Doug Marshall's Blog, page 2

October 10, 2020

Six Success Principles Every Newbie CRE Investor Should Live By

I find it fascinating to observe a newbie CRE investor in action. You know you’re dealing with a newbie because they openly admit they’re novices and say something like, “Please can I ask you one more question,” which leads to ten more questions. For the most part, I don’t mind answering their questions. Generally, those who have an abundance of common sense and humility do just fine as first time real estate investors. But to increase their chances of success at real estate investing, I have six suggestions for them to consider.

1. Overcome the fear of failure.

Hey, I get it. It’s scary the first few times you invest in commercial real estate. A lot of that fear could be eliminated or at the very least significantly reduced, if the newbie investor does their homework before he or she buys their first property. See Five questions new CRE investors should answer before buying their first property.

But even if you have these five questions answered in spades the newbie CRE investor needs to adopt a mindset of “You either win or you learn.” In everything we do, we either win (we make the right decision) or we learn an important lesson so next time we have a better outcome. Winston Churchill said it best when he said, “Success is not final, failure is not fatal: it is the courage to continue that counts.” And that is particularly true in CRE investing. Sometimes your CRE investment is a home run, and sometimes you learn what not to do so next time is a success.

2. Focus on one market and one property type.

The fastest way to become a seasoned real estate investor is to become an expert in one property type and in one market, or better yet, one submarket. Don’t try to understand all the nuances of each property type. Instead invest all of your time and effort in learning the peculiarities of the property type of your choice. To become an expert quickly, focus on one submarket. If apartments is your focus, then devote your energies to knowing all about the apartment market in your defined geographic area. What demographic factors influence this market? How have rents increased in the past year? What is the current vacancy rate in this submarket? How is the market trending? Seek out the answers to these questions and you’ll soon become a market expert.

3. Don’t attempt to do this by yourself.

You need a team of knowledgeable advisors. There is absolutely no need to invest in CRE based solely on your expertise. How foolish would that be! Here’s a list of advisors you should consider:

a. Real estate broker

b. Mortgage broker

c. General contractor/handy repairman

d. Property management company

e. CPA/accountant

f. Real estate attorney

g. Insurance agent

Do an honest self-assessment of your CRE skills and experience. Wherever you fall short, hire someone to fill in the gap. For example, if you’ve never managed a property before, at the very least hire someone to do it for you until you think you’re ready to try it on your own.

4. Stay the course.

Investing in commercial real estate requires “staying power.” Investing in CRE is typically a long-term hold of several years. Don’t expect to buy and flip like some residential investors do. When I invest I expect to own the property for 5 to 10 years, or possibly longer. Staying power also requires that you have working capital set aside for those unexpected expenses, typically capital repairs or tenant improvements needed to get a space ready.

5. Treat everyone with respect.

Your reputation is everything. How you treat people eventually catches up to you. Do you treat your team of advisors respectfully? How about your tenants? Do you treat them like you would like to be treated? Do you have a win at all costs mentality when negotiating on the purchase or sale of your properties? Or do you try to negotiate in such a way that both sides feel like a fair deal was achieved?

6. Be a person of integrity.

It only takes one shady transaction to stain your reputation. The real estate community is surprisingly small. If you’re caught doing something unethical the news gets around very quickly. Once your reputation is tarnished, it takes years of consistently doing the right thing to ever have the chance of rehabilitating your good name.

Over the years I’ve been fortunate to have had many clients that I’ve enjoyed working with. Occasionally, I’ve had clients who are either unethical or treat me or others disrespectfully. The next time they contact me to use my services they seem a bit surprised that I’m not available. In reality I could be twiddling my thumbs and I wouldn’t work for them again. Life is too short to work for a paycheck. So treat everyone like you would like to be treated.

Those are my thoughts. What are yours? What advice would you give a newbie CRE investor?

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check out his book on Amazon!

The post Six Success Principles Every Newbie CRE Investor Should Live By appeared first on MarshallCf.

September 27, 2020

What’s Going to Happen to US Real Estate in 2021?

This is the second part of a two part series on 2021. The two most likely questions on the minds of real estate professionals and real estate investors are:

What is going to happen to the US economy in 2021?

And as a result of the health of the US economy, what’s going to happen to the real estate market in 2021?

Good questions, aren’t they? Today I attempt to answer the second question. If you want to know my prediction for the US economy in 2021 click here.

Single Family Homes

You can’t have a comprehensive discussion about real estate without including the single-family housing market. The average interest rate on a 30-year fixed rate mortgage fell to a record low of 2.88% recently. These historic low interest rates have driven the demand for new home sales this summer to the fastest rate since before the Great Recession. If your job is related to the housing industry all is well. The current pace of sales is actually causing a housing shortage in some parts of the country.

But not is all well with the housing market. With the economy still in the lurch, some homeowners are having difficulty paying their mortgages. By the end of 2020 it is predicted that several million borrowers who received mortgage forbearance will have gone nine months without making a mortgage payment. In July, the delinquency rate on FHA-insured homes nationwide was 17 percent.

Something has to give, as these two statistics are polar opposites of one another. My guess (and that is what it is, a guess) is that the housing market will turn downward once the artificially supported economy begins to falter. Some are even predicting that the single-family housing market and mortgage bubbles are about to burst.

Commercial Real Estate Sales

According to data from JLL, commercial real estate investments fell 29 percent globally in the first six months of 2020 compared to the previous year. That makes sense to me. Why would you buy a rental property if you don’t have an accurate understanding of a property’s rent collections? I believe this trend will slowly improve in 2021 as rent collections without government intervention become known. Depending on what the “new normal” is for rent collections, it would not surprise me if we see a softening of property values in most property types.

Multifamily Housing

The apartment market is affected differently by COVID-19 than the single-family housing market. As mentioned in my previous post on the economy, the virus has impacted lower income wage earners more so than those in higher paying professions. It’s the retail workers, the restaurant and hospitality employees that have been affected most by COVID-19. This means that C quality apartments that generally house the blue collar workforce are much more affected than A & B quality apartments.

But at the moment, with rent forbearance continuing through the end of this year, the full impact of COVID-19 is not being fully experienced. Once rent forbearance is lifted, then and only then, will we actually know how badly the multifamily market will be impacted. Does anyone really believe that those tenants that are several months behind on their rent will have the ability to pay back what is owed to their landlords even with generous repayment terms? I don’t. Most blue collar renters in the good times live paycheck to paycheck.

With that in mind, I believe that C quality apartments in the first quarter of 2021 will experience significant problems with rent collections with the better quality apartments likely having less issues with nonpayment of rent. If there is one more round of rent forbearance early in 2021 then the impact of COVID-19 will be delayed into the second or third quarter of next year.

