Steve Bull's Blog, page 1208

January 27, 2018

Macron’s pledge to wipe out coal is just as meaningless as Trump’s plan to revive it

In a speech at the 2018 World Economic Forum held in Davos, Switzerland, French President Emmanuel Macron said he wanted to “make France a model in the fight against climate change” and promised to shut all coal-fired power plants by 2021 – two years earlier than the timetable put forward by his predecessor.

While Macron’s move is mainly symbolic since France only generates about 2.2 percent of its power from coal, it signals his government is actively trying to wean itself off fossil fuels in sharp contrast to the current policy of his U.S. counterpart. “We have finally ended the war on coal,” pretty much sums up American policy these days, as President Donald Trump declared in a recent speech.

Behind the headlines and clear policy contrasts, however, lies an important point: The U.S. is likely to become coal plant free anyway, with or without presidential support. The reason is economics, which, as always, trumps the words of a politician – even if it can take longer.

The US and coal

In the U.S., the Energy Information Administration has been charged, since the energy crises of the 1970s, with providing an unbiased view of the types of energy used to power the U.S. economy.

Its data show that in 2006 about 10 percent of all electric power plants – 616 – ran on coal. By 2016, the latest year for which data are available, that figure dropped to just 4 percent, or 381 coal-fired power plants. That compares with 1,801 natural gas plants and 3,624 “other renewables” such as wind, up from 1,659 and 843 in 2006, respectively.

In other words, slightly more than 20 coal plants are shutting down each year on average. If the trend continues at the same rate, then most coal-fired power plants will be closed in the U.S. within 18 years, or around 2035. A few will likely remain, since utilities close the oldest, least efficient plants first, but the trend is clear.

…click on the above link to read the rest of the article…

Delusions of Grandeur in Building a Low-Carbon Future

Some excerpts from Carey King’s excellent paper titled “Delusion of Grandeur in building a low-carbon future” (2016). By all means worth reading: it identifies the delusionary approach of some policy proposals. Image Credit: K. Cantner, AGI.

…. the outcomes of economic models used to inform policymakers and policies like the Paris Agreement are fundamentally flawed to the point of being completely delusional. It isn’t the specific economic assumptions related to the “low-carbon” transition that are the problem, but structural flaws in the economic models themselves.

There is a very real trade-off between the rate at which we address climate change and the amount of economic growth we can expect during the transition to a low-carbon economy, but most economic models insufficiently address this trade-off, and thus are incapable of assessing the transition. If we ignore this trade-off, or worse, we rely on models that are built on faulty premises, then we risk politicians and citizens revolting against the energy transition midway into it when the substantial growth and prosperity they’ve been told to expect will accompany the low-carbon transition don’t materialize. It is important to note that citizens are also told that doubling-down on fossil energy also only provides growth and prosperity. But this is a major point of this article: mainstream economic models can’t tell the difference. There are foreseeable feedbacks of a fast transition to a low-carbon economy that increase the risk of major recessions.

The AR5 indicates that if the world invests enough to reduce greenhouse gas emissions over time — such that total annual greenhouse gas emissions are practically zero by 2100 — to stay within the 450 ppm and 2-degree-Celsius target, then the modeled decline in the size of the economy relative to business-as-usual scenarios is typically less than 10 percent.

…click on the above link to read the rest of the article…

How To Grow Vegetables Year-Round in Container Gardens

For many of us, our jobs dictate that we live near a city and, as a result, our yards are smaller and may not provide adequate space for a large garden. As well, those that are renting homes may also be limited to what they can do with a yard. For a short time, I lived in the sprawling outskirts of Houston, TX where my yard was not very big. I had to get creative in terms of where to grow my plants. I started dabbling in container gardening and got pretty good at it.

For many of us, our jobs dictate that we live near a city and, as a result, our yards are smaller and may not provide adequate space for a large garden. As well, those that are renting homes may also be limited to what they can do with a yard. For a short time, I lived in the sprawling outskirts of Houston, TX where my yard was not very big. I had to get creative in terms of where to grow my plants. I started dabbling in container gardening and got pretty good at it.

