Steve Bull's Blog, page 1197

February 9, 2018

Asia Crashes, Europe Slides, US Rebounds But Yields Resume Ominous Rise

“$5 trillion was wiped out from global stocks this week.”

After yesterday’s violent last hour plunge in US stocks, which also sent the VIX surging back to the mid-30s, the overnight session was somewhat muted, with European stocks falling further on Friday morning, but at a slower pace than the sharp sell offs in Asia and New York.

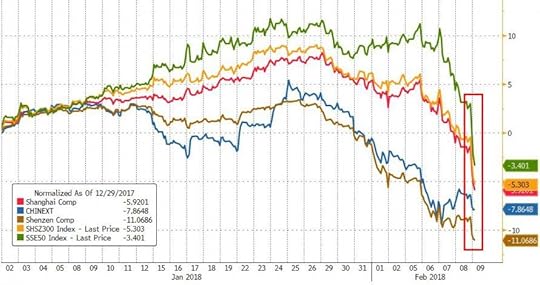

Europe’s 600 Index, down -1% as of this moment and back to session lows after a modest rebound earlier, was set for its worst week since 2016 as banks and financial-services stocks led most industry sectors lower. The drop, however, was relatively modest and followed a sheer plunge in Asia, where stocks tumbled across the region, wiping out most of their gains from the previous two sessions. The Shanghai Composite recouped some gains to close down “only” 4.1% – in what has now been a two-week selloff without the Chinese National Team making an appearance and buying stocks – the Hang Seng was down 3.1% with losses across all sectors. Tokyo’s Topix closed down 1.9 per cent.

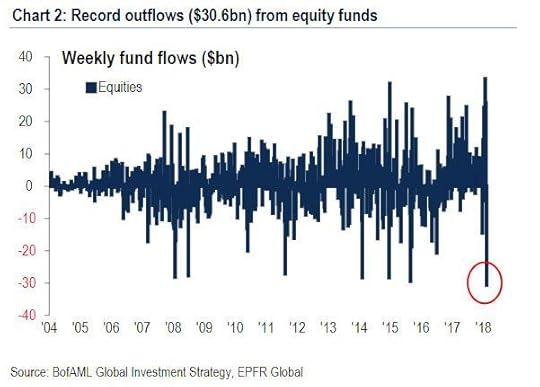

The renewed slide followed Thursday’s drop in the S&P 500, which pushed the index to a 10 per cent decline from its January high – officially, a correction – stirred renewed concerns over the future of the long bull market that followed the 2008 financial crisis, and whether the selloff that was catalyzed by systematic quant funds would spill over to retail investors. And, as we highlighted overnight, that’s precisely what happened following the single biggest weekly outflow from equity funds on record.

And while we look forward to today’s session to see if the retail liquidation continues, S&P 500 futures little changed, after earlier rising as much as 0.9%, while Dow contracts reverse advance to slide 0.3%, even as Congress passed a delayed budget deal, after the government was briefly shut down.

…click on the above link to read the rest of the article…

February 8, 2018

Is it possible for everyone to live a good life within our planet’s limits?

Imagine a country that met the basic needs of its citizens – one where everyone could expect to live a long, healthy, happy and prosperous life. Now imagine that same country was able to do this while using natural resources at a level that would be sustainable even if every other country in the world did the same.

Such a country does not exist. Nowhere in the world even comes close. In fact, if everyone on Earth were to lead a good life within our planet’s sustainability limits, the level of resources used to meet basic needs would have to be reduced by a factor of two to six times.

These are the sobering findings of research that my colleagues and I have carried out, recently published in the journal Nature Sustainability. In our work, we quantified the national resource use associated with meeting basic needs for a large number of countries, and compared this to what is globally sustainable. We analysed the relationships between seven indicators of national environmental pressure (relative to environmental limits) and 11 indicators of social performance (relative to the requirements for a good life) for over 150 countries.

The thresholds we chose to represent a “good life” are far from extravagant – a life satisfaction rating of 6.5 out of 10, living 65 years in good health, the elimination of poverty below the US$1.90 a day line, and so on.

Nevertheless, we found that the universal achievement of these goals could push humanity past multiple environmental limits. CO₂ emissions are the toughest limit to stay within, while fresh water use is the easiest (ignoring issues of local water scarcity).

…click on the above link to read the rest of the article…

U.S. Oil Production Is Rising Much Faster Than Expected

Shale executives have gone to great lengths to convince investors that they will not drill aggressively now that oil prices have rallied into the $60s. But in a new report released on Tuesday, the EIA essentially said that those assurances are just a lot of hot air.