But even so the need for shelter remains inelastic: we all need a place to live. In a typical recession, when people lose their jobs, they move back in with family or friends, or renters in one-bedroom units pair up with a friend and move into a two-bedroom unit as a way to save money. I suspect this is what will happen once the government subsidies run their course.

Hospitality Industry

The hospitality industry has been the most severely impacted by COVID-19. Hotel properties are largely dependent on conferences, special events and tourism, all of which have been dramatically curtailed. In August, occupancy was down 32 percent over the previous year and the average daily rate was down 23 percent. This represents the worst occupancy level on record for the month of August. Not surprisingly, delinquent hotel loans have spiked to $21 billion with an overall delinquency rate in June of 24 percent of CMBS loans compared to less than 2 percent in January of this year.

Not all is bleak, however. A promising trend is emerging. There has been a surge in “work from hotel” bookings, from 12 percent pre-pandemic, to over 30 percent this summer. So COVID-19 appears to have kick-started a new emerging trend.

Retail

The second biggest loser resulting from the pandemic is retail. In March, physical stores closed as lockdowns forced shoppers to stay away. As a result, e-commerce has boomed as consumers have more goods than ever before delivered directly to their homes. What happens when a vaccine for the virus becomes available? Will consumers return to purchasing their goods at brick and mortar stores? Maybe but certainly not at the same volume as pre-COVID-19. E-commerce is here to stay. It is too convenient to go back to the way things were.

Even before the pandemic, retail was in serious trouble. In January of this year 4 percent of retail CMBS loans were delinquent. That number has soared to 18 percent this summer. This has much to do with bankruptcy filings of major retailers – JC Penney, Brooks Brothers, Neiman Marcus, Jos. A Bank, Lord & Taylor to name just a few. These retailers were already limping along before COVID-19 hit and the virus just helped push them over the edge.

Office

In theory, the virus had little impact on office properties. Some tenants have asked for rent concessions and forbearance but in reality the office market was only marginally impacted by COVID-19. But the problem is many of us learned to work from home. I don’t know about you, but I like the convenience of working from home. I like the lack of a commute. I like having casual Friday every day of the week. I think I actually get more done from home than I do at the office because I have less interruptions. And I believe I’m not alone in my thinking.

The verdict is still out but I believe many companies have come to the same realization. I would not be surprised that these companies will decide to lease less space the next time their lease comes due. The virus has accidentally kick-started a trend of working from home that had been slowly developing over the past several years. Working from home is now the norm. It is no longer a novel idea.

Summary

I could write about other commercial property types, but I’m running out of time so let me give you my final thoughts. How badly commercial real estate (which includes apartments) is impacted by this pandemic is dependent upon how long the COVID-19 social distancing restrictions are left in place. The longer they stay in place the worse it will be for commercial real estate. I know that’s stating the obvious but sometimes you have to start with the obvious.

If you are looking for real estate bargains in the next year, you should seriously consider hospitality and retail, but only if you are experienced in these two sectors, which I am not. If the social distancing restrictions continue for another six months I believe there is serious potential for a bloodbath in the hospitality real estate market. Long term, I think both retail and office properties are at risk. The virus has kick-started trends that will likely reduce the long term demand for both property types. I think next year will be difficult for C quality apartments but the long term trend for apartments remains good. We all need a place to live.

Those are my thoughts. I welcome yours. How do you think commercial real estate will fare in 2021?

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Buy the book on Amazon!

Sources: Opinion: The COVID-19 lockdown is squeezing real estate from all sides and threatens to burst the housing and mortgage bubble, by Kieth Jurow, Market Watch, September 21, 2020; Global commercial real estate markets feel impact of COVID-19, JLL, August 11,2020; STR: US hotel performance of August 2020, by Hotel News Now Newswire, September 18, 2020; COVID-19 hit the hotel industry hard. Here’s how hotels are pivoting in the new reality, Tomi Kilgore, MarketWatch, August 31, 2020; Commercial Mortgage Delinquencies Near Record Levels, by Dorothy Neufeld, Visual Capitalist, July 16, 2020; Many companies realize they can get by and do business without the office, by Jonathan Miller, GlobeSt.com, July 1,2020;

The post What’s Going to Happen to US Real Estate in 2021? appeared first on MarshallCf.

What’s Going to Happen to the US Real Estate in 2021?

This is the second part of a two part series on 2021. The two most likely questions on the minds of real estate professionals and real estate investors are:

What is going to happen to the US economy in 2021?

And as a result of the health of the US economy, what’s going to happen to the real estate market in 2021?

Good questions, aren’t they? Today I attempt to answer the second question. If you want to know my prediction for the US economy in 2021 click here.

Single Family Homes

You can’t have a comprehensive discussion about real estate without including the single-family housing market. The average interest rate on a 30-year fixed rate mortgage fell to a record low of 2.88% recently. These historic low interest rates have driven the demand for new home sales this summer to the fastest rate since before the Great Recession. If your job is related to the housing industry all is well. The current pace of sales is actually causing a housing shortage in some parts of the country.

But not is all well with the housing market. With the economy still in the lurch, some homeowners are having difficulty paying their mortgages. By the end of 2020 it is predicted that several million borrowers who received mortgage forbearance will have gone nine months without making a mortgage payment. In July, the delinquency rate on FHA-insured homes nationwide was 17 percent.

Something has to give, as these two statistics are polar opposites of one another. My guess (and that is what it is, a guess) is that the housing market will turn downward once the artificially supported economy begins to falter. Some are even predicting that the single-family housing market and mortgage bubbles are about to burst.

Commercial Real Estate Sales

According to data from JLL, commercial real estate investments fell 29 percent globally in the first six months of 2020 compared to the previous year. That makes sense to me. Why would you buy a rental property if you don’t have an accurate understanding of a property’s rent collections? I believe this trend will slowly improve in 2021 as rent collections without government intervention become known. Depending on what the “new normal” is for rent collections, it would not surprise me if we see a softening of property values in most property types.

Multifamily Housing

The apartment market is affected differently by COVID-19 than the single-family housing market. As mentioned in my previous post on the economy, the virus has impacted lower income wage earners more so than those in higher paying professions. It’s the retail workers, the restaurant and hospitality employees that have been affected most by COVID-19. This means that C quality apartments that generally house the blue collar workforce are much more affected than A & B quality apartments.

But at the moment, with rent forbearance continuing through the end of this year, the full impact of COVID-19 is not being fully experienced. Once rent forbearance is lifted, then and only then, will we actually know how badly the multifamily market will be impacted. Does anyone really believe that those tenants that are several months behind on their rent will have the ability to pay back what is owed to their landlords even with generous repayment terms? I don’t. Most blue collar renters in the good times live paycheck to paycheck.

With that in mind, I believe that C quality apartments in the first quarter of 2021 will experience significant problems with rent collections with the better quality apartments likely having less issues with nonpayment of rent. If there is one more round of rent forbearance early in 2021 then the impact of COVID-19 will be delayed into the second or third quarter of next year.

