Doug Marshall's Blog, page 3

May 23, 2020

COVID-19 Update: What can RE investors expect over the next year or two?

I am an enthusiastic reader of Afford Anything, a blog by Paula Pant. In her latest blog post she said, “The greatest risk is assuming that we know the future. Beware of certainty. Those who pretend to know the future are clinging to security at the expense of honesty and accuracy. Don’t listen to any economic or market projections that are expressed with too much confidence. We don’t have a crystal ball. Nobody knows what the future holds. The wise ones recognize this and accept it.” Well said, don’t you think?

No one knows the future

No one knows what will happen moving forward. Some experts expect the economic reopening that’s beginning now to result in a second half recovery followed by the development of a vaccine that puts the coronavirus behind us. Others see a second wave of infections resulting from reopening too early, prolonging the recession and pushing the economic recovery out to 2021 or possibly longer.

It’s too early to determine which position (or something in between) will prevail. I make no predictions of my own. How foolish would that be if I did! No one knows what the future holds. Certainly not me.

What we do know

But this we do know. A world in an economic crisis creates investment opportunities. It’s obvious that there will be losers. Those of us who have invested in retail and office properties will likely be the big losers. Less obvious, but also true, there will be big winners in the months ahead.

Those sitting on the sidelines flush with cash, may not lose by doing nothing, but they certainly won’t be considered winners either when the dust settles and everything returns back to normal, whatever the new normal turns out to be. They will have missed the best buying opportunity since the Great Recession. They will look back two or three years from now and regret not taking advantage of the turmoil in the real estate market.

It’s time to be greedy

Real estate investors should be asking ourselves daily this one question: “What investment opportunity is staring me in the face that I need to take advantage of?” Warren Buffett said it best when he said, “I tell you how to become wealthy. Be fearful when others are greedy. Be greedy when others are fearful.” How true! And right now, this virus has made many of us fearful, and rightly so. Millions of people have lost their jobs or have experienced significant declines in their personal net worth. People have a right to be fearful. But fear need not prevent us from making sound investment decisions.

Don’t give in to fear

In 2009 I, along with a group of like-minded investors, purchased an apartment that had been recently foreclosed upon by the lender. The real estate market at that time was in a freefall. Everybody and their brother was trying to get out of real estate. Was I fearful? You bet I was! It was a scary time. But that acquisition turned out to be the best real estate investment I have ever made. The key was moving forward with the purchase regardless of my fear because it made sense to do so. And now we are again in that same type of environment. I urge you not to let fear get in the way of what you truly want in life.

Buy the “blue light specials”

In the months ahead, real estate investors who are cash buyers should purchase those “blue light specials” that become available in the market. The rest of us should consider pooling our money with other like minded investors when a promising real estate opportunity surfaces.

Be a cash buyer of real estate

But notice I said real estate investors should be cash buyers. Why shouldn’t they finance their acquisitions with debt? With the exception of Fannie Mae and Freddie Mac, most lenders are not lending at this time. And those that are, their rates and terms are significantly less competitive than they were 60 days ago. In addition, many lenders are requiring the borrower to fund at closing a 12 month reserve for mortgage payments, property taxes and insurance. And because of these mediocre rates and terms, this is not the time to seek out long term fixed rate financing.

That said, if you don’t have the means to buy a property all cash, then I suggest you finance the property with short term fixed rate debt that has a modest prepayment penalty. I suggest a fixed rate loan of no more than three years, shorter if you can find it.

Big winner strategy – buy now, refinance later

Why? Because I believe the big winners of this pandemic are going to be real estate investors who buy now and refinance their acquisitions in the next year or two. Regardless of which candidate wins the presidential election in November, the winner will put pressure on The Federal Reserve to implement another round of quantitative easing (QE) which will artificially lower long term interest rates as a strategy to stimulate the economy out of this COVID-19 recession.

Due to the effects of QE, I would not be at all surprised if a year or so from now, 10 year fixed rate loans for apartments and other property types are in the mid to high 2 percent range, possibly lower. If true, you want to have the ability to refinance your properties with debt that significantly reduces your property’s annual debt service. That means you don’t want to finance the purchase of these “blue light specials” with agency debt (Fannie Mae or Freddie Mac) as their prepayment penalty of choice is yield maintenance. Yield maintenance is so onerous that no sane borrower would ever pay off a loan that has a yield maintenance prepayment penalty.

Positive influences of QE

QE has two positive influences on rental properties:

The lower interest rates will result in reducing annual debt service which will improve a property’s cash-on-cash return; and

Over time, cap rates will compress to adjust for a property’s improved cash flow. Lower cap rates mean property values will increase, quite likely very significantly.

Must solve our dismal rent collections first

So it’s possible that in a couple of years, that one of the big unintended winners of the COVID-19 recession will be real estate investors. We’ll see. In the short term, we need to figure out how to overcome dismal rent collections. If that issue is not resolved favorably over the next few months, then all bets are off.

Those are my thoughts. I welcome yours. Who do you believe will be the big winners of the COVID-19 recession?

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon!

The post COVID-19 Update: What can RE investors expect over the next year or two? appeared first on MarshallCf.

May 7, 2020

Three Important Life Lessons I Learned from Mom

When I was growing up, Dad was the quintessential Ward Cleaver of the 1950s TV show, “Leave it to Beaver.” Everyone liked Dad. He always had a kind word for you. But Mom, who passed away in 1994, was no June Cleaver. Far from it. She had very little maternal instinct and she was quite scary to my friends as she barely tolerated kids in general. Her motto: “Kids should be seen, not heard.” In reality, she was harmless, but my friends didn’t know that. This being Mother’s Day I thought I’d share three life lessons I learned from my mother.

When confronted by a bully don’t back down.

While in grade school a kid who was a couple of years older than me began bullying me. I told Mom about it and she told me to fight back. “Don’t take his crap” (her words, not mine). So the next time I went toe to toe with the bully and because I didn’t take his crap he started picking on someone else who would. That lesson has served me well over the years.

I have had several bosses and clients who have been bullies. They purposely tried to intimidate, not only me, but everyone around them. I have learned the best way to approach them is not to back down. Tell them what they need to hear and even if they don’t follow your counsel, they grudgingly respect you. The problem with that approach is in business you don’t advance up the corporate ladder that way. Ain’t gonna happen. There’s a reason why I’m self-employed.

