Doug Marshall's Blog, page 6

April 4, 2019

9 Reasons Why Owning CRE is Far Superior to Owning REIT Stocks

I recently read an article titled, What I Wish I Knew Before Investing In Rental Properties by Jussi Askola. Mr. Askola is the President of Leonberg Capital who has authored several academic papers on REIT investing.

A Distorted View of Real Estate Investing

The premise of his article is that real estate investing:

Is a lot of work

It’s a lot of worrying

It’s not passive

You will have sleepless nights

You won’t have freedom of movement

He concludes, “Sooner or later toilets get clogged, tenants will cause problems, rents will get unpaid, you need a lawyer and roofs will leak… If your goal is financial freedom, investing in rental properties will most often be a mistake.”

Wow. What a distorted view of real estate investing. And I suppose if you invest in single family homes or small plexes and self-manage your properties there is some truth to his opinion.

Mr. Askola then devotes the rest of his article espousing the benefits of Real Estate Investment Trusts better known as REITs. Essentially, REITs are corporations that own and manage a portfolio of real estate properties and mortgages. Anyone can buy shares in a publicly traded REIT.

Let me make my position perfectly clear, I’m not trashing REITs as an investment vehicle. I do believe that there is a legitimate place for REITs in an investor’s investment portfolio along with mutual funds, stocks, bonds and precious metals. But I am annoyed with Mr. Askola’s skewed view of real estate investing.

A More Objective Analysis of REITs vs CRE

So let’s begin with the basics. A real estate sponsor, also called a syndicator, finds a property to invest in and then searches for equity partners, also called passive investors. It’s a symbiotic relationship between the real estate sponsor and the equity partners. The real estate sponsor puts the deal together but without the passive investor’s equity the deal does not close. They need each other. One can’t succeed without the other.

My guess is that most real estate assets today are owned by passive investors, such as myself. I don’t know about you, but as a passive investor I’ve never unclogged a toilet or dealt with a difficult tenant late on his rent as Mr. Askola tells us is inevitable if we invest in real estate. Nor has my real estate sponsor. That’s why we hire property management companies. Nor do I have sleepless nights worrying about my rental properties.

So let’s go through Mr. Askola’s reasons for owning a REIT.

1. Professional management.

This is not an advantage over owning real estate. I wouldn’t own real estate if I had to manage my own properties.

2. Liquidity and low transaction costs.

Half true. Yes, owning real estate is an illiquid asset. You shouldn’t buy a rental property unless you plan to hold it for a minimum of five years, preferably longer. Low transaction costs? That depends on how you look at it. The cost of purchasing real estate whether directly by purchasing your own rental property or indirectly by owning real estate in the form of a REIT are more or less the same.

I would argue that the transaction costs are substantially more when a REIT buys a property than when a smaller investor buys a property. Why? REITs typically buy very large properties in the $50 to $100 million range. Lenders who finance these properties require substantially more due diligence in the way of third-party reports. And these reports are expensive. And the legal bills associated with these transactions are ginormous! These higher closing costs in the form of additional third-party reports and legal bills are baked into the cost of the REIT stock. Or if the stock price is unaffected then you’re paying for these closing costs through a lower return on your investment. So make no mistake, you the owner of a REIT stock are paying for these closing costs one way or the other.

3. Diversification.

Agreed. REITs generally have a diversified portfolio of 20 or more real estate assets. But diversification has its drawbacks. True it does reduce your risk, but it also reduces your return. It brings your return on your investment down to the median return for that asset class. Warren Buffett didn’t become one of the wealthiest men on the planet by diversifying his stock portfolio. He did it by focusing on buying companies that he deemed were bargains. And that is what real estate investors do. They search the real estate market for properties that are underperforming the market and buy them.

4. Passive income.

Investing in real estate is all about passive income. And owning rental properties has a significant leg up on REITs and here’s why: Not only do real estate investors receive monthly distributions we also from time to time get to refinance our properties and take cash out. Once needed improvements have been made to a value-add property, rents increase significantly, and the property’s value skyrockets. I’ve had instances where the cash back from the refinance has paid back all of my original equity and then some. And the property with the new debt still continues generating healthy monthly ownership distributions. REIT stocks do not have the ability to generate large cash distributions when refinancing a property.

5. Better long-term returns.

Mr. Askola pivots at this point and compares the return on REITs with the return on the S&P 500. He boasts that REITs have a 12.4% average annual return compared to 10.9% with the S&P 500. But notice he does not compare a REITs return with investing in commercial real estate. Why not? Because a side-by-side comparison between these two asset classes would show the superiority of investing in real estate. I regularly receive offering memorandums from real estate sponsors seeking equity partners to invest in their latest acquisition. Typically, their pro formas show a 17% or greater Internal Rate of Return (IRR). From personal experience I believe a 17% IRR is very realistic. Sure, some investments turn out to fall well below this return but on average a 17% IRR is quite likely.

Now let me explain my reasons why I believe owning real estate is far superior to owning REIT stock:

6. REITs are notorious for overpaying for their property acquisitions.

Today, the only way to make a decent return from investing in CRE (commercial real estate) is to purchase value-add type properties, i.e., properties that are in poor condition and/or are poorly managed. With the right improvements and a change in management these properties can dramatically increase rents. With increased rents comes a corresponding increase in the property’s value. That’s how smart investors are investing today in CRE.

REITs not only don’t buy value-add type properties, they buy turnkey properties, i.e., properties that are well maintained and well managed. To make matters worse they gravitate towards the Class A properties with the exceptionally low cap rates. They buy properties that look great on the front cover of their investment brochures. And because they have considerable funds they pay overpay for these assets. There is no way they can get better returns than an investor who buys value-add properties. It’s not going to happen!

7. REIT stocks are at the mercy of the whims of the stock market.

When the stock market plunges all stocks are affected, including REIT stocks. In 2008 when the U.S. stock market lost a third of its value overnight it made no difference what stock you owned. They all plummeted together like lemmings stampeding over a cliff to their deaths. Not so real estate. Real estate that maintained a good vacancy rate weathered the economic turbulence of the Great Recession quite well. Those investors who over leveraged their properties on the other hand, paid the ultimate price and lost their properties.

8. Rental properties have the tax advantage of depreciation. REITs do not.

A rental property can generate both positive cash and a tax loss at the very same time because of depreciation. A tax loss on rental properties shelters other income on the taxpayer’s tax return resulting in less taxes owed. It’s a beautiful thing to behold! Again, REITs do not share this tax advantage.

9. Rental properties can defer capital gains taxes. REITs cannot.

When you eventually sell your REIT stock you pay taxes on any capital gains made. However, when you sell a rental property you can defer capital gains taxes by doing a 1031 exchange. A 1031 exchange is a deferral of the capital gains tax on the sale of an investment property when it is exchanged for a like-kind replacement property. In reality a real estate investor can permanently defer the capital gains tax over his lifetime by continuing to buy a like-kind replacement property each time he sells a rental property. When he dies, his heirs receive a stepped-up basis in the property based on the value of the property at the time of his death. So no capital gains taxes are paid even by his heirs.

I believe I’ve made a convincing argument why owning rental properties is far superior to owning REIT stocks. Those are my thoughts. I welcome yours. Where is my argument flawed? What have I overlooked?