But even so the need for shelter remains inelastic: we all need a place to live. In a typical recession, when people lose their jobs, they move back in with family or friends, or renters in one-bedroom units pair up with a friend and move into a two-bedroom unit as a way to save money. I suspect this is what will happen once the government subsidies run their course.

Hospitality Industry

The hospitality industry has been the most severely impacted by COVID-19. Hotel properties are largely dependent on conferences, special events and tourism, all of which have been dramatically curtailed. In August, occupancy was down 32 percent over the previous year and the average daily rate was down 23 percent. This represents the worst occupancy level on record for the month of August. Not surprisingly, delinquent hotel loans have spiked to $21 billion with an overall delinquency rate in June of 24 percent of CMBS loans compared to less than 2 percent in January of this year.

Not all is bleak, however. A promising trend is emerging. There has been a surge in “work from hotel” bookings, from 12 percent pre-pandemic, to over 30 percent this summer. So COVID-19 appears to have kick-started a new emerging trend.

Retail

The second biggest loser resulting from the pandemic is retail. In March, physical stores closed as lockdowns forced shoppers to stay away. As a result, e-commerce has boomed as consumers have more goods than ever before delivered directly to their homes. What happens when a vaccine for the virus becomes available? Will consumers return to purchasing their goods at brick and mortar stores? Maybe but certainly not at the same volume as pre-COVID-19. E-commerce is here to stay. It is too convenient to go back to the way things were.

Even before the pandemic, retail was in serious trouble. In January of this year 4 percent of retail CMBS loans were delinquent. That number has soared to 18 percent this summer. This has much to do with bankruptcy filings of major retailers – JC Penney, Brooks Brothers, Neiman Marcus, Jos. A Bank, Lord & Taylor to name just a few. These retailers were already limping along before COVID-19 hit and the virus just helped push them over the edge.

Office

In theory, the virus had little impact on office properties. Some tenants have asked for rent concessions and forbearance but in reality the office market was only marginally impacted by COVID-19. But the problem is many of us learned to work from home. I don’t know about you, but I like the convenience of working from home. I like the lack of a commute. I like having casual Friday every day of the week. I think I actually get more done from home than I do at the office because I have less interruptions. And I believe I’m not alone in my thinking.

The verdict is still out but I believe many companies have come to the same realization. I would not be surprised that these companies will decide to lease less space the next time their lease comes due. The virus has accidentally kick-started a trend of working from home that had been slowly developing over the past several years. Working from home is now the norm. It is no longer a novel idea.

Summary

I could write about other commercial property types, but I’m running out of time so let me give you my final thoughts. How badly commercial real estate (which includes apartments) is impacted by this pandemic is dependent upon how long the COVID-19 social distancing restrictions are left in place. The longer they stay in place the worse it will be for commercial real estate. I know that’s stating the obvious but sometimes you have to start with the obvious.

If you are looking for real estate bargains in the next year, you should seriously consider hospitality and retail, but only if you are experienced in these two sectors, which I am not. If the social distancing restrictions continue for another six months I believe there is serious potential for a bloodbath in the hospitality real estate market. Long term, I think both retail and office properties are at risk. The virus has kick-started trends that will likely reduce the long term demand for both property types. I think next year will be difficult for C quality apartments but the long term trend for apartments remains good. We all need a place to live.

Those are my thoughts. I welcome yours. How do you think commercial real estate will fare in 2021?

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Buy the book on Amazon!

Sources: Opinion: The COVID-19 lockdown is squeezing real estate from all sides and threatens to burst the housing and mortgage bubble, by Kieth Jurow, Market Watch, September 21, 2020; Global commercial real estate markets feel impact of COVID-19, JLL, August 11,2020; STR: US hotel performance of August 2020, by Hotel News Now Newswire, September 18, 2020; COVID-19 hit the hotel industry hard. Here’s how hotels are pivoting in the new reality, Tomi Kilgore, MarketWatch, August 31, 2020; Commercial Mortgage Delinquencies Near Record Levels, by Dorothy Neufeld, Visual Capitalist, July 16, 2020; Many companies realize they can get by and do business without the office, by Jonathan Miller, GlobeSt.com, July 1,2020;

The post What’s Going to Happen to the US Real Estate in 2021? appeared first on MarshallCf.

September 9, 2020

What’s Going to Happen to the US Economy in 2021?

This is the first part of a two part series on 2021. The two most likely questions on the minds of real estate professionals and real estate investors are:

What is going to happen to the US economy in 2021?

And as a result of the health of the US economy, what’s going to happen to the real estate market in 2021?

Good questions, aren’t they? Today I attempt to answer the first question. To do so, we should begin by reviewing what’s happened with the US economy in 2020, beginning with the general economic trends prior to COVID-19 and secondly as a result of how the virus has impacted the US economy.

Here are some recent economic data:

Economic Data

Unemployment Rate

As we all know, the unemployment rate soared to 14.7% in April. But less well known is the steady improvement in the unemployment rate in recent months to 8.4% in August.

Lost income skewed to lower income earners

Those whose jobs are in the service industries, e.g., hospitality, restaurants, retail, etc. are fairing much worse than those in higher wage earning professions.

Consumer Spending

Consumer spending plummeted 32% in March, but has rebounded to about 10% below pre-COVID-19 levels.

US Corporate Debt

US corporate debt was at a record high prior to COVID-19 and has soared in the 2nd quarter of this year.

“Zombie” companies”

Firms whose debt servicing costs are more than their profits are vividly described as “zombie companies.” They are continuing to stay in business by borrowing more hoping that their earnings before debt service will eventually exceed their mortgage payments. The number of zombie firms has tripled since 2008 and is approaching 20%, exacerbated in part by COVID-19.

U.S. Bankruptcies

With four months remaining in 2020, U.S bankruptcies have soared to 84, the most since 2008. Some of the more well-known companies are:

24 Hour Fitness

Borden Dairy

Brooks Brothers

Dollar Thrifty Automotive Group

GNC

Gold’s Gym

The Hertz Corporation

J.C. Penny

J. Crew

Jos. A. Bank

Lord & Taylor

Neiman Marcus

Pier 1

COVID-19

COVID-19 has had a negative effect on 83% of small businesses. Those in retail or in the restaurant business who rely on in-store traffic have had to find new ways to get their product to their customers or go out of business.

Government Response to COVID-19

Since March, federal and state governments have responded in a variety of ways to the COVID-19 induced economic crisis.

Paycheck Protection Plan – a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll

Stimulus Plan – checks of $1,200 for individuals and $2,400 for married couples

Unemployment Benefits – varies by state

Student Loan Deferment and Forbearance – with either of these options you can temporarily suspend your payments

Rent Forbearance – Eviction ban for nonpayment of rent extended through December 31, 2020

Mortgage Forbearance – federally back mortgage borrowers can have 180 days of forbearance, and are allowed another 180-day extension

At the present time, Congress and President Trump are at an impasse about the next round of stimulus, how much it will be and what form it will take. My guess is that they will come to some agreement before the November election.