The EIA’s Short-Term Energy Outlook predicted that U.S. oil production would top 11 million barrels per day (mb/d) this year. Last month, the agency said that the U.S. wouldn’t hit that threshold until November 2019.

The revision from just a few weeks ago is dramatic. In January the EIA estimated that the U.S. would surpass 10 mb/d at some point in February. But recently published data shows that the U.S. actually hit that milestone last November, and now, the agency says the U.S. actually averaged 10.2 mb/d in January.

On an annual basis, the U.S. produced 9.3 mb/d last year, a figure that is set to jump to 10.6 mb/d for 2018. Things slow down a bit in 2019, with an average of 11.2 mb/d.

What do we make of all of this? Well, the shale industry is clearly drilling at a frenzied pace, with an increasing concentration in the Permian basin. The rig count continues to rise in the Permian, while remaining mostly flat elsewhere. So far, the Permian has shown no signs of slowing down, despite some evidence of bottlenecking and cost inflation. Production continues to rise at a scorching rate.

The big question at this point is how rapidly expanding shale production will interact with the pace of inventory builds/declines and the OPEC production limits. Some analysts, including Goldman Sachs and S&P Global Platts, recently raised the prospect of OPEC tightening the oil market too much, allowing inventories to drain well below the five-year average.

…click on the above link to read the rest of the article…

US-Led Coalition Bombs Syrian Forces Following Israeli Strike Near Damascus

A US-led coalition has conducted several “defensive” airstrikes against Syrian forces allied with President Bashar al-Assad on Wednesday in Syria’s Deir al-Zor province, in retaliation for what the coalition said was an “unprovoked” attack on the US-backed left-wing Syrian Democratic Forces (SDF) headquarters.

Furthermore, CNN reported late Thursday that US forces are now investigating whether Russian contractors were involved in the initial attack against the SDF, after a US official told the news outlet that the possibility could not be ruled out.

The retaliatory airstrikes are said to have occurred 8km (5 miles) east of the Euphrates River, while no U.S. troops embedded with the local fighters at their headquarters are believed to have been wounded or killed in the attack on the headquarters, reports Reuters.

The US-led coalition did not say whether any pro-Syrian forces were killed in the retaliatory strike.

“Syrian pro-regime forces initiated an unprovoked attack against well-established Syrian Democratic Forces headquarters,” reads a Feb 7 press release from Central Command. “In defense of Coalition and partner forces, the Coalition conducted strikes against attacking forces to repel the act of aggression against partners engaged in the Global Coalition’s defeat-Daesh mission.”

Although no U.S. servicemembers were reportedly involved in the attack on the SDF, the US-led coalition has previously asserted a “non-negotiable right to act in self-defense,” pointing to the fact that coalition service members are embedded with the SDF “partners” on the ground in Syria.

Syrian President Bashara al-Assad has repeatedly stated that the presence of the US-led coalition on Syrian soil is an act of aggression and a violation of Syrian sovereignty. Officially, Russian and Syrian air forces are the only military allowed to operate in Syria – however Syria and Iran are close strategic allies, with the latter providing logistical, technical and financial support to the Syrian government during the ongoing Syrian Civil War.

…click on the above link to read the rest of the article…

Democrats and Republicans: United on Glorifying Authoritarian Systems

With President Donald Trump fighting against the Federal Bureau of Investigation (FBI), his Republican minions have managed to navigate a somewhat tortuous road. They have to somehow criticize one of the many authoritarian organizations that they generally revere. Ultimately, this has proved not too difficult for them; they simply attack the leadership, while praising the rank-and-file.

Democrats, on the other hand, are able to avoid this conundrum altogether, by maintaining their obvious adoration for the corrupt, invasive bureau.

As the Russia-Trump Campaign probe drags on, providing headlines that few people are genuinely interested in, the worship of authority continues unabated. The U.S. military, the largest and most powerful terrorist organization in the world, one that is responsible for the murders of at least 20,000,000 people over the last fifty years, continues to receive increasing amounts of U.S. taxpayers’ money, to the determent not only of the millions of people victimized by the U.S. military, but also of those very taxpayers. Money that goes to weaponry has to come from somewhere, and in the eyes of those who run the U.S. government, both Republican and Democrat, such frivolities as food for the poor, roads, public education and higher education are expendable, as long as the war machine gets all that its lobbyists want.

And then, of course, we have the Central Intelligence Agency (CIA). Talk about a rogue organization! This is the arm of the U.S. government that is responsible for overthrowing democratically-elected governments, funding and training foreign terrorists, and torturing U.S. citizens and others at various sites around the world.

