Steve Bull's Blog, page 1267

November 2, 2017

How Afghans View the Endless US War

To understand why the 16-year-old U.S. war in Afghanistan continues to fail requires a look from the ground where Afghans live and suffer, a plight breeding strong opposition to the U.S. presence, explains Kathy Kelly.

On a recent Friday at the Afghan Peace Volunteers‘ (APV) Borderfree Center, here in Kabul, 30 mothers sat cross-legged along the walls of a large meeting room. Masoumah, who co-coordinates the Center’s “Street Kids School” project, had invited the mothers to a parents meeting. Burka-clad women who wore the veil over their faces looked identical to me, but Masoumah called each mother by name, inviting the mothers, one by one, to speak about difficulties they faced.

Afghan children await school supplies from Allied forces at Sozo School in Kabul. (French navy photo by Master Petty Officer Valverde)

From inside the netted opening of a burka, we heard soft voices and, sometimes, sheer despair. Others who weren’t wearing burkas also spoke gravely. Their eyes expressed pain and misery, and some quietly wept. Often a woman’s voice would break, and she would have to pause before she could continue:

“I have debts that I cannot pay,” whispered the first woman.

“My children and I are always moving from place to place. I don’t know what will happen.”

“I am afraid we will die in an explosion.”

“My husband is paralyzed and cannot work. We have no money for food, for fuel.”

“My husband is old and sick. We have no medicine.”

“I cannot feed my children.”

“How will we live through the winter?”

“I have pains throughout my whole body.”

“I feel hopeless.”

“I feel depressed, and I am always worried.”

“I feel that I’m losing my mind.”

…click on the above link to read the rest of the article…

‘Divest The Globe’ protests urge banks to cut ties with fossil fuels

On Monday, activists in Washington, D.C. demonstrated outside the John A. Wilson Building — home to both the mayor and city council. (350 DC)

While banking executives from over 90 of the world’s largest financial institutions gathered in Sao Paulo, Brazil on Monday for the start of a three-day meeting on the environmental and social impacts of their infrastructure investments, activists in at least 15 U.S. states and several other countries staged protests under the banner of “Divest The Globe.” Their message to the banks was simple: cut ties with fossil fuel companies, or face major divestment campaigns.

The demonstrations unfolded in over 50 cities — including Seattle, where at least six people were arrested during a protest at a Chase bank — and are being called the largest ever protest against banks’ investments in fossil fuels. As the meeting continues in Sao Paolo over the next two days, solidarity protests are expected in more cities across Europe, Asia and Africa.

The group largely responsible for organizing these Divest The Globe actions is the Seattle-based, indigenous-led divestment campaign Mazaska Talks, which means “money talks” in Lakota. They chose this gathering of bankers as their target because it’s the annual meeting of the Equator Principles Association, which provides guidelines, or so-called Equator Principles, “for determining, assessing and managing environmental and social risk in projects.”

According to organizer Jackie Fielder, activists want to ensure the association gets its “Equator Principles in line with the Paris Agreement, as well as internationally-recognized standards on indigenous rights upheld in the United Nations Declaration on the Rights of Indigenous People.” Fielder went on to cite “the spirit of the Standing Rock resistance camps” as inspiration for the Divest The Globe protests, saying it “really raised the consciousness of people to think about where their money has been going when it’s sitting in a bank.”

…click on the above link to read the rest of the article…

Is The U.S. Solar Boom In Jeopardy?

The U.S. solar industry has surged in recent years, accounting for the largest source of new electric capacity in the past year, with plenty of room to grow. However, the Trump administration is weighing a trade tariff that could seriously curtail the explosive growth figures for U.S. solar.

On Tuesday, the U.S. International Trade Commission (ITC) recommended a 35 percent tariff on imported solar panels in response to a complaint from a U.S.-based solar manufacturer over cheap imported panels. The trade case has been cited by the solar industry as one of the most significant dangers to its otherwise bright future, labeling potential tariffs an “existential threat.” Many solar project developers use cheaper panels imported from places like China, and trade barriers could upend the economics of new solar projects.

But all is not lost. The 35 percent tariff proposed by the ITC is actually less than what Suniva Inc., the company lodging the complaint, had asked for. Suniva filed for bankruptcy earlier this year, blaming a wave of cheap imported panels for its demise. Suniva wanted tariffs on the order of 32 cents per watt, which is roughly equivalent to the full price for a panel on a per-watt basis. The proposed 35 percent tariff would translate into about 10 to 11 cents per watt, about a third of the 32 cents Suniva wanted.