Life is not fair so get over it.

“Quit your bellyaching” was a favorite saying of hers. Mom was not a nurturer. She was in short supply of sympathy and empathy. Having come through the Great Depression, Mom had first hand experience with real deprivation, not the trivial things I was whining about.

I remember early on how much more stoic I was than my friends when something went wrong. They would be blubbering feeling sorry for themselves and I would be rolling my eyes thinking, “suck it up.” In reality life is not fair. We all know that but the sooner we come to that realization, the sooner we learn to be thankful for those many blessings we do have. The alternative is to become bitter at every slight, real or imagined, that happens to us throughout the day.

Diplomacy is for sissies.

My mom was an excellent judge of character. And although she was often too critical of the faults of others she really was right on her assessment of the situation or the person. She did not “Suffer fools gladly.” She had no problem telling people what she was thinking with little consideration for their feelings.

Unfortunately, I’m not much better in this regard. I too am known for being brutally honest with people. I really don’t know any other way to be. It would be so much easier if I had the ability to be more diplomatic in my responses to difficult situations but unfortunately that’s not who I am. My motivation for being blunt is never to hurt someone’s feelings. Rather it’s to quit beating around the bush and just tell the truth, which many people avoid because it’s not the polite thing to do.

How many times in a week do I get a telephone call from a prospect who needs to hear that his property, as it stands now, is not financeable? He has called more people than he can count but none have told him the truth. Instead, to get him off the phone quickly, they refer him to another lender or mortgage broker. Eventually he ends up calling me, only to hear the honest truth no one else was willing to say.

Thank you Mom

I learned many lessons from my mother. For good or ill she has influenced me much more than my kind-hearted, well-liked father. In some ways, she was certainly flawed (aren’t we all) but in hindsight I am so very grateful that she toughened me up to take on life’s challenges head on. And if she were alive today, I would sincerely thank her for that. And though my mom was at times a difficult person to be around, it was quite obvious she loved her family. She just showed it differently. So do I love my mom? Absolutely, without reservation. I learned some very important life lessons from her that I wouldn’t have learned any other way.

These are my thoughts. I welcome yours. What life lessons did you learn from your mom?

Need financing? Email me today at doug@marshallcf.com to schedule a time to discuss your financing need.

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing: How to Build Wealth and Grow Passive Income From Your Rental Properties.

The post Three Important Life Lessons I Learned from Mom appeared first on MarshallCf.

April 24, 2020

You Better Have a Post Covid-19 Game Plan – Part II

In my previous article titled, You Better Have a Post Covid-19 Game Plan. I mentioned three things:

We need to develop a game plan. As Dwight Eisenhower as Allied Supreme Commander for Europe during World War II once said,“In preparing for battle I have always found that plans are useless, but planning is indispensable.” By that the meant they serve a useful purpose: It defines our goal, which is critical to our eventual success.

Much of what is going on at the moment is completely out of our control. But we do have control over one very critical aspect of our lives: our minds. We can choose to focus on a healthy mindset. For example, we can focus on the crisis or we can focus on the heroes who are putting their lives at risk helping us.

Our plan should begin by protecting and feeding our minds. We should protect our minds from listening too much negative news about the harmful effects of COVID-19. And instead we feed our minds on content that encourages and inspires us to action.

Those of us who work in real estate sales or some related field, such as finance, title and escrow, legal, etc, have been and will continue to be particularly hard hit by the dramatic slowdown in the economy. But there are five time-proven principles that you should consider adding to your post COVID-19 game plan.

1. Go Back to the Basics

For those of us in any kind of sales profession, we learned the critical importance of marketing ourselves when we got started. It wasn’t easy, but we learned to make those telephone calls or attended those networking meetings where we met potential customers for our business. We learned the hard way that our ultimate success was dependent almost solely on how many marketing contacts we made each week.

But when times are good, which they have been for many years, we slowly drift away from the discipline of making those marketing contacts, instead relying on satisfied clients to refer business back to us.

Now the phone has stopped ringing. What do we do? We go back and do what made us successful in the first place. In a slow economy like this, marketing ourselves becomes more critical than ever.

2. Stay Absolutely Focused

At the beginning of every year my wife and I go to the beach for a weekend to plan for the year. We prepare questions about our personal and professional lives that we ask ourselves, reflect on, and discuss with each other. It’s like developing our personal game plan for the year.

Ask yourself, “What one thing do I need to do this year that will best help me survive this economic slowdown? Identify it, and forget all the other things that are begging for your time and effort but which are simply distractions to the bigger picture.

3. Be 110% Committed to Your Career

I had a friend, years ago, when I was first starting out as a commercial mortgage broker. We both were struggling to pay the bills and at that point in our careers we were wondering if we were going to make it or not.

I remember him saying that if this did not work out he had another lucrative opportunity with a newly established dot-com company. He asked me what my plans were if I didn’t succeed at being a commercial mortgage broker. I told him I had no other plans.

My choice was to succeed as a commercial mortgage broker or fail miserably and utterly. There was no other alternative. Because I knew the consequences of failure I eventually succeeded. It was a difficult struggle and took years to be successful but giving up was not an option for me. On the other hand, my friend was out of the business within a year and the opportunity with the dot-com company never materialized.

The lesson to be learned is this: It is very difficult to succeed in any profession or any endeavor if you are not 100% committed to it. In today’s economy that principle is truer than ever. Some may view having another job waiting in the wings as a prudent safety net should their current job not pan out. In reality, it’s a recipe for failure.

4. If Necessary, Redefine Yourself

Sometimes after you go through the self-assessment process you realize you’re not the problem, the market is. No matter how good you may be at differentiating yourself from your competition, there may not be enough remaining market share left to make a living, no matter how good you are at your profession. If that is true for you, redefine yourself by finding a new market niche within your profession.

With every change in the economy there are winners and losers. Find those clients who are in the most financial pain resulting from the poor economy. They are the ones in need of assistance and they are motivated to make changes in their current situations. Then find a market niche that helps those who are in financial distress. Follow the pain!

