Steve Bull's Blog, page 1215

January 4, 2018

The Entire East Coast Needs to Get Ready for “Snow Bombogenesis”

We’re starting the New Year off with a bang in the form of Winter Storm Grayson. The next weather threat heading our way is a phenomenon called a “bombogenesis.” This occurs when a system’s central pressure plummets dramatically — “24 millibars or more — in 24 hours” according to Bloomberg.

Basically, it’s a hurricane. A winter hurricane. The same high winds (up to 80 mph) and the same precipitation, but with snow instead of rain.

Because what could be more exciting than a hurricane and a blizzard all rolled into one kick-bootie storm?

The entire East Coast is at risk, from the northern part of Florida all the way up into Canada. The Southern US will get some snow and wind on Wednesday, and New England will be hit hard on Thursday.

…ice has already formed on fountains in some southern cities, including Savannah, Georgia, and Charlotte, North Carolina.

In northern Florida and southern Georgia, a dangerous mix of snow and ice are in the forecast for Wednesday morning.

Residents of cities including Tallahassee, Florida, and Valdosta, Georgia, may see up to an inch of snow on the roadways during the Wednesday morning commute…

Through Wednesday the low pressure will ride up the East Coast, bringing a wintry mix of snow and ice through Georgia, South Carolina, and North Carolina.

Georgia and the Carolinas may see 1 to 3 inches of snow…

The storm will strengthen as it moves north overnight Wednesday. By Thursday morning, there will be heavy snow across the Mid-Atlantic coast, including Philadelphia and the New Jersey shore.

The Mid-Atlantic is forecast to have about 3 to 6 inches of snow, with lower amounts inland and higher amounts near the coast.

The snow will continue north Thursday. Long Island and New England — especially Maine — may get over 6 inches of snow. (source)

…click on the above link to read the rest of the article…

What the Prepper Needs to Know About the Usefulness of Chainsaws

As I’ve told you in previous articles, most of my woodcutting I do with a bowsaw and my ax. They give me a great workout, as well as being economical on fuel. Well, for the most part, as Mrs. JJ would tell you, I eat like a horse at the end of a day! I keep a couple of chainsaws handy, though, because you never know when you might need one. Not just for cutting wood, but in an emergency.

As I’ve told you in previous articles, most of my woodcutting I do with a bowsaw and my ax. They give me a great workout, as well as being economical on fuel. Well, for the most part, as Mrs. JJ would tell you, I eat like a horse at the end of a day! I keep a couple of chainsaws handy, though, because you never know when you might need one. Not just for cutting wood, but in an emergency.

The situation I’m describing is nothing “covert” or where noise discipline is required post SHTF. The times I’m referring to are such as when a tree falls on your house or vehicle, or you have a bunch of downed trees blocking the road that you can’t drive by. A chainsaw can be a great tool that will save you time and maybe bail you out.

On a personal note, I’m using mine this season, because we had wildfires in Montana and for the better part of a month, everyone had to stay indoors most of the time and when we were outdoors we needed to wear masks. Yes, that is one of the disadvantages to living in Montana during fire season. The other disadvantage is that you’re not allowed to use a chainsaw when the fire danger is either high or extreme.

Buy the Best Equipment You Can Afford

Natura lly, this placed a damper on my woodcutting, so I’ve been a little bit behind. Time to break out the chainsaw. Firstly, allow me to say that I don’t receive any money from any companies (chainsaw or otherwise) for my recommendations. I believe that the two best types of saw are Stihl and Husqvarna, bar none. In the case of chainsaws, the old adage “Cheap you buy, cheap you get,” although grammatically heinous is wisdom wrapped in brevity.

lly, this placed a damper on my woodcutting, so I’ve been a little bit behind. Time to break out the chainsaw. Firstly, allow me to say that I don’t receive any money from any companies (chainsaw or otherwise) for my recommendations. I believe that the two best types of saw are Stihl and Husqvarna, bar none. In the case of chainsaws, the old adage “Cheap you buy, cheap you get,” although grammatically heinous is wisdom wrapped in brevity.

