Steve Bull's Blog, page 1214

January 5, 2018

The Leveraged Economy BLOWS UP In 2018

Enjoy the good times while you can because when the economy BLOWS UP this next time, there is no plan B. Sure, we could see massive monetary printing by Central Banks to continue the madness a bit longer after the market crashes, but this won’t be a long-term solution. Rather, the U.S. and global economies will contract to a level we have never experienced before. We are most certainly in unchartered territory.

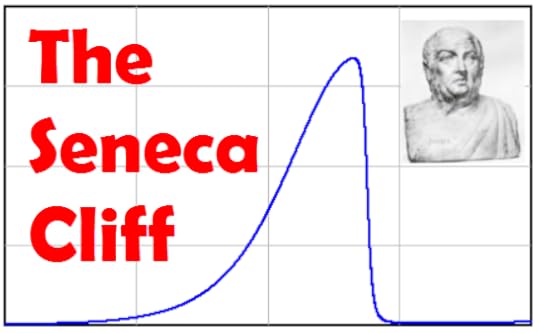

Before I get into my analysis and the reasons we are heading towards the Seneca Cliff, I wanted to share the following information. I haven’t posted much material over the past week because I decided to spend a bit of quality time with family. Furthermore, a good friend of mine past away which put me in a state of reflection. This close friend was also very knowledgeable about our current economic predicament and was a big believer in owning gold and silver. So, it was a quite a shame to lose someone close by who I could chat with about these issues.

Before I get into my analysis and the reasons we are heading towards the Seneca Cliff, I wanted to share the following information. I haven’t posted much material over the past week because I decided to spend a bit of quality time with family. Furthermore, a good friend of mine past away which put me in a state of reflection. This close friend was also very knowledgeable about our current economic predicament and was a big believer in owning gold and silver. So, it was a quite a shame to lose someone close by who I could chat with about these issues.

While some of my family members know about my work, I don’t really discuss it with them. If they ever have a question, I will try to answer it, but I found out years ago that it was a waste of time to try and impose my knowledge upon them. Which is the very reason I started my SRSrocco Report website… LOL. So, now I have a venue to get my analysis out to the public. I don’t care about reaching everyone, but rather to provide important information to those who are OPEN to it.

…click on the above link to read the rest of the article…

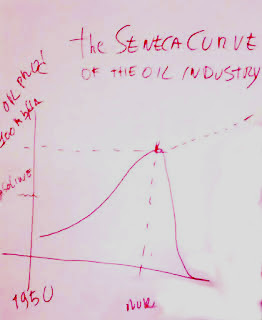

The Impending Curtailment of Conventional Oil and the Total Resource Curtailment

In a previous post titled “The Soft Belly of the Oil Industry“, I mentioning the impending unlocking of numerous negative feedbacks affecting the oil industry. I argued that the gradual increase of production costs, the need of reducing emissions, the weakened demand created by the electrification of transport, and more were going to take the industry on a ride along the “Seneca Cliff.” Here, Geoffrey Chia goes beyond that, arguing that the negative feedbacks generated by a collapsing oil industry will affect the whole economic system. It may be pessimistic as an interpretation, but it is a perfectly possible chain of events.

Why the impending curtailment of Conventional Oil will lead to Total Energy curtailment and Total Resource curtailment

Outside of Medicine I am an expert in nothing*. In depletion matters I defer to the resource and energy experts such as Professor Ugo Bardi and Alice Friedemann who have conducted painstaking research and performed exhaustive quantitative analyses to arrive at robust conclusions. My main use, if I have any use at all, is to transmit important concepts from the experts to the general public in a qualitative manner, sometimes using my own original visual metaphors and bad jokes, which may hopefully facilitate better understanding by the lay audience. I also tend to view these issues through a medical lens in terms of diagnosis, prognosis and management planning, my aims being to prevent or minimise human morbidity (suffering) and mortality (premature death). Unfortunately due to gross overshoot, humanity are now well past any hope of cure and we are now into the phase of palliative care of a terminally ill industrial civilisation.