Want more CRE investing tips? Check out my book!

Sources: What I Wish I Knew Before Investing In Rental Properties, by Jussi Askola, Seeking Alpha, March 30, 2019; How REITs Work, by Lee Ann Obringer, https://home.howstuffworks.com/real-e...

The post 9 Reasons Why Owning CRE is Far Superior to Owning REIT Stocks appeared first on MarshallCf.

March 30, 2019

How to Determine Where We Are in the Real Estate Market Cycle

I often get asked, “Is this the right time to invest in real estate?” It’s a legitimate question. As capitalization rates have steadily declined and property values have rapidly increased, this question becomes ever more important to answer. Other insightful questions asked are: “When will the real estate market turn?” and “Has the market peaked?” All good questions.

Before we can answer these, we need to determine where we are on the real estate market cycle. You may be aware that the real estate market cycle is cyclical with four distinct phases: Recovery, Expansion, Hyper-Supply, and Recession. The chart below shows these four phases and how each one impacts new construction and vacancy rates.

Before I explain the four phases of the real estate market cycle, let’s discuss the basics of the chart. The X axis (horizontal line at the bottom) represents Time and the Y axis (vertical line on the left) represents Occupancy. The horizontal dotted line in the middle represents the long-term average occupancy for the market. The vertical dotted line toward the middle represents when supply and demand are perfectly in balance. The black solid line that travels through all four quadrants represents the change in occupancy over time.

Now let’s discuss the four quadrants.

Phase I – Recovery

The Recovery quadrant of the real estate market cycle (shown in the lower left-hand corner of the chart) is characterized by high vacancy and no new construction. Though it’s not shown on this graph, generally rents are flat or declining during this phase. Owners offer rent concessions to avoid their property’s occupancy rate from further declining.

The mood of investors in this quadrant begins with panic: Oh, my, am I going to survive? (recall market conditions in 2009). As the occupancy rate improves to the market’s long-term average occupancy rate, investor attitude slowly turns to one of relief: Whew, I made it through the worst of the market.

Phase II – Expansion

The Expansion quadrant (shown in the upper left-hand corner of the chart) is characterized by declining vacancy and the start of new construction. As occupancy improves, concessions are eliminated and rent growth begins.

The mood of investors turns from relief—I dodged a bullet—to giddiness as vacancy rates decline and rents increase dramatically. Life is extremely good for investors at this point in the real estate cycle.

Phase III – Hyper-Supply

The Hyper-Supply quadrant (shown in the upper right-hand corner of the chart) is characterized by more new construction, and for the first time in a long time, vacancy rates begin to rise. Rent growth, though still positive, grows at a slower pace. And some neighborhoods start to experience rent concessions as new product that has recently come on line becomes increasingly more difficult to lease.

The investor mood turns from giddiness to one of caution and then denial that there is a problem brewing. The glass half full type of investors are still confident everything is going to work out just fine. They are thinking, The slow rent up is only a bump in the road that will self-correct as long as I don’t panic.

Phase IV – Recession

The Recession quadrant (see the lower right-hand corner of the chart) is characterized by the completion of more and more product, which results in a substantial decline in occupancy rates. Newly completed product is sitting there unoccupied so developers begin running “blue light specials” to get them rented up. Concessions are abundant. Even investors with established properties are forced to offer concessions to avoid wholesale move outs.

In this phase, investor mood goes from denial to one of outright panic. Developers begin to wonder, Am I going to make it? The truth is, some will not. Also, some investors who recently bought properties at premium prices and then loaded them with lots of debt realize their mistake. Because they are leveraged to the hilt, a small drop in vacancy results in properties that no longer generate positive cash flow.

Which real estate market phase are we in?

These are the four phases of the real estate market cycle. Understanding where the real estate market is on the cycle is critical to successful investing. Is the market climbing closer to a market peak or is it starting down the slippery slope to recession? How we answer this question may determine the difference between a successful investment or an albatross hanging around our necks.

So where are we today in the real estate market cycle? For the past several years (2013–2018), most real estate pundits have described the real estate market as being in Phase II, the Expansion Phase, which is characterized by high rent growth in a tight rental market. This time period can be best described by a quote from former Federal Reserve Chairman Alan Greenspan. He called it “irrational exuberance” when describing a euphoric stock market. I use a highly technical term to describe this part of the real estate cycle. I call it “The Silly-Stupid Phase.”

What Is the Cycle of Market Emotions?

Describing the real estate market as being in the Expansion Phase is kind of a Mr. Spock approach to evaluating market trends—all logic and no emotion. But emotions play a huge role in the real estate cycle. A useful tool called the Cycle of Market Emotions helps us understand how market phases are interconnected with prevailing moods, such as optimism, excitement, fear, panic, and hope. Imagine an emotional rollercoaster, and you’ll get the idea.

When the real estate market is at the very top of the incline, the predominant emotions are thrill and then euphoria. This happened in 2015-2017. And when it does occur, you can almost hear a big brass band playing “Happy Days Are Here Again.” During times such as these, investors in the real estate market usually have good justification for euphoria. Rents typically increase, sometimes dramatically, interest rates may hit new lows and remain there for some time, and developers may be slow to meet the demand. These conditions are great for investor return, both in appreciation of property values and increases of cash-on-cash returns. So why do I call this phase in the market the Silly-Stupid Phase?

Two Factors Fuel the Silly-Stupid Phase

The Silly-Stupid Phase is characterized by two factors:

The first factor is cap rate compression.

Cap rate compression happens when a real estate market gets stronger (i.e., investors are more confident) and the perceived risk of owning a rental property declines. Ken Griggs, president of the Real Estate Research Corporation, has talked about the precarious balance of value versus price in real estate. When assessing a most recent market condition, he said, “Our analysis showed upward pressure on pricing without a corresponding increase in value.” That’s a little scary. Now why does this happen? I believe buyers get caught up in the euphoria. They act as if this particular phase in the real estate cycle will continue forever. So they justify their price hikes, assuming rents will continue to rise and that their unrealistic pro forma projections will come to pass. But eventually, rents top out and vacancies start to rise.

The second factor associated with the Silly-Stupid Phase is lender aggressiveness.

What I have observed and my lending peers confirm is that outlier lending institutions provide rates and terms that are significantly better than what is typically offered by most lenders. They aren’t just competing for the business. In some instances, they outright buy it. And the larger financial institutions start offering rates and terms that are reminiscent of the years prior to the Great Recession—namely, interest-only loans, higher loan-to-value ratios, lower debt coverage ratios, and compressing of their spreads on interest rates. They hope that offering these “blue light specials” will help them hit their loan quotas.

You may be thinking, Why should I care if lenders are bending over backwards for my business? Let them. I don’t have to accept what they are offering. You’re right. You don’t. My advice is for you to take advantage of all these very favorable loan terms as long as you don’t overleverage your properties. When the market turns— and it inevitably will—make sure that your rental property can support the mortgage payment when vacancy rates rise to levels associated with the bottom of the real estate cycle. This way you can protect yourself and your property investment.

Are We in the Hyper-Supply Phase of the Real Estate Market?

