Steve Bull's Blog, page 1264

November 5, 2017

Saudis Call Missile Attack “Blatant Act Of Aggression” By Iran, “Could Be Considered Act Of War”

War is coming…

This weekend’s chaos in the middle east just got considerably more serious.

Yesterday we detailed reports that the Saudis intercepted a ballistic missile over the nation’s capital Riyadh…

At the time, Al Jazeera reported that Yemen’s Houthi rebels claimed responsibility for the attack, saying they launched the Yemeni-made, long-range ballistic missile Burqan 2-H (with a range of 500 kilometers) from the Saudi-Yemeni border before being intercepted.

But tonight, according to a statement from the Saudi coailition carried by the state-run Saudi Press Agency, the missile that targeted Riyadh has been called “a direct military aggresion” by Iran against Sauid Arabia, that “could rise to be considered an act of war.” Furthermore, the Saudi-led coalition has closed all Yemen’s land, sea and air ports after missile targeted Riyadh.

Following on what the Coalition had previously announced regarding the ballistic missiles launched by the Iranian-controlled Houthi militias from within Yemeni territory that targeted the Kingdom of Saudi Arabia, the most recent of which was the flagrant military aggression by the Iranian-controlled Houthi militias which targeted the city of Riyadh on November 11, 2017 (Corresponding to 15/2/1439 Hijri) using a ballistic missile with a range of more than 900 Km.

And, after the thorough examination of the debris of these missiles, including the missile launched on July 22, 2017 (Corresponding to 28/10/1438 Hijri) by experts in military technology, has confirmed the role of Iran’s regime in manufacturing these missiles and smuggling them to the Houthi militias in Yemen for the purpose of attacking the Kingdom, its people, and vital interests.

…click on the above link to read the rest of the article…

The $200 Trillion Question

Perhaps the most remarkable trend in global macroeconomics over the past two decades has been the stunning drop in the volatility of economic growth. In the United States, for example, quarterly output volatility has fallen by more than half since the mid-1980’s. Obviously, moderation in output movements did not occur everywhere simultaneously. Volatility in Asia began to fall only after the financial crisis of the late 1990’s. In Japan and Latin America, volatility dropped in a meaningful way only in the current decade. But by now, the decline has become nearly universal, with huge implications for global asset markets.

Indeed, the main question for 2007 is whether macroeconomic volatility will continue to decline, fueling another spectacular year for markets and housing, or start to rise again, perhaps due to growing geopolitical tensions. I lean slightly toward the optimistic scenario, but investors and policymakers alike need to understand the ramifications of a return to more normal volatility levels.

Investors, especially, need to recognize that even if broader positive trends in globalization and technological progress continue, a rise in macroeconomic volatility could still produce a massive fall in asset prices. Indeed, the massive equity and housing price increases of the past dozen or so years probably owe as much to greater macroeconomic stability as to any other factor. As output and consumption become more stable, investors do not demand as large a risk premium. The lower the price of risk, the higher the price of risky assets.

Consider this. If you agree with the many pundits who say stock prices have gone too high, and are much more likely to fall than to rise further, you may be right—but not if macroeconomic risk continues to drain from the system.

…click on the above link to read the rest of the article…

Make No Mistake: “Tensions Are Heating Up” With North Korea

Unprecedented actions occurred over the last two weeks as the tensions between the United States and North Korea remain at an all-time high. The North Koreans (as reported by Reuters and AP news) have been conducting mass evacuation drills for cities and towns. These drills have been augmented with “blackout” drills, where lights are either cut or masked in homes and businesses to make them less readily visible.

U.S. Secretary of defense Mattis has announced that President Trump (who travels with the “football,” the apparatus with the nuclear launch codes) will not be limited by Congress and will act on his (the President’s) executive authority to conduct a first-strike against North Korea. Mattis went on to say that such would occur if North Korea had either launched, or if a launch was imminent against the U.S. Although these statements were not ambiguous, the latter is certainly subjective: after a nuclear war or strike, how would it be verified that a launch by North Korea had been imminent?

