Ruth Soukup's Blog, page 107

July 13, 2014

Weekend Wandering

Happy Sunday! This morning I am actually writing this from the Atlanta airport, on my way back from the World Domination Summit in Portland. While the whole trip was a bit of a whirlwind, it was great to catch up with my mom, sister, brother, and cousin. In addition to meeting Darren Rowse, who has been a huge source of inspiration for me since I started blogging, I also had a chance to hang out with my friends Michelle and Andy as well.

I usually attend conferences more for the connections than the actual sessions, but I have to say that Michael Hyatt’s keynote yesterday afternoon was downright awesome. I’ve seen him speak several times over the past year, and he always has great information to share, but this time he literally rocked the house. It was awesome!

But now, on to my picks for Weekend Wandering! There were once again well over 450 budget-friendly posts linked up this week at Thrifty Thursday, and as always, it was SO hard to choose! Here are just a few of the posts I loved:

* * *

First of all, This Pesto Caprese Macaroni Salad from Sizzling Eats looks so fresh and yummy! What a perfect summer meal!

This Southwest Quinoa Salad from Luv a Bargain is also hearty enough for a refreshing summer meal and it’s also gluten free. Wow, does that look good!

Keeping with the Southwest theme…A New York Foodie has an Easy Guacamole recipe that is just crying out for some tortilla chips. This would be perfect poolside with a frozen margarita!

Frugal Coupon Living has a Chipotle Parmesan Summer Corn Seasoning that sounds delicious!

Moving on to some sweeter treats. These Individual Frozen Key Lime Pies from This Silly Girl’s Life are so cute and look so tasty!

Switching gears to some cute projects, this No Sew Patchwork Teepee from Sunshine and Hurricanes is adorable and looks like so much fun.

Getting ready for a summer trip? Mrs. Organised has a printable Travel and Packing Checklist that is free! This is so handy.

If you dream of an organized pantry Sweet Haute has the Fit and Happy Pantry Organization before and after photos to help guide you through the process.

It’s hard to believe that it is already time to start thinking about back-to-school, but now is the time to save big on school supplies! Saving the Family Money has 10 Ways to Save on Back to School Supplies. Number 2 has lots of great tips!

Of course ideas for saving on food are always useful! A Mitten Full of Savings has 10 Cheap & Healthy Foods to Buy on a Tight Budget.

Financial mistakes can cause you a lot of headaches. Learning how to avoid them is key! Millennial on a Budget has 15 Things You Should Never Finance which has some really great tips.

Finally, Sarah Titus has 10 Ways to Earn Extra Income from Home. This topic has come up a lot lately on our Living Well Spending Less Facebook community. Can you think of any more?

* * *

What did you love this week?

Pin It

The post Weekend Wandering appeared first on Living Well Spending Less®.

July 11, 2014

10 BIG Money Mistakes You Might Be Making

Most of us want to believe we have a pretty good handle on our money. Oh sure, we may splurge on the occasional overpriced coffee, but in general we practice sound principles of saving where we can, and at least trying to plan for our future financial well-being. We don’t fall victim to obvious scams, and we know that if something seems too good to be true, it probably is!

But money mistakes can happen to the best of us, even when we think we are being smart.

How? Simply put, the financial world is full of ideas that might seem beneficial at first glance but are actually quite costly in subtle ways. And while these sneaky money drains can take a toll, they are also easily fixable once identified. Today let’s take a look at ten of these common money mistakes you might be making — and exactly how to fix them.

1. Letting Your Spouse Take Care of All Your Finances

If you’re married, which of you is in charge of the money? This might seem to have an easy answer: in many cases it’s the one who earns more—or the money nerd who enjoys the job. But having just one person in your family who does it all should be a red flag. If the main money manager dies or is disabled, who would pay the bills? Often, when only one partner takes care of everything, the other is in the dark — no place to be while dealing with a medical crisis or, worse, a funeral. And while we always want to trust in our spouses, there is nothing wrong with a little accountability!

So how do we avoid this disaster-in-the making? First, create a centralized record with all account numbers, dates, amounts to be paid, addresses, etc., and make sure everyone in the family knows where it is. Second, according to the Allstate financial experts we questioned, it is also important to make sure you have set aside a certain amount of money for an emergency fund that both partners have access to. You never know when unforeseen bills or a sudden layoff might occur and having an emergency fund can cover the entire cost or at least alleviate much of what is owed. No one wants to be stuck with a 10K hospital bill unexpectedly, but having an emergency fund as small as a couple thousand dollars can really help in these situations.

2. Giving Your Kids a Pass

Many parents don’t want burden their kids with financial concerns, or don’t even think it is possible to teach their kids about money when they’re small. Unfortunately this approach means kids often have fuzzy ideas about spending and saving, and especially about exactly where money comes from. Until, of course, they get their first “real” job…and then they’re barraged with “easy credit” offers that aren’t easy to resist!

Fortunately, teaching kids from early age that money comes from work is a great way to teach money basics, with the additional benefit of being a tangible start on sensible money habits for life. Our Allstate experts warn parents to avoid becoming an ATM for their children, pointing out that bankrolling your children’s every whim doesn’t do them any favors and even worse, actively damages your bank account. Providing them with all of their needs sets a precedence and can put you in a financial scramble.

Instead, set up a commission system in your home, where your kids can earn money for the work they do, and where they also have to take responsibility for purchasing the things they want with money they’ve earned themselves. Giving your children the gift of financial independence is one of the best things you will ever do for them.

3. Assuming that Ignorance is Bliss

As much as we would like to sometimes bury our heads in the sand, some of the biggest financial crises come from avoiding small issues until they become big ones. Even if you’re not the money mogul in the family, pay attention to the financial details, even when they seem tedious or overwhelming. Know what you’re entitled to on taxes, insurance claims, and the like, and how to file for it.

