Steve Bull's Blog, page 1263

November 7, 2017

No-Till Farming For Healthier Soil and Lifestyles

NO-TILL FARMING FOR HEALTHIER SOIL AND LIFESTYLES

Masanobu Fukuoka, the late Japanese farmer, developed a unique farming system he called “Natural Farming.” Trying to replicate what he saw in Nature, Fukuoka´s no till system allowed the soil to continually grow in fertility. Through the use of mulch and cover crops, this system effectively allows for continuous harvests of crop rotations, eliminates weeds and builds healthy top soil allowing for organic food production that is ecologically sustainable.

PROBLEMS WITH TILL AGRICULTURE

Farmers have been tilling the soil for 10,000 years. It is what exemplifies the occupation of those who make their living from the land. Tilling the soil allowed humanity to produce higher concentrations of food in one place giving rise to the denser populations of city centers and eventually the development of modern civilization as we know it. However, tilling the soil also brought with it a whole host of undesirable effects, including erosion and the loss of the microbial life of the soil. Some studies have linked the fall of major civilizations such as the Mayans of Mesoamerica to the over farming of the land which eventually led to a decreasing soil capacity.

By tilling the soil year after year, the microscopic life of billions of creatures in the top three inches of the soil is essentially killed off. What’s left over is a barren, lifeless medium incapable of offering the nutrients plants need to grow and offer us their fruit. Furthermore, the more we till the soil, the more we leave the precious humus that is the life-sustaining “skin” of our planet vulnerable to the elements of wind and rain. The erosion of top soil caused by tilling and the “baring” of the soil has led to soil compaction, loss of fertility, poor drainage, and problems with plant reproduction.

…click on the above link to read the rest of the article…

Is A Venezuelan Default Inevitable?

Bondholders, creditors, and any company with operations in Venezuela are all agog for news from Caracas after President Nicolas Maduro announced Venezuela will look to restructure its US$89 billion worth of debt to be able to continue servicing it.

Forecasts about what will happen next are all pessimistic, and that’s no wonder. By the end of next year, the government and state-owned PDVSA must repay debt obligations to the tune of US$13 billion, and foreign currency reserves are less than that already, at US$10 billion. What’s more, the country is subject to economic sanctions from the United States, which prohibit any U.S. entities from taking part in any business dealings with Venezuela, including debt restructuring.

It is these sanctions that many analysts view as the main reason for an unavoidable default. As Bloomberg author Katia Porzecanski wrote in a recent overview of the Venezuela situation, lack of access to U.S.-based banks and investment companies will make the debt restructuring initiative very difficult if not impossible, as debt restructuring almost invariably involves new debt issuance.

Some observers believe a default might be the lesser evil for Venezuela: imports are at multi-year lows and the population is suffering from shortages in basic goods including food and medicine. The government could stop servicing its debt and use what money remains in the state coffers to tackle the shortages.

A default, however, is in nobody’s favor, which makes the situation extremely complicated. Bondholders are just fine with payments coming in, even if they are late, as the bonds carry a quite attractive coupon. What they are not fine with is the possibility of a default followed by fights about the order of repayment of the various debts.

…click on the above link to read the rest of the article…

Italy Target2 Imbalance Hits Record €432.5 Billion as Dwindling Trust in Banks Plunges

Contrary to ECB propaganda, Target2 imbalances are a direct result an unsustainable balance of payment system. The imbalances represent both capital flight and debts that can never be paid back. If you think Italy can pay German and other creditors a record €432.5 Billion, you are in Fantasyland.

The interesting aspect of Italy’s new record Target2 Imbalance is that it comes just as Dwindling Trust in Italian Banks is on the rise.

Just 16 percent of Italians have confidence in the country’s lenders, down from an already meager 17 percent in June, according to a poll by the SWG research group of Trieste on Friday. Only 24 percent trust the Bank of Italy, plunging from 36 percent in June.

One likely reason: a tortuous bank crisis that caused losses for savers and led the government to rescue three lenders with taxpayers’ money this year. The vanishing confidence is likely to show in campaigns for national elections expected by next spring.

