anyone else in the world.

#26 The United States has the most complicated tax system on the entire planet.

#27 Corruption is rampant throughout our society. In fact, America leads the world in money given to fake charities.

#28 America leads the world in soft drink consumption by a wide margin. Today, the average American drinks more than 600 sodas a year.

#29 In 2008, 53 percent of all Americans considered themselves to be “middle class”. In 2014, only 44 percent of all Americans consider themselves to be “middle class”.

#30 70 percent of Americans do not “feel engaged or inspired at their jobs”.

#31 40 percent of all workers in the United States actually make less than what a full-time minimum wage worker made back in 1968 after you account for inflation.

#32 Back in the 1970s, about one out of every 50 Americans was on food stamps. Today, about one out of every 6 Americans is on food stamps.

#33 The marriage rate in the United States has fallen to an all-time low. Right now it is sitting at a yearly rate of 6.8 marriages per 1000 people.

#34 In the United States today, more than half of all couples “move in together” before they get married.

#35 America has the highest divorce rate in the world by a good margin.

#36 America has the highest percentage of one person households on the entire planet.

#37 100 years ago, 4.52 were living in the average U.S. household, but now the average U.S. household only consists of 2.59 people.

#38 According to the Pew Research Center, only 51 percent of all American adults are currently married. Back in 1960, 72 percent of all adults in the United States were married.

#39 For women under the age of 30 in the United States, more than half of all babies are being born out of wedlock.

#40 At this point, approximately one out of every three children in the United States lives in a home without a father.

#41 In 1970, the average woman had her first child when she was 21.4 years old. Now the average woman has her first child when she is 25.6 years old.

#42 America has the highest teen pregnancy rate in the world by a very wide margin.

#43 Approximately one out of every four teen girls in the United States has at least one sexually transmitted disease.

#44 America has the highest STD infection rate in the entire industrialized world.

#45 According to the latest figures released by the U.S. Centers for Disease Control, there are 20 million new sexually-transmitted infections in the United States every single year, and Americans in the 15 to 24-year-old age range account for approximately 50 percent of those new sexually-transmitted infections.

#46 As I wrote about recently, there are 747,408 registered sex offenders in the U.S. according to the National Center for Missing & Exploited Children.

#47 America produces more pornography than any other nation in the world.

#48 America has the most lawyers per capita in the entire world.

#49 If you choose to be a “Constitutionalist” in America today, you may get labeled as a potential terrorist by the U.S. government.

#50 America has the largest national debt in the history of the world. Back in 1980, the U.S. national debt was less than one trillion dollars. Today, it is over 17 trillion dollars.

#51 According to the Congressional Budget Office, interest payments on the national debt will nearly quadruple over the next ten years.

#52 Americans spend more money on elections than anyone else does in the world by a very wide margin.

#53 65 percent of Americans are dissatisfied “with the U.S. system of government and its effectiveness”. That is the highest level of dissatisfaction that Gallup has ever recorded.

#54 Only 8 percent of Americans believe that Congress is doing a “good” or “excellent” job.

#55 70 percent of Americans do not have confidence that the federal government will “make progress on the important problems and issues facing the country in 2014.”

OUCH!! Not in every item, but what do I see on display in much of this list? Two things:

1. A decline of values widely associated with a strong nuclear family.

2. A lack of real leadership.

What to do?

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 12, 2014

‘Canaries In Coal Mines’: Copper and Iron Ore Markets Breaking Down

Having focused meaningful attention on developments in China in recent commentaries, I am compelled to draw even further focus to the ‘canaries in the coal mines,’ that is, the copper and iron ore markets.

Having focused meaningful attention on developments in China in recent commentaries, I am compelled to draw even further focus to the ‘canaries in the coal mines,’ that is, the copper and iron ore markets.

Let’s navigate eastward once again as the FT writes,

Copper continued to take a pummelling, with Shanghai traded futures in the metal falling by their daily limit on Wednesday morning.

That came after a frenzied day of trading on Tuesday, when copper prices sank below $6,500 a tonne to a near four-year low as concerns mounted over the fragility of the Chinese market.

