Steve Bull's Blog, page 1201

February 3, 2018

Taxation Is Robbery

[This article was originally published in 1947 as a pamphlet from Human Events Associates. It was reprinted in 1962 as chapter 22 of of

Out of Step: The Autobiography of an Individualist

.] Mises.org

[This article was originally published in 1947 as a pamphlet from Human Events Associates. It was reprinted in 1962 as chapter 22 of of

Out of Step: The Autobiography of an Individualist

.] Mises.org

The Encyclopaedia Britannica defines taxation as “that part of the revenues of a state which is obtained by the compulsory dues and charges upon its subjects.” That is about as concise and accurate as a definition can be; it leaves no room for argument as to what taxation is.

In that statement of fact the word “compulsory” looms large, simply because of its ethical content. The quick reaction is to question the “right” of the state to this use of power. What sanction, in morals, does the state adduce for the taking of property? Is its exercise of sovereignty sufficient unto itself?

On this question of morality there are two positions, and never the twain will meet. Those who hold that political institutions stem from “the nature of man,” thus enjoying vicarious divinity, or those who pronounce the state the keystone of social integrations, can find no quarrel with taxation per se; the state’s taking of property is justified by its being or its beneficial office. On the other hand, those who hold to the primacy of the individual, whose very existence is his claim to inalienable rights, lean to the position that in the compulsory collection of dues and charges the state is merely exercising power, without regard to morals.

The present inquiry into taxation begins with the second of these positions. It is as biased as would be an inquiry starting with the similarly unprovable proposition that the state is either a natural or a socially necessary institution. Complete objectivity is precluded when an ethical postulate is the major premise of an argument and a discussion of the nature of taxation cannot exclude values.

…click on the above link to read the rest of the article…

Are Oil Prices Heading for Another Spike?

Joe Sohm/Visions of America/UIG via Getty Images

Joe Sohm/Visions of America/UIG via Getty ImagesAre Oil Prices Heading for Another Spike?

The decline in the dollar’s exchange rate seems to have gathered momentum, in part because the person who has his signature on US currency, Treasury Secretary Steve Mnuchin, seems unperturbed by its weakness. If it continues, will energy costs spiral upward?

CAMBRIDGE – The price at the pump for premium gasoline topped $3 per gallon in much of the United States over the past few weeks, which is surprising to consumers but not to analysts of the world’s oil markets. From its local low two years ago, the price of oil has more than doubled. As with any market, where you stand on this price increase depends on where you sit.

Higher oil prices buttress the fortunes of producers abroad and at home. The International Monetary Fund upgraded the GDP growth outlook of all six of the top ten oil producers that were shown separately in its 2018 forecast update, and the projected growth of world trade volumes was raised half a percentage point this year and next. Increased oil revenues improve the fiscal positions of most producing economies, and some have taken advantage of global investors’ hardier appetite to issue sovereign debt.

In the US, the five states with the largest gains in oil production this decade recorded employment growth of 2.75% in 2017, double the national average. Meanwhile, the number of oil rigs nationwide increased by roughly 50%.

At the same time, a doubling of energy costs takes a significant bite out of US households’ budgets, with energy costs directly accounting for about 6.5% of consumer spending. Even more problematic, this is a regressive tax, disproportionately draining lower-income households’ discretionary spending power.

…click on the above link to read the rest of the article…

“The Market Is On The Edge Of Chaos, A Zone Where Rare Events Become Typical”

According to Fasanara Capital, which has long argued that the market’s systemic fragility is approaching its breaking point, markets stand at a critical juncture, ready to snap, as the following note from Fasanara’s Francesco Filia lays out.

* * *

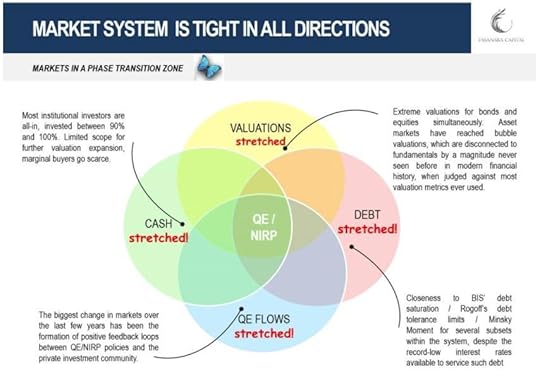

The Market System Is Tight In All Directions

The Four Pillars Holding Markets Up Are Strained, All At The Same Time

Viewed as a combination of intertwined components, each component is showing growing signs of pressure and seem to be running out of road for further advancing. The synchronicity of them, more than any single component taken independently, is what should draw attention, as it compounds systemic risk.