Supporters of the populist Five Star Movement and anti-migrant Northern League have the least confidence in lenders and the Bank of Italy among those with a definite opinion, according to the survey of 1,000 adults conducted Oct. 23-25.

Confidence in Banks Plunges

The eurosceptic Five Star Movement just happens to have the largest share of the vote in recent polls.

Target2 Discussion

Target2 stands for Trans-European Automated Real-time Gross Settlement System. It is a reflection of capital flight from the “Club-Med” countries in Southern Europe (Greece, Spain, and Italy) to banks in Northern Europe.

Pater Tenebrarum at the Acting Man blog provides this easy to understand example: “Spain imports German goods, but no Spanish goods or capital have been acquired by any private party in Germany in return. The only thing that has been ‘acquired’ is an IOU issued by the Spanish commercial bank to the Bank of Spain in return for funding the payment.”

…click on the above link to read the rest of the article…

Is Korea Just a Smokescreen?

In my last article (Sticking the arson charge on a couple of patsies) I questioned why North Korea’s nuclear program was attracting such attention from the United States. North Korea is a very poor and backwards country whose bellicosity reflects the regime’s need for an external enemy like the United States to galvanize domestic support. Attacking America and its allies in the region is the last thing North Korea’s leaders would want to do as such an attack would guarantee an American response that would be sure to destroy their lives, their government and the lives of millions of innocent Korean civilians.

However, this month I was made aware of another possible reason for the attention being paid to North Korea and its nuclear program. What if the escalating tensions over Korea are just a smokescreen intended to legitimize an American military buildup in the region aimed at intimidating China?

In 2011, former U.S. President Barack Obama announced a change in U.S. foreign policy that was termed a ‘Pivot to Asia.’ The official thinking was that as China and the emerging countries of South-East Asia gained in economic importance, it made sense to devote more military and diplomatic attention to the region while reducing the attention paid to Europe and the Middle East.

Of course, observers also saw the pivot as a response to the rising economic, political and military power of a resurgent China. Just as the U.S. sought to contain the Soviet Union during the Cold War with a string of encircling alliances and economic agreements, so America today seeks to keep China in check through military alliances with East Asian countries like Japan, South Korea and Taiwan and trade agreements such as the Trans-Pacific Partnership (TPP).

…click on the above link to read the rest of the article…

Is Saudi Arabia Heading For War With Iran?

Is a major war in the Middle East looming on the horizon? Most of us living in the western world simply do not realize how much Saudi Arabia and Iran truly hate one another. Saudi Arabia is the global center for Sunni Islam, and Iran is the global center for Shia Islam, and the two major sects of Islam have a history of bad blood that literally goes back for over a thousand years. The Saudis and the Iranians are already engaged in “proxy wars” in Syria and in Yemen, and now a missile that was fired at Riyadh’s international airport threatens to turn the conflict between the two regional powers into a hot war.

Is a major war in the Middle East looming on the horizon? Most of us living in the western world simply do not realize how much Saudi Arabia and Iran truly hate one another. Saudi Arabia is the global center for Sunni Islam, and Iran is the global center for Shia Islam, and the two major sects of Islam have a history of bad blood that literally goes back for over a thousand years. The Saudis and the Iranians are already engaged in “proxy wars” in Syria and in Yemen, and now a missile that was fired at Riyadh’s international airport threatens to turn the conflict between the two regional powers into a hot war.

If you are tempted to think that I am exaggerating one bit, just consider what the New York Times is saying about this…

Saudi Arabia charged Monday that Iran had committed “a blatant act of military aggression” by providing its Yemeni allies with a missile fired at the Saudi capital over the weekend, raising the threat of a direct military clash between the two regional heavyweights.

The accusations represent a new peak in tensions between Saudi Arabia and Iran at a time when they are already fighting proxy wars in Yemen and Syria, as well as battles for political power in Iraq and Lebanon.

And Yahoo is reporting that the Saudis are saying that this missile attack “may amount to an act of war”…

On Monday, a Saudi-led military coalition battling Tehran-backed rebels in Yemen said it reserved the “right to respond” to the missile attack on Riyadh at the weekend, calling it a “blatant military aggression by the Iranian regime which may amount to an act of war”.

