Doug Marshall's Blog, page 11

September 9, 2017

When will interest rates go back up? How about never!

In the back of the minds of most commercial real estate investors is the never ending question, “When will interest rates go back up?” We have collectively fretted over rising interest rates for the past 35 years. And yet the truth is this: Those who have locked in long-term interest rates over the years have been the big losers. It would have been in the borrowers’ best interests if they had chosen a short-term variable rate or even a five-year fixed rate than to have locked in a 10-year fixed rate loan or longer. Thinking rates certainly have to go back up, those who locked in the longer fixed term rates over the years have consistently paid larger mortgage payments than those who did not. I know of no exceptions.

Inflation our last great battle

Why do we fixate on this thinking of rates having to go back up? I think part of the reason is human nature is always fighting the last battle and for most of us over 50 years of age the last great battle was inflation. We remember when our money market account was giving us 18 percent interest. We remember the adverse effects of runaway inflation. Likewise, those who grew up during the Great Depression their lifetime battle was hunger and poverty so even when they prospered after World War II, they were still overly careful about spending their money.

So where are we at this moment in time? Will rates eventually rise? Yes, they will fluctuate over time but there is no reason to believe interest rates will inevitably rise. It’s just as likely that they will go down or possibly stay within a range that we have seen over the past couple of years. Here’s why:

Who controls interest rates?

Interest rates are not controlled by The Federal Reserve, the federal government or some nefarious secret society. Yes, The Federal Reserve does set the overnight interest rate between banks, but increasing this rate has little or no impact on 5-year, 10-year or 30-year U.S. treasury yields. So when you hear about Fed Chair Janet Yellen proposing to increase the federal funds rate at the next meeting of the Federal Open Market Committee it really doesn’t make any difference. Who cares?

However, The Federal Reserve does have the ability to manipulate interest rates. They did this in spades with Quantitative Easing. To get us out of the Great Recession The Fed purchased massive quantities of government bonds and other financial assets. The result was a lowering of U.S. Treasury yields. But even then The Fed still had to work within the bounds of the Law of Supply and Demand.

The Law of Supply and Demand

You see U.S. treasury yields are affected by the Law of Supply and Demand. Here’s how it works:

It all begins with the U.S. Treasury needing to sell bonds because the federal government is spending more money than they are taking in in tax revenues. Hence, the growing national debt. At some point in time we will have to pay the piper for spending more than we take in. Who knows when that will happen? Likely we will be long dead and gone when that happens. I fear for my grandchildren, but I digress.

I don’t pretend to understand the government bond auction process. Suffice to say the U.S Treasury Department auctions off government bonds at different maturity dates from 1 month to 30 years. Let’s say the U.S. Treasury auctions off $100 billion of 10-year treasury notes. One of three things will happen.

If demand for the 10-year bond equals the supply the asking interest rate (whatever that treasury yield is at the moment) remains the same.

If demand for the 10-year bond exceeds supply then the asking interest rate trends lower until the demand at the lower treasury yield levels off to meet the supply.

If demand for the 10-year bond is less than the supply then the asking interest rate will trend higher until demand improves so supply and demand are equalized. That’s how it works. It’s as simple as that.

The effect of Quantitative Easing on interest rates

So let’s get back to the quantitative easing program that The Fed employed to stimulate the economy out of the Great Recession. When The Fed purchased huge quantities of U.S. treasury bonds they in affect artificially increased the demand for treasuries thereby lowering treasury yields.

The impact of China dumping U.S. Treasuries

Do you remember when Donald Trump won the U.S. presidency the 10-year treasury rate zoomed up 70 basis over night? The reason given at the time for the increase was that the economic policies of a Trump administration would be good for the U.S. economy resulting in inflationary pressure on the dollar. Doesn’t that disprove my thinking that treasury rates are all about supply and demand? It would poke a big hole in my theory if it were true. But it isn’t. What really happened was that China was going through a severe liquidity crisis at the time which required the People’s Bank of China to sell massive amounts of U.S. treasury bonds. So what happens when the supply of U.S. bonds increases? The interest rate must increase to increase the demand commensurately. And that is exactly what happened when China dumped U.S. treasuries. Our treasury rates zoomed up overnight.

Why treasury yields will likely remain low

Where are interest rates going in the years ahead? Understand this: The Federal Reserve is only one of several central banks worldwide. In order to stimulate the Japanese and European economies over the past several years the central banks of Japan and Europe have artificially lowered interest rates to near zero using their version of quantitative easing.

Let’s say you’re a Japanese citizen and you have a choice of investing your excess cash in a Japanese 10-year bond at 0.2% or you could invest your cash in a U.S. Treasury bond at 2.0%. Which would you choose? Also let’s say the U.S. dollar is appreciating 10% in value when compared to the Japanese yen. So instead of getting a 2% return on their U.S. treasury note they are now getting a 12% return. Which would you choose? It’s a no-brainer, isn’t it? And that’s what’s been happening.