As a result, the solar industry is breathing a sigh of relief, having potentially dodged a massive bullet. “That’s below the price that people have been hoarding panels for,” Jeffrey Osborne, an analyst at Cowen & Co., told Bloomberg. “On the demand side, jobs cuts won’t be as bad as feared, but on the manufacturing side, job creation won’t be as big. This would have a limited effect.”

…click on the above link to read the rest of the article…

What’s Driving Social Discord: Russian Social Media Meddling or Soaring Wealth/Power Inequality?

The nation’s elites are desperate to misdirect us from the financial and power dividethat has enriched and empowered them at the expense of the unprotected many.

There are two competing explanatory narratives battling for mind-share in the U.S.:

There are two competing explanatory narratives battling for mind-share in the U.S.:

1. The nation’s social discord is the direct result of Russian social media meddling– what I call the Boris and Natasha Narrative of evil Russian masterminds controlling a vast conspiracy of social media advertising, fake-news outlets and trolls that have created artificial divides in the body politic, or exacerbated minor cracks into chasms.

2. The nation’s social discord is the direct result of soaring wealth/power inequality– the vast expansion of the wealth and power of the nation’s financial elites and their protected class of technocrat enablers and enforcers (the few) at the expense of the unprotected many.

Core to this narrative is the view that the elites and technocrats have engaged in a massive, coordinated official/media propaganda campaign of fake newsaimed at persuading the bottom 95% that their prosperity and financial security are expanding when the reality is they have lost ground they will never be able to recover.

This propaganda campaign includes official (i.e. gamed/distorted) statistics such as unemployment and inflation, a reliance on the manipulated stock market to “signal widespread prosperity” and a steady drumbeat of corporate media coverage promoting the Boris and Natasha Narrative as the primary source of all our troubles.

The reality the elites must mask is that the few (the elites) have benefited at the expense of the many. The rising tide of financialization, globalization and neofeudal-neocolonial neoliberalism has not raised all boats; the yachts have floated higher while the rowboats have either sunk or are leaking badly.

The Boris and Natasha Narrative is the primary propaganda tool of the ruling elites and their technocrat/ corporate media enablers.

…click on the above link to read the rest of the article…

Dear Mario Draghi: About Your Victory Over Deflation Speech in March

In March, ECB President Mario Draghi declared victory over deflation. Let’s take a look at Eurozone inflation since his victory speech.

On March 10, 2017, I reported ECB Declares Victory Over Deflation: Hallelujah!

My lead-in comment was “ECB President Mario Draghi Declares Victory Over Deflation. That’s much like shouting hallelujah when you miss the game-winning field goal.”

In the Eurozone, consumer price inflation is measured by the Harmonised Index of Consumer Prices (HICP). Harmonized means all the countries in the Eurozone use the same methodology. HICP is essentially the same as the CPI in the US.

Core HICP excludes food, energy, alcohol, and tobacco. In the US, core CPI excludes food and energy.

It’s been seven months since Draghi’s victory speech. Let’s investigate details from the October Fash Estimate of Eurozone HICP.

Year-over-year Inflation in services is down from 1.5% to 1.2%. The core HICP is down from 1.1% to 0.9%. Thus most of the decline in the core is due to a drop in the rate of inflation in services.

Mario Draghi, like his counterparts at the Fed, are not pleased with such results. Like all economic illiterates, the Central Banks are happiest when your money decreases in value every month.

Meanwhile, consumers are happy to see prices decline. It takes years of brainwashing to believe rising prices are a good thing.

Washington D.C. is Swarming With Unaccountable Parasites

In theory, Americans should be proud of their national capital and all the important work that gets done there. In theory.

In reality, our nation’s capital is an utter cesspool of self-serving, unethical and unaccountable parasites. We all know it and, even worse, it’s probably a hundred times more grotesque than we can imagine. A distressingly high number of people attracted to this swamp don’t go there to do good public work or help the American people. They go in order to enrich themselves at our expense.

A particularly degenerate strain of D.C. cretin is the lobbyist. These people swarm into Washington to influence the purse-strings of the U.S. government and funnel as much American treasure as possible in the direction of their clients, including Wall Street oligarchs, defense contractors and barbaric foreign monarchies like Saudi Arabia. We’re told that Washington D.C. exists specifically to protect and benefit the American public, yet the average citizen is the one constituency which has virtually no actual representation there. Helping the vulnerable doesn’t pay very well.

