Steve Bull's Blog, page 1257

November 14, 2017

The Reverse Midas Touch of Saudi Arabia’s Crown Prince is Turning the Middle East to Dust

KUDOS TO GERMANY’S spooks. Back in December 2015, the German foreign intelligence agency, BND, distributed a one-and-a-half-page memo to various media outlets titled: “Saudi Arabia — Sunni regional power torn between foreign policy paradigm change and domestic policy consolidation.” The document was pretty astonishing, both in its undiplomatic bluntness and remarkable prescience.

“The current cautious diplomatic stance of senior members of the Saudi royal family will be replaced by an impulsive intervention policy,” the memo warned, focusing on the role of Mohammed bin Salman, who had been appointed as deputy crown prince and defense minister at the age of 30 earlier that year.

Both MBS, as he has come to be known, and his elderly father King Salman, the BND analysts wrote, want Saudi Arabia to be seen as “the leader of the Arab world” with a foreign policy built on “a strong military component.” Yet the memo also pointed out that the consolidation of so much power in a single young prince’s hands “harbors a latent risk that in seeking to establish himself in the line of succession in his father’s lifetime, he may overreach,” adding: “Relations with friendly and above all allied countries in the region could be overstretched.”

And so it has come to pass. In fact, despite being repudiated at the time by a German government more concerned about diplomatic and commercial relations with Riyadh, the BND warning turned out to be eerily prophetic.

Consider recent events in the Gulf. Can you get more “impulsive” than rounding up 11 fellow princes, including one of the world’s richest menand the commander of the national guard, and holding them at the Ritz Carlton on charges of corruption?

…click on the above link to read the rest of the article…

Why the Worst Humans Are Able to Rise to Power

In chapter ten of The Road to Serfdom, “Why the Worst Get on Top,” Hayek continues to warn about the dangers of planned economies, but with a slightly different approach from earlier chapters.

Stepping into new territory, here we see Hayek not only identifying economic problems but also discussing the very nature of power itself. Specifically, he addresses how totalitarians are able to rise to power and coerce entire populations into absolute despotism.

What is so fascinating about Hayek’s warnings in this chapter is the fact that they were written at a time when the world was desperately trying to make sense of what had just occurred in Germany during WWII. Hitler and the Third Reich were all too fresh in the minds of all mankind, making Hayek’s warnings extraordinarily relevant.

History’s most notorious dictators did not rise to power randomly.

The world was determined to never let that kind of evil loose on civilization again, but as Hayek warned, it is not merely a matter of making sure “good” people get elected to office; it is making sure totalitarianism is rejected at all corners: economic, political, social and all other forms imaginable.

Three Reasons Why

History’s most notorious dictators did not rise to power randomly. And in this chapter of his book, Hayek explains why the most despicable people always end up with political power and why, to paraphrase Lord Acton, absolute power always corrupts absolutely.

Hayek explains:

There are three main reasons why such a numerous and strong group with fairly homogeneous views is not likely to be formed by the best but rather by the worst elements of any society. By our standards the principles on which such a group would be selected will be almost entirely negative.

…click on the above link to read the rest of the article…

Food as Medicine

Food as Medicine

Hippocrates said “Let food be they medicine, and medicine be thy food.” At the doctor’s office for my annual checkup I was asked to list any herbs I take and I thought “this should be interesting.” Sure, I take herbal supplements but what about all the fresh or dried herbs I cook with or drink as tea? What about Mediterranean herbs in spaghetti, garlic in hummus, basil in pesto, chamomile or mint tea? What about carrots, sweet potatoes and squash in navy bean soup to boost our immune system and fight off colds? I asked the doctor if I should list basil in pesto and was told “No, that’s food!” (along with a look that said I must be an idiot). Well isn’t that the point, that our food is our medicine!

I was watching T.V. and listening to the warnings of side effects from the medicine being advertised, and wondered why people consider the risk worth taking the medicine! Many food and drugs sold seem to cause health problems. There’s a phenomenon called ‘prescription cascade’ where one prescription causes side effects that require another prescription, which causes side effects that require another prescription, which causes side effects…. and well, you get the idea. Nice profit for drug companies and doctors who control the prescriptions.