So to understand future treasury rates you need to understand the concept of the Law of Supply and Demand. As long as U.S. Treasury yields are higher than bond yields from other nations, U.S. treasury rates will continue to stay low because demand for our treasuries will remain high. It’s as simple as that. Until the global situation changes, U.S. Treasury yields will likely remain low.

Are negative interest rates possible in the U.S.?

One more thought and then I’ll shut up. What happens when the next recession hits the U.S. and normal economic stimulus is not sufficient to revive the economy? Don’t be surprised if The Fed manipulates interest rates to near zero or possibly even encourages negative interest rates by using Quantitative Easing once again. I think that is likely. If so, what happens to all those real estate investors who’ve locked in long term interest rates? They don’t get the opportunity to take advantage of these historic rates. And what happens to those investors who can? They make out like bandits.

So the next time a lender or mortgage broker encourages you to lock in that low rate for 10 years or longer, think twice. Is that really a good decision? I don’t think so. That’s my opinion. I welcome yours. What do you think?

Past articles on interest rates you may find of interest: A Bubble in Search of a Pin: The Unintended Consequences of Low Interest Rates and Negative Interest Rates – Coming to a Bank Near You!

The post When will interest rates go back up? How about never! appeared first on MarshallCf.

August 30, 2017

Help me come up with a title for my new book!

I need your feedback. I’m writing a book about real estate investing that will be published later this year by Morgan James Publishing. The book manuscript is currently in the editing phase and will soon be finished.

I need a title for the book and that’s where you come in. I’m stymied over what to name the book. Would you be willing to answer four questions that will help me figure out a good title?

The post Help me come up with a title for my new book! appeared first on MarshallCf.

August 18, 2017

Why IRR is not the best approach for valuing commercial real estate

During my 30+ years in commercial real estate I’ve come to realize there are two common ways investors value properties. Many savvy real estate investors have a fairly simple analysis, an almost “back of the napkin” approach to making purchase decisions. And it works well for them. They value properties based on a combination of a big picture, “30,000-foot view” of the property and gut instinct.

And then there are some investors I’ve worked with who like to “get in the weeds.” They enjoy the process of getting as much data as possible to make an informed decision. This is my personality bent too. I want to make sure I’m not missing some arcane but important detail that will make my purchase decision a no brainer.

IRR assumes way too much

Where I differ from most of my fellow detail oriented investors is on the best approach to analyzing a property. As a CCIM designee I have been trained in Internal Rates of Return (IRR) and Net Present Value (NPV) valuation methods. But over time I realized that approach assumes way too many variables you have no answer to when you purchase the property, such as:

How much are rents going to increase over time?

How long will you hold the property?

What will be the rate of inflation over the holding period?

What will be the cap rate at the time you sell the property?

These questions are all unknowns. In fact, they are unknowable. And yet all of these assumptions have to be made in order to determine an IRR. It’s a classic example of GIGO (garbage in, garbage out). I’ve listened to CCIM instructors tell their students that you should buy the property with the highest IRR when one property had a 14.19% IRR and the other had a 14.23% IRR. Really?

A simpler, better approach than using IRR

Though I enjoy gathering and analyzing as many details as possible, my approach is much simpler than doing an IRR calculation. My property valuation method is based on knowable assumptions or at least reasonably educated guesses such as:

What will I offer for the property in an as-is condition?

What is needed to renovate the property and how much will it cost?

When the improvements are completed what will be the new market rents?

How long will it take me to achieve stabilized occupancy?

What type of financing should I get? A perm loan with a holdback for repairs? Or a full-blown bridge loan followed by a competitive non-recourse loan?

All of these assumptions are at the very least educated guesses, if not very knowable inputs. Once it’s modeled up, I focus in on a before-tax return-on-equity in the first year of stabilized operation. If it’s in the 5% or better range then I know it will do well over time.

Two examples of poor outcomes using IRR

Now some of you are probably thinking, “this guy is just intimidated by the sophistication of the IRR method.” Nope, I actually enjoy doing an IRR calculation. It’s so analytical. I love it. I just don’t believe it provides the best approach to making a buy/no-buy decision. It reminds me of the Mark Twain saying, “There are liars, damned liars and then there are statisticians.” Here are two examples of what I mean:

Depending on your assumptions, you can get whatever IRR you want to get. If it’s not high enough to justify purchasing the property, then increase your annual rent growth by another 1% or lower your sales cap rate in year 10 by 50 basis points. Thirty years ago, as a financial analyst for a syndicator that was my job. I played with the numbers until I got the desired return my boss wanted for our investor presentations.

In my opinion cash flow is king. But you can use an IRR calculation to justify purchasing a property having little or no annual cash flow but a higher IRR by inflating the sales price in year 10 over a property that has generous cash flows over the holding period. Sorry, I would rather choose the property with the good cash flow and slightly lower IRR than the property with little cash flow and higher IRR. Wouldn’t you?