…click on the above link to read the rest of the article…

It’s Not About Democracy: Control Fraud Is the Core of our Political System

The many are finally calling out the abusers of power because there’s no longer any need to pay the corrupting costs of centralization.

If we strip away the pretense of democracy, what is the core of our political System? Answer: control fraud, which I define as those with control/ power in centralized institutions enriching themselves at the expense of the citizenry by selectively modifying what’s permissible, and doing so in a fully legally compliant process, i.e. within the letter of the law if not the intent of the law.

I addressed control fraud a bit in The Hidden-in-Plain-Sight Mechanism of the Super-Wealthy: Money-Laundering 2.0 (December 29, 2017), in which I quoted Correspondent JD.

Here are JD’s additional comments on Money Laundering 2.0, control fraud and the political process:

Money Laundering 1.0: You make a bunch of dirty money and you have to find a way to make it legit. How can you turn a bunch of drug money into proper investments? This was a problem for bootleggers and persists into current times. With control fraud, you co-opt the legal machinery and use it to steal. The system protects the deceit. In 2008 we bailed the jerks out. The two are often used together.

I think Money Laundering 2.0 is the second part of this equation and the big global trend. With 2.0, the holder of wealth uses the wheels of the world system to offshore gains (legit or not) to safe places where they cannot be taxed or clawed back. The concept is simple, but the mechanisms are by nature complex to conceal the deal. Think Cayman Islands, Paradise Papers, shell companies, etc, etc. etc. Dump money into crazy cars, homes, etc. If physical goods aren’t easy, give to a key foundation or politician and you will be rewarded with complicity at a later date.

…click on the above link to read the rest of the article…

Economists Think Inflation Will Rise Sharply in 2018: They’re Wrong

Let’s investigate six reasons economists think inflation is about to pick in 2018, and why I think they are dreaming.

Reason Number One – Wage Hikes

Minimum wages rise in 18 states starting in 2018.

Former Fed Vice-Chairman Stanley Fischer told Bloomberg TV on October 4, “I still believe we will have higher inflation. The basic mechanism here is unemployment is declining all the time, wages will start going up at some stage.”

Wage Hike Rebuttal

The National Bureau of Economic Research paper: Minimum Wage Increases, Wages, and Low-Wage Employment: Evidence from Seattle, 2017 concludes there was a negative benefit to low wage workers as a result of wage hike.

The NBER Two-Page Synopsis finds:

A 9% reduction in hours worked at wages below $19/hour.

A reduction of over $100 million per year in total payroll for low-wage jobs, measured as total sum of increased wages received less wages lost due to employment reductions. Total payroll losses average about $125 per job per month.

The findings that total payroll for low-wage jobs declined rather than rose as a consequence of the 2016 minimum wage increase is at odds with most prior studies of minimum wage laws. These differences likely reflect methodological improvements made possible by Washington State’s exceptional individual-level data. When we replicate methods used in previous studies, we produce the same results as previously found.

This is an issue that’s debated over and over again, mostly with poor methodologies to come to the desired conclusion.

In contrast, the NBER had “exceptional individual-level data”.

Adding support the NBER’s conclusion, the Bank of Canada estimates Minimum Wage Hikes Could Cost Canada’s Economy 60,000 jobs by 2019.

By the way, and as discussed in Staggering Rent Increases in 2017, the median U.S. rental now requires 29% of median monthly income, according to Zillow. Between 1985 and 2000, renters spent about 25.8% of their income on housing.

Next, factor in student debt.

…click on the above link to read the rest of the article…

January 3, 2018

“Everyone Is Affected”: Why The Implications Of The Intel “Bug” Are Staggering

Earlier today, we reported that according to a press reports, Intel’s computer chips were affected by a bug that makes them vulnerable to hacking. Specifically, The Register said the bug lets some software gain access to parts of a computer’s memory that are set aside to protect things like passwords, and making matters worse, all computers with Intel chips from the past 10 years appear to be affected. The news, which sent Intel’s stock tumbling, was later confirmed by the company.