In frenetic afternoon trading, prices tumbled more than 2.5 per cent to a low of $6,470. Since Thursday, copper for three-month delivery on the London Metal Exchange has tumbled by nearly $600, or 8.9 per cent.

On Wednesday morning, Shanghai traded copper futures fell 5.4 per cent, a fifth straight daily loss, to Rmb43,690 ($7,115) a tonne – the lowest since July 2009.

The slump in copper was sparked by China’s first corporate bond default on Friday, which has caused a reassessment of credit risk in the country.

Copper has become an increasingly popular source of collateral for Chinese traders who can obtain US dollar loans and profit from interest rate arbitrage. As a result, copper imports have rocketed in recent months, with much of the stock headed into warehouses rather than factories.

If the financing deals were to suddenly unwind, vast quantities of metal would pour into an already well-supplied market. China accounts for 40 per cent of global copper consumption, but demand in the physical market has been weak this year.

Tuesday’s reported suspension of trading of Baoding Tianwei Baobian Electric Co bonds and shares on the Shanghai stock exchange, because of mounting losses, added to the copper jitters, according to Stephen Briggs, analyst at BNP Paribas.

“The market is worried about what could happen in China, since financing deals have now become much less attractive,” he said.

Iron ore prices in China have come under pressure as mills that opened three-month letters of credit in December to tide themselves over during end-of-the-year credit tightness sold stock to repay their loans.

“The main problem is financing,” said Chen Yan, iron ore analyst with SteelHome in Shanghai.

Financing is always the issue especially when entities are excessively leveraged as many in China are.

I would keep a close eye on these commodity markets specifically and the ripple effect that they have on emerging markets generally and then developed markets beyond that.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 11, 2014

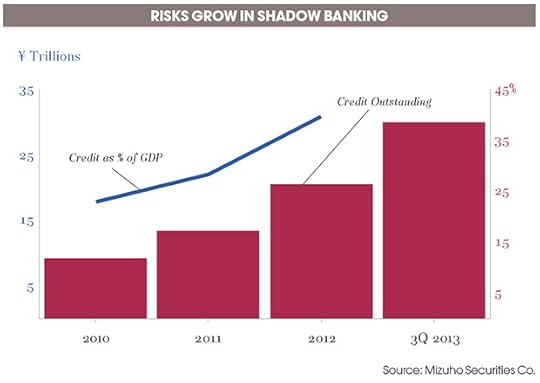

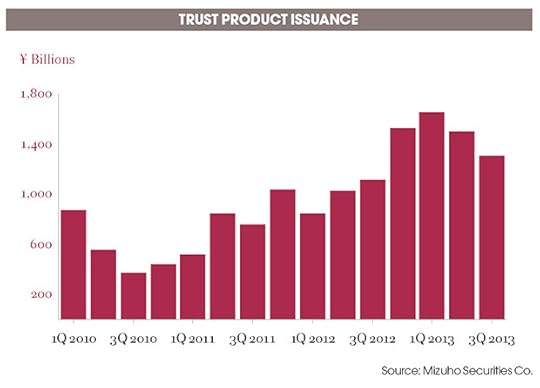

Greatest Market Risk: China’s Shadow Banking

As I navigate the markets and global economy, I am always on the lookout for sectors and regions where leverage has built up to the point where it bubbles over and needs to be reined in. In the process, markets tend to retrace.

On this note, I drew attention to what I deemed our current, greatest market risk when I wrote in mid-January about the shadow banking system in China (What Is Greatest Global Risk Lurking In Shadows? Look East).

Much as the shadow banking system in our country grew to the point where it was lending 40-45% of the total credit that flowed into our economy, the explosive growth in the shadow banking system in China now equates to a not insignificant ~60% of China’s GDP. Why should we be concerned? Did you notice the recent 8% decline in the price of iron ore and a similar decline in the price of copper stemming from concerns over the Chinese economy? A slowing in China presents a challenge for those entities that have borrowed short (paying dearly in the process) and lent long and leveraged up in the process.

Institutional Investor writes a “must read” for anybody who cares about keeping their pulse on risks in the global markets and economy.

I strongly recommend reading China’s Shadow Banking Sector Poses Risks to Economy.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 10, 2014

Baupost’s Seth Klarman Warns of Asset Bubble

More often than not, I take the wisdom provided by selected talking heads and industry insiders with a pound of salt.

