Steve Bull's Blog, page 1209

January 26, 2018

“This Is 1987”: Some “Haunting Math” On Today’s GDP Number From David Rosenberg

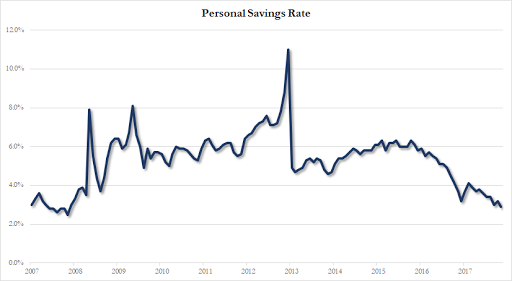

When discussing today’s unexpectedly weak Q4 GDP print, which came in at 2.6%, far below consensus and whisper estimates in the 3%+ range, and certainly both the Atlanta and NY Fed estimates, we pointed out the silver lining: personal spending and final sales, which surged 4.6% Q/Q (vs 2.2% in Q3), although even this number had a major caveat: “as we discussed previously, much of it was the result of a surge in credit card-funded spending while the personal savings rate dropped to levels last seen during the financial crisis.”

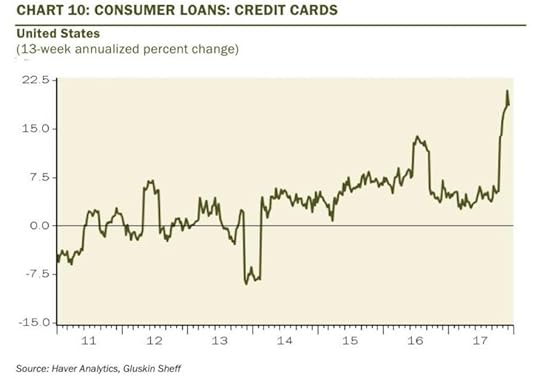

Indeed, recall the stunning Gluskin Sheff chart we presented a month ago, which showed that 13-week annualized credit card balances in the U.S. had gone “completely vertical” in the last few months of 2017 which we said “should make for some great Christmas.”

Meanwhile, even more troubling was the ongoing collapse in the US personal savings rate, which last month tumbled to the lowest level since the financial crisis as US consumers drained what little was left of their savings to splurge on holiday purchases.

And while we highlighted and qualified two trends as key contributors to the spending surge in Q4 personal spending, Gluskin Sheff’s David Rosenberg – who is once again firmly in the bearish camp – did one better and quantified the impact. Not one to mince words, the former Merrill chief economist described what is going on as “The Twilight Zone Economy” for the following reason:

how many times in the past have we seen a 2.6% savings rate coincide with a 4.1% jobless rate? How about never…huge ETF flows driving equities higher, but these metrics are screaming ‘late cycle’.

He then proceeded to give “some haunting math” from the GDP number: “The savings rate fell from 3.3% to 2.6%. If it had stayed the same, real PCE would have been 0.8% (annualized) instead of 3.8% and GDP would have been 0.6% instead of 2.6%.”

…click on the above link to read the rest of the article…

Untying PropOrNot: Who They Are … and a Look at 2017’s Biggest Fake News Story

A little over a year ago, the deep-state graced the world with Propornot. Thanks to them, 2017 became the year of fake news. Every news website and opinion column now had the potential to be linked to the Steele dossier and Trump collusion with Russia. Every journalist was either with us or against us. Every one that was against us became Russia’s trolls.

Fortunately for the free world, the anonymous group known as Propornot that tried to “out” every website as a potential Russian colluder, in the end only implicated themselves.

Turnabout is fair play and that’s always the fun part, isn’t it? With that in mind, I know the dogs are going to howl this evening over this one.

The damage Propornot did to scores of news and opinions websites in late 2016-2017provides the basis of a massive civil suit. I mean huge, as in the potential is there for a tobacco company sized class-action sized lawsuit. I can say that because I know a lot about a number of entities that are involved and the enormous amount of money behind them.

How serious is this? In 2016, a $10,000 reward was put out for the identities of Propornot players. No one has claimed it yet, and now, I guess no one will. There are times in your life that taking a stand has a cost. To make sure the story gets out and is taken seriously, this is one of those times.

If that’s what it takes for you to understand the danger Propornot and the groups around them pose to everyone you love, if you understand it, everything will have been well worth it.