Over the past couple of days, I’ve be reading political stories describing the “beltway buzz” in the aftermath of the Paul Manafort and Rick Gates indictments. I’ve found these articles quite instructive. The common theme is that hordes of the shady crooks who operate in D.C., and add absolutely zero value to society, are panicking that their gravy train of legalized corruption may be coming to an end.

To see what I mean, let’s examine two recently published articles. First from Politico:

Washington lobbyists who represent foreign powers have taken comfort for decades in the fact that the Justice Department rarely goes after them for potentially breaking the law. That all changed on Monday.

…click on the above link to read the rest of the article…

November 1, 2017

Deutsche Asks A Stunning Question: “Is This The Beginning Of The End Of Fiat Money?”

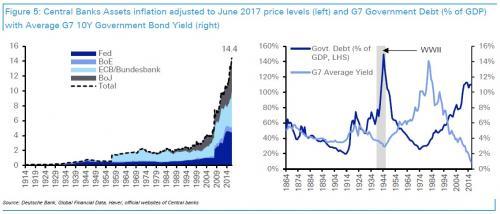

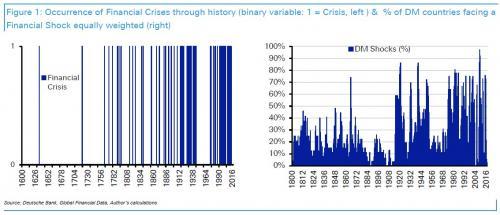

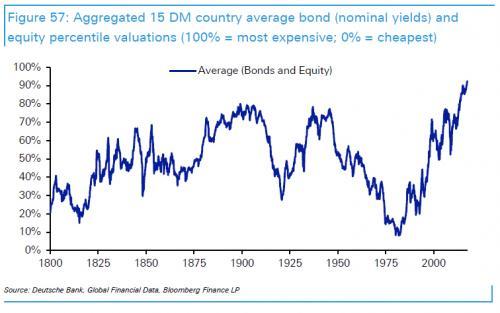

One month ago, Deutsche Bank’s unorthodox credit analyst, Jim Reid published a phenomenal report, one which just a few years ago would have been anathema, as it dealt with two formerly taboo topics: is a financial crisis coming (yes), and what are the catalysts that have led the world to its current pre-crisis state, to which Reid had three simple answers: central banks, financial bubbles and record amounts of debt.

Just as striking was Reid’s nuanced observation that it was the modern fiat system itself that has encouraged and perpetuated the current boom-bust cycle, and was itself in jeopardy when the next crash hits:

We think the final break with precious metal currency systems from the early 1970s (after centuries of adhering to such regimes) and to a fiat currency world has encouraged budget deficits, rising debts, huge credit creation, ultra loose monetary policy, global build-up of imbalances, financial deregulation and more unstable markets.

The various breaks with gold based currencies over the last century or so has correlated well with our financial shocks/crises indicator. It shows that you are more likely to see crises/shocks when we break from hard currency systems. Some of the devaluation to Gold has been mindboggling over the last 100 years.

The implications of this allegation were tremendous, especially coming from a reputable professional who works in a company which only exists thanks to the current fiat regime: after all, much has been said about Deutsche Bank’s tens of trillions in gross liabilities, mostly in the form of various rate derivatives, backed by hundreds of billions in deposits and, implicitly, the backstop of the German government as Deutsche Bank discovered the hard way one year ago.

…click on the above link to read the rest of the article…

The Changing Geopolitics of Energy

In 2008, US policymakers worried that increasing dependence on energy imports, together with rising prices, would severely constrain American geopolitical influence. Instead, the revolution in shale energy has brought about a tectonic shift in international relations, one that promises to boost US global power in the long term.

TOKYO – In 2008, when the United States’ National Intelligence Council (NIC) published its volume Global Trends 2025, a key prediction was tighter energy competition. Chinese demand was growing, and non-OPEC sources like the North Sea were being depleted. After two decades of low and relatively stable prices, oil prices had soared to more than $100 per barrel in 2006. Many experts spoke of “peak oil” – the idea that reserves had “topped off” – and anticipated that production would become concentrated in the low-cost but unstable Middle East, where even Saudi Arabia was thought to be fully explored, with no more giant fields likely to be found.

