Steve Bull's Blog, page 1206

January 29, 2018

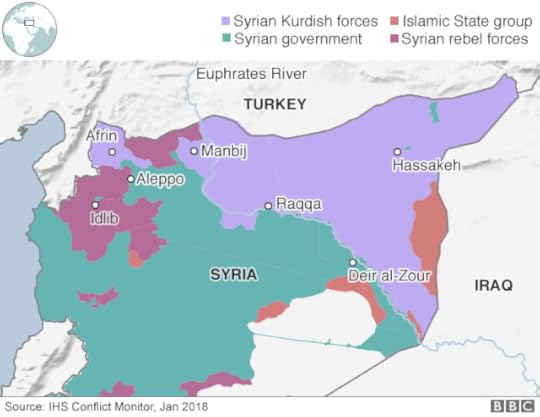

US, Turkish Troops Headed For Military Showdown In Syria

Two days after we reported that Turkey valiantly demanded that US forces vacate military bases in the Syrian district of Manbij, when Turkey’s foreign minister Melet Cavusoglu also said that Ankara is calling upon the US to cease any and all support to Syrian Kurdish forces and militias, not surprisingly the US refused, and on Monday a top American general said that US troops will not pull out from the northern Syrian city of Manbij, rebuffing Ankara demands to withdraw from the city and risking a potential confrontation between the two NATO allies.

Speaking on CNN, General Joseph Votel, head of the United States Central Command, said that withdrawing US forces from the strategically important city is “not something we are looking into.”

Last week Turkish troops crossed into Syria in an push to drive US-backed Kurds out of Afrin. As part of the Turkish offensive, which is grotesquely code-named ‘Operation Olive Branch’, president Erdogan warned that the offensive could soon target “terrorists” in Manbij, some 100km east of Afrin.

“With the Olive Branch operation, we have once again thwarted the game of those sneaky forces whose interests in the region are different,” Erdogan said in a speech to provincial leaders in Ankara last week. “Starting in Manbij, we will continue to thwart their game.”

But not if the US is still there, unless for the first time in history we are about to witness war between two NATO members. And the US has no intention of moving.

Colonel Ryan Dillon, spokesperson for the US-led coalition, told Kurdish media on Sunday that American forces would continue to support their Kurdish allies – despite Erdogan’s threats.

…click on the above link to read the rest of the article…

Stormy Weather

For those of us who are not admirers of President Trump, it’s even more painful to see the Democratic opposition descend into the stupendous dishonesty of the Russian Collusion story. When the intelligentsia of the nation looses its ability to think — when it becomes a dis-intelligentsia — then there are no stewards of reality left. Trump is crazy enough, but the “resistance” is dragging the country into dangerous madness.

It’s hard not to be impressed by the evidence in the public record that the FBI misbehaved pretty badly around the various election year events of 2016. And who, besides Rachel Maddow, Anderson Cooper, and Dean Baquet of The New York Times, can pretend to be impressed by the so far complete lack of evidence of Russian “meddling” to defeat Hillary Clinton? I must repeat: so far. This story has been playing for a year and a half now, and as the days go by, it seems more and more unlikely that Special Prosecutor Robert Mueller is sitting on any conclusive evidence. During this time, everything and anything has already leaked out of the FBI and its parent agency the Department of Justice, including embarrassing hard evidence of the FBI’s own procedural debauchery, and it’s hard to believe that Mr. Mueller’s office is anymore air-tight than the rest of the joint.

If an attorney from Mars came to Earth and followed the evidence already made public, he would probably suspect that the FBI and DOJ colluded with the Clinton Campaign and the Democratic Party to derail the Trump campaign train, and then engineer an “insurance policy” train wreck of his position in office.

…click on the above link to read the rest of the article…

Central Banks Put a Safety Net Under Financial Markets

Most early business cycle indicators suggest that the global economy is pretty much roaring ahead. Production and employment are rising. Firms keep investing and show decent profits. International trade is expanding. Credit is easy to obtain. Stock prices keep moving up to ever higher levels. All seems to be well. Or does it? Unfortunately, the economic upswing shows the devil’s footprints: central banks have set it in motion with their extremely low, and in some countries even negative, interest rate policy and rampant monetary expansion.

Artificially depressed borrowing costs are fueling a “boom.” Consumer loans are as cheap as ever before, seducing people to spend increasingly beyond their means. Low interest rates push down companies’ cost of capital, encouraging additional, and in particular risky investments – they would not have entered into under “normal” interest rate conditions. Financially strained borrowers – in particular states and banks – can refinance their maturing debt load at extremely low interest rates and even take on new debt easily.

