Steve Bull's Blog, page 1213

January 6, 2018

New President–Same BLS Bullshit

I spent most of Obama’s presidency obliterating the jobs recovery narrative every month, as millions supposedly left the workforce because their financial situation was so wonderful. The bullshit shoveled by the BLS was nothing but manipulated misinformation then and it is still bullshit now. Just because the president is now Trump, doesn’t make the false narrative about a strong jobs recovery now valid. After a disappointing December jobs report, the cackling and tooting of horns might die down a little, but the propaganda peddlers will somehow spin it as a positive. Buy Stocks!!!!

Candidate Trump railed against the fake data put out by the BLS. He railed about the ridiculously low interest rates manufactured by the Fed. He declared the stock market was a bubble ready to burst. That was over 5,000 points ago. As expected, now that he is el presidente, Trump embraces the fake data, low interest rates and the most overvalued stock market in history. He tweets about the great economy and stock market every day. GDP has risen at a scintillating 2.5% pace in 2017. This is up from 2% in the prior two years, driven by people going further into debt to survive or buy shit they don’t need.

The narrative being propagated by the corporate MSM was this was the best holiday retail season in years. Americans were back to spending like drunken sailors. Trump is making America great again, so why not spend money we don’t have using that little piece of plastic. Those future tax savings will more than pay the bill. Except for a couple nagging questions.

…click on the above link to read the rest of the article…

‘Preparing for the Unthinkable’: CDC to Hold Briefing on How to Prepare the Public for a Nuclear Detonation in America

Amid rising tensions between the United States and North Korea, the Centers For Disease Control and Prevention have scheduled a briefing for later this month that will teach healthcare professionals how to better prepare the public for a nuclear detonation in America.

The “teaching session” will target doctors, nurses, epidemiologists, pharmacists, veterinarians, certified health education specialists, laboratory scientists, and others and will be held January 16th.

A posting on the CDC website outlines the agencies “Public Health Response to a Nuclear Detonation” which details the need to be able to inform the public on how to possibly survive such an attack.

“While a nuclear detonation is unlikely, it would have devastating results and there would be limited time to take critical protection steps. Despite the fear surrounding such an event, planning and preparation can lessen deaths and illness,” the notice reads.

“For instance, most people don’t realize that sheltering in place for at least 24 hours is crucial to saving lives and reducing exposure to radiation. While federal, state, and local agencies will lead the immediate response efforts, public health will play a key role in responding.”

Stat News reports:

A spokesperson for the agency said planning for the event has been underway for months — in fact, since CDC officials took part in a “radiation/nuclear incident exercise” led by the Federal Emergency Management Agency last April, Kathy Harben said in an email.

“CDC participants felt it would be a good way to discuss public health preparedness and share resources with states and other partners. State and local partners also have expressed interest in this topic over time,” she said.

…click on the above link to read the rest of the article…

China’s Xi Warns Military: Be Ready For War & “Don’t Fear Death”

In what is being characterized as a rare address to the world’s largest fighting force, President Xi Jinping on January 04 urged the Chinese military to be ready for war and ‘don’t fear death’.

As the beat of the war drums gets louder in East Asia and abroad, Xi’s rare speech to the military kicked off the New Year with a grim warning, as China and other countries in the region could be preparing for a turbulent year ahead.

China’s soldiers should “neither fear hardship nor death,” Xi told thousands of troops during an inspection visit Wednesday to the People’s Liberation Army’s (PLA) Central Theater Command in northern Hebei province, according to the official Xinhua news agency.

Xi advised the military to continue improving upon its equipment, tactics, technology, and combat readiness by engaging in “real combat training.”

He further said, the need to “create an elite and powerful force that is always ready for the fight, capable of combat and sure to win in order to fulfill the tasks bestowed by the Party and the people in the new era.”

In recent years, Xi has ushered in a period of modernization of China’s military, which has worried Asia and Washington alike. Xi is head of the Communist Party’s Central Military Commission, who is also the commander-in-chief of China’s two million-strong military. In October, he claimed his status to be the strongest leader in China that country has seen in decades during the 19th communist party congress.

Local Chinese media outlets report that Xi’s mobilization meeting with the entire armed forces is a first of its kind. Xi stated the goal of the Chinese military is to become a “world class” force by 2050. Perhaps, Xi has hinted at the time period when China expects to overtake the United States.

…click on the above link to read the rest of the article…

Weekly Commentary: Issue 2018: Market Structure

Financial conditions are much too loose. They remain too loose at home; they remain too loose abroad.