A new Cold War has taken shape and materialized over the course of the past several years. The Mainstream Media (MSM) is quick to “paint” one side as the “hero/good guy” and the other as the “villain.” In this case the villain in journalistic obfuscation (the piece is “journalistic” and not objective journalism) is the The Sun. Here are two excerpts. You make the call, with the underlined words being the “sticking point”:

“President Donald Trump sent a nuclear-capable B-2 stealth bomber from Whiteman Air Force Base in Missouri on a long-range mission to the Pacific this weekend.”

Here’s number two:

…click on the above link to read the rest of the article…

Financial Storm Clouds Gather Over Italy

Wishful thinking may not be enough.

The financial markets have been exceedingly calm in Italy of late. At the end of October the government was able to sell €2.5 billion of 10-year debt at auction at a yield of 1.86%, the lowest since last December — an incredible feat for a country that four months ago witnessed a major bank bailout and two bank resolutions, and that has so much public debt that it spends €70 billion a year to service it, the world’s third-highest.

And there’s the ECB’s recent decision to slash its bond buying from roughly €60 billion a month to €30 billion as of Jan 1, 2018. Then there’s the over €432 billion of Target 2 debt the government owes the ECB, the growing likelihood of political instability as elections approach in 2018, the recent referendums for greater fiscal and political autonomy in Lombardy and Veneto and serious unresolved issues in the banking sector.

Monte dei Paschi di Siena may still be alive as a bank, but it’s not out of the woods. Last week its stock resumed trading after ten months of being suspended from Italy’s benchmark index, the FTSE MBE. Shares opened on Wednesday at €4.10, then rose 28% to €5.26. But it didn’t stick. On Friday, shares closed at €4.58.

It’s a far cry from the €6.49 a share the Italian government paid in August when it injected €3.85 billion into the bank to keep it alive. It spent another €1.5 billion shielding some of the bank’s junior bondholders, whose debt was converted into equity. As part of the rescue, the Tuscan bank was forced to present a plan to cut 5,500 jobs and close 600 branches until 2021, in addition to transferring 28,600 million euros in unproductive loans and divesting non-strategic assets. Investors clearly have their doubts.

…click on the above link to read the rest of the article…

Eric Peters: “The Next Market Cleanse Will Be Sharp, Deep, Fast And Feel Like The End Of The World”

The latest weekend note by Eric Peters, CIO of One River Asset Management, is his latest masterpiece in lyrical, stream of consciousness, financial analysis, and can be broadly divided into to broad parts: his latest take on financial markets analyzing the build up of disequilibrium which eventually culminates with discrete “flushes” that reset the system; how bold investors inevitably give up on financial sense and logic long (or just) before said flush takes place, and what this upcoming Minsky Moment could mean for the future. We have excerpted from this section in the current note, as for the remainder of his weekend observations – which deal with tectonic macro and geopolitical shifts – we will follow up in a subsequent post.

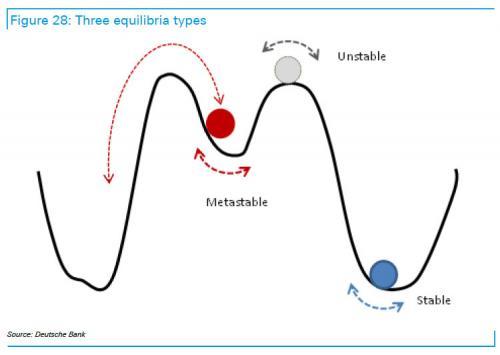

Anecdote: “The most common example is a ball sitting atop a hill,” she said, polished accent, hint of condescension. “Locally stable, but one nudge and it’s all over.”

She drove terribly fast, discussing Minsky Moments; the idea that persistent stability breeds instability. “Naturally each cycle is different in key respects, and that’s because you’re far better at preventing past problems from recurring than new ones from arising.”

I smiled, amused, insulted. “Despite knowing this all too well, you humans remain inexplicably fixated on the rearview mirror. And this blinds you to all manner of hazards ahead.”

