Steve Bull's Blog, page 1218

December 31, 2017

Why Americans Will Never Agree on Oil Drilling in the Arctic National Wildlife Refuge

After decades of bitter struggle, the Arctic National Wildlife Refuge seems on the verge of being opened to the oil industry. The consensus tax bill Republicans recently passed retains this measure, which was added to gain the key vote of Alaska Sen. Lisa Murkowski.

This bill, however, stands no chance of being the final word. ANWR has been called America’s Serengeti and the last petroleum frontier, terms I’ve seen used over more than a decade studying this area and the politics around it. But even these titles merely hint at the multifold conflict ANWR represents — spanning politics, economics, culture and philosophy.

Differing Views From the Start

Little of this debate, which stretches back decades, makes sense without some background. Let’s begin with wildlife, the core of why the refuge exists.

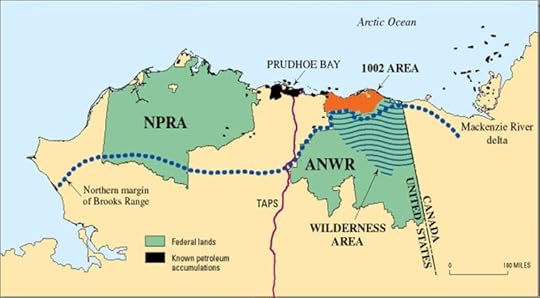

With 45 species of land and marine mammals and over 200 species of birds from six continents, ANWR is more biodiverse than almost any area in the Arctic. This is especially true of the coastal plain portion, or 1002 Area, the area now being opened up to exploration and drilling. This has the largest number of polar bear dens in Alaska and supports muskoxen, Arctic wolves, foxes, hares and dozens of fish species. It also serves as temporary home for millions of migrating waterfowl and the Porcupine Caribou herd which has its calving ground there.

All of which merely suggests the unique concentration of life in ANWR and the opportunity it offers to scientific study. One part of the debate is therefore over how drilling might impact this diversity.

…click on the above link to read the rest of the article…

China Launches New Capital Controls: Puts $15,000 Annual Cap On Overseas ATM Withdrawals

Back in September 2015 – long before bitcoin became the “world’s biggest bubble in history”, and when it was still trading at just $200 – we explained not only that the primary purpose behind the use of the cryptocurrency was evading capital controls, but predicted that it would rise much, much higher as more Chinese, and not only, money launderers caught on to the real function of bitcoin and other cryptos, to wit:

… we would not be surprised to see another push higher in the value of bitcoin: it was earlier this summer when the digital currency, which can bypass capital controls and national borders with the click of a button, surged on Grexit concerns and fears a Drachma return would crush the savings of an entire nation. Since then, BTC has dropped (in no small part as a result of the previously documented “forking” with Bitcoin XT), however if a few hundred million Chinese decide that the time has come to use bitcoin as the capital controls bypassing currency of choice, and decide to invest even a tiny fraction of the $22 trillion in Chinese deposits in bitcoin (whose total market cap at last check was just over $3 billion), sit back and watch as we witness the second coming of the bitcoin bubble, one which could make the previous all time highs in the digital currency, seems like a low print.

A little over two years later, and several thousand percent higher, we were right on both counts: not only did bitcoin proceed to soar to meteoric highs, but the Chinese capital outflows were just getting started and only a series of draconian interventions by China in 2016 managed to briefly halt the hot money exodus which amount to roughly $1 trillion in Chinese reserve outflows.

…click on the above link to read the rest of the article…

Top 10 Prepper Articles of 2017

This time of year takes me into deep contemplation. Have I accomplished all that I set out to do this year? Was I the best person and example I could be? Was I a good friend? How can I strive to be a better in the coming year? While I know the answer to some of these questions, I can honestly say that I did not accomplish all that I set out to do.

This time of year takes me into deep contemplation. Have I accomplished all that I set out to do this year? Was I the best person and example I could be? Was I a good friend? How can I strive to be a better in the coming year? While I know the answer to some of these questions, I can honestly say that I did not accomplish all that I set out to do.

A friend wrote to me the other day saying that “2017 was quite the year, almost impossible to summarize and filled with many successes and many challenges.” I can so relate! In the blink of an eye, 2017 went by and although I had goals of my own, there were times they had to be put on the back burner so that my family could grow into better versions of themselves.

