Steve Bull's Blog, page 1260

November 10, 2017

How Central Banks Widen Wealth and Income Gaps

The Federal Reserve’s latest Survey of Consumer Finances, according to Federal Reserve Governor Brainard, shows that the share of income held by the top 1 percent of households has risen from 17 percent in 1988 to 24 percent in 2015, and that the wealth held by that same group rose from 30 percent in 1989 to 39 percent in 2016.

There are many explanations of why the gap between the rich and the poor widens. Governor Brainard attributes some of it to labor market disparities relating to geography and to race and ethnicity. She and Robert Frank say it results from the wealthiest households being much more likely to invest additional money received than those in other income groups. Vincent Del Giudice and Wei Lu blame automation and robotics. John Tamny says it is a consequence of the explosion in entrepreneurship that has benefited us all. A Tax Policy Center report concludes that it will widen even more if the president’s income tax overhaul is enacted.

The Brookings Institute held a conference to explore whether monetary policy widens the wealth gap. Mainstream economists support expansionary monetary policy because the income gap closes after mortgage payments are lowered when homes are refinanced at lower interest rates. However, a conference panelist and former Federal Reserve (Fed) board member Kevin Warsh referred to the Fed’s monetary policy during the financial crisis as being “reverse Robin Hood.” This view has merit because the Fed’s purchases of securities push interest rates down and expand the money supply. The expansion of money then inflates the prices of financial assets, which are disproportionately owned by the rich.

In a previous article for Mises Wire, I discussed data that seems to support both sides of the Brookings debate.

…click on the above link to read the rest of the article…

Is There Any Way Out of the ECB’s Trap?

The ECB faces the Devil’s Alternative that Frederick Forsyth mentioned in one of his books. All options are potentially riskly. Mario Draghi knows that maintaining the so-called stimuli involves more risks than benefits, but also knows that eliminating them could make the eurozone deck of cards collapse.

Despite the massive injection of liquidity, he knows that he can not disguise political risks such as the secessionist coup in Catalonia. The Ibex reflects this, making it clear that the European Central Bank does not print prosperity, it only puts a floor to valuations.

The ECB wants a weak euro. But it is a game of juggling to pretend a weak euro and at the same time a strong economy. The European Union countries export mostly to themselves. Member countries sell more than two-thirds of their goods and services to other countries in the eurozone. Therefore, the more they export and their economies recover, the stronger the euro, and with it, the risk of losing competitiveness. The ECB has tried to break the euro strength with dovish messages, but it has not worked until political risk reappeared. With the German elections and the prospect of a weak coalition, the results of the Austrian elections and the situation in Spain, market operators have realized – at last – that the mirage of “this time is different “in the European Union was simply that, a mirage.

A weak euro has not helped the EU to export more abroad. Non-EU exports from the member countries have been stagnant since the monetary stimulus program was launched, even though the euro is much weaker than its basket of currencies compared to when the stimulus program began. The Central Bank Trap, which I explain in my new book.

…click on the above link to read the rest of the article…

Time Is Running Out for the Planet

Bill Moyers talks with Bill McKibben about his new novel Radio Free Vermont and the nonfiction ways to fight the system.

Environmental activists in kayaks protest the arrival of the Polar Pioneer, an oil drilling rig owned by Shell Oil, in Seattle. The rig is part of a fleet that will lead a controversial oil-exploration effort off Alaska’s North Slope. (Photo: Backbone Campaign/flickr/ CC 2.0)

BillMoyer.com editor’s note: I wasn’t one of the 50,766 participants who finished the New York City Marathon last weekend. Instead, I spent the average marathon finish time of 4:39:07 to read a book — obviously a small book. In the interest of disclosure, I didn’t even start the race, but that’s another and even shorter story than Radio Free Vermont, the book from which I did occasionally look up and out the window to check on the stream of marathoners passing our apartment, their faces worn and haggard. A shame, I thought, that I couldn’t go outside and hand each one a copy of the book that had kept me smiling throughout the day while also restoring my soul; I was sure the resilience would quickly have returned to weary feet and sore muscles now draped in aluminum foil for healing’s sake. I admire those athletes, but wouldn’t have traded their run for my read, because Radio Free Vermont is funny, very funny, all the more so considering the author is one of the more serious men on the planet — the planet he has spent his adult life trying to save. Bill McKibben’s calling has been a footrace of its own, not to report to Athenians the victory of Greek warriors over the Spartans, but to wake up Americans to the once creeping, now billowing threat of global warming. .