Economic Summary

Prior to COVID-19, the historically high US corporate debt and the record high number of “Zombie” companies indicated that all was not well with the US economy. Most of the 84 companies that filed for bankruptcy this year had nothing to do with the economic fallout from the virus.

Then came the devastating economic impact from COVID-19 and the government’s response to soften its adverse impact on the economy. The Federal Reserve and the US Treasury Department deserve our praise for their quick action in implementing these six different economic stimulus measures since early March. But doing so has created an artificial economy which is not sustainable.

I am not criticizing these institutions for doing this. It was sorely needed and without these programs the economy could possibly have collapsed to the level of the Great Depression. Thank goodness someone had the courage to lead in these unprecedented times.

2021 Economic Forecast

But the downside to all this economic stimulus is that the real economy, the one that existed before COVID-19, is presently in limbo and will continue to be so until the artificial economy begins to wane. At some point money available for economic stimulus will come to an end. It has to. The government does not have an endless supply of money to throw at the problem. And when that day happens, we’ll then see what the real economy can do to pull us out of this recession.

There has been much speculation as to when a viable COVID-19 vaccine will come to market. But even if it was rolled out today, many economists are predicting it will be two, possibly three years before the economy fully recovers and unemployment dips down to pre-COVID-19 levels.

And if we do have a slow economic recovery, it will likely push some of the “Zombie” companies over the edge. They are living on borrowed time. Once they are no longer artificially propped up, bankruptcy is inevitable for many of them making economic recovery that much more difficult.

Action Steps to Take

Not a rosy picture is it? So let’s assume this dire economic outlook is on the mark. What does that mean for real estate investors? In my next article I will discuss the outlook for each major property type but today, let’s talk in general terms. How should we prepare ourselves for what’s coming? There are three things you should do:

Sell baby sell. Now is the time to sell that rental property that you don’t want to be stuck with during an economic downturn. You know the property. It’s the one that is currently limping along. It’s not doing badly but it never seems to perform like you had hoped it would. The good news is that it is still a sellers’ market. I believe in the Greater Fool Theory. Sell that property to a greater fool than you were when you purchased it. Let them work out the issues that have kept this property underperforming your expectations. Unload it while there’s still time to do so. In another few months it may be too late. The sellers’ market may be coming to an end and you want to sell that underperforming property while the market is still strong.

Hoard cash. I know, I know. The kneejerk reaction to selling a property is to do a 1031 exchange to avoid paying the capital gains tax. I get it and I will say that every property I’ve ever sold, I’ve done exactly that. But this time may be different. I believe in a year or two there will be bargains galore to purchase for those who have the courage to buy when everyone else is selling. You should seriously consider paying the tax and waiting patiently for the market to turn to a buyers’ market. Because it will, and you will want to have cash in hand when that happens.

Refinance. Interest rates are at an all-time low and going lower. For those properties you want to keep through the economic downturn and also have a modest prepayment penalty, now will be the time to refinance. One of the last arrows The Federal Reserve has in its economic stimulus quiver is low interest rates. They can and will play that card. In fact they are already doing so. But I suspect that after the election is over, regardless of who wins, we will see treasury rates dip even further than they are now. Imagine refinancing your property with interest rates in the low two percent range! That day is coming. And you will want to take advantage of it when it comes.

With every change in the economy, there are winners and there are losers. There is no reason why you can’t be one of the winners. But it requires careful planning, doing these three things I’ve suggested and then having the courage to follow through on your plan. Good luck.

Sources: Unemployment Rate, U.S. Bureau of Labor Statistics, https://www.bls.gov/charts/employment... 2020-21 State of the Union for RE Investors & Private Lenders by David Stech of Access; Total U.S. debt surges to $55.9 trillion amid big increases in corporate and government borrowing, Jeff Cox, CNBC.com, June 11, 2020; “Zombie” companies my soon represent 20% of U.S. firms, Dion Rabouin, Axios, June 15, 2020; Companies that filed for Chapter 11 bankruptcy in 2020, Wikipedia; Paycheck Protection Program, U.S. Small Business Administration.

The post What’s Going to Happen to the US Economy in 2021? appeared first on MarshallCf.

August 31, 2020

Have you fallen in love with your property? Take the 4 question test.

Over the many years I’ve been in the commercial real estate business I’ve come across all sorts of investors. Occasionally, I encounter someone who has fallen in love with their commercial property. You know the type. Their approach to their property is based more on feelings than sound investment decisions.

Want to find out if you’ve fallen in love with your property? Answer these four questions. Do I do these things?

The 4 Question Test

Do I consider my commercial real estate a “trophy property?” Is it a real beauty? Do I drive by and just smile? Or do I like to show it off to my friends?

Do I make cosmetic improvements to the property for no other reason than I want to?

Would it be difficult for me to sell my property, even at a premium price, because it holds special significance for me? Would it be like selling an old friend? Or has the property been owned by my family for decades and selling it would be tantamount to betraying good ol’ dad?

Do I ignore or am I oblivious to my property’s abysmal return on equity because I’m unwilling to refinance the property even though it’s highly likely it’s in my best interests to do so?

If you answered yes to two or more of these questions, it’s time for an intervention! Yes my friend, you have fallen in love with your property but it’s not too late. Call your team of commercial real estate advisors – your real estate broker, your mortgage broker, your real estate attorney, your property manager, your CPA. Call anyone that will help you see the error of your way. Have them set up an intervention so you can start making real estate investment decisions again based on good and wise counsel.

I apologize for my lame attempt at humor. Let’s be clear. There is no sin in falling in love with your property. There are far worse things that you could do like neglecting your property altogether, or consciously deciding to be a slumlord. But if you decide it’s time to manage your property like an investment here are three suggestions to turn things around:

3 Steps to Recovery

Let’s start with the obvious: Consider your property an investment, not a love object. As we all know, love can make us do stupid things. Let’s limit love to our personal relationships and not to our investments.

Always have a well maintained property. Always have pride of ownership but make improvements that can be justified by either higher rents or an upside in long term appreciation.

Once a year go through the exercise of determining your property’s Return on Equity (ROE). If it’s yielding a return you find acceptable then leave it alone. If not, take action. What action? Either sell the property or refinance it and pull cash out. The cash back to you from a refinance can be used to purchase another property or enjoyed as you see fit.

To determine whether it’s time to sell a property I’ll leave to another article. I couldn’t do the topic justice in a few short paragraphs. So let’s focus for a moment on when it’s appropriate for an investor to refinance his property. Again, I believe it starts with determining if the property is generating an acceptable return on your money, better known as Return on Equity (ROE).

