Steve Bull's Blog, page 1268

November 1, 2017

Oh Canada, Why Can’t You Shelter War Resisters?

Deb Ellis’ and Dennis Mueller’s film Peace Has No Borders tells the story of U.S. war resisters in Canada in opposition to the 2003-present war on Iraq, and the efforts of the War Resisters Support Campaign to win them the right not to be deported.

Many members of the U.S. military in recent years have deserted and moved to Canada, where they have in some cases spoken out against the U.S. war on Iraq. This film shows us a bit of some of their stories.

Jeremy Hinzman was the first.

Kimberly Rivera was a U.S. Army truck driver in Iraq who lost her belief in the lies about the war.

Patrick Hart was also in the Army. He says another soldier told him he’d pulled the hair of many Iraqi children out of the grill of his vehicle, and that one needed to simply treat kids as speed bumps. Hart wasn’t down with that.

Chuck Wiley was in the U.S. Navy for 16 years and finally objected to bombing civilian buildings, which he says — wearing his Veterans For Peace shirt — left him the choice of going to prison or leaving the United States.

The War Resisters Support Committee was founded in 2004 and grew rapidly in 2005. Resisters sought refugee status on the grounds of refusing to participate in an “illegal war.” They were denied.

Polling found that two-thirds of Canadians wanted to allow resisters to stay. The Canadian government was much more reluctant, representing — as it does — the United States government, more so than Canadian people.

Olivia Chow, MP, said that she believed anyone resisting the war on Iraq was courageous, and that Canada needed more courageous people. Chow proposed a non-binding motion, which passed through Parliament. Every member of Parliament had to choose, said Chow, to say yes to the war or yes to the courageous war resisters.

…click on the above link to read the rest of the article…

Officials Warn: Airborne Black Death Epidemic Could ‘Explode’

The bubonic plague outbreak that is taking Madagascar to its knees will more than likely last another six months. But the worst news is that the epidemic could explode anytime unleashing the sickness on the globe.

At least 128 people have been killed and more than 1,300 infected by the deadlier pneumonic strain of the medieval disease. But the oncoming rainy season could see the number of those infected explode exponentially. The rainy season poses a threat to the containment of the plague because outbreaks of this magnitude often seem to be seasonal.

The Foreign Office recently warned that the deadly outbreak is entering its most dangerous phase. Its website said that “outbreaks of plague tend to be seasonal and occur mainly during the rainy season.” The African island’s wet season officially began today and will last until the end of April, meaning the downward trend the plague had seen over the past few days, will likely turn upward again.

Because the disease can be spread easily through a cough or sneeze, experts are fearful. It would take just one infected traveler who made it to Africa’s mainland or even nearby British honeymoon paradises like Mauritius, the Maldives or the Seychelles to spread the disease globally. The Seychelles is currently putting anyone traveling from Madagascar into quarantine on arrival as a precaution.

The outbreak has been fueled by performing the ancient practice of Famadihana. Famadihana is the “dancing with the dead” ritual which sees locals dig up deceased relatives and dance with them before they are reburied. Just contact with a corpse who’s death was because they contracted the plague could sicken a person.

…click on the above link to read the rest of the article…

The Curious Case of Missing Defaults

THE CURIOUS CASE OF THE MISSING DEFAULTS

CAMBRIDGE – Booms and busts in international capital flows and commodity prices, as well as the vagaries of international interest rates, have long been associated with economic crises, especially – but not exclusively – in emerging markets. The “type” of crisis varies by time and place. Sometimes the “sudden stop” in capital inflows sparks a currency crash, sometimes a banking crisis, and quite often a sovereign default. Twin and triple crises are not uncommon.

The impact of these global forces on open economies, and how to manage them, has been a recurring topic of discussion among international policymakers for decades. With the prospect of the US Federal Reserve raising interest rates in the near and medium term, it is perhaps not surprising that the International Monetary Fund’s 18th Annual Research Conference, to be held on November 2-3, is devoted to the study and discussion of the global financial cycle and how it affects cross-border capital flows.

