Doug Marshall's Blog, page 9

June 3, 2018

Five Must-Read Books for Your Summer Reading Pleasure

I am an avid reader and recently I’ve read some really awesome books that I would encourage you to consider. If summer is a time for catching up on your reading I suggest you read the following five books:

#1 – 9 Things You Simply Must Do To Succeed in Love and Life by Dr. Henry Cloud

I’m a sucker for self-help books with titles like this one. For whatever reason, I gravitate toward this book genre. So it came as a pleasant surprise that Dr. Cloud could write content for a self-help book that I hadn’t heard before in some form or fashion. This he has done. He begins his book by introducing the reader to “déjà vu people.” These are people who succeed in love and life because they have a pattern of behavior that they consistently follow that moves them forward. They do not stay stuck repeating the same mistakes over and over again. And as a result, they are getting what they have decided they want out of life, whether it be healthy relationships, a strong marriage, successful business pursuits, you name it. Avoiding these principles can lead to disastrous consequences. And unfortunately, over the years I’ve observed that these principles are often ignored.

If you would like to read a summary of the book, click this link: 9 Things You Simply Must Do

#2 – Peak Performance: Elevate Your Game, Avoid Burnout and Thrive with the New Science of Success by Brad Stulberg and Steve Magness

The secret to sustainable success is a simple formula: Stress + Rest = Growth. In this book, Peak Performance, the authors show in many ways how this equation holds true regardless of what you are trying to grow. If you are really interested in improving your performance, you should incorporate the rhythm of stress and recovery into all aspects of your life. Studies show that just-manageable challenges, those opportunities that make you feel a bit out of control, are the best for growth. Actively seek out challenges that just barely exceed your ability. If you want to learn the science of success this is the book for you.

If you would like to read a summary of this book, click this link: Peak Performance.

#3 – Grit: The Power of Passion and Perseverance by Angela Duckworth

My April 21st blog post was titled, “What do you when you get discouraged?” I encourage you to read it if you haven’t already done so. In this article I reference Angela Duckworth’s book. This is a must-read book for anyone striving to succeed personally or professionally. For example, a high grit score for cadets entering West Point, is more important than any other factor in predicting whether a cadet will succeed in not dropping out during the first year at the military college. Grit is more important than intelligence, grade point average, athletic ability, leadership skills, etc. As the author says on the inside cover of her book, “Grit is a book about what goes through your head when you fall down, and how that – not talent or luck – makes all the difference.”

#4 – Building a Story Brand: Clarify Your Message So Customers Will Listen by Donald Miller

Most of us are clueless on how to clarify our message so that even a caveman (the author’s attempt at humor) would understand what we do for a living. There are seven elements of great storytelling. Follow these steps in the storytelling process and you will attract customers who will want to do business with you. One mistake we commonly make is believing that we are the hero in the story. Most websites portray themselves as the hero because it’s their company that provides the product or service that comes to save the day. Right? WRONG! The hero is the customer and we are the guide. To use a Star Wars analogy, the customer is Luke Skywalker (the hero) and we are Yoda (the guide). Get that concept wrong, and most do, and your message falls on deaf ears. For most of us, it’s time to rewrite our website based on the concepts found in this book.

#5 – Platform: Get Noticed In A Noisy World by Michael Hyatt

Gone are the days when the three TV channels and the major newspapers control how products and services are marketed. Now anyone, including you, can successfully compete with the major players in your field. Michael Hyatt is an authority on how to get yourself noticed using social media marketing. He has gone from no following on social media to one of the largest in the world by blogging and interacting principally on Facebook and Twitter. Creating a successful social media platform is the key to success and Mr. Hyatt explains in very easy, step-by-step instructions how you go about doing it.

These are my five book recommendations for summer reading. What have you been reading lately? Is there a book you can recommend to us?

Need financing? Email me today at doug@marshallcf.com to schedule a time to discuss your financing need.

The post Five Must-Read Books for Your Summer Reading Pleasure appeared first on MarshallCf.

May 19, 2018

Three Life Lessons I Learned from Mom

When I was growing up, Dad was the quintessential Ward Cleaver of the 1950s TV show, “Leave it to Beaver.” Everyone liked Dad. He always had a kind word for you. But since last week was Mother’s Day I thought I would write about the lessons I learned from Mom.

My mother, who passed away in 1994, was no June Cleaver. Far from it. She had very little maternal instinct and she was quite scary to my friends as she barely tolerated kids in general. Her motto: “Kids should be seen, not heard.” In reality, she was harmless, but my friends didn’t know that. So what lessons did I learn from my mother? A lot. Here are three:

When confronted by a bully don’t back down.

While in grade school a kid who was a couple of years older than me began bullying me. I told Mom about it and she told me to fight back. “Don’t take his crap” (her words, not mine). So the next time I went toe to toe with the bully and because I didn’t take his crap he started picking on someone else who would. That lesson has served me well over the years.

I have had several bosses and clients who have been bullies. They purposely tried to intimidate, not only me, but everyone around them. I have learned the best way to approach them is not to back down. Tell them what they need to hear and even if they don’t follow your counsel, they grudgingly respect you. The problem with that approach is in business you don’t advance up the corporate ladder that way. Ain’t gonna happen. There’s a reason why I’m self-employed.

Life is not fair so get over it.

“Quit your bellyaching” was a favorite saying of hers. Mom was not a nurturer. She was in short supply of sympathy and empathy. Having come through the Great Depression, Mom had first hand experience with real deprivation, not the trivial things I was whining about.