In a statement issued on Monday afternoon, Intel said it was working with chipmakers including Advanced Micro Devices Inc. and ARM Holdings, and operating system makers to develop an industrywide approach to resolving the issue that may affect a wide variety of products, adding that it has begun providing software to help mitigate the potential exploits. Computer slowdowns depend on the task being performed and for the average user “should not be significant and will be mitigated over time” the company promised despite much skepticism to the contrary.

As Bloomberg helpfully puts it, Intel’s microprocessors “are the fundamental building block of the internet, corporate networks and PCs” and while Intel has added to its designs over the years trying to make computers less vulnerable to attack, arguing that hardware security is typically tougher to crack than software, there now appears to be a fundamental flaw in the design.

In a vain attempt to mitigate the damage, Intel claimed that the “flaw” was not unique to its products.

“Intel and other technology companies have been made aware of new security research describing software analysis methods that, when used for malicious purposes, have the potential to improperly gather sensitive data from computing devices that are operating as designed,” the Santa Clara, California-based company said. “Intel believes these exploits do not have the potential to corrupt, modify or delete data.”

…click on the above link to read the rest of the article…

Russia Boosts 2017 Crude Oil Production To 30-Year High

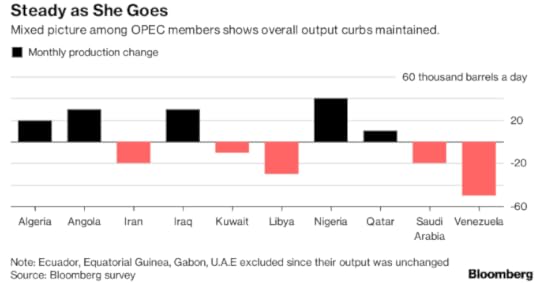

OPEC’s crude production held steady in December as the group approached a fresh year of output curbs in full compliance with its supply deal.

The 14 members of the Organization of Petroleum Exporting Countries pumped 32.47 million barrels a day, according to a Bloomberg News survey of analysts, oil companies and ship-tracking data.

Libya saw a 30,000-barrel-a-day decline to 970,000 a day following a pipeline blast, which was offset by an increase from Nigeria.Both countries were exempt from cuts last year but are now expected to join the effort with a combined limit of 2.8 million barrels a day. OPEC and its allies agreed Nov. 30 to extend their output agreement until the end of 2018 to balance the market.

Production in Saudi Arabia, OPEC’s biggest member, slipped by 20,000 barrels a day to 9.95 million a day, the surveyed showed. Venezuela, which has suffered a slump in output amid economic collapse and U.S. sanctions, reduced volumes by a further 50,000 barrels a day to 1.81 million a day.

But, as OilPrice.com’s Tsvetana Paraskova writes, despite the fact that Russia is cutting its oil production as part of OPEC and allies’ deal to restrict global oil supply, Moscow’s average daily crude oil production inched up again in 2017, to a 30-year-high of 10.98 million bpd, according to Russian Energy Ministry data.

Non-OPEC Russia, like OPEC’s de facto leader Saudi Arabia and most of the other cartel members, entered the joint deal on January 1, 2017 at a very high level of production, which took much of the sting out of the cuts. In the last quarter of 2016, Russia’s production had hit a post-Soviet era high, while year over year in 2016, production grew to 10.96 million bpd, from 10.72 million bpd in 2015.

Russia’s pledge in the OPEC/non-OPEC deal is to shave off 300,000 bpd from the October 2016 level, which was the country’s highest monthly production in almost 30 years–11.247 million bpd.

…click on the above link to read the rest of the article…

War, Peace and Recession

December and January are usually two busy months for researchers as they release prediction/forecast of the New Year. We are going to briefly discuss two such forecasts here.

Top 5 World War III Crises

The first one is a geopolitical forecast, 5 Places World War III Could Start in 2018, published last month. Now let’s take a quick look at the top five crises that could lead to the greatest conflict in 2018:

North Korea: North Korea is probably the worst foreign-policy and war potential facing the world today. The country has repeatedly conducted missile and nuclear tests over the last decade, and North Korea is showing no inclination to relent under US pressure. The neighboring China is said to secretly support North Korea, while president Trump claims he has a bigger nuke button than Kim Jong-un. The escalating tension means likely war conflict between US (South Korea, possibly Japan) vs. North Korea (and China) destabilizing East Asia.

