Steve Bull's Blog, page 1205

January 31, 2018

The Fed Will Ignite The Next “Financial Crisis”

There seems to be a very large consensus the markets have entered into a “permanently high plateau,” or an era in which price corrections in asset prices have been effectively eliminated through fiscal and monetary policy.

Partnering with this fairytale like mindset is an overwhelming sense of complacency. Throughout the entire monetary ecosystem, there is a rising consensus that “debt doesn’t matter” as long as interest rates remain low. Of course, the ultra-low interest rate policy administered by the Federal Reserve is responsible for the “yield chase” which has fostered a massive surge in debt in the U.S. since the “financial crisis.”

As Ray Dalio, CEO of Bridgewater, recently noted:

“We’re in a perfect situation, inflation is not a problem, growth is good, but we have to keep in mind the part of the cycle we’re in.”

Yes, current economic growth is good, but not great. Inflation and interest rates currently remain low which creates an environment in which using debt remains opportunistic. But rising debt levels has a negative economic consequence. As shown, prior to the deregulation of the financial industry under Ronald Reagan, which led to an explosion in consumer credit issuance, it required just $1.25 of total system-wide debt to create $1.00 of economic growth. Today, it requires $3.83 to create the same $1 of economic growth. This shouldn’t be surprising, given that “debt” detracts from economic growth as the required “debt service” diverts income from savings and productive investment leading to a “diminishing rate of return” for each new dollar of debt.

However, debt levered economic cycles are a function of the ability to draw forward future consumption. But there is a finite limit to the “positive” effect of a debt-driven economic cycle.

Eventually, the “bill” must be paid.

…click on the above link to read the rest of the article…

Weather Terrorism, W.T.F.?

Photo by The National Guard | CC BY 2.0

As the predicted storm pounded the narrow canyons in the hills above Montecito early in January, a rumble began to overtake the percussion of hard rain on scorched earth. It built, once the torrent of water had dislodged first soil, pebbles, small rocks, then boulders, into a mighty thunder as the mud gathered speed over the resin-slicked surface of the newly burned wild lands.

From out of the Wildland-Urban-Interface, the mudslide drove down into the leafy suburbs of Montecito and tangled with the fragile infrastructure that supports the life-styles of the rich and famous, the merely rich, and all those others who call this Santa Barbara suburb home. It smashed through homes, businesses and, most critically, fractured the system of pipes, suspended across the naturally occurring drainages, that link a chain of reservoirs that serve as the community’s water source.

The broken pipes unleashed a sea of nearly ten million gallons of fresh water released from the reservoirs because their electrically operated control valves were inoperative in the storm related blackout. Much of the mud and water found its way to U.S. Route 101 which runs from Los Angeles to the Oregon border. The section that runs through Montecito, a few hundred yards east of the beach, was transformed into a rock and tree strewn delta where water ran twelve feet deep in places and over 100,000 tons of debris were spread along its length. The highway was reopened recently after a two-week closure. Restoration of the area’s water supply will take longer. Both were the collateral damage of extreme weather events.

We are a species in retreat. Pusillanimous descriptions of our geo-historical circumstances such as ‘climate change’ are daily challenged by the occurrence of extreme weather events that disrupt society, destroy infrastructure, and obliterate human life.

…click on the above link to read the rest of the article…

Economic Collapse: Will Cryptocurrency Save the Financial System?

Economic Collapse: Will Cryptocurrency Save the Financial System?

In the second article of my three part series, I addressed how we got to the current state of this financial chaos. In this last article, I explain where we are heading and how cryptocurrency could be the last chance to create a sustainable economic system.

Where to go from here?

If trust and sustainability were the two conditions that allowed for the transition from physical gold to paper currency, it is from this basis that we must start to analyze where we are going and what effects the next economic crisis could have.

In 2008, confidence in central banks saved the global economy. But as Mario Draghi said, the bazooka of quantitative easing was fired and a second hit during a crisis would have proved ineffective. The reason is complex and must be clearly explained. Most people are paid in a currency deposited in the bank, because that is where one keeps one’s currency, able to withdraw it at any time. But in the event of an economic crisis, priority is given to the banks, whatever remaining liquidity being for the customers. The reason why there was no bank run in 2008, which would have led to the collapse of the global banking system, lies in the trust that ordinary people continued to place in the financial system, courtesy of what the corporate-controlled media told them.