If you’re not sure what you are entitled to, or how to handle a financial issue, do your research. Ask a trusted friend or financially savvy acquaintance for assistance, or find some other way to learn what you need to know. You can learn how to save on taxes, for instance, from free seminars at libraries or local colleges. Ask questions of a local tax preparer, or call the IRS directly; they DO answer questions! The same goes for your insurance broker: get all the rate “breaks” that come with safe driving, maintaining good health, and keeping your credit in order.

4. Ignoring your Employee Benefits

Like ignoring other financial essentials, not paying attention to the details of your employee benefit package can come back to haunt you, usually at the worst possible time.

Really read employee benefit handbooks and know what you’re entitled to. Yes, we know that can be tough, but once again…it pays off when you need it the most. When you file a claim, have all your forms and documents in order, so you don’t need to chase information under a tight deadline or risk getting denied on something that’s rightfully yours.

5. Letting Big Words Intimidate You

No one wants to feel stupid, which means that often it seems easier to just do nothing than to try to figure out the meaning behind big scary financial terms and acronyms such as annuities, compounding interest, IRAs, mutual funds, etc.

If you don’t understand any complicated terms, ask. Badger those n the know until you understand all the ins and outs of what your benefits are, what your premiums buy, and what’s excluded. Don’t be afraid to comparison-shop for health, life, home, and auto insurance coverage (start with these smart ways to save on home insurance and save on car insurance), and be sure to ask your agent for all applicable discounts. Speaking up versus staying silent can add up to thousands of dollars over time.

6. Drowning in Subscriptions

What have you signed up for lately? Subscribing to a bunch of different services, product deliveries, and reading material is way too easy — especially when it’s done electronically. Then, the bills hit your credit card or bank account and you wonder what happened!

Remember that when you sign up for a free trial, it is just a trial–you will have to pay eventually. Record pertinent info on a computer desktop sticky note, on a list in a document file, or even on good old-fashioned paper in a small notebook. Then, regularly check that list for expiration or renewal dates; it’s easier to cancel a potential charge than reverse it later on. Even if you’re keeping the subscription, review it often. Publications often raise subscription rates by “just a little,” but over time, that “little” adds up.

7. Paying Too Much…

Another drain off the budget can be paying too much for anything — car or home repairs, an appliance, a clothing or gift item, or a service. Sometimes we pay more than we should out of boredom, or because we need to solve a problem fast, but often saving money on the things we need most is a matter of doing our due diligence and spending smart.

Shop around, get recommendations, and beware the convenience of shopping without thinking. Your grocery store may also carry office supplies, jewelry, or tools, but resist the urge to pick those things up while you’re there anyway, but stocking up on office supplies during the back-to-school sales means getting paper, printer cartridges, or pencils for a fraction of what you’ll pay the rest of the year, particularly at a store that doesn’t specialize in those items. The same goes for automotive accessories, hardware, housewares, and pet gear. You’ll not only give yourself a better selection but a better bargain by going to the right store.

Furthermore, for bigger ticket items, our Allstate financial experts recommend buying used or refurbished, if possible. When it comes to phones, electronics, and even cars, it is almost never necessary to have to have the newest, flashiest item. Purchasing 1 or 2 year old used car can save a lot of money over purchasing brand new. We’ve all heard the saying of how a car loses a large portion of its value when it’s driven off the lot!

8. …Or Paying Too Little

On the other hand, choosing to purchase lower quality items that can’t stand the test of time is not only an exercise in frustration, it is literally like throwing money away.

Know and appreciate when a premium price is an investment. Discount and consignment shops are great for getting high-end quality at a fraction of a high-end price, as are sites like Overstock.com. Fine furniture will last years beyond the cheap particle-board stuff in mail-order catalogs; the same goes for well-tailored clothing, well-made shoes, and necessary help from those aforementioned tradespeople. Purchasing high-quality, locally made items is almost always preferable to cheaper but often shoddier foreign alternatives. When it comes to a purchase that can affect your health, safety, or security, the best bargains in the world don’t come cheap! Always value quality over quantity.

9. Paying for a House You Can’t Really Afford

It happens to many of us: we wake up one morning and realize we’re living in a house that is more than we truly need — and costs the earth to maintain. Unfortunately, it’s easy to find ourselves here. Realtors almost always show us the nicest homes anywhere near our price range…and, usually, above it. The pressure to keep up with the Jones’ can be intense as well. We want to show the world we’ve succeeded, that we outdid a rival classmate or sibling.

Unfortunately, buying too much house can quickly become a huge drain on even a healthy budget. The bigger the house, the more maintenance, the higher the utilities, and the more STUFF required to fill it. On the other hand, deciding to spend less than the recommended 28 percent of your budget has the the benefit not only of costing less, but of simplifying your life by letting you pare down your belongings to only the essentials.

10. “Saving” with Your Credit Card

While I do believe in theory that it is possible to use credit wisely, I also believe that in practice it can be very, very difficult. Credit cards are not designed to save you money, they are designed to earn a healthy return for the creditor.

Don’t be fooled by discount offers that are only available when paired with credit, such as a store offering 10 percent off on purchases with a charge application. Unfortunately, 10 to 20 percent off, balanced against an annual interest rate of 18 to 22 percent (or more!), will never result in tipping the cash flow in your favor! Annual or activation fees, maintenance charges…the list of ways credit cards “ding” your pocketbook is endless. And, unless you have iron discipline and pay the entire balance before it’s due, anything bought on credit is always more expensive than a cash purchase. So, as tempting as that discount might look, think again. It’s an expensive way to “save,” one you can easily avoid with a little thought.