What’s an acceptable return you ask? For other investment vehicles – stocks, bonds, precious metals, etc. we have in the back of our minds an acceptable yield that we want to achieve. It’s not uncommon for my friends to tell me that their IRA or stock portfolio made X percent last year. That’s their way of saying that their investments did well (notice they never tell you when they’ve had a bad year how much money they lost, only when things are going well).

Return on Equity Defined

It’s surprising to me that most real estate investors don’t apply the same standard to their commercial real estate investments. So let me show you a simple method that I use to calculate a property’s Return on Equity. To do this I look at two things:

The annual owner distributions. In the example below, to simplify things, we are going to equate owner distributions with Cash Flow after Debt Service.

The amount of equity in the property, which simply defined is the market value of the property less the mortgage balance.

Let’s say years ago you purchased an apartment for $4 million. At the time of purchase you financed it with a 75% LTV loan or a loan of $3 million. The strong rental market over the past several years has significantly increased the property’s value to $6 million today. In the meantime, you have paid down the mortgage balance to $2.0 million. So let’s do the math:

Status Quo ROE vs Refinance ROE

STATUS QUO

Market Value

6,000,000

Mortgage Balance

-2,000,000

Equity in the Property

4,000,000

Cash Flow Before Debt Service

360,000

Annual Debt Service @ $3M, 6%, 30 Yr Am

-215,838

Cash Flow After Debt Service

144,162

Return on Equity ($144,162 ÷ $4,000,000)

3.6%

In the Status Quo example shown above the property is currently generating a paltry 3.6% Return on Equity. Would you consider a 3.6% annual return on your stock portfolio acceptable? Heck no! No way! So why are many CRE investors satisfied with that type of return on their commercial real estate? They shouldn’t be.

So let’s look at what happens to the property’s ROE if the property were to be refinanced at 75% LTV. Notice it has the same market value and the same cash flow before debt service as in the previous example. The only two factors that have changed are the amount of equity in the property and the annual debt service.

REFINANCE

Market Value

6,000,000

Mortgage Balance

-4,500,000

Equity in the Property

1,500,000

Cash Flow Before Debt Service

360,000

Annual Debt Service @ $4.5M, 4%, 30 Yr Am

-257,808

Cash Flow After Debt Service

102,192

Return on Equity ($102,192 ÷ $1,500,000)

6.8%

What would you do?

If the owner was to refinance with a 75% LTV loan, not only would he increase the property’s ROE to 6.8% but he also gets $2.5 million ($4.5 million – $2.0 million) in cash back! It’s a win-win for the investor. He gets a higher ROE on his property and he gets $2.5 million in his pocket to do as he pleases.

Under this scenario, why wouldn’t he want to refinance his property? Yet, there are many investors that don’t take advantage of refinancing their properties. Are you one of them? Do you have a substantial amount of equity in your properties generating an abysmal return on your equity? If so, let’s talk. Let me see what I can do for you.

Those are my thoughts. I welcome yours. What real estate investing principles do you live by?

Want more CRE investing tips? Check out my book!

The post Have you fallen in love with your property? Take the 4 question test. appeared first on MarshallCf.

August 12, 2020

Do People Trust You? Learn the 13 Behaviors of High-Trust People

Years ago I was employed as a loan officer by a small bank. I enjoyed working for my immediate boss but the more I got to know the bank president, the more concerned I became. You see, this man didn’t mind cutting ethical corners in small ways and he demonstrated a complete lack of integrity towards his employees. Have you ever worked for someone you didn’t trust?

About three years with the bank I realized that I couldn’t continue working there because I didn’t respect the bank president. Fortunately I was able to find employment elsewhere as the economy was still going strong.

On the way out the door I remember saying to my fellow employees that when the next recession occurs this man won’t think twice about laying you off. When the economy collapsed into the Great Recession my premonition proved true. It wasn’t just that he laid people off. In all fairness to the bank president, lots of people in commercial real estate lending were being laid off. No it wasn’t what he did, it was how he did it. Without getting into the specifics, his behavior exhibited a lack of empathy and respect for those who lost their jobs.

The Speed of Trust

While vacationing on the Oregon coast I read an insightful book on the topic of trust titled, The Speed of Trust: The One Thing That Changes Everything by Stephen M. R. Covey (his father was the author of the Seven Habits of Highly Effective People). As I was reading The Speed of Trust I couldn’t help thinking back about the bank president. You see, he violated several of the principles outlined in the book for generating trust.

How about you? Are you someone that people naturally trust? Do you know the behaviors that high-trust people exhibit? In this book, the author identifies 13 behaviors that builds trust between individuals.

The 13 Behaviors of High Trust People

Behavior #1: Talk Straight

Be honest. Tell the truth. Let people know where you stand. Use simple language. Call things what they are. Demonstrate integrity. Don’t manipulate people or distort facts. Don’t spin the truth. Don’t leave false impressions.

Behavior #2: Demonstrate Respect

Behave in ways that show fundamental respect for people. Respect the dignity of every person and every role. Treat everyone with respect, especially those who can’t do anything for you. Behave in ways that demonstrate caring and concern. Don’t fake caring.

Behavior #3: Create Transparency

Tell the truth in a way people can verify. Get real and genuine. Be open and authentic. Err on the side of disclosure. Operate on the premise of “What you see is what you get.” Don’t have hidden agendas. Don’t hide information.

Behavior #4: Right Wrongs

Make things right when you’re wrong. Apologize quickly. Make restitution where possible. Demonstrate personal humility. Don’t cover things up. Don’t let pride get in the way of doing the right thing.

Behavior #5: Show Loyalty

Give credit to others for their part in bringing about favorable results. Speak about people as if they were present. Represent others who aren’t there to speak for themselves. Don’t bad-mouth others behind their backs. Don’t disclose others’ private information.

Behavior #6: Deliver Results

Establish a track record of results. Get the right things done. Make things happen. Accomplish what you’re hired to do. Be on time and within budget. Don’t overpromise and underdeliver. Don’t make excuses for not delivering.

Behavior #7: Get Better

Continuously improve. Increase your capabilities. Be a constant learner. Develop feedback systems. Act on the feedback you receive. Thank people for feedback. Don’t assume today’s knowledge and skills will be sufficient for tomorrow’s challenges.

Behavior #8: Confront Reality

Take issues head on, even the “undiscussables.” Address the tough stuff directly. Acknowledge the unsaid. Don’t skirt the real issues. Don’t bury your head in the sand.

Behavior #9: Clarify Expectations

Disclose and reveal expectations. Discuss them. Renegotiate them if needed. Don’t violate expectations. Don’t assume that expectations are clear and shared.

Behavior #10: Practice Accountability

Hold yourself accountable. Hold others accountable. Take responsibility for results. Be clear on how you’ll communicate how you’re doing – and others are doing. Don’t blame others or point fingers when things go wrong.