The problem concerns the next financial crisis and how the world population will react. The path already seems to be traced, especially in geopolitical terms. Countries like China and Russia have created their own alternative banking and financial system to escape dollar sanctions; but they have also begun to de-dollarize by accumulating gold and using different payment methods to the US currency.

…click on the above link to read the rest of the article…

January 30, 2018

Too Many Wars. Too Many Enemies

If Turkey is not bluffing, U.S. troops in Manbij, Syria, could be under fire by week’s end, and NATO engulfed in the worst crisis in its history.

Turkish President Erdogan said Friday his troops will cleanse Manbij of Kurdish fighters, alongside whom U.S. troops are embedded.

Erdogan’s foreign minister demanded concrete steps by the U.S. to end its support of the Kurds, who control the Syrian border with Turkey east of the Euphrates, all the way to Iraq.

If the Turks attack Manbij, the U.S. will face a choice: Stand by our Kurdish allies and resist the Turks, or abandon the Kurds.

Should the U.S. let the Turks drive the Kurds out of Manbij and the entire Syrian border area with Turkey, as Erdogan threatens, U.S. credibility would suffer a blow from which it would not soon recover.

But to stand with the Kurds and oppose Erdogan’s forces could mean a crackup of NATO and loss of U.S. bases inside Turkey, including the air base at Incirlik.

Turkey also sits astride the Dardanelles entrance to the Black Sea. NATO’s loss of Turkey would thus be a triumph for Vladimir Putin, who gave Ankara the green light to cleanse the Kurds from Afrin.

Yet Syria is but one of many challenges to U.S. foreign policy.

The Winter Olympics in South Korea may have taken the threat of a North Korean ICBM that could hit the U.S. out of the news. But no one believes that threat is behind us.

Last week, China charged that the USS Hopper, a guided missile destroyer, sailed within 12 nautical miles of Scarborough Shoal, a reef in the South China Sea claimed by Beijing, though it is far closer to Luzon in the Philippines. The destroyer, says China, was chased off by one of her frigates. If we continue to contest China’s territorial claims with U.S. warships, a clash is inevitable.

…click on the above link to read the rest of the article…

Is the World Becoming Less Free?

Is the World Becoming Less Free?

Erosion of the rule of law and various civil liberties are causing the world to be a less free, less prosperous place.

The Cato Institute has, in cooperation with the Canadian Fraser Institute and the German “Friedrich-Naumann Stiftung für die Freiheit,” assembled a comprehensive 396-page report on human freedom in the world. Overall, governments worldwide have reduced the level of freedom in recent years.

The Link between Individual Liberty and Prosperity

Freedom of movement, expression, and information, as well as the rule of law, have seen the largest decreases since 2008.

Since 2008, the global Human Freedom Index (HFI) has gone down to 6.93/10 from 7.05/10. According to Ian Vasquez and Tanja Porčnik, who drafted the report, important factors for the score were performances in the categories regarding individual and civil liberties, as well as economic liberty. When it comes to the latter, the researchers point out that the individual liberty is very much linked to economic prosperity: the freest countries show a higher GDP per capita ratio compared to those with very low levels of individual freedom. Hong Kong, which ranks second in Cato’s Human Freedom Index, is a noticeable exception on this point.In total, twelve major categories determined the overall freedom score of a country. The Cato Institute found that particularly in the area of freedom of movement, expression, and information, as well as the rule of law, have seen the largest decreases since 2008. “In many parts of the world, freedom is under assault, with nationalism, populism, and hybrid forms of authoritarianism being sold as viable alternatives. As such, the largest deteriorations in freedom have occurred in Syria, Egypt, Venezuela, Belize, and Greece,” says Tanja Porčnik.

…click on the above link to read the rest of the article…

Making Local Woods Work

The Forestry Commission estimates that 47% of England’s woodlands are unmanaged. If you like to think of woods as wild places and flinch at the idea of a tree being felled, then you might consider this a good thing. But woodlands, at least in this country, need management.