Use IRR at time of sale, not for purchases

Now that the IRR aficionados have labeled me an IRR Neanderthal, I must confess that I do use a before-tax IRR calculation after I’ve sold a property. Because at that point all the variables are known. I know:

How much equity was required when I purchased the property

My annual owner distributions

The number of years I owned the property

The amount of cash or 1031 equity I received at closing when I sold the property

Knowing those 4 things, I can then run an accurate IRR calculation. The properties I’ve sold have had an IRR as low as 7% and as high as 28%. But I calculate an IRR calculation after the property is sold, not before because there are way too many unknowns.

If you would like to learn the specifics of how I analyze a property purchase, I would encourage you to listen to a short two-minute video presentation by clicking on this link to my website and then download for FREE my Property Investing Analysis Spreadsheet.

Give me your thoughts. What approach do you use to value your real estate purchases?

The post Why IRR is not the best approach for valuing commercial real estate appeared first on MarshallCf.

IRR is a fool’s approach to valuing commercial real estate

During my 30+ years in commercial real estate I’ve come to realize there are two common ways investors value properties. Many savvy real estate investors have a fairly simple analysis, an almost “back of the napkin” approach to making purchase decisions. And it works well for them. They value properties based on a combination of a big picture, “30,000-foot view” of the property and gut instinct.

And then there are some investors I’ve worked with who like to “get in the weeds.” They enjoy the process of getting as much data as possible to make an informed decision. This is my personality bent too. I want to make sure I’m not missing some arcane but important detail that will make my purchase decision a no brainer.

IRR assumes way too much

Where I differ from most of my fellow detail oriented investors is on the best approach to analyzing a property. As a CCIM designee I have been trained in Internal Rates of Return (IRR) and Net Present Value (NPV) valuation methods. But over time I realized that approach assumes way too many variables you have no answer to when you purchase the property, such as:

How much are rents going to increase over time?

How long will you hold the property?

What will be the rate of inflation over the holding period?

What will be the cap rate at the time you sell the property?

These questions are all unknowns. In fact, they are unknowable. And yet all of these assumptions have to be made in order to determine an IRR. It’s a classic example of GIGO (garbage in, garbage out). I’ve listened to CCIM instructors tell their students that you should buy the property with the highest IRR when one property had a 14.19% IRR and the other had a 14.23% IRR. Really?

A simpler, better approach than using IRR

Though I enjoy gathering and analyzing as many details as possible, my approach is much simpler than doing an IRR calculation. My property valuation method is based on knowable assumptions or at least reasonably educated guesses such as:

What will I offer for the property in an as-is condition?

What is needed to renovate the property and how much will it cost?

When the improvements are completed what will be the new market rents?

How long will it take me to achieve stabilized occupancy?

What type of financing should I get? A perm loan with a holdback for repairs? Or a full-blown bridge loan followed by a competitive non-recourse loan?

All of these assumptions are at the very least educated guesses, if not very knowable inputs. Once it’s modeled up, I focus in on a before-tax return-on-equity in the first year of stabilized operation. If it’s in the 5% or better range then I know it will do well over time.

Two examples of poor outcomes using IRR

Now some of you are probably thinking, “this guy is just intimidated by the sophistication of the IRR method.” Nope, I actually enjoy doing an IRR calculation. It’s so analytical. I love it. I just don’t believe it provides the best approach to making a buy/no-buy decision. It reminds me of the Mark Twain saying, “There are liars, damned liars and then there are statisticians.” Here are two examples of what I mean:

Depending on your assumptions, you can get whatever IRR you want to get. If it’s not high enough to justify purchasing the property, then increase your annual rent growth by another 1% or lower your sales cap rate in year 10 by 50 basis points. Thirty years ago, as a financial analyst for a syndicator that was my job. I played with the numbers until I got the desired return my boss wanted for our investor presentations.

In my opinion cash flow is king. But you can use an IRR calculation to justify purchasing a property having little or no annual cash flow but a higher IRR by inflating the sales price in year 10 over a property that has generous cash flows over the holding period. Sorry, I would rather choose the property with the good cash flow and slightly lower IRR than the property with little cash flow and higher IRR. Wouldn’t you?

Use IRR at time of sale, not for purchases

Now that the IRR aficionados have labeled me an IRR Neanderthal, I must confess that I do use a before-tax IRR calculation after I’ve sold a property. Because at that point all the variables are known. I know:

How much equity was required when I purchased the property

My annual owner distributions

The number of years I owned the property

The amount of cash or 1031 equity I received at closing when I sold the property

Knowing those 4 things, I can then run an accurate IRR calculation. The properties I’ve sold have had an IRR as low as 7% and as high as 28%. But I calculate an IRR calculation after the property is sold, not before because there are way too many unknowns.

If you would like to learn the specifics of how I analyze a property purchase, I would encourage you to listen to a short two-minute video presentation by clicking on this link to my website and then download for FREE my Property Investing Analysis Spreadsheet.