Rising international interest rates have usually been bad news for countries where the government and/or the private sector rely on external borrowing. But for many emerging markets, external conditions began to worsen around 2012, when China’s growth slowed, commodity prices plummeted, and capital flows dried up – developments that sparked a spate of currency crashes spanning nearly every region.

In my recent work with Vincent Reinhart and Christoph Trebesch, I show that over the past two centuries, this “double bust” (in commodities and capital flows) has led to a spike in sovereign defaults, usually with a lag of 1-3 years. Yet, since the peak in commodity prices and global capital flows around 2011, the incidence of sovereign defaults worldwide has risen only modestly.

…click on the above link to read the rest of the article…

100% renewable electricity in Australia

Guest post by Energy Matters commentator Roger Young. Roger is a retired businessman from Australia who is concerned by the renewables free-for-all.

Guest post by Energy Matters commentator Roger Young. Roger is a retired businessman from Australia who is concerned by the renewables free-for-all.

The object of his post, which was originally submitted as a comment, is an academic study published by Blakers et al that claims Australia can become a 100% renewables nation at relatively low cost. Roger Young questions the modelling work presented and asserts that the storage requirement has been under-estimated by a factor of 12 which naturally has a profound impact on the cost estimates.

To set the scene, here is the abstract from the Blakers study, Rogers post follows.

An hourly energy balance analysis is presented of the Australian National Electricity Market in a 100% renewable energy scenario, in which wind and photovoltaics (PV) provides about 90% of the annual electricity demand and existing hydroelectricity and biomass provides the balance. Heroic assumptions about future technology development are avoided by only including technology that is being deployed in large quantities (>10 Gigawatts per year), namely PV and wind.

Additional energy storage and stronger interconnection between regions was found to be necessary for stability. Pumped hydro energy storage (PHES) constitutes 97% of worldwide electricity storage, and is adopted in this work. Many sites for closed loop PHES storage have been found in Australia. Distribution of PV and wind over 10-100 million hectares, utilising high voltage transmission, accesses different weather systems and reduces storage requirements (and overall cost).

The additional cost of balancing renewable energy supply with demand on an hourly rather than annual basis is found to be modest: AU$25-30/MWh (US$19-23/MWh). Using 2016 prices prevailing in Australia, the levelised cost of renewable electricity (LCOE) with hourly balancing is estimated to be AU$93/MWh (US$70/MWh). LCOE is almost certain to decrease due to rapidly falling cost of wind and PV.

…click on the above link to read the rest of the article…

The Biggest Ponzi in Human History

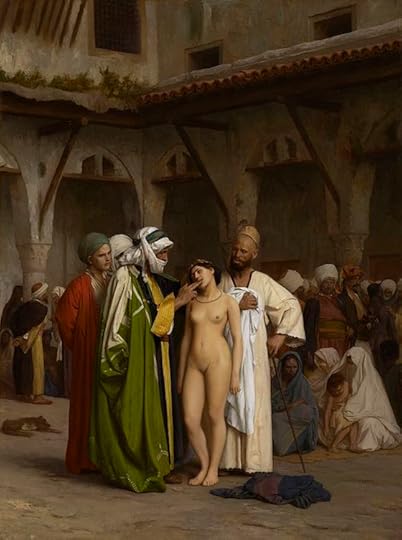

Jean-Léon Gérôme Slave market 1866Here’s the story in a nutshell: Ultra low interest rates mark a shift away from people’s wealth residing in their savings and pension plans, and into to so-called wealth residing in their homes, which are bought with ever growing levels of debt. When interest rates rise, they will lose that so-called wealth.

It is grand theft auto on an unparalleled scale, and it’s a piece of genius, because while people are getting robbed in plain daylight, they actually think they’re winning. But as I wrote back in March of this year, home sales, and bubbles, are the only thing that keeps our economies humming.

We haven’t learned a thing since March, and we haven’t learned a thing for many years. People need a place to live, and they fall for the scheme hook line and sinker. Which in a way is a good thing because the economy would have been dead without that ignorance, but at the same time it’s not because it’s a temporary relief only and the end result will be all the more painful for it.

Whatever Yellen decides as per rates, or Draghi, it doesn’t really matter anymore, this sucker’s going down something awful. This is a global issue. Housing bubbles have been blown not only in the Anglosphere, though they are strong there, many other countries have them as well, Scandinavia, Netherlands, even Germany and France. It’s what ultra low rates do.