More often than not, I take the wisdom provided by selected talking heads and industry insiders with a pound of salt.

Without being overly cynical strictly for cynicism’s sake, I discount a fair bit of the analysis put forth by many financial sleuths based on the individual ‘talking his own position.’ In fact, I believe that many outlets predominantly look for guests who play the game and toe the industry’s party line.

To that end, I look elsewhere for insights and perspectives that I really appreciate. Who are some of the money managers I truly respect but are rarely seen on major financial outlets? Bob Rodriguez, Jeremy Grantham, and Seth Klarman, who just so happens to offer some pointed insights highlighted today in a commentary in the FT: >>>>>>

One of the world’s most respected investors has raised the alarm over a looming asset price bubble, calling out “nosebleed valuations” in technology shares like Netflix and Tesla Motors and warning of the potential for a brutal correction across financial markets.

Seth Klarman, the publicity-shy head of the $27bn Baupost Group whose investment opinions have attracted almost a cult-like following, said that investors were underplaying risk and were not prepared for an end to central banks reversing a five-year experiment in ultra-loose money.

While noting that he could not predict exactly when a significant market correction would occur, Mr Klarman wrote in a private letter to clients: “When the markets reverse, everything investors thought they knew will be turned upside down and inside out. ‘Buy the dips’ will be replaced with ‘what was I thinking?’ . . . Anyone who is poorly positioned and ill-prepared will find there’s a long way to fall. Few, if any, will escape unscathed.”

Baupost, which is closed to new investment, returned $4bn to clients last year.

The warning by Mr Klarman, who has won a devoted audience for his highly cautious, value-driven approach, and whose out-of-print book on investment sells second-hand for as much as $2,900 on Amazon, comes after US shares surged by almost a third last year. Many well known technology companies, such as Facebook, more than doubled.

“Any year in which the S&P 500 jumps 32 per cent and the Nasdaq 40 per cent while corporate earnings barely increase should be a cause for concern, not for further exuberance,” Mr Klarman wrote.

“On almost any metric, the US equity market is historically quite expensive. A sceptic would have to be blind not to see bubbles inflating in junk bond issuance, credit quality, and yields, not to mention the nosebleed stock market valuations of fashionable companies like Netflix and Tesla Motors,” he wrote.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 7, 2014

World Justice Project: 2014 Rule of Law Report Recommended

[image error]Among various reports that I look for on an annual basis, I appreciate the Rule of Law Index produced by the World Justice Project as much as any.

Why do I anticipate reading and reviewing this report so much? Because we are a nation of laws and not of men. At least I think we are . . . although sometimes I wonder. As the WJP highlights:

“Effective rule of law helps reduce corruption, alleviate poverty, improve public health and education, and protect people from injustices and dangers large and small,” said William H. Neukom, WJP Founder and CEO. “Wherever we come from, the rule of law can always be strengthened.”

The Index is the most comprehensive index of its kind and the only to rely solely on primary data.

The more serious students in the audience may care to review the entire report. For those who might care for an abbreviated version of how the United States is doing, I welcome informing you of the following:

Our overall rank across all factors measured: 19th out of 99 nations. But let’s dig a little deeper and be a little more rigorous in our review. On a regional basis the USA is little better than average and relative to those nations with similar income levels, we consistently rank near the lower third if not worse than that by most measures.

A great nation? True leaders and statesmen know that a nation needs to uphold and embrace the rule of law, protect property rights, and expose corruption in order to be a nation worthy of being called ‘great.’

We have a lot of work to do.

Additionally, the following line jumps out of the report on page 46:

“The United States saw a significant decline during the past year in people’s trust in the system of checks and balances and the protection of the right to privacy.”

Trust is the cornerstone of our markets, our economy, and ultimately our nation.

Is it any real surprise given all that we have witnessed, not only over the last year but preceding years as well, why people are less trustworthy about our system of checks and balances in America? Think of the massive abuses of power — with little meaningful accountability and truth — that have weighed upon our nation.