I remember early on how much more stoic I was than my friends when something went wrong. They would be blubbering feeling sorry for themselves and I would be rolling my eyes thinking, “suck it up.” In reality life is not fair. We all know that but the sooner we come to that realization, the sooner we learn to be thankful for those many blessings we do have. The alternative is to become bitter at every slight, real or imagined, that happens to us throughout the day.

Diplomacy is for sissies.

My mom was an excellent judge of character. And although she was often too critical of the faults of others she really was right on her assessment of the situation or the person. She did not “Suffer fools gladly.” She had no problem telling people what she was thinking with little consideration for their feelings.

Unfortunately, I’m not much better in this regard. I too am known for being brutally honest with people. I really don’t know any other way to be. It would be so much easier if I had the ability to be more diplomatic in my responses to difficult situations but unfortunately that’s not who I am. My motivation for being blunt is never to hurt someone’s feelings. Rather it’s to help that person understand their situation as it really is.

How many times in a week do I get a telephone call from a prospect who needs to hear that his property, as it stands now, is not financeable? He has called more people than he can count but none have told him the truth. Instead, to get him off the phone quickly, they refer him to another lender or mortgage broker. Eventually he ends up calling me, only to hear the honest truth no one else was willing to say.

Thank you Mom

I learned many lessons from my mother. For good or ill she has influenced me much more than my kind-hearted, well-liked father. In some ways, she was seriously flawed but in hindsight I am so very grateful that she toughened me up to take on life’s challenges head on. And if she were alive today, I would sincerely thank her for that. And though my mom was at times a difficult person to be around, it was quite obvious she loved her family. She just showed it differently. So do I love my mom? You bet, but as the saying goes, “It’s complicated.”

These are my thoughts. I welcome yours. What life lessons did you learn from your mom?

Need financing? Email me today at doug@marshallcf.com to schedule a time to discuss your financing need.

The post Three Life Lessons I Learned from Mom appeared first on MarshallCf.

May 5, 2018

Five questions new CRE investors should answer before buying their first property

Over the years I’ve had several conversations with would-be investors where they tell me that once they find the right property to purchase they will come back to me for the financing.

Months, if not years, go by and once again the same would-be investor says to me (this time not so eagerly) that as soon as he finds the right property he plans to use my services to get the loan he needs. You know where I’m going with this story. I believe there are lots of would-be investors out there who can’t pull the trigger. Why?

Fear. Fear of failure, fear of the unknown, fear of looking foolish in the eyes of their friends and family. I can understand their fear. For most of us, investing in real estate is a big leap into the unknown. But it need not be that way. Every new investor could take away much of the uncertainty of real estate investing by answering five questions before they buy their first rental property.

The first question they need to answer is:

Question #1 – Do I want to be an active or passive real estate investor?

Let’s begin by defining an active investor in contrast to a passive investor. An active investor is the person who makes all of the decisions, such as what property to buy, how much to offer, how to manage the property and which lender to use for financing their property. A passive investor allows someone else to make all those decisions and many, many more.

So let’s say you want to be an active investor. You still have a choice to make.

Question #2a – Do I want to invest by myself or do I want to be the decision maker for a group of CRE investors?

The advantage of being a solo investor is that you don’t have anyone else to satisfy about your commercial real estate investment strategy. But the disadvantage of going it alone is that often times you don’t have the financial resources to buy anything more than a small rental property, e.g., a duplex. If on the other hand, you are the managing member of an LLC with, let’s say four other investors, you now have significantly more money for a down payment and with more equity the group can buy a larger property. But the downside is you now have investors you will need to keep happy.

But let’s say for the moment that you would rather be a passive investor. You still have a choice to make.

Question #2b – Who do I invest with? A traditional sponsor? Or do I find a sponsor through a crowdfunding portal?

There is no doubt in my mind that every major real estate market in the country has several reputable commercial real estate sponsors that are looking for people like you to be passive investors in their next real estate venture. You need them for their real estate expertise and they need you because they are tapped out of funds to buy the next rental property. It’s truly a symbiotic relationship. For further information on how to vet a sponsor read, Don’t be a lemming: Vet your CRE Investment Sponsor.

In recent years crowdfunding sources on the internet have come into being to fill the role of the savvy CRE sponsor. Before you seriously consider crowdfunding I suggest you read my blog post, Crowdfunding – The Basic Facts and the Potential Opportunity.

If you’ve decided you want to be a passive investor, then once you’ve decided between investing with a traditional sponsor or a crowdfunding source, you can kick back and relax. Your major decisions are made.

If on the other hand you’ve decided to be an active investor you’ve got three more basic decisions to make. They are:

Question #3 – Who do I want on my real estate advisory team?

You should add people to your advisory team where you lack expertise. Each of these advisors should bring their unique backgrounds and experience to the team enhancing your chances that all the potential issues will be identified upfront during the due diligence process instead of being unpleasantly surprised after the transaction closes. At the very minimum you should consider having on your advisory team a:

Real estate broker

Mortgage broker/loan officer

Real estate attorney

General Contractor/Building inspector

Property management company

CPA/Accountant

Question #4 – How will I finance the property?