…click on the above link to read the rest of the article…

November 9, 2017

Perpetual Notes – China’s New Way To Hide Debt (Call It Equity)

The legacy of the soon-to-retire PBoC governor, Zhou Xiochuan, will be that in sharp contrast to his western brethren, he warned that China’s credit bubble would burst before the fact. Two weeks ago, Zhou warned during the Party Congress that China’s financial system could be heading for a “Minsky moment” due to high levels of corporate debt and rapidly rising household debt (see here).

“If we are too optimistic when things go smoothly, tensions build up, which could lead to a sharp correction, what we call a ‘Minsky moment’. That’s what we should particularly defend against.”

Perhaps sensing that nobody in the Middle Kingdom was paying attention, we noted two days ago his lengthy essay published on the PBoC website. It contained another warning that latent risks are accumulating in the Chinese system, including some that are “hidden, complex, contagious and hazardous.” He also highlighted “debt finance disguised as equity” as a concern. Talking of which, there’s a new growth market in the gargantuan Chinese corporate debt market – we are referring to perpetual notes. Are you ready for the clever part about perpetual notes – they are debt but it’s permissible under Chinese accounting regulations to classify them as “equity” – et voila, corporate gearing has fallen. According to Bloomberg.

Under pressure to trim borrowings, China’s companies have found a way to reduce their lofty debt burdens — even if some of the risk remains. Sales of perpetual notes – long-dated securities that can be listed as equity rather than debt on balance sheets given that in theory they could never mature — have soared to a record this year as Beijing zeros in on leverage and the threat it poses to the financial system.

…click on the above link to read the rest of the article…

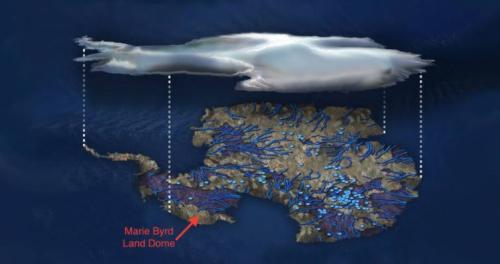

“This Is Crazy” – Antarctic Supervolcano Is Melting The Ice-Caps From Within

As we’ve pointed out, the supervolcano phenomenon is hardly unique to Yellowstone National Park, where a long dormant volcano with the potential to cause a devastating eruption has been rumbling since mid-summer, making some scientists uneasy.

Surprisingly active supervolcanos have been documented in Italy, North Korea and, now, Antarctica after scientists at NASA’s Jet Propulsion Laboratory (JPL) have found new evidence to support a theory that the breakup of Antarctic ice may be caused in part by a massive geothermal heat source, with output close to the scale of Yellowstone National Park.

Of course, if accurate, this theory would help rebut the notion that man-made climate change is in part responsible for the melting ice, Russia Today reports.

A geothermal heat source called a mantle plume, a hot stream of subterranean molten rock that rises through the Earth’s crust, may explain the breathing effect visible on Antarctica’s Marie Byrd Land and elsewhere along the massive ice sheet.

While the mantle plume is not a new discovery, the recent research indicates it may explain why the ice sheet collapsed in a previous era of rapid climate change 11,000 years ago, and why the sheet is breaking up so quickly now.

“I thought it was crazy. I didn’t see how we could have that amount of heat and still have ice on top of it,” said Hélène Seroussi of NASA’s Jet Propulsion Laboratory in Pasadena, California.

Seroussi and Erik Ivins of JPL used the Ice Sheet System Model (ISSM), a mathematical depiction of the physics of ice sheets developed by scientists at JPL and the University of California, Irvine. Seroussi then tweaked the ISSM to hunt for natural heat sources as well as meltwater deposits.

…click on the above link to read the rest of the article…

Kingdom Of Fear: Saudi Arabia On Lockdown

Events in Saudi Arabia are unfolding at a blinding pace, with a radical shift taking place within the upper echelons of government. Last weekend, King Salman announced the set-up of a special anti-corruption force that wasted no time in rounding up more than a dozen government officials—both former and current—five members of the royal family, and several businessmen. Since then, the list has been growing, to more than 60 as of today.