So where are we today in the real estate cycle? Since I’m most knowledgeable about commercial real estate in the Pacific Northwest, I’ll speak to this question using the world I know best. As I have explained, the real estate cycle moves in definable phases, and while timing is a bit unpredictable, I believe the evidence suggests that in 2018 we started the beginning of Phase III, the Hyper-Supply Phase. Here’s why:

After double-digit rent increases the past couple of years, rents are beginning to level off. They are still rising but much more modestly.

As of this writing, construction is booming throughout the Pacific Northwest. Seattle and Portland are experiencing record amounts of construction. Seattle has more cranes dotting the skyline than any other city in the country. Portland has $2.5 billion worth of new development under construction.

For the first time in a long time, rent concessions are being offered on new product.

These three factors are all classic indicators that the market is in Phase III, the Hyper-Supply Phase.

Should we still be investing?

So for the moment, let’s assume that the real estate market is, in fact, in this quadrant of the real estate market cycle. Does this mean that investors should stop buying real estate right now? Heck no. I’m currently in the process of buying a mixed use property with a group of investors so I strongly believe you can find good investments regardless of what phase of the real estate market cycle you are currently in.

If you know of future development that will have a positive influence on the property’s neighborhood that the seller is not aware of, or you have a vision for how to turn a property from a loser to a winner, it makes little difference what phase of the market cycle we are currently in. You can still make a good investment.

Even so, it’s still important to understand that some phases of the real estate cycle are more difficult for profitable investing than others. If we truly are in the beginning of the downward real estate market cycle, then I advise that you proceed with caution. Don’t be one of the Pollyanna investors who throws caution to the wind. Be prudent. Be alert for sudden changes in the market. If you do, you’ll increase your chances for success.

Those are my thoughts. I welcome yours. Where do you think we are in the real estate market cycle?

Want more CRE investing tips? Check out my book!

The post How to Determine Where We Are in the Real Estate Market Cycle appeared first on MarshallCf.

March 23, 2019

The Genius of Robert Kiyosaki’s Book Rich Dad, Poor Dad

Today, the most dangerous advice you can give a child is “Go to school, get good grades and look for a safe secure job.” That is old advice, and it is bad advice because if you want your child to have a financially secure future, they can’t play by the old set of rules. It’s just too risky, says Robert Kiyosaki in his iconic masterpiece, Rich Dad, Poor Dad.

I read this book many years ago and I was struck then by the simplicity and the transformational truth of its message. Those words are more true today, than when Mr. Kiyosaki penned them in 1997. In Rich Dad, Poor Dad, Mr. Kiyosaki outlines six principles for creating wealth. They are:

Principle #1 – The Rich Don’t Work for Money

The poor and the middle class work for money. The rich have money work for them. To live life dictated by the size of a paycheck is not really living. Quit clinging to the illusion of job security. In order to become financially free requires taking calculated risks.

Principle #2 – Know the difference between an asset and a liability, and buy assets

Rich people acquire income producing assets. The poor and the middle class acquire liabilities, but they think they are assets.

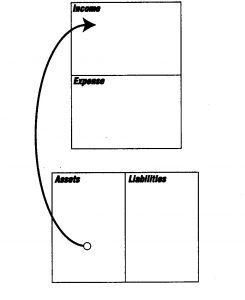

This is the Cash Flow Pattern of an Asset

The top two boxes represent an Income Statement, identifying money coming in and going out. The bottom diagram is the Balance Sheet showing a person’s assets and liabilities. An income producing asset generates a source of income separate from your salary. The rich have their assets working for them.

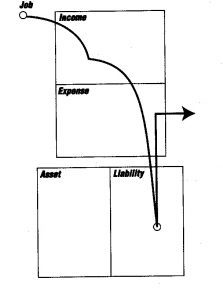

This is the Cash Flow Pattern of the Middle Class

The poor and the middle class buy liabilities, which do not generate income and take money to maintain. Liabilities are mortgages, consumer loans and credit card debt.

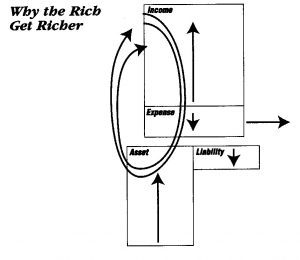

This is the Cash Flow Pattern of the Rich

Over time, the rich build their asset base. Their liabilities become smaller. Income from their assets increases to the point where it exceeds their expenses. The excess cash flow is used to invest in more income producing assets. And when the income generated from the asset column exceeds their personal expenses, it is at that point that the wealthy can retire.

Principle #3 – Build and Keep Your Asset Base Strong

To become financially secure focus on your asset column instead of your income column. Keep your daytime job, but start buying real assets, not liabilities or personal assets that have no real value once you get them home. What type of assets should you acquire?

Businesses that do not require your presence. You own them, but they are managed or run by other people.

Income generating real estate

Notes (IOUs)

Royalties from intellectual property such as patents, books, etc.

And anything else that has value, produces income or appreciates and has a ready market.

Principle #4 – Know the Power of Corporations

An individual with the knowledge of the tax advantages and protection provided by a corporation can get rich so much faster than someone who is an employee or a small-business sole proprietor. There are two primary advantages of a corporation:

Tax Advantages – A corporation earns, spends everything it can and then is taxed on anything that is left. Employees earn and get taxed and they try to live on what’s left.

Protection from Lawsuits

Corporations and trusts protect a person’s assets from creditors. They control everything, but own nothing.

Principle #5 – The Rich Have Financial Intelligence

We all have tremendous potential and are blessed with gifts. What holds us back is self-doubt. It is not so much the lack of technical information that holds us back, but more the lack of self-confidence. To become rich requires both financial intelligence as well as courage.

Financial intelligence is made up of four main technical skills

Financial literacy – the ability to read numbers

Investment strategies – the science of money making money

The market – supply and demand

The law – the awareness of accounting, corporate, state and national rules and regulations

The rich have financial intelligence. They find an opportunity that everyone else has missed. They learn how to raise capital other than from lending institutions. They associate with smart people. They work with or hire people more intelligent than themselves. And they choose wise advisers to counsel them.

Principle #6 – Work to Learn, Don’t Work for Money

The world is filled with smart, talented, and educated people. Talent is not enough. They are one skill away from great wealth. If they mastered one more skill their income would jump exponentially. Take a long term view of your life and learn new skills.

The main management skills needed for success are:

The management of cash flow

The management of your time

The management of people

The most important specialized skills are sales and understanding of marketing. It is the ability to sell that is basic to personal success.

This is my summary of Mr. Kiyosaki’s masterpiece Rich Dad, Poor Dad. Such simple principles of how to become financially successful. And yet so profound. The pure genius of the book does not come from the principles taught. Those principles were well known long before the book was written. No, the genius of the book came from the clarity of the author to state these truths in such a way that all of us could understand their importance.

Those are my thoughts. I welcome yours. What is your opinion about Rich Dad, Poor Dad?

Want more CRE investing tips? Check out my book!

Source: Rich Dad, Poor Dad: What the Rich Tell Their Children About Money That the Poor and the Middle Class Do Not by Robert Kiyosaki, 1997

The post The Genius of Robert Kiyosaki’s Book Rich Dad, Poor Dad appeared first on MarshallCf.

March 7, 2019

Is it the right time to invest in CRE?

We would all be better investors, regardless of the type of investment we choose, if we understood two foundational truths about when is the optimal time to risk our hard earned money.