I utilized my lack of space with a patio garden where I had herbs, vegetables, and berries growing. As well, I had pots of fruit trees started and vertical gardening systems hanging so I could make use of as much space and lighting as possible.

When we don’t have the option of moving out into the sprawling countryside to live off of the land, we have to make use of what we have. Urban and suburbanites can garden in their small spaces using some of the most popular vertical gardening and small space gardening techniques:

Vertical gardening systems

Window boxes

Grow bags

Ceramic containers

Pallets

Hanging planters

Container Plants Prefer Lots of Drainage

Ensure that your pots and containers have adequate drainage holes at the bottom. Plants do not like to sit in soggy soil and will quickly develop root rot, as a result. Plant shallow-rooted plants such as small herbs, green leafy vegetables, strawberries, and green onions which can be grown close to one another and will help plant roots stay shaded from the hot sun. This is a principle of xeriscaping and will also help to cut down on watering.

…click on the above link to read the rest of the article…

Weekly Commentary: America First and the Decapitation of King Dollar

The U.S. ran a $71.6 billion Goods Trade Deficit in December, the largest goods deficit since July 2008’s $76.88 billion. The U.S. likely accumulated a near $550 billion Current Account Deficit in 2017, also near the biggest since before the crisis. Going all the way back to 1982, the U.S. has posted only two quarterly surpluses (Q1, Q2 1991) in the Current Account. Since 1990, the U.S has run cumulative Current Account Deficits of $10.177 TN. From the Fed’s Z.1 report, Rest of World holdings of U.S. financial asset began the nineties at $1.738 TN; closed out 2008 at $13.699 TN; and ended Q3 2017 at $26.347 TN. It’s gone rather parabolic – with a curiously similar trajectory to equities markets.

For better than three decades, the U.S. has been in an enviable position of trading new financial claims for foreign manufactured goods. The U.S. has literally flooded the world with dollar balances. In the process, the U.S. exported Credit Bubble Dynamics (including financial innovation and central bank doctrine) to the world. When the central bank to the world’s reserve currency actively inflates, the entire world is welcome to inflate. The resulting global monetary disorder ensured a world of fundamentally vulnerable currencies.

Despite unrelenting Current Account Deficits, there have been two distinct “king dollar” episodes. There was the “king dollar” period of the late-nineties, fueled by global financial instability, a U.S. edge in technology and, importantly, the Greenspan Fed’s competitive advantage in sustaining U.S. securities market inflation. More recently, a resurgent “king dollar” was winning by default in 2013-2016, as the ECB, BOJ and others implemented massive “whatever it takes” QE and rate programs. Moreover, the shale revolution and a dramatic reduction in oil imports was to improve the U.S. trade position. Oil imports did shrink dramatically, but this was easily offset by American consumers’ insatiable appetite for imported goods.

…click on the above link to read the rest of the article…

January 26, 2018

The Flavour of Good Farming

Earlier this month, I was at the Oxford Real Farming Conference, where I was thrilled to be immersed in lively discussion about the power of sustainable food production systems to change the world for the better. Real farming holds the promise to restore lost biodiversity to the rural landscape, preserve critically endangered breeds, sequester carbon, reduce exposure of plants and animals to antimicrobials, pesticides and antibiotics, and secure the future health and vitality of the soil.

But there was one important element missing, and for a conference all about better food production, it was particularly striking. Flavour was absent from the discussion.

The sustainable food movement’s relationship with gastronomic considerations is problematic. No one would deny that ecologically and morally reprehensible farming systems can be optimised to provide hyper-palatable, nutritionally-bereft foods whose only appeal – other than its cheapness – is to the brain’s natural proclivity for the compelling combination of salt, sugar and fat. At the other end of the economic spectrum, haute gastronomic culture, with its £1000 bottles of wine, smacks uncomfortably of elitism.

But hiding within this emotional tangle is an opportunity to re-valorise farming that is ecologically scrupulous, biodiversity-enhancing and demanding of exemplary animal welfare through a conversation about great flavour. Critically, this is a strategy to extend the attraction of these farming systems and their potential social impact far beyond the realm of already-converted eco-warriors. If we care about increasing the reach of sustainable farming, it is our moral duty to address, and ultimately bridge, this rift between the sustainable food movement and the importance of flavour.