Furthermore, according to our Allstate experts, it is important to avoid opening multiple lines of credit, if possible. The more credit cards you have, the harder it can be to keep track of all of the differing payments. Falling behind on payments is never a good thing, and high interest rates can make the amount you owe skyrocket.

At the end of the day, when it comes to money it is not always what you earn that matters, but what you keep. Avoiding these ten common financial mistakes can help you keep more of your hard-earned money. This, in turn, leads to a life rich in things that truly matter: conscious stewardship, financial freedom, and peace of mind.

* * *

Have you been making any of these money mistakes?

This post was written as part of the Allstate Influencer Program and sponsored by Allstate. All opinions are mine. As the nation’s largest publicly held insurance company, Allstate is dedicated not only to protecting what matters most—but to guiding people to live the Good Life, every day.

Pin It

The post 10 BIG Money Mistakes You Might Be Making appeared first on Living Well Spending Less®.

July 10, 2014

Thrifty Thursday {Week 68}

Happy Thursday! I hope you are all having a fantastic week!

Have you ever done something totally crazy and irrational? This weekend I am all the way on the other side of the country, in Portland, Oregon, to attend at least a little bit of the World Domination Summit. I’ve heard it is a great conference, and I’m sure it will be inspiring, and I also get to hang out with my mom and sister for a couple of days while I am here, so it’s all good.

But do you want to know the truth?

My main reason for traveling 3,000 miles was to get a chance to meet Darren Rowse of ProBlogger.

When I first started blogging, I must have read Darren’s book ProBlogger: Secrets to Blogging Your Way to a Six Figure Income at least 50 times, maybe even more. It taught me a lot, but even more than that, it inspired me, motivated me, and encouraged me that I really could make a living by blogging. And after I met that goal, it was what inspired me to write my own book on blogging. I wanted to be able to help others the way Darren helped me.

I don’t normally get star struck, but today I totally am. Wish me luck!

Here are the most clicked links from last week:

1.Mended Wheels { The Dave Ramsey Tribe: Stop Being Bullies! }

2. The Latina Homemaker { Money Saving Tips for Tight Budgets }

3. Busy Mom Budgets { Budgeting Shouldn’t be This Easy(…but it is!) }

4. Letters from Sunnybrook { REALLY Get Out of Debt }

5. Practical Stewardship { Is It Time to Give Up Coupons? }

6. Creative Savings { Ditch the Cooking Spray }

7. Snail Pace Transformations { 10 Ways Thrifty People Save Money on Vacations }

8. Setting in the Pew { How to Organize Your Entire Life }

9. Involving Living { Financial Independence-Why DIY is the Key }

10. Always, Al { 10 Inappropriate Things to Say to Someone Who Isn’t Married }

Never linked up before? Here’s how:

Scroll down, find the little blue “Add your Link” Button and click on that.

Follow the instructions on the next page – add a great image of your project and an interesting title. Make sure you link to the direct page of your budget friendly post – not the main page of your blog!

Try to visit at least a few other blogs at the party. Be sure to leave a comment to let them know you stopped by!

Please link back to this post somehow. There are badges available here; a simple text link is just fine too.

Feel free to tweet about Thrifty Thursday so others can join the fun, and don’t forget to check back here Sunday morning to see which posts have been featured this week at Weekend Wandering!

Feel free to tweet about Thrifty Thursday so others can join the fun, and don’t forget to check back here Sunday morning to see which posts have been featured this week at Weekend Wandering!

If this is your first time here I also invite you to check out my eBook, How to Blog for Profit (Without Selling Your Soul). It is a fantastic resource if you are interested in building your blog, getting more traffic, or learning how to monetize. Or, if you have read the book and are still looking to take your blog to the next level, I encourage you to check out my options for one-on-one blog consulting.

An InLinkz Link-up

Pin It

The post Thrifty Thursday {Week 68} appeared first on Living Well Spending Less®.

July 9, 2014

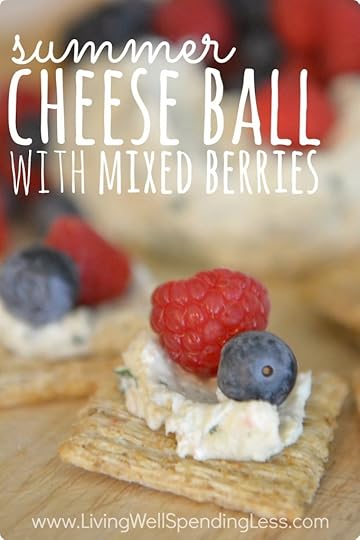

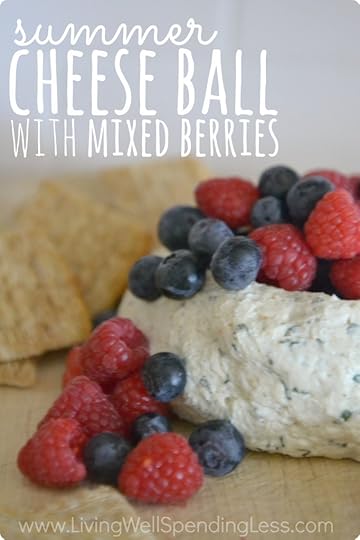

Summer Cheese Ball with Mixed Berries

When it comes to entertaining, I try to keep things as stress-free as possible. I discovered long ago that few appetizers beat the simplicity, versatility, and sheer deliciousness of a simple cheese ball paired with Triscuits. Thus, when the folks over at Martha Stewart asked if I’d be interested in entering a little summer recipe challenge they were hosting called the Triscuit Summer Snackoff, I said heck yeah!