…click on the above link to read the rest of the article…

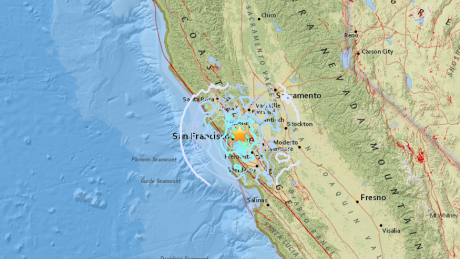

Strong Earthquakes Hit San Francisco And Mount St. Helens And Experts Warn They May Be Foreshocks For ‘Something Larger’

Just when it seemed like things may be settling down, two very unusual earthquakes have hit the west coast within the past couple of days. A 4.4 magnitude quake struck Berkeley, California just prior to 3 AM on Thursday morning, and a 3.9 magnitude earthquake hit Mount St. Helens in Washington state on Wednesday. Overall, there have been 68 earthquakes in the vicinity of Mount St. Helens since New Year’s Day, and there have been a total of 629 earthquakes in the state of California within the last 30 days. Could it be possible that all of this activity is leading up to a historic seismic disaster on the west coast?

Just when it seemed like things may be settling down, two very unusual earthquakes have hit the west coast within the past couple of days. A 4.4 magnitude quake struck Berkeley, California just prior to 3 AM on Thursday morning, and a 3.9 magnitude earthquake hit Mount St. Helens in Washington state on Wednesday. Overall, there have been 68 earthquakes in the vicinity of Mount St. Helens since New Year’s Day, and there have been a total of 629 earthquakes in the state of California within the last 30 days. Could it be possible that all of this activity is leading up to a historic seismic disaster on the west coast?

The 4.4 magnitude earthquake along the Hayward fault very early on Thursday jolted people out of bed all over the San Francisco area…

A strong 4.4 magnitude earthquake has rattled the Bay Area shortly before 3 a.m.

USGS is reporting the quake was centered in Berkeley. On KRON4’s real time earthquake map it shows the epicenter.

The quake struck at 2:39 a.m. and was centered near the Claremont hotel. The earthquake had a preliminary depth of 8 miles, according to USGS.

This wasn’t a soft and gentle earthquake that everyone kind of laughs about after it is over.

Rather, this was the kind of extremely intense earthquake that puts the fear of God into people. In fact, one Bay area resident said that it “felt like a truck hit my house”…

“I was actually awake putting my shoes on for work. It felt like a truck hit my house from the back which pushed my against the staircase railing, the walls were cracking and threw my cell phone and keys down the stairs. Pretty scary”

If this was the worst quake in this particular swarm, it won’t ultimately be that big of a deal.

…click on the above link to read the rest of the article…

Climate Change – Is this an OMG Event?

QUESTION: Is it in your view a minor cold blip or “OMG we’re all going to freeze to death and run out of food ?”

BR

ANSWER: We are looking at an unbelievable decline in the energy output of the sun which appears to be the most rapid decline in nearly 10,000 years. The Global Warming crowd may be setting society up for mass famine and death because they are deliberately pointing everyone in the opposite direction to get their portion of the $1 billion grants. Natural disasters are the most disastrous when the energy output of the sun declines. There has been a fatal interaction of ecological, agricultural, economic, and political factors that seem to be setting the stage for at least a repeat of what is known as the Great Famine of 1315-1317. The Great Famine started with bad weather in spring 1315. Crop failures lasted through 1316 until the summer harvest in 1317, and Europe did not fully recover until 1322. The period was marked by extreme levels of crime, disease, mass death and even cannibalism and infanticide. The crisis set in motion the great economic collapse that began during the fourteenth century. In our arrogance, we seem to believe we have conquered every aspect of the planet and many argue we can even alter the climate of the planet.

The collapse from the Medieval Warm period was rapid, but also deadly. When the climate turned down, what followed was suddenly bitter cold winters and drenching rains which then froze. Europe had expanded as the society always does in warm periods. A study has shown that desert rodent populations of many species tend to “fluctuate synchronously owing to pulses of primary production and seed availability during rainy years, and reduced seed production during droughts” (PLOS 2013).