The US was regarded as increasingly dependent on energy imports, and this, together with rising prices, was seen as a major limit on American geopolitical influence. Power had shifted to the producers.

The NIC analysts did not neglect the possibility of a technological surprise, but they focused on the wrong technology. Emphasizing the potential of renewables such as solar, wind, and hydro, they missed the main act.

The real technological breakthrough was the shale-energy revolution. While horizontal drilling and hydraulic fracturing are not new, their pioneering application to shale rock was. By 2015, more than half of all the natural gas produced in the US came from shale.

The shale boom has propelled the US from being an energy importer to an energy exporter. The US Energy Department estimates that the country has 25 trillion cubic meters of technically recoverable shale gas, which, when combined with other oil and gas resources, could last for two centuries.

…click on the above link to read the rest of the article…

Another Gulf Crisis: Dinar Devaluation Looms As Bahrain Begs Neighbors For Bailout

Despite the recent rise in oil prices, all is not well among the allies in the Gulf. The ‘pegged-to-the-dollar’ Bharaini Dinar has tumbled in the last few days as Bloomberg reports the nation has asked Gulf Arab allies for financial assistance as it seeks to replenish its foreign-exchange reserves and avert a currency devaluation – which could spread contagiously through MidEast markets.

Bloomber notes that the slump in oil prices has battered the six-member Gulf Cooperation Council, at times raising questions over whether a dollar peg seen as a bedrock for economic stability for more than three decades was sustainable. And while bets against the region’s currencies have subsided this year, a devaluation of a GCC member would risk shifting the attention to others. Gulf central banks, including Bahrain’s, have repeatedly brushed aside talk of abandoning their exchange-rate regimes.

But Bahrain has seen its central bank’s foreign reserves collapse over 75% from 2014 highs as they have defended the currency peg.

And so, as Bloomberg reports, according to people with knowledge of the talks, Bahrain has asked for a bailout.

The request was made to Saudi Arabia and the United Arab Emirates, two of the people said.

A third person said Kuwait was also asked.

The countries responded by requesting the island kingdom do more to bring its finances under control in return for the money, the people said on condition of anonymity because the discussions were private.

The talks are at an early stage, one person said.

It appears the FX markets are not convinced as the Dinar tumbled…

The IMF estimates that Bahrain needs oil prices at $99 a barrel to balance its budget this year, compared with $73.1 a barrel for Saudi Arabia, which is overhauling its economy.

…click on the above link to read the rest of the article…

Meet Monsanto’s Other Herbicide Problem…

http://www.zerohedge.com/news/2017-11-01/meet-monsantos-other-herbicide-problemEarlier this year we wrote about a series of court documents that were unsealed and seemingly revealed a startling effort on the part of both Monsanto and the Environmental Protection Agency (EPA) to work in concert to kill and/or discredit independent, albeit inconvenient, cancer research conducted by the World Health Organization’s International Agency for Research on Cancer (IARC) related to their key herbicidal product, RoundUp. The efforts to kill the research came even as Monsanto’s own lead toxicologist, Donna Farmer, admitted that she “cannot say that Roundup does not cause cancer” because “[w]e [Monsanto] have not done the carcinogenicity studies with Roundup” (see: Monsanto Colluded With EPA, Was Unable To Prove Roundup Does Not Cause Cancer, Unsealed Court Docs Reveal).

But, as points out today, RoundUp isn’t the only Monsanto herbicide causing outrage in the ag community these days as state regulators all across the country say they’re being flooded with reports from farmers that Dicamba, Monsanto’s other herbicide, is increasingly becoming airborne and killing crops far away from the fields where they were actually applied.

U.S. farmers have overwhelmed state governments with thousands of complaints about crop damage linked to new versions of weed killers, threatening future sales by manufacturers Monsanto Co (MON.N) and BASF SE (BASFn.DE).

Monsanto is banking on weed killers using a chemical known as dicamba – and seeds engineered to resist it – to dominate soybean production in the United States, the world’s second-largest exporter.

The United States has faced a weed-killer crisis this year caused by the new formulations of dicamba-based herbicides, which farmers and weed experts say have harmed crops because they evaporate and drift away from where they are applied.

Regulators in several major soybean-growing states, including Arkansas, Missouri and Illinois, each say they received roughly four years’ worth of complaints about possible pesticide damage to crops this year due to dicamba use.

…click on the above link to read the rest of the article…