Steve Bull's Blog, page 1259

November 11, 2017

How Facebook and Google threaten public health – and democracy

The sad truth is that Facebook and Google have behaved irresponsibly in the pursuit of massive profits. And this has come at a cost to our health

‘Substance cannot compete with sensation, which must be amplified constantly, lest consumers get distracted and move on.’ Photograph: Anadolu Agency/Getty Images

‘Substance cannot compete with sensation, which must be amplified constantly, lest consumers get distracted and move on.’ Photograph: Anadolu Agency/Getty ImagesIn an interview this week with Axios, Facebook’s original president, Sean Parker, admitted that the company intentionally sought to addict users and expressed regret at the damage being inflicted on children.

This admission, by one of the architects of Facebook, comes on the heels of last week’s hearings by Congressional committees about Russian interference in the 2016 election, where the general counsels of Facebook, Alphabet (parent of Google and YouTube), and Twitter attempted to deflect responsibility for manipulation of their platforms.

The term “addiction” is no exaggeration. The average consumer checks his or her smartphone 150 times a day, making more than 2,000 swipes and touches. The applications they use most frequently are owned by Facebook and Alphabet, and the usage of those products is still increasing.

In terms of scale, Facebook and YouTube are similar to Christianity and Islam respectively. More than 2 billion people use Facebook every month, 1.3 billion check in every day. More than 1.5 billion people use YouTube. Other services owned by these companies also have user populations of 1 billion or more.

Facebook and Alphabet are huge because users are willing to trade privacy and openness for “convenient and free.” Content creators resisted at first, but user demand forced them to surrender control and profits to Facebook and Alphabet.

The sad truth is that Facebook and Alphabet have behaved irresponsibly in the pursuit of massive profits. They have consciously combined persuasive techniques developed by propagandists and the gambling industry with technology in ways that threaten public health and democracy.

…click on the above link to read the rest of the article…

Caution: Slowdown

Many of you know I keep posting charts keeping taps on the macro picture in the Macro Corner . It’s actually an interesting exercise watching what they do versus what they say. Public narratives versus reality on the ground.

I know there’s a lot of talk of global synchronized expansion. I call synchronized bullshit.

Institutions will not warn investors or consumers. They never do. Banks won’t warn consumers because they need consumers to spend and take up loans and invest money in markets. Governments won’t warn people for precisely the same reason. And certainly central banks won’t warn consumers. They are all in the confidence game.

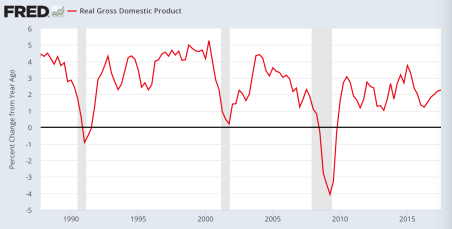

Well, I am sending a stern warning: The underlying data is getting uglier. Things are slowing down. And not by just a bit, but by a lot. And I’ll show you with the Fed’s own data that is in stark contrast to all the public rah rah.

Look, nobody wants recessions, They are tough and ugly, but our global economy is on based on debt and debt expansion. Pure and simple. And all that is predicated on keeping confidence up. Confident people spend more and growth begets growth.

But here’s the problem: Despite all the global central bank efforts to stimulate growth real growth has never emerged. Mind you all this is will rates still near historic lows:

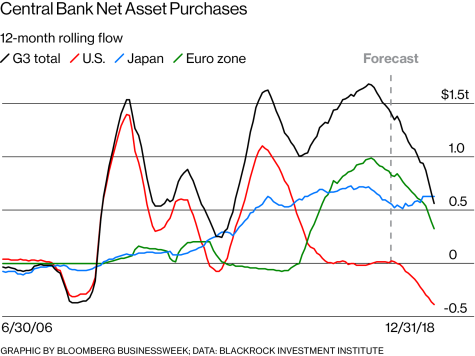

And central banks supposedly are reducing the spigots come in 2018:

I believe it when I see it. In September the FED told everyone they would start reducing their balance sheet in October. It’s November:

…click on the above link to read the rest of the article…

The Destruction of the Dollar

“Inflation” occurs when the creation of currency outruns the creation of real wealth it can bid for… It isn’t caused by price increases; rather, it causes price increases.