January 3 – ETF.com (Heather Bell): “…ETF flows really blew away previous records. Flows into exchange-traded funds were going full blast throughout the year and finished on a particularly strong note. A whopping $51 billion in new money came into U.S.-listed ETFs during December, pushing inflows for the year to $476.1 billion. Total assets now top $3.4 trillion. The data, which comes from FactSet, includes flows for every trading day of 2017. The $476.1 billion figure was far and away a record for annual inflows, blowing past the previous all-time high from last year of $287.5 billion.”

Think of this: 2017 ETF flows surpassed the previous year’s record flows by 66%. And while U.S. equities attracted the strongest flows at $180 billion, international equities were not far behind at $162 billion. There’s never been anything comparable to this Market Structure.

The Nasdaq100 jumped 4.0% in 2018’s initial four sessions. The Nasdaq Computer Index surged 4.2%. The Semiconductors jumped 5.8%. The Nasdaq Industrials gained 3.1%, the NYSE Healthcare Index 3.2%, the Philadelphia Stock Exchange Oil Services Sector Index 5.1% and the S&P500 Index 2.6%. The mania is global. Germany’s DAX jumped 3.1% in four sessions, France’s CAC 40 3.0%, Spain’s IBEX 3.7%, and Italy’s MIB 4.2%. Japan’s Nikkei jumped 4.2%, Hong Kong’s Hang Seng 3.0%, and the Shanghai Composite 2.6%. Notable EM gainers included Brazil (3.5%), Russia (4.6%), Argentina (7.1%), Poland (2.5%), Czech Republic (2.5%), Romania (3.0%), Philippines (2.5%) and Pakistan (5.1%). Portending a wild year in the currencies, a number of EM currencies went nuts this week.

Bubbles are self-reinforcing but inevitably unsustainable inflations. Asset Bubbles are fueled by some underlying source of unsound monetary inflation. Major speculative Bubbles and manias are always propelled by key misperceptions and resulting monetary disorder. Bubble flows intensified in 2017, as misperceptions became only more deeply embedded in the Structure of Securities Market Pricing. Loose finance is ensured indefinitely.

…click on the above link to read the rest of the article…

January 5, 2018

Why You Should Embrace the Twilight of the Debt Bubble Age

People are hard to please these days. Clients, customers, and cohorts – the whole lot. They’re quick to point out your faults and flaws, even if they’re guilty of the same derelictions.

People are hard to please these days. Clients, customers, and cohorts – the whole lot. They’re quick to point out your faults and flaws, even if they’re guilty of the same derelictions.

The recently retired always seem to have the biggest axe to grind. Take Jack Lew, for instance. He started off the New Year by sharpening his axe on the grinding wheel of the GOP tax bill. On Tuesday, he told Bloomberg Radio that the new tax bill will explode the debt and leave people sick and starving.

“It’s a ticking time bomb in terms of the debt.

“The next shoe to drop is going to be an attack on the most vulnerable in our society. How are we going to pay for the deficit caused by the tax cut? We are going to see proposals to cut health insurance for poor people, to take basic food support away from poor people, to attack Medicare and Social Security. One could not have made up a more cynical strategy.”

The tax bill, without question, is an impractical disaster. However, that doesn’t mean it’s abnormal. The Trump administration is merely doing what every other administration has done for the last 40 years or more. They’re running a deficit as we march onward towards default.

We don’t like it. We don’t agree with it. But how we’re going to pay for it shouldn’t be a mystery to Lew. We’re going to pay for it the same way we’ve paid for every other deficit: with more debt.

A Job Well Done

Of all people, Jack Lew should know this. If you recall, Lew was the United States Secretary of Treasury during former President Obama’s second term in office. Four consecutive years of deficits – totaling over $2 trillion – were notched on his watch.