Saudi Foreign Minister Adel al-Jubeir also warned Tehran.

…click on the above link to read the rest of the article…

Norway’s Oil Sector Faces Existential Crisis

Oil companies have recently focused on frontier exploration drilling in the Barents Sea offshore in Norway, neglecting the powerhouse of the Norwegian oil industry, the North Sea.

Exploration activity in the North Sea—the most mature area of Western Europe’s biggest oil producer—is at an 11-year low this year, which is a concern for the industry’s regulator, the Norwegian Petroleum Directorate (NPD).

“That worries me,” NPD Director General Bente Nyland told Bloomberg in a recent interview, voicing the industry concern that without new oil discoveries, especially in mature areas with well-connected infrastructure, the decline in Norway’s oil production would be even bigger than expected.

Following a continual decline between 2001 and 2013, Norway’s crude oil production rose last year for the third year running, but according to the Norwegian Petroleum Directorate (NPD), oil production this year would be nearly half the volume from the peak in 2000-2001.

Two huge fields discovered in 2010 and 2011, Johan Sverdrup in the North Sea, and Johan Castberg in the Barents Sea, are expected to start operations in 2019 and 2022, respectively, and will lift Norway’s oil production in the early 2020s compared to expected declines in 2018 and 2019.

But after 2025, production and activity are expected to significantly drop off unless there are new discoveries, according to oil major Statoil.

Related: Trump’s China Trip To Reap Billions In Energy Deals

Norway’s Ministry of Petroleum and Energy, and NPD say:

“Production from new fields that come on stream will compensate for the decline in production from ageing fields. However, in the longer term, the level of production will depend on new discoveries being made, the development of discoveries, and the implementation of improved recovery projects on existing fields.”

…click on the above link to read the rest of the article…

November 5, 2017

PBOC’s Zhou Warns Of “Sudden, Complex, Hidden, Contagious, Hazardous” Risks In Global Markets

Just two weeks after warning of the potential for an imminent ‘Minsky Moment’, Chinese central bank governor Zhou Xiaochuan has penned a lengthy article on The PBOC’s website that warns ominously of latent risks accumulating, including some that are “hidden, complex, sudden, contagious and hazardous,” even as the overall health of the financial system appears good.

The imminence of China’s Minksy Moment is something we have discussed numerous times this year.

The three credit bubbles shown in the chart above are connected. Canada and Australia export raw materials to China and have been part of China’s excessive housing and infrastructure expansion over the last two decades. In turn, these countries have been significant recipients of capital inflows from Chinese real estate speculators that have contributed to Canadian and Australian housing bubbles. In all three countries, domestic credit-to-GDP expansion financed by banks has created asset bubbles in self-reinforcing but unsustainable fashion.

And then at the latest Communist Party Congress meeting in Beijing, the governor of the PBoC (People’s Bank of China) said the following;

“If we are too optimistic when things go smoothly, tensions build up, which could lead to a sharp correction, what we call a ‘Minsky moment’. That’s what we should particularly defend against.”

Yet, stock markets shrugged off his warning… while the Chinese yield curve has now been inverted for 10 straight days – the longest period of inversion ever…

Which appears to be why he wrote his most recent and most ominous warning yet… (as Bloomberg reports)

The nation should toughen regulation and let markets serve the real economy better, according to Zhou.

The government should also open up financial markets by relaxing capital controls and reducing restrictions on non-Chinese financial institutions that want to operate on the mainland, he wrote.

…click on the above link to read the rest of the article…

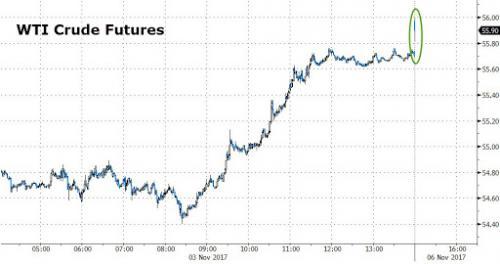

Oil Jumps To $56, Highest Since July 2015 On Saudi Turmoil, Venezuela Default

With the launch of electronic trading, WTI crude has jumped from the highest close since July 2015 amid Saudi turmoil which over the weekend included a crackdown on 11 Saudi princes – including billionaire Alwaleed – and dozens of current and former ministers as Saudi Crown Prince Mohammed bin Salman, i.e. MbS, who’s backed policy of capping oil output to raise prices, consolidates power with anti-graft probe, and shortly after a helicopter that carried 8 high-ranking Saudi officials inexplicably crashed near the Yemen border.