Give me your thoughts. What approach do you use to value your real estate purchases?

The post IRR is a fool’s approach to valuing commercial real estate appeared first on MarshallCf.

August 8, 2017

Is healthcare a fundamental right? Some thoughts to consider.

I know I enter dangerous territory when my wife, Carol, tells me not to write on a particular topic. So, it is today as I let my opinion be known about the current healthcare debate. You see, her advice is really sound. The country is about equally divided on this topic and my giving my two cents worth will only irritate one segment of my reader base, if not a large majority. But I have been observing this healthcare debate debacle now for eight years and I can no longer keep quiet.

Before I get started, those of you who read my commercial real estate commentary on a regular basis and expect me to somehow tie my thoughts on healthcare back to commercial real estate are going to be sorely disappointed. So, if you expect that to happen, now is the time to stop reading this article. Yes, you have my permission. STOP READING NOW. For the rest of you, I hope my thoughts can help crystallize your thinking on this very important subject.

My thoughts on healthcare

Is healthcare a fundamental right?

There are some who believe that healthcare is a fundamental right. I respectfully disagree. Our rights as U.S. citizens come from our Constitution and the Bill of Rights. Nowhere in the U.S. Constitution or Bill of Rights does it state that healthcare is a right. Now some will say that the clause “promote the general welfare” found in the U.S. Constitution implies that healthcare would fall under this purview. You can’t convince me that the founding fathers were thinking at all about healthcare when they wrote this clause into our Constitution. Ain’t going to happen.

A moral obligation, not a fundamental right

I do believe as the richest nation on earth and a nation that believes in Abraham Lincoln’s view of “malice toward none and charity for all” that we have a moral obligation to help our fellow man with the absolute basics of life and that includes healthcare. There needs to be a healthcare “safety net” that provides a minimum standard for all our citizens regardless of wealth.

The difference between a fundamental right and a moral obligation

In summary, healthcare is not a fundamental right; rather it is a moral obligation. This is an important distinction. If you believe it is a right then everyone should have equal access to all medical procedures regardless of cost. If you believe it is a moral obligation then those who can afford to pay for top notch healthcare should be allowed to do so and those who cannot should be thankful that the government is covering the basics.

I was against Obamacare

Eight years ago, I was against Obamacare. Not the concept, but how it came to be. When the Democrats controlled the House, the Senate and the White House they forced their will on the American people and passed the Affordable Care Act. Some will say that the Republicans were the ones who were uncooperative. And that was likely true. The point I’m trying to make is this: No political party should pass comprehensive legislation of this magnitude by forcing it down the throats of the minority party. If the majority party cannot get bipartisan support for their legislation they should wait until they can.

I’m against repeal and replace

Likewise, I am against the repealing and replacing of Obamacare by President Trump and the Republicans in the Senate and the House for the exact same reason. I repeat, no political party should pass comprehensive legislation of this magnitude by forcing it down the throats of the minority party. If the majority party cannot get bipartisan support for their legislation they should wait until they can.

Crafting legislation requires compromise

Neither political party has a monopoly on good ideas. Both parties, if they worked together and learned to compromise, could come up with a healthcare bill that would be far superior to what we currently have. But for that to happen, there needs to be less finger pointing and demonizing of our political opponents, and more humility and conciliatory reaching out to the other side. The real question is this: Are there enough adults in the House and the Senate that can swallow their pride and for the good of the American people pass bipartisan healthcare legislation?

Incremental legislation is the best approach

Over the years I’ve come to the conclusion that Congress is not particularly good at passing comprehensive legislation. This is not their strength. But they are good at passing incremental legislation. By that I mean, it becomes readily apparent that there is a flaw in a piece of legislation they passed previously. A congressperson realizes their legislation is not working as intended and promotes a new piece of legislation that fixes the problem. That is an example of incremental legislation. And this is how they should fix Obamacare. Quit attempting to pass a comprehensive bill to replace Obamacare. Let’s face it. Your track record of passing well written comprehensive legislation is not particularly good. Instead fix some of its broken parts. To begin, I suggest the following incremental changes:

Allow the federal government to negotiate lower drug prices for Medicaid and Medicare. Right now, they aren’t allowed to negotiate. How silly is that? A 15 percent reduction in drug costs would produce a $600 billion savings in healthcare costs over 10 years (Democrat party idea).

Tort reform should be considered. The abuse of malpractice suits results in hospitals over-treating and over-testing. If tort reform shaved just two percent off of health-care costs, that would yield about $800 billion over a decade (Republican party idea).

Repeal the individual mandate forcing everyone to either get insurance or pay a penalty. Instead treat everyone as adults and give everyone this option: Your pre-existing conditions are covered as long as you have insurance. If you decide not to have insurance that’s your decision. But if you then get cancer, etc. prior to getting coverage the cost is on you. No longer can you wait to get insurance until after you need it (my idea).