#1 – Sow seeds of success in the downtimes

A wise man once said, “The season of failure is the best time for sowing the seeds of success.” I have found that when the real estate market is in a season of failure (recall the downturn that happened in 2008 and 2009), that is when you need to sow your seeds of success. Looking back, the Great Recession was a golden age for CRE investing.

In the summer of 2009, I was approached by a real estate investor about teaming up with him in purchasing a recently foreclosed apartment. Even during the recession, this property had remained fully occupied. The bank had an asking price of $39,000 per unit. Yes, the property needed modest amounts of renovations, but on paper it appeared to make a lot of sense. Like almost everyone else, though, my emotions were saying no. Fortunately, I didn’t listen to my emotions. I, along with a group of other investors, purchased the property. Today it is conservatively worth $125,000 per unit. Over the years, my owner distributions have more than tripled my original investment in the property, and the property continues to cash flow beautifully.

Understand this important truth: Those who buy when everyone else is selling usually end up the big winners. This is true of all types of investing, but it’s especially true with commercial real estate. Individuals who bought real estate at the bottom of the market cycle during the tough years made out like bandits. As the saying goes, “You make your money when you buy, not when you sell.” In other words, to be a successful investor requires buying commercial real estate at the right price, and the best time to find bargain prices is at the bottom of the market when it’s the scariest time to invest.

#2 – Avoid sowing seeds of failure in the good times

But the corollary of this truth is unfortunately also true. It’s during prosperous times that many investors sow seeds of failure. They do this when they act as if the good times will last forever and then make foolish investment decisions. They forget the tough times and the hard lessons they should have learned. They say during the bleak times, “Never again will I …” only to have selective amnesia when the market turns around. Always remember what you learn, especially the lessons learned the hard way. And then live and invest according to those lessons. This approach will grow success in life—personally and professionally.

Three Questions before You Decide to Invest

So when is the right time to buy real estate? You need to start by asking yourself these questions:

What is my time horizon? Do I have less than ten years before retirement? If so, it may be best to invest in assets that are more liquid than commercial real estate and therefore easier to sell.

What is my risk tolerance? Can I afford to lose money if the real estate market goes in the tank? If not, it may be prudent to invest your money in lower-risk investments.

Will I need the equity I accumulate in my real estate portfolio for other more important pursuits within the next few years? Or can I leave it alone and let it work for me?

How you answer these questions will largely determine the correct course of action for you to follow.

Here are some reasons that may help you decide whether you should buy investment properties:

Good Reasons to Buy

Ideally, the best time to buy is when it’s a buyers market—that is, when the “herd” is selling.

Buy when you’ve identified a replacement property for a potential 1031 exchange that has more upside than the property you currently own.

Buy when you find a property with rents that are significantly below market value.

Buy when you find a property that is being poorly managed resulting in a significantly higher vacancy rate than the overall market.

Buy when you have a vision to improve a property that the current owner does not see.

Buy when you see the property’s neighborhood is in the path of growth.

Good Reasons Not to Buy

Don’t buy because everyone else is buying. Fight the urge to follow the herd. Don’t be a lemming. Be patient. Those who buy when it’s a sellers market are forced to pay top dollar for acquiring the property.

Don’t buy if your investment analysis shows the return on your equity is unacceptable. Don’t assume that rising rents over time will bail out your poor return.

Even with all the cautions I’ve shared, finding good real estate deals is always possible. There will always be sellers who poorly manage their properties. There will always be sellers who don’t know the real value of their properties. Often it just takes an investor who can bring the right vision and new management to the property to raise its value to the next level. And there isn’t any good reason why that real estate investor with the right vision can’t be you!

Those are my thoughts. I welcome yours. Is now a good time to be purchasing CRE? Why or why not?

Want more CRE investing tips? Check out my book!

The post Is it the right time to invest in CRE? appeared first on MarshallCf.

March 1, 2019

Use Six Degrees of Separation Theory to Find Your CRE Sponsor

In a previous blog post, What Wealthy CRE Professionals Do That Most of Us Do Not, I stated the following five premises:

There is real wealth to be created in owning commercial real estate. It is not a get rich scheme, it actually works.

The savings generated from your day job should be invested in assets that generate passive income. Most retirement accounts invest in assets that generate little to no passive income. I explain in another blog post How to Retire Well by Growing Passive Income why assets that generate passive income are far superior to assets that are typically found in retirement accounts.

Everything we really want in life is on the other side of fear. In other words, don’t let fear stop you from investing in CRE. Investors need to adopt the mindset that we “win or we learn.” Most of us have the debilitating thinking of “we win or we lose.”

The best way for most of us to invest in CRE is as a passive investor, a.k.a., as an equity partner. Let’s be real, most of us don’t have the time or the experience to invest in CRE on our own.

To succeed as a passive investor requires finding the right sponsor, i.e., the guy with all the experience to invest with.

That’s the gist of the article. The article was written specifically for commercial real estate professionals – loan officers, title & escrow officers, insurance agents, real estate attorneys, etc., people who work in commercial real estate but typically don’t invest in rental properties. The main premise of the article was to encourage CRE professionals to invest in commercial real estate. It seems like a no-brainer but sadly you would be surprised how few do.

For Those Who Aren’t CRE Professionals

Today, I would like to focus on the fifth point in that article but from a different perspective. Again, the fifth point is to succeed as a passive investor requires finding the right sponsor to invest with. But this time I’m assuming two things:

You don’t work in the commercial real estate business, and because that’s true you don’t have obvious real estate sponsors to choose from, and

You would like to invest in CRE as an equity partner (passive investor) and not as an active investor making all your own CRE decisions.

If you want to invest on your own then this article is not for you. Now’s the time to click off. But for those of you who are in the situation described above, how do you go about finding the right real estate sponsor?

Alternative #1 – Crowdfunding Sites

One alternative is to search the many online crowdfunding sites and choose a sponsor from one of these sources. But I have a real problem with choosing a syndicator from a crowdfunding site. I have no idea the character of the person I’m trusting with my hard earned money.

I’m sure there are many fine real estate syndicators on these crowdfunding sites but I have no sure fire way of determining who is honest and who is a wolf in sheep’s clothing. Who is offering a fair fee split for their services and who is gouging their investors? It’s often times hard to tell. The point is, I’m wary of syndicators that I do not know personally and you should be too.

Alternative #2 – Six Degrees of Separation

I believe there is a much better way to find a real estate sponsor. This alternative approach was made famous by the actor Kevin Bacon. In 1994 he was interviewed about the film he recently acted in The River Wild. In this interview he offhandedly said that he had either worked with everybody at one time or another in Hollywood or he knows people who have worked with everyone in Hollywood.

The comment snowballed into a game and eventually a book called Six Degrees of Kevin Bacon. The six degrees of separation is a rule of thumb that postulates that most of us are separated by no more than six people from the person we want to know. Your friend knows a friend, who knows a friend… you get the idea, and by the sixth person they know the person you want to know.

My Six Degrees of Separation Story

Years ago, when I was just getting started in commercial real estate, the company I worked for at the time transferred me from California to Atlanta to oversee the property management of the apartments they intended to build in the Southeast. Less than two years later I was laid off when the economy dipped.