Whilst truly wild woodlands are ‘climax vegetation’ that has achieved a balance between death and renewal, these generally need to be at a scale much bigger than any of our remaining woodlands to thrive independently of humans.

Here in Britain, “the wildwood” has a central place in our culture and imaginations, but the reality is that active management has shaped our woodlands since the ice age, providing supplies of food, fuel and timber, and creating diverse habitats amongst the trees. Unmanaged woodland lacks diversity and can result in poor tree health and increase the spread of tree diseases.

Whilst most of that unmanaged woodland is in private ownership, the future management of our public forest estate also remains uncertain. Attempts in 2010 to sell off the national forest estate were abandoned in the face of a public outcry, but austerity has resulted in many local authority woodland teams being disbanded and the future for the management of the national public forest estate – at least in England – remains unclear.

It is in that gap between the market and the state that we find the commons and, increasingly, a diverse range of community businesses, co-operatives and other forms of social enterprise creating value and livelihoods from its management. So does social and community business have a role in reinvigorating our woods and forests and rebuilding our woodland culture?

In 2012, in the aftermath of the failed forestry sell off and in the wake of the Independent Panel on Forestry’s report, a number of organisations came together to discuss alternative approaches to the management of our woods and forests.

…click on the above link to read the rest of the article…

Facebook Cracks Down On Independent Media, Under Guise Of ‘Enhancing Relationships’

January 30, 2018

Nothing could have more perfectly exemplified the establishment’s use of Orwellian Newspeak than Facebook’s latest move to censor independent thought under the pretense of caring about the emotional wellbeing of the masses. The media giant has been documented live-streaming murders, suicides, rapes, and abuse. Despite this, The New York Post reported that Facebook officially stated they were ‘unable to stop live-streaming suicides.’ But, trust them, they care about your mental health, and that’s why they don’t want you to read certain news stories.

A recent press report on the matter stated: “Facebook said it’s changing the formula that determines users’ news feeds by decreasing business and media posts and focusing more on personal connections.” However, in reality, the changes seem to have been used to specifically target anti-establishment news sources.

Though Facebook CEO Mark Zuckerberg enthused regarding the changes, the company’s shareholders appeared less impressed with the news. According to CNBC, Facebook shares fell by four percent at market the morning after Zuckerberg’s announcement of the new policy. Stocks fell during the first day by following the announcement by 6.1% which was reported to have amounted to a $3.3 billion loss.

Despite this, Zuckerberg appeared totally unfazed by the stock price drop, and openly admitted that the changes would lead to an overall decline in user engagement.

The Guardian’s coverage of the news not only chided Zuckerberg for not having made the move earlier, while also directly identifying the core of the real impetus behind the changes, which had nothing to do with bringing you closer to your family. The Guardian’s writing on the issue reveals that the real reason for the changes is in order to actively censor what the legacy press outlet deems to be “fake news” that “interfered” in the outcome of the 2016 US Presidential election.

…click on the above link to read the rest of the article…

Pipeline Wars: Realpolitik meets Geography

The headlines are ablaze this month with news from all over about new pipeline projects coming into Europe. Never one to miss an opportunity to do the U.S. State Department’s bidding in how it presents pipeline politics, Oilprice.com published a howler of a piece about the Southern Gas Corridor.

Titled, “Is This the World’s Most Critical Pipeline?” the piece is pure marketing fluff designed to make you think that Azerbaijani gas will change the face of European gas politics.

The beginning is the most telling, “Europe wants to become less dependent on Russian gas and use more clean energy…” This is a lie.

Europe doesn’t want this as a continent, the leaders of the European Union who are aligned with the United States who view Russia as the enemy want to become less dependent on Russian gas.

Most of Europe wants Russia to supply them with natural gas because it is 1) cheap and 2) plentiful. For geopolitical reasons the U.S. doesn’t want an ascendant Russia. The EU technocracy agrees because a strong Russia owning more than 40% of European gas sales is a Russia that can’t be destabilized through currency and proxy wars.

Southern Gas Boondoggle

The Southern Gas Corridor is a nearly 4000km (2500 mile) gas pipeline project to bring Caspian Sea natural gas into southern Europe. It is slated, when completed with all the side projects tying into it, between 60 and 120 billion cubic meters of gas annually (bcma) starting with an unknown amount from Azerbaijan in 2019.