Behavior #11: Listen First

Listen before you speak. Understand. Diagnose. Don’t assume you know what matters most to others. Don’t presume you have all the answers – or all the questions.

Behavior #12: Keep Commitments

Say what you’re going to do, then do what you say you’re going to do. Make commitments carefully and keep them. Don’t break confidences. Make keeping commitments the symbol of your honor.

Behavior #13: Extend Trust

Demonstrate a propensity to trust. Extend trust abundantly to those who have earned your trust. Extend trust conditionally to those who are earning your trust. Don’t withhold trust because there is risk involved.

The benefits of trust

When people have confidence in you, in your integrity and in your abilities to perform as promised, trust is the end result. And when potential clients trust you, your chances of getting their business improves dramatically. On a personal level, high-trust individuals are more likely to be promoted, make more money and have more fulfilling relationships. So the benefits of trust are huge both personally and professionally.

I would encourage you to buy the book. It’s a keeper! But if you’re not sure you have the time to read it, click on this link, The Speed of Trust to get my 7 page summary of the book. And if you like this summary you may want to check out my Recommended Reading List on my website. There are nearly 250 recommended books of all sorts of genres on my book list with more than 50 book summaries that you can download for free on a variety of topics.

The post Do People Trust You? Learn the 13 Behaviors of High-Trust People appeared first on MarshallCf.

July 17, 2020

6 Principles for Investing in Real Estate That Will Make You Rich (Slowly)

I get questions from investors regularly that sound more or less like this:

Should I buy this rental property?

Is this a good buy at this price?

Would you still buy this property in light of COVID-19?

All good questions. As we all know there is no sure fire way to determine whether a potential real estate purchase will turn out well. That’s why I titled my book Mastering the Art of Commercial Real Estate Investing. Investing in real estate really is more of an art than it is a science. That said, I believe if you apply the six principles I mention below, you have a much higher probability of investing successfully.

These principles I’m about to share with you help thwart two counter-productive emotions that if not resisted will likely torpedo your chances of being a successful real estate investor. What are these two emotions? Fear and greed.

Fear & Greed

Fear prevents us from buying at the bottom of the real estate cycle. It causes the average investor to sit on the sidelines while all the good investment opportunities are snatched up by seasoned real estate investors. Fear also urges us to sell after the market plunges which absolutely makes no sense.

Greed, on the other hand, urges us to buy when the market is overheated, typically at or close to the top of the real estate cycle. In my opinion the fear of missing out (FOMO) has done far more harm than any other factor affecting real estate investment returns. As the saying goes, “You make your money when you buy,” is very true. And if you buy an overpriced property, it is highly unlikely that it will ever yield a reasonable cash-on-cash return.

Warren Buffett said it best when he said, “The most important quality for an investor is temperament, not intellect.”

Six Principles for RE Investing

If you follow these six real estate investing principles, you should be able to protect your real estate investments from the common pitfalls that can adversely impact your returns.

James Montier, the author of the well-known book The Little Book of Behavioral Investing, wrote a white paper called “The Seven Immutable Laws of Investing.” In his thesis, he identifies seven principles for sensible investing in the stock or bond markets. I was intrigued by the title, so I read the article and somewhere along the way realized that six of these seven “immutable laws of investing” also apply to investing in commercial real estate.

Always insist on a margin of safety

In other words, the goal is not to buy at fair market value but to purchase with a margin of safety because property performance, market conditions, and the like may not live up to expectations. This means finding a property that is underperforming in the market, but, with a change in ownership, the property’s performance will turn around.

This time is never different

The four most dangerous words in investing are “This time is different.” The dot.com bubble that occurred from 1999 to 2001 is a perfect example. Investors were buying stock in companies that hadn’t turned a profit because they expected these companies would become the next Google or Amazon.com. Stock prices soared, and even though it made no logical sense, the contention that was bandied about was “this time is different.” The same was true of real estate prior to the Great Recession. Many people believed that house prices could never go down, that we had hit a new permanent high. In both examples, however, a speculative fever resulted in a bubble that caused stocks and house prices to plummet in value.

Whenever someone starts saying, “This time it’s different,” get out of that investment as quickly as you can.

Be patient and wait for the fat pitch

Mr. Montier states in his white paper: “Patience is integral to any value-based approach on many levels. … However patience is in rare supply.” In commercial real estate, there is a time to wait and a time to act. When things go bad, like what occurred after the Great Recession, the tendency is to dump our rental properties as quickly as we can. But the prudent thing to do is wait.

Most investors suffer from an “action bias”—a desire to do something. But often the best thing to do is to stand at the plate and wait for the “fat pitch.” A “fat pitch” is a baseball analogy where the pitcher is behind in the count and his next pitch needs to be a strike or he’s walking the batter. He knows that, and more importantly the batter knows that. So the batter just patiently waits for that fat pitch that he can hit for extra bases. Likewise, real estate investors need to be patient as they look for those buying opportunities that will be home runs for them.

Be contrarian

Humans are prone to the herd instinct. Investors are often no exception. When everyone is buying, investors typically buy; when everyone is selling, they sell.

In 2009, during the worst of the recession, a group of us put under contract an apartment that had been foreclosed on by the lender. It took me six months to find a lender who would finance this property. Today, the property is by far my best investment. The value has shot up dramatically, and the property is truly a cash cow.

Are all the bargains gone in a high-priced market? I don’t believe so, but finding them is certainly more challenging. Anytime can be a good time to buy. But if you go along with the herd and sit on the sidelines with them, you may miss out on some of the best deals to be had.

Be leery of leverage

As an investor, I’m always trying to improve my property’s cash-on-cash return. Adding modest amounts of debt to be paid from the property’s cash flow is the easiest way to substantially improve its cash-on-cash return. Why? As you add debt, you reduce the equity invested in the property. Counterbalancing reduced equity is an incremental reduction in the property’s cashflow after debt service resulting from the monthly mortgage payment modestly increasing.

So leverage can positively influence the property’s cash-on-cash return. But there is a limit, and we investor’s need to be very leery of leveraging our properties too much. In many instances, those owners with properties that were over-leveraged in 2008 paid the ultimate price—the loss of their properties. Those homeowners prior to the Great Recession who used their homes as ATM machines learned the hard way too. Seven million homeowners lost their homes to foreclosure during the last recession.

Never invest in something you don’t understand

This is just plain old common sense. All too often, I have found myself talking with commercial real estate investors who are clueless about their property holdings. This puts them at the mercy of their real estate advisors. Many times these advisors have a different agenda than the owner. The owner, not knowing the fundamentals of CRE, is unaware of the conflict of interest. It’s a simple truth: If you don’t understand the investment concept, then you shouldn’t be investing in it.