At the time I knew only three people in the Atlanta area that might be able to help. Only three. I called them and though I knew that they couldn’t hire me, I was hoping they would know someone who could.

Each gave me names of people to contact. I would call these people and begin the conversation by saying, “My name is Doug Marshall and so and so suggested I call you. I’m looking for a job. May I come by and briefly introduce myself to you?” I did this so often that I knew if I called 10 people I would get 4 people who would say yes to my request to meet. Over a 17 month period, I contacted 330 people and eventually my tenacity paid off with a job.

Now it doesn’t sound like I was separated by six people from my new job, did it? Maybe I wasn’t. But if I could look back on the referral chain, my guess is that the first person who suggested I talk to his contact, to the last person who offered me the job, wasn’t more than than 8 to 10 names.

Conclusion – Use Kevin Bacon’s Six Degrees of Separation

Sorry for the long-winded explanation of a better way to find a real estate sponsor. It’s rather simple. Use the Kevin Bacon Six Degrees of Separation rule of thumb. It makes no difference that you don’t know a quality real estate syndicator to invest with. The important thing to understand is that somebody within six degrees of separation from you does. Who do you know that could possibly start the referral chain process?

Whether you call it the Kevin Bacon factor or old fashioned networking it makes little difference. I believe this approach to finding a sponsor has a higher probability of finding a trustworthy and experienced sponsor than choosing one from a crowdfunding web site. Start calling.

Those are my thoughts. I welcome yours. How would you go about choosing a real estate sponsor?

Want more CRE investing tips? Check out my book!

Source: Everyone Has 6 Degrees of Separation From Kevin Bacon by Thomas DeMichele, http://fact/myth.com/factoids/everyone-has-6-degrees-of-separation-from-kevin-bacon/, August 17, 2017

The post Use Six Degrees of Separation Theory to Find Your CRE Sponsor appeared first on MarshallCf.

February 19, 2019

Three Not So Obvious Reasons for Owning CRE

Why should you invest in real estate, especially since there are many other types of assets to choose from? There is one overpowering reason to do so, but before I tell you what it is, I want to explain the benefits of owning commercial real estate.

Four Well-Known Reasons

When comparing commercial real estate to owning most other types of investments, there are four distinct advantages:

The positive cash flow from real estate is a major advantage over owning most other types of investment. Stocks and bonds can also provide positive cash flow from their dividends. Bonds much more so than stocks, as an average dividend yield on the New York Stock Exchange is about 2 percent. But well managed CRE should generate significantly better cash flow, conservatively 6 to 8 percent and higher is not uncommon.

1031 exchanges on the sale of investment properties allow investors to defer capital gains taxes for decades. But if you sell another type of investment, you pay the capital gains that year.

Depreciation on real estate shelters income, reducing the investor’s income tax burden. No such tax benefit exists for owning other asset classes.

Using debt to buy property substantially increases an investor’s cash-on-cash return. How this happens will be explained in greater detail later in the book, but for now realize that modestly leveraging a property with debt can significantly improve its return on investment. This is a huge advantage of owning CRE over other types of investments.

These four reasons for owning real estate are commonly known benefits. However there are also three not so obvious reasons why investing in real estate is far superior to owning other types of investment assets. In my comments below, I will specifically focus on comparing real estate to owning stocks, because for many investors that is the logical alternative investment to owning real estate. But I believe this comparison is true of most other types of investments, not just owning equities.

Three Not So Obvious Reasons

1. The Concept of Efficient vs Inefficient Markets

The first less obvious reason to invest in real estate rather than owning stock has to do with the concept of efficient vs. inefficient markets. In an efficient market, everyone has the same financial information.

And you buy at whatever the price is. The stock market is a good example of an efficient market. Investors know the value of each stock. They have no legal way to buy a stock below the established market price.

The real estate market, on the other hand, is a perfect example of an inefficient market. The price of a piece of property is determined by what the seller and buyer agree upon. It has very little to do with the market at large. You make me an offer, and if I agree to it, we have a deal. It’s as simple as that.

It is far more advantageous to invest in an inefficient market because you may have information that the seller doesn’t, and this can make your investment worth much more than what the seller thinks it is worth. This happens all the time. The buyer sees a for-sale listing through a different set of eyes than the seller. He sees the property, not as it is, but for what it has the potential to become. Now the seller has decided it’s time to sell, for whatever reason. He doesn’t see the property’s potential. Instead he sees the issues that plague his property. Who has the more accurate assessment of the property? No one knows with certainty, even when the sales price is agreed to between seller and buyer. But over time, the property’s true potential will become readily apparent.

So the first not so obvious advantage of owning real estate over owning common stock is that it’s possible to buy real estate at a bargain price. You can never buy stock at a bargain, only at what is considered the market price.

2. RE Owners Can Influence the Outcome of Their Investments

The second not so obvious reason to invest in real estate rather than owning other types of investments is that real estate owners have considerable influence on the outcome of their investments. They can:

make capital improvements to tired properties,

change management for those properties that are poorly managed, an

re-tenant properties with better quality and higher paying tenants.

As an owner of stock, you’re a passive investor with no influence whatsoever on the value of your investment. You are truly a passive investor. You are at the whim of the emotions that control the stock market. Your particular stock might be doing well right now. But if the market takes a downward cycle, your stocks are going down in price with the rest of the market.

But the successful CRE investor is actively engaged with considerable influence on the value of his investment through a variety of ways. In commercial real estate, you actually have quite a bit of control over your investment and its potential for growth.

3. No More Need for Retirement Calculators

Finally, the third less obvious reason to invest in real estate versus stocks is no more need for retirement calculators. Yes, you heard me right, and here’s why I say this. You’ve likely seen the television commercials where people are asked how much money they think they need to save over their lifetime in order to retire comfortably. Their response is typically a shrug of the shoulders, a bewildered look, a financial guess, a “beats me,” or something equivalent. If your investments are in stocks, bonds, undeveloped land, precious metals, or other commodities, then a guess is about the best answer you can give. Who knows where these markets will be in ten years, twenty years, or thirty? It’s anybody’s guess, including the investment banking firm that produced the TV commercial.

But this is not so with commercial real estate. You can make a reasonable estimate as to how much you’ll need to have accumulated in real estate in order to retire comfortably. All you need to know are the answers to these three basic questions:

How much annual income before taxes do you need to retire comfortably?

When you retire, how much are you expecting to receive annually from social security or other pensions you will receive?

What is the current cash-on-cash return you’re receiving on your real estate investments?

Here’s an example

For example, let’s assume that you want $100,000 a year in income before taxes to live comfortably. As you get close to retirement age, the Social Security Administration sends you an annual letter stating what you will receive from them when you retire. Let’s assume you and your spouse will receive a total of $40,000 annually from social security.

Now, to determine your current cash-on-cash return on your real estate investments, add up all owner disbursements you received last year on your rental properties and then divide by the total initial cash investment in all of your properties. Depending on how good an investor you are, that could be anything, but I believe a 6- to 8-percent cash-on-cash return is a conservative estimate on well managed properties. So for discussion purposes, let’s assume your commercial real estate portfolio had a 6 percent cash-on-cash return last year. Now, let’s do the math:

Dividing $60,000 by 6 percent results in $1 million you will need to invest to make up the shortfall from your social security checks. In other words, over your lifetime, you will need to slowly grow your real estate investments until you have $1 million invested. If you are just starting out investing in real estate, this sounds like an enormous sum. But in reality, with prudent investing, this amount is attainable, in fact, quite likely to reach.