What are your thoughts?

These are three common sense proposals that would help improve healthcare and significantly reduce costs. These are just the beginning. There are many, many more good ideas that should be debated and passed in a bi-partisan way. There you have my thinking on healthcare. Now it’s your turn. How would you make it better if you could waive a magic wand?

Sources: Nine Ways to Really Fix Obamacare, by Steven Brill, The Washington Post, June 30, 2017

The post Is healthcare a fundamental right? Some thoughts to consider. appeared first on MarshallCf.

July 28, 2017

Is it the right time to invest in real estate? You asked. I answered.

I often get asked these days, “Is this the right time to invest in real estate?” It’s a legitimate question. As capitalization rates have steadily declined and property values have rapidly increased this question becomes ever more important to answer. Other insightful questions being asked are, “When will the real estate market turn?” Or another way of saying it, “Has the market peaked?” All good questions.

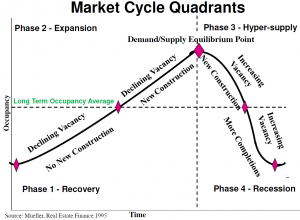

Before we can answer these questions, we need to determine where we are on the real estate market cycle. As you are probably aware, the real estate market cycle is cyclical with four distinct phases: Recovery, Expansion, Hyper-supply and Recession. The chart below shows these four phases and how each phase impacts new construction and vacancy rates.

The Real Estate Market Cycle

Before I talk about the four phases of the real estate market cycle, let’s discuss the basics of the chart. The X axis (horizontal line) represents time and the Y axis (vertical line) represents the occupancy rate. The horizontal dotted line represents the long-term average occupancy for the market. The vertical dotted line represents when supply and demand are perfectly in balance. The black solid line that travels through all four quadrants represents the change in the occupancy rate over time. Now that we’ve discussed the basics, let’s discuss the four quadrants.

Phase I – Recovery

This quadrant of the real estate market cycle, shown in the lower left hand corner of the chart, is characterized by high vacancy and no new construction. Though it’s not shown on this graph, generally rents are flat or declining. Rent concessions are common to avoid the occupancy rate from further declining.

The mood of investors in this quadrant begins with panic, “Oh my, am I going to survive?” (think 2009). Slowly investor attitude turns to one of relief, “Whew, I made it through the worst of the market” as the occupancy rate improves to the market’s long-term average occupancy rate.

Phase II – Expansion

This quadrant, shown in the upper left hand corner of the chart, is characterized by declining vacancy and the start of new construction. As occupancy improves, concessions are eliminated and rent growth begins.

The mood of investors turns from relief, “I dodged a bullet” to giddiness as vacancy rates decline and rents increase dramatically. Life is very, very good at this point in the real estate cycle for investors.

Phase III – Hyper-Supply

This quadrant, shown in the upper right hand corner of the chart, is characterized by more new construction and for the first time in a long time vacancy rates begin to rise. Rent growth, though still positive, is growing at a slower pace. And some neighborhoods are beginning to experience rent concessions as new product that has recently come on line is becoming increasingly more difficult to lease up.

The investor mood turns from giddiness to one of caution and then denial that there is a problem brewing. The “glass half full” type of investors are still confident everything is going to work out just fine. They rationalize the slow rent up as only a bump in the road which will self-correct itself as long as they don’t panic.

Phase IV – Recession

This quadrant, shown in the lower right hand corner of the chart, is characterized by more and more product being completed resulting in a substantial decline in occupancy rates. Newly completed product are sitting there unoccupied so developers begin running blue light specials to get them rented up. Concessions are abundant and established properties to avoid wholesale move outs are forced to offer concessions too.

Investor mood goes from denial, early on in this phase, to one of outright panic. Developers begin to wonder, “Am I going to make it?” and some will not. Also some investors who recently bought properties at premium prices and then loaded them with lots of debt realize their mistake as well. Because they are leveraged to the hilt, a small drop in vacancy results in properties that no longer cash flow.

Those are the four phases of the real estate market cycle. Understanding where the real estate market is on the cycle is critical to successful investing. Is the market climbing closer to a market peak or is it starting down the slippery slope to recession? How we answer this question will in large part determine the difference between a successful investment or an albatross hanging around our necks.

So where are we today? The 3 indicators

I believe the evidence suggests that we are at the beginning of Phase III, the Hyper-Supply Phase. Why?

After double digit rent increases the past couple of years, rents are beginning to level off. Rents are still going up but much more modestly.

Construction in the Portland market is at an all time high. The Oregonian in a front page article a couple of weeks ago indicated there was $2.5 billion worth of new development under construction. This was the single largest amount of construction in the Portland area ever, easily eclipsing the previous high of $1.9 billion set the year before.

For the first time in a long time, concessions are being offered on new product.