…click on the above link to read the rest of the article…

One Bank Asks If The PBOC Is Secretly Goosing Markets

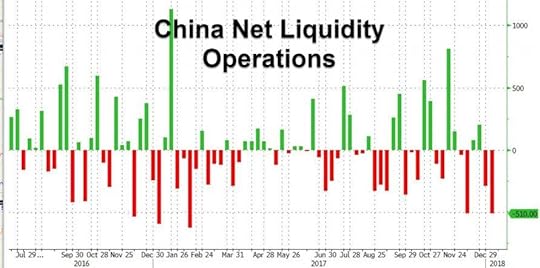

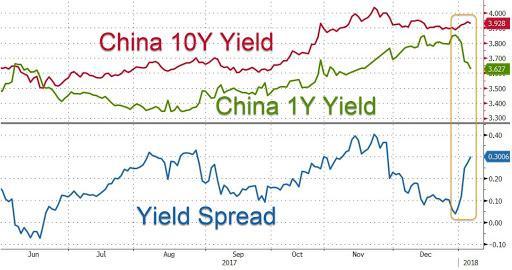

Something odd is going on in China. On one hand, the PBOC has been soaking up excess liquidity from the market like a drunken sailor, and after not conducting reverse repos for 10 consecutive days, it has reduced the excess liquidity level by 510bn yuan in the latest week as existing open market operations matured, and roughly half that in the week prior.

On the surface, this would suggest a sharp tightening in monetary conditions, and yet precisely the opposite is taking place: over the past week, instead of rising short-term rates – the traditional indicator of tighter conditions in China – yields on Chinese short-dated instruments have tumbled. Putting the move in context, 1Y yields have plunged nearly 20bps in the first week of 2018, the biggest weekly slide since June 2015.

In parallel, on Thursday the 7-Day repurchase rate slid to the lowest since April.

While some have provided theoretical explanations, nobody really knows what is going on. In fact, some such as Citi have put on the tinfoil hat and speculate that the PBOC is covertly adding tons of liquidity on the short-end of the curve, to wit:

It looks like the PBoC has been adding quite a lot of liquidity in the shorter end of the curve in recent days -with a variety of interbank rates softer, and the 1y CGB yield notably lower by 21bps YTD whereas 5s and 10s yields have stayed broadly flat.

Assuming that Citi is correct, it would explain many things, not least of all the stunning surge higher in Chinese, global and even US stocks. This is how Citi puts it:

Against that background, it is no surprise that equity markets have been so well supported and the SHPROP has exploded upward.

…click on the above link to read the rest of the article…

Quantitative Tightening Is the Biggest Economic Threat in 2018

In response to the 2008 financial crisis, the Fed and other central banks deployed zero or near-zero interest rates, quantitative easing, and assorted other interventions.

These may have averted an even worse disaster, but their impacts were far from ideal. Nonetheless, the economy slowly lifted off as consumers rebuilt their balance sheets and asset values rose.

The asset values climbed in large part because the Fed practically forced everyone with money to invest it in risk assets: stocks, real estate, corporate bonds, etc. But as my long-time Thoughts from the Frontline readers know, the Fed’s trickle-down monetary policy hasn’t really worked.

The resulting wealth effect theoretically enabled more spending, at least by those in the top income quintile. But the recovery has been slow and ugly, and too many people still don’t feel the progress.

QE Benefits Were Not Evenly Distributed

Those who gripe about income inequality actually have points to make.

Even if you filter out the top one half of 1% (the tech billionaires, Warren Buffett, et al.), there is still a large imbalance in how much the top and bottom earners have benefited from the Fed’s lopsided monetary policy.

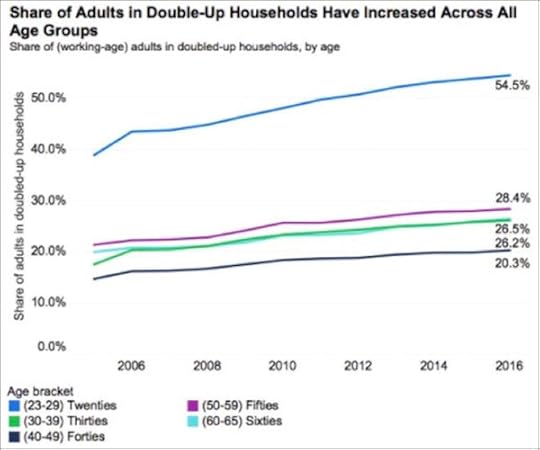

The chart below shows that the share of unmarried adults in double-up households has increased in all age brackets, and especially among Millennials.

Source: Zillow

Having a few Millennials in my own family, and even some young Gen Xers, the need to double up is readily apparent to me. Rents are just too high for the average person. Also notice that nearly one in three people between ages 50 and 59 is living with someone else in order to save on rent and other expenses.