First, here’s what I said in March:

Our Economies Run On Housing Bubbles

What we have invented to keep big banks afloat for a while longer is ultra low interest rates, NIRP, ZIRP etc. They create the illusion of not only growth, but also of wealth. They make people think a home they couldn’t have dreamt of buying not long ago now fits in their ‘budget’. That is how we get them to sign up for ever bigger mortgages. And those in turn keep our banks from falling over.

…click on the above link to read the rest of the article…

Chinese “Ghost Collateral” Scam Leads To Market “Shockwaves”, Huge Loss For Giant Commodity Trader

Back in 2014, a scandal erupted when media reports confirmed what many had previously speculated about China’s banking system: namely that much of China’s staggering loan issuance had been built (literally) upon air and that trillions in loan collateral had been “rehypothecated” between two, three or many more debtors – or never even existed – forcing banks to accept that they would never recover much if any of the pledged collateral – in most cases various commodities – if the economy were to suffer a hard-landing resulting in mass defaults. The most famous example involved collateral fraud at China’s 3rd largest port, Qingdao, where numerous borrowers were found to have “pledged” the same collateral of steel and copper to obtain funding from various banks.

For those unfamiliar there is an extensive selection of stories covering the topic, which peaked three years ago, and then quietly faded away as China did everything in its power to deflect attention from what some have said is the biggest threat facing its economy: a giant hole . Below we link to some of our more comprehensive articles on the topic:

China’s “Evaporated” Collateral Scandal Spreads To Second Port

What Is The Common Theme: Iron Ore, Soybeans, Palm Oil, Rubber, Zinc, Aluminum, Gold, Copper, And Nickel?

China Faces “Vicious Circle” As Commodity Collateral Collapses

China Scrambling After “Discovering” Thousands Of Tons Of Rehypothecated Copper, Aluminum Missing

Copper Plunges Most In 3 Months As “Rehypothecation Evaporation” Concerns Grow

Western Banks Scramble As China’s “Rehypothecation Evaporation” Goes Global

BIS Warns About Rehypothecation Threats

How China’s Commodity-Financing Bubble Becomes Globally Contagious

China’s Collateral Rehypothecation Fraud Is Systemic

…click on the above link to read the rest of the article…

What the Kennedy Assassination Records Reveal: Uncontrollable Incompetence

Imagine Harvey Weinstein wielding a “top secret” stamp to block any exposure of the uncomfortable truth and you have the FBI, CIA and NSA.

One way to interpret the intelligence community’s reluctance to let all the Kennedy assassination archives become public is that the archives contain evidence of a “smoking gun”: that is, evidence that the intelligence agencies of the United States of America were complicit in the assassination of the President.

I think the agencies fear something larger: exposure of their gross incompetence, their “cowboy” recklessness and their disavowal of elected-civilian control. Their fear of this exposure is based on one simple fact: nothing’s changed since 1963. They were unaccountable and incompetent then, and they remain unaccountable and incompetent now. The only difference is their funding has greatly increased.

We rarely get an insider’s glimpse of the intelligence community’s pettiness, hubris and incompetence. The Ministry of Propaganda is tasked with showing the NSA, CIA, FBI, et al. as super-competent, super-dedicated, and focused on defeating evil (which is always presented as unambiguously evil, i.e. anti-American.)

Although it’s 30 years old, I still recommend this account of a top MI5 (U.K.) officer, SpyCatcher: The Candid Autobiography of a Senior Intelligence Officer.

I’ve read many books on the intelligence community, but few (if any) reveal the inter-agency rivalries and bad blood that (as far as I can tell) still exist beneath a formal veneer of co-operation. The CIA and FBI were always envious of the NSA’s SigInt (signal intelligence, i.e. eavesdropping), and so they’ve attempted to create their own versions, with laughably incompetent results in the case of the FBI’s “Russians stole the election” inquiry.

…click on the above link to read the rest of the article…

We Live in Revolutionary Times

Pluto takes 248 years to orbit the sun.