…click on the above link to read the rest of the article…

January 4, 2018

The Debt Beneath

Debt is irrelevant and matters not. It’s different this time. That’s the message from politicians, markets and participants. Tax cuts pay for themselves (they do not), leverage doesn’t matter (it does) and the increased costs of servicing the debt as a result of rising rates will be offset by imaginary real wage growth to come (they won’t). But the calmest market waters in history continue to keep these illusions alive as asset prices keep levitating from record to record.

Debt is irrelevant and matters not. It’s different this time. That’s the message from politicians, markets and participants. Tax cuts pay for themselves (they do not), leverage doesn’t matter (it does) and the increased costs of servicing the debt as a result of rising rates will be offset by imaginary real wage growth to come (they won’t). But the calmest market waters in history continue to keep these illusions alive as asset prices keep levitating from record to record.

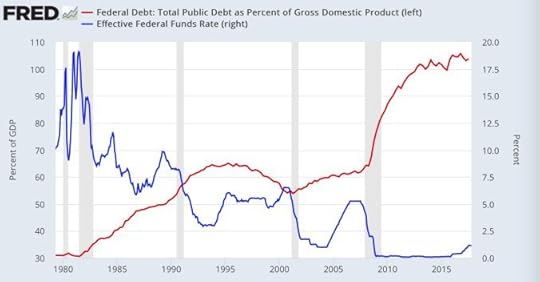

Debt does matter and it was ironically left to Janet Yellen to voice any remnant concerns about the sustainability of debt to GDP: “It’s the type of thing that should keep people awake at night” she said.

With good reason:

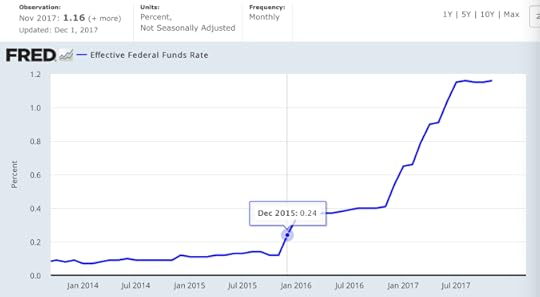

After all the debt burden has never been higher and rates, following years of enabling the largest debt expansion in human history, are starting to rise in the US. In the larger historic context rates are still low, but let’s be clear, they are rising:

And with rising rates come questions of the sustainability of servicing incredibly high debt loads.

The worldwide equity rally since the early 2016 lows has resulted in a massive increase in the market capitalization of global asset prices which have increased by over $25 trillion in value since then. As discussed in my 2017 Market Lessons US market capitalization is now north of 143% of US GDP.

Low rates and free money in form of global QE and now US tax cuts make it all possible and consequence free. But is it?

Let’s take a look at the leveraging game over the past 2 years since this is when the most recent rally began. And note in many cases we don’t have full 2017 data yet so I’m using the running 2 year data where I can pull it. The trend is the same: Up, up and away.

…click on the above link to read the rest of the article…

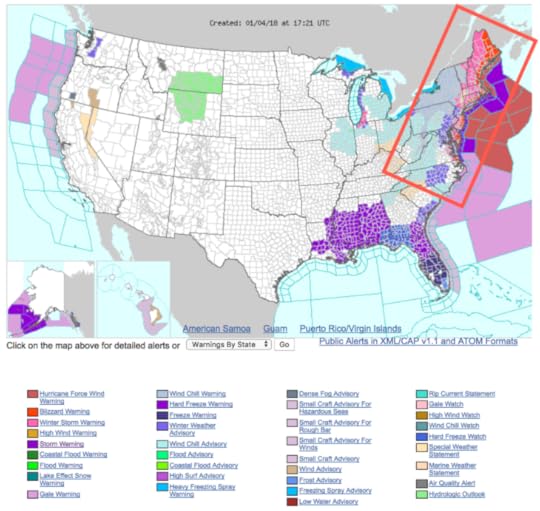

“Bomb Cyclone” Explodes Over East Coast, Sends NYC Nat Gas Price To Record High

“The strong storm system off the east coast continues to rapidly strengthen, bringing strong winds, heavy snow, and bitter wind chills to the I-95 corridor. As of 11 AM EST Thursday, the system had strengthened to 951mb, which is a drop of 59mb in 24 hours – more than double the criteria for bombogenesis (24mb/24hours). This storm will continue to produce winds in excess of 50mph from New York City into New England along with heavy snowfall and blizzard conditions. This will continue to lead to airport closures and delays along with other infrastructural damages. The combination of wind and snowfall may also lead to localized power outages,” said Ed Vallee, a meteorologist at Vallee Weather Consulting LLC.