Taiwan: With only 99 miles from each other across the Taiwan Strait, China and Taiwan have been blood-feuding for more than 70 years. China on many occasions openly insists on reunification of the two without ruling out the use of force. Partly in response to the increasing Chinese bombers, fighters and military vessels crossing over to the Strait, Taiwan announced it would raise military budget by 2% a year to about $10.7 billion in 2018, while the US seeks to “strengthen US-Taiwan military alliance”. Potential war conflict: Taiwan (and US, possibly Japan) vs. China and could seriously impact the entire Southeast Asia, and US interests.

Ukraine: Although there’s supposed to be a cease fire in Easter Ukraine, the country is experiencing increasing violence between Kiev and Moscow-supported local militias and possible collapse of the government altogether. Russia’s Putin is not shy about taking advantage of the situation with military incursion into Ukraine. Potential war conflict: Europe (and US) vs. Russia

…click on the above link to read the rest of the article…

Dark Days For German Solar Power, Country Saw Only 10 Hours Of Sun In All Of December!

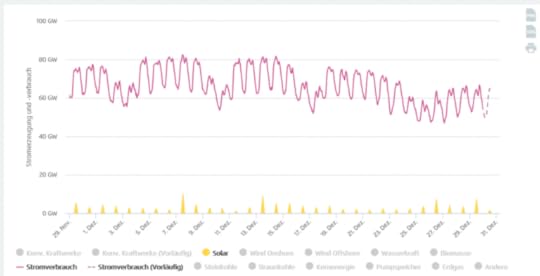

What follows is a chart showing the measly amount of power that Germany’s more than 40 gigawatts of installed solar electricity capacity actually managed to produce (yellow) in December, 2017 (you may have to squint):

Germany’s more than 40 gigawatts of installed solar capacity barely produced anything in December 2017. Curved line shows German demand. Chart source: Agora.

Now that you’ve fallen on the floor with laughter and managed to get back on your chair, you can understand what is going on in green la-la-land.

This is the story of Germany’s Energiewende: install as much capacity of each type renewable energy as possible, and hope that one of them works when the others don’t. Currently Germany has well over 40 gigawatts of installed PV capacity, enough to power half of the country at lunchtime on a sunny day. But it all does nothing at night, or in the wintertime when the sun stays blotted out by Germany’s notoriously cloudy climate and short daylight hours.

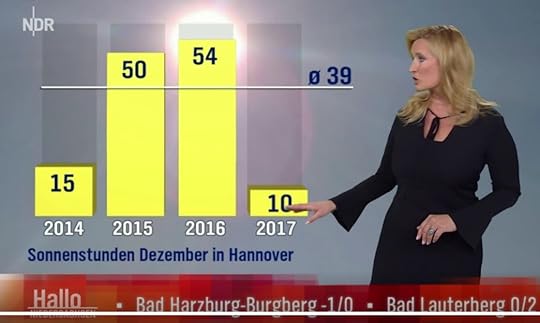

This past December in Hanover the the sun shined a mere 10 hours over the entire month. In Lüdenscheid the sun was seen less than one hour!

Michael Kruger writes at Science Skeptical:

“Photovoltaic: 10 hours of sun in December 2017

Image: NDR German Public Television – “Hallo Niedersachsen”

Weathergirl Claudia Kleinert of NDR television above showed on ‘Hallo Niedersachsen’ [Hello Lower Saxony] the number of sunshine hours in December 2017. Hanover reached a whole 10 hours for December. The average value for December in Hanover is 39 hours, thus this past December reached only a quarter of the sun’s usual output.

The operators of photovoltaic systems have not seen any real output at all. Imagine if the coal power plants had operated only 10 hours for the whole month of December, and only a bit over the daytime. They’d be mothballed immediately because of lack of economy.”

Unhinged, Part 1: The GOP’s Fiscal Madness

The watchword for 2018 is: UNHINGED!

That refers to Wall Street, Washington, the Dems and the GOP, and all the far and near corners of the planet which are implicated in their collective follies.