My Greatest Blessings

One of my greatest blessings is my sweet husband, Mac. While many of you know him as the man behind SHTFPlan who gives his take on economic and financial happenings, he’s my amazing husband (of almost 15 years!) who works tirelessly and will bend over backward to make sure his family is cared for. I gotta say, I’m such a lucky lady!

My children are also counted as some of my greatest blessings. I am so lucky to have these little kids in my life. I have overwhelming pride in the individuals they are growing up to be and thank God for blessing me with them.

am also blessed that my dear friend, Jeremiah Johnson has been writing so much for Ready Nutrition this year. As a veteran and long-time prepper, he offered valuable, out-of-the-box wisdom that no doubt helped you in your prepping endeavors.

…click on the above link to read the rest of the article…

The Greatest Bubble Ever: Why You Better Believe It, Part 2

During the 40 months after Alan Greenspan’s infamous “irrational exuberance” speech in December 1996, the NASDAQ 100 index rose from 830 to 4585 or by 450%. But the perma-bulls said not to worry: This time is different—-it’s a new age of technology miracles that will change the laws of finance.

It wasn’t. The market cracked in April 2000 and did not stop plunging until the NASDAQ 100 index hit 815 in early October 2002. During those a heart-stopping 30 months of free-fall, all the gains of the tech boom were wiped out in an 84% collapse of the index. Overall, the market value of household equities sank from $10.0 trillion to $4.8 trillion—-a wipeout from which millions of baby boom households have never recovered.

Likewise, the second Greenspan housing and credit boom generated a similar round trip of bubble inflation and collapse. During the 57 months after the October 2002 bottom, the Russell 2000 (RUT) climbed the proverbial wall-of-worry—-rising from 340 to 850 or by 2.5X.

And this time was also held to be different because, purportedly, the art of central banking had been perfected in what Bernanke was pleased to call the “Great Moderation”. Taking the cue, Wall Street dubbed it the Goldilocks Economy—-meaning a macroeconomic environment so stable, productive and balanced that it would never again be vulnerable to a recessionary contraction and the resulting plunge in corporate profits and stock prices.

Wrong again!

During the 20 months from the July 2007 peak to the March 2009 bottom, the RUT gave it all back. And we mean every bit of it—-as the index bottomed 60% lower at 340. This time the value of household equities plunged by $6 trillion, and still millions more baby-boomers were carried out of the casino on their shields never to return.

…click on the above link to read the rest of the article…

December 30, 2017

The Inescapable Reason Why the Financial System Will Fail

girardatlarge.com

The Inescapable Reason Why the Financial System Will Fail

Credit cannot expand faster than fundamentals forever

Modern finance has many complex moving parts, and this complexity masks its inner simplicity.

Let’s break down the core dynamics of the current financial system.

The Core Dynamic of the “Recovery” and Asset Bubbles: Credit

Credit is the foundation of the current financial system, for credit enables consumers to bring consumption forward, that is, buy more stuff today than they could buy with the cash they have on hand, in exchange for promising to pay principal and interest with their future income.

Credit also enables speculators to buy more assets than they otherwise could were they limited to cash on hand.

Buying goods, services and assets with credit appears to be a good thing: consumers get to enjoy more stuff without having to scrimp and save up income, and investors/speculators can reap more income from owning more assets.

But all goods/services and assets are not equal, and all credit is not equal.

There is an opportunity cost to any loan (i.e. credit), as the income that will be devoted to paying principal and interest in the future could have been devoted to some other use or investment.

So borrowing money to purchase a product or an asset now means foregoing some future purchase.

While all products have some sort of payoff, the payoffs are not equal. If I buy five bottles of $100/bottle champagne and throw a party, the payoff is in the heady moments of celebration. If I buy a table saw for $500, that tool has the potential to help me make additional income for years or even decades to come.

If I’m making money with the table saw, I can pay the debt service out of my new earnings.

…click on the above link to read the rest of the article…

Weekly Commentary: A Phenomenal Year

2017 was phenomenal in so many ways. The year will be remembered for a tumultuous first year of the Trump Presidency, the passage of major tax legislation and seemingly endless stock market records. It was a year of synchronized global growth and stock bull markets, along with record low market volatility. It was the year of parabolic moves in bitcoin and cryptocurrencies. “Blockchain the Future of Money.”