Our industrial agriculture and food manufacturing practices are making food with lower nutritional value. Fresh minimally processed ‘whole’ food contains nutrients important for our health such as calcium, magnesium, potassium, iron, beta-carotene, vitamin B-complex, vitamin-C, vitamin-A, and vitamin K, antioxidants, soluble and insoluble fiber. Processed food has nutritional supplements added back in along with preservatives and artificial color and flavors, and many other food additives. We no longer think of food as medicine, or expect it to be medicine. We are more often concerned about the negative aspects, avoiding the unhealthy foods we shouldn’t eat. Plants have provided our medicine for most of human history.

…click on the above link to read the rest of the article…

The War That Would Transform Oil Markets

A fire erupted at an oil pipeline connecting Bahrain and Saudi Arabia, and the two Arab allies are pointing the finger at Tehran. Iranian officials denied any involvement, but the incident is the latest in a series of events that are intensifying conflict between the Middle Eastern rivals.

The oil pipeline resumed operations in a matter of hours, but the war of words is heating up. Bahrain’s Foreign Minister Khalid Al-Khalifa said on Twitter that the “attempt to bomb the Saudi-Bahraini oil pipeline is a dangerous Iranian escalation that aims to scare citizens and hurt the global oil industry.” A spokesperson for Iran fired back, saying that the Bahrainis “need to know that the era for lies and childish finger-pointing is over.”

The incident comes only days after a missile was fired from Yemen into Saudi Arabia, which the Saudis pinned on Iran.

Meanwhile, a web of intrigue has enveloped Lebanon, the small country in which all the regional powers hope to exert their influence. Earlier this month, Lebanese Prime Minister Saad al-Hariri resigned and decamped to Saudi Arabia, blaming Iran and Hezbollah for putting his life and his family’s safety at risk.

But, Hezbollah said Hariri is actually being held captive by the Saudis. Riyadh, in turn, warned Saudi nationals to leave Lebanon. Israeli leaders have said they would bomb Lebanon back to the Stone Age.

To further confuse matters, Hariri said he could withdraw his resignation and continue on as prime minister, so long as Hezbollah quit interfering in regional conflicts. “I am not against Hezbollah as a party; I have a problem with Hezbollah destroying the country,” he said.

…click on the above link to read the rest of the article…

U.S. Grid Narrowly Escapes Apocalyptic Attack

The American grid security story grows increasingly grim. Last week, security consulting firm Symantec warned that recent cyberattacks gave hackers direct access to the nation’s power grid on multiple occasions, according to a new report by Wired.

This time, not only the United States was exposed, said Symantec. Europe also experienced similar vulnerabilities, proving the hackers could have induced blackouts on both sides of the Atlantic. Thankfully, this apocalyptic scenario didn’t happen.

In spring and summer 2017, the Dragonfly 2.0 hacker group—a primary culprit featured in cybersecurity reports from many experts lately—launched campaigns against energy companies. They succeeded 20 times, hacking their way into full access to their target companies’ corporate servers and operations controls. This meant they could turn off circuit breakers that control the direct flow of electricity to homes and businesses.

“There’s a difference between being a step away from conducting sabotage and actually being in a position to conduct sabotage… being able to flip the switch on power generation,” Eric Chien, a Symantec security analyst, told Wired. “We’re now talking about on-the-ground technical evidence this could happen in the U.S., and there’s nothing left standing in the way except the motivation of some actor out in the world.” Related: Venezuela Just 24 Hours Away From Formal Declaration Of Default

The Ukrainian grid power blackouts of 2015 and 2016 are generally considered the firstinstances of cyberattacks wreaking havoc on a nation’s power supplies. Analysts believe that the perpetrator of the first attack on Ukraine’s power back in December 2015 was the Sandworm team, a group of hackers who previously targeted Europe and the United States. An updated version of their most lethal software, Blackenergy 3, was at the root of Ukraine’s initial power crisis.