The good life – living off your rental property cash flow

So, in this example, in order to live comfortably, you will need to have invested $1 million in real estate generating on average a 6 percent cash-on-cash return. If you do, you will never have to worry about running out of money as long as your properties are generating 6 percent annually.

What happens if high inflation hits? If your rents over time increase with the rate of inflation, you’ll be fine. Living off the cash flow of your real estate portfolio means you never need to sell your properties to maintain your lifestyle. In fact, over time, your properties will continue to appreciate, increasing your equity even further in the years ahead.

Those are my thoughts. I welcome yours. What do you see as the primary advantages of owning CRE over another type of investment?

Want more CRE investing tips? Check out my book!

Sources: “Dividend Yield for Stocks in the S&P 500,” IndexArb, February 26, 2014, http://www.indexarb.com/dividendYield... Reasons Why Investing in Real Estate Is Awesome (and Better Than Stocks!),” by Mark Ferguson, BiggerPockets, November 10, 2013, https://www.biggerpockets.com/renewsb.... “Real Estate Is Better Than Stocks—Fact, Not Opinion,” by Ben Leybovich, BiggerPockets, November 19, 2013, https://www.biggerpockets.com/renewsb....

The post Three Not So Obvious Reasons for Owning CRE appeared first on MarshallCf.

February 16, 2019

Learn How to Split Profits in CRE

In commercial real estate, there is a symbiotic relationship between the real estate promoter (also called the syndicator or the sponsor) and the equity partners (also called the passive investors). They need each other. One can’t succeed without the other. But how each is compensated for their share of risk is completely different. The purpose of this article is to assist the equity partners in answering three very important questions:

Is the fee split proposed by the real estate syndicator fair?

Or, is the syndicator taking advantage of you?

More importantly, how would you know?

This article will help answer these three questions.

Why the promoter deserves a better profit split

The promoter puts the deal together, but he couldn’t have done so without the equity partners. The promoter may contribute less capital, but he is the one who identified the real estate opportunity, negotiated a price that works and got the property under contract. And most importantly, he has the expertise to complete the transaction that equity partners do not have. And this is why he deserves a better profit split than the equity partners.

To counterbalance the profit split that favors the promoter, the equity partners are typically offered a preferred return in order to make the deal more attractive to them. There are many different profit split models, and each can have countless variations on how profits are split between the sponsor and the passive investors.

Six Profit Splitting Models

I recently had the opportunity to listen to the Splitting Profits in Commercial Real Estate webinar by Jeffrey Engelstad offered by the CCIM Institute’s Ward Center. Mr. Engelstad is a CCIM instructor and a professor at the University of Denver’s Franklin L. Burns School of Real Estate and Construction Management. In his presentation he identified six different profit splitting models. Reading down the list, their descriptions sound like something out of a Las Vegas gambler’s instruction manual:

Traditional Split

Rake

Preference

Promote

Subordinated Interest

Waterfall

There is no way I can describe in this short blog post the six different profit splitting models presented in this webinar. If this is a topic of interest to you, I highly recommend you sign up for the course. Mr. Engelstad is an excellent instructor.

Is the proposed profit split equitable?

Imagine for a moment that you are considering investing in a property with a sponsor that has a good track record. The sponsor is proposing a profit split other than the typical traditional split which is based on each partner’s ownership percentage. Is the profit split being offered reasonable? Or is the sponsor taking advantage of you? How would you know?

Now think about this scenario. The sponsor proposes a profit split and because you understand exactly what he’s doing, you counter with a profit split that provides the sponsor with a higher return, but not as high as he originally proposed. Wouldn’t you prefer to be in this situation rather than not knowing whether he’s in fact fleecing you? Me too. And that was my motivation for signing up for the splitting profits webinar.

An Example of a Profit Splitting Model

Just for the purpose of introducing you to this subject, let me show you one example. This splitting profits model is called a Disproportionate Buy-In with a Simple Back-End Promote. Whoa! Sounds really complicated doesn’t it? But with a little explanation I think you’ll see it’s not as difficult to understand as you might think.

Let’s begin with the Property Analysis:

Here are the highlights:

$1,400,000 Purchase Price

$375,000 Funds Required to close

$27,946 Cash Flow After Debt Service in Year 1

5 year Holding Period

$1,650,000 Sales Price in Year 5

600,097 Net Sale Proceeds

Disproportionate Buy-In with a Simple Back-End Promote

The sponsor, Karl, is proposing that the profit split be adjusted from a traditional profit split in two ways:

1. Disproportionate Buy-In

Karl is proposing that he receive a higher initial ownership interest in the property than the actual equity he is investing in the deal. He is investing 10% of the equity but he is proposing that he gets a 15% interest in the property.

2. Simple Back-End Promote

Karl is also proposing that he get a 10% back-end promote. Think of a promote like you would a bonus. In this situation, everyone gets their original money back and then Karl would get his 10% bonus. Then the remaining sales proceeds are split based on the investor’s ownership percentage.

Now let’s look at how profits are split under this profit splitting model:

First Step – Determine property’s IRR

The first step is to determine the property’s Internal Rate of Return. As you can see above, the initial investment is $375,000 and the annual cash flows from the operations of the property in Year 1 are $27,946 increasing each year until Year 5 when it tops out at $45,839. With the sale of the property in Year 5, total proceeds for that year is $645,843. This results in an IRR for the property of 18.09%.

Second Step – Determine the promoter’s proposed IRR

So let’s look at the impact of giving Karl 15% interest in the property. Everyone else’s interest is diminished a skosh. For example, Jim, Natasha and Pat invested 10% of the equity in the deal but only get 9.444% of the cash distributions. Likewise, Ed and Gabriella invested 20% of the equity in the deal but only get 18.889% of the cash distributions.

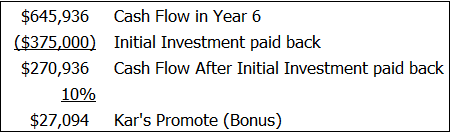

Now let’s look at Karl’s Back-End Promote. Recall, Karl is to receive a 10% promote (bonus) after all the partners receive their initial investment back.

So after Karl receives his back-end promote of $27,094, the remaining cash proceeds in Year 5 are distributed according to the investors’ ownership percentages. Under this proposed profit split scenario, the equity partners receive a 15.7% IRR while Karl receives a very handsome 34.53% IRR.

Third Step – Counter the Promoter’s proposal with one you like

Let’s say, you’re not satisfied with a 15.7% IRR or maybe you think Karl is getting a bit greedy. Now that you know how the game is played you counter with the following profit split proposal: In lieu of a disproportionate buy-in, you propose that Karl receive a 12.5% promote on the back-end instead of the 10% he originally proposed. Below shows how this would affect Karl’s and the equity investors’ IRRs.

The equity partners would receive a higher 17.0% IRR and Karl’s IRR would be reduced to 26.33% IRR, which is still a very good return. If I were Karl, I would take it. And if I were the equity partners, I would be satisfied with this counter proposal. In my opinion, the original profit split proposed by Karl was too one-sided in favor of Karl.