Yet none of the above is worthy of Story of the Year. For that, I turn to this era’s Masters of the Universe: global central bankers. 2017 was a fateful year of central bank failure to tighten financial conditions in the face of bubbling markets and economies. Fed funds ended the year below 1.5%, in what must be history’s most dovish “tightening” cycle. The Draghi ECB stuck to its massive open-ended QE program, though reluctantly reducing the scope of monthly purchases. In Japan, the Kuroda BOJ held the “money” spigot wide open despite surging asset markets and a 2.7% unemployment rate. As for China, the People’s Bank of China was an active accomplice in history’s greatest Credit expansion.

Loose global financial conditions fed and were fed by record Chinese Credit growth. After almost bursting in early 2016, the further energized Chinese Bubble attained overdrive “terminal” status in 2017. Importantly, another year passed with Beijing unwilling to forcefully rein in rampant excess. The situation becomes only more perilous, with global markets increasingly confident that Chinese officials dare not risk bursting the Bubble. Powerful Chinese and global Bubbles were instrumental in stoking Bubble excess throughout the EM “periphery.” In the face of mounting fragilities, “money” inundated the emerging markets. What is celebrated in 2017 will later be recognized as dysfunctional.

…click on the above link to read the rest of the article…

Blowout Week 209

This week’s lead story features the imminent return of the Ice Age to UK – good news for those looking forward to a White Christmas. After that the usual mix: record production from the Permian, Putin replaces petroleum with natural gas; New England replaces natural gas with petroleum; nuclear plant restarts and shutdowns in Japan; German factories paid for using electricity; batteries and the California Duck Curve, solar in the Canadian Arctic; renewables in South Korea; the Scotland-Wales transmission link, UK frackers running out of time; the brutal US-Canada cold snap; Santa relocates to the South Pole and a Happy New Year to all.

This week’s lead story features the imminent return of the Ice Age to UK – good news for those looking forward to a White Christmas. After that the usual mix: record production from the Permian, Putin replaces petroleum with natural gas; New England replaces natural gas with petroleum; nuclear plant restarts and shutdowns in Japan; German factories paid for using electricity; batteries and the California Duck Curve, solar in the Canadian Arctic; renewables in South Korea; the Scotland-Wales transmission link, UK frackers running out of time; the brutal US-Canada cold snap; Santa relocates to the South Pole and a Happy New Year to all.

Sky News: Scientists predict ‘mini ice age’ could hit UK by 2030

A mini ice age that would freeze major rivers could hit Britain in less than two decades, according to research from universities in the UK and Russia.

A mathematical model of the Sun’s magnetic activity suggests temperatures could start dropping from 2021, with the potential for winter skating on the River Thames by 2030. A team led by maths professor Valentina Zharkova at Northumbria University built on work from Moscow to predict the movements of two magnetic waves produced by the Sun. It predicts rapidly decreasing magnetic waves for three solar cycles beginning in 2021 and lasting 33 years. Very low magnetic activity on the Sun correspond with historically documented cold periods on Earth. Professor Zharkova claims 97% accuracy for the model which dovetails with previous mini ice ages, including the Maunder Minimum period from 1645 to 1715 when frost fairs were held on the frozen Thames. But she cautions that her mathematical research cannot be used as proof that there will be a mini ice age this time around, not least because of global warming.

…click on the above link to read the rest of the article…

The Biggest Oil Story Of 2017

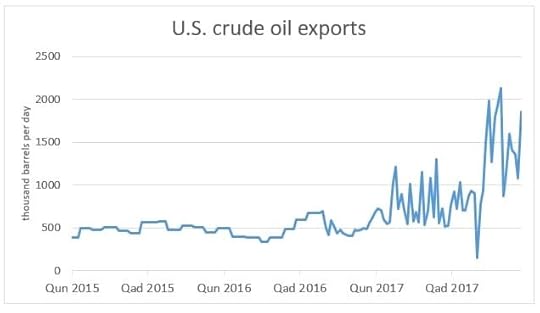

There have been plenty of eye-catching stories in the energy industry this year, but one notable development has been the rise of the U.S. as a crude oil exporter.

The ban on crude exports from the U.S. was lifted at the end of 2015, and exports ticked up in the following year, but only modestly. 2017, however, was the year that the floodgates opened.

In the first half of the year, there were several weeks when the U.S. topped 1 million barrels per day (mb/d), but exports averaged about 750,000 bpd between January and June.