Now there are reports about the Riyadh Ritz-Carlton being turned into a luxury prison for the detainees. There are rumors—which Riyadh has denied—that one of the targets of the purge, Prince Abdulaziz bin Fahd, was killed while resisting arrest. There are also reports that the purge could fill the state coffers with as much as US$800 billion in assets seized from those arrested—all members of the Saudi elite.

Speculation abounds and there is growing worry that the situation could spiral out of control. There is a constant flow of new information coming from Saudi Arabia, such as that one of the Arab world’s leading broadcasters, MBC, has been put under government control. Part of its management was removed and the owner detained. News is also emerging that even the former Saudi Energy Minister Ali al-Naimi, Saudi Arabia’s media face for decades, has been forcibly confined to his quarters.

There is talk that a travel ban has been issued for a number of government officials, including executives from Aramco. That’s on top of reports that Aramco board member Ibrahim al-Assaf, a former Finance Minister in the Kingdom, was also among those arrested.

…click on the above link to read the rest of the article…

Monsanto In Court Again As Powerful New Herbicide Accidently Kills 3.6 Million Acres Of Crops

Monsanto thought they had developed an amazing scheme to corner the Midwest farming market when they developed new genetically engineered seeds that were resistant to their new herbicide called dicamba. The resistance of Monsanto’s new magical seed crops to dicamba meant that the herbicide could be sprayed liberally by farmers to eradicate weeds and boost yields.

Alas, as we pointed out last week (see: Meet Monsanto’s Other Herbicide Problem…), a small problem emerged when spray drifts from those liberal herbicide applications began to wipe out the crops of neighboring farmers who didn’t plant Monsanto’s dicamba-resistant seeds.

Now, as the Wall Street Journal points out today, after allegedly wiping out millions of acres of farm ground across the Midwest, Monsanto once again finds itself in a familiar spot: the courtroom.

Monsanto’s new version of the herbicide called dicamba is part of a more than $1 billion investment that pairs it with new genetically engineered seeds that are resistant to the spray. But some farmers say their nonresistant crops suffered after neighbors’ dicamba drifted onto their land.

The agricultural giant in October sued the Arkansas State Plant Board following the board’s decision to bar Monsanto’s new herbicide and propose tougher restrictions on similar weed killers ahead of the 2018 growing season. Monsanto claims its herbicide is being held to an unfair standard.

Arkansas has been a flashpoint in the dispute: About 900,000 acres of crops were reported damaged there, more than in any other state.

About 300 farmers, crop scientists and other attendees gathered in Little Rock on Wednesday for a hearing on Arkansas’s proposed stiffer dicamba controls, which Monsanto and some farmers are fighting. The proposed restrictions are subject to the approval of a subcommittee of state legislators.

…click on the above link to read the rest of the article…

It Begins: Pension Bailout Bill To Be Introduced This Week

Over the past year we have provided extensive coverage of what will likely be the biggest, most politically charged, and most significant financial crisis facing the aging U.S. population: a multi-trillion pension storm, which was recently dubbed “one of the most heated battles of a lifetime” by John Mauldin. The reason, in a nutshell, why the US public pension problem has stumped so many professionals is simple: for lack of a better word, it is an unsustainable Ponzi scheme, in which satisfying accrued pension and retirement obligations requires not only a constant inflow of new money, but also fixed income returns, typically in the 6%+ range, which are virtually unfeasible in a world where global debt/GDP is in the 300%+ range. Which is why we, and many others, have long speculated that it is only a matter of time before the matter receives political attention, and ultimately, a taxpayer bailout.

That moment may be imminent. According to Pensions and Investments magazine, Democratic Senator Sherrod Brown from Ohio plans to introduce legislation that would allow struggling multiemployer pension funds to borrow from the U.S. Treasury to remain solvent.

The bill, which is co-sponsored by another Democrat, Rep. Tim Ryan, also of Ohio, could be introduced as soon as this week or shortly after. It would create a new office within the Treasury Department called the Pension Rehabilitation Administration. The funds would come from the sale of Treasury-issued bonds to financial institutions. The pension funds could borrow for 30 years at low interest rates. The one, and painfully amusing, restriction for borrowers is “they could not make risky investments”, which of course will be promptly circumvented in hopes of generating outsized returns and repaying the Treasury’s “bailout” loan, ultimately leading to massive losses on what is effectively a taxpayer-funded pension bailout.