She initiated a few perfect turns of the Tesla, dodging a squirrel or two, tumbling, unhurt. “The source of instability in this cycle is your dissatisfaction with ultra-low bond yields.” $8trln of sovereign debt carries a negative yield, still our central bankers buy. “You should logically respond to this historic rise in valuations across asset classes with a reduction in your expectations for future returns.” I nodded. “But instead you respond with indignation.”

…click on the above link to read the rest of the article…

Saudis Intercept Ballistic Missile Over Capital Riyadh

Just hours after the previously reported unexpected, and shocking resignation of Lebanon’s pro-Saudi prime minister Saad al-Hariri, Saudi defense forces said they had intercepted a ballistic missile over the capital Riyadh, which was fired from Yemen. According to Yemen’s Houthi-controlled Defense Ministry, the Yemeni Air Force targeted King Khalid International Airport in the Saudi capital of Riyadh on Saturday with a ballistic missile.

Al-Arabiya reported that the missile was intercepted over north-east Riyadh, Saudi Arabia’s Ministry of Defense said in a statement, even as Yemen’s Defense Ministry said the missile attack “shook the Saudi capital” and the operation was successful.

The Riyadh-based newspaper Al Riyadh released a video on its Twitter account showing the interception of a missile.

عادل بن عارف @abumiftah

Remnants of the intercepted #ballisticmissile landed near King Khalid International Airport in #Riyadh, #SaudiArabia

1:15 PM – Nov 4, 2017

Photos, allegedly pieces of the intercepted missile, have also emerged on the web.

Miriam Goldman Eps ✔@Miriam411

Photos (via @NajranToday) reportedly showing pieces of a ballistic missile fired from #Yemen and intercepted over northern #Riyadh

1:26 PM – Nov 4, 2017

Houthis are Shi’ite militants that have been involved in the Yemeni civil war that started when the Saudi-led coalition launched its air campaign in the country in 2015. They have been fighting against the government headed by President Abd Rabbuh Mansur Hadi.

..click on the above link to read the rest of the article…

November 4, 2017

100+ Respected Academics Slam EU in Letter to Juncker Citing “Rule of Law”

On Thursday, over 100 well-respected academics slammed the EU in a letter sent a letter to European Commission president Jean-Claude Juncker and European Council president Donald Tusk. The academics cited the rule of law.

The open letter , signed by highly-respected academics and members of the European Parliament, cited Spain’s “undisputable abuse of power”.

We are deeply concerned that the EU’s governing bodies are condoning the systematic violation of the Rule of Law in Spain, in particular regarding the Spanish central authorities’ approach to the 1 October referendum on Catalan independence. We do not take political sides on the substance of the dispute on territorial sovereignty and we are cognizant of procedural deficiencies in the organization of the referendum. Our concern is with the Rule of Law as practised by an EU Member State.

The Spanish government has justified its actions on grounds of upholding or restoring the constitutional order.

The Tribunal has violated Constitutional provisions on freedom of peaceful assembly and of speech – the two principles which are embodied by referendums and parliamentary deliberations irrespective of their subject matter. Without interfering in Spanish constitutional disputes or in Spain’s penal code, we note that it is a travesty of justice to enforce one constitutional provision by violating fundamental rights. Thus, the Tribunal’s judgments and the Spanish government’s actions for which these judgments provided a legal basis violate both the spirit and letter of the Rule of Law.

In the days preceding the referendum, the Spanish authorities undertook a series of repressive actions against civil servants, MPS, mayors, media, companies and citizens. The shutdown of Internet and other telecom networks during and after the referendum campaign had severe consequences on exercising freedom of expression.

…click on the above link to read the rest of the article…

The Great Deficit Ruse

Your intuition is right: tax cuts are good and tax increases are bad.

If your profligate friend blew his budget on liquor, you might feel bad for him. But it’s unlikely that you would be willing to fork over money to cover his mistake. He needs to figure it out. And maybe, then, he will learn a lesson for the future.

This is exactly how I feel about all this whining about the federal deficit. I didn’t cause it. It’s not my problem. I should not be forced to pay for it. I don’t work every day in order to earn money to pay for other people’s problems.