By no means less important is the fact that central banks have effectively spread a “safety net” under financial markets: Investors feel assured that monetary authorities will, in case things turning sour, step in and fend off any crisis. The central banks’ safety net has lowered investors’ risk concern. Investors are willing to lend even to borrowers with relatively poor financial strength. Furthermore, it has suppressed risk premia in credit yields, having lowered firms’ cost of debt, which encourages them to run up their leverage to increase return on equity.

…click on the above link to read the rest of the article…

Message from Planet Japan: The good times never last forever

Message from Planet Japan: The good times never last forever

After having traveled to more than 120 countries in my life, the only person I know who’s been to more places than I have is Jim Rogers.

Jim is a legend– a phenomenal investor, author, and all-around great guy.

(His book Adventure Capitalist is a must-read, chronicling his multi-year driving voyage across the world.)

Some time ago while we were having drinks, Jim remarked that he occasionally tells people, “If you can only travel to one foreign country in your life, go to India.”

In Jim’s view, India presents the greatest diversity of experiences– mega-cities, Himalayan villages, coastal paradises, and a deeply rich culture.

My answer is different: Japan.

To me, Japan isn’t even a country. Japan is its own planet… completely different than anywhere else in ways that are incomprehensible to most westerners.

(Watch my friend Derek Sivers explain it to a TED audience here.)

On one hand, this is a culture that strives to attain beauty and mastery in even mundane tasks like raking the yard or pouring tea.

Everything they do is expected to be conducted to the highest possible standard and precision.

They start the indoctrination from birth; Japanese schools typically do not employ janitors and instead train children to clean up after themselves.

Later in life, the Japanese salaryman is expected to practically work himself to death (or suicide) for his company.

Obedience and collectivism are core cultural values, and the tenets of Bushido are still prevalent to this day.

One of the most remarkable examples of Japanese culture was the aftermath of the devastating 2011 earthquake (and subsequent tsunami) in the Fukushima prefecture.

…click on the above link to read the rest of the article…

“There’s Anger Building Out There” – One Man’s Message To Davos Elites

One man went to Davos and dared to say what Pepe Escobar thought no one would – that “it’s the inequality, stupid.”

Amid all the back-slapping exuberance of record high global stock markets and record high global net worth, John McDonnell, the U.K. opposition Labour Party’s spokesman on finance, came to the World Economic Forum in Davos with an uncomfortable message for the global elite…

“I just warn the Davos establishment: There’s an anger building out there that you need to recognize and deal with,”

As Bloomberg reports, most delegates in Davos have adopted an upbeat tone this week — reflected in the optimism of top bankers at JPMorgan Chase & Co. and Deutsche Bank AG who told Bloomberg they see a continuation in a global boom in dealmaking.

But as McDonnell warns, there’s an “avalanche of discontent” out there among the masses.

But in the Swiss resort, “there’s almost a sense of euphoria, it is extraordinary, and I think there’s a sense of complacency.”

McDonnell’s warning carries weight because he would be chancellor of the exchequer if Labour came to power — something investors are preparing for.

“Out there, beyond the Davos compound, many people — we saw it in the Oxfam report — feel the markets have been rigged against them, not for them,” McDonnell said.

“When they’re told we’re coming out of that recession, growth is returning and they don’t feel they’re participating in the benefits of that growth, that’s when people become really alienated and angry.”

Bloomberg reports that McDonnell then laid out a recipe for regaining the trust of the masses, including:

Paying workers a “real living wage” and allowing them to share in the profits of the companies they work for.

Recognizing trade unions and appointing workers to company boards.

…click on the above link to read the rest of the article…

In the Western World Lies Have Displaced Truth

Last year I was awarded Marquiss Who’s Who In America’s Lifetime Achievement Award. This did not prevent a hidden organization, PropOrNot, from attempting to brand me and my website along with 200 others “Putin stooges or agents” for our refusal to lie for the corrupt, anti-American, anti-constitutional, anti-democratic, warmonger police state interests that rule the Western World.

The only honest, factual media that exists in the Western World today are the names on the PropOrNot list of “Putin agents.”

The purpose of ProOrNot is to convince Americans that freedom of speech must be halted by destroying fact-based Internet media, such as this website and 200 others that provide factual information at odds with Big Brother’s universal brainwashing as delivered by CNN, NPR, the New York Times, the Washington Post, and the rest of the utterly corrupt presstitute media, a collection of scum devoid of all integrity and all respect for truth.