5. Don’t Give Up

In his book, Good to Great, Jim Collins refers to the Stockdale Paradox, named after Vice Admiral James Stockdale. Stockdale is one of the most highly decorated officers in the history of the United States Navy. In 1965, he led aerial attacks from the carrier USS Ticonderoga. His plane was shot down over enemy territory, he was captured, and he spent years in a North Vietnamese prison. While in prison he encouraged his men to retain their absolute faith that they would prevail in the end regardless of their difficulties AND at the same time to confront the most brutal facts of their current reality.

Do the same thing:

Retain absolute faith that you can and will prevail in the end, regardless of the difficulties you face.

At the same time confront the most brutal facts of your current reality, whatever they might be.

In his classic book, The Greatest Salesman in the World, Og Mandino spoke eloquently about the importance of persisting through adversity. His book tells the story of Hafid, a poor camel boy who longs to learn the secrets of salesmanship. One of the ten secret scrolls reveals to him that to succeed in life requires the character quality of perseverance. The scroll states,

“I was not delivered into this world in defeat, nor does failure course through my veins. I am not a sheep waiting to be led to the slaughter. I am a lion and I refuse to talk, to walk, to sleep with the sheep.”

When all else fails, that attitude can carry us through many, many difficult times. Don’t give up, no matter what.

Let’s run as hard as we can

In summary, there is an old African proverb that may say it best:

Every morning in Africa, a gazelle wakes up.

It knows it must run faster than the fastest lion or it will be killed.

Every morning a lion wakes up.

It knows it must outrun the slowest gazelle or it will starve to death.

It doesn’t matter whether you are a lion or a gazelle.

When the sun comes up, you better start running.

We need to have the same attitude as the lion and the gazelle – let’s run as hard as we can so as not to become the economy’s next victim. To do so will likely require adopting a game plan that is different than doing “business as usual” will not work in today’s faltering economy. Improve your chances of still being around when the economy rebounds by adopting the business principle that’s most appropriate to your specific situation.

I am confident that weathering this economic perfect storm will prove us to be more resilient than we could have ever hoped or imagined.

The post You Better Have a Post Covid-19 Game Plan – Part II appeared first on MarshallCf.

April 10, 2020

You Better Have a Post-COVID-19 Game Plan

Dwight Eisenhower, the Supreme Allied Commander in Europe during WWII said, “In preparing for battle I have always found that plans are useless, but planning is indispensable.”

The purpose of planning

Most plans are rendered useless as soon as they are put to paper. But they serve a useful purpose: It defines our goal, which is critical to our eventual success. There are many ways to accomplish the goal but we must first clarify in our mind what it is we want to accomplish.

And if we know the end game, i.e., we know what we want to accomplish, then we have a chance to adapt our plans when obstacles get in the way. That is why planning is so important.

Our lives from this point forward will be divided into two distinct segments: Pre-COVID-19 and post-COVID-19. Those who think that once the pandemic is over the world will return to what it was prior to the virus will be sorely disappointed. That world is over, never to return. For each of us to succeed we need to prepare ourselves for a post-COVID-19 comeback.

What We Have Control Over

So how do we do that? That’s the question, isn’t it? At the moment, there is not much that we personally have control over. We have control over keeping ourselves safe from the virus and all that entails. Many of us have the ability to work from home but even that is limited because for the vast majority of us our business is on hold or worse. At least for me it is. How about you?

But we do have control over one very critical aspect of our lives: our minds. You can’t control much these days but you can choose to focus on a healthy mindset. Stress, fear, grief, anxiety, and depression are all natural responses to the crisis we are confronting at the moment. Or we can choose to focus our minds on other things.

Fred Rogers learned this idea early in life. “When I was a boy” he said, “I would see scary things, my mother would say to me, “Look for the helpers. You will always find people who are helping.”” How true. We can focus on the crisis or we can focus on the heroes who are putting their lives at risk helping us.

Protect and Feed Your Mind

There are two things you can do to promote a healthy mindset:

Protect your mind. By that I mean, minimize the amount of news you listen to or view on TV and radio. Remember that the news media understands that fear sells. I bet the ratings of the radio talk shows and TV news shows are up dramatically since the COVID-19 crisis began because they realize that fear sells. I confess I’ve been consuming way too much news lately and it is having a negative impact on my outlook. Starting today, I’m limiting my news viewing to 15 minutes.

Feed your mind. There is so much good content that we can focus on, that is uplifting and inspirational. Now is the time to voraciously consume whatever inspires and uplifts you. As a believer in Jesus, I need to focus on his promises like “… do not worry about your life, what you will eat or drink, or about your body, what you will wear… Look at the birds of the air; they do not sow or reap or store away in barns, and yet your heavenly Father feeds them. Are you not much more valuable than they?”

How are you going to respond COVID-19?

We are living in extraordinary times. Darren Hardy, host of Today on DarrenDaily, recently said, “What will we be telling future generations about this crisis? I believe we were born for this moment. We can decide to make the COVID-19 crisis the most positive, defining event in our lives.” Or we can give into the temptation to consider ourselves victims of our circumstances. What you do at this very moment in time will greatly define your future. Now is the time to prepare your comeback!

Those are my thoughts. I welcome yours. What would you add to this conversation?

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing: How to Build Wealth and Grow Passive Income From Your Rental Properties.

The post You Better Have a Post-COVID-19 Game Plan appeared first on MarshallCf.

March 29, 2020

Lending as we know it is stopping for now

Wow, what a difference a couple of weeks make. Since my last blog post, the governor of the State of Oregon, Kate Brown, has issued the following executive orders:

Executive Orders from Oregon’s Governor

March 12th – Bans large gatherings of more than 250 people for at least the next four weeks. Schools are to be kept open except for non-essential group gatherings.

March 13th – Directs all Oregon K-12 schools to close starting March 16th through March 31st.

March 16th – Bans groups larger than 25 and limits restaurants to carry out and delivery orders only.

March 17th – Orders public schools to remain closed from March 16th through April 28th

March 19th – Announces she will not be instituting a shelter in place order for the state.

March 23rd – Issues a detailed “stay home” order prohibiting any social or recreational gatherings outside the home of any size in which people do not remain at least six feet apart. It also prohibits non-essential businesses from operating.