In thinking of all that we have experienced since the crisis that was centered on Wall Street and ran across our nation and the global economy, I think we should reflect on the concluding remark from this piece entitled, Perspectives on the Constitution:

. . . democratic republics are not merely founded upon the consent of the people, they are also absolutely dependent upon the active and informed involvement of the people for their continued good health.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

Is That Broker Soliciting You an Ex-Con?

Not that we needed any more evidence that Wall Street’s primary self-regulator is a challenged organization when it comes to protecting investors, but in a lead commentary in today’s Wall Street Journal we get it:

Not that we needed any more evidence that Wall Street’s primary self-regulator is a challenged organization when it comes to protecting investors, but in a lead commentary in today’s Wall Street Journal we get it:

The Financial Industry Regulatory Authority “routinely” strips out some possible red flags on brokers from its database in the information it makes available to investors, according to a study released Thursday by an organization of lawyers who represent investors in claims against brokers.

The study followed a Wall Street Journal investigation, which disclosed in a page-one article Thursday that more than 1,600 brokers’ records don’t show personal bankruptcies and criminal charges that should be reported.

Criminal charges, huh? Such as . . .

The criminal charges uncovered by the Journal, which don’t show up on brokers’ records—in accordance with the current rules—include assault, sexual contact without consent, hit-and-run and habitual substance abuse.

Would you want to know if an individual soliciting you has a rap sheet with charges such as those? I would.

FINRA would maintain how could they possibly keep up with the hundreds of thousands of brokers populating our nation, and that fairness dictates some material be expunged. I am all for rehabilitation, but I am also a big proponent of protecting investors –many of whom are senior citizens viewed as easy prey by unscrupulous brokers.

Investors can look up brokers on a Finra website called “BrokerCheck” and quickly find out their professional history. But the Public Investors Arbitration Bar Association, the lawyer group, said Thursday that Finra was scrubbing potential black marks from the information it provided to investors.

Scrubbing black marks? How do you spell complicit? How about aiding and abetting?

Finra defended its BrokerCheck tool. “While the system may not be perfect, we do have to make determinations on what information…is appropriate to release, while at the same time balancing fairness,” it said.

Fairness? Please. Tell that to the countless number of truly decent individuals in our nation who our government and financial regulators have massively failed to properly protect.

How is it that ex-cons are in a position to solicit often uninformed and largely unprotected investors? I will tell you how. Because the meter maids running FINRA do not hold the banks and brokers who hire ex-cons to proper account when a whole host of bad practices occur. When penalties do not fit the crime, then the message sent to the industry is ‘keep doing what you’re doing.’

While we fully check and disclose the backgrounds of the ex-cons, how about we also mandate that the execs running FINRA release all the data and records regarding a whole host of other questionable practices (kangaroo courts, misappropriation of funds, allegations of lying, and so much more) surrounding FINRA itself.

For those unaware, FINRA is not subject to the Freedom of Information Act — although it should be — and utilizes the defense of an absolute immunity privilege when challenged in court. Absolute immunity without total transparency is nothing more than a license to steal.

This edition of “You Can Not Make This Stuff Up” is merely further evidence that this self-regulator is indeed ‘In Bed with Wall Street.’

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

T. Hoenig: ‘TBTF’ Banks Insufficient Equity Capital; The Case for Glass-Steagall

I inadvertently overlooked a recent commentary written by a Sense on Cents favorite, Simon Johnson, that ran at Project Syndicate.

Johnson writes a fabulous piece entitled Truth From the Top highlighting the work of former Fed governor Thomas Hoenig about just how fragile our banking system truly is and how the politics of promoting the ‘too big to fail’ model have persisted. Let’s navigate.

It is unusual for a senior government official to produce a short, clear analytical paper. It is even rarer when the official’s argument both cuts to the core of the issue and amounts to a devastating critique of the existing order.

In a speech delivered on February 24, Thomas M. Hoenig, Vice Chairman of America’s Federal Deposit Insurance Corporation (FDIC), did exactly that. These four pages are a must-read not only for economic policymakers around the world, but also for anyone who cares about where the global financial system is heading.

Hoenig, former President of the Federal Reserve Bank of Kansas City, has spent his career working on issues related to financial regulation. He communicates effectively to a broad audience – and understanding the technicalities of finance is not needed to grasp his main points.