Inflation is not caused by the butcher, the baker, or the auto maker, although they usually get blamed. On the contrary, by producing real wealth, they fight the effects of inflation. Inflation is the work of government alone, since government alone controls the creation of currency.

In a true free-market society, the only way a person or organization can legitimately obtain wealth is through production. “Making money” is no different from “creating wealth,” and money is nothing but a certificate of production. In our world, however, the government can create currency at trivial cost, and spend it at full value in the marketplace. If taxation is the expropriation of wealth by force, then inflation is its expropriation by fraud.

To inflate, a government needs complete control of a country’s legal money. This has the widest possible implications, since money is much more than just a medium of exchange. Money is the means by which all other material goods are valued. It represents, in an objective way, the hours of one’s life spent in acquiring it. And if enough money allows one to live life as one wishes, it represents freedom as well. It represents all the good things one hopes to have, do, and provide for others. Money is life concentrated.

As the state becomes more powerful and is expected to provide more resources to selected groups, its demand for funds escalates. Government naturally prefers to avoid imposing more taxes as people become less able (or willing) to pay them. It runs greater budget deficits, choosing to borrow what it needs.

…click on the above link to read the rest of the article…

“This Is A Dangerous Iranian Escalation”: Bahrain Blames Pipeline Explosion On Iran, Terrorists

There was something odd about Friday’s night’s explosion of an oil pipeline belonging to Bahrain’s state-run oil company BAPCO, which local authorities initially said was the result of an accident: as we said, the giant fireball had all the hallmarks of either sabotage or a terrorist event, the only question is whether it was real or staged, and who would ultimately be blamed for it.

[image error]Anas Alhajji

✔@anasalhajji

This video circulating on social media shows an #oil pipeline explosion in Bahrain. It look Nms Bahrain to Saudi Arabia

3:41 PM – Nov 10, 2017

حسن سجواني

Spanish Government Blames Russian “Dezinformatsiya” Campaign For Catalan Uprising

No, not The Onion…

In what is perhaps the least surprising tactic from the Spanish establishment, a government-backed research institute in Madrid has stated that Spain’s struggle to quash separatism in its Catalonia region was disrupted by Russian hackers agitating for a break-up, in a hallmark propaganda effort to fracture Europe.

As Bloomberg reports, the unidentified Russians spread both true and false messages on Facebook and Twitter during the illegal separatist referendum on Oct. 1, according to Mira Milosevich, a senior analyst at the Elcano Royal Institute.

The “dezinformatsiya” campaign deployed trolls, bots and fake accounts, and was backed by intense coverage from Russia’s state-supported television, she said.

“Russia has a nationalist agenda, and it supports nationalist, populist movements in Europe because that serves to divide Europe,” Milosevich said Wednesday in an interview.

The researcher had just published an article building on a Sept. 25 El Pais newspaper report that linked fake news on Catalonia with allegations of Russian influence in the Brexit campaign.

Elcano is part-funded by the Spanish government and its board’s honorary chairman is King Felipe VI.

Milosevich further claims that the most significant comments spread on Twitter and Facebook came from WikiLeaks editor Julian Assange and government-secrets leaker Edward Snowden, Milosevich said, particularly that the “banana republic” of Spain used violence to suffocate a democratic vote.

For his Twitter profile photo, Assange is using a shot of Spanish riot police, clad in black protective gear, with one of them swinging his baton.

…click on the above link to read the rest of the article…

Northeast Facing Record-Low Temperatures As Polar Vortex Returns

The return of the dreaded polar vortex is battering much of the eastern US this week, sending temperatures well into freezing territory and close to record lows – a phenomenon that could persist for much of the week leading up to Thanksgiving.

According to the New York Post, record-low temperatures are forecast for Friday and Saturday, with nighttime and early-morning mercury dipping into the 20s.