Here are the four components, characterizing the basin of chaotic attraction for markets nowadays:

What happens when the system is tight in its key possible directions of expansion? That it expands no more. Stochastically, on one of the components a tipping point is reached, which jumpstarts the autolytic effect, spreading back through the vectors of the complex system, and snapping the unstable equilibrium into an alternative stable state. That is our thesis.

In this recent interview, we discuss the impending tipping points for markets due to a synchronicity of excess valuations, excess indebtedness, excessively low cash balances and a drawback in excessive public flows.

Let’s give a cursory look across the four components. Again, the list is by no means exhaustive, but rather a work-in-progress (seemingly endless) collecting of data points, following on to our previous work of ‘a long list of anomalies’ here and here.

…click on the above link to read the rest of the article…

ECONOMIC CRASH LIKELY? Stock Market Insanity & Risk Reaching Nose-Bleed Levels

With the Dow Jones Index falling 665 points today, the risk of a large market correction has just increased significantly. Ironically, I discussed the very indicators that were setting up for a huge market correction in my newest video which I recorded on Tuesday. Unfortunately, I wasn’t able to get the video posted on my Youtube channel on Friday morning and now on my website until late in the evening.

With the Dow Jones Index falling 665 points today, the risk of a large market correction has just increased significantly. Ironically, I discussed the very indicators that were setting up for a huge market correction in my newest video which I recorded on Tuesday. Unfortunately, I wasn’t able to get the video posted on my Youtube channel on Friday morning and now on my website until late in the evening.

Regardless, the 665 point decline is just the beginning. Oh sure, we could see a continued selloff and then a move towards 27,000 or even higher. But, for the stock market to move up to 27,000 or 30,000 means absolutely nothing. Well, maybe it provided investors with a brief feeling of higher wealth until the markets really crashed.

In my newest video, I provide some fundamental analysis and indicators of why the Stock Market is reaching totally unsustainable levels. Also, I discuss what would happen with the gold and silver price during a big market correction. And, it resembled what happened today in the markets. The gold and silver price will initially selloff because most trades are done via algorithms. Thus, when the markets crack by 665 points in one day, it does damage all across the board.

Furthermore, the gold and silver price are based on their commodity-price mechanism… and this is the cost of production. So, if the price of oil declines, so will the gold and silver price… FOR A SHORT WHILE. However, after the initial selloff, I see both gold and silver moving higher as the broader markets continue to decline.

…click on the above link to read the rest of the article…

How Big a Disaster Can Climate Change Be?

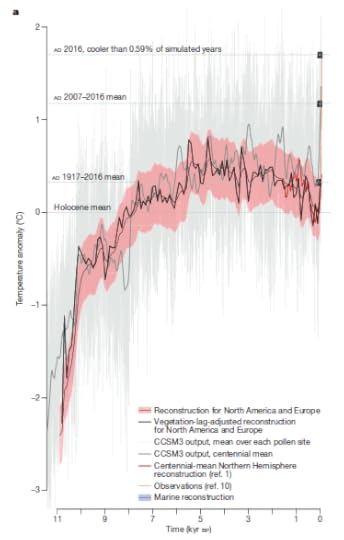

Above, you can see an image from, just appeared on Nature. It shows a reconstruction from pollen records of the temperatures of the past 10,000 year or so, the “Holocene,” for North America and Europe. Note the black squares, showing how fast temperatures have been growing during the past 50 years or so.

As all reconstructions of the past, this one has to be taken with some caution, but it fits well with the various “hockey sticks” that research continues to produce despite the attempts to discredit both the science and the scientists who work in this field. So, we can assume these results to be reasonably reliable. Then, we can note a few interesting things.