These three are factors all classic indicators that the market is in Phase III, the Hyper-Supply Phase. So for the moment, let’s assume that the real estate market is in fact in this quadrant of the real estate market cycle. Does this mean that investors should stop buying real estate right now? Heck no and here’s why.

Be cautious, but continue investing

If you have inside information about a property that is for sale that the seller is not privy to, or you have a vision for how to turn a property from a “loser” to a “winner” it makes little difference what phase of the market cycle we are currently in. Even so, it’s still important to understand that some phases of the real estate cycle are more difficult for profitable investing than others. If we truly are in the beginning of the downward real estate market cycle then proceed with caution. Don’t be one of the Pollyanna investors who throws caution to the wind. Be prudent. Be alert for sudden changes to the market. If you do, you’ll increase your chances for success.

So what phase do you believe the real estate market is in? I’d like to hear from you. Please give me your thoughts.

Sources: Real Estate Cycles, Glenn R. Mueller, Ph.D., Professor Daniels College of Business, University of Denver; 21 cranes, 15 hotels, 10,000 jobs: Inside Oregon’s development spree, Jeff Manning and Anna Marum, The Oregonian, July 17, 20017.

The post Is it the right time to invest in real estate? You asked. I answered. appeared first on MarshallCf.

July 14, 2017

What keeps you up at night? I asked. You answered. See survey results.

Last week I asked my 1,700 blog readers to take a short survey. The questions asked fell into one of four categories:

Who is reading my blog?

What topics would you like me to write about?

What keeps you up at night?

Do you have an author, blogger, or news source that you enjoy reading on topics of interest for real estate investors and professionals?

Who is reading my blog?

Last year, the survey indicated that 90% of my blog readers were men. I didn’t ask the question this year, but I have no reason to believe this has changed. Let’s face it, commercial real estate is a male dominated profession and most real estate investors are men too.

Real estate is also an old man’s profession. Sixty five percent of those surveyed were 50 years of age or older. No one under 30 participated in the survey.

When asked how they would describe themselves fully 65% identified themselves as investors, of which half of these considered themselves both investors and real estate professionals. Seventy seven percent of those who identified themselves as real estate professionals indicated they were CRE Brokers/Sales Agents.

When asked, “What type of real estate is your primary focus?” fully 55% responded with apartments, 17% with office, and 11% with industrial.

So the typical respondent to the survey was in his sixties (probably white and male) who is a CRE Broker/Sales Agent specializing in apartments.

What topics would you like me to write about?

Shown below in order of interest are the top 6 topics the survey respondents asked me to write about:

Case studies – real loan quotes on real deals

Real estate market trends

Current events

Global issues affecting real estate

Principles of real estate investing

The economy

Case Studies – Real Quotes On Real Deals was the runaway favorite by those surveyed. This surprised me and also encouraged me a bit. One of the unparalleled strengths of the Marshall Commercial Funding website are the Mortgage Solutions Blueprints. Have you taken a look at these? None of my peers do anything similar. Not even close. About once a quarter I provide a very detailed case study of a recent loan closing. It begins with a brief description of the property, the financing request and the issues associated with the deal. It includes a side-by-side comparison of three or four lender quotes and how each loan alternative affects:

Cash required to close

Cash Flow After Debt Service

Before- and After-Tax Return on Equity

If you haven’t taken advantage of this free service, you should. Click on this link to see the last dozen or so Mortgage Solutions Blueprints I’ve posted. They are there for your benefit.

What keeps you up at night?

Last year 40% of the respondents replied to this question with, “Nothing. I sleep like a baby.” This year only 17% responded similarly. I believe in the past year, we have begun to see a sea change in the CRE market. Other real estate professionals are sensing it too, which is the reason for the slip in confidence. The market has peaked and we are just in the beginning stages of the Hypersupply Phase of the real estate market cycle.

Now for those 83% who weren’t so bullish about the market, their answers were all over the map. The top 4 concerns were:

Factors adversely impacting my real estate

Personal matters

The economy tanking

Not living a healthy lifestyle

Do you have an author, blogger, or news source that you enjoy reading on topics of interest for real estate investors and professionals?

Surprisingly, fully two-thirds of survey respondents answered, “No.” That’s a bit shocking, isn’t it? But maybe not. Sadly, I have found very few real estate related bloggers or news sources worth following. And I’ve found no well written books on commercial real estate. Most bloggers are boring, writing on topics I have no interest in, or they are self-serving, trying to convince you to use their services or buy their product.

Very few survey respondents provided any source for real estate related news. Here are all the sources cited:

Authors

The Perfect Investment: Create Enduring Wealth from the Historic Shift to Multifamily Housing by Paul Moore

Bloggers

Marshall Commercial Funding Blog

theBrokerList Blog

News Sources

The Wall Street Journal

Forbes magazine

The advantage of reading theBrokerList Blog is that it’s a compilation of 20 or so bloggers in the real estate industry. I would recommend you signing up for this blog.