The latter begins with the fact that Imperial Washington has become so dysfunctional that the most powerful government on earth can’t seem to keep its doors open for more than a few weeks at a time.

The next continuing resolution (CR) deadline is January 19 and the route thereto resembles nothing less than kick-the-can-alley. It’s strewn with $100 billion of unfunded disaster aid, defense and nondefense sequester caps fixing to be busted by another $100 billion, 700,000 dreamers waiting to be deported, 9 million poor children (CHAPS) facing termination of medical care and millions more ObamaCare recipients who have been promised that cost abatement subsidies to insurance companies will be funded forthwith.

And along with those major bouncing cans are countless more articles of graft and booty cued-up on Capitol Hill looking for a legislative gravy train (i.e. CR) to hop aboard.

Likewise, the casino gamblers on Wall Street complacently attempt to tag another record at 2700 on the S&P 500. Yet that would represent a nosebleed 25X LTM earnings heading into a bond market rout that is certain to result from soaring treasury issuance and the Fed’s impending bond dump-a-thon.

Worse still, the Donald insouciantly unleashes tweet storms about the alleged Trumpian boom when the next recession is statistically just around the corner. After all, the current so-called recovery will pass the existing 118 month record, which occurred under the far more propitious circumstances of the 1990s, in April 2019.

But when it comes to Unhinged, nothing tops the GOP’s disgraceful plunge into fiscal turpitude. The once and former party of fiscal rectitude and a constitutionally required balanced budget has unleashed a torrent of red ink, which under the circumstances, makes Barack Obama’s profligacy pale by comparison.

…click on the above link to read the rest of the article…

2018 Economy Goes Cold – Inflation Hot – Danielle DiMartino Booth

Former Fed insider Danielle DiMartino Booth is not optimistic about a surging economy in 2018. Booth contends, “We have seen 24 consecutive back-to-back months when credit card spending has outpaced incomes. That tells you households are struggling to get by. This is not Eve Saint Laurent handbags and Jimmy Choo shoes. These are families who are using their credit cards to take care of the necessities, to fill up the gas tank, to buy groceries and fill up their refrigerator. . . . We have seen month after month of subprime automobile delinquencies, and we are starting to see a big tic up in FHA mortgage delinquencies as well. . . . We are at almost 10% (delinquencies) of FHA mortgage loans. Underlying this sugar high that we will see from all of these hurricanes and rebuilding efforts and wildfires, underneath that, still waters run deep and the economy is not doing well. We are a consumption driven economy that is weakening underneath. The sugar high will absolutely wear off in 2018.”

Former Fed insider Danielle DiMartino Booth is not optimistic about a surging economy in 2018. Booth contends, “We have seen 24 consecutive back-to-back months when credit card spending has outpaced incomes. That tells you households are struggling to get by. This is not Eve Saint Laurent handbags and Jimmy Choo shoes. These are families who are using their credit cards to take care of the necessities, to fill up the gas tank, to buy groceries and fill up their refrigerator. . . . We have seen month after month of subprime automobile delinquencies, and we are starting to see a big tic up in FHA mortgage delinquencies as well. . . . We are at almost 10% (delinquencies) of FHA mortgage loans. Underlying this sugar high that we will see from all of these hurricanes and rebuilding efforts and wildfires, underneath that, still waters run deep and the economy is not doing well. We are a consumption driven economy that is weakening underneath. The sugar high will absolutely wear off in 2018.”

What about the bond market in 2018? Booth says, “We have gone from $150 trillion (in global debt) in 2007 to $220 trillion and counting today. If you delude yourself into thinking a rising rate environment can be good when we have tacked on $70 trillion of debt in the last decade, you are fooling yourself. It is an accident waiting to happen, and anyone who doesn’t think that it will take the stock market down with it is more optimistic than I am by a country mile.”

Booth says, along with a “bond market debacle,” the world will see inflation right along with it. Booth explains, “Look at lumber prices, look at the cost of packaging, plastics, raw materials, the producer price index . . . is at a six year high right now. It’s called the mother of all margin squeezes.

…click on the above link to read the rest of the article…