Learn How to Split Profits in CRE

In commercial real estate, there is a symbiotic relationship between the real estate promoter (also called the syndicator or the sponsor) and the equity partners (also called the passive investors). They need each other. One can’t succeed without the other. But how each is compensated for their share of risk is completely different. The purpose of this article is to assist the equity partners in answering three very important questions:

Is the fee split proposed by the real estate syndicator fair?

Or, is the syndicator taking advantage of you?

More importantly, how would you know?

This article will help answer these three questions.

Why the promoter deserves a better profit split

The promoter puts the deal together, but he couldn’t have done so without the equity partners. The promoter may contribute less capital, but he is the one who identified the real estate opportunity, negotiated a price that works and got the property under contract. And most importantly, he has the expertise to complete the transaction that equity partners do not have. And this is why he deserves a better profit split than the equity partners.

To counterbalance the profit split that favors the promoter, the equity partners are typically offered a preferred return in order to make the deal more attractive to them. There are many different profit split models, and each can have countless variations on how profits are split between the sponsor and the passive investors.

Six Profit Splitting Models

I recently had the opportunity to listen to the Splitting Profits in Commercial Real Estate webinar by Jeffrey Engelstad offered by the CCIM Institute’s Ward Center. Mr. Engelstad is a CCIM instructor and a professor at the University of Denver’s Franklin L. Burns School of Real Estate and Construction Management. In his presentation he identified six different profit splitting models. Reading down the list, their descriptions sound like something out of a Las Vegas gambler’s instruction manual:

Traditional Split

Rake

Preference

Promote

Subordinated Interest

Waterfall

There is no way I can describe in this short blog post the six different profit splitting models presented in this webinar. If this is a topic of interest to you, I highly recommend you sign up for the course. Mr. Engelstad is an excellent instructor.

Is the proposed profit split equitable?

Imagine for a moment that you are considering investing in a property with a sponsor that has a good track record. The sponsor is proposing a profit split other than the typical traditional split which is based on each partner’s ownership percentage. Is the profit split being offered reasonable? Or is the sponsor taking advantage of you? How would you know?

Now think about this scenario. The sponsor proposes a profit split and because you understand exactly what he’s doing, you counter with a profit split that provides the sponsor with a higher return, but not as high as he originally proposed. Wouldn’t you prefer to be in this situation rather than not knowing whether he’s in fact fleecing you? Me too. And that was my motivation for signing up for the splitting profits webinar.

An Example of a Profit Splitting Model

Just for the purpose of introducing you to this subject, let me show you one example. This splitting profits model is called a Disproportionate Buy-In with a Simple Back-End Promote. Whoa! Sounds really complicated doesn’t it? But with a little explanation I think you’ll see it’s not as difficult to understand as you might think.

Let’s begin with the Property Analysis:

Here are the highlights:

$1,400,000 Purchase Price

$375,000 Funds Required to close

$27,946 Cash Flow After Debt Service in Year 1

5 year Holding Period

$1,650,000 Sales Price in Year 5

600,097 Net Sale Proceeds

Disproportionate Buy-In with a Simple Back-End Promote

The sponsor, Karl, is proposing that the profit split be adjusted from a traditional profit split in two ways:

1. Disproportionate Buy-In

Karl is proposing that he receive a higher initial ownership interest in the property than the actual equity he is investing in the deal. He is investing 10% of the equity but he is proposing that he gets a 15% interest in the property.

2. Simple Back-End Promote

Karl is also proposing that he get a 10% back-end promote. Think of a promote like you would a bonus. In this situation, everyone gets their original money back and then Karl would get his 10% bonus. Then the remaining sales proceeds are split based on the investor’s ownership percentage.

Now let’s look at how profits are split under this profit splitting model:

First Step – Determine property’s IRR

The first step is to determine the property’s Internal Rate of Return. As you can see above, the initial investment is $375,000 and the annual cash flows from the operations of the property in Year 1 are $27,946 increasing each year until Year 5 when it tops out at $45,839. With the sale of the property in Year 5, total proceeds for that year is $645,843. This results in an IRR for the property of 18.09%.

Second Step – Determine the promoter’s proposed IRR

So let’s look at the impact of giving Karl 15% interest in the property. Everyone else’s interest is diminished a skosh. For example, Jim, Natasha and Pat invested 10% of the equity in the deal but only get 9.444% of the cash distributions. Likewise, Ed and Gabriella invested 20% of the equity in the deal but only get 18.889% of the cash distributions.

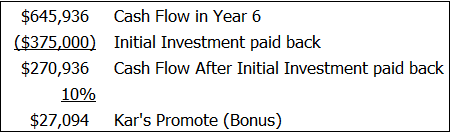

Now let’s look at Karl’s Back-End Promote. Recall, Karl is to receive a 10% promote (bonus) after all the partners receive their initial investment back.

So after Karl receives his back-end promote of $27,094, the remaining cash proceeds in Year 5 are distributed according to the investors’ ownership percentages. Under this proposed profit split scenario, the equity partners receive a 15.7% IRR while Karl receives a very handsome 34.53% IRR.

Third Step – Counter the Promoter’s proposal with one you like

Let’s say, you’re not satisfied with a 15.7% IRR or maybe you think Karl is getting a bit greedy. Now that you know how the game is played you counter with the following profit split proposal: In lieu of a disproportionate buy-in, you propose that Karl receive a 12.5% promote on the back-end instead of the 10% he originally proposed. Below shows how this would affect Karl’s and the equity investors’ IRRs.

The equity partners would receive a higher 17.0% IRR and Karl’s IRR would be reduced to 26.33% IRR, which is still a very good return. If I were Karl, I would take it. And if I were the equity partners, I would be satisfied with this counter proposal. In my opinion, the original profit split proposed by Karl was too one-sided in favor of Karl.

Conclusion

In order to level the playing field between you and the sponsor you need to learn how the game of splitting profits is played. If you want to learn how, sign up for the Splitting Profits in Commercial Real Estate course offered by the CCIM Institute. Here is the link to register for the class: Splitting Profits in Commercial Real Estate.

Those are my thoughts. I welcome yours. How do you think profits should be split between sponsor and equity partners?

The post Learn How to Split Profits in CRE appeared first on MarshallCf.