…click on the above link to read the rest of the article…

Mideast Turmoil: Follow the Oil, Follow the Money

In this scenario, time is running out for Saudi Arabia’s free-spending royalty and state– and for all the other free-spending oil exporters.

While there are numerous dynamics at work in the turmoil roiling Saudi Arabia and by extension, the Mideast, one way to cut to the chase is to follow the oil, follow the money. Correspondent B.D. recently posited a factor that has been largely overlooked in the geopolitical / fate-of-the-petrodollar discussions:

Perhaps the core dynamic is a technical one of diminished oil production. Here is Bart’s commentary:

“I think the Saudis may be quickly running out of profitable oil to produce/export.

I think they tried to over-produce for a while to damage the competition… and they now have production issues resulting from that. (As has happened in the past)

I think they may have recently slipped over the event horizon for being the world’s swing producer of ‘cheap-ish and abundant’ oil. That has huge ramifications for the global markets ability to quickly respond to supply/demand fluctuations.

I suspect they’re no longer cutting production voluntarily … they are now in the grip of a technically driven decline in output. (Why else begin selling off ARAMCO now?)

I doubt that many national economies can handle $70+ oil for very long… price will be limited by the ability of the consumers to pay. What I assume should happen is relentless severe volatility in the absence of a big swing producer that can open up or shut in production with comparative ease.”

Thank you, B.D. Let’s start with what’s well-established about Saudi oil production:

1. The days of sticking a straw in the sand and oil gushing out are long gone. Oil production now depends on costly technologies such as pressurizing the wells with seawater, CO2, etc.

…click on the above link to read the rest of the article…

People Act Where US Fails On Climate

The climate crisis is upon us. It seems that every report on climate conditions has one thing in common: things are worse than predicted. The World Meteorological Report from the end of October shows that Greenhouse Gases (GHGs) are rising at a rapid rate and have passed 400 parts per million. According to Dr. Kevin Trenberth of the National Center for Atmospheric Research, “the changes we’re making today are occurring in 100 years, whereas in nature they occur in 10,000 years.”

The United States is experiencing a wide range of climate impacts from major hurricanes in the South to unprecedented numbers of wildfires in the West to crop-destroying drought in the Mid-West. In October, the General Accounting Office reported that the US has spent over $350 billion in the last decade on disaster relief and crop insurance, not counting this year’s hurricanes. These costs will continue and rise.

We are past the time to make a major commitment to the transformation we need to mitigate and adapt to the climate crisis. Imagine the benefits that such a commitment would have in creating a cleaner environment, better health and more jobs and, if structured in a way that is democratized and benefits the public, in ending environmental racism and economic injustice.

Climate talks in Germany

The 23rd session of climate talks is taking place right now in Bonn, Germany. The United States formally withdrew from its commitment to the Paris climate treaty, but delegations of people from the US are in attendance to show their commitment to addressing the climate crisis. A group of organizations, such as 350.org and Indigenous Environmental Network, presented their climate platform as “the people’s delegation.” They are calling for a just transition to a fossil-free future and an end to market schemes to offset carbon use.

…click on the above link to read the rest of the article…

November 13, 2017

OPEC Reports 151Kbpd Drop In October Crude Output; Raises Demand Forecast For 2018

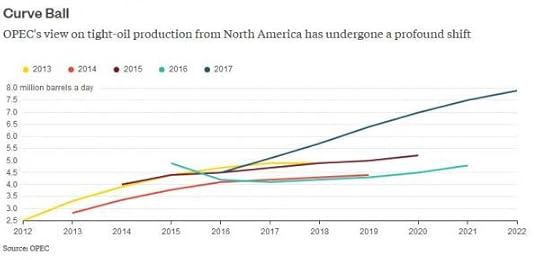

True to its perpetually optimistic form, OPEC, which only last week for the first time conceded the threat posed by rising US shale production…

… sharply raised its demand forecast for cartel oil in 2018, ahead of a key meeting of the group’s ministers later this month. According to OPEC’s monthly market report, the oil exporters said the forecast demand for its oil next year had been increased by around 400,000 barrels a day from the previous month to 33.4mmbpd, about 0.46mmbpd higher than in 2017. Overall, the cartel now expects global demand growth to rise by 1.53 million barrels a day in 2017 – an upward revision of 74kbps from the October report citing better than expected performance from China – and 1.51 million barrels a day in 2018.