1. What we call “civilization” arose and continued to exist during a period of relatively constant temperatures, that is, during the past 5000 years or so. During this period, the oscillations in the graph are never more than about half a degree. That’s probably not a coincidence. Agriculture and civilization come together and it is unlikely that agriculture could have been developed for wildly oscillating temperatures and rapidly varying climates

2. Civilizations seem to grow and collapse because of internal factors – the fall of empires doesn’t seem to be correlated to climate change. For instance, you can look in the graph for the data corresponding to the fall of the Roman Empire, between 2000 and 1500 years ago. Temperatures are flat, at most cooling a little. It is a point that I already made on the basis of another set of data specific for the region occupied by the Roman Empire. These more detailed data show a cooling period in Europe, but after the fall of the Empire.

…click on the above link to read the rest of the article…

Weekly Commentary: The Grand Crowded Trade of Financial Speculation

Even well into 2017, variations of the “secular stagnation” thesis remained popular within the economics community. Accelerating synchronized global growth notwithstanding, there’s been this enduring notion that economies are burdened by “insufficient aggregate demand.” The “natural rate” (R-Star) has sunk to a historical low. Conviction in the central bank community has held firm – as years have passed – that the only remedy for this backdrop is extraordinarily low rates and aggressive “money” printing. Over-liquefied financial markets have enjoyed quite a prolonged celebration.

Going back to early CBBs, I’ve found it useful to caricature the analysis into two distinctly separate systems, the “Real Economy Sphere” and the “Financial Sphere.” It’s been my long-held view that financial and monetary policy innovations fueled momentous “Financial Sphere” inflation. This financial Bubble has created increasingly systemic maladjustment and structural impairment within both the Real Economy and Financial Spheres. I believe finance today is fundamentally unstable, though the associated acute fragility remains suppressed so long as securities prices are inflating.

The mortgage finance Bubble period engendered major U.S. structural economic impairment. This became immediately apparent with the collapse of the Bubble. As was the case with previous burst Bubble episodes, the solution to systemic problems was only cheaper “money” in only great quantities. Moreover, it had become a global phenomenon that demanded a coordinated central bank response.

Where has all this led us? Global “Financial Sphere” inflation has been nothing short of spectacular. QE has added an astounding $14 TN to central bank balance sheets globally since the crisis. The Chinese banking system has inflated to an almost unbelievable $38 TN, surging from about $6.0 TN back in 2007. In the U.S., the value of total securities-to-GDP now easily exceeds previous Bubble peaks (1999 and 2007). And since 2008, U.S. non-financial debt has inflated from $35 TN to $49 TN. It has been referred to as a “beautiful deleveraging.”

…click on the above link to read the rest of the article…

It’s Looking A Lot Like 2008 Now…

It’s Looking A Lot Like 2008 Now…

Did today’s market plunge mark the start of the next crash?

Economic and market conditions are eerily like they were in late 2007/early 2008.

Remember back then? Everything was going great.

Home prices were soaring. Jobs were plentiful.

The great cultural marketing machine was busy proclaiming that a new era of permanent prosperity had dawned, thanks to the steady leadership of Alan Greenspan and later Ben Bernanke.

And only a small cadre of cranks, like me, was singing a different tune; warning instead that a painful reckoning in our financial system was approaching fast.

It’s fitting that I’m writing this on Groundhog Day, as to these veteran eyes, it sure has been looking a lot like late 2007/early 2008 lately…

The Fed’s ‘Reign Of Error’

Of course, the Great Financial Crisis arrived in late 2008, proving that the public’s faith in central bankers had been badly misplaced.

In reality, all Ben Bernanke did was to drop interest rates to 1%. This provided an unprecedented incentive for investors and institutions to borrow, igniting a massive housing bubble as well as outsized equity and bond gains.

It’s worth taking a moment to understand the mechanism the Federal Reserve used back then to lower interest rates (it’s different today). It did so by flooding the banking system with enough “liquidity” (i.e. electronically printed digital currency units) until all the banks felt comfortable lending or borrowing from each other at an average rate of 1%.

The knock-on effect of flooding the US banking system (and, really, the entire world) in this way created an echo bubble to replace the one created earlier during Alan Greenspan’s tenure (known as the Dot-Com Bubble, though ‘Sweep Account’ Bubble is more accurate in my opinion):

…click on the above link to read the rest of the article…

The Nature of Panics

I have been asked my “opinion” with respect to the existence of a Collective unconscious in terms of the Carl Gustav Jung (1875 – 1961), who disagreed with Freud and believed his personal development was influenced by factors he felt were unrelated to sexuality. Nevertheless, Jung’s work has led to many considering it to be a form of collective unconsciousness that exists whereby we are all connected somehow and respond in a herd manner.