One of those points is that the world’s largest financial firms have equity that is worth only about 4% of their total assets. As shareholders’ equity is the only real buffer against losses in these corporations, this means that a 4% decline in their assets’ value would completely wipe out their shareholders – taking the companies to the brink of insolvency.

In other words, this is a fragile system. Worse, the current regulatory treatment of derivatives and of funding for large complex financial institutions – the global megabanks – exacerbates this fragility. Perhaps we are moving in the right direction – that is, toward greater stability – but Hoenig is skeptical about the pace of progress.

As he points out, the relevant studies show that the megabanks receive large implicit government subsidies, and this encourages them to stay big – and to take on a lot of risk. In principle, such subsidies are supposed to be phased out through measures being taken as a result of the 2010 Dodd-Frank financial-reform legislation. In practice, these subsidies – and the politics that makes them possible – are firmly entrenched.

The facts may startle you. In 1984, the US had a relatively stable financial system in which small, medium, and – in that day – what were considered large banks had roughly equal shares in US financial assets. (See Hoenig’s chart for precise definitions.) Since the mid-1980’s, big banks’ share in credit allocation has increased dramatically – and what it means to be “big” has changed, so that the largest banks are much bigger relative to the size of the economy (measured, for example, by annual GDP). As Hoenig says, “If even one of the largest five banks were to fail, it would devastate markets and the economy.”

The Dodd-Frank legislation specifies that all banks – of any size – should be able to go bankrupt without causing massive disruption. If the authorities – specifically the Federal Reserve and the FDIC – determine that this is not possible, they have the legal power to force the banks to change how they operate, including by reducing their scale and scope.

But the current reality is that no megabank could go bankrupt without causing another “Lehman moment” – that is, the kind of global panic that resulted in the days after Lehman Brothers failed in September 2008.

In particular, experts like Hoenig who have thought about the cross-border dimensions of bankruptcy emphasize that it simply would not work for a corporation the size of JPMorgan Chase ($3.7 trillion in assets), Bank of America ($3 trillion), or Citigroup ($2.7 trillion).

“Panic is about panic,” Hoenig says, “and people and nations generally protect themselves and their wealth ahead of others. Moreover, there are no international bankruptcy laws to govern such matters and prevent the grabbing of assets.” I would add that the chance of bankruptcy courts cooperating across borders in this context is nil.

As a result, the Federal Reserve and the FDIC should move immediately to force the megabanks to become much simpler legal entities. Current corporate structures are opaque, with the risks hidden around the world – and various shell games allowing companies to claim the same equity in more than one country.

Breaking down the components of banks into manageable pieces makes sense. The Federal Reserve has recently taken a step in that direction by requiring that global banks with a significant presence in the US operate there through a holding company that is well-capitalized by US standards.

This is not about preventing the flow of capital around the world. It is about making the financial system safer. Anyone who disputes the need to do this – and much more – should read and respond to Hoenig.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 6, 2014

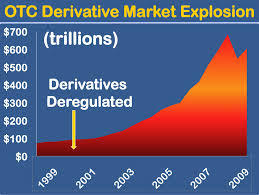

Making Swiss Cheese of Derivatives Reform

In what would appear to be a classic case of pandering to the public while allowing Wall Street to effectively write its own set of rules and ‘reforms’, we witness this bait and switch tactic within the legislation pitched to the American public as having brought meaningful transparency to the derivatives markets.

In what would appear to be a classic case of pandering to the public while allowing Wall Street to effectively write its own set of rules and ‘reforms’, we witness this bait and switch tactic within the legislation pitched to the American public as having brought meaningful transparency to the derivatives markets.

Yes, that quadrillion (thousand trillion) sized market with 95% of the concentration in the 5 largest ‘too big to fail’ banks.

Thanks to our friends at POGO for highlighting the following loopholes large enough for a Mack truck:

Last week, the Roosevelt Institute hosted a conference on financial regulatory reform with a panel of experts including Joseph Stiglitz, Simon Johnson, and Elizabeth Warren, among others. The conference coincided with the release of the Institute’s new report, Make Markets Be Markets – Step 1: Restoring the Integrity of the U.S. Financial System. (LD’s comment: This report appears to be a fabulous resource.)