When it comes to entertaining, I try to keep things as stress-free as possible. I discovered long ago that few appetizers beat the simplicity, versatility, and sheer deliciousness of a simple cheese ball paired with Triscuits. Thus, when the folks over at Martha Stewart asked if I’d be interested in entering a little summer recipe challenge they were hosting called the Triscuit Summer Snackoff, I said heck yeah!

For this recipe challenge I needed to find a way to combine Martha’s selected seasonal ingredient–mixed berries–with Triscuits, (which coincidentally just happen to be my favorite snack cracker of all time), and I knew right away that whatever I came up with would have to be quick, easy, and delicious. The natural choice for me? A Summer Cheese ball with Mixed Berries. Around the holidays I often make this delicious Cranberry and Cheddar cheese ball, so the summer berry & cheese combo seemed like a natural fit. The best part? It took less than 10 minutes to come together, which makes it the perfect lazy summer appetizer.

Also? You can be entered to win a trip to New York City to meet Martha Stewart in person by sharing a photo of your own Triscuit creation at TriscuitSummerSnackoff.com, and by sharing it on social media using the hashtag #TriscuitSnackoff. How fun is that?

Here is what you need:

For the cheese ball:

15-20 fresh basil leaves

2 tablespoons butter, softened

1 8oz package cream cheese, softened

3/4 cup blue cheese crumbles

1/2 teaspoon minced garlic

1/4 teaspoon pepper

1/4 teaspoon seasoned salt (optional)

For serving:

fresh mixed berries to place on top

Triscuit Crackers

Step 1: Finely chop basil to make approximately 1 1/2 tablespoons; set aside.

Step 2: Combine softened butter and cream cheese in bowl of stand mixer fitted with whisk attachment; whip on medium-high speed until fluffy, approximately 30 seconds, scraping sides with spatula if necessary.

Step 3: Add blue cheese crumbles, minced garlic, pepper, salt, and fresh basil; whip again on medium-high speed until combined, approximately 15-30 seconds, scraping sides with spatula if necessary.  Step 4: Scrape mixture into a ball using spatula; wrap with plastic wrap and chill until firm, approximately one hour.

Step 4: Scrape mixture into a ball using spatula; wrap with plastic wrap and chill until firm, approximately one hour.

Step 5: Place ball on serving dish; flatten slightly and create a slight indentation in the middle. Cover with fresh mixed berries and serve with Triscuits.

Print This!

Recipe: Summer Cheese Ball with Mixed Berries

Summary: This summer inspired appetizer is super easy, delicious and a perfect addition to any backyard barbeque, pool party or picnic!

Ingredients

2 tablespoons butter, softened

1 8oz package cream cheese, softened

3/4 cup blue cheese crumbles

1/2 teaspoon minced garlic

1/4 teaspoon pepper

1/4 teaspoon seasoned salt

20 fresh basil leaves

fresh mixed berries

Triscuit Crackers

Instructions

Finely chop basil to make approximately 1 1/2 tablespoons; set aside.

Combine softened butter and cream cheese in bowl of stand mixer fitted with whisk attachment; whip on medium-high speed until fluffy, approximately 30 seconds, scraping sides with spatula if necessary.

Add blue cheese crumbles, minced garlic, pepper, salt, and fresh basil; whip again on medium-high speed until combined, approximately 15-30 seconds, scraping sides with spatula if necessary.

Scrape mixture into a ball using spatula; wrap with plastic wrap and chill until firm, approximately one hour.

Place ball on serving dish; flatten slightly and create a slight indentation in the middle. Cover with fresh mixed berries and serve with Triscuits.

Preparation time: 5-7 minutes Cooling time: 1 hour

Number of servings (yield): 16

Martha Stewart is challenging consumers to create a delicious snack using a secret seasonal ingredient she selects along with Triscuit crackers. Consumers are encouraged to share photos of their creations at TriscuitSummerSnackoff.com to be entered for a chance to win a trip to New York City to meet Martha Stewart ( as well as lots of other prizes!) Consumers can learn about the bi-weekly challenges and ingredients at TriscuitSummerSnackoff.com

* * *

What is your favorite summer snack or appetizer?

Pin It

The post Summer Cheese Ball with Mixed Berries appeared first on Living Well Spending Less®.

July 7, 2014

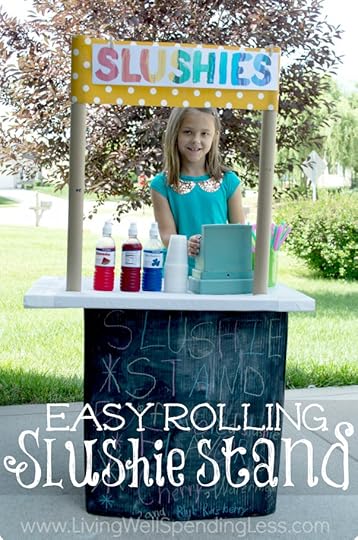

Easy Rolling Slushie Stand

This is Week 6 of our 12-week Summer Fun with Kids series here at LWSL! Today we are welcoming Heather & Angela from Sports Mom Survival Guide, who are sharing an easy and creative way to make a Rolling Slushie Stand to keep all the neighbors cool & refreshed. For more summer fun, check out the overview page.

* * *

Hi LWSL readers we are Angela and Heather from Sports Mom Survival Guide, where we share “first string” ideas for busy families!! I don’t know about you, but my kids are hitting the age where they want to earn money. My oldest is all about setting up lemonade stands on the weekends and while she does tend to get a few neighbors who stop by (mostly just to be nice) she doesn’t have too many customers. One day she had the brilliant idea to take her stand down to the neighborhood pool…one thing lead to another and we had our Rolling Slushy Stand.