I really have no opinion on Jung’s work. Nevertheless, there is clearly a sort of collective unconsciousness that comes into play creating panics. I tend to see it more as a herd of zebra. They are all clustered together and one on the fringe of the herd sees a lion approaching. He starts to run and the others all panic and run as well without knowing why nor did they see the lion. They run because everyone else is running. This is the same thing that dominates a panic in markets. At the end of the day, everyone sells because everyone else is selling. There is usually no solid reason that can be asserted as a fundamental.

Crash of Outsourcing Giant with 70,000 Employees Globally Sparks New Panic

“Not another Carillion,” says UK government to soothe frazzled nerves, as entire industry is teetering.

Since the sudden downfall of the British infrastructure giant Carillion two weeks ago, investors’ nerves in London are frayed. And short-sellers, scanning the horizon for their next prey, seem to have found it.

Its name is Capita. It is one of the UK government’s biggest outsourcing firms with contracts to provide services to government entities, such as NHS cleaning, school dinners, and prison maintenance. It has 70,000 employees in the UK, Europe, South Africa, and India.

On Wednesday, its shares tumbled 47.5% to a 15-year low after its new CEO, Jon Lewis, slashed profit forecasts, announced plans to tap the capital market for £700 million, and suspended a dividend that was worth more than £200 million to shareholders last year.

On Thursday, the rout continued , with shares dropping a further 13%. On Friday, shares bounced off a tiny 2.3% to close at 162.3 pence, down 77% from June 2017 and down 88% from July 2015.

In a desperate bid to calm market nerves at the height of Wednesday’s rout, the UK government released a statement insisting that Capita was “not another Carillion.”

But whatever the government might say, there is a striking resemblance between the two companies:

Like Carillion, Capita is massively dependent on government contracts. In the last two years alone it was awarded 226 public sector contracts — 10 times more than Carillion — making it the biggest supplier of local government services in the country, according to public sector data provider Tussel.

Like Carillion, Capita is massively in debt, with an estimated £1.1 billion of funds outstanding. And like Carillion, it’s been exceptionally generous with its dividend policy in recent years. So did it, as Carillion is accused of doing, borrow money and sell-off assets in order to pay its dividends, in direct contravention of UK law?

…click on the above link to read the rest of the article…

EPA Division That Studies the Health Risks of Toxic Chemicals is in a Fight For Its Life–Against the EPA

Photo: Justin Sullivan/Getty Images

EPA DIVISION THAT STUDIES THE HEALTH RISKS OF TOXIC CHEMICALS IS IN A FIGHT FOR ITS LIFE — AGAINST THE EPA

A SMALL BUT vitally important program within the Environmental Protection Agency is in a fight for its life. The Integrated Risk Information System, or IRIS, is the only division of the EPA that independently assesses the toxicity of chemicals. IRIS supplies evaluations used by states, tribes, private developers, Superfund sites, and foreign countries, among others, and has long been a target of the companies whose profits can rise and fall based on its findings.

A meeting at the National Academy of Sciences on Thursday and Friday to review the program’s recent progress brought IRIS’s defenders together with its critics. Though the agenda focused on IRIS’s scientific process and whether the program has adequately incorporated guidance the academy gave it in 2014, questions about its survival permeated the meeting.

It’s not clear how IRIS might lose its ability to continue independently evaluating chemicals, but one possibility is that it would be folded into another division of the EPA, as the 2018 Senate Appropriations Bill proposes. According to that plan, staff would be moved from the current division of the agency, which is primarily concerned with science, to the Office of Chemical Safety and Pollution Prevention, which deals with regulation.

The transfer from a scientific to a regulatory part of the agency would hobble the program, according to many familiar with its work. “Moving it would bias the risk assessments,” said Tracey Woodruff, director of the Program on Reproductive Health and the Environment at the University of California, San Francisco. “You should try to keep the science separate, then use the independent science for regulation.”

An arguably bigger cause for concern is the current leader of that regulatory office: Nancy Beck, who worked at the American Chemistry Council before joining the EPA and seems to have maintained her allegiance to industry.

…click on the above link to read the rest of the article…