POGO is still reading through the report, but couldn’t help but notice that there’s an entire section dedicated to the regulation of over-the-counter (OTC) derivatives written by Professor Michael Greenberger, the former Director of Trading and Markets at the Commodities Futures Trading Commission (CFTC) under Brooksley Born. Over the past few months, POGO has been raising concerns about some potential loopholes in Congress’s legislation to overhaul the regulation of OTC derivatives, including one that would create an “alternative swap execution facility” with much weaker requirements for transparency and disclosure.

POGO was pleased to see Professor Greenberger highlight this provision as one of three “deregulatory measures” that “crept into the House bill.” Here’s his take on it:

Swaps Execution Facility. First, while the bill continues to require that swaps not otherwise exempt must be exchange traded, at the behest of Wall Street lobbyists, the exchange trading requirement can be satisfied by placement of a privately executed swap on a “swaps execution facility,” which includes electronic trade execution or voice brokerage. While the electronic trade must be conducted by an entity “not controlled” by the counterparties, if the “SEF will not list the contract, it does not have to be executed.” In other words, the swap does not need to be exchange traded if it is submitted to a swaps execution facility that will not trade the swap. Pursuant to vigorous Wall Street lobbying, this SEF (introduced in House Agriculture Committee mark up) appears to undercut completely the bill’s and the Obama Administration’s exchange trading requirement. The provision for the SEF must be removed from any bill addressing the regulation of derivatives and swaps.

When politicians in Washington or elsewhere say that the derivatives market has been reformed and become much more transparent, go ahead and call bull$#@& on them and then ask how the language highlighted above got into the bill.

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.

March 5, 2014

Insider Trading at the SEC??

The abbreviated definition of insider trading is “the buying or selling of a security by someone who has access to material, nonpublic information about the security.”

The abbreviated definition of insider trading is “the buying or selling of a security by someone who has access to material, nonpublic information about the security.”

Who could possibly be more “inside” than an individual who is in the position to take action against a company, that is employees of the Securities and Exchange Commission?

In another edition of “You Can Not Make This Stuff Up,” a recent paper highlights how employees at the SEC are superb in terms of their stock trading and specifically their stock selling skills. Let’s navigate.

. . . results suggest that SEC employees potentially trade profitably under the new rules, and that at least some of their profits potentially stem from trading ahead of costly SEC sanctions and on privileged non-public information. In short, it appears that SEC employees continue to take advantage of non-public information to trade profitably in stocks under their regulatory purview.

Think the recently convicted SAC trader Matthew Martoma might have liked the cover provided by SEC rules allowing employees to liquidate positions prior to a potential action being brought against a company?

When confronted by the findings in this paper, SEC officials were initially mute prior to releasing the following statement as highlighted by The Washington Post:

“Each of the transactions was individually reviewed and approved in advance by the Ethics office,” said John Nester, spokesperson for the SEC. “Most of the sales were required by SEC policy. Staff had no choice. They were required to sell.”

The requirement is based on the premise that an SEC official cannot work on a case while owning stock in the company in question.

In my opinion, that rule does not come anywhere close to passing the smell test. Employees primarily within the SEC’s Enforcement Division should either liquidate all individual stock holdings upon time of employment and/or freeze all holdings and trading of stocks until time of departure.

In regard to the SEC’s Ethics Office, is that an oxymoron?

Not to impugn everybody within the SEC, but the question of ethics within this commission should not be answered by an SEC spokesperson but by the many whistleblowers who have been violated in the past by the SEC (Peter Scannell, Gary Aguirre, David Weber, Peter Sivere, et al) and those who are still wondering what is going on with their cases and receiving what is commonly referred to as ‘the silent treatment.‘

Navigate accordingly.

Larry Doyle

Please order a hard copy or Kindle version of my book, In Bed with Wall Street: The Conspiracy Crippling Our Global Economy.

For those reading this via a syndicated outlet or receiving it via e-mail or another delivery, please visit the blog to comment on this piece of ‘sense on cents.’

Please subscribe to all my work via e-mail.

The opinions expressed are my own. I am a proponent of real transparency within our markets so that investor confidence and investor protection can be achieved.