Because everyone knows a kid can’t resist a slushie!

Here is what you need to Make the Rolling Slushy Stand:

a rolling cooler

large cardboard boxes

paint (we chose chalkboard paint)

foam brush

zip ties

razor knife

2-3 rolls of wrapping paper rolls or fabric bolt rolls

(you can get empty fabric bolts rolls from any fabric store)

duct tape

scrap fabric

*metal washers and glue optional

Use our simple directions below to make your own Rolling Slushy Stand with your kids!

If you want to make a simpler version, simply modify by leaving off the banner.

Step 1: Open the cardboard to make it flat and bend it around three sides of the cooler. Then mark the height of the lid in the open position.

Step 2: Make a straight line off the mark you just made and cut off the excess cardboard using the razor knife.

Step 3: Paint the outside of the cardboard surround.

Step 4: For the “counter” we used another large thin, FLATTER box. If you can’t find one, you can make one out a larger box. The top needs to be 3 dimensional so it’s sturdy. Once you have the counter, use the cardboard tube to trace two circles. Each circle needs to be about 3-4 inches from the side and about 5 inches from the front.

Step 5: Use the razor knife to cut out the circle. Don’t cut through to the bottom portion of the box. (Adult job)

Step 6: Attach a scrap piece of fabric (approx. 4 inches wide and 40 inches long) to the top of both cardboard tubes using a piece of duct tape.

Step 7 (optional): If you used chalkboard paint, make sure you “season” the paint first by completely covering it in chalk then wiping it clean with a damp cloth.

Step 8: Make one hole (big enough to thread the zip ties through), on both side of the cardboard surround. OPTIONAL: glue metal washers around the holes to keep the cardboard from tearing.

Step 9: Assemble the stand!! Use zip ties to hold to around the cooler.

Step 10: Place the counter on top of the surround, then put the banner poles in each of the holes you cut.

Step 11: Twist each pole around (winding the fabric) to make the fabric taunt. You might need to add an extra cardboard tube in-between to stabilize it. The tension should hold everything in place.

Now your kids can have fun using this stand all summer long!!

**I added a Dollar Store table cloth to the top of the counter to keep it from getting wet and the kids wrote the flavors and price on the front of the stand with chalk.**

To transport it we just used a bungee cord to hold everything together.

We made the “slushy ice” in advance using a slushie maker and just put it in the cooler, so no power was required. (You could also crush the ice in a blender or food processor.) This stand is holding up really well and should last for a while!

Bonus: We also included a printable version of the “SLUSHIES” sign.

And now for the giveaway! One lucky reader will their own Summer Slushie Stand package that includes a set of flavored syrups, slushie ice maker, and portable cooler. This fun package has a retail value of approximately $85 and will provide hours of fun this summer! To enter, just follow the instructions in the box below.

Sports Mom Survival Guide bloggers and friends Angela Lerew &

Heather Mortiz live in the heart of the good ole’ Midwest….Indianapolis. Angela is a sports mom to 2 beautiful ballet and soccer girls & Heather Moritz is sports mom to 3 active boys. These neighbors enjoy DIY projects, taxing kids, hanging out in the bleachers with the other moms and spending time with family. Sports Mom Survival Guide offers first string ideas & tips to help you manage sports mom life.

* * *

What is your favorite slushie flavor?

Pin It

The post Easy Rolling Slushie Stand appeared first on Living Well Spending Less®.

July 6, 2014

Weekend Wandering

Happy Sunday! I hope you are all having a wonderful Fourth-of-July weekend! Ours has been nice and low-key–after spending the whole day in the sun on Friday, we completely crashed yesterday. We slept in until almost 10am and then the girls and I stayed in bed for the rest of the morning while we watched The Pirate Fairy movie on Netflix. It was surprisingly entertaining!

I also enjoyed spending some time checking the posts shared at this week’s Thrifty Thursday–465 of them! There were lots of interesting reads this week, which made it especially hard to choose. Then again, I always say that! In any case, here is what I loved this week:

* * *

First of all, this Chicken Alfredo Pizza from Belle of the Kitchen is definitely a must try! Doesn’t it look delicious?

This next recipe seems too yummy and easy to be true… a Fritos Bagged Walking Taco from Frugal Coupon Living. This is so clever! Pretty sure my kids–and my husband–would go crazy for this one!

After our cruise last week my husband and I are definitely trying to keep our menu on the light side, and these Guacamole Stuffed Cucumbers from Faith Filled Food for Moms seems to fit the bill. And with only 3 ingredients this is right up my alley!

Are you trying to get your kids to help in the kitchen more? Play 2 Learn with Sarah has a kid friendly recipe that they will love. Homemade Fruit Chews that use real fruit juice! FUN!

Or you could have your kids help make these 3 Ingredient Pina Colda Popsicles from The Pretty Bee. Yummy!

If only I wasn’t watching my waistline…these Chocolate Salted Caramel Bars from A Thrifty Table look amazing! I’m actually drooling right now…..

Nothing says summer like fresh strawberries. These Strawberry Shortcake Cupcakes from The Simple Sweet Life look like the perfect dessert for any summer party!

Moving on to easy DIY projects, I loved this simple tutorial for making making Homemade Chicken Stock in the Slow-Cooker from Don’t Waste the Crumbs.

These Brown Bag Utensil Holders from The Life of a Craft Crazed Mom are such a great idea for a backyard barbeque, picnic or outing on the boat! You could customize them to match any occasion.

I’m sure most of us are planning at least one little getaway this summer. If so, be sure to check out these 5 Tips for an Awesome Family Vacation from Kruse’s Workshop. I love the suggestions shared in tip number 5!