…click on the above link to read the rest of the article…

US Crude plus Condensate and Tight Oil, Jan 2018 Update

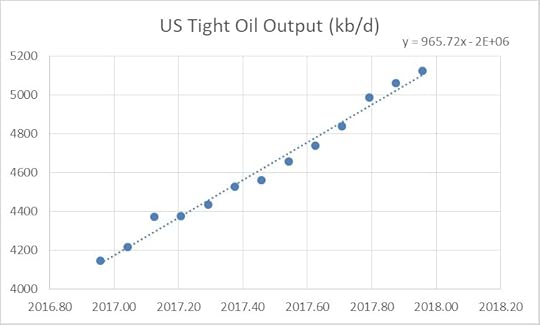

From Dec 2016 to Dec 2017 US Tight oil output has increased by 975 kb/d based on US tight oil output data from the EIA.

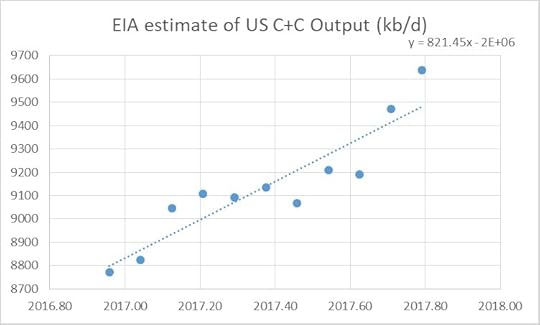

For the entire US we only have EIA monthly output estimates through Oct 2017. Over the Dec 2016 to Oct 2017 period US output has increased by 866 kb/d and the OLS trend has a slope of 821 kb/d.

Note that the 866 kb/d increase in US output over 10 months would be a 1040 kb/d increase over a 12 month period.

Most of the increase in US output has been from increased LTO output. The forecasts by several agencies (EIA, IEA, and OPEC) of more than a 1000 kb/d increase in US output in 2018 may assume that the recently increased oil price level will lead to increased investment in the oil sector.

Much of the increase in LTO output has been in the Permian basin and several factors may slow down the recent rapid growth. Among these are limited fracking crews, inadequate pipeline capacity for natural gas, which will limit output as flaring limits are reached, and potential water shortages.

Longer term the various LTO plays will run out of space to drill more wells in the tier one areas (the so-called sweet-spots) and this will limit the rate of increase within 2 or 3 years. It is likely that the Eagle Ford is close to this point, the Bakken might reach that point by 2019, and the Permian basin perhaps by 2021.

For US C+C output, I expect about a 600+/-100 kb/d increase in 2018.

Selco: What an “Average Day” Is REALLY Like When the SHTF

Did you ever think about how different your day to day life would be after an SHTF event? The little things we take for granted now, like making a meal, staying warm, or having water to drink and bathe in would suddenly become a whole lot more complicated.

Who better to tell us what that is like than Selco? For those who don’t know, Selco spent a year in a city in Bosnia that was blockaded. During that year, he and the other residents lived without our normal amenities like heat, running water, electricity, and supplies that could be purchased at the stores.

I asked him some questions about daily life after the SHTF. I think you’ll agree that his answers are eye-opening.

(Note: Selco’s interviews are lightly edited for clarity, but I want to use his own words. The authenticity of his stories remains intact. For those of you who don’t know of Selco, please note that English is his 4th language. Whiny grammar Nazi comments will be deleted. Comments complaining about my use of the word “Nazi” will be posted, however, so we can publicly mock them, and then the commenter will be banned forever for being a whiner.)

What time did you usually get up? What woke you?

A few weeks after the collapse came, all aspects of our normal life changed based on the new reality around us.

One aspect was “sleep cycle“- the time when we sleep and when we were awake and active.

One of the most basic rules that jumped in was that most of the activities got done during the night.

…click on the above link to read the rest of the article…

Family Preparedness Essentials: Assessing Your Emergency Medicine Supply For the Home

ReadyNutrition Guys and Gals, it doesn’t take a stretch of the imagination to see that we’re living in perilous times and on the brink of a slew of problems. There are several flashpoints throughout the world that can translate into war at any time, such as Ukraine, Syria, and North Korea. Knowing these things, your preparations and training need to continue. You can continue this preparation by conducting a home assessment regarding medicines and supplies you will need.