The temperature dropped into the 20s in some places in the northeast last night, and could sink as low as 21 degrees fahrenheit on Saturday, according to AccuWeather forecasts.

The record low for November 10 was 27 degrees in 1914. The high Saturday will be 37 to 43 degrees – up from the predawn low of about 24 degrees. The record low for November 11 was 29 degrees, set in 1933.

The forecast calls for 50 degrees on Monday, setting off eight straight days with high temps of at least 50, AccuWeather said.

Play

Current Time0:00

/

Duration Time0:04

Progress: 0%

0:00

Fullscreen

00:00

Unmute

The forecasting service added that signs are pointing toward a shift of the polar vortex that may cause snow, rain and other hazardous weather conditions like icy roads in some parts of the Northeast.

Right now, a cold snap is bringing an abrupt November reality check to most of the eastern US that will persist for the rest of the Veterans’ Day weekend. As Accuweather explains, the weather pattern will become even more interesting later in the week because it will feature a meteorological phenomenon called “the Greenland block”.

This pattern consists of relatively high pressure wind pattern near greenland that forces the polar jet stream to move sharply south toward the eastern US.

…click on the above link to read the rest of the article…

The Non-Compete Clause – Modern Day Slavery

From Wikipedia:

“…The Thirteenth Amendment (Amendment XIII) to the United States Constitution abolished slavery and involuntary servitude, except as punishment for a crime. In Congress, it was passed by the Senate on April 8, 1864, and by the House on January 31, 1865. The amendment was ratified by the required number of states on December 6, 1865. On December 18, 1865, Secretary of State William H. Seward proclaimed its adoption. It was the first of the three Reconstruction Amendments adopted following the American Civil War…”

Unfortunately, the thirteenth amendment to our Constitution did not put an end to slavery. It has changed form, but it is still very much alive today.

There has been a push by companies and major corporations over the past decade or so to what they call a ‘non-compete clause’ as a requirement for employment. They require an employee, whether they be new hires or even some that have been employed with them for many years, to sign one of these in order to obtain or to continue their employment there.

These clauses state that an employee cannot seek employment in the same field for a designated period (usually at least one year and oftentimes several years) after leaving their company.

In most cases, the reason for an employee’s departure makes no difference. Whether they went to a competitor for more money or better benefits, were laid off from their current company, or even fired for any reason. They are still bound by this unconscionable clause.

If you have been in a given business for all of your professional career and at some point you choose to leave and go to another employer for whatever reason, these clauses state that you cannot, and your former employer can and will sue you if you do.

…click on the above link to read the rest of the article…

November 10, 2017

Why Saudi Purge Signals War Footing

Why Saudi Purge Signals War Footing

Mass arrests of senior royals, amid fear of assassinations, indicate that what is going on in Saudi Arabia is a far-reaching purge. The facade of a “corruption probe” – promoted in part by Western news media and US President Donald Trump – is a barely credible cover.

The cover is not just for a ruthless power grab within the desert kingdom by Saudi rulers, but a realignment that also puts the entire Middle East region on notice for more conflict and possibly even an all-out war with Iran. A war that the Israeli state and the Trump administration are enthusiastically egging on.

This move towards war with Iran could explain why the Saudi royals made a landmark trip to Moscow last month. Was it an attempt to buy off Russia with oil and weapons deals in order to free the Saudi hand with regard to Iran?

In typical fragmented fashion, Western media have tended to report the mass arrest last weekend of royal princes, ministers and business leaders, carried out under the orders of King Salman and his heir Crown Prince Mohammed bin Salman, as a crackdown on corruption and business sleaze.

Omitted in media coverage is the significant wider context of the Saudi rulers moving at the same time to exert political control over regional politicians, as well as making sensational claims that Iran and Lebanon have “declared war” on Saudi Arabia by allegedly supporting a missile strike from Yemen.