A conspiracy of US government agencies, tax-exempt think tanks funded by the ruling interests, and media acting in behalf of a war and police state agenda work to shape perceived reality as it is described in George Orwell’s book, 1984, and in the film, The Matrix. Controlled perception-based reality is only a Facebook “like” away from killing one person or one million or elevating a liar or the warmonger responsible for the killing to hero status or to the conrol of the CIA or FBI or the US presidency.

Here on OpEdNews is an article by George Eliason that reports on who exactly PropOrNot is and who is underwriting the disinformation that is PropOrNot.

https://www.opednews.com/populum/printer_friendly.php?content=a&id=219560

…click on the above link to read the rest of the article…

How To Stay Warm in a Long-Term SHTF Event

As well-informed readers, you know the world situation does not appear to be improving. At any time, we could well find ourselves in the middle of a SHTF event…be it economic collapse, a nuclear attack, or a string of natural disasters. Regarding this last item, the steady string of hurricanes bringing a deadly swath of death and destruction to the United States has been happening as we speak. The unmentioned problem: we’re on the “butt” end of winter, and as such, you’ll have to take extra precautions in the event it hits the fan.

As well-informed readers, you know the world situation does not appear to be improving. At any time, we could well find ourselves in the middle of a SHTF event…be it economic collapse, a nuclear attack, or a string of natural disasters. Regarding this last item, the steady string of hurricanes bringing a deadly swath of death and destruction to the United States has been happening as we speak. The unmentioned problem: we’re on the “butt” end of winter, and as such, you’ll have to take extra precautions in the event it hits the fan.

10 Ways to Stay Warm in a Long-Term SHTF Event

This is going to be a very specific list; however, it is not exhaustive. There will always be more to add, and there is never enough: that’s the bottom line. This will get you started on your checklist, either physical or mental to ready your preparations before the winter hits.

Warm clothing: and plenty of it. Gore-Tex top and bottoms are an absolute necessity, and plenty of warm socks, thermal underwear, and good boots that are waterproof, have plenty of Thinsulate and good soles, and give good ankle support.

Sleeping bag, Gore-Tex cover, and sleeping pad: Remember to go for the best in terms of quality and performance. Another essential in this regard is a good compression bag and a wet-weather bag. A soaking wet sleeping bag is not fun. Stay warm, dry, and insulated from the conduction of lying on the ground.

Plenty of hand warmers: Why? Because if you’re going to give an IV in the middle of the winter, you want to warm up the bag, that’s why. Because you may need to thaw something out and not be able to light a fire due to operational security reasons.

…click on the above link to read the rest of the article…

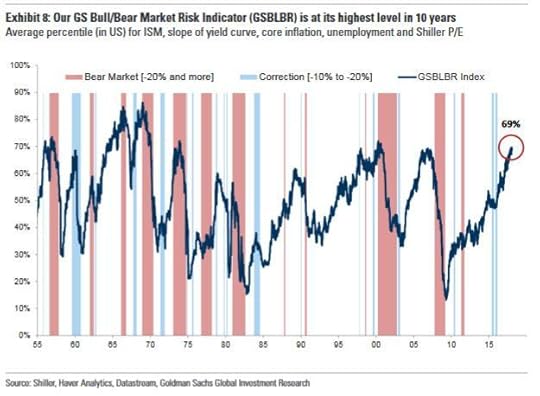

Goldman: “Expect A Market Correction In The Coming Months”

While there are reasons to be bullish on global equities in 2018 and bear market risks are low, a correction is becoming increasingly likely, Goldman’s equity strategist Peter Oppenheimer writes in an overnight note, repeating our observation from Friday that this has been the strongest start for global equity markets in any year since the infamous 1987.

As Goldman notes, this “melt-up” has occurred despite the already strong returns last year. The S&P 500 had its second-highest risk-adjusted returns in more than 50 years and MSCI World ($) had its second-highest risk-adjusted returns since the index began in 1970. More concerning, at least for the risk-party folks, is that te year-to-date sharp rise in equity returns has also continued even as bond markets are experiencing sharp risk-adjusted losses.

Confirming that a major market move lower is likely imminent – something Bank of America cautioned on Friday – the Goldman Bull/bBar Market Risk Indicator is at elevated levels – in fact at the same level it was before the dot com and credit bubble crash – though, Goldman adds in an attempt to mitigate growing fears, “the continuation of low core inflation and easy monetary policy suggests a correction is more likely than a bear market.” And while monetary policy may be easy now, is getting tighter by the day…

In this context, and expecting the inevitable, Goldman writes that “drawdowns within bull markets of 10% or more are not uncommon” and points out that “there are many historical examples of corrections — drawdowns of 10-20% – – that are short-lived and do not turn into drawn-out bear markets associated with economic weakness.”