Other bloggers that I’ve found worth following:

A Student of the Real Estate Game

Bigger Pockets

Location Advice – Allen C Buchanan

Massimo Group

Metropolitan Capital Advisors

Who do you like to read for real estate related news? Yes, I’m asking you. There’s got to be some other sources out there.

The post What keeps you up at night? I asked. You answered. See survey results. appeared first on MarshallCf.

I asked. You answered. See 2nd Annual Survey Results

Last week I asked my 1,700 blog readers to take a short survey. The questions asked fell into one of four categories:

Who is reading my blog?

What topics would you like me to write about?

What keeps you up at night?

Do you have an author, blogger, or news source that you enjoy reading on topics of interest for real estate investors and professionals?

Who is reading my blog?

Last year, the survey indicated that 90% of my blog readers were men. I didn’t ask the question this year, but I have no reason to believe this has changed. Let’s face it, commercial real estate is a male dominated profession and most real estate investors are men too.

Real estate is also an old man’s profession. Sixty five percent of those surveyed were 50 years of age or older. No one under 30 participated in the survey.

When asked how they would describe themselves fully 65% identified themselves as investors, of which half of these considered themselves both investors and real estate professionals. Seventy seven percent of those who identified themselves as real estate professionals indicated they were CRE Brokers/Sales Agents.

When asked, “What type of real estate is your primary focus?” fully 55% responded with apartments, 17% with office, and 11% with industrial.

So the typical respondent to the survey was in his sixties (probably white and male) who is a CRE Broker/Sales Agent specializing in apartments.

What topics would you like me to write about?

Shown below in order of interest are the top 6 topics the survey respondents asked me to write about:

Case studies – real loan quotes on real deals

Real estate market trends

Current events

Global issues affecting real estate

Principles of real estate investing

The economy

Case Studies – Real Quotes On Real Deals was the runaway favorite by those surveyed. This surprised me and also encouraged me a bit. One of the unparalleled strengths of the Marshall Commercial Funding website are the Mortgage Solutions Blueprints. Have you taken a look at these? None of my peers do anything similar. Not even close. About once a quarter I provide a very detailed case study of a recent loan closing. It begins with a brief description of the property, the financing request and the issues associated with the deal. It includes a side-by-side comparison of three or four lender quotes and how each loan alternative affects:

Cash required to close

Cash Flow After Debt Service

Before- and After-Tax Return on Equity

If you haven’t taken advantage of this free service, you should. Click on this link to see the last dozen or so Mortgage Solutions Blueprints I’ve posted. They are there for your benefit.

What keeps you up at night?

Last year 40% of the respondents replied to this question with, “Nothing. I sleep like a baby.” This year only 17% responded similarly. I believe in the past year, we have begun to see a sea change in the CRE market. Other real estate professionals are sensing it too, which is the reason for the slip in confidence. The market has peaked and we are just in the beginning stages of the Hypersupply Phase of the real estate market cycle.

Now for those 83% who weren’t so bullish about the market, their answers were all over the map. The top 4 concerns were:

Factors adversely impacting my real estate

Personal matters

The economy tanking

Not living a healthy lifestyle

Do you have an author, blogger, or news source that you enjoy reading on topics of interest for real estate investors and professionals?

Surprisingly, fully two-thirds of survey respondents answered, “No.” That’s a bit shocking, isn’t it? But maybe not. Sadly, I have found very few real estate related bloggers or news sources worth following. And I’ve found no well written books on commercial real estate. Most bloggers are boring, writing on topics I have no interest in, or they are self-serving, trying to convince you to use their services or buy their product.

Very few survey respondents provided any source for real estate related news. Here are all the sources cited:

Authors

The Perfect Investment: Create Enduring Wealth from the Historic Shift to Multifamily Housing by Paul Moore

Bloggers

Marshall Commercial Funding Blog

theBrokerList Blog

News Sources

The Wall Street Journal

Forbes magazine

The advantage of reading theBrokerList Blog is that it’s a compilation of 20 or so bloggers in the real estate industry. I would recommend you signing up for this blog.

Other bloggers that I’ve found worth following:

A Student of the Real Estate Game

Bigger Pockets

Location Advice – Allen C Buchanan

Massimo Group

Metropolitan Capital Advisors

Who do you like to read for real estate related news? Yes, I’m asking you. There’s got to be some other sources out there.

The post I asked. You answered. See 2nd Annual Survey Results appeared first on MarshallCf.

July 8, 2017

2nd Annual Blog Reader Survey – What topics interest you?

In an effort to better serve you, please complete the 2nd Annual Reader Survey of the Marshall Commercial Funding Blog. I want to know more about you, the reader of my blog, in order for me to write on topics of interest to you.

Who are you?

What is your real estate experience?

What are your reading preferences?

Who are your trusted sources for real estate related articles?

The survey is short – only 7 questions. It should take you less than 2 minutes to complete. It is also confidential. No one will know your answers, including me. A summary of the survey results will be shared the following week.