He further warned, “Behind the storm, brutally cold air will invade the Northeast, with wind chills dipping well below zero. Numerous record low temperatures are expected this weekend across the Northeast Couple this with power outages, and this turns into a life-threatening situation quickly.”

High winds and heavy snow have contributed to whiteout conditions from coastal Delaware to New England, shutting airports, government offices, and schools, leaving much of the East Coast paralyzed.

On Thursday, New York Gov. Andrew Cuomo declared an official weather emergency in New York City, Long Island and Westchester County. Nearly all flights out of La Guardia, New York City’s other major airport have been canceled. The airline-tracking site FlightAware is reporting more than 3,200 flights have been canceled as of late Thursday morning.

Blizzard and winter storm warnings are in place along the coast from North Carolina to Maine, with the Weather Channel forecasting “snowfall rates of 1 to 3 inches per hour” and “wind gusts over 70 mph.”

…click on the above link to read the rest of the article…

What’s Behind The Canadian Rig Count Crash

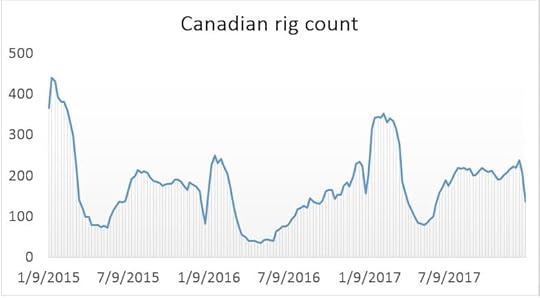

The U.S. rig count has been on the rise for months, despite some recent hiccups, but Canada’s rig count recently plunged amid low oil prices.

Canada’s rig count fell from 210 to 136 for the week ending on December 29, a massive drop off. That took the rig count to a six-month low. Obviously, the losses were concentrated in Alberta, where most of the rigs tend to be. Alberta’s rig count sank from 162 to 118 in the last week of 2017. But Saskatchewan also saw its rig count decimated—falling from 43 in mid-December to just three at the close of the year.

The losses can likely be chalked up to the meltdown in prices for Canadian oil. Western Canada Select (WCS), a benchmark that tracks heavy oil in Canada, often trades at a significant discount to oil prices in the United States. But the WCS-WTI discount became unusually large in November and December for a variety of reasons. The outage at the Keystone pipeline led to a rapid buildup in oil inventories in Canada, and storage hit a record high in December.

Also, Canada’s oil industry has been unable to build new pipelines to get the landlocked oil from Alberta to market. Alberta oil producers are essentially hostage to their buyers in the U.S., and with oil production now bumping up against a ceiling in terms of pipeline capacity, the glut is starting to weigh on WCS prices.

In December, Enbridge announced that it will ration the space on its Mainline oil pipeline system for January as Canada’s pipelines are essentially at full capacity. Enbridge said that it will apportion lines 4 and 67, which move heavy crude, by 36 percent. The term “apportionment” is a euphemism for rationing—essentially oil producers are unable to get all of their product onto the pipeline and are hit with restrictions. That means the oil has to be diverted into storage.

…click on the above link to read the rest of the article…

Russia Slams US “Attempts To Interfere” In Iran After Macron Warns Of “Conflict Of Extreme Brutality”

Russia has joined China in calling for a policy of non-interference in Iran’s domestic affairs after a week of unrest has gripped multiple major cities and towns across the country in what started as protests over economic grievances, but which have since increasingly turned to riots and calls for President Rouhani and the clerical regime to step down, resulting in the deaths of at least 22 people, including at least one police officer who was shot dead.