What a dramatic and unprecedented list of executive orders by the governor! And the governor of Oregon is not alone as many other states are following the same course of action. As a result, national unemployment claims this week skyrocketed to 3.28 million from the week prior of 282,000.

Impact of Eviction Ban for Non-Payment of Rent

In an attempt to help renters, the state legislatures for Oregon and Washington have issued statewide eviction bans for non-payment of rent. The ban does not require proof or notification of the inability to pay due to COVID-19 related causes.

The direct impact to owners of apartments, retail and office buildings will be dramatic. Rich Miller is the Managing Director of Affinity Property Management, a property management company headquartered in Portland, Oregon. In a March 23rd online webinar on how COVID-19 will impact commercial real estate, Mr. Miller estimated a “30 to 50% delinquency rate” in April’s apartment rental payments. And if that actually occurs and does so for a few months, apartment owners are going to have a difficult time paying their mortgages.

Forbearance Agreements For Mortgagees

As a result, the COVID-19 outbreak has triggered forbearance help from Freddie Mac, Fannie Mae. How does that work you ask? A mortgage forbearance agreement is made between the lender and the delinquent borrower. The lender agrees not to exercise its legal right to foreclose on a mortgage and the borrower agrees to a mortgage plan that will, over a certain time period, bring the borrower current on his payments. Hopefully other lenders will follow Freddie Mac and Fannie Mae’s example and offer borrowers mortgage forbearance agreements.

Impact on Lending

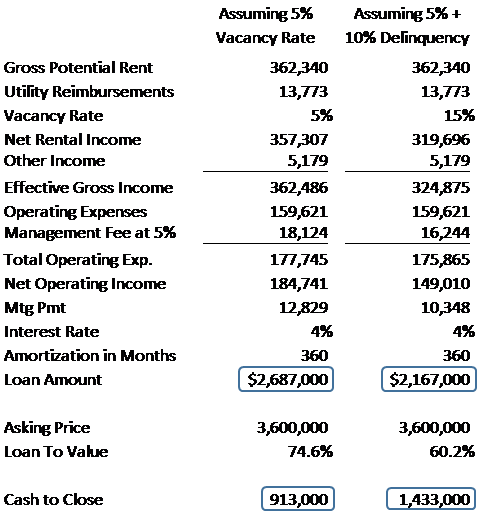

So let’s look at the implications of delinquency rates in the 30 to 50% range. Not only will borrowers have serious difficulty paying their mortgage payments without a forbearance agreement, lending as we know it today will cease until things return to normal. You think not? How will lenders underwrite and size a property’s loan amount? They will have to include a significant delinquency rate that heretofore has been negligible. Even a 10% delinquency rate will have a significant impact on lowering the loan amount. Here’s an example:

In this example a typical loan with a 5 percent vacancy rate results in a loan amount of $2,687,000. A loan including a 10% delinquency rate lowers the loan amount to $2,167,000 a difference of $520,000. Ouch!! As a result of this one change, lending as we know it will temporarily stop. Lenders will become more conservative and rates will likely rise. So things are not looking so good for the real estate market for the time being.

Is now the time to buy CRE?

This reminds me of the well-known quote by Warren Buffett. “I will tell you how to become wealthy,” he said. “Be fearful when others are greedy. Be greedy when others are fearful.” It’s no exaggeration to say that people at this moment in time are fearful. Now would be an excellent time to take advantage of this real estate market, don’t you think?

In the period of a few weeks, the real estate market has gone from a seller’s market to a buyer’s market. If I had cash sitting on the sideline, now would be the time to find a fearful seller and see what bargains I could conjure up. A few months back there were seller’s who were spurning reasonable offers for their for-sale listings. I bet their attitudes have changed or will change very soon.

Those are my thoughts. I welcome yours. What do you see coming down the road for real estate?

Sources: Read Oregon Gov. Kate Brown’s new executive order, The Oregonian/Oregon Live, https://www.oregonlive.com/coronaviru..., March 23, 2020; Office of the Governor State of Oregon Executive Order No. 20-12, https://govsite-assets.s3.amazonaws.c..., March 23, 2020; Mortgage Forbearance Agreement, Investopedia by Julia Kagan, https://www.investopedia.com/terms/f/..., March 20, 2020.

The post Lending as we know it is stopping for now appeared first on MarshallCf.

March 14, 2020

The Silver Lining to the Coming Economic Storm

In my last blog post, What the Coronavirus Could Mean for Commercial Real Estate, I stated that this virus has become a black swan market event. I went onto explain that a black swan in economic terms is an event that has not happened in the past, making it impossible to predict.

I also went onto explain that most economic experts are now in agreement that regardless of how severe this virus turns out to be, the damage to the world economy has already resulted in tipping it into recession. It is too late to stuff the genie back in the bottle. The damage has already been done.

A Silver Lining to this Economic Storm

But there is a silver lining to this economic storm. Not everyone is going to feel equally the adverse impact of the world economy going into recession. As we all know, stock market investors are taking it on the chin and there is no end in sight. I shudder to think how long before the stock market begins to rebound. But those of us who own commercial real estate, especially those of us who own B and C quality apartments, should weather the economic storm. It is possible we might even prosper. Why?

As I mentioned in my last blog post, there are two reasons why CRE investors might actually prosper going forward:

Reason #1 – Increased demand for CRE

I believe that some stock market investors fleeing the equity markets will choose to start investing in real estate. Why wouldn’t they invest in CRE? After taking the drubbing they’ve taken the last few weeks it only seems logical that some of them would say enough is enough I’m going to pull my money out of the stock market and invest it in some other less risky type of investment.

Reason #2 – Treasury rates at historic lows

Treasury rates have plummeted to historic lows. On March 9th, the ten year treasury bottomed out at 0.569%! Yikes. It closed on Friday substantially higher at 0.981%. A year ago, the ten year treasury closed at 2.592% so the decline has been dramatic. Those of us who have debt, whether it is a home loan or loans on our rental properties, are going to benefit by refinancing debt with significantly lower interest rates.

Those are the two reasons why we CRE investors could benefit from the current economic crisis.