You have three choices: 1) you can go back to an existing lender relationship; 2) you can shop the mortgage market on your own; or 3) you can employ the services of a commercial mortgage broker. You should know my bias by now. I believe your best changes of getting the best possible loan for your property is going through a mortgage broker. If you want to know my reasoning, I suggest you listen to Parts 7 & 8 of my video series Secrets of a Commercial Mortgage Broker: How to Get the Possible Loan for Your Property.

Question #5 – How will I manage the property?

Again, you have three choices: 1) you can self-manage; 2) you can hire an on-site manager who reports directly to you; or 3) you can hire a property management company to manage your property. Each option has its advantages and disadvantages and which you choose is based on those criteria that are most important to you.

The Five Decisions

Now think back to the would-be real estate investor I mentioned in the opening paragraphs. How much easier would it be for him to buy a property if he already knew the answers to these five questions?

These are my thoughts. I welcome yours. What do you think prevents would-be investors from buying their first rental property?

Need financing? Email me today at doug@marshallcf.com to schedule a time to discuss your financing need.

The post Five questions new CRE investors should answer before buying their first property appeared first on MarshallCf.

April 21, 2018

What do you do when you get discouraged?

We’ve all been discouraged at one time or another. Even the big boys, those at the top of the food chain in commercial real estate, have had their setbacks. Those of us who make a living on commission income know the euphoric highs of closing a lucrative transaction. We’ve also experienced many disappointments. I know I’ve had my share.

My Early Years on Commission

I remember my early years on commission. I had no safety net. My spouse was a stay-at-home mom. My very first year as a commercial mortgage broker, I worked long hours only to earn $7,000. To stay afloat, I lived off my savings, and when they were gone, I tapped into the equity in my house. To say the least I was deeply discouraged. Ever so slowly I began to succeed as a commercial mortgage broker. But to get to that point required that I borrow against the equity in my house. It was a bit of an exaggeration, but I remember telling people I still had the equivalent of the equity in my door knobs. Years have passed and today I own my home free and clear and I’m completely debt free.

Discouragement Takes Many Forms

In commercial real estate, discouragement takes many forms. It could be a day when every cold call you make, is not only a “no” but it’s a “hell no” or worse yet, the prospect hangs up on you. It could be a client, who through his words or actions, makes it readily apparent that he doesn’t appreciate what you bring to the table. And maybe the most discouraging, is losing a deal that you thought was a sure thing.

Grit and Success

So how do we keep moving forward in the face of discouraging setbacks? I recently read Grit: The Power of Passion and Perseverance by Angela Duckworth. This is a must-read book for anyone striving to succeed personally or professionally. For example, a high grit score for cadets entering West Point, is more important than any other factor in predicting whether a cadet will succeed in not dropping out during the first year at the military college. Grit is more important than intelligence, grade point average, athletic ability, leadership skills, etc.

The Hard Thing Rule

The book also reveals how grit can be learned by adopting the Hard Thing Rule. The author and her husband have incorporated this rule for their family members to live by. I liked the concept, so I’ve morphed it a bit so it can apply to commercial real estate professionals. There are three parts to the Hard Thing Rule. It is acknowledging that:

To succeed in commercial real estate, we must do something hard, something that requires deliberate practice. For the newbie in the CRE business, it’s making a specific number of marketing calls each week, or attending a particular number of business luncheons, etc.

You can quit the real estate business, but not until you’ve given yourself a chance to succeed. In my mind, it takes a bare minimum of three years before you can really know if the CRE profession is a good fit for you. Very few of us are overnight successes but those who persevere usually are rewarded for their efforts.

To succeed in commercial real estate, our “hard thing” will change over time. It starts with cold calling and eventually we find a better way to market ourselves that is more productive. Whatever that new “hard thing” is, it’s not necessarily easier than cold calling, but it yields a far better return for the effort we put in. This could be focusing on the Pareto Principle, i.e., that 80 percent of your business comes from 20 percent of your clients. Maybe it’s becoming a thought leader in your particular niche in commercial real estate. By becoming the expert, slowly over time it attracts more clients who want to employ your services.

The Buddy System

One more thought about persevering when we are discouraged. I believe in the buddy system. Find someone you can confide in, someone you can tell your deepest, darkest fears to. This person should not be your spouse, nor someone you work with.

For me, I meet with my friend Rick on Thursday mornings at Starbucks. We’ve been getting together over coffee for about ten years. We talk about our families, our businesses, our ministries. We do not talk about the weather or sports. When I’m discouraged Rick hears about it and vice versa. Just talking to Rick about my latest setback, whatever it may be, encourages me to pick myself up, dust myself off and get back into the arena of life. Life is not easy. But it’s far easier when you’re not doing it by yourself.

Those are my thoughts. What are yours? What do you do when you get discouraged?

The post What do you do when you get discouraged? appeared first on MarshallCf.

April 7, 2018

Six CRE Calculations Every Investor Needs To Know

To be a knowledgeable commercial real estate investor requires having a solid grasp of the numbers associated with real estate investing. There are at least six different types of calculations an investor needs to fully understand. Commonly, I find that investors are very knowledgeable in two or more of these categories, but rarely all six.

The Six Types of CRE Calculations

How is commercial real estate valued?

How do you determine the loan amount based on a lender’s underwriting parameters?

How do you calculate a property’s cash-on-cash return?

How does leverage impact a property’s cash-on-cash return?

How does loan amortization impact your investment?

What minimum financial requirements do lenders require of borrowers in order for them to be approved for a loan?