…click on the above link to read the rest of the article…

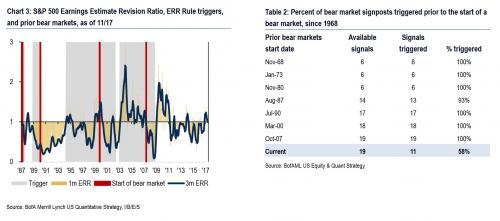

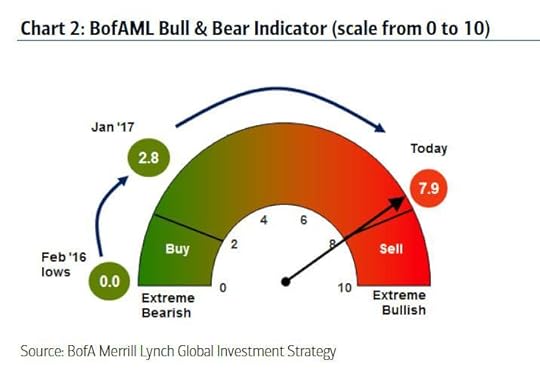

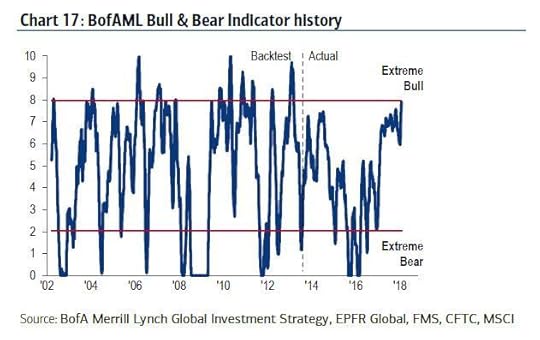

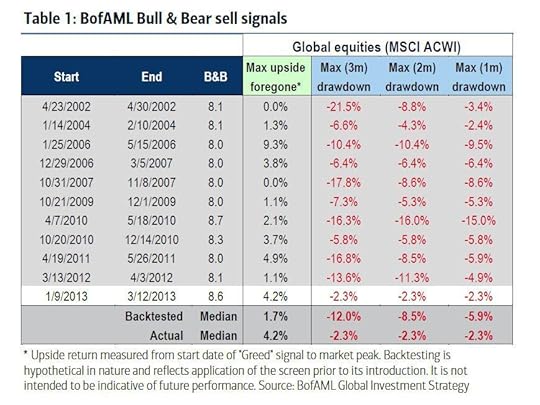

One of BofA’s “Imminent Market Crash” Indicators Was Just Triggered

Early last month, we showed that one of Bank of America’s “guaranteed bear market” indicators, namely the three-month earnings estimate revision ratio (ERR) which since 1988 has had a 100% hit rate of predicting upcoming bear markets, was just triggered. As Bank of America explained at the time, “since 1986, a bear market has followed each time that the ERR rule has been triggered.”

The only weakness of that particular indicator is that while a bear market always followed, the timing was unclear and the upcoming bear could arrive as late as two years after the trigger hit.

Well, fast forward to today when overnight another proprietary “guaranteed bear market” indicator created by the Bank of America quants was just triggered.

As we explained earlier today, as part of the unprecedented, historic rush to dump cash and buy any stocks that one can find, BofA’s “Bull & Bear indicator” surged to 7.9 – effectively 8 – a level that is indicative of broad market euphoria, and the highest it has been since March of 2013, or nearly 5 years ago.

There is another, far more important, reason why the triggering of the Bull and Bear Indicator is a remarkable event: according to Bank of America back-tests, not only does this particular indicator also have a 100% hit rate once triggered…

… but on 11 out of 11 signals since 2002, the market dropped on average 12% after it was triggered.

And yes, it also works in the opposite direction: the last Bull & Bear indicator flashed was a buy signal of 0 on Feb 11th 2016. Since then the S&P has been up on 22 of the next 23 months.

Finally, and most importantly, unlike other “bear market” indicators which confirm if a crash is imminent but not when, this one gives an explicit time window: the market always dumps within the next 3 months once a Sell signal has been trigerred.