Of course, there are many drawdowns of 10% or more which turn into full blown recessions, if not a depression. GS defines a bear market as a drop of 20% or more.

…click on the above link to read the rest of the article…

Cosmic Rays, Magnetic Fields and Climate Change

In my recent post on The Cosmogenic Isotope Record and the Role of The Sun in Shaping Earth’s Climatean interesting discussion developed in comments where there was a fair amount of disagreement among my sceptical colleagues. A few days later, retired Apollo astronaut Phil Chapman sent me this article which lays some of the doubts to rest. Phil never got to fly in space but was mission Scientist on Apollo 14. It is not every day I get the opportunity to publish an article from such a pre-eminent scientist.

In my recent post on The Cosmogenic Isotope Record and the Role of The Sun in Shaping Earth’s Climatean interesting discussion developed in comments where there was a fair amount of disagreement among my sceptical colleagues. A few days later, retired Apollo astronaut Phil Chapman sent me this article which lays some of the doubts to rest. Phil never got to fly in space but was mission Scientist on Apollo 14. It is not every day I get the opportunity to publish an article from such a pre-eminent scientist.

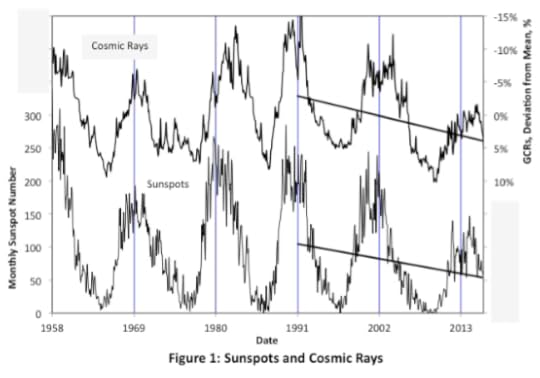

1. Sunspots and GCRs

There is absolutely no doubt that solar activity (via the solar wind) directly affects the flux of galactic cosmic rays (GCRs) reaching the Earth. The lower curve in Figure 1 shows the monthly average sunspot count since 1958, from the database (SILSO) maintained by the Royal Observatory of Belgium and the upper chart gives the monthly average GCR flux (as percentage deviations from the average for the period), as measured by the neutron monitor in Moscow.

Note that the scale for GCRs is inverted, increasing downward, to facilitate comparison with the sunspot record; that the major time division is 11 years, to illustrate the well- known approximate periodicity of the sunspot cycle; and that the GCR minimum usually lags the sunspot maximum by a year or two. The linear trend lines in the figure show the decline in the average number of sunspots since the early 1990s and the corresponding increase in GCRs, as we began a new Grand Solar Minimum (already named the Eddy Minimum by the solar physics community).

…click on the above link to read the rest of the article…

The world in 2018 – Part Two

‘The World in 2018’ is a world full of concerns about the future, yet a world that seems to be getting slightly more optimistic about its economic prospects. Ten years after the onset of the financial crisis, there are hopes that the global economy may have turned the corner and could finally be starting to pick up after years of slow growth. Are we seeing light at the end of the tunnel – or rather getting deeper into the fog?

To make sense of ‘The World in 2018’, what we need is maybe not so much to try guessing what might be on our way over the next 12 months than to develop a more acute consciousness and comprehension of the road we are travelling, of where it is leading us, and of where we currently stand on that path. This is certainly not an easy task: volatility, uncertainty, complexity and ambiguity (‘VUCA’) reign more supreme than ever, and, together with the ever-accelerating pace of global change, they make it increasingly difficult to understand the world’s trajectory and situation. Some key themes of the ‘global conversation’ can however give us a few clues about how these trajectory and situation tend to be perceived at this particular moment in time.

In early 2018, the ‘global conversation’ seems to denote a growing sense of concern about a whole series of ongoing events or developments and about their possible or likely ramifications into the future. These include America’s descent into a spiral of political insanity and retreat from global leadership, the multiple and often widening cracks in European unity, the erosion of the international liberal order and of liberal democracy in many places, as well as the rising or persisting geopolitical tensions in Asia, the Middle East or Eastern Europe.

…click on the above link to read the rest of the article…