Adding to the upside pressure are concerns about Venezuela’s viability, following Friday’s default-cum-restructuring confusion, which sent PDVSA bonds crashing on the realization that the long-deferred sovereign default may finally be inevitable.

As shown in the chart below, December WTI briefly touched $56, and was up +0.5% to $55.87/bbl shortly after 6pm ET, the highest price since July 6, 2015…

… while January Brent was also higher by 0.5% to $62.39/bbl.

US Boosts Special Operations Forces Presence at Russia’s Border

US Boosts Special Operations Forces Presence at Russia’s Border

The deployment of US Special Operations Forces in Europe is never in spotlight but it is rapidly increasing. There can be no other purpose than acquisition of capability to deliver strikes deep into Russia’s territory.

The Trump administration is relying heavily on Special Operations Forces (SOF). They are deployed to 137 countries or 70% of them in the world. At least 8,000 of SOF are operating in around 80 countries at any given moment. The numbers have ballooned from a few thousands in the 1980s to 70,000 at present. In 2016, the US deployed special operators to Taiwan, Mongolia, Kazakhstan, Tajikistan, Afghanistan, Nepal, India, Laos, the Philippines, South Korea, and Japan. In 2006, 3 percent of special operators deployed overseas were in Europe. In 2016, the number topped 12 percent.

Much has been said recently about SOF operations in Africa, which are going to expand and intensify. Formally, they are on train and assist missions to counter terrorist threats. But one can hardly imagine the need to deploy such special purpose forces from overseas to fight terrorists in the Old Continent.

The United States increased the presence of SOF in Europe four times last year. The forces are mainly deployed near Russia’s borders, including such countries as the Baltic States, Romania, Poland, Ukraine and Georgia. In 2017, SOF have deployed to more than 20 European countries.

In March, SOF (Army Green Berets) trained along local troops in Lapland, Finland, during exercise Northern Griffin 2017. In May, Navy SEALs were part of exercise Flaming Sword 17 in Lithuania. In June, members of the US 10th Special Forces Group trained near Lubliniec, Poland. In July, naval SOF took part in Sea Breeze annual military exercise in Ukraine.

…click on the above link to read the rest of the article…

Pentagon Says Securing North Korean Nuclear Sites Would Require “Ground Invasion”

With President Donald Trump arriving in Japan today to kick off a 10-day Asia tour, the Washington Post is reporting that the only way to locate and secure all of North Korea’s nuclear weapons sites “with complete certainty” would be a ground invasion, and in the event of conflict, Pyongyang could use biological and chemical weapons, the Pentagon told lawmakers in a newly released assessment of what war on the Korean Peninsula might look like.

The Pentagon, in a letter to lawmakers, said that a full discussion of U.S. capabilities to “counter North Korea’s ability to respond with a nuclear weapon and to eliminate North Korea’s nuclear weapons located in deeply buried, underground facilities” is best suited for a classified briefing.

The letter also said that Pentagon leaders “assess that North Korea may consider the use of biological weapons” and that the country “has a long-standing chemical weapons program with the capability to produce nerve, blister, blood and choking agents.”

The Pentagon repeated that a detailed discussion of how the United States would respond to the threat could not be discussed in public.

The letter noted that Seoul, the South Korean capital, is a densely populated area with 25 million residents.

The Pentagon’s candid assessment appears to validate claims made by former White House Chief Strategist Steve Bannon, who famously said in an interview with the American Prospect before he was forced out of his White House job that there are no “good” military options for toppling the Kim regime. A ground invasion, he said, would lead to millions of casualties in the South Korean capital of Seoul from conventional weapons fire.

…click on the above link to read the rest of the article…