Skewering a Commonly Held Belief

Before I move on, I feel compelled to skewer a commonly held belief about The Federal Reserve’s ability to lower interest rates. On March 3rd, The Federal Reserve lowered the federal funds rate by ½ of one percent. It was met with applause and much ballyhoo by the talking heads. Who cares! It’s irrelevant. The federal funds rate refers to the interest rate that banks charge other banks for lending them money from their reserve balances on an overnight basis. Let me make this perfectly clear: The federal funds rate has no impact on ten year treasury yields. None.

Treasury yields are impacted solely by the law of supply and demand. When stock markets plummet worldwide, stock market investors sell their equities and invest them in less risky assets. What is their asset of choice? Most believe there is nothing less risky than U.S. Treasury bonds. So when there is a huge increase in demand for treasuries (as there has been the last couple of weeks) and the supply of treasuries remains the same, it takes less and less of a yield to sell the bonds on the market. And that is why treasury rates have plummeted these past weeks. They will continue to do so until stock markets around the world begin to stabilize.

In the meantime, those of us that own assets with debt have the opportunity to benefit by the lower interest rates. But even if we do not refinance we will likely benefit by the value of our real estate rising. Why you ask?

Further Cap Rate Compression

If there is increased demand for CRE and interest rates remain low, the logical result will be that capitalization rates will continue to compress even further than they are right now. This means that even if a real estate investor doesn’t refinance his rental properties, the value of his real estate will still go up as cap rates continue to compress. So bottom line is that those of us who have invested in commercial real estate will inadvertently benefit from this black swan event.

Conclusion

I wouldn’t wish a worldwide recession on my worst enemies. A lot of people throughout the globe are going to suffer economically from the coming economic storm. But let’s keep this upcoming recession in perspective. This isn’t our first rodeo. We’ve done this before (think Great Recession) and we were able to come out on the other side. We’ll do so again.

Quick Survey

Are you more concerned you will:

Catch the Coronavirus, or

Be affected economically by the Coronavirus?

I welcome your comments.

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon!

The post The Silver Lining to the Coming Economic Storm appeared first on MarshallCf.

February 28, 2020

What the Coronavirus Could Mean for Commercial Real Estate

You ever wonder why China seems to be the incubator for deadly viruses? Me too. In recent years it’s been the swine flu, then the bird flu and now the Coronavirus (Covid-19). I think it’s unfair that they name the latest virus after my favorite beer, but they didn’t ask me. In tribute to my beer of choice, from this point forward I will call the virus by its scientific name, Covid-19.

Is the Covid-19 hype or not?

At first, I was wondering why everyone was so concerned about Covid-19. Last year in the U.S. we had 80,000 deaths attributed to the flu. I don’t recall anyone being more than mildly concerned about the deadly nature of last year’s flu outbreak. But then I decided to find out why everyone is so alarmed about Covid-19. Here are some of the most recent assertions about this virus.

It’s not if the virus will spread to the U.S. It’s only a matter of when and how severe. So says Dr. Nancy Messonnier, director of the National Center for Immunization and Respiratory Diseases. 1

It is estimated that once Covid-19 spreads to a population that 25 to 70% of the population will contract it. 2

It is estimated to be 5 to 10 times more deadly than the flu which has a mortality rate of 0.1% 2

Let’s do the math.

The best-case scenario is that 25% of the US population (330 million) will get the virus and that it will be 5 times more deadly than the flu. Under that scenario:

330 million people x 25% x 0.5% = 400,000 deaths

The worst-case scenario is that 70% of the US population will get the virus and it will be 10 times more deadly. Under this scenario:

330 million people x 70% x 1.0% = 2,300,000 deaths

So if these assumptions are in the ballpark we can expect between 400,000 to 2.3 million deaths in the US resulting from Covid-19. This assumes that the spread of the virus to the US is inevitable, etc. That sounds apocalyptic. Doesn’t it? No wonder government officials are rightly concerned about this potential pandemic outbreak.

The Markets Finally React to Covid-19

And as the seriousness of the worldwide Covid-19 outbreak became apparent, the financial markets last week finally figured out that this pandemic could have serious consequences on the world economy. And as of last Friday’s market close:

Last week the Dow Jones Industrial Average dropped 12% the biggest weekly losses since 2008.

And the 10-year treasury closed on Friday at 1.156%, a new record low.

Let’s face it. No one at this point knows how Covid-19 virus will play out. Will it be as severe as these number suggest? Or is this all hype? No one knows. No one! At this point it is all speculation.

Black Swan Event

That said, it appears that the Covid-19 has become a black swan market event. A black swan event is a metaphor that describes an event that comes as a surprise and has a major effect on a market. By definition black swans have not occurred in the past, thus rendering useless risk management models based on historic data.

Most talking heads are in agreement that regardless of how severe this virus turns out to be, the damage to the world economy has already resulted in tipping it into recession. It’s too late to stuff the genie back in the bottle. The damage has been done.

What impact will Covid-19 have on US CRE?

Those of you who have read my blog over the years know that I am not some Pollyanna blogger, painting rosy pictures of kittens and lollipops when events say otherwise. I am cynical of the major real estate brokerage firms always trying to paint an optimistic view of the market to encourage investors to continue buying real estate. I admit, I am by nature a glass half empty type of person so my opinion about this crisis may surprise you. Let’s logically think through the impact of this black swan event on CRE.

Interest Rates

Covid-19 has driven down interest rates to historic lows. If lenders do not put a floor on their interest rates, borrowers are going to benefit. They could benefit big time! If interest rates remain low for the foreseeable future I see many investors refinancing their properties resulting in either substantial cashback refinances or significantly improved cash-on-cash returns on their rental properties. Either way it’s a big win!

Increased Demand for CRE

I see stock market investors fleeing the equity markets and investing in real estate. Why wouldn’t they invest in CRE? After taking the drubbing they’ve taken last week it only seems logical that some of them would say enough is enough I’m going to pull my money out of the stock market and invest it some other less risky type of investment.

Further Cap Rate Compression

If there is increased demand for CRE and interest rates remain low, the logical result will be that capitalization rates will continue to compress even further than they are right now. This means that even if a real estate investor doesn’t refinance his rental properties, the value of his real estate will still go up as cap rate continue to compress. So bottom line is that those of us who have invested in commercial real estate will inadvertently benefit from this black swan event.