As long as you follow these six fundamental principles of CRE investing, you can be confident you’re investing wisely. Otherwise, you can go through life being part of the herd, following the latest trend only to be sadly mistaken when the real estate market turns.

Those are my thoughts. I welcome yours. What real estate investing principles do you live by?

Want more CRE investing tips? Check out my book!

The post 6 Principles for Investing in Real Estate That Will Make You Rich (Slowly) appeared first on MarshallCf.

July 1, 2020

After 13 years of CRE investing, this is what I would do differently

We’ve all heard the saying, “Hindsight is 20-20,” meaning it’s easy to know the right thing to do after the fact, but when you’re in the moment it’s all together a different matter. And so it is with my CRE investing. I’ve been investing in commercial real estate since 2007 and when I look back from the vantage point of time, I recognize six things that I would do differently if I could wave my magic wand and go back in time and do it over. I would have:

#1 – Started CRE investing sooner

I was in my mid-50s before I invested in my first rental property. I wish I had started sooner. Though I’m very grateful for my current financial strength, I wonder where my net worth and liquidity would be today if I had started investing just five years earlier. But looking back, my priorities were where they should have been. I had two kids in college and tuition was a major financial hurdle to overcome. And I was in my third year as a solo entrepreneur and much of my time was rightly devoted to making sure Marshall Commercial Funding would survive the Great Recession. I have no regrets. My priorities were good. At least I wasn’t throwing my money away on a bigger house or on expensive man toys. Still it would have been nice to have started my CRE investing sooner.

#2 – Bought more properties at the bottom of the real estate cycle

The properties that I purchased during the Great Recession have been home runs. Actually, one property was not a home run. It was a grand slam. I doubt if I will ever sell these properties as they cash flow beautifully. The saying that “You make your money when you buy” is certainly true. Where would I be financially if I had invested in one or two additional properties between 2009 and 2011?

#3 – Been more discerning with whom I invested with

My approach to CRE investing is to be a passive investor. I let someone else be the sponsor who makes all the important decisions. This sponsor assembles a group of investors to buy a property. Surprisingly, the most contentious confrontations I’ve had in the last eleven years have been with these other investors. Sometimes investors have different priorities. For example, some want to fix and flip. Others want to hold long term. Occasionally a difference in investment strategy causes friction. But the biggest battles have more to do with strong personalities wanting to dominate instead of building consensus among the investor group. If I had to do it all over again, I would be far more selective with whom I invest. At the first investor meeting I would do my best to try to determine whether there is anyone in the proposed investor group who has an over inflated ego. And if so, I would run, not walk away from the deal as fast as I can.

#4 – Focused on appreciation over cash flow

One way to gain net worth faster is to leverage your properties with more debt. One way to improve a property’s cash flow is leveraging it less. This debate has been an on-going internal battle with me over my investment years. Do I want to maximize equity appreciation or maximize cash flow? Early on, I wish I had tilted more towards equity appreciation. If I had, I would likely be that much better financially. Now that I’m in my 60’s, cash flow is my #1 priority.

#5 – Sold my “loser” properties sooner

I need to make a confession: Not all properties I invest in are “home runs.” Yes, I know that’s hard to believe. NOT! One of the biggest lessons I’ve learned these past 13 years is that if your initial capital improvements are unsuccessful in turning around a poorly performing property, then future capital expenditures will likely have little positive impact either. Even with a strong second effort in time and money, the best we were ever able to do was to get only modest improvements in appreciation and/or cash flow on these loser properties. So if I had to do it over, I would dump them sooner. There is no benefit keeping a property that doesn’t perform well. Sell it and use the equity from the sale to buy another property that has a better chance at success.

#6 – Kept closer tabs on the property managers

I believe that the on-site property manager has more influence on how well a property performs than any other single factor. Let me say it another way: The on-site property manager can make or break your investment. And because that is true, I wish I had monitored my on-site managers much more closely than I have. The saying, “You get what you inspect, not what you expect” is absolutely true.

Reading back what I’ve just written sounds like I’m full of regrets. Not so. Just the opposite. Without a doubt, investing in commercial real estate has substantially improved my financial health. I am on the path to financial freedom and I want to take as many of my readers along with me.

What would you do differently with your CRE investing if you had to do it all over again?

Need financing. Email me today at doug@marshallcf.com to schedule a time to discuss your financing need.

The post After 13 years of CRE investing, this is what I would do differently appeared first on MarshallCf.

June 17, 2020

3 Important Life Lessons I Learned from Dad

This weekend is Father’s Day and even though my father passed away several years ago, I’m surprised how often I think about him. Something happens during the normal course of my day, and it triggers a flashback of him. It wasn’t a conscious decision to think about him, but rather a situation that somehow transported me forty years back in time, hearing my dad say or do something.

Dad, Good Role Model, Lousy Teacher

My father was a good role model in many ways. He also had his faults. But as time passes, the good memories of him are winning out and the not-so pleasant memories are fading. I hope that’s what happens with my two adult children when I’m dead and gone.

Although my dad was a good role model, he was a lousy teacher. I don’t ever recall him ever trying to teach me an important life lesson. He just lived what he believed. At the time, I didn’t understand the importance of or appreciate what I was witnessing. It was just my dad saying or doing what he always said or did. It was nothing special, or so it seemed. It was just vintage Dad. But the older I get, the more I appreciate the values he lived.

Here are some life lessons I learned from my father. You may find them valuable too.

Live Well within Your Means

Growing up, my family lived in a very middle class neighborhood. The neighbor on our left was a grocer, the neighbor on our right owned a gas station, and the neighbor across from us was a high school music teacher.

Although my mom drove new cars, I don’t recall Dad driving anything but used pickups. A vacation to us was visiting our relatives, certainly not going to a destination resort. We lived quite modestly.

It wasn’t until I was in college that it dawned on me that my parents were financially well off. Over the years there had been hints of my parents’ wealth, but I hadn’t been able to put the pieces together enough to realize that. This changed when Dad, who owned his own CPA practice, sold his business and retired at the age of fifty. He lived quite comfortably for the next thirty-plus years off the income generated from his investments. Living within his means paid off admirably for him.

Treat Everyone Equally

After retiring, my dad spent most of his days working on his tree farms. Having grown up in the rolling farmland of Iowa, he was in awe of the beauty of the forests in the Pacific Northwest. About ten years before he retired, he bought a parcel of logged over timberland and spent his weekends nursing the land back to health. He was comfortable working alongside loggers, foresters, and other blue-collar workers associated with the forest products industry. And they were equally accepting of him as one of their own.

I’m not sure why (it’s a question I wish I had asked him), but he was politically well connected in Oregon state politics. I remember back in the sixties that he was a pallbearer at a funeral where a fellow pallbearer was Mark Hatfield, the then governor of Oregon.