A free gift is given to those who take the time to complete it.

Thank you for doing this for me. I truly appreciate it.

The post 2nd Annual Blog Reader Survey – What topics interest you? appeared first on MarshallCf.

June 24, 2017

Fractured Condos – Big Opportunity but Buyer Beware

Just saying the three dreaded words, “fractured condo project” to a lender is one of the fastest ways to cut a conversation short. Before you know it, you’re hearing dial tone. I know first hand because I recently went through the process of financing a fractured condo totaling 150 units. Only 113 were owned by the seller; the remaining 37 condos were owned by 23 other individuals. After reviewing the numbers and asking a lot of questions I decided to invest in it too. But to do so I had to get over the stigma of this property type.

You see, fractured condos are the modern day “pariah” of commercial real estate. And I don’t completely blame lenders for their unwillingness to lend on this property type. Historically there are many instances where lenders have been forced to foreclose on unsuccessful condominium developments.

What is a Fractured Condo?

But let me start at the beginning by defining a fractured condominium. It is a condo development where some of the units go unsold, typically a large majority. In 2008, fractured condos became prevalent as developers, who were unable to sell their condos, opted to rent the unsold units. Eventually the developer’s construction loan came due. They were unable to pay it off causing the bank to foreclose.

What is a Condo Conversion?

In the Portland market, we also had the condo conversion craze. These were properties that were originally built as apartments and then were converted to condominiums by starry-eyed developers thinking they could make a quick buck. And they did. Those early in the process found good candidates for conversion. They were located in good urban areas where condominiums make sense. But as the good properties in good locations were converted, developers over time had to find apartments in less affluent neighborhoods farther away from the downtown core. It was inevitable that some of these condo conversion projects would fail. And they did.

Opportunity for Good Return on Investment

Fast forward to today. These fractured condo properties, whether built originally as condos or condo conversions, are one of the last property types where an investor can make a good return on their investment. Where capitalization rates for other properties are in the “silly-stupid” range, fractured condos still represent an excellent buying opportunity. But they are without question in the “high risk, high reward” category. That said, there are several common-sense solutions for overcoming the issues associated with a fractured condo.

8 things you can do to mitigate risk

Find a real estate sponsor who has experience with fractured condos. If you’ve never owned a fractured condominium project, DON’T DO THIS ON YOUR OWN. Find a sponsor with a good track record owning and converting a fractured condo project back into apartments. Let him be the managing member and you the passive investor riding on his coattails.

Find a lender who will provide BOTH a bridge loan and a permanent loan. Fractured condos as a rule are in poor condition and typically need significant upgrades to get them to an acceptable condition. You don’t just want a short-term bridge loan of 2 or 3 years to renovate the property. You want the peace of mind of knowing that there is a permanent loan available once the renovation is complete.

Carefully review the sponsor’s rehab budget for the property. Make sure there are sufficient funds available to do a thorough upgrade to the property. You don’t want to be found in the unenviable position of owning a fractured condo and not having the financial resources to make the necessary improvements.

Make sure the sponsor has complete control over the Homeowner’s Association (HOA). The sponsor must not only have legal control through voting rights but the ability to manage and operate the property without interference from disgruntled condo owners. He must have the ability to approve a capital call from all condo owners for their fair share of exterior upgrades and common area improvements. He must also have the ability to increase HOA dues in order to have adequate replacement reserves when capital repairs are needed.

Make sure the HOA documents can be amended to be in compliance with the lender’s loan documents. Specifically, the provisions in the HOA agreement regarding the use of insurance proceeds and condemnation procedures are consistent with the new loan documents. Also, the HOA documents need to allow the lender the right to cure any late HOA dues on behalf of the sponsor.

I know it sounds obvious, but make sure you have clear title to the property. For the property I just invested in, garages, open parking spaces and storage lockers were the possession of specific condominiums. It took considerable effort by the title company to determine who owned what.

Find an experienced property management company that understands the nuances of managing a fractured condominium development. Don’t employ the services of a property management company that has never managed a fractured condo.

Review the exit strategy the sponsor is proposing. Are the assumptions about rental growth realistic? Does he use an above average interest rate on the permanent loan just in case interest rates are higher than they would be in today’s interest rate environment? Does the sponsor assume he will buy out all the condo owners in order to achieve his projected return on investment? Or is the ROI achieved regardless of whether all the condo owners eventually sell their units to your investor group?

Following these eight suggestions will go a long way in reducing the risk of buying a fractured condo project. Did I personally make a good investment? I hope so, but the verdict is still out. Ask me in three years.

Have you had experience with fractured condos? If so, have they worked out well for you?

Source: Fractured Condos: Broken Doesn’t Mean Busted, by Gabe Gonzalez, Metropolitan Capital Advisors, August 13, 2013.

The post Fractured Condos – Big Opportunity but Buyer Beware appeared first on MarshallCf.