Of course if you are more interested in keeping your vacation budget to a minimum, Snail Pace Transformations provides 10 Ways Thrifty People Save Money on Vacations. Number 10 is a must!

* * *

What did you love this week?

Pin It

The post Weekend Wandering appeared first on Living Well Spending Less®.

July 4, 2014

12 Simple Ways to Celebrate Freedom

For most of us here in the USA, the Fourth of July means barbecues, fireworks, and a long, relaxing weekend of fun in the summer sun. And while there is nothing wrong with enjoying ourselves, it is also important to remember that our freedom wasn’t free. Instead, it was hard fought through blood, sweat, and tears.

With that in mind, here are twelve simple ways to celebrate that freedom:

1. Fly the Flag

Let your patriotic spirit show by displaying Old Glory for everyone to see. Take the time to teach your kids the Pledge of Allegiance, and be sure to follow proper flag etiquette.

2. Wear Red, White, and Blue

If there is one day a year you should make an effort to wear our nation’s colors it is on the Fourth of July! Everyone’s got jeans and a white t-shirt. Just add a red bandana and you’ve got it covered.

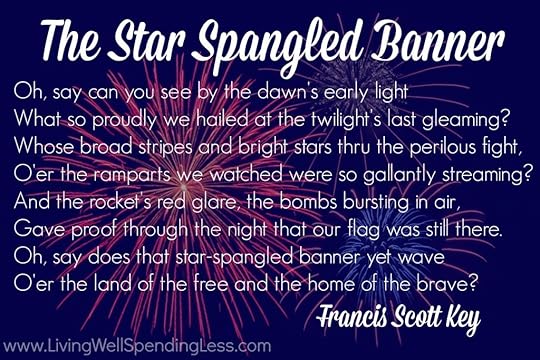

3. Learn all the words to the National Anthem

If you can’t remember all the words to our National Anthem, it is time to take a refresher course. Fun fact: Did you know the Spangled Banner actually has five verses? We normally sing just the first verse.

4. Make a Flag Cake

It doesn’t get much easier than a box of cake mix and some whipped cream, but a flag cake is both festive and a great way to get your kids into the patriotic spirit. Watching your weight? Try these diet flag cupcakes instead!

5. Play “I’m Proud to Be an American”

I’ll admit it, this one chokes me up every single time.

6. Watch a Fireworks Display

Whether you do your own, watch the local city display, or even watch it on TV, don’t let the 4th pass you by without seeing at least a few fireworks go off.

7. Learn about American History

Read a book or watch a documentary about some aspect of American history and learn exactly what our Founding Fathers fought for….and what we should continue to fight for today. Not sure where to start? Try these bestsellers about the American Revolution.

8. Send a Care Package to the Troops

Take a few minutes to collect goodies and write letters for an American soldier on active duty. Have your kids draw pictures and spend time talking about what it means to be a soldier and what they fight for. USO flat rate boxes are available at the post office; check out AnySoldier.com for a list of addresses of where to send your package.

9. Eat a Rocket Pop

Not every celebration has to be a grand gesture. Enjoy the most patriotic of frozen treats—an old fashioned Rocket Pop!

10. Celebrate with friends & family

Freedom means the ability to gather with the ones we love without fear of oppression. Invite your loved ones for a 4th of July celebration and enjoy a day of being together.

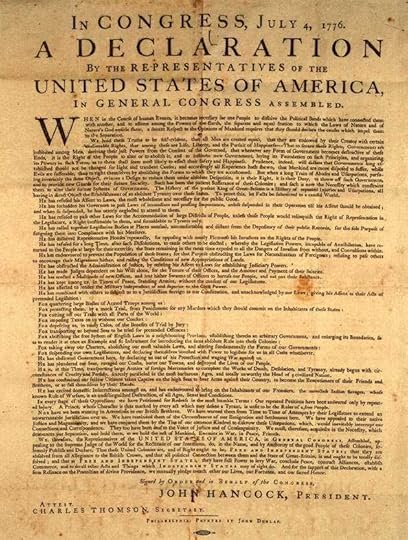

11. Read the Declaration of Independence

One simple document that was at the time considered an act of treason. Take the time to read it, then ponder the bravery of the men who dared to change the course of history.

12. Visit a National Park or Monument

It is hard not to be in awe of our amazing and incredibly diverse country while visiting our nation’s greatest treasures—the National Parks. Visit, explore, take advantage of fantastic opportunities, and celebrate the Land of the Free. Check out this post for five awesome National Park activities to do with your kids!

* * *

How will you celebrate this Fourth of July?

Pin It

The post 12 Simple Ways to Celebrate Freedom appeared first on Living Well Spending Less®.

July 3, 2014

Thrifty Thursday {Week 67}

Happy Thursday! I hope you are all having a great week so far, and if you are anything like me you are really looking forward to the long 4th of July weekend tomorrow! What are your plans for the holiday. I wish you all a wonderful day with family and friends, and if you haven’t already, be sure to pop in on this week’s Summer Fun With Kids project and enter to win a $100 Amazon Gift Card!

Here are the most clicked links from last week:

1.Pulling Curls { Things Your Mom Did Wrong }

2. The Latina Homemaker { When You Can’t Afford to Pay the Utilities }

3. Simplee Thrifty { 30 Clever Organizational Ideas }

4. Life in the Orchard { How I Avoid Spending Money }

5. Retired By 40 { Feed Your Family on $300 a Month }

6. An Inviting Home { A Modern Homework Station }

7. A Cultivated Nest { 11 Small Bathroom Organization Ideas }

8. Sarah Titus { Got eBay? Everyone Who Has An Account Should Read This! }

9. A Mitten Full of Savings { 60 Ways to Save Money }

10. Simply Different Imperfect Change { How I Save Money at Target }

Never linked up before? Here’s how:

Scroll down, find the little blue “Add your Link” Button and click on that.