Conclusion

In order to level the playing field between you and the sponsor you need to learn how the game of splitting profits is played. If you want to learn how, sign up for the Splitting Profits in Commercial Real Estate course offered by the CCIM Institute. Here is the link to register for the class: Splitting Profits in Commercial Real Estate.

Those are my thoughts. I welcome yours. How do you think profits should be split between sponsor and equity partners?

The post Learn How to Split Profits in CRE appeared first on MarshallCf.

January 31, 2019

How I size up a real estate investment opportunity – Part 3

This is the third and final part of a series on how I personally size up real estate investment opportunities. Over the past year I’ve had several people ask me this question, so I thought what the heck, sure I’ll explain how I determine whether a property is worth investing in.

Part 1 – Does it meet my 4 criteria?

In the first part of this series I explained that the initial step in the process for a rental property to be considered it must meet four criteria. If you want to read what these four criteria are, click on this link: Part 1. If the real estate opportunity doesn’t meet all four criteria, it doesn’t make the cut. It’s as simple as that.

Part 2 – Is the property’s story & analytics compelling?

If a property has survived the first cut and is worth further consideration, then I:

Want to hear the property’s story (it better be a compelling story)

Run the numbers

Size the loan based on how the lender will size the loan, not on how the seller’s agent sizes the loan in the offering memorandum

If you would like a further explanation of these three steps on how I size up a real estate opportunity, then I would encourage you to click this link: Part 2

Part 3 – Should I buy this property?

The fifth and final step in the process is to evaluate the property’s return on investment. My method will be viewed by some as being too simplistic. I, on the other hand, believe their approach is off the charts inaccurate. Who’s right? You decide.

5. Evaluate the property’s return on investment

My property valuation method is based on knowable assumptions or at least reasonably educated guesses, such as:

What will I offer for the property in an as-is condition?

What is needed to renovate the property, and how much will it cost?

When the improvements are completed, what will be the new market rents?

How long will it take me to achieve stabilized occupancy?

What type of financing should I get? A permanent loan with a holdback for repairs? Or a full-blown bridge loan followed by a competitive non-recourse loan?

All of these questions require and can receive at the very least educated guesses. Once these questions are answered objectively as possible with the most likely outcomes, they can be inputted into a CRE investing spreadsheet. I focus in on a before-tax return-on-equity in the first year of stabilized operation. If it’s in the 5 percent or better range, then I know the property will do well over time.

The problem with using an IRR calculation

Now you may be thinking, “This guy is just intimidated by the sophistication of the Internal Rate of Return method.” Not so. I actually enjoy doing an IRR calculation. It’s so analytical, and I love that. I just don’t believe it provides the best approach to making a buy/no-buy decision. Here are two examples of what I mean:

Problem #1 – Garbage In/Garbage Out

Depending on your assumptions, you can get whatever IRR you want to get. If your IRR is not high enough to justify purchasing the property, then increase your annual rent growth by 1 percent or lower your sales cap rate in year ten by fifty basis points.

Thirty years ago, as a financial analyst for a syndicator, that was my job. I played with the numbers until I got the desired return my boss wanted for our investor presentations.

Problem #2 – Cash flow vs Property Appreciation

In my opinion, cash flow is king. But you can use an IRR calculation to justify purchasing a property having little or no annual cash flow. You can do this by inflating the sales price in year ten over a property that has generous cash flows over the holding period.

I would rather choose the property with the good cash flow and slightly lower IRR than the property with little cash flow and higher IRR. Wouldn’t you?

Am I an IRR Neanderthal?

Now that the IRR aficionados have labeled me an IRR Neanderthal, I must confess that I do use a before-tax IRR calculation after I’ve sold a property. At that point, all the variables are known. I know:

How much equity was required when I purchased the property;

My annual owner distributions;

The number of years I owned the property; and

The amount of cash or 1031 equity I received at closing when I sold the property.

Knowing those four things, I can then run an accurate IRR calculation. The properties I’ve sold have had an IRR as low as 7 percent and as high as 28 percent. But I calculate an IRR calculation after the property is sold, not before.

Doing so after the property is sold yields an informed and accurate return on my investment. In contrast, using the IRR method to value a potential purchase is a fool’s approach to valuing commercial real estate because there are too many unknown variables.

Want to know more?

If you would like to learn the specifics of how I analyze a property purchase, I would encourage you to listen to a short two-minute video presentation on my website. Click this link Spreadsheet to listen to the video. If you like what you hear then download my Property Investing Analysis Spreadsheet for FREE.

And of course if you want the full meal deal, buy my book Mastering the Art of Commercial Real Estate Investing by clicking on the Amazon link below.

Those are my thoughts, I welcome yours. How do you evaluate a property purchase?

The post How I size up a real estate investment opportunity – Part 3 appeared first on MarshallCf.

January 18, 2019

How I size up a real estate investment opportunity – Part 2

This is the second part of a three-part series on how I personally size up real estate investment opportunities. Over the past year I’ve had several people ask me this question. So I thought what the heck, sure I’ll explain how I determine whether a property is worth investing in.

In Part 1 of this series I explained that the first step in the process. For a rental property to be considered it must meet four criteria. If you want to read what these four criteria are, click on this link: Part 1. If the real estate opportunity doesn’t meet all four criteria, it doesn’t make the cut. It’s a simple as that. If a property has survived the first cut and is worth further consideration, then these are the next steps in the process.

2. I want to hear the property’s story

I want to hear why I should buy this property and it needs to be a convincing story. For me to invest in a property, it needs to be a value-add play in order to get an acceptable return on my investment. Gone are the days that you can buy a turnkey property whose rents are at market that will yield an acceptable ROI. Those properties do not exist today in the Pacific Northwest.

What do I mean by “value-add?” I mean there is some reason why the property is under performing the market. And if the problem were corrected it would result in an excellent return on your original investment. For example it could be that the property has been poorly managed, or possibly the property needs to be renovated.

A couple of years ago I invested in a fractured condo project. Fractured condos typically consist of a small minority of units that are individually owned, but the bulk of the units are owned and operated as apartments. As an investor I was purchasing those units that were operated as apartments. Fractured condos are a pariah in the real estate market. They are avoided like the plague and rightly so. But if you have experience with fractured condos and can solve the problems associated with this property type, you are handsomely rewarded for your efforts.

Bottom line: For me to invest in a rental property, its story needs to be compelling. It needs to be believable too. How many times have I heard a supposedly value-add play when in fact it’s just an overpriced property with no real upside.

3. I run the numbers

Notice that I don’t even look at the property’s numbers until I get this far along in the process. I begin by spreading out the historical operating statements. I specifically want the current year-to-date operating statement and the previous two years. I also want the current rent roll. There are times when the seller is reluctant to provide me more than a Trailing 12 Month statement. Sorry, but if I’m going to invest in a property, I insist on getting the documents I’ve requested, or I refuse to go any further in the buying process.

One more thought: Don’t ever use the pro forma income and expenses found in the seller’s marketing package, sometimes called an Offering Memorandum. To paraphrase Mark Twain, “There are liars, damned liars and then there are people who prepare Offering Memorandums.” The income and expenses on an OM rarely reflect reality.