In remarks given to Russia’s TASS news agency Russian Deputy Foreign Minister Sergey Ryabkov expressly warned the US “against attempts to interfere in the internal affairs of the Islamic Republic of Iran,” while stressing, “What is happening there is an internal affair, which attracts the attention of the international community.” Russia’s stance is similar to that of China’s voiced previously on Tuesday. When asked about the Iran protests at a regularly scheduled press conference, China’s foreign ministry spokesperson Geng Shuang simply gave a one-sentence answer, saying, “China hopes that Iran can maintain stability and achieve development.”

Image source: Reuters via al Monitor

Both Russia and China – permanent members of the UN Security Council – have already signed deals worth billions to develop sectors related to travel, energy, and infrastructure, soon after international sanctions were lifted in January 2016 as part of the 2015 nuclear deal brokered by the United Kingdom, United States, France, Russia, China, and Germany. Last August Russia and Iran signed a $2.5 billion deal to jump start the rebuilding of Iran’s ailing rail lines. Forbes described Iran as poised for an “infrastructure building bonanza” at a moment when trade with Russia doubled over the course of 2016, which has included the sale of military equipment such as helicopters and various rocket systems, and has also seen Russian oil and gas giants such as Gazprom quickly move into Iran.

…click on the above link to read the rest of the article…

NY Declares State Of Emergency: JFK, La Guardia Close Due To Huge Winter Storm

Flights at JFK airport have been temporarily suspended “due to strong winds and whiteout conditions” caused by Winter Storm Grayson.

Kennedy Airport

Kennedy Airport @JFKairport

@JFKairportDue to strong winds and whiteout conditions, flights at JFK have been temporarily suspended. Travelers are urged to contact their airline carriers for updates on resumption of service

11:05 AM – Jan 4, 2018

“Travelers are urged to contact their airline carriers for updates on resumption of service,” the JFK Twitter account advised.

New York Gov. Andrew Cuomo declared an official weather emergency in New York City, Long Island and Westchester County on Thursday as the storm is expected to drop up to a foot of snow on New York City.

Nearly all flights out of La Guardia, New York City’s other major airport, were cancelled late last night in anticipation of the storm.

LaGuardia Airport

@LGAairport

Almost all #LGA airport flights are cancelled today (January 4) due to weather. To determine if your carrier may still operate later this evening or what your flight status will be tomorrow (January 5), please contact them directly.#LaGuardia#Winterstorm#Grayson#Blizzard2018

11:08 AM – Jan 4, 2018

Newark Airport warned flyers to double check on the status of their flights because many had been cancelled.

…click on the above link to read the rest of the article…

Iranian Protests – Target of Opportunity or Necessity?

From the moment reports of protests in Iran surfaced I was skeptical of the narrative. It only makes sense to be. So many things are coming together in the first half of 2018 that the timing of these protests warrants scrutiny.

The earliest reports were of legitimate and peaceful protests of changes in law creating huge price spikes in certain foods and commodities. But, that was quickly hijacked by forces both internal and external to foment wider strife and violence.

I recommend Moon of Alabama’s commentary on the early days of these protests to get up to speed with how complicated the situation may be in Iran (here and here). In short, what started as normal grievance airing has blossomed into something uglier but that still hasn’t reached anything close to the critical mass needed to replicate successful regime change operations in Libya and Ukraine.

And with very good reason. Iranians are not as fractious in their opinion of their government as simplistic narratives spun by the U.S., Saudi Arabia and Israel would have you believe. This commentary by Ramin Mazaheri over at The Saker’s Blog makes this very salient point:

For 8 horrible years the West foisted Iraq on Iran, supplied Iraq with weapons, turned a blind eye to the worst chemical weapons atrocities since World War One, and did all they could to create, prolong and influence the deadliest war in the last quarter of the 20th century.

And it was still not enough.

A 2nd phony Western war would also totally backfire in 2018 – have no doubt about that. The Iran-Iraq War created a nationalist unity which Libya did not have; Libya’s revolution did create the highest standard of living in Africa and fewer poor people than the imperialist Netherlands (and free loans, education, health care, etc.), but it was never really tested.

…click on the above link to read the rest of the article…