Now let’s look at the possible CRE losers

If the US economy goes into recession it seems quite logical that retail and office properties will be adversely impacted. Do you remember the impact the Great Recession had on these two property types? During the Great Recession office and retail properties in the Pacific Northwest saw significant increases in their vacancy rates. I would expect the same thing to occur this time around. So expect to see some pain and suffering for those investors investing in these two asset classes.

Those are my thoughts. I welcome yours. What do you think will be the impact of Covid-19 on the US real estate market?

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon!

Sources:

1 CDC urgest Americans to prepare for coronavirus outbreak: ‘This might be bad’, Jackie Salo and Tamar Lapin, New York Post, February 25, 2020

2 The virus is coming, The Economist, February 27, 2020

The post What the Coronavirus Could Mean for Commercial Real Estate appeared first on MarshallCf.

February 15, 2020

The Fourth Financing Trap You Need to Avoid Like the Plague

In the first part of this series, How to Get the Best Possible Loan for Your Property, I explained the importance of selecting a competent commercial mortgage broker to guide you through the process of financing your rental properties. If you didn’t read this article, I suggest you do so by clicking on this link: Four Advantages of Using a Commercial Mortgage Broker. Bottom line, they will substantially increase your chances of getting the best possible loan for your property.

In Part II of this series, I explained that one of the most common mistakes that real estate investors make is focusing too much on one loan parameter to the exclusion of all other loan terms. Most borrowers make the mistake of focusing on one of three loan parameters. Click on this link to find out what they are.

In the third and final part of this series I discuss the financing trap that should be avoided like the plague: onerous prepayment penalties. A discussion on getting the best possible loan for your property would be incomplete without talking about prepayment penalties. There are prepayment penalty traps that you, the borrower, need to be aware of so you can avoid choosing a loan that you will later regret.

The Bearer of Bad News

On a regular basis, I am contacted by property owners who want to refinance their properties. When I ask them if their existing loan has a prepayment penalty, many times they can’t recall. I tell them the first thing they need to do is review their loan documents to find out what their current prepayment penalty is. When they call me back and tell me the type of prepay, I frequently have to be the bearer of bad news. As much as I would like to refinance their property, the size of the prepayment penalty precludes that from happening. But I’m jumping the gun. Let’s begin with the basics about prepayment penalties, and then you’ll understand why many times I have to give the borrower this bad news.

Two rules of thumb about prepayment penalties

1. The longer the fixed interest rate, the longer the prepayment penalty.

This is just plain common sense. If you request a five-year fixed rate, your prepayment penalty will be five years or less. If you request a ten-year fixed rate, your prepayment penalty will be for ten years or less. I’m surprised at how many borrowers regularly ask for the best of both worlds. They want the longest fixed rate interest rate possible, and they want no prepayment penalty, but they will grudgingly accept a short prepayment penalty. You can have one or the other. You can’t have both.

2. Lenders that have the most competitive interest rates generally have the worst prepayment penalties.

As stated previously, it’s not uncommon that the most competitive interest rates generally have the most onerous prepayment penalties.

Three Most Common Types of Prepayment Penalties

Step-Down

This type of prepayment penalty is a gradually declining penalty over the term of the loan. It is the most common type of prepayment penalty, and it has the advantage of being easy to calculate. A typical ten-year term might have the following prepayment penalty: 5-5-4-3-2-1-1-0-0-0. In this example, in the first two years of the loan, the borrower’s penalty will be five percent of the existing loan balance. And if the borrower can wait to pay the loan off during the seventh year or later, the borrower will avoid paying a prepayment penalty altogether.

Yield Maintenance

This type of prepayment penalty protects the lender against a decline in interest rates. In an environment where interest rates are declining, borrowers typically try to refinance their loans to reduce the interest rate on their debt.

If the loan is paid off early at a lower interest rate than when the original loan was closed, the lender loses a high-yielding investment and gets, in return, a lower rate of return on it. To reduce the effect of an early payoff, lenders often require that the borrower provide compensation, called yield maintenance.

The yield maintenance prepayment penalty calculates the net present value of the remaining interest due on the loan to the end of the prepayment period. The loan payoff discount rate would be the difference between the new interest rate and the original mortgage’s interest rate. The difference between the two cash flows for the remaining of the balance of the original loan term, discounted to the present, is the yield maintenance prepayment penalty.

Defeasance

Defeasance is the substitution of the current collateral (the property) with US Treasuries that exactly mimic the stream of payments promised at the origination of the loan. The borrower’s property is released in exchange for this new collateral.

If Treasury rates rise above the original mortgage rate, the borrower benefits from this, because the price of Treasuries will fall, and the borrower will be able to setup a portfolio that mimics the original cash flows at a lower price than the amount that would have had to be repaid.

With yield maintenance, the note is paid off. But with defeasance, the note continues to term. Defeasance does not change anything about the cash inflows to the lender. While yield maintenance penalizes the lender when Treasury rates fall, fluctuations in the Treasury rates do not affect the lender using defeasance.

Other Financing Criteria

Also, there are some lenders that have lockout periods at the beginning of the loan that will not allow you to pay off the loan. Generally, a lockout period is for one or two years. After the lockout period expires, the borrower can prepay the loan. Lenders with a lockout period generally have yield maintenance for a prepayment penalty.

Some lenders will allow you to pay down up to 20 percent of the loan balance in any given year without incurring a prepayment penalty. If your goal is to pay off the loan as soon as possible, this is a perfect prepayment option to have.

Two Questions to Consider Before Choosing the Type of Prepayment Penalty

Now that you know the basics about prepayment penalties, you’re ready to make two important decisions about financing.

1. How long do I plan to own this property?

If you really don’t know, then go with a shorter fixed rate loan. You’ll get the advantage of a lower interest rate and a prepayment penalty that will be less onerous if you plan to sell or refinance sooner than you thought you would.

2. Do I really want to choose the loan quote with the lowest interest rate if it comes with an awful prepayment penalty?

Many times the answer to this question is a resounding no. As you can sense, not all prepayment penalties are equally bad. Many times that smokin’ interest rate comes with either a yield maintenance or defeasance prepayment penalty.