…click on the above link to read the rest of the article…

Death of Democracy? – Part I

“The result of 25 years of multiculturalism has not been multicultural communities. It has been mono-cultural communities… Islamic communities are segregated.” – Ed Husain, former Muslim extremist.

This approach, giving social-services, is based on the belief — oft-refuted — that Muslim extremists (both Muslims-by-birth and converts) have suffered from deprivation. It also greatly rests on the naïve assumption that rewarding them with benefits — for which genuinely deprived citizens generally need to wait in line — will turn them into grateful patriots, prepared to stand for the national anthem and hold hands with Christians and Jews.

The British government has shown itself incapable of enforcing its own laws when it comes to its Muslim citizens or new immigrants. Rather than stand up to our enemies, both external and internal, are we so afraid of being called “Islamophobes” that we will sacrifice even our own cultural, political, and religious strengths and aspirations?

For many complex reasons, Europe is in an advanced state of decline. In recent years, several important studies of this condition have appeared, advancing a variety of reasons for it: Douglas Murray’s The Strange Death of Europe: Immigration, Identity, Islam, James Kirchik’s The End of Europe: Dictators, Demagogues, and the Coming Dark Age, as well as Christopher Caldwell’s ground-breaking 2010 study, Reflections on the Revolution in Europe: Immigration, Islam and the West. Soeren Kern at Gatestone Institute has also been detailing the steady impact of immigration from Muslim regions on countries such as Germany, Sweden, and the United Kingdom.

It is clear that something serious is happening on the continent in which I live.

The threat is not restricted to Europe, but has a global dimension. Michael J. Abramowitz, President of Freedom House, writes in his introduction to the organization’s 2018 report:

…click on the above link to read the rest of the article…

February 7, 2018

Steve Keen: “Why Did It Take So Long For This Crash To Happen?”

As originally written at RT, outspoken Aussie economist Steve Keen points out that everyone who’s asking “why did the stock market crash Monday?” is asking the wrong question; the real question, Keen exclaims, is “why did it take so long for this crash to happen?”

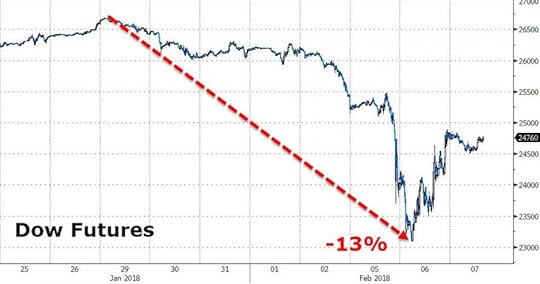

The crash itself was significant – Donald Trump’s favorite index, the Dow Jones Industrial (DJIA) fell 4.6 percent in one day. This is about four times the standard range of the index – and so according to conventional economics, it should almost never happen.

Of course, mainstream economists are wildly wrong about this, as they have been about almost everything else for some time now. In fact, a four percent fall in the market is unusual, but far from rare: there are well over 100 days in the last century that the Dow Jones tumbled by this much.

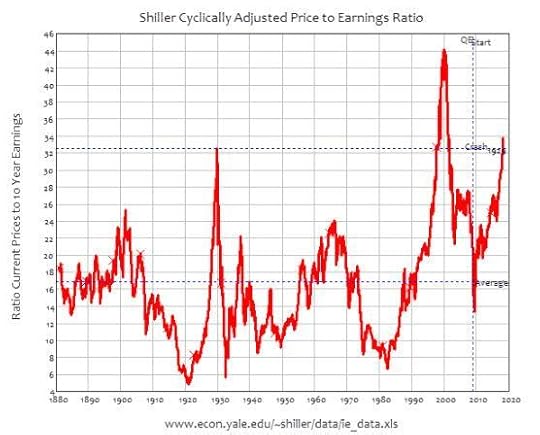

Crashes this big tend to happen when the market is massively overvalued, and on that front this crash is no different.

It’s like a long-overdue earthquake. Though everyone from Donald Trump down (or should that be “up”?) had regarded Monday’s level and the previous day’s tranquillity as normal, these were in fact the truly unprecedented events. In particular, the ratio of stock prices to corporate earnings is almost higher than it has ever been.

More To Come?

There is only one time that it’s been higher: during the DotCom Bubble, when Robert Shiller’s “cyclically adjusted price to earnings” ratio hit the all-time record of 44 to one. That means that the average price of a share on the S&P500 was 44 times the average earnings per share over the previous 10 years (Shiller uses this long time-lag to minimize the effect of Ponzi Scheme firms like Enron).