The most recent, and perhaps most important, network challenge to hierarchy comes with the advent of virtual currencies and payment systems like Bitcoin. Since ancient times, states have reaped considerable benefits from monopolizing or at least regulating the money created within their borders. It remains to be seen how big a challenge Bitcoin poses to the system of national fiat currencies that has evolved since the 1970s and, in particular, how big a challenge it poses to the “exorbitant privilege” enjoyed by the United States as the issuer of the world’s dominant reserve (and transaction) currency. But it would be unwise to assume, as some do, that it poses no challenge at all.

Clashes between hierarchies and networks are not new in history; on the contrary, there is a sense in which they are history. Indeed, the course of history can be thought of as the net result of human interactions along four axes.

The first of these is time. The arrow of time can move in only one direction, even if we have become increasingly sophisticated in our conceptualization and measurement of its flight. The second is nature: Nature means in this context the material or environmental constraints over which we still have little control, notably the laws of physics, the geography and geology of the planet, its climate and weather, the incidence of disease, our own evolution as a species, our fertility, and the bell curves of our abilities as individuals in a series of normal distributions. The third is networks. Networks are the spontaneously self-organizing, horizontal structures we form, beginning with knowledge and the various “memes” and representations we use to communicate it.

…click on the above link to read the rest of the article…

Venezuela’s Grim Reaper: A Current Inflation Measurement – Current Annual Rate 2875%

The Grim Reaper has taken his scythe to the Venezuelan bolivar. The death of the bolivar is depicted in the following chart. A bolivar is worthless, and with its collapse, Venezuela is witnessing the world’s worst inflation.

As the bolivar collapsed and inflation accelerated, the Banco Central de Venezuela (BCV) became an unreliable source of inflation data. Indeed, from December 2014 until January 2016, the BCV did not report inflation statistics. Then, the BCV pulled a rabbit out of its hat in January 2016 and reported a phony annual inflation rate for the third quarter of 2015. So, the last official inflation data reported by the BCV is almost two years old. To remedy this problem, the Johns Hopkins – Cato Institute Troubled Currencies Project, which I direct, began to measure Venezuela’s inflation in 2013.

The most important price in an economy is the exchange rate between the local currency and the world’s reserve currency — the U.S. dollar. As long as there is an active black market (read: free market) for currency and the black market data are available, changes in the black market exchange rate can be reliably transformed into accurate estimates of countrywide inflation rates. The economic principle of Purchasing Power Parity (PPP) allows for this transformation.

I compute the implied annual inflation rate on a daily basis by using PPP to translate changes in the VEF/USD exchange rate into an annual inflation rate. The chart below shows the course of that annual rate, which last peaked at 3473% (yr/yr) in late October 2017. At present, Venezuela’s annual inflation rate is 2875%, the highest in the world (see the chart below).

…click on the above link to read the rest of the article…

So This Is What Happens With Government Disaster Relief?

There is no possibility of eliminating corruption in government.

The idea of having government assist after a natural disaster sounds great. It makes us feel good. Houston floods? Send millions. New Orleans floods? Send hundreds of millions. Puerto Rico? The place is a mess and needs billions and billions. It all seems right.

The great truth about government is that every penny it spends must come from somewhere and must land somewhere else.

Until you look at the details. Someone gets the money. Whether they are the same institutions who actually do the reconstruction is another matter. And what kind of relief they provide is still another question. Other people’s money usually works this way. Look closely enough and you find corruption at every level.I recall living in a town hit by a hurricane many years ago. The town mayor instructed people not to clean up yet because FEMA was coming to town. To get the maximum cash infusion, the inspectors needed to see terrible things. When the money finally arrived, it went to the largest real estate developers, who promptly used it to clear cut land for new housing developments. That’s some nice capital if you can get it.

And now we have the remarkable case of Whitefish Energy. It’s a good example of how a website can make anything seem awesome. You would never know by looking at the impressive digital space that this is a father/son business. That’s right: just two employees.

It does seem highly strange that this desktop operation in Montana would be awarded a $300 million contract to rebuild the electrical grid in Puerto Rico. That sounds outrageous. But guess what? This is a day and a half of disaster relief spending.

…click on the above link to read the rest of the article…