Follow the instructions on the next page – add a great image of your project and an interesting title. Make sure you link to the direct page of your budget friendly post – not the main page of your blog!

Try to visit at least a few other blogs at the party. Be sure to leave a comment to let them know you stopped by!

Please link back to this post somehow. There are badges available here; a simple text link is just fine too.

Feel free to tweet about Thrifty Thursday so others can join the fun, and don’t forget to check back here Sunday morning to see which posts have been featured this week at Weekend Wandering!

Feel free to tweet about Thrifty Thursday so others can join the fun, and don’t forget to check back here Sunday morning to see which posts have been featured this week at Weekend Wandering!

If this is your first time here I also invite you to check out my eBook, How to Blog for Profit (Without Selling Your Soul). It is a fantastic resource if you are interested in building your blog, getting more traffic, or learning how to monetize. Or, if you have read the book and are still looking to take your blog to the next level, I encourage you to check out my options for one-on-one blog consulting.

An InLinkz Link-up

Pin It

The post Thrifty Thursday {Week 67} appeared first on Living Well Spending Less®.

July 2, 2014

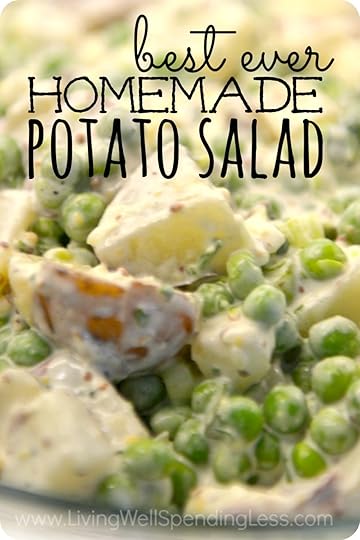

Best Ever Homemade Potato Salad

Everyone needs a go-to potato salad recipe, and this one is mine! The dressing is the perfect combination of tangy vinegar and creamy mayonnaise, with the zip of coarse ground Dijon mustard thrown in for good measure. The peas add great flavor and color, and the red potatoes have a great firm texture with no peeling required. In a word? Perfection.

Best of all, the whole recipe takes just a few simple ingredients and comes together fast. Add this to the menu at your next barbecue and watch this often-forgotten side dish finally get the attention it deserves!

Here is what you need:

2 pounds red potatoes

1 bag frozen peas, rinsed and drained

1 bunch green onions

1/2 cup mayonnaise

1 1/2 tablespoon brown mustard

1 tablespoon cider vinegar

1 1/2 teaspoon seasoned salt

1/4 teaspoon black pepper

2 tablespoons fresh parsley (optional)

1 teaspoon mustard seed (optional)

Step 1: Chop green onions; set aside. Chop parsley, if using; set aside. Place potatoes in large pot; cover with heavily salted water. Bring water to boil and boil for 15 minutes. Drain potatoes and set aside until cooled.

Step 2: In small bowl, mix mayonnaise, mustard, vinegar, salt, pepper, green onions, parsley, and mustard seed; set aside.

Step 3: Cut potatoes into bite-sized chunks.

Step 4: In large bowl, mix potatoes, peas, and mayonnaise mixture; refrigerate 1-2 hours, until chilled.

Print This!

Recipe: Best Ever Homemade Potato Salad

Summary: Nothing says summer like a homemade potato salad. This recipe is my all time favorite!

Ingredients

2 pounds red potatoes

1 bag frozen peas,rinsed and drained

1 bunch green onions

1/2 cup mayonnaise

1 1/2 tablespoon brown mustard

1 tablespoon cider vinegar

1 1/2 teaspoon seasoned salt

1/4 teaspoon black pepper

2 tablespoons fresh parsley (optional)

1 teaspoon mustard seed (optional)

Instructions

Chop green onions; set aside. Chop parsley, if using; set aside. Place potatoes in large pot; cover with heavily salted water. Bring water to boil and boil for 15 minutes. Drain potatoes and set aside until cooled.

In small bowl, mix mayonnaise, mustard, vinegar, salt, pepper, green onions, parsley, and mustard seed; set aside.

Cut potatoes into bite-sized chunks.

In large bowl, mix potatoes, peas, and mayonnaise mixture; refrigerate 1-2 hours, until chilled.

Preparation time: 15 minutes

Cooking time: 15 minutes

Chill time: 1-2 hours

Number of servings (yield): 16

* * *

What’s your favorite way to prepare potato salad?

Pin It

The post Best Ever Homemade Potato Salad appeared first on Living Well Spending Less®.

July 1, 2014

5 Ways to Lavish Love on Your Kids

Today I am happy to introduce you to my friend Emily Wierenga. I first met Emily last October, and in the months since I have been so blessed and inspired by her writing about faith, parenting, and life after anorexia. Her brand new memoir, Atlas Girl, launches today, and I can’t say enough good things about it! It is a very moving look at Emily’s own experience in traveling the world in search of herself but finally finding home in the last place she thought to look. I was deeply touched by her story and I’m sure you will be too. Get it in bookstores, starting today, or order it online.

Today I am happy to introduce you to my friend Emily Wierenga. I first met Emily last October, and in the months since I have been so blessed and inspired by her writing about faith, parenting, and life after anorexia. Her brand new memoir, Atlas Girl, launches today, and I can’t say enough good things about it! It is a very moving look at Emily’s own experience in traveling the world in search of herself but finally finding home in the last place she thought to look. I was deeply touched by her story and I’m sure you will be too. Get it in bookstores, starting today, or order it online.