The good news is that you don’t need to understand the definitions of yield maintenance and defeasance to make an informed decision (you can breathe a sigh of relief now). All you need to understand is this very important point: You will never, ever pay off a loan with yield maintenance or defeasance. Why? Because the cost of the prepayment penalty is so egregious that no sane person would do it. Even in the last year of the prepayment penalty, when the cost of prepaying the loan will be at its lowest, the cost is still prohibitive.

You may be wondering how expensive could it really be? Unfortunately, you don’t have the ability to calculate a yield maintenance or defeasance prepayment penalty. It’s that complicated. Contact your existing lender to request an estimate of what it will cost to pay off your loan early. But when they call you back with the answer, be sure you’re sitting down. The cost is so absurdly high that you won’t even be angry with the answer. Instead, you’ll be astounded, and you’ll start chuckling to yourself.

My advice regarding prepayment penalties

Regardless of the type of prepayment penalty, make sure that it in no way impedes on your time horizon for refinancing or selling your property. And under no circumstances should you get a loan that has yield maintenance or defeasance if you think there is even the remotest possibility that you will want to sell or refinance your property before the loan comes due since the cost of the prepayment penalty will be so expensive.

Don’t handcuff yourself with a prepayment penalty that has the potential of preventing you from making sound financing or investment decisions in the future for the sake of a slightly better interest rate or a longer fixed rate period. It’s not worth it.

Doug Marshall, CCIM is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon!

The post The Fourth Financing Trap You Need to Avoid Like the Plague appeared first on MarshallCf.

January 28, 2020

Three Financing Traps That Borrowers Need to Avoid at All Costs

In the first part of this series, How to Get the Best Possible Loan for Your Property, I explained the importance of selecting a competent commercial mortgage broker to guide you through the process of financing your rental properties. Employing the services of a commercial mortgage broker has four distinct advantages over shopping the mortgage market on your own. If you didn’t read the previous article, I suggest you do so by clicking on this link: Four Advantages of Using a Commercial Mortgage Broker. Bottom line, they will substantially increase your chances of getting the best possible loan for your property.

But you also need to be knowledgeable about financing. It’s not all on their shoulders to find you the best financing for your property. In Part II of this series, How to Get the Best Possible Loan for Your Property, I explain that one of the most common mistakes that real estate investors make is focusing too much on one loan parameter to the exclusion of all other loan terms. Most borrowers make the mistake of focusing on one of three loan parameters. Avoid these financing traps.

Three Common Financing Traps to Avoid

Financing Trap #1 – Focusing on Getting the Lowest Interest Rate

For many borrowers, their hot button is getting the lowest interest rate. I understand their reasoning but as you can see in the following example, what they really want is the lowest mortgage payment, not the lowest interest rate. I recently had a client who told me that he had decided to proceed with another lender than what I had presented to him because this other lender had quoted a lower interest rate. When I asked him how many years was the loan being amortized over, he initially didn’t know, and he would get back to me. He discovered that the lender had quoted a 20-year loan amortization. The loan quote I presented to him was amortized over 30 years and my lender’s mortgage payment, even though it had a 1/4 point higher interest rate, had a substantially lower mortgage payment than the other lender’s quote. Once I explained this to my client, he quickly understood that the longer amortization made a huge difference on the monthly mortgage payment and he chose my lending source.

Financing Trap #2 – Attempting to Minimize the Down Payment Needed to Close

I understand why investors would focus on minimizing their down payment: They only have so much money to invest! I get it. But minimizing the down payment results in maximizing the debt needed to finance the property. And having too much debt does not come without risk: Highly leveraged properties are more susceptible to downturns in the real estate cycle. Those properties that are the most leveraged are at risk of not being able to generate positive cash flow. As market vacancies continue to climb, at some point a highly leveraged property will not be able to pay its mortgage payment. That is what happened during the Great Recession resulting in many properties being foreclosed upon by lenders for getting behind on their mortgage payments. Are you sure you want to minimize your down payment?

Financing Trap #3 – Choosing Non-Recourse Financing over Recourse Financing

A recourse loan gives the lender the right, in the event of default on the loan, to recover against the personal assets of the borrower. For example, let’s say an investor purchases a property for $1,000,000 and finances it with a $750,000 loan. Time goes by, and the real estate market goes into a deep recession causing vacancies to rise significantly at the property. As a result, the cash flow generated by the property is no longer sufficient to make the mortgage payment. The lender forecloses and sells the property for $650,000. The current loan balance has been amortized down to $700,000 leaving a deficit of $50,000 that is still owed by the borrower. The lender has the right to recover the $50,000 deficit by going after the borrower’s personal assets. That is an example of the downfall of a recourse loan.

The Advantage of Using Non-Recourse Financing

A non-recourse loan bars the lender from seeking a deficiency judgment against a borrower in the event of default. The borrower is not personally liable if the value of the collateral for the loan falls below the amount required to repay the loan. So in the example above, the lender sells the property for $650,000 and takes a loss of $50,000 with no recourse to go after the borrower to make up the difference.

So which loan would you prefer? A recourse or non-recourse loan? It seems like a no-brainer doesn’t it? We would all choose a non-recourse loan because there is less risk to the borrower when things go bad. In a worst case scenario with a non-recourse loan, the borrower would hand the keys of the property over to the lender and not have to worry about the lender being made whole by going after other personal assets of the borrower.

Why Non-Recourse Financing May Not Be the Right Choice

Unfortunately it’s not that simple, and here’s why. In most instances, a non-recourse loan is paired with an onerous prepayment penalty, typically yield maintenance. And as we’ll discuss in the section below, you want to avoid prepayment penalties that prevent you from selling or refinancing your property when you think it’s best time to do so. So maybe, just maybe, recourse financing is not so bad after all.

Another way of looking at it is this: In the example above, the investor purchased the property for $1,000,000 and the bank eventually sells the property for $650,000. That represents a 35 percent drop in the property’s value. What are the chances that we will ever experience a recession that results in that significant of a drop in a property’s value? During the Great Recession, we experienced a 10 percent decline in apartment values and maybe as much as a 20 or 25% drop in some property types. I shudder to think what type of recession/depression would result in a 35 percent or more decline in property values.