…click on the above link to read the rest of the article…

Review: No Is Not Enough

Samir Dathi reviews No Is Not Enough: Defeating the New Shock Politics, by Naomi Klein

Naomi Klein’s new books always provoke plenty of excitement on the left. For starters, they always seem to augur new waves of popular struggle. The Canadian journalist’s debut No Logo, an exposé of corporate super-branding, went to print with prophetic timing just months after the 1999 Seattle protest kicked off the alter-globalisation movement. Her 2007 follow up The Shock Doctrine, on how elites use crises to push through neoliberal policy, pre-empted the credit crunch. And This Changes Everything, on the clash between free-market fundamentalism and climate justice, was published during the tense build-up to the COP21 climate talks. Each book in this anti-neoliberal trilogy became a left-wing manifesto of sorts, making sense of pivotal moments in the movements and capturing the prevailing dissident mood.

Naomi Klein’s new books always provoke plenty of excitement on the left. For starters, they always seem to augur new waves of popular struggle. The Canadian journalist’s debut No Logo, an exposé of corporate super-branding, went to print with prophetic timing just months after the 1999 Seattle protest kicked off the alter-globalisation movement. Her 2007 follow up The Shock Doctrine, on how elites use crises to push through neoliberal policy, pre-empted the credit crunch. And This Changes Everything, on the clash between free-market fundamentalism and climate justice, was published during the tense build-up to the COP21 climate talks. Each book in this anti-neoliberal trilogy became a left-wing manifesto of sorts, making sense of pivotal moments in the movements and capturing the prevailing dissident mood.

Klein’s latest book No Is Not Enough, on the rise of Trumpism, comes at another pivotal (perhaps epochal) moment. But unlike her previous books, each of which took years to write, she wrote No Is Not Enough in a few months. This rapid turnaround was for a couple of reasons. First, due to necessity – Trump’s shock win required urgent analysis. And second, because this time she hasn’t sought to break new ground – for Klein, Trump embodies the worst excesses of the neoliberal phenomena she already covered in her first three books. She writes: ‘Trump is not a rupture at all, but rather the culmination – the logical end point – of a great many dangerous stories our culture has been telling for a very long time.’ So No Is Not Enough mainly revisits and ties together threads from her earlier canon. Much of the book is taken up describing Trump the ultimate super-brand, Trump the doctor of shock therapy, and Trump the climate vandal – as well as, of course, Trump the sexist and racist.

…click on the above link to read the rest of the article…

Where are Europe’s Fault Lines?

Beneath the surface of modern maps, numerous old fault lines still exist. A political earthquake or two might reveal the fractures for all to see.

Correspondent Mark G. and I have long discussed the potential relevancy of old boundaries, alliances and structures in Europe’s future alignments.Examples include the Holy Roman Empire and the Hanseatic League, among others.

In the long view, Europe has cycled between periods of consolidation and fragmentation for two millennia, starting with the Roman Empire and its dissolution. Various mass movements of tribes/peoples led to new political structures and alliances, and a dizzying range of leaders rose to power and schemed their way through an equally dizzying array of wars, alliances and betrayals.

Regardless of the era or players, security is a permanent priority: this includes defensible borders, alliances to counter potential foes, treaties to end hostilities and whatever is necessary to secure access to resources and trade routes.

When consolidation served these priorities, then fragmented polities either consolidated by choice or by conquest. When smaller polities served these priorities, then imperial structures fragmented into naturally cohesive territories that were unified by language, culture and geography.

Security is also economic, as people support structures that keep their bellies filled and enable social stability and mobility.

For the sake of argument, let’s say that the European Union is the high water mark of consolidation, and the next phase is fragmentation. Where are Europe’s natural fault lines? Much has changed in the past 600 years, but geography hasn’t changed, and that defines some basic security threats.

German Army Prepares For “Break-Up Of European Union” Or Worse

The Germans are making contingency plans for the collapse of Europe

…click on the above link to read the rest of the article…