I review the historical operating statements. I look specifically for trends in the numbers. I also look for large swings in the numbers from one year to the next and if I find something that looks odd, I ask the seller for an explanation. Based on the historical operating statements, I then generate my own pro forma. Since any purchase I make is a value-add play, I estimate the market rents after the completion of the capital improvements.

4. I size the loan

One of the more common mistakes of investing in commercial real estate is not fully understanding the importance the lender has on a property’s return on investment. Now I know what you’re thinking. “Doug, of course the lender is important to a property’s ROI. The lower the interest rate the higher the ROI. Duh.” Yes, that’s true but that’s not what I’m referring to.

Maybe even more critical to a property’s return on investment is the size of the loan. It’s the lender that ultimately determines the loan size. Not the pro forma found in the marketing flyer, nor the buyer’s proposed budget. It’s the lender. And without having an accurate estimate of the loan amount, the buyer doesn’t know how much cash is required at closing. And how much equity that’s required to purchase the property is a key factor in determining the property’s cash-on-cash return.

This is not an academic exercise. As an investor the sizing of the loan is a critical component for calculating the property’s return on investment. That’s why it’s important to understand that lenders have rules of thumb that they use in their underwriting guidelines. It has the potential of significantly affecting the property’s cash-on-cash return. Not all lenders have the same rules of thumb. That would be too easy. Generally there are seven rules of thumb that most lenders will use to determine the loan amount. So the next step in the process is to apply these rules of thumb to the property I’m analyzing to get a good estimate of the loan amount.

If you would like a copy of the Excel spreadsheet that I use to size a loan based on these seven rules of thumb, click this link: Property Investing Analysis Spreadsheet.

The Final Decision – The Property’s Investment Return

Now that I have an understanding of the property’s story and I’ve run the numbers including an estimate of the loan amount, the last piece of the puzzle is to evaluate a property’s return on my initial investment. Is it worth buying? Is the return sufficient to make an offer?

In the third and final part of the series l discuss why I favor using a more simplistic Cash-on-Cash Return instead of the more sophisticated Internal Rate of Return. I’m going to let you in on a poorly kept secret: I’m not a fan of using IRR for the buy/no buy decision which I will discuss in my next blog post.

Those are my thoughts. I welcome yours. What criteria do you use to decide if you should purchase a rental property?

The post How I size up a real estate investment opportunity – Part 2 appeared first on MarshallCf.

January 4, 2019

How I size up real estate investment opportunities – Part 1

Like you, I get many opportunities to invest my hard-earned money in commercial real estate. Most of these opportunities I say no to rather quickly, but occasionally one comes across my desk that interests me. Lately I’ve had several people ask me, “How do you go about choosing a rental property to invest in out of the many that are presented?” Good question. To answer that question I’ve written a three part series explaining my selection process.

Let me begin by saying that I strongly believe investing in commercial real estate is more of an “art” than a “science.” That is why I titled my recently published book, Mastering the Art of Commercial Real Estate Investing. Everyone has their own method of analyzing the merits of buying a property. I rely heavily on my investing criteria I’ve developed over the years, as well as my intuition and finally on my own approach to analyzing the numbers. So let’s get started.

The first step in the process is identifying which investment opportunities fit in my “box.” By that I mean, which real estate opportunities fit my narrowly defined criteria for consideration. This is a relatively simple first step. For a rental property to be considered it must meet four criteria. If it doesn’t, it doesn’t make the cut. It’s as simple as that. What are my four investing criteria you ask?

1. Acceptable sponsor

As a passive investor I let someone else make all the investing decisions. My responsibility is to provide some of the equity needed to purchase the property. So, the very first decision I have to make is, “Who do I want to trust with my money?” This decision is very important, maybe the most critical of all the decisions I have to make about investing in CRE.

But for me it’s an easy choice. I do all my investing with one real estate sponsor that I’ve known personally for about 25 years. I know his excellent CRE investing track record. I know that he is a man of integrity and because of that I trust him. At this point he is the only person I invest with. Not to say I couldn’t invest with another sponsor. I could, but until something drastically wrong happens with my current sponsor, it’s highly unlikely.

2. Acceptable property type

I believe you should only invest in rental properties where you thoroughly understand their unique qualities. For me, my property type of choice is apartments as most of my real estate lending experience over the past 35 years has been financing apartments. I know apartments well but I could be convinced to buy multi-tenanted office, retail or industrial properties and mobile home parks.

Of the ten rental properties I’ve invested in so far, eight have been apartments, one was student housing and one was a multi-tenanted office building. For an example of the winnowing process in action, I was recently asked by my sponsor if I would like to invest in a Class A vacation rental property. It isn’t a property type that I understand so I easily passed on this investment opportunity.

3. Acceptable geographic market

I only invest in real estate markets that I’m familiar with. For me that means I only invest in the states of Oregon and Washington. Investing in other parts of the U.S. doesn’t make sense to me because I don’t know the strengths and weaknesses of other cities. Yes I could do a thorough investigation of these other markets and maybe get comfortable with investing in a particular city. That’s possible. But that only solves the first problem.

In my business as a mortgage broker, I’ve seen way too many properties in poor condition only to find out that the owner lives out of state and rarely visits the property. That in my opinion, is a recipe for disaster. The adage, “You get what you inspect, not what you expect” is particularly true in CRE. If I’m not willing to regularly visit my rental properties I won’t invest there. Most of my rental properties I could drive to in less than an hour.

For example, I’ve had opportunities to invest in apartments in Arizona and Idaho, and because I’m not willing to fly to these states to regularly inspect them, I’ve passed on these investment opportunities.

4. Acceptable market size

Not only do I want to purchase properties in markets that I’m familiar with, I also want to invest in larger metropolitan areas. There is a reason why cap rates are higher on properties located in small towns. It’s much riskier than investing in large MSAs. Rents and occupancy rates in small towns lag what’s happening in the large cities. My experience is that small towns are much slower in rebounding from a recession than larger markets. Is the lower purchase price of a property in a small town worth it? Nope. Not for me it isn’t. So I’m willing to invest in Seattle, Tacoma, Olympia, Portland, Salem and Eugene. Under the right circumstances I might invest in Corvallis, Bend and Spokane.

The filtering process is a big time saver

When a for-sale listing comes across my desk, I filter it through these four investing criteria. Imagine for a moment my decision making process. How long do you think it takes for me to say “no” or for a few properties to say “maybe?” In very little time at all, a couple of minutes at most, I’ve filtered out 95% of the deals that come across my desk. By using these four investing criteria have I possibly missed some great properties to invest in? You bet I have. But I’ve also substantially reduced my risk of ending up buying a property that I will later regret.

Set your own CRE investing criteria

So if you are following my example, the first step in the rental property selection process is to establish a set of investing criteria that you deem inviolable. I have my four benchmarks, but yours may be completely different. How do you develop your investing criteria? I’ve discovered that my selection standards have been highly influenced by past investment failures. In other words, I’ve learned from my past mistakes. You may want to start there too. But whatever yardsticks you come up with, be very cautious of not following them when a potential opportunity doesn’t quite fit your “box.” It’s far better to pass on what looks like a good deal than to regret it later because you invested in the wrong rental property.

Those are my thoughts. I welcome yours. What are your non-negotiable investment criteria?

The post How I size up real estate investment opportunities – Part 1 appeared first on MarshallCf.