…click on the above link to read the rest of the article…

The “Meltdown” Story: How A Researcher Discovered The “Worst” Flaw In Intel History

Daniel Gruss didn’t sleep much the night he hacked his own computer and exposed a flaw in most of the chips made in the past two decades by hardware giant Intel, something we discussed in “Why The Implications Of The Intel “Bug” Are Staggering.” And as Reuters describes in fascinating detail, the 31-year-old information security researcher and post-doctoral fellow at Austria’s Graz Technical University had just breached the inner sanctum of his computer’s CPU and stolen secrets from it.

Until that moment, Gruss and colleagues Moritz Lipp and Michael Schwarz had thought such an attack on the processor’s ‘kernel’ memory, which is meant to be inaccessible to users, was only theoretically possible.

“When I saw my private website addresses from Firefox being dumped by the tool I wrote, I was really shocked,” Gruss told Reuters in an email interview, describing how he had unlocked personal data that should be secured.

Gruss, Lipp and Schwarz, working from their homes on a weekend in early December, messaged each other furiously to verify the result.

“We sat for hours in disbelief until we eliminated any possibility that this result was wrong,” said Gruss, whose mind kept racing even after powering down his computer, so he barely caught a wink of sleep.

Gruss and his colleagues had just confirmed the existence of what he regards as “one of the worst CPU bugs ever found”.

The flaw, now named Meltdown, was revealed on Wednesday and affects most processors manufactured by Intel since 1995.

Separately, a second defect called Spectre has been found that also exposes core memory in most computers and mobile devices running on chips made by Intel, Advanced Micro Devices and ARM Holdings, a unit of Japan’s Softbank.

…click on the above link to read the rest of the article…

Iran in 2018

In 1953 Washington and Britain overthrew the democratically elected government of Mohammad Mosaddegh and installed a dictator to rule Iran for the benefit of Washington and the British. In declassified documents, the CIA has admitted its role in overthrowing the Iranian government. The overthrow pattern is always the same. Washington hires protesters, then introduces violence, controls the explanation, and unseats the government.

Ever since the Iranian Revolution that overthrew the Washington-installed dictator in1979, Washington has been trying to regain control of Iran. In 2009 Washington financed the “Green Revolution,” which was an attempt to overthrow the Ahmadinejad government.

Today Washington is again at work against the Iranian people. It is difficult to believe that any Iranian, after watching what Washington-organized protests have done to Hondurus, Libya, Ukraine, and Syria, have attempted to do to Iran in 2009, and is attempting to do today to Venezuela, could possibly in good faith go out into the streets against their own government. Are these Iranian protesters utterly stupid or are they hired to commit treason against their country?

Why does Iran permit foreign-funded operatives to attempt to destabilize the government as Ukraine did and as Venezuela does today? Are these governments so brainwashed by the West that they think that democracy means permitting foreign agents to attempt to overthrow the government?

Are governments so intimidated by the Western presstitutes that they find it challenging to defend themselves against foreign-paid provocateurs?

Having succeeded in causing violent protests in Iran, Washington now intends to use an emergency UN Security Council meeting on Iran in order to set the stage for more intervention against Iran. The Washington-incited violence has been turned into a “human rights issue” against Iran. Will Washington get away with it?

…click on the above link to read the rest of the article…

Selco: How to Stay Warm During a Long-Term SHTF Situation

As America is dealing with a record-breaking cold snap and a weird storm hitting the East Coast, some folks are having to handle the whole thing with the power out also. But we all know that at least this time, our situation is temporary. Most of us have power, and those who don’t will have it restored within a few days. But what if you had to stay warm during a long-term SHTF situation?

After your warm response to Selco’s story about Christmas during the SHTF in Bosnia, I hired him to start writing for us more often. Today, he shares with us what it was like to try and stay warm during an entire year in a war zone without any type of utilities. It’s a lot of information, and we can apply this to our preps.

Selco’s information is incredibly valuable because he has actually been through what we plan for during our preparedness endeavors. He teaches this information in-depth on his website, SHTF School. Let’s get started.

The US is dealing with quite a cold snap right now, and it got me thinking about your SHTF year in Bosnia. First of all, what is the winter like there? How cold does it get and what is the climate?

In a small part of the country close to Adriatic sea it is Mediterranean climate with mild winters and temperatures then goes just below 0 or -5 Celsius (32-23 Fahrenheit) and in other parts of country it is a Continental climate with temperatures during the winter -10 or -18 (14-5 Fahrenheit), with cold waves down to -26 (-15 Fahrenheit) and a lot of snow.

Very usual are periods of strong cold wind (Bora) that actually can lower your body temperature very fast and complicate things.

…click on the above link to read the rest of the article…

.