Why I like Recourse Financing

So in most instances, I will gladly accept recourse financing to avoid being locked into a loan with an onerous prepayment penalty. I want the freedom to choose when I want to refinance or sell the property and I will gladly accept the additional risk of recourse financing in the unlikely event that I lose the property to foreclosure due to not paying the mortgage payment.

There you have it, avoid these three financing traps and you will have a much better chance of getting the best possible loan for your property.

These are my thoughts. I welcome yours. What financing traps do you see that borrowers make?

Doug Marshall, CCIM is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon!

The post Three Financing Traps That Borrowers Need to Avoid at All Costs appeared first on MarshallCf.

January 19, 2020

Four Advantages of Using a Commercial Mortgage Broker

Today, we are starting a three part series on how to get the best possible loan for your property. Today we begin the series by looking at the three options a borrower has for finding a loan for his property, They are:

Today, we are starting a three part series on how to get the best possible loan for your property. Today we begin the series by looking at the three options a borrower has for finding a loan for his property, They are:

Go back to a lender you’ve already done business with

Shop the mortgage market on your own, or

Employ the services of a commercial mortgage broker

In the past, in an effort to sound objective, I would encourage people to choose the option that best met their needs. No longer. I believe you always want to use the services of a competent, journeyman commercial mortgage broker. Why? There are four reasons why this is true and Part I of this series discusses these four advantages over shopping the mortgage market on your own or going back to a lender you’ve already done business.

Four Advantages of Using a Commercial Mortgage Broker

He knows more lending sources than you do.

The first step in shopping for a loan on your own is finding which lenders have the most competitive rates and loan terms. That is not an easy undertaking. The primary advantage of using a commercial mortgage broker is that he knows the lenders who have the most competitive rates and terms. Not all lenders are interested in your specific loan, but a broker likely knows those lenders who are. In fact, it’s his job to know.

A good commercial mortgage broker regularly works with five to fifteen lenders, depending on who is the most competitive at the moment for a particular property type. Sometimes he knows that his most trusted lending sources do not have the rate and terms he needs to win the business. When that happens, a good broker has another ten or more lenders he has called on over the years who would be eager to do business with him again. He will find the most competitive loan terms because, if he doesn’t, he will not get your business.

He has already established a relationship based on trust with his lending sources.

This is one of the most overlooked advantages of employing his services. Developing trust between the borrower and the lender is essential for insuring a successful loan outcome. In commercial real estate, trust is everything. It is absolutely vital for getting a transaction completed.

If you’ve never worked with a particular lender, a trust relationship has not been established. On the other hand, a commercial mortgage broker may have worked on several loans with this lender. They know each other. They know each other’s idiosyncrasies, and because of their prior relationship, there is a higher probability of getting the loan closed with a commercial mortgage broker than by you going directly to the same lender. That’s right. You, the borrower, can go to the same lender and be turned down for a loan because you have no relationship with the lender.

The commercial mortgage broker, on the other hand, has done several deals with this lender, and because they know and trust each other, the lender is willing to proceed with a loan application. As a borrower, why not take advantage of these established relationships between the commercial mortgage broker and the lender? Why not leverage those relationships?

Now some people will say that using a commercial mortgage broker will cost you an additional loan fee. That could happen, but it may not. It just depends on the lender. Let’s assume for the moment that such a fee is charged to you. Many times, because the commercial mortgage broker knows where to go to get the best rates and terms, any additional fee is more than offset by a lower interest rate, a longer amortization, or more loan dollars than what you would have found shopping the mortgage market on your own. The old saying “Penny wise, pound foolish” applies here. You may save some money on the front end by not using the services of a commercial mortgage broker if he charges an additional loan fee. But you could easily pay out much more money on the back end without his expertise and relationships.

Compared to shopping the market on your own, this option takes significantly less time and effort.

If you use a commercial mortgage broker, he will do the heavy lifting of finding the right lender and processing the loan. This will save you a great deal of time and effort.

A commercial mortgage broker can be your best advocate should things go wrong.

There are times in the loan process where you need someone to be your advocate, someone who strenuously defends your best interests. This can best be accomplished by a commercial mortgage broker who has an established relationship with the lender. The lender wants to keep the commercial mortgage broker happy because she doesn’t want to jeopardize her relationship with him. He brings her deals, which is in her best interest. She wants him to continue bringing deals to her, so it’s in her best interest to be fair to his clients or next time he may go to one of her competitors.

Now compare the commercial mortgage broker’s importance to the lender with your importance to the lender. In most instances, lenders will likely see you as a “one-off” transaction and won’t consider the loss of your loan as having anywhere near the impact of losing a valued relationship with a mortgage broker. Now consider the loan officer. Can the lender’s loan officer adequately fill this role of advocate if something were to go wrong with the loan? She works for the lender. She is being paid by the lender. Whose best interest do you think she is looking after? Yours or the bank’s?

So the commercial mortgage broker is your best choice to be your advocate if things go wrong with your loan. Neither you nor the loan officer can fill that need nearly as well as the commercial mortgage broker can. A good commercial mortgage broker will “go nuclear” if the actions of the lender are so egregious that it requires drastic measures to handle what she’s done.

The Nuclear Option

Years ago, a lender approved a loan for one of my clients as proposed on the letter of interest. But prior to closing the loan, the lender changed their minds without notifying the borrower or me that they had reduced the amortization from twenty-five years down to fifteen years, effectively killing the property’s cash flow. The reduced amortization was only revealed at closing. I told my client to walk out of the closing without signing anything. The borrower was distraught.

I then wrote a letter to the loan officer’s superior that included a copy of an email from the loan officer stating that the loan was approved with a twenty-five-year amortization. I went on to say in my letter that if the borrower decides to litigate this matter, I would be more than willing to testify on his behalf. In response, the lender decided to honor the original twenty-five-year amortization. And because I chose to go to bat for my client, I lost what had been a good lending relationship. But a good commercial mortgage broker does what he has to in order to protect his client.

So these are my reasons why I believe employing the services of a commercial mortgage broker. Those are my thoughts. I welcome yours.

Doug Marshall is the award winning author of Mastering the Art of Commercial Real Estate Investing. Check it out on Amazon.

The post Four Advantages of Using a Commercial Mortgage Broker appeared first on MarshallCf.