…click on the above link to read the rest of the article…

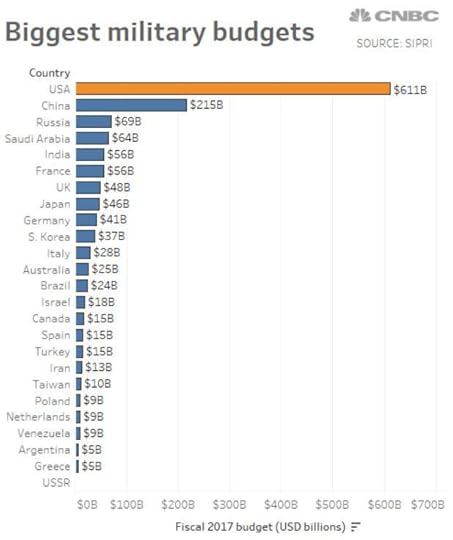

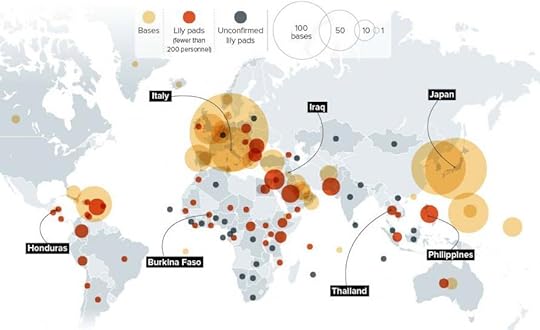

Trump Ups Defense Budget By 13% – “Can’t Have World’s Best Military On An Obama Budget”

With Washington having seemingly turned its turret away from ‘terror’ and back to “revisionist, authoritarian” regimes like ‘Russia and China’, the Military-Industrial Complex is ‘gonna need a bigger budget’ – a 13% bigger $716 billion one by 2019.

US military spending already dwarfed the rest of the world…

But, while presenting the 2018 National Defense Strategy (NDS2018) of the United States on Friday at the Johns Hopkins University, Secretary of Defense James Mattis painted a picture of a dangerous world in which U.S. power – and all of the supposed “good” that it does around the world – is on the decline.

“Our competitive edge has eroded in every domain of warfare – air, land, sea, space, and cyberspace,” he said. “And it is continually eroding.”

And now, as The Washington Post reports, President Trump is expected to ask for $716 billion in defense spending when he unveils his 2019 budget next month, a major increase that signals a shift away from concerns about rising deficits, U.S. officials said.

The proposed budget is a victory for Defense Secretary Jim Mattis, who recently unveiled a strategy that proposes retooling the military to deter and, if necessary, fight a potential conflict with major powers such as China and Russia.

And it represents a setback for deficit hawks such as Mick Mulvaney, director of the Office of Management and Budget, who last year pressed for an increase in defense spending that could be offset by cuts to domestic programs.

The $716 billion figure for 2019 would cover the Pentagon’s annual budget as well as spending on ongoing wars and the maintenance of the U.S. nuclear arsenal. It would increase Pentagon spending by more than 7 percent over the 2018 budget, which still has not passed through Congress.

…click on the above link to read the rest of the article…

Happy Landings

The blow-off orgy in the stock markets is supposedly America’s consolation prize for what many regard as the electoral bad acid trip of the Trump presidency. Sorry to tell you, it’s just another hallucination, something you’re going to have to come down from. Happy landings!

While the markets have roared parabolically up, in Technicolor, with sugar-on-top, that ole rascal, Reality, is working some hoodoo in the other rings of this psychedelic circus: namely the dollar and the bond market. The idiots on NPR’s Marketplace and the Cable TV financial shows haven’t noticed the dollar tanking the past several months or the interest rates creeping up in the bond markets. Well, isn’t that the point of living as if anything goes and nothing matters, the mantra of the age?