ReadyNutrition Guys and Gals, it doesn’t take a stretch of the imagination to see that we’re living in perilous times and on the brink of a slew of problems. There are several flashpoints throughout the world that can translate into war at any time, such as Ukraine, Syria, and North Korea. Knowing these things, your preparations and training need to continue. You can continue this preparation by conducting a home assessment regarding medicines and supplies you will need.

What do I mean by this? I mean for you to specifically identify all the needs of each of your family members and begin acquiring them. Family members have varying needs depending on age and physical condition. Now is the time to ensure you have all the meds you need and the vitamins you will need when the SHTF. Allow me to sound the personal “trumpet” that I have been sounding throughout the years and in many articles:

You guys and gals need to get into good physical shape: it cannot be overemphasized.

Assessing Your Emergency Medicine Supply For the Home

That being said, how do you start? It is simple enough if you just insert a measure of organization and preparedness planning into it. Let’s do it, shall we?

Start by identifying family members who have special needs and/or ongoing, long-term treatment in terms of medication. Examples of conditions can be Type I Diabetics, Blood Pressure/Circulatory patients (meds such as Calcium Channel blockers, etc.), and family members with respiratory compromise (such as COPD, or severe, chronic asthma).

…click on the above link to read the rest of the article…

OUTBREAK ALERT: Yellow Fever Death Toll Triples In Brazil

The yellow fever outbreak in Brazil has taken a backseat to the flu outbreak spreading globally. But, the death toll from yellow fever has now tripled and travelers are being warned.

The World Health Organization (WHO) said on Monday there are 35 confirmed cases of the disease, including a case confirmed in the Netherlands for a traveler who had recently visited Sao Paulo state. Sao Paulo even closed its zoo and botanical gardens Tuesday as the yellow fever outbreak that has led to 70 deaths is picking up steam.

The big Inhotim art park, which attracts visitors from all over the world, also announced that all visitors would have to show proof of yellow fever vaccination to be allowed to enter. The park said the measure was preventative only and that so far, no case of yellow fever had been found there.

Yellow fever is a potentially life-threatening viral disease that is transmitted to people by the bite of an infected mosquito. Yellow fever is a very rare cause of illness in U.S. travelers. The degree of sickness ranges in severity from a self-limited febrile illness to severe liver disease with bleeding, and even death. The virus has killed 20 people since July.

Health officials have said the disease could quickly spread and become an epidemic in crowded areas, but immunologist Dr. Anthony Fauci told Daily Mail Online that getting the yellow fever shot is the best way to prevent travel-related cases of yellow fever. Brazilians stood in lines for hours to get yellow fever vaccinations in the country’s largest states, including Sao Paulo, last week.

…click on the above link to read the rest of the article…

Will Monetary Policy Trigger Another Financial Crisis?

Getty Images

Getty ImagesWill Monetary Policy Trigger Another Financial Crisis?

Sustained unconventional monetary policies in the years after the 2008 global financial crisis created the conditions for the second-longest bull market in history. But they also may have sown the seeds of the next financial crisis, which might take root as central banks continue to normalize their policies and shrink their balance sheets.

LONDON – Former US President Ronald Reagan once quipped that, “The nine most terrifying words in the English language are: I’m from the government and I’m here to help.” Put another way, policymakers often respond to problems in ways that cause more problems.

Consider the response to the 2008 financial crisis. After almost a decade of unconventional monetary policies by developed countries’ central banks, all 35 OECD economies are now enjoying synchronized growth, and financial markets are in the midst of the second-longest bull market in history. With the S&P 500 having risen 250% since March 2009, it is tempting to declare unprecedented monetary policies such as quantitative easing (QE) and ultra-low interest rates a great success.

But there are three reasons for doubt. First, income inequality has widened dramatically during this period. While negative real (inflation-adjusted) interest rates and QE have hurt savers by repressing cash and government-bond holdings, they have broadly boosted the prices of stocks and other risky financial assets, which are most commonly held by the wealthy. When there is no yield in traditional fixed-income investments such as government bonds, even the most conservative pension funds have little choice but to pile into risk assets, driving prices even higher and further widening the wealth divide.

…click on the above link to read the rest of the article…

Economic Collapse and Dollar Hegemony – How Did This Start?

Economic Collapse and Dollar Hegemony – How Did This Start?