The apparent forced resignation of Lebanese premier Saad Hariri last weekend after having been summoned to Saudi capital Riyadh provided convenient substance to Saudi claims that Iran and its Lebanese ally Hezbollah were destabilizing Lebanon and indeed plotting to assassinate Hariri.

…click on the above link to read the rest of the article…

Oil Production Vital Statistics October 2017

Last month I drew attention to the fact that the WTI-Brent spread had opened to $7 and that this could be a bullish signal for the oil price. A strong rally in Brent has since continued and the price now stands close to $64 / bbl while the spread remains at $6.50 (Figure 3).

Last month I drew attention to the fact that the WTI-Brent spread had opened to $7 and that this could be a bullish signal for the oil price. A strong rally in Brent has since continued and the price now stands close to $64 / bbl while the spread remains at $6.50 (Figure 3).

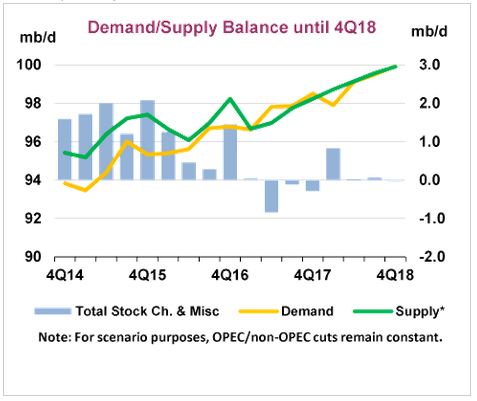

The main reason for this sustained recovery is that the oil market has been brought back into balance thanks to a high level of compliance in the OPEC-Russia+others production cuts and continued growth in global demand for oil. There are several other factors discussed below which suggest that the oil price rally may continue.

[Inset image of the Ku Maloob Zaap production facilities offshore Mexico. Maintenance, delayed by Hurricanes, underlies falling production. When injected nitrogen hits the producing wells, production will collapse.]

The chart below from the October 2017 IEA OMR shows how in the course of 2017 the oil market has been brought back into balance. There is still a vast >3 billion barrels of crude and refined products in storage within the OECD, but the very fact that storage capacity no longer has to grow is bullish since this avoids the scenario where tanker loads have nowhere to go (full storage) which can dump the price.

One reason it has taken so long for the production cuts to work is that production in both Libya and Nigeria have recovered from lows (Figure 17), caused by civil unrest, adding over 1 Mbpd to OPEC supply. Both are now on cyclical highs and are unlikely to rise much further. Indeed, the normal direction post-high is downward. At worst, the Libya – Nigeria market drag should now become neutral.

…click on the above link to read the rest of the article…

Interest Rates will Double

QUESTION: Mr. Armstrong; Thank you for an excellent conference. I have been attending since 2011. Each time you deliver a different conference and they are always better than the last. I could not help to notice on Zero Hedge they ran a piece about a Harvard University’s visiting scholar at the Bank of England who claims:

“We trace the use of the dominant risk-free asset over time, starting with sovereign rates in the Italian city states in the 14th and 15th centuries, later switching to long-term rates in Spain, followed by the Province of Holland, since 1703 the UK, subsequently Germany, and finally the US.”

Besides claiming to calculate the 700-year average real rate at 4.78% suggesting that rates will rise sharply when your models are 5,000 years, the two ridiculous statements are a 700-year average as if this really means something in the near-term when rates have been below that for nearly 10 years, and second the statement that he traces “the dominant risk-free asset over time.” You have demonstrated that moving averages are not valid in forecasting and that government routinely defaults.

You forecast at the conference that rates would rise very rapidly as we move into the Monetary Crisis Cycle. When I returned home to Greece, the latest news here is that so many people do not even have the money left to pay taxes. Is this part of the first stone in the water that sets off the waves of the Monetary Crisis Cycle?

ANSWER: It is very nice to trace 700 years and come up with the average of 4.78% by switching to the dominant economy as the financial capital of the world moved. However, starting the study in the 14th century skips the crazy part. There was the Great Financial Crisis of 1092 in Byzantium.

…click on the above link to read the rest of the article…