* * *

This is a guest post from Emily Wierenga.

I grew up in a mushroom cut and second-hand clothes. I was a pastor’s kid whose father’s salary flirted with the poverty line. Mum would visit “Sally Ann” or the Salvation Army once a month and I remember dreading what she would find because it never fit quite right and it wasn’t what the other kids were wearing. I remember the day our van window shattered on the way to church because it was minus forty in northern Canada, the four of us kids in the back shivering and Dad duct-taping cardboard across the door to keep out the drafts. Dad would gather us in the living room and do a budget meeting with us, telling us how much we could spend on heat, water and food, and he installed a flow limiter in the shower to cut down the amount of water we used. We had dump days when we’d go with Dad and root for things of value. Our first television was found in a heap of trash.

And on the way home from church some Sundays we’d stop and get day-old donuts. And those donuts were delicious.

But they didn’t fill the hole.

The one carved deep in my chest, the one that ached to know I was worth purchasing something new for. Something so new it had that smell, the never-been-opened-before smell. I wanted to know I was worth spending water and heat on—I remember being so cold in the winters and begging Dad to turn up the thermostat, but he told me to put on a sweater, and while he was just trying to be consistent and frugal with a tight preacher’s budget, I heard that I wasn’t worth it.

When you’re only ever given other people’s garbage, you begin to feel like other people’s garbage.

And I remember sitting on my bed one day in the basement, making a list of all the things I would do differently when I was a parent, like having a warm house, using Bounce sheets instead of having stiff towels from hanging them on the line—not appreciating that we even had a house, that we had towels, not realizing that the bed I slept on was a gift and the clothes I wore too, second-hand as they were. It wouldn’t be until years later when I visited Uganda and talked with mothers about their dreams, and they told me they longed to “have a mattress of their own, and a mop, and a bucket,” that I realized I knew nothing of poverty.

But the problem wasn’t so much a lack of things, as an association with my worth to it.

I believe in being frugal. I believe in using money wisely and in being selfless. I believe in thrift stores and in day-old donuts.

But I also believe in generosity. The Bible says God loves a cheerful giver, and this doesn’t just mean giving to the church or to charities. It means giving to yourself and to your family. And it doesn’t just mean spending money. It means lavishing time, affection and laughter—as well as money—and not all the time, but enough to tell them they matter.

I knew my parents loved me, but I didn’t feel it.

In addition to not having much money, time and affection were tight. Dad would spend most days in his office and evenings visiting parishioners, and Mum would be so busy mending and baking and homeschooling that there was no time for just being held. Neither had been complimented much growing up—my mother doesn’t remember being told “I love you”—so they in turn didn’t know how to extend affirmation to their kids.

So how do we do it, friends? How do we lavish on our children, without creating a sense of entitlement? How do we teach our kids their true worth—priceless—without spoiling them? How do we balance frugality and wisdom with generosity, not only with others but with our own family?

Here are five tips which guide me as I raise my two sons—perhaps they’ll help you too?

1. Let your children be children.

That is, don’t worry them with money problems; don’t let them hear you and your husband arguing about the bills or expenses, and don’t hold monthly budget meetings. They will be faced with financial pressures soon enough. Let them be children. As far as they’re concerned, life is free.

2. Don’t be afraid to splurge on your family.

The other day I took my son Aiden to the doctor to get him tested for allergies. As a reward for being brave during the appointment, I told him I’d buy him ice cream. But then, he saw a Spiderman balloon. All thoughts of ice cream fled, as he begged for the balloon. It was $10—I thought it was a complete rip-off. But I also knew that my four-year-old was worth so much more than $10, and that I wanted him to know that. So I bought him the balloon, not because material things will satisfy our children’s souls, but because it’s good to give—both to others, and to our children.

3. Lavish affection and time.

Many parents are so busy they don’t have time or energy to lavish what really matters on their children: time and affection. More than any number of Spiderman balloons, spend an extra five minutes just holding your son or daughter, or getting down on the floor and playing Legos with them. Read them another bedtime story, and then just sit and snuggle. If your kids are older, take them on coffee dates or to the movies. You may not think they notice, but the more you spend on your children, the less they’ll hunger after material things.

4. Teach your kids financial responsibility.

When the right time comes, start giving your kids a monthly allowance and helping them to budget it, or implement a commission system for them to earn money through working. Take them to the bank, and teach them to put a percentage of their allowance in savings. Take them to church, and teach them to tithe. Budgeting is a lost art; help them to appreciate the commodity and to invest it wisely, without inspiring fear in them.

5. Spend money occasionally on yourself.

Growing up, my parents didn’t spend money on themselves. Dad would only allow himself to shower twice a week because he was very conscious (and rightly so) of conserving resources. Mum would rarely buy herself even a second-hand outfit. I truly appreciate my parents’ self-sacrifice and their desire to spend money wisely, but coupled with lack of affection and time, it created low self-esteem within their children. When you occasionally spend money on a new handbag or a haircut, or on taking a vacation with your husband, you’re giving your children permission to enjoy life as well.

We live in a love-starved, consumerist society. But we can take back money, friends, and instead use it as a gift—both for the world, and for our families.

Emily T. Wierenga is an award-winning journalist, artist, and the author of five books.

Her first novel, A Promise in Pieces, is releasing Spring of 2014, and her memoir, Atlas Girl: Finding Home in the Last Place I thought to Look (Baker Books) is releasing July 1, 2014. Emily is also a blogger with World Help, and in January of 2014 traveled to Rwanda and Uganda on a bloggers’ trip.

* * *

How do you lavish love on your kids without spoiling them?

Pin It

The post 5 Ways to Lavish Love on Your Kids appeared first on Living Well Spending Less®.