…click on the above link to read the rest of the article…

Exxon To Produce All Of Its Oil Despite Peak Demand Fears

ExxonMobil was forced to finally acknowledge the possibility that future climate change policy could lead to peak oil demand, a serious threat to the company’s operations over the long-term.

In response to a shareholder resolution passed last year, the oil major just released a reportthat recognizes the danger of peak oil demand. By 2040, climate change policies and regulations could cut into oil demand, leading to a drop in consumption by 20 percent.

Under this scenario, oil demand would decline by an average of 0.4 percent per year, with the lower end of the range seeing declines of 1.7 percent per year.

This would mean that global oil demand would decline to 78 million barrels per day (mb/d) by 2040, down from 95 mb/d in 2016. In the most pessimistic scenario (from the oil industry’s perspective), demand drops to 53 mb/d.

It’s a rather bleak picture for oil, and one echoed by a long list of analysts, environmental groups, and increasingly, the oil industry itself. A few weeks ago, a report coauthored by a top BP official, lays out a case in which oil demand peaks and declines, ushering in an era of permanently lower oil prices.

Still, Exxon was clearly issuing the report under duress. The tone of Exxon’s “2°C pathway” scenario suggests that the company doesn’t really see it playing out. While the report suggests that oil demand could fall, Exxon goes to great lengths to downplay the significance, arguing that “[o]il demand is projected to decline modestly on average, and much more slowly than its natural rate of decline from existing producing fields,” and “[e]ven under a 2°C pathway, significant investment will be required in oil and natural gas capacity,” and “[p]roduction from our proved reserves and investment in our resources continue to be needed to meet global requirements,” and the like.

…click on the above link to read the rest of the article…

Man Who Sold America the Iraq War Just Warned Iran Is Next, but Is Anyone Listening?

(ANTIMEDIA) — Fifteen years after the calamitous U.S. invasion of Iraq, an architect of the propaganda used to drum up support for the war is warning that it’s happening again — this time with Iran.

Lawrence Wilkerson, who was chief of staff to former Secretary of State Colin Powell, helped the then-secretary “paint a clear picture that war was the only choice” in his infamous 2003 speech to the U.N. This week, writing for the New York Times — an outlet that, at the time, parroted misleading narratives in support of the war — Wilkerson accused the Trump administration of manipulating evidence and fear-mongering in the same way the Bush administration did to cultivate public support for ousting Saddam Hussein.

In his Monday op-ed, titled “ I Helped Sell the False Choice of War Once. It’s Happening Again,” he wrote:

“As his chief of staff, I helped Secretary Powell paint a clear picture that war was the only choice, that when ‘we confront a regime that harbors ambitions for regional domination, hides weapons of mass destruction and provides haven and active support for terrorists, we are not confronting the past, we are confronting the present. And unless we act, we are confronting an even more frightening future.’”

Though the U.N. and much of the world didn’t buy it, Wilkerson says Americans did, and it amounted to the culmination of a two-year effort by the Bush administration to initiate the war, which he now condemns.

“That effort led to a war of choice with Iraq — one that resulted in catastrophic losses for the region and the United States-led coalition, and that destabilized the entire Middle East,” he wrote, going on to call out the Trump administration for pushing the United States down the same path in Iran.

…click on the above link to read the rest of the article…

Should we Restore the Gold Standard?

Would it make sense to rebuild an international gold standard like the one we had in the late 1800s? Larry White says the idea has merit, David Glasner believes it isn’t worth the risk. Over the years I’ve followed the back-and-forth between these two blogging economists, each of whom has done an admirable job defending their respective side for and against the gold standard. Let’s look at one or two of the most important themes running through the White v Glasner debate.

Like a ruler measures distances, a nation’s monetary standard serves as a measuring stick for the value of goods and services. People need to be able to set sticker prices with the unit, calculate profit and loss, negotiate labour contracts, and establish the terms of long-term debts using it. If the measuring stick is faulty, then all these important tasks becomes unnecessarily difficult.

Gold as Unit of Account

Since 1971 we have been on a fiat money standard in which all currencies float against each other. Central banks try to ensure that, within the confines of their nation, the general level of domestic consumer prices stays constant, or at least rises at a constant rate of around 2-3%. And while the first decade of the fiat standard was a disaster characterized by high and rising inflation, central bankers in developed nations have generally managed to keep inflation on track for the last thirty or so years.

To re-establish a modern gold standard, each nation’s unit of account—say the $ or ¥ or £—would have to be redefined as a certain fixed number of ounces of gold.

…click on the above link to read the rest of the article…