That number comes from an announcement in the Financial Times circa 2008. A better number for it is closer to just 16 bcma.

…click on the above link to read the rest of the article…

Spanish Government Uses Hate Speech Law To Arrest Critic Of The Spanish Government

from the shocked-SHOCKED-to-find-such-a-predictable-use-of-a-bad-law dept

Spain’s government has gotten into the business of regulating speech with predictably awful results. An early adopter of Blues Lives Matter-esque policies, Spain went full police state, passing a law making it a crime to show “disrespect” to law enforcement officers. The predictable result? The arrest of someone for calling cops “slackers” in a Facebook post.

Spain’s government is either woefully unaware of the negative consequences of laws like this or, worse, likes the negative consequences. After all, it doesn’t hurt Spain’s government beyond a little reputational damage. It only hurts residents of Spain. When you’re already unpopular, thanks to laws like these and suppression of a Catalan independence vote, what difference does it make if you’re known better for shutting down dissent than actually protecting citizens from hateful speech?

One Catalan resident is getting the full “hate speech” rap-and-ride.

A Catalan high school teacher, Manel Riu, appeared in court on Thursday accused of hate speech for his tweets and Facebook posts criticizing Spain, government members and the Guardia Civil police. Over a hundred people escorted him to court in Tremp, west of Catalonia, where he denied any wrongdoing and asked for the case’s dismissal.

As a Catalan, Riu certainly has reason to criticize the Spanish government. During the last attempted referendum, the Spanish government sent police to seize ballots, voters’ cellphones, and ordered Google to remove a voting location app from the Play store. The evidence against Riu is composed of 119 tweets gathered by the Guardia Civil, Spain’s oldest law enforcement agency — one that blurs the line between playing soldier and playing cop far more often than its US counterparts.

…click on the above link to read the rest of the article…

January 29, 2018

The Liquidity Punch Bowl

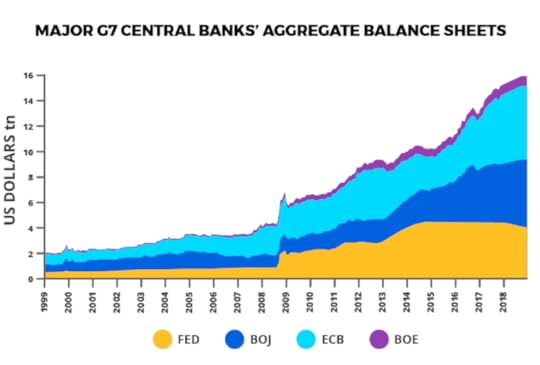

It is appropriate with the inauguration of this weekly column to look at the “Big Picture”. The biggest risk to world stock markets, and asset prices in general, in 2018 is that G7 central banks (led by the Federal Reserve) are finally attempting to normalise monetary policy nine years after the American central bank commenced quantitative easing in December 2008, in the midst of the so-called “global financial crisis”.

Since late 2008, G7 central banks, comprising the Fed, the Bank of Japan, the European Central Bank and the Bank of England, have committed to massive balance sheet expansion (through the purchase of mortgage and government debt). Their balance sheets continued to rise in aggregate during 2017 even though the Fed itself stopped expanding its own balance sheet in November 2014. Aggregate assets of G7 central banks increased by 17.2% last year to $15.2tn at the end of 2017, up from US$4.3tn at the beginning of 2008 (see following chart).

Sources: Bloomberg, Federal Reserve, Bank of England, ECB, Bank of Japan, CEIC Data, CLSA

That the Fed has commenced balance sheet reduction from last October is a risk for stock markets since it amounts to another form of monetary tightening, in addition to interest rate hikes. That it has not yet caused market fallout reflects two factors:

The Fed is beginning extremely tentatively by decreasing its reinvestment of principal payments from maturing bonds.

Other G7 central banks are still expanding in aggregate, albeit at a slower pace. This is why there will be much focus on what the European Central Bank will do in coming months. For now, it looks like G7 central bank balance sheets will start to contract in aggregate in 2019 rather than 2018.

…click on the above link to read the rest of the article…