(Click to enlarge)

In the third quarter, the export machine really kicked into high gear, and Hurricane Harvey was arguably the spark. It may seem odd at first blush that a disastrous storm that ravaged Texas would be the thing that spurred a rise in U.S. oil exports, but because so many refineries were damaged, a lot of the oil produced in Texas had to go elsewhere.

That surplus of crude and the temporary shortage of refining capacity was visible in the discount for WTI relative to Brent, a price differential that widened to as much as $7 per barrel after the storm, the largest disparity in years. If you are a buyer in say, China, paying $7 less per barrel than elsewhere is pretty appealing, even after factoring in high transport costs. As such, it is no surprise that U.S. oil exports to China surged this year.

U.S. oil exports hit a high at 2.133 mb/d in the last week of October, and have fallen back a bit since. In fact, it would seem to be a struggle for the U.S. to maintain such a high level of shipments. The more oil that is exported, the more likely the discount between WTI and Brent would narrow, which would essentially eat away at the competitiveness of U.S. crude.

…click on the above link to read the rest of the article…

Facebook Says it is Deleting Accounts at the Direction of the U.S. and Israeli Governments

Photo: Eric Risberg/AP

Facebook Says it is Deleting Accounts at the Direction of the U.S. and Israeli Governments

IN SEPTEMBER OF LAST YEAR, we noted that Facebook representatives were meeting with the Israeli Government to determine which Facebook accounts of Palestinians should be deleted on the ground that they constitute “incitement.” The meetings – called for and presided over by one of the most extremist and authoritarian Israeli officials, its pro-settlement Justice Minister Ayelet Shaked – came after Israel threatened Facebook that its failure to voluntarily comply with Israeli deletion orders would result in the enactment of laws requiring Facebook to do so, upon pain of being severely fined or even blocked in the country.

The predictable results of those meetings are now clear and well-documented. Ever since, Facebook has been on a censorship rampage against Palestinian activists who protest the decades-long, illegal Israeli occupation, all directed and determined by Israeli officials. Indeed, Israeli officials have been publicly boasting about how obedient Facebook is when it comes to Israeli censorship orders:

Shortly after news broke earlier this month of the agreement between the Israeli government and Facebook, Israeli Justice Minister Ayelet Shaked said Tel Aviv had submitted 158 requests to the social media giant over the previous four months asking it to remove content it deemed “incitement”. She said Facebook had granted 95 percent of the requests.

She’s right. The submission to Israeli dictates is hard to overstate: as the New York Times put it in December of last year: “Israeli security agencies monitor Facebook and send the company posts they consider incitement. Facebook has responded by removing most of them.”

What makes this censorship particularly consequential is that “96 per cent of Palestinians said their primary use of Facebook was for following news.” That means that Israeli officials have virtually unfettered control over a key communications forum of Palestinians.

…click on the above link to read the rest of the article…

U.S. Rig Count Falls Slightly As Canada’s Rig Count Tanks

The number of active oil and gas rigs dipped this week, according to Baker Hughes data, decreasing by 2 rigs, bringing the total rigs to 929 rigs, which is an addition of 271 rigs for the 2017 calendar year.

The number of oil rigs in the US stayed the same for the second week in a row, while the number of gas rigs decreased by 2. The number of oil rigs stands at 747 versus 525 a year ago. The number of gas rigs in the US now stands at 182, up from 132 a year ago.

At 10:04pm EST, the price of a WTI barrel was down $0.20 (+0.33%) to $60.04—a 2.5-year high, while the Brent barrel was trading up $0.18 (+0.27%) to $66.34, largely on the back of weeks of falling US crude oil inventory, and a surprise decrease in US crude oil production.

US crude oil production has been on a steady upward trajectory for nearly a quarter, which has previous limited price spikes that came on the back of the Forties shutdown and a pipeline bombing in Libya. But US crude oil production for the week ending December 22 came in at 9.754 million barrels per day—a hair off the previous week’s high, and breaking a nine-week production increase in the US. While the 9.754-million-barrel-per-day production level is still the second highest, the fact that production didn’t increase for a tenth week bolstered confidence.

The most alarming news this week is Canada’s rig count, which saw a decrease of 58 oil rigs and 16 gas rigs.

The Permian basin rig count stayed flat this week, but stands at 134 rigs above this same week last year. Williston and Haynesville basins lost rigs this week, with DJ-Niobrara gained 3.

At 1:09pm EST, WTI was trading at $60.36 (+$0.52) with Brent trading at $66.82 (+$0.66).