The increase comes on the back of the recent global economic strength, which has exceeded many analysts’ expectations, helping to draw down inventories that built up during the crude glut since late 2014. Furthermore, the rise in demand has combined with the 1.8mmbpd in production cuts by OPEC and non-OPEC nations since January of this year to help tighten the market, pushing the price of Brent back above $60 a barrel for the first time in two years.

As the FT adds, cartel analysts said demand for Opec crude is expected to reach 34m b/d in the second half of next year, roughly 1.4mmbpd above what they pumped last month, according to secondary sources. As usual, oil demand is contingent not only on overall confidence (i.e. the stock market), but also whether the global economy is expanding or contracting, which all boils down to whether China is creating lots of new debt each month.

…click on the above link to read the rest of the article…

Global Gold Investment Demand To Overwhelm Supply During Next Market Crash

When the next market crash occurs, global gold investment demand will likely overwhelm supply. When this occurs, we could finally see the gold price surpass its previous high of $1,900. Now, this isn’t mere speculation, as we already have seen this taking place in the past. When the broader markets crashed to the lows in Q1 2009 and the 10% correction in Q1 in 2016, these periods were to two highest quarters of Gold ETF investment demand.

I don’t really care on whether the physical gold is actually in the Gold ETF’s, rather I like to look at it as an important indicator that shows us how much investor fear there is in the market. Moreover, with the amount of leverage and debt now in the system, when the market crashes this time around, it will push gold investment demand up to a record we have never seen before.

The chart below shows the amount of physical global gold investment demand over the past 14 years. As the gold price increased, so did amount of gold bar and coin demand:

As we can see, during the U.S. Banking and Housing Market crash in 2008, gold bar and coin demand doubled to 868 metric tons (mt), up from 434 mt in 2007. That was quite a lot of gold bar and coin demand as it totaled nearly 28 million oz (1 metric ton = 32,150 oz). Furthermore, as the gold price jumped to $1,571 in 2011, gold bar and coin demand shot up to nearly 1,500 mt (48 million oz).

Now, the reason for the huge spike in physical gold investment in 2013 was due to the huge price smash as the gold price fell from nearly $1,700 in the beginning of the year to a low of $1,380 by the middle of April. Investors thought this was a huge sale on gold so demand for bars and coins reached a new record of 1,716 mt.

…click on the above link to read the rest of the article…

Are you ready for a new round of mass exterminations?

The great “pulse” of mass exterminations that occurred during the 20th century (graph created by Rummel). According to this chart, 262 million people were exterminated during the last century, mainly by governments in a series of actions that Rummel defines as “democides”. The question is, could something similar occur in the future? It turns out that mass exterminations are like earthquakes, their occurrence cannot be predicted exactly; but we can estimate the probability of an event of a certain size to occur. And the more time passes, the more likely a new pulse of mass exterminations becomes.

In this sobering exclusive analysis for INSURGE, Professor Ugo Bardi dissects historical statistics on war to unpick the patterns of violence of the past and uncover what this says about the present — and our coming future. He warns that statistical data suggests we are on the brink of heading into another round of major wars resulting, potentially, in mass deaths on a scale that could rival what we have seen in the early 20th century. Far from mere doom-mongering, Bardi’s warning is based on a careful assessment of statistical patterns in the data.Such a future, however, may not be set in stone — given that for the first time we are able to assess our past to discern these patterns, in a way we could not do before. Perhaps, then, the path to freedom from the patterns of the past remains open. The question is: what are we going to do with this information?

Humans are dangerous creatures; this much is clear. During the 20th century, about one billion humans were killed, directly or indirectly, by other humans.

Not all these murders were intentional, but a good fraction was, including some 262 million people killed in what Rummel calls “democides”, the government-organized extermination of a large number of people for political, racial, or generally sectarian reasons.

…click on the above link to read the rest of the article…