In the previous article I explained why bitcoin should be considered a reaction to US dollar hegemony and how other nations and central banks are facing the crisis of the dollar brought on by de-dollarization. In this article I will go into how we came to this point and what mechanisms helped to bring about a debt-based society. In the third and last article we will examine the nature of the future geopolitical and geo-financial transition as well as the signals we need look out for in the immediate future.

From Gold to Paper

To understand what is happening today we must look back to simpler times, back when people bartered with each other. The utility and availability of commodities determined their value. Gold in particular represented a finite good that was difficult to find and was useful in various fields. For this reason gold has always been considered the highest example of a valuable good, together with diamonds, platinum, silver and other elements that are difficult to find but have a common or daily use. For example, the importance of utility transformed uranium, an otherwise worthless element, into a valuable commodity following the discovery of atomic energy. Returning to gold, one can understand how in the era of barter, gold was the reference element with which to price the value of everything. Little by little, gold was joined by silver and then bronze in simplifying the exchange of goods and increasing convenience of use.

Gold had its own intrinsic value and was valid in every empire around the world; the same with silver and bronze. Gold had become not only a means of exchange and a measure of value but also a reservoir of value to be bequeathed to heirs. Above all it was a means of payment.

…click on the above link to read the rest of the article…

Mastercard Pushes Biometrics, Banks Follow

Biometric authentication “will be of great benefit to everyone.”

Mastercard has set a deadline for widespread use of biometric identification for its services across the whole of the EU: April 2019. Mastercard Identity Check, currently available in 37 countries, enables individuals to use biometric identifiers, such as fingerprint, facial, and iris recognition, to verify their identities when using a mobile device for online shopping and banking. The technology is not mandatory for customers, but from next year it will be vigorously promoted throughout the EU and many consumers will welcome it.

The impact will be felt not just by consumers but also by most European banks, since any bank that issues or accepts Mastercard payments will have to support identification mechanisms for remote transactions, alongside existing PIN and password verification. The deadline will also apply to all contactless transactions made at terminals with a mobile device.

Citing research it carried out with Oxford University, Mastercard says that 92% of banking professionals want to introduce biometric ID. This high number shouldn’t come as much of a surprise given the vast untapped value consumer data holds for banks and corporations as well the preference most banks have for electronic transactions. The study also claims that 93% of consumers would prefer biometric security to passwords, which is a surprise given the array of thorny issues biometrics throws up, including the threat it poses to privacy and anonymity and its deceptively public nature.

“A password is inherently private,” says Alvaro Bedoya, Professor of Law at Georgetown University. “The whole point of a password is that you don’t tell anyone about it. A credit card is inherently private in the sense that you only have one credit card.”

…click on the above link to read the rest of the article…

EPA Orders Testing for GenX Contamination Near Chemours Plant in West Virginia

EPA ORDERS TESTING FOR GENX CONTAMINATION NEAR CHEMOURS PLANT IN WEST VIRGINIA

DuPont introduced GenX in 2009 to replace PFOA, also known as C8, a chemical it had used for decades to make Teflon and other…

THE ENVIRONMENTAL PROTECTION AGENCY has asked Chemours to test water near its plant in West Virginia for the presence of the chemical GenX. In a January 11 letter to Andrew Hartten, Chemours’ principal project manager for corporate remediation, Kate McManus, acting director of the EPA’s water protection division, noted that GenX has already “been detected in three on-site production wells and one on-site drinking water well” at the company’s factory in West Virginia, which is known as Washington Works.

McManus also referred to GenX contamination near the Chemours factory in Fayetteville, North Carolina, where DuPont and its spinoff Chemours dumped approximately 200,000 pounds of GenX into the Cape Fear River since 1980, according to Detlef Knappe, a North Carolina State University professor who has studied the contamination. In that time, more than 200,000 people have been exposed to GenX in their drinking water.

“EPA is concerned that drinking water wells in the vicinity of the Washington Works facility may similarly be contaminated by GenX,” the letter explained.

DuPont introduced GenX in 2009 to replace PFOA, also known as C8, a chemical it had used for decades in North Carolina, West Virginia, and other locations to make Teflon and other products. Like GenX, PFOA escaped the West Virginia plant and seeped into local drinking water. The contamination — and the fact that DuPont executives knew about it and hid their knowledge — set off a mammoth class-action suit, which DuPont settled for $671 million.

…click on the above link to read the rest of the article…