Dad never showed preferential treatment to his wealthy friends. Those in a lower socio-economic class were treated no differently than the rich and powerful. He treated everyone with the same friendly, Jimmy Stewart-like manner.

Put Together Win-Win Agreements

Dad didn’t believe in winning at all costs. He proposed agreements that were fair for both parties, not just for him. He had no problem leaving a little bit on the table if it meant getting the deal done sooner rather than later and with both parties satisfied.

Sometimes the person he was negotiating with would attempt to take advantage of his desire to strike a fair deal and would respond back with some unrealistic and unjustified counter offer. You see, not everyone plays by the same set of rules. But for the most part, people intuitively understood that he was proposing an agreement that was fair, and they respected him for that.

Sometimes life’s most important lessons are better absorbed, not through formal instruction, but by the consistent actions of a role model over a lifetime.

What life lessons did you learn from your dad?

Need financing? Email me today at doug@marshallcf.com to schedule a time to discuss your financing need.

The post 3 Important Life Lessons I Learned from Dad appeared first on MarshallCf.

June 6, 2020

My Obsessive Love Affair Revealed

The nice thing about writing a blog, is that I get to choose what I want to write about. And you, the reader, can decide whether the topic interests you. Today, I’m writing about my obsessive love affair. Yes, my love affair with golf! Were you thinking something differently? I am an avid golfer. Now don’t confuse avid with good. I am not a good golfer. I am unfortunately a mediocre golfer, a 15 handicapper to be precise.

The greatest flaw in my game

If you asked the guys I regularly play golf with, “What is Doug’s greatest flaw in his game?” it wouldn’t take them three nanoseconds to identify my Achilles heel. They’d say my putting, especially short putts under six feet, which varies from one day to the next from so-so to really awful, depending on the mood of the golf gods.

One of the unintended consequences of the COVID-19 pandemic is that the golf course I play regularly, Quail Valley Golf Course, has never been so busy. And since my business has come to a roaring halt, I’ve had ample opportunities to indulge in my favorite pastime.

Even before the pandemic caused everything to come to a roaring halt, I had committed to 2020 being the year I significantly improved my putting skills.

Improving the mental approach to golf

In January I purchased the book, Golf is Not a Game of Perfect by Dr. Bob Rotella. Dr. Rotella is a well-known sports psychologists who has helped some of the greatest players on the PGA tour with their mental approach to the game of golf. Here are some of his tips on creating a pre-shot routine for putting:

Pick out a target.

For a straight putt, pick a particular spot in the cup.

For breaking putts, pick a spot on your target line.

Once you’ve selected your target, focus on it exclusively. Don’t let your eyes wander to the cup.

Take a practice stroke or two until the swing feels good. Take them with your eyes on the target, not the ball and not on the putter blade.

Then look at the target. Look at the ball. Then let the putt go.

I bought his book as an Audible book, so while I’m driving to the golf course, I listen to his tips on creating the right mental approach to golf before I even step onto the course.

Think “straight back, straight forward”

I’ve added to Dr. Rotella’s putting tips one of my own. Actually, it came from my playing partner Steve who after seeing me badly miss an 18” tap-in showed mercy on me by giving me one of the most basic of putting tips. “When you take the putter head back,” he said, “think straight back, and then straight forward.” So now when I start my backswing I now say to myself “straight back” as I take my back swing and “straight forward” when I take my follow through. Saying “straight back, straight forward” also helps my rhythm. I know it’s embarrassing to admit, but it actually works.

Changes to putting grip & stance

I’ve also made changes to my putting grip and my putting stance. When it comes to putting, there is no right or wrong way to grip a putter. The same is true for how you stand over a putt. Putting is the most free thinking of any part of the game. To remove any wrist action from my putting stroke I now grip the putter with my right hand as far down the shaft as possible while I leave my left hand where traditionally most golfers hold the club. So instead of my two hands overlapping one another they are separated by a couple of inches. Yes I know. I look like an 8 year old gripping a club for the first time, but I don’t care. It makes for a much more solid feel on the club.

And for the past 50 years I’ve putted with an open stance. But I’ve decided to square up my stance because it makes it much easier to know if my backswing and follow through are actually going straight back and straight forward. When you have an open stance how would you know?

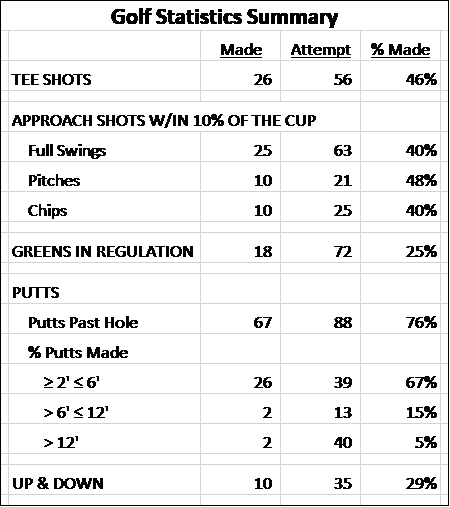

The golf statistics I track

For those who know me best, they will tell you I am a numbers guy. I love analyzing everything. When it comes to golf, there are so many stats that you could keep track of. To record those stats most important to me I created my own scorecard which has slowly evolved over time. Here is the latest version of my scorecard.

I know what you’re thinking. You’re rolling your eyes and thinking this guy is really seriously weird. Even the golfers reading this article are thinking that. That’s okay. I’ve gotten used to the disparaging comments (you know, “sticks and stones may break my bones…”). Notice about half my scorecard records putting stats because as any golfer will tell you the old saying, “Drive for show, putt for dough” is very true.

More aggressive approach to putting

I’ve made two changes to my putting stats this year. For years I recorded lag putts within 2 feet of the hole. It’s not a bad stat but I realized that I was consistently leaving my putts short and as we all know, “Never up, never in.” So this year I’ve changed this putting stat to Putts Past Hole. My goal now is to consistently putt every putt past the hole. It’s a more aggressive approach to putting, and yes, occasionally I will pay for this aggressiveness by my ball blowing past the hole resulting in a 3 putt. But my formerly tentative attitude about putting has been replaced with more of killer instinct. I like this change in attitude.

Tracking putting success

Also notice that I’m now tracking my putting success. All putts from 2 feet or more are divided into one of three distance categories. My goal is to make 80% of the putts that are two to six feet from the hole. I know that would be a substantial improvement in my putting but unfortunately I don’t know what my success rate at this distance was prior to recording this stat but I assure you it wasn’t close to 80%.

So how am I doing since I implemented all these changes? See below.

Give me six months and I’ll know if these changes have improved my putting prowess. So now you know what I obsess over. What putting tips can you give me? Any and all comments will be appreciated. And if anyone would like to get together to play a round just give me a call at (503) 705-4723.

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon!

The post My Obsessive Love Affair Revealed appeared first on MarshallCf.