It’s bad citizenship always to be willing to pay the government’s debts.

Admit that you agree. You don’t really care about the deficit. Not really. It’s an abstraction to you. More crucially, the deficit is not your fault. You are not responsible for paying for one dime of the federal debt. No portion of your justly made income should be taken to cover the fiscal irresponsibility of anyone except perhaps your children.Actually, it’s very bad parenting always to be ready to pay the kids’ debts. It’s similarly bad citizenship always to be willing to pay the government’s debts.

All this media talk–and it is incessant and ubiquitous–about how the deficit is way more important than your property rights completely disregards the realities of politics. Namely: politicians and bureaucrats desperately need an excuse to take your money. Making you pay for their past mistakes is as good an excuse as any.

Your intuition is right: tax cuts are good and tax increases are bad.

But hold on: doesn’t that just shove the burden of debt onto the next generation? My answer: not if the next generation is similarly unwilling to cough up taxes to pay for the dumb things government does.

…click on the above link to read the rest of the article…

Fossil Fuel Dollars Flow into Local Elections Threatening Development in the West

This election season, cities in Colorado and Washington are proving to be battlegrounds for community groups pushing to locally restrict oil, gas, and coal development. And in both places, the fossil fuel industry has been pouring hundreds of thousands of dollars into making sure that doesn’t happen.

In Colorado, the drilling boom that accompanied hydraulic fracturing (“fracking”) is coming under increasing scrutiny, especially in the wake of several lethal accidents in frontline communities. On November 7, Broomfield, a large town between Denver and Boulder, will vote on a charter amendment that would require oil and gas development to safeguard the environment and “not adversely impact the health, safety, and welfare of Broomfield’s residents.”

The citizen-initiated charter amendment, Question 301, reiterates a Colorado Court of Appeals ruling from earlier this year, which some say changes the mandate of the state regulatory commission in charge of oil and gas. Following a lawsuit by Colorado teen Xiuhtezcatl Martinez, the court ruled in March that safeguarding public health and the environment was indeed “a condition that must be fulfilled” prior to oil and gas drilling.

This decision was a stark divergence from the Colorado Oil and Gas Conservation Commission’s long-held stance that the commission only had to “balance” health and the environment, with its mandate to facilitate fossil fuel extraction.

A campaign to defeat Broomfield’s charter amendment has received over $344,000 in contributions from the industry. The Colorado Petroleum Council — a local chapter of the American Petroleum Institute — is involved with a suite of campaign activities against it, including phone outreach, direct mailing, polling, data, digital outreach, and online advertising.

Supporters of Question 301, meanwhile, have so far raised about $7,000.

…click on the above link to read the rest of the article…

Weekly Commentary: End of an Era

Of the diverse strains of inflation, asset inflation is by far the most dangerous. A bout of consumer price inflation would be generally recognized as problematic and rectified through a tightening of monetary conditions. On the other hand, asset price inflation is both celebrated and venerated. There is simply no constituency calling for a tightening of conditions to ward off the deleterious effects of rising asset prices, Bubbles and attendant economic maladjustment. And as we’ve witnessed, the bigger the Bubble the more powerful the constituencies that rationalize, justify and promote Bubble excess.

About one year ago, I was expecting a securities markets sell-off in the event of an unexpected Donald Trump win. A Trump presidency would create disruption, upheaval and major uncertainties – political, geopolitical, economic and social. Instead of a fall, the markets experienced a short squeeze and unwind of hedges. Over-liquefied markets and a powerful inflationary bias throughout global securities markets won the day – and the winning runs unabated.

We’ve come a long way since 1992 and James Carville’s “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” New age central banking has pacified bond markets and eradicated the vigilantes. These days it’s the great equities bull market as all-powerful intimidator.

The President admitted his surprise in winning the election. I suspect he and his team were astounded by the post-election market rally. I’ve always held the view that prolonged bull markets foster a portentous concentration of power – not only in the financial markets but within the financial system more generally.

…click on the above link to read the rest of the article…