Alas , things are connected and consequences await. It would be rich if a flash crash ripped the Dow, S & P, and the Nasdaq to shreds twenty minutes after the Golden Golem of Greatness finished schooling the weenies of Davos on the bigly wonderfulness of his year in office. In fact, it would be a crowning comic moment in human history. I can imagine Trump surrounded by the fawning Beta Boys of Banking as the news comes in. Poof! Suddenly, he is alone in the antechamber backstage, nothing left of his admirers but the lingering scent of aftershave. The world has changed. The dream is over. In the mirror he sees something that looks dimly like Herbert Hoover in a polka-dot clown suit, with funny orange wig….

A financial smash-up is really the only thing that will break the awful spell this country is in: the belief that everyday life can go on when nothing really adds up. It seems to me that the moment is close at hand. Treasury Secretary Mnuchin told the Davos crowd that the US has “a weak dollar” policy.

…click on the above link to read the rest of the article…

If Currency Wars Have Indeed Started, This Is What Comes Next

Even as overall volatility remains tame, things are rapidly changing in the world of currency trading where FX vol has spiked to the highest level since early October after this week’s dramatic FX rollercoaster which saw the US Treasury Secretary get this close to launching currency war, and required the verbal intervention of both (a rather angry) Mario Draghi and Donald Trump himself to normalize things, if only for the time being.

While some were quick to point out that what Mnuchin did with his “weak dollar” commentary was a dramatic reversal of decades of US “strong dollar” policy (which is nothing more than lip service as Hank Paulson showed so very well when he launched QE1 in 2008), others such as FX strategist Alan Ruskin saw a more innocuous explanation: as we noted earlier, he suggested that what you have here “is two officials who like a weak(er) USD in the short-term that will help the US trade accounts and support growth, albeit to the point where strong growth will eventually support a strong USD longer-term.”

In Alan’s view this is a way of saying that in the short-term a weak USD is good for US trade, and in the long-term a strong USD is good because it is indicative of strong growth a healthy economy. Still, Ruskin concedes that that this is clearly a very confusing message to convey and it’s unlikely to either be reported or understood correctly, which doesn’t really help the message.

And then there is the less subtle explanation: that trade wars have indeed broken out. That’s the assumption used by DB’s Masao Muraki, who today writes that it his view that the Trump Administration, having completed the tax reforms, will shift focus to trade policy.

…click on the above link to read the rest of the article…

US Rig Count Soars Most In 10 Months As Production Hits Record High

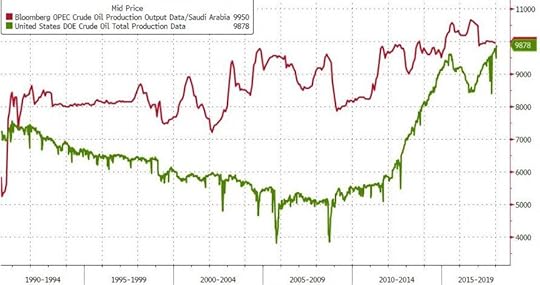

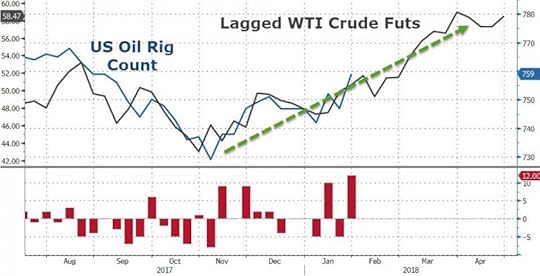

US rig counts rose by 12 in the last week – the biggest rise since March 2017 – as the lagged crude price is sparking more drilling and in turn sending production surging to a new record high… just shy of Saudi Arabia!

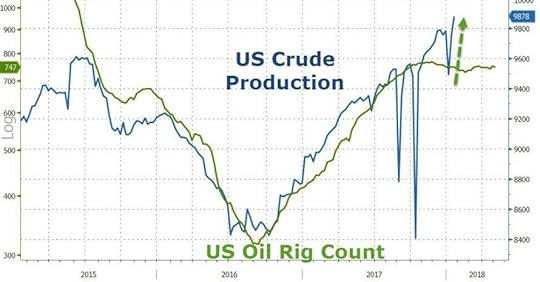

US crude production surged back from its weather-impacted plunge to a new record high last week…

And is set to overtake Saudi Arabia very soon…