Want to find out how good you are with the numbers? Take my 10 question quiz. This is not some namby-pamby quiz. The average quiz result is 4 correct answers out of 10. But the quiz will give you a good understanding of how well you know the numbers associated with CRE investing. For those questions you miss, I’ll explain in detail how these commercial real estate formulas are calculated. Common on. Take the quiz. I dare you.

March 23, 2018

Will Commercial Real Estate Values Fall? You Betcha. Find Out Why.

Prior to the Great Recession I remember hearing that everyone should be investing in single-family homes because house prices never go down. And for years this was so. Houses prices had steadily increased in value for a number of years. This belief that housing was a sure bet was stated as an inviolable truth. Do you remember people saying that? I do. And of course, the recession hit, and housing prices plummeted.

A Real Inviolable Truth

Want an inviolable truth? I’ll give you one: The real estate market is cyclical. Real estate values go up. Real estate values go down. And that is true for both residential and commercial real estate. So I’m always taken aback when professional colleagues deride me for stating the obvious. As if my acknowledging this truth is being pessimistic. It’s not being pessimistic, any more than saying the sun always rises in the east and sets in the west.

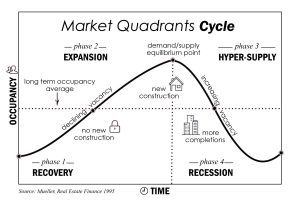

Market Quadrants Cycle

If you haven’t seen the chart below before you should spend as much time as necessary to get a full grasp of its intended meaning. No CRE professional or CRE investor should be in the real estate business without fully understanding the four phases of the real estate market cycle.

If you are interested in learning more about the real estate market cycle I suggest you read, Is it the right time to invest in real estate? You asked. I answered where I explain in detail each of the four market quadrants.

The real question is not, “Will commercial real estate values fall?” We know unequivocally the answer to that question. Of course they will. The real question is: What will trigger commercial real estate values to fall? I can think of four reasons:

#1 – Overbuilding

When developers get ahead of demand values decline. This is a classic reason for commercial real estate values falling. At this moment in the real estate cycle are developers overbuilding? Unfortunately, I believe they are. In Portland, the city I’m most familiar with, 2016 and 2017 were record years for new development with $1.9 billion and $2.5 billion under construction respectively. The product from this two-year construction boom has already begun impacting the CRE market. Vacancy rates in most property types are slowly beginning to rise once again. As more product comes on line we can anticipate the introduction of concessions and eventually the lowering of rents as property owners struggle to maintain their property’s occupancy rate.

#2 – The Economy Dips into Recession

When the economy stops expanding workers get laid off. The lucky ones who don’t lose their jobs see their wages stagnate. To cope, some apartment dwellers find cheaper places to live. Others who enjoyed living in a one-bedroom apartment by themselves now realize they need to share a two-bedroom to make it through the downturn. Companies with declining sales realize they too need to downsize into smaller spaces or less desirable locations. Some companies go out of business altogether. When the economy dips commercial real estate values are adversely impacted.

At this moment in time do I believe we are in a recession? Nope. The economy is growing at a healthy rate, the best it has in a long, long time.

#3 – Rental Increases Outpace Wage Growth

Apartment rents have experienced double digit annual growth over the past few years. For apartment owners these have been heady days. But there is a limit to what apartment dwellers can pay in rent. And once this line is crossed apartment values will be affected. Anecdotal evidence suggests that apartment renters in San Francisco have said enough is enough. Even though the rental market is tight, renters are unwilling or unable to shell out the exorbitant rents offered at the upper end Class A properties. When that happens, there eventually is a trickle-down effect to the Class B and C properties.

Is this happening in the Portland market? It is definitely happening in Northwest Portland and maybe a few other upscale neighborhoods. There are only so many renters who will pay $2,000 a month for the opportunity to live in these fashionable properties. If this trend becomes more prevalent then the whole apartment market will feel the impact, not just those properties at the top of the food chain.

#4 – Interest Rates Rising

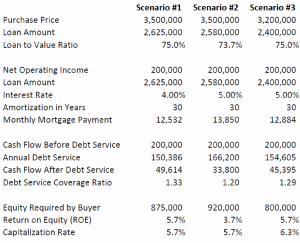

Capitalization rates are inextricably tied to interest rates. If interest rates rise, cap rates must eventually follow. To prove my point, shown below are three scenarios for purchasing a property with a $3,500,000 asking price and a $200,000 Net Operating Income. The purchaser is requesting a loan equal to the lower of a 75% Loan to Purchase Price or a 1.20 Debt Service Coverage Ratio (DSCR) using a 30 year amortization. So let’s go through each scenario.

Scenario #1 – Under this scenario the borrower finds a lender that will offer him a 4.0% interest rate. Doing the math, the loan amount is constrained by the purchase price, not the DSCR. So the loan amount is 75% of the purchase price or $2,625,000. The equity required to close the loan is $875,000. Both the Cap Rate and the Return on Equity are 5.7%.

Scenario #2 – Under this scenario the purchase price and NOI are exactly the same as before but the interest rate is now 5.0% not 4.0%. When that happens the loan amount is now constrained by the DSCR, not the purchase price. In order to maintain a minimum 1.20 DSCR the loan amount has to be reduced from $2,625,000 to $2,580,000. This requires more equity from the buyer at closing. His equity is now $920,000, not $875,000. With the higher interest rate and more equity required to purchase the property, his ROE is reduced to 3.7%. Notice that the property’s 5.7% Cap Rate stays exactly the same.

Scenario #3 – The buyer under this scenario goes back to the seller and says I won’t pay $3.5 million for this property anymore because if I do I get a paltry 3.7% Return on Equity. The buyer proposes a haircut to the purchase price in order to match the 5.7% ROE he received in Scenario #1. To get a 5.7% ROE with a 5.0% interest rate the purchase price needs to be reduced by $300,000 to $3,200,000. Reducing the purchase price raises the Cap Rate from 5.7% in Scenarios #1 & #2 to 6.3%. So in this case when the interest rate increases from 4.0% to 5.0% the value of the property declines by $300,000 from $3.5 million to $3.2 million and the cap rate increase from 5.7% to 6.3%.

Are interest rates rising? You bet they are. They have been going up steadily for the past several months and should continue to do so for the foreseeable future. If you would like to get a better understanding why I believe interest rates will continue to rise I suggest you read, Four Reasons Interest Rates Will Rise in 2018 where I explain in detail my thinking on this subject.

Will Real Estate Values Fall This Year?

So what are the chances commercial real estate values will fall this year? I think they are very likely to fall. The driver of this trend will be interest rates rising more so than the other three factors. If interest rates continue rising, buyers will demand sales prices be lowered to compensate for a lower return on equity. And if sellers balk at lower sales prices, buyers will stop buying altogether. Those are my thoughts. I welcome yours. What do you think will happen with CRE values this year?

The post Will Commercial Real Estate Values Fall? You Betcha. Find Out Why. appeared first on MarshallCf.

March 6, 2018

How to Succeed Financially as a CRE Professional

I have been in commercial real estate since 1980. That year I went to work as a financial analyst for The Grupe Company, a real estate development company located out of Stockton, California. Over the years, I’ve gotten to know many CRE professionals – real estate brokers, lenders and mortgage brokers, title people, appraisers, etc. I’ve observed those who have prospered and unfortunately I’ve seen those who have failed. Those who truly succeed financially in our business do so because they do things a certain way that over time gives them the best opportunity for a financially rewarding career.

My Definition of Financial Success

Before I go on, let me give you my definition of financial success. Those who succeed financially are free from financial worries. They have multiple sources of passive income and need not continue working in order to maintain their current lifestyle. They continue working because they enjoy what they do, not because they have to work to pay the bills.

Salary versus Commission

I will get my bias stated right up front. Except for a very few at the very top of the organizational chart, those who exclusively work for a salary have almost no chance to financially succeed in commercial real estate. Worse yet, when an economic downturn comes (think the Great Recession) salaried employees work at the whim of their employers resulting in many of them being laid off. There is no such thing as job security in commercial real estate. Bottom line: There is almost no chance for someone who draws a salary to retire financially well off.

Sisyphus and Commission Based Compensation

But commission based compensation is no piece of cake either. For those of us who work on commission, we know how difficult it is to get started in the business. Some will say it takes a good two to three years before a commission based CRE professional can say they are “over the hump” and on their way to success. I disagree. Yes, it gets easier the longer you’re in the business, assuming you’re doing all the right things, but very few of us rarely “arrive.”

Commission-based compensation reminds me of the story of Sisyphus of Greek mythology. Recall he was punished for his many sins by being forced to roll an immense boulder up a hill only for it to roll down when he was near the top, repeating this action for eternity. We who are on commission, like Sisyphus, are always chasing the next deal and once it closes we’re back on the never ending quest looking for the next deal. Only the very successful CRE professional, the top 10 or 20 percent, accumulate sufficient wealth from earning commissions. The rest of us, just limp along.

How to Succeed Financially as a CRE Professional

Now I don’t want to sound like a Debbie Downer. I really don’t, but before I give you my answer on how to financially succeed in commercial real estate, an honest appraisal (no pun intended) has to be aired. And that is what I’ve now done. Unfortunately most CRE professionals will not succeed financially. But that doesn’t have to be your fate. You can succeed. As I said in the first paragraph, successful real estate professionals follow a very observable pattern of behavior. I have noticed five things that most successful CRE professionals do:

Their spouse works outside of CRE drawing a salary with good benefits – About every ten years or so there is a downturn in the real estate market. The easiest way to survive the downturns is to have a spouse that earns their living outside of commercial real estate who draws a salary with good health insurance coverage. Can you succeed in CRE without a spouse working? Yes, but it’s certainly more difficult to do so.

They live well within their means – I once had a friend that when he received a large commission check he would spend it on the latest man toy. It wasn’t in his thinking to save a portion of that check for the next slow time. He made good money but he spent all of it and then some. I don’t have to tell you his fate. You already know that he is no longer in the business. Successful CRE professionals live well within their means. They intuitively know that there are good times with euphoric highs and there are bad times when everything comes to a roaring halt. When the CRE market slows, the successful CRE professional has saved sufficient funds to hunker down and wait until the market turns once again.

They know their marketing/sales system – I couldn’t tell you what it takes to succeed as a commercial real estate broker. But I do know what it takes to succeed as a commercial mortgage broker. I know: a) How many marketing contacts I need to generate one loan inquiry; b) How many loan inquiries it takes to generate one loan package; c) What percentage of loan package are converted to loan applications; d) What percentage of loan applications are converted to signed applications; and e) What percentage of signed applications close. Every successful real estate professional knows their numbers, backwards and forwards.

They have grit – What is grit, you ask? People with grit are not easily discouraged. And as we all know, it is so easy to get discouraged as a CRE professional. People with grit consistently make those marketing calls even after being told “no” countless times. They persevere during times of adversity. They never give up, no matter what. And slowly over time, they succeed.

They invest in commercial real estate – The first four factors above are necessary to become a CRE journeyman. Actually none of them by themselves will help you succeed financially at commercial real estate. Consider them the prerequisites for success. There is only one sure way you will ever be financially successful in this business. You invest in commercial real estate. Commercial real estate is the road to wealth but it’s not from drawing a salary or from earning commissions. It’s from owning commercial real estate. Andrew Carnegie said it best when he said, “Ninety percent of all the millionaires become so through owning real estate.” If you go through your entire CRE career without ever owning a rental property there is very little chance of retiring well. It isn’t going to happen.

Strategy for Owning Commercial Real Estate

So how does a CRE professional go about buying a rental property especially if they are new to the business and have modest financial resources? I think the easiest way to break into CRE investing is for the commission-compensated professional to invest their portion of the fee into the deal. So instead of putting their fee into their bank account, they instead invest their commission check as a small interest in the property they helped their client to purchase or finance.

Now many of the clients you have will likely not want you as a minority partner. Don’t take it personally. They wouldn’t want anyone as a partner, including you. And then there are some clients that you wouldn’t want to invest with for a variety of reasons. But there is a small subset of clients that like you, and you like them. These are the ones that you should be investing with.

Retiring Well

Imagine investing just one commission check into a rental property every other year. How would that change your financial situation when it came time to retire? Instead of just retiring on your social security check and your 401(K), you would also have passive income being generated by a dozen or more rental properties. No longer would you be concerned about retiring well. You would be financially free.

Tired of watching TV commercials showing you how much money you need to have to retire well? Read my article on Three Not So Obvious Reasons for Owning Commercial Real Estate.

Those are my thoughts. What do you think?

The post How to Succeed Financially as a CRE Professional appeared first on MarshallCf.

February 21, 2018

Are Retail Stores Going the Way of the Dinosaur?

I attended the Sperry Van Ness CRE Economic Forum last week hosted by Curt Arthur. When the topic turned to the retail market, Curt asked a very insightful question: “How many of you in the audience (there were about 200 people attending) have not received a package delivered to your home in the last 90 days?” Only one hand was raised. Only one out of 200. I wonder if that question were asked five years ago how many hands would have shot up? Certainly, a lot more.

Online Shopping Causes Big Box Retailers Suffer

It comes as no surprise that online retailers in recent years are increasingly taking a larger percentage of all retail purchases made in the U.S. This trend will become even more dominant in the years ahead.

And it comes as no surprise that many brick and mortar retailers are suffering because of it. According to Cushman and Wakefield, more than 12,000 stores are expected to close in 2018, up from roughly 9,000 in 2017. There could be as many as 25 retailers filing for bankruptcy this year, with Sears being the most well known.

Chore Shopping vs. Experiential Shopping

Retail can be divided into “chore” shopping and “experiential” shopping. The “chore” buying (buying things because we have to) will continue the trend towards online purchasing. Let’s face it, most of us enjoy the convenience of shopping from home. So as a result of this trend big box retailers – Sears, Macy’s, Kmart, JC Penny and even Nordstrom will be closing stores this year.

Experiential shopping on the other hand, allows consumers to buy an experience not just an object or service. When a person buys a cup of coffee at Starbucks, they are not just buying the coffee they are buying the ambiance of the store. Those retailers that provide experiential opportunities for consumers will be less affected by online shopping.

Shopping Malls Put at Risk

Shopping malls are being put at risk of going out of business as a result of these big box retailers closing stores. CoStar has estimated that nearly a quarter of all malls in the US are at risk of losing an anchor tenant. The loss of one anchor tenant at a mall can cause a downward spiral in the property’s potential rent. Malls don’t only lose the income and shopper traffic from the anchor tenant, but such closings in many instances trigger lease clauses that allow the remaining mall tenants to exercise their right to either terminate their leases or lower their rents. That’s a great opportunity for the remaining retailers in the short run, but it could potentially cause malls to go out of business if they can’t stop the spiraling down of rents.

Grocery Stores the Next to Innovate

Chore shopping, buying commodities because we have to, also includes grocery shopping. So it comes as no surprise that Amazon, who bought Whole Foods last year, is introducing Amazon Go stores. Amazon recently opened in Seattle a grocery store that allows the customer to fill their cart and walk out without the hassle of the checkout line. Other retailers are experimenting with the convenience of home delivery. It will be interesting to see how these new trends develop over time.

Discount and Convenience Stores Doing Well

It would be misleading to say that all chore shopping is at risk to online buying. Many discount and convenience retailers are doing quite well. In 2017 Dollar General added 1,290 stores, Dollar Tree added 650 stores, and 7-Eleven added 412 stores. I believe this suggests that we are experiencing a shrinking middle class with an ever-larger demographic that can’t afford shopping at stores that are now beyond their family budget.

Fast Food Restaurants Doing Well

This trend is also expressing itself in the demand for restaurants. Restaurants are by their very nature immune to online shopping. At the same time though, most restaurants can’t be categorized as experiential shopping. Getting a quick bite to eat (chore shopping so to speak) that’s easy on the budget is doing well. Dunkin’ Donuts, Chipotle, Domino’s, Chick-Fil-A, Taco Bell, KFC to name just a few are increasing their numbers of restaurant locations. My guess is that due to a shrinking middle class the next tier up in price for restaurants – like Appelbee’s, Ruby Tuesday, etc – are probably feeling the pinch.

3 Things Retail Stores Must Do to Survive

I believe retailers are now beginning to realize they must change or go the way of the dinosaur. Brick and mortar stores will need to do three things to survive:

Ramp up their social media marketing. They need to create and nuture their “tribe of followers.”

Innovate their stores so that coming to one of their stores is not chore shopping it is experiential shopping (e.g., the ambience of a Starbucks store).

They will need to figure out ways that give customers more control and convenience of the buying process (e.g., Amazon Go grocery stores).

Are brick and mortar stores doomed? Absolutely not. But they have their work cut out for them to successfully transition in this changing retail environment.

Those are my thoughts. What are yours? Any real estate brokers specializing in retail properties want to weigh in?

Sources: Retail Trends for 2018 by Walter Loeb, Forbes, December 29, 2017; There Will Be More Stores Opening Than Closing in 2017 by Richard Kestenbaum, Forbes, September 11, 2017; 2018 Retail Trends and Predictions, by Vaughn Rowsell, www.vendhq.com; A tsunami of store closings is about to hit the US – and it’s eclipse the retail carnage of 2017, by Hayley Peterson, www.businessinsider.com, January 1, 2018.

The post Are Retail Stores Going the Way of the Dinosaur? appeared first on MarshallCf.

February 9, 2018

The Cringe Factor: Know When to Fire a Bad Client

I’ve been reading 9 Things You Simply Must Do to Succeed in Love and Life by Dr. Henry Cloud. I find his “9 Things” to be a combination of common sense principles and erudite, counterintuitive thinking. It’s a very easy read, chock full of interesting real-life examples of how to live life to the fullest.

Principle 2 is titled, Pull the Tooth, meaning successful people do not hang onto bad stuff for long. Sometimes they get rid of bad stuff quickly and sometimes through a process, but either way they get rid of it. They do not allow negative things to take up space in their lives, draining them of time, energy and resources. If the tooth is infected, they pull it. As a result, new energy, time, and resources become available on those things that really matter to them.

4 examples of bad clients

One of those bad things that we need to get rid of as quickly as possible is the bad client. You know the type. They come in many different forms. Fortunately, the vast majority of my clients are people I want to do business with. They are honest and honorable people. But from time to time I run into:

The Time Waster – They conveniently forget that my time is the most valuable resource I have. They have no problem wasting my time on things that have a small probability of me ever receiving a paycheck for my services.

The Unethical – They knowingly withhold adverse information from me about the property or about themselves. They have no problems cutting ethical corners if that is what it takes to get a more favorable deal.

The Know-It-All – They think they know more about commercial real estate than they actually do. They ignore my counsel on my areas of expertise because they consider themselves the ultimate authority on commercial real estate.

The Cheapskate – They complain about the fee I charge, or worse yet they attempt to re-negotiate my fee just prior to the transaction closing.

What is the cringe factor?

When dealing with questionable people Dr. Cloud refers to the cringe factor. If you have to take a big gulp before committing to working with someone, that’s the cringe factor. Sometimes when I meet a client for the very first time, I sense during the conversation that something is not quite right with this person. That’s the cringe factor. Or sometimes I’ve actually worked with a bad client before and he contacts me again to employ my services. If I ignore the bells and whistles going off in my brain, that’s the cringe factor I’m ignoring.

Recently I crossed paths with two bad clients: The Know-It-All and the Cheapskate. One I handled beautifully, the other got the best of me.

The Know-It-All

A prospective client, thirty years my junior, contacted me about financing for a marina with a lot of unique challenges. Based on the preliminary information provided, I told him that likely I could do a 65% LTV loan for him and if the moon and the stars aligned perfectly, maybe a 70% LTV. “That’s all you can get me,” he said? He was confident that he could find a lender who would allow a second behind their first deed of trust so that he would only have to put 5 or possibly 10% down with the seller financing the difference. That’s when I cringed.

I told him I knew of no conventional lender that would knowingly allow him to have a second mortgage on the property. Our conversation came quickly to a close with him thinking that his vast real estate experience of 5+ years trumped my 35+ years in the commercial real estate financing business. When confronted with a know-it-all tell them the truth and when he leaves in a huff count yourself lucky you didn’t waste your time working on his deal.

The Cheapskate

A former client contacted me about financing three properties he had under contract. He would need about $5 million in financing. As the weeks progressed the three properties unexpectedly narrowed down to one property needing a loan of about $1 million. So instead of eventually receiving a nice sized commission the fee for my services would be very modest. Over the years I’ve learned I work just as hard for a small commission as you do for a large one, but I get paid a whole lot less. So I rarely do loans below $2 million because the commission is too small for the time spent.

But because he was a previous client of mine I willingly went to work finding the best possible loan for him. The property had significant issues making it difficult to find financing. I contacted a dozen lenders and found three that provided letters of interest. The lender he chose came with a ¼ point loan fee and my client required that I subtract this fee from my already meager loan fee. Wow! Talk about not appreciating what I had done for him! After thinking about my alternatives, I decided a small fee for my services was better than no fee, but I promised myself I will never do business with this guy again.

Don’t ignore the cringe factor

At this point in my career I rarely ignore the cringe factor. But when I do, I almost always live to regret it. The best way to fix a problem, in this case a bad client, is not to have one to begin with. Learn to listen to that little voice inside that tells you not to become involved with a bad client. A wise man once said about the cringe factor: “A prudent man sees danger and takes refuge, but the simple keep going and suffer for it.”

How about you? How have you handled bad clients? Or have they gotten the better of you?

Source: 9 Things You Simply Must Do to Succeed in Love and Life: A Psychologist Learns from His Parents What Really Works and What Doesn’t by Dr. Henry Cloud

The post The Cringe Factor: Know When to Fire a Bad Client appeared first on MarshallCf.

January 21, 2018

Four Reasons Interest Rates Will Rise in 2018

Those who regularly read my blog know that I believe over the long-term interest rates will remain flat or possibly continue on their downward spiral (see link: When will interest rates go back up? How about never!). That said, I believe for the first time in decades we have a very real chance of rising interest rates happening this year. We are entering into the “perfect storm” as several factors are converging at the very same time that will inevitably cause interest rates to rise. But before I explain my reasoning, give me a paragraph or two to set the stage.

Who Controls Interest Rates?

A common misconception is that The Federal Reserve controls interest rates. This is not true. Interest rates are not controlled by The Federal Reserve, the federal government, or some nefarious secret society. Yes, The Fed does set the overnight interest rate between banks, but increasing this rate has little or no impact on five-year, ten-year, or thirty-year US treasury yields.

That said, the Fed does have the ability to manipulate interest rates. They did this in spades with quantitative easing. To get us out of the Great Recession, the Fed purchased massive quantities of government bonds and other financial assets. The result was a lowering of US Treasury yields. But even then the Fed still had to work within the bounds of the Law of Supply and Demand.

The Law of Supply and Demand

Here’s how it works. It all begins with the US Treasury needing to sell bonds because the federal government is spending more money than it is taking in in tax revenues. Hence, the growing national debt.

For example, let’s say the US Treasury auctions off $100 billion of ten-year treasury notes. One of three things will happen:

If demand for the ten-year bond equals the supply, the asking interest rate (whatever that treasury yield is at the moment) remains the same.

If demand for the ten-year bond exceeds supply, then the asking interest rate trends lower until the demand at the lower treasury yield levels off to meet the supply.

If demand for the ten-year bond is less than the supply, then the asking interest rate will trend higher until demand improves so supply and demand are equalized.

I’m sure my explanation is an over simplification of the process, but generally that is how it works.

Four Reasons Interest Rates Will Rise

In the context of the Law of Supply and Demand let’s look at four factors that will either increase the supply of bonds or conversely decrease demand for bonds. Either way when that happens, treasury yields have to rise to compensate.

1. The New Tax Plan Will Explode the Deficit

The new tax plan enacted into law and signed by President Trump December 20th of last year will explode the already gigantic budget deficit. Using the most conservative estimate, it increases the deficit by $1.5 trillion over the next ten years. Increasing the deficit requires the U.S. Treasury to sell more bonds. For the Law of Supply and Demand to work, an increase in supply requires interest rates to rise to increase demand for the increased supply.

2. The Fed is Shrinking Its Balance Sheet

As a result of quantitative easing, The Fed purchased huge quantities of US treasuries. Now that the economy is doing well, The Federal Reserve has begun shrinking its $4.4 trillion balance sheet. In other words, The Fed is now beginning to sell the treasury bonds it once purchased. And as we now know, if the supply of bonds goes up, treasury yields have to go up to increase the demand for treasury bonds.

3. John Q. Public is Buying Stocks Not Bonds

If you had a choice between two investments, one provided you a 2% return and the other one a 25% return, which one would you choose? It’s a no-brainer isn’t it? In 2017, the stock market increased 25%! For the foreseeable future, the public is going to be much more incentivized to purchase equities over bonds. Do you blame them? Heck no! This means the demand for U.S. treasuries will decline and if demand slumps then treasury yields must rise to increase the demand.

4. China is re-thinking its U.S. Bond Strategy

The largest owner of U.S. treasuries is China. They own about $1.2 trillion of our debt. According to Bloomberg News, Chinese officials are reviewing their foreign exchange holdings. They have recommended that they slow or halt purchases altogether of U.S. Treasuries. At this point, this is more an unconfirmed rumor than a fact. But assuming they just moderate their purchases of US treasuries it would have a significant impact on the bond market. If they stopped purchasing US debt altogether it could have a catastrophic impact on the bond market. And as we now know reducing the demand for U.S. treasuries requires treasury yields to rise in order to make them more attractive so that supply and demand equalize.

When Supply Up or Demand Down, Interest Rates Rise

Two of these factors will increase the supply of bonds. Two of these factors will reduce the demand for purchasing bonds. Regardless, they all have the same impact: They will inevitably cause treasury yields to rise. If one of these four factors happen, interest rates will rise. If all four of these factors happen, we are in for turbulent times.

This is my opinion. I welcome yours. What do you think will happen with interest rates in 2018?

Sources: Shrinking balance sheet may protect Federal Reserve from losses and political criticism: Fed study, by Jonathan Spicer, Reuters, January 8, 2018; Mnuchin’s Treasury is Tested by China’s Bond Policy Signals, by Saleha Mohsin, Bloomberg News, January 10, 2018

The post Four Reasons Interest Rates